Wine, packaging and lots of divestments

AdVini, Carl Zeiss Meditec, Emeis, Nanobiotix, Sopra Steria, Sanofi, Wendel, Fraport, Vidrala, Sava Re, Schneider Electric

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

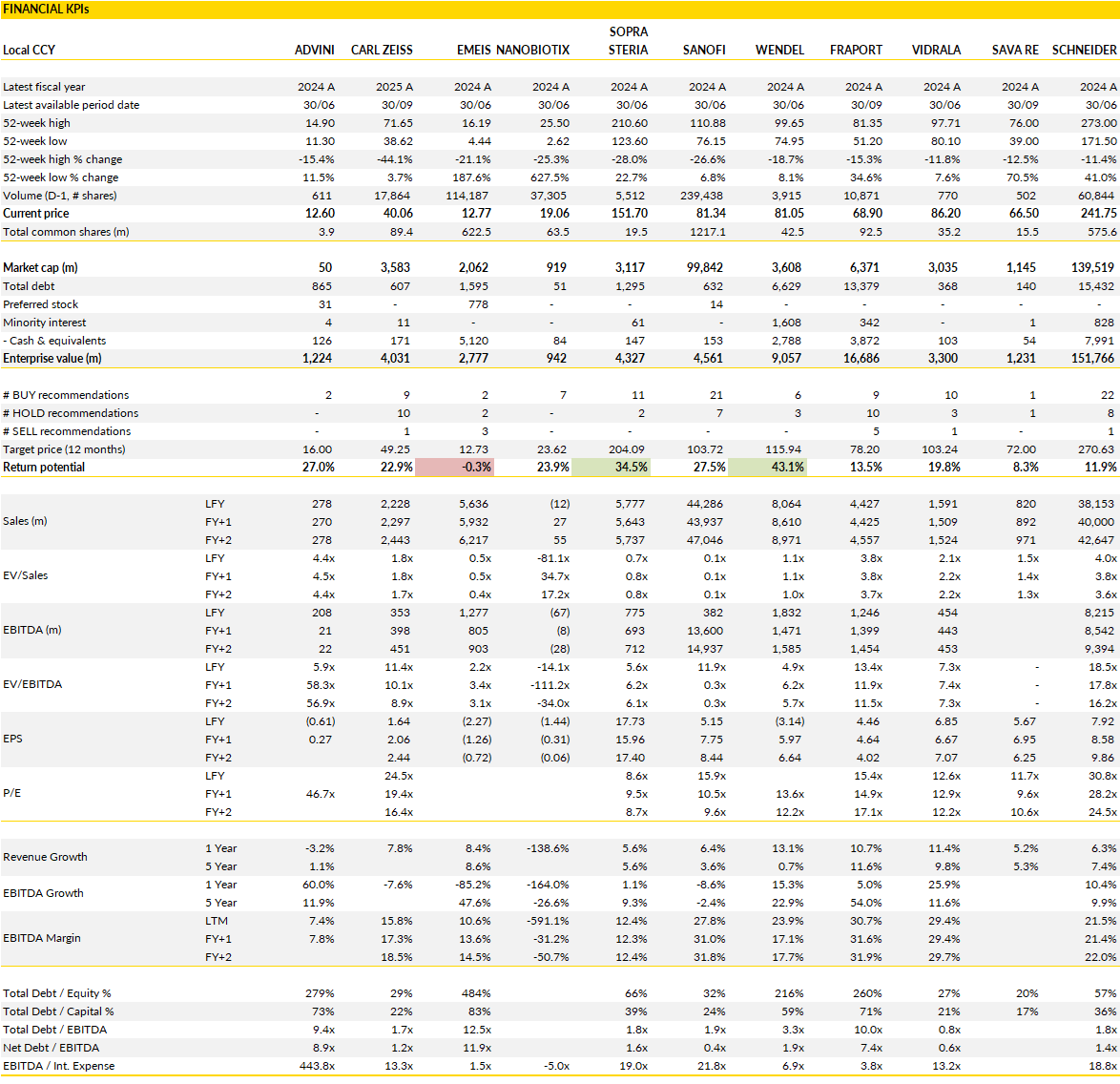

Financial KPIs

AdVini (ALAVI France): a bold tie-up with Cordier by InVivo to reshape French wine consolidation

In an industry long defined by fragmentation and heritage, AdVini’s announcement of exclusive talks to merge operations with Cordier by InVivo marks one of the most significant French wine consolidations in years. The rationale: AdVini brings deep winemaking expertise and a portfolio anchored in regional authenticity, while Cordier contributes scale, vertical integration, and global distribution reach.

Cordier has built a 29,000-hectare footprint and commands a network of 10 partner cooperatives representing over 4,000 winegrowers. Its brand portfolio (spanning both traditional and modern labels) is supported by strong distribution capabilities in Europe, North America, Asia, and South Africa. A merger would create a combined entity of roughly €320 million in sales, with about two-thirds of revenues generated outside France, materially improving AdVini’s export balance and diversification profile.

Strategically, the transaction is interesting. It would allow AdVini to anchor itself more firmly in Bordeaux, gain access to the fast-growing sparkling and low-alcohol segments through Cordier’s Café de Paris brand, and leverage a much broader distribution infrastructure. For a group that has spent years refining its house-by-house approach to branding and terroir, this partnership could unlock commercial scale without diluting its premium positioning.

Structurally, the deal is to be executed through a contribution of assets from Cordier by InVivo and its subsidiaries to AdVini, with InVivo becoming a key shareholder alongside the Jeanjean family and Chairman Antoine Leccia (who will retain an absolute majority). Importantly, the transaction requires no new debt, preserving AdVini’s already conservative balance sheet and providing optionality for further expansion once integration stabilises.

Beyond the mechanics, this deal signals a changing landscape for French wine. Scale and international distribution are increasingly prerequisites for competitiveness in a global market under pressure from shifting consumption habits, regulation, and pricing volatility. AdVini’s combination with Cordier represents a pragmatic response: focus on brand strength, supply-chain control, and international reach rather than chasing volume growth domestically.

If finalised by March 2026 as planned, the merger would mark AdVini’s emergence as a leading integrated player, one that can navigate the sector’s structural headwinds while capturing opportunities in premiumisation and global diversification.

Carl Zeiss Meditec (AFX Germany): waiting for clarity as China weighs on growth

Carl Zeiss Meditec remains caught between solid product execution and regional headwinds that are proving difficult to shake.

The group’s ophthalmic division continues to deliver strong underlying demand in premium intraocular lenses and surgical equipment, yet China, still a key market for the segment, remains sluggish. The Visumax 800 device installments met the upper end of management’s target, but consumable growth has flattened and foreign exchange, tariffs, and weaker local sentiment have eroded profitability.

The picture is somewhat brighter in microsurgery, where the rollout of the Kinevo 900S system is finally gaining traction after early software issues. The new model’s adoption has accelerated into year-end, supporting better-than-expected Q4 sales and validating the product’s technological edge in neurosurgical precision. Still, the delayed ramp-up weighed on the mix and, together with tariff and currency effects, suppressed near-term margins.

Overall, management’s FY2026 guidance (mid-single-digit revenue growth and an EBITA margin of roughly 12.5%) signals cautious optimism but also a back-end-loaded trajectory, implying that the recovery will take several quarters to materialize.

At today’s levels, the shares already reflect much of the bad news. The valuation has compressed meaningfully, and the downside risk looks limited from here, yet investors are unlikely to re-rate the stock until evidence of a sustained rebound in China and margin stability emerges.

Carl Zeiss Meditec remains a high-quality medtech franchise with enviable positions in ophthalmology and microsurgery, but the company’s near-term growth narrative depends too heavily on a market still struggling to regain momentum. With estimates moving down and earnings growth deferred once again, the stock’s recovery story looks postponed (again).

Emeis (EMEIS France): portfolio pruning and deleveraging reshape the recovery path

Emeis continues to accelerate its restructuring and deleveraging strategy with another significant divestment, this time selling most of its Swiss operations for €270 million.

The deal transfers 40 retirement homes and local home-care activities, representing roughly €375 million in revenue and €22 million in pre-IFRS 16 EBITDA, to Tertianum and two real estate investors. Importantly, the sale includes real estate assets valued at about €124 million, or just over 2% of the group’s total property portfolio.

With completion expected in early 2026, this move brings the cumulative proceeds from asset disposals since late 2023 to around €2.4 billion. It also marks the continued retreat from non-core geographies (following exits in the Netherlands, Ireland, Portugal, Chile, and the Czech Republic) and underlines Emeis’ focus on capital discipline rather than scale.

Financially, the transaction meaningfully advances the group’s deleveraging goals. Emeis’ consolidated leverage ratio should now fall below 10x, down from roughly 13x at mid-2025 and nearly 20x a year earlier.

The Swiss deal, struck at an estimated 9.3x pre-IFRS 16 EBITDA multiple (excluding property), appears fair in light of the portfolio’s modest growth prospects and the ongoing operational challenges in the region. Emeis retains a small number of clinics in Switzerland, which are not part of the transaction, but otherwise has effectively exited a market that contributed solid occupancy rates but limited upside in profitability. The sale follows the November disposal of French senior living assets and represents another step toward simplifying the group’s structure, concentrating capital on higher-margin markets, and restoring balance sheet flexibility after years of elevated leverage and investor scrutiny.

Strategically, Emeis is finally gaining traction with a clear, methodical approach to reshaping its portfolio. Management has demonstrated both discipline and urgency in disposing of non-core assets while maintaining operational stability across its core segments. The pipeline of asset sales, coupled with stronger occupancy rates and operating leverage improvements, provides credible visibility into free cash flow recovery over the next year.

Execution risk remains, especially around refinancing and maintaining margins amid rising labour costs, but sentiment should improve as deleveraging continues. For now, Emeis’ steady progress in simplifying its structure and restoring financial health suggests a company gradually emerging from years of balance sheet strain.

Nanobiotix (NANO France): new clinical data strengthen the case for a breakthrough oncology platform

Nanobiotix’s story continues to evolve from a speculative biotech to a credible contender in next-generation oncology. The latest phase 1 data in melanoma, pancreatic cancer, and head and neck cancer add weight to the company’s long-held claim that its lead asset, JNJ-1900 (also known as NBTXR3), can produce both potent local tumor control and meaningful systemic immune responses.

That dual mechanism has always been the scientific heart of the thesis: a physical, radiotherapy-activated nanoparticle that converts radiation energy directly inside the tumor while simultaneously triggering the body’s immune system to sustain the effect. The new data reaffirm that concept across multiple tumor types and treatment lines, reinforcing confidence in the program’s versatility. With safety and efficacy outcomes tracking consistently across studies, Nanobiotix’s platform looks increasingly like a foundation technology instead of than a niche therapeutic.

JNJ-1900 remains one of the few oncology candidates that operate independently of tumor biology, an important differentiator in an era when many therapies are genetically or receptor-specific. Because it can be paired with radiotherapy, it targets a vast addressable population: roughly twelve million cancer patients annually. The phase III NANORAY-312 study in locally advanced head and neck cancer, run by Janssen, will be pivotal, with interim data due in 2027.

Beyond that, the pipeline now spans around eight clinical programs, including non-small-cell lung cancer and pancreatic tumors. Financially, Nanobiotix has shored up its runway with a $71 million collaboration deal with HCRx, giving it clear visibility to 2028 and allowing management to focus fully on advancing clinical and regulatory milestones without near-term funding pressure. The company’s strategic partnership with Janssen not only validates the science but also ensures global commercialization capabilities once efficacy is confirmed.

The investment case now rests on scale. Positioned in two of the largest oncology markets (head and neck and lung cancers) JNJ-1900’s potential addressable market exceeds $45 billion by 2030, and the product’s risk-reward profile has shifted decisively in investors’ favor. While the long road to final approval still carries execution risk, successive clinical successes, diversified indications, and strong backing from major partners are steadily de-risking the story.

In short, Nanobiotix is moving from proof-of-concept to platform validation. The science is working, the partners are in place, and the financials are stable. What was once a high-risk moonshot now looks like a structured bet on a genuine breakthrough in radiotherapy-enhanced immuno-oncology.

Sopra Steria Group (SOP France): leadership change and renewed momentum signal a turning point

Sopra Steria appears to be entering a more constructive phase, both operationally and strategically, after a difficult first half of the year. The appointment of Rajesh Krishnamurthy as CEO, effective February 2026, marks a decisive step in broadening the company’s international management bench. Krishnamurthy’s background at Expleo and Infosys brings deep experience in digital transformation and large-scale service delivery, precisely the skill set Sopra Steria needs as it seeks to restore growth and improve execution across its European footprint.

Meanwhile, recent internal updates suggest that the group’s long-awaited rebound is materializing in the fourth quarter. France and the UK, which together account for the bulk of revenues, are both turning a corner: the French public sector remains resilient despite political uncertainty around the 2026 state budget, banking contracts signed earlier in the year are scaling, and the long-troubled Airbus account is recovering. In the UK, growth has swung back into positive territory after the loss of the UKVI contract, helped by a recovery at the NHS.

The near-term guidance still looks measured, but the tone is changing. A stable operating margin in the second half would signal that Sopra Steria is regaining operational rhythm. The working capital clean-up that weighed on cash flow earlier in 2025 is largely behind it, though the end-of-year collection calendar remains unfavourable.

For 2026, management is understandably cautious, given political headwinds in key markets, but the underlying momentum looks healthier than at any point in the past two years. France’s private sector demand is improving, Germany and Norway are expected to contribute more materially, and efficiency gains should lift the operating margin by roughly 20 basis points.

Valuation remains the elephant in the room. At roughly 6x forward EV/EBIT, Sopra Steria still trades as if it were a structurally declining IT services firm, despite recurring revenue streams, resilient margins, and a growing backlog in digital transformation. The market’s skepticism reflects execution risk rather than fundamentals, and a perception that Sopra Steria lacks the growth dynamism of global peers.

If the company can deliver two or three quarters of consistent organic expansion under new leadership, that narrative could change quickly. Krishnamurthy’s arrival, coupled with a stabilizing macro backdrop and a cleaner balance sheet, sets the stage for a genuine re-rating story. Sopra Steria’s turnaround may still be early, but the pieces are falling into place for a potential recovery.

Sanofi (SAN France): setbacks in MS add to the noise, but the long-term case remains intact

Sanofi’s multiple sclerosis ambitions took a hit after the Phase 3 PERSEUS trial of its BTK inhibitor tolebrutinib failed to meet its primary endpoint in primary progressive MS. The study, which tested whether the oral therapy could delay disability progression, showed no statistically significant benefit over the control arm, though safety remained consistent with prior studies. With this outcome, Sanofi is shelving plans to pursue registration for this indication, acknowledging the limits of the current data but emphasizing that the result will have no financial impact on its 2025 outlook.

It’s another reminder of how hard it is to make meaningful clinical advances in progressive MS, a notoriously difficult area where few drugs have shown efficacy.

Compounding the disappointment, Sanofi also disclosed a regulatory delay in the U.S. for tolebrutinib’s other indication, non-relapsing secondary progressive MS. The FDA’s review, initially expected to conclude by late December, will now stretch into 2026, as the agency seeks additional clarification. This prolongs uncertainty around one of Sanofi’s few remaining high-profile neurology assets and may raise questions about the drug’s safety profile or potential label restrictions once approved. While expectations for the compound were already modest, limited mostly to niche secondary progressive MS use, the delay reinforces the perception of weak pipeline momentum after a string of mixed or underwhelming readouts.

That said, the investment case for Sanofi remains rooted elsewhere. The group’s valuation already reflects skepticism, trading at less than 10x next year’s earnings (a 30% discount to European large-cap peers) and its core franchises in immunology, vaccines, and specialty care continue to deliver steady growth and resilient cash flow.

Management’s focus on cost control, capital discipline, and shareholder returns provides a solid floor under earnings, even as R&D volatility persists. The latest tolebrutinib headlines will fuel short-term noise, but they don’t alter the broader narrative: Sanofi is a mature healthcare platform whose upside depends less on individual drug breakthroughs and more on steady execution and structural undervaluation. In other words, this setback stings, but it doesn’t change the long-term story.

Wendel (MF France): a strategic reset towards asset management as the holding model winds down

Wendel’s Investor Day laid out the company’s intentions for the next 5 years: preparing to reinvent itself from a classic investment holding into a focused, capital-light asset manager.

By 2030, management expects to generate roughly €7 billion in cash, about €1 billion from dividends via its third-party asset management arm, Wendel Investment Management (WIM), and the rest from selling the entire proprietary investment portfolio (WPI). This implies a near-total disposal of Wendel’s legacy holdings, such as Bureau Veritas, Stahl, and CPI, within five years.

The company did not frame this as an abrupt liquidation but as a gradual wind-down of its balance sheet investments, accompanied by selective reinvestment of about €1.7 billion into new strategies under WIM’s umbrella. In other words, the “dual model” of self-owned assets and third-party funds is giving way to a single, scalable platform focused on external capital, a fundamental philosophical shift for one of Europe’s oldest family investment groups.

The logic: scale and recurring management fees offer higher returns on capital than a shrinking pool of industrial participations. Wendel’s plan is to triple WIM’s value to roughly €4.5 billion by 2030 through new fund sponsorships, strategic M&A in adjacent asset classes, and selective expansion into infrastructure, secondaries, and private credit. By that point, WPI’s role will likely be residual, a legacy book managed for exit rather than growth. The move reflects a broader trend among European holding companies: pivoting from balance-sheet investing to institutional asset management as capital markets penalize conglomerate discounts.

Yet, the near-term path remains delicate. Most portfolio assets are either in cyclical recovery (Stahl, CPI) or too small to move the needle. Bureau Veritas remains constrained by market overhang risk and subdued sentiment around potential Wendel placements. Meanwhile, leverage is hovering near internal limits (c. 20% LTV), leaving little room for new acquisitions until cash proceeds from disposals start flowing.

To bridge this transition, Wendel plans an outsized share buyback program of about €300 million (equivalent to 9% of capital) in 2026. It is, in effect, a way to buy time with investors while strategic repositioning unfolds. The repurchase should help narrow the extreme holding-company discount, but real value creation will depend on whether WIM can establish itself as a credible, competitive asset manager in a crowded European landscape.

The Investor Day outlined the architecture for a more predictable, fee-driven Wendel with lower balance-sheet risk and higher return visibility. The direction is bold: dismantling the company’s old structure to fund its own reinvention.

Fraport (FRA Germany): dividend return signals recovery, but accounting drag clouds 2026 optics

Fraport’s long-awaited dividend resumption marks an important psychological milestone for investors still wary of post-pandemic overhangs in the airport sector. The Supervisory Board has approved the business plan for 2026, which includes a proposed €1.00 per share payout, the first since Covid disrupted the group’s capital return policy.

The move reflects a clear shift in priorities: the worst of the capex-heavy expansion phase is finally behind the company, free cash flow is turning positive, and management is signaling enough balance sheet confidence to restart distributions while continuing debt reduction. The commitment to return to a 40–60% payout ratio over time re-establishes a framework that institutional investors had been missing for years. Symbolically, it confirms that Fraport now sees itself back in normal operating mode after a decade of simultaneous heavy investment in Frankfurt and abroad.

However, the good news is tempered by accounting reality. Management guided for a sharp hit to 2026 net income, mainly due to higher depreciation and interest expenses linked to the commissioning of new terminals in Frankfurt and Lima. While these are non-cash items, they will compress reported earnings more severely than previously expected; roughly €140 million in additional D&A and €90 million in higher interest costs as capitalized expenses phase out.

Investors were prepared for some drag, but not the full impact concentrated in a single year. The effect may shave around 10% off consensus 2026 EPS, even though the underlying cash flow profile is improving. It’s a timing issue rather than a structural one, but it underscores the challenge of communicating through a year when headline profitability and free cash flow tell opposite stories.

Structurally, Fraport’s fundamentals remain sound. Passenger traffic is stabilizing at near pre-pandemic levels, tariff increases at Frankfurt Airport provide visibility, and the opening of Terminal 3 should unlock new retail and capacity upside in 2027 and beyond. International assets continue to diversify earnings, particularly as emerging-market airports recover.

Yet, with near-term earnings optics still pressured by non-cash distortions, the risk–reward looks balanced rather than compelling. The dividend comeback is meaningful, but the real investment case hinges on 2027, when normalized earnings should better reflect the company’s true cash-generating potential.

Vidrala (VID Spain): a modest Latin American move that adds reach, not rerates the story

Vidrala’s acquisition of Chile’s Cristalerías Toro marks another small but deliberate step in the group’s gradual internationalisation strategy. The €77 million transaction, valued at roughly 6.4x estimated 2025 EBITDA, gives Vidrala full control of a glass packaging operator it already knew well, having provided technical support to Toro in recent years. Toro brings about €70 million in annual sales and €12 million of EBITDA, less than 5% of Vidrala’s own 2025 estimates, and operates a single plant near Santiago with an installed capacity of 145,000 tonnes.

The strategic rationale is straightforward: deepen exposure to faster-growing Latin American markets, notably Chile and Brazil, and offset the structural stagnation of glass demand in Western Europe. For a company that has historically grown through disciplined reinvestment and bolt-on acquisitions, this is a logical, if unsurprising, addition.

The deal modestly expands Vidrala’s geographic footprint but not its margin profile. Toro’s EBITDA margin of roughly 17% compares unfavourably with Vidrala’s near-29% profitability, leaving limited immediate uplift to consolidated earnings. Management nonetheless sees scope for operational improvement; leveraging Vidrala’s technical expertise, efficiency standards, and procurement scale to narrow the margin gap over time.

The deal also demonstrates Vidrala’s continued preference for fully controlled, cash-funded acquisitions with minimal balance sheet risk: net leverage will remain below 0.5x EBITDA even after closing, underlining the group’s conservative financial posture. For a business as cyclical and capital-intensive as glass manufacturing, that prudence remains a core part of the equity story.

That said, the broader challenge remains unchanged. Vidrala’s European operations face subdued consumption trends, particularly in alcoholic beverages, and weak pricing power in certain end-markets. Expanding into Latin America offers diversification but not yet scale, and with Latin America accounting for just 15% of sales post-acquisition, the group’s trajectory remains tethered to the slow-growth dynamics of Iberia and the UK. The Toro acquisition is a sensible, well-priced strategic fit that incrementally improves growth visibility but does not materially change the investment case.

Vidrala remains a quality operator with a clean balance sheet and steady execution, yet near-term upside looks capped by demand softness in its core regions.

Sava Re (POSR Slovenia): steady guidance, cautious outlook as nat cat risk normalizes

Sava Re’s 2026 guidance lands almost exactly where the market expected, reinforcing its reputation for consistency but offering little by way of surprise.

Management projects at least 5% topline growth next year, with momentum still anchored in the non-EU and reinsurance businesses, where double-digit expansion remains achievable. The group continues to see structural opportunity in underpenetrated markets across Southeast Europe, especially in non-life and specialty lines beyond mandatory motor insurance. Within the EU, the focus will remain on cross-selling, digital service integration, and gradual customer acquisition rather than aggressive expansion.

Return on equity is guided above 12% and the combined ratio below 93%, reasonable but unambitious figures that imply some margin compression as catastrophe budgets revert to more typical levels. The group now expects around €50 million in nat cat losses, roughly in line with the two years preceding 2025 but about €20 million higher than this year’s unusually benign claims environment.

This return to normalized losses, coupled with softer reinsurance pricing, underpins a more cautious earnings trajectory for 2026. Management expects net profit to exceed €95 million, a touch below 2025’s anticipated €108 million, reflecting both a weaker technical result and slightly higher loss assumptions. Still, profitability remains robust for a regional composite insurer: Sava’s underwriting discipline, strong solvency (around 215%), and well-diversified portfolio continue to distinguish it from smaller local peers.

The emphasis on digital transformation also suggests a gradual evolution in the business model; expanding online distribution channels, automating claims management, and embedding AI-driven risk analytics to enhance efficiency. This technology-driven angle is increasingly central to the company’s identity, allowing Sava to extract operational leverage even in slower-growth European markets.

Sava Re remains well-capitalized and prudently managed, but earnings growth is likely to flatten as external conditions normalize. The group’s dividend yield, near 4%, remains respectable, though slightly below the sector average. At roughly one times book value, valuation looks fair for a company whose risk–return profile is steady but unspectacular.

The latest guidance underscores a disciplined insurer preparing for a more challenging underwriting cycle: still solid, still reliable, but offering limited catalysts until either reinsurance pricing or regional growth dynamics turn decisively more supportive.

Schneider Electric (SU France): digital leadership extends its runway into 2030

Schneider Electric’s latest capital markets day in London effectively marked the start of its next strategic cycle under CEO Oliver Blum, one year into the job.

The message was continuity with conviction: the group reaffirmed its medium-term ambitions but extended the horizon to 2030, underlining confidence in its structural positioning at the intersection of electrification, automation, and digitalisation. Management is targeting organic revenue growth of 7–10% annually through 2030, driven primarily by North America and by expansion in software, services, and recurring digital revenue, all areas that enhance visibility and resilience.

By the end of the decade, over 70% of sales are expected to come from digital solutions, up from 60% today, with software and services alone reaching a quarter of total revenue. Return on capital employed is projected to rise to between 15–20%, while cash conversion should remain near 100%, maintaining the balance sheet flexibility that underpins Schneider’s disciplined M&A and buyback strategy.

Operationally, the group continues to see its addressable markets expanding at roughly 6–7% per year, with data centers and networks leading at a double-digit pace. This segment, already a quarter of sales, remains Schneider’s most powerful structural growth engine as global power demand, AI compute intensity, and thermal management complexity all accelerate. Meanwhile, the company is tightening its execution levers: productivity savings of €2–2.5 billion, mix improvement from higher-margin software, and ongoing pricing discipline should deliver a cumulative 250-basis-point organic uplift in EBIT margin between 2026 and 2030. The automation division, which has been through a difficult normalisation period, is expected to regain an 18% adjusted EBIT margin by 2028 as cyclical headwinds ease and efficiency measures take hold.

Strategically, the group’s capital allocation priorities remain unchanged: maintain its strong credit rating, grow the dividend progressively, execute selective disposals (€1–1.5 billion) and a €2.5–3.5 billion share buyback through 2030.

The combination of consistent growth, operational improvement, and disciplined balance sheet management positions Schneider as one of the highest-quality compounders in the European industrial space.

If you appreciate this post, feel free to share and subscribe below!