Trades, coatings and potential recoveries

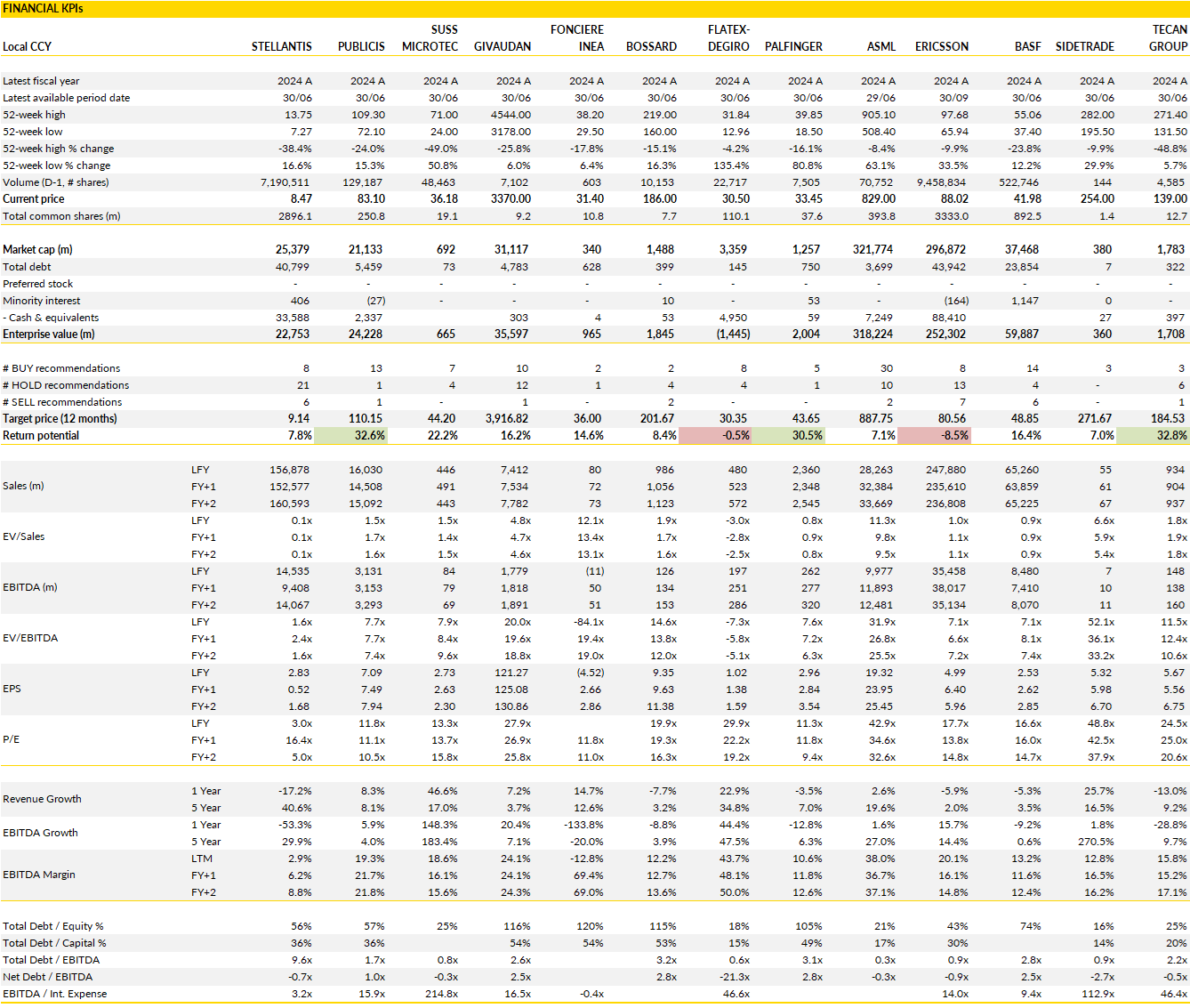

Stellantis, Publicis, SÜSS MicroTec, Givaudan, Foncière INEA, Bossard, FlatexDEGIRO, Palfinger, ASML, Ericsson, BASF, Sidetrade, Tecan Group

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

Financial KPIs

Stellantis (STLAM Italy): The rebound begins, but conviction remains elusive

For Stellantis, the quarter seems to have brought a much-needed dose of relief. Shipments rose 13%, marking the first quarterly increase since 2023 and finally hinting at stabilization in a bruised global auto cycle. North America led the charge, helped by fleet sales and an easier comparison base, while other regions showed patchier progress.

The short-term picture looks better, but it’s still too early to call a full turnaround. Beneath the rebound in shipments lies a company still wrestling with structural issues: weak pricing power in Europe, a soft product cadence in key brands, and limited clarity on how new management intends to fix them.

While the market will off course welcome the ‘recovery’, it will be waiting for proof that growth can actually translate into profits.

The US remains Stellantis’s swing factor. The recent uptick in market share and new model launches offer a shot at momentum, yet execution risk is high given rising tariffs and fierce competition. Europe continues to underperform, with market share erosion and temporary plant shutdowns weighing on margins. The so-called “third engine” regions (Latin America and the Middle East) are still profitable, but not enough to offset the challenges in mature markets.

Management’s ambition to return to breakeven in the second half is plausible, but the visibility on 2026 targets remains thin, leaving cautiousness about the real pace of recovery.

In the bigger picture, Stellantis feels like a company searching for its next identity. The merger gave it scale, but not yet coherence; its brands remain fragmented, and its electric strategy lacks the crispness of its peers.

The bounce in volumes is encouraging, but without clearer strategic direction and consistent execution, it may not yet mark a true inflection point. For now, investors have reasons to watch, but not to rush back in.

Publicis Groupe (PUB France): Still setting the pace as AI turbocharges its edge

Publicis keeps proving that consistency can still surprise. The group once again outperformed market expectations in Q3, notching 5.7% organic growth and prompting management to raise full-year guidance.

What’s interesting is that the growth is coming from genuine structural momentum across clients and geographies. Demand for its data-driven and AI-enabled offerings, particularly within Epsilon and Sapient, continues to accelerate, turning Publicis into the de facto tech platform of the advertising world. The model that blends creative, media, and digital transformation is working, and it’s increasingly hard for traditional rivals to replicate.

North America remains the engine of the story, growing more than 7% organically, with digital and data-led solutions continuing to take share. Europe was more uneven, held back by softness in France and Germany, though the UK remains a bright spot. Meanwhile, Asia-Pacific’s 6% growth underlines the group’s broad resilience, even as China normalizes.

The key takeaway is that Publicis continues to show balanced performance across regions and product lines, which is a rare feat in a fragmented industry still digesting structural shifts. What really moves the story now, however, is AI: the group’s early investments in proprietary AI tools and data integration seem to begin paying off as clients redirect budgets toward measurable performance and personalized engagement.

So the focus is more about a new foundation for sustainable growth. Publicis’s transformation from a creative agency network into a data-and-technology-driven platform is largely complete, positioning it as one of the few European players with real leverage in the AI economy.

With strong cash generation, an strong margins and steady share gains across clients, the valuation still doesn’t seem to fully capture the previously mentioned shifts.

SÜSS MicroTec (SMHN Germany): AI megaprojects to the rescue?

After a long stretch of hesitation, sentiment around SÜSS MicroTec seems ready to shift gears.

The German semiconductor equipment maker, long buffeted by cyclicality in memory spending, finally appears to have most of the bad news priced in. The stock, down a third this year, is still trading at depressed multiples that assume little to no recovery in sight, yet the setup for a turnaround is quietly taking shape.

With the market for advanced memory packaging showing early signs of revival and new AI-driven infrastructure projects stirring global capex, SÜSS could be heading into a phase where expectations start working in its favor again. The company’s role in high-bandwidth memory (HBM) bonding tools makes it a direct beneficiary of renewed investment from giants like Samsung and Micron, which are preparing for the next generation of AI data processing demands.

The short-term outlook still looks transitional, with 2026 set to absorb a temporary slowdown after two exceptionally strong years. But what matters is that the trough appears shallower than feared. The lull in HBM investments that hurt orders in early 2025 may soon reverse as industry approvals and AI megaprojects - including those involving NVIDIA and OpenAI - push chipmakers to expand capacity again.

SÜSS’s core bonding segment, roughly a third of total revenue, stands at the center of this inflection. Meanwhile, other divisions such as Coating and Imaging are holding their ground, with steady demand from packaging specialists and robust activity in UV projection tools for AI chip applications. Only the Photomask cleaning business remains soft, hit by a cooling Chinese equipment cycle, but it’s likely to recover alongside broader semiconductor spending later next year.

Beyond the cyclical chatter, SÜSS MicroTec’s appeal lies in its leverage to structural growth areas like advanced packaging and AI data infrastructure. The company’s mix of niche technologies and close customer relationships gives it operating resilience that often gets overlooked in volatile markets. As memory manufacturers pivot toward more complex architectures like HBM4, SÜSS’s tools will become increasingly critical in maintaining yield and precision.

After years of investors bracing for bad news, the stage may finally be set for positive revisions and a rerating of a stock that looks fundamentally too cheap for its technological relevance.

Givaudan (GIVN Switzerland): Holding its fragrance while growth normalizes

Givaudan continues to navigate the post-boom normalization phase with precision. The latest quarter showed another solid performance, with 4.4% like-for-like growth driven primarily by volume gains and resilient demand across both fragrance and taste businesses.

The standout once again was Fine Fragrances, where double-digit growth over tough comps underscores the group’s unique positioning with global luxury brands. Consumer Products also remained steady, helping offset softness in Ingredients and Active Beauty, which are still struggling on last year’s exceptional highs and weakening end markets. The result is continued growth (above the market) even as global consumer spending cools.

Taste & Wellbeing posted modest but consistent growth, with healthy momentum in snacks and dairy and stabilization across North America. The drag came from Asia-Pacific, where a few markets are still working through elevated comps.

Input cost inflation remains manageable, with Givaudan’s pricing discipline and natural hedges helping protect margins. Management reiterated its confidence in achieving roughly 5.5% organic growth for the full year and an EBITDA margin above 24%.

After years of premium valuation, Givaudan’s multiple has somwhat reset, bringing it closer to fair value but not yet offering a clear catalyst for re-rating ioo. The fundamentals, market leadership, diversification and balance sheet strength, remain impeccable, but growth has shifted back from extraordinary to steady.

Foncière INEA (INEA France): Staying steady as disposals reset the balance sheet

Foncière INEA’s nine-month update reinforced the sense of quiet consistency that has defined the group’s year.

Revenue rose nearly 5% on a like-for-like basis, continuing the same moderate pace of growth seen earlier in 2025, while management pressed ahead with its plan to simplify the portfolio and reduce leverage. The slight slowdown in headline growth simply reflects fewer project deliveries, a deliberate choice as the company focuses more on asset quality and selective development than expansion for its own sake.

With a portfolio anchored in regional business parks and energy-efficient offices, INEA continues to benefit from solid tenant demand in secondary French cities, where modern office supply remains scarce and rents are well supported.

The most notable update lies in capital rotation. The company completed its first two non-core disposals (small assets in Nancy and Strasbourg sold at book value) and confirmed that a larger €22 million disposal program remains on track to close before year-end. These sales are modest in scale but nonetheless significant in message: INEA is methodically shifting toward a leaner, more sustainable balance sheet, targeting an LTV below 50%. The proceeds also free up flexibility for pipeline development projects.

While the political backdrop in France adds a layer of uncertainty, INEA’s fundamentals look remarkably solid. Its portfolio is composed largely of new or refurbished regional offices, an area of structural undersupply, and long leases indexed to inflation continue to provide a reliable cushion to income.

In short, operational execution remains strong, disposals are progressing smoothly and cash flow visibility is improving. INEA may not deliver fireworks, but certainly stability.

Bossard (BOSN Switzerland): Signs of stabilization as volumes turn positive again

After a sluggish first half, the fastening and logistics specialist has managed to return to organic growth territory in the third quarter, helped by both a pickup in underlying demand and the steady integration of Ferdinand Gross, its most recent acquisition.

Reported sales grew 10% year-on-year, roughly 4% organically, marking the first clear sign that volumes are stabilizing after several quarters of erosion. The performance was broad-based; America and Asia led the way, while Europe finally edged back into positive territory. FX headwinds remain an unavoidable drag, but overall the top line beat market expectations by around 3%, giving investors a glimpse of a potential change in momentum.

Management’s tone remains measured. The new full-year outlook, with sales of around CHF 1.06 billion and an EBIT margin near 10%, signals that the recovery is real but not yet robust. The acquisition-driven boost is doing its part to cushion slowdowns elsewhere, and the company continues to manage costs and pricing effectively.

What’s more interesting is the emerging green shoot in the US and Asia, regions benefiting from ongoing supply chain diversification and production relocations. In Europe, sectors like aerospace and electronics are holding up better than traditional industrial clients, hinting that Bossard’s diversified exposure remains a quiet advantage.

The upcoming strategy day later this month is likely to highlight continuity rather than reinvention. The focus will be on operational efficiency, cultural alignment, and incremental growth, particularly through Smart Factory Solutions, which now accounts for roughly a quarter of revenues and ties neatly into automation trends.

For now, the company’s fundamentals look sound but not yet compelling enough to justify a strong change in momentum in our view. Bossard is slowly regaining its footing, proving it can deliver steady growth even as the broader manufacturing cycle remains patchy. But investors may need a few more quarters of evidence before confidence fully returns.

FlatexDEGIRO (FTK Germany): Strong trading quarter sets stage for another guidance lift

FlatexDEGIRO looks set to extend its streak of positive surprises. Ahead of its Q3 earnings release, the online broker continues to benefit from elevated trading volumes and a loyal retail base that has remained active even as rate tailwinds begin to fade.

Revenues are expected to climb ~20% year-on-year, with commissions (the company’s key growth driver) up even more. While interest income is softening due to lower rates, the combination of higher cash balances and margin loans is helping offset some of the drag. The net result should be another quarter of double-digit profit growth and, most likely, another upgrade to full-year guidance.

The company also launched securities lending in the Netherlands and Spain, expanding a potentially lucrative new revenue stream that taps into its €20 billion-plus customer asset base. The rollout offers retail investors an extra yield while providing Flatex a steady, low-risk income source. Though the near-term financial impact is modest, the initiative strengthens the platform’s ecosystem and reinforces its positioning as one of Europe’s most scalable retail brokerage network. Management’s decision to expand cautiously but consistently across markets continues to pay off, as the firm builds depth in customer engagement rather than just chasing new accounts.

That said, valuation limits the excitement. Trading at roughly 22x forward earnings, the stock already reflects much of the operational improvement, and while Flatex remains cheaper than Nordic peers, it trades at a hefty premium to its own long-term average. The business is firing on most cylinders again, but without a clear structural growth catalyst beyond trading activity, the risk/reward balance feels fair.

Palfinger (PAL Austria): Lifting ambitions with a decade-long roadmap

At its recent Capital Markets Day in Vienna, Palfinger unveiled its “Reach Higher” 2030+ strategy, an ambitious roadmap that aims to push the group beyond €3 billion in annual sales, with a 12% EBIT margin and a 15% return on capital employed.

In summary, behind the presentational CMD slogans lies a more fine-tuned vision for a company that has spent years shifting from a product manufacturer to a full-lifecycle solutions provider. The emphasis going forward will be on raising customer value through continuous innovation and integrating digital services, supported by R&D spending (>4% of revenues).

Growth will be anchored by expanding the higher-margin services business (Palfinger wants to double service revenues to roughly €700 million by 2030 ) and by scaling its aerial work platforms and EMEA footprint. The company also continues to build out its global infrastructure, including a new plant in India and a spare parts hub in the US, both key to its regional diversification goals.

Still, the margin ambitions remain a stretch: Palfinger hasn’t reached double-digit EBIT margins since before the global financial crisis, and while recent progress has been tangible, structural headwinds persist. The 10% margin target for 2027 is a first test, and management’s focus on leaner operations, AI-driven logistics, and inventory optimization will need to deliver visible payoffs before the market fully buys in.

While the 2030 goals aren’t fantasy (achievable growth of 3–4% per year, mostly from services and the EMEA recovery), execution risks are real, especially with macro uncertainty and US tariffs still lingering.

Investors may not yet price in the long-term margin potential, but Palfinger’s low valuation and renewed operational discipline make it an appealing industrial compounder in the making. If management can deliver on even part of its plan, the company’s next lift may be higher than most expect.

ASML (ASML Netherlands): The AI wave reignites confidence in the long game

After a year of sector anxiety, ASML is back in the spotlight as the backdrop has changed dramatically: the AI-driven revival in memory and logic chips has reignited long-term optimism across the semiconductor landscape. With high-bandwidth memory (HBM) demand surging and investment cycles restarting at the big guys (Micron, Samsung and TSMC), ASML’s near-monopoly on advanced lithography tools puts it squarely at the center of the next semiconductor boom.

The near term remains a bit opaque (order intake is always the wild card) but the strategic outlook remains quite strong. The AI hardware build-out, spanning GPUs, CPUs, and memory modules, is translating into tangible capex recovery, particularly in areas where ASML dominates. The introduction of its next-generation High-NA EUV machines adds another layer of competitive moat, reinforcing a technological lead that no rival seems close to challenging.

In parallel, recent macro and political developments, including US support for domestic chip manufacturing and the stabilization of export restrictions, are adding to visibility after a volatile year.

ASML’s cyclical exposure will always make short-term earnings unpredictable, but the structural tailwinds are powerful enough to sustain a multiyear investment case. Demand for AI compute power, coupled with the industry’s need for efficiency gains at smaller nodes, plays directly to ASML’s strengths.

The group’s blend of scarcity value, deep technological barriers, and global strategic importance gives it a near-unique status in European equities. In essence, ASML is not just riding the AI wave, but it’s selling the shovels for the gold rush.

Ericsson (ERICB Sweden): Strong quarter hides structural stasis

While Ericsson’s latest quarterly report delivered the kind of headline beat that investors like to see, i.c. better-than-expected revenue, gross margin, and cash flow, the underlying story remains one of stagnation rather than renewal.

The improvement came mainly from cost discipline and prior restructuring efforts, and not from a genuine rebound in demand. Network sales, the core of the business, were down 5% year-on-year, and the long-declining radio access network (RAN) market remains flat at best. Still, the company deserves credit for executing cleanly: an adjusted EBITA margin of 28% (versus consensus at 26%) and a solid SEK 6.6 billion in free cash flow show that Ericsson can deliver when it tightens the screws on expenses.

Regional trends were mixed. North America, long the company’s profit engine, continues to shrink, offset by modest growth in Europe, Africa, and Japan. The Enterprise segment looked weak on the surface, but that’s mostly noise from the one-off gain tied to the Iconectiv divestment. The balance sheet remains robust, with SEK 51.9 billion in net cash; enough firepower for buybacks or special dividends if management dares to use it.

That said, the strategic backdrop is uninspiring. The RAN market has stopped expanding, cloud software remains a slow grind, and despite new partnerships like the one announced with Vodafone, Ericsson’s growth horizon looks narrow.

The company is doing the right things operationally, i.c. cutting costs, stabilizing margins, managing cash, but these are defensive moves, not growth initiatives. Without a new technology cycle to reignite demand, Ericsson risks remaining a well-run, cash-rich company trapped in a structurally ex-growth industry.

The quarter was better than feared, but it doesn’t change the long-term story: this is a business efficiently buying time, not breaking new ground.

BASF (BAS Germany): Unlocking value, cash first, complexity later

BASF is taking some big steps in the right direction. That is, turning complexity into (big) cash.

The group’s sale of a 60% stake in its automotive and industrial coatings business to Carlyle marks a major milestone in its long-promised portfolio reshaping. With an enterprise value of €7.7 billion, the deal landed well above market expectations and will bring in roughly €5.8 billion in pre-tax proceeds when it closes in mid-2026. Add to that earlier divestments, such as the Brazil decorative paints sale, and BASF will have monetized nearly €9 billion of assets at close to 13x EBITDA, which is an impressive multiple for a sector still weighed down by weak sentiment.

The result is a leaner balance sheet, a cleaner structure, and enough firepower to fund both deleveraging and shareholder returns well before next summer. Management expects about €7 billion in cash inflows from disposals and government guarantees over the next year, giving it flexibility to start its €4 billion share buyback earlier than planned while keeping leverage in check. With that, net debt could fall to ~€14 billion, or roughly 2.2x EBITDA, a much healthier level than the market had assumed a few quarters ago.

The broader message here is strategic discipline: BASF is not chasing growth but focusing on asset quality and capital efficiency. This kind of self-help story doesn’t often come from cyclical industrials, but BASF’s mix of cash generation, asset sales, and a resilient dividend yield above 5% makes it stand out even as the chemical sector struggles with demand weakness and price deflation.

What remains is the core; businesses spanning specialty chemicals, ag solutions, catalysts, and battery materials, trading at around 6x EBITDA, a steep discount to peers (20-30%). That discount reflects skepticism about structural profitability, but the company’s recent deals show there’s real value embedded in the portfolio. In effect, BASF is demonstrating that private markets see it as worth more than public markets do.

The next year may not be about growth, but it will almost certainly be about value creation.

Sidetrade (ALBFR France): Expanding east, scaling fast

Sidetrade’s acquisition of Australia’s ezyCollect looks small on paper but could be transformative. The deal instantly adds more than 15% to group revenue and gives Sidetrade a strong foothold in the Asia-Pacific region, a key gap in its geographic footprint until now.

With ezyCollect focused on mid-market order-to-cash software, the acquisition complements Sidetrade’s enterprise offerings, opening up a much larger pool of potential clients for its AI-powered credit management platform.

The €37 million purchase price, less than 4x 2026 revenue, looks disciplined for a fast-growing SaaS player that’s expected to post 30% annual growth. Funded through cash and modest debt, it’s also financially prudent, leaving Sidetrade’s balance sheet intact and still well within comfort levels.

Strategically, this is Sidetrade’s (intended) playbook: integrating smaller, niche players to expand its ecosystem and data pool. Beyond scale, the deal adds new capabilities, notably in electronic payments, and provides a regional platform to distribute Sidetrade’s upcoming agentic AI suite, aimed at automating financial workflows for SMEs.

The timing also makes sense; 2025 has been a transitional year, with growth temporarily slowing as the company invests in its next generation of products. This move both offsets that lull and positions Sidetrade for faster scaling once macro conditions improve.

The deal reinforces Sidetrade’s credibility as a consolidator in the SaaS credit management space, one that can consistently add double-digit top-line contributions without overpaying.

With 75% of revenues now generated internationally, Sidetrade is evolving into a truly global software player. Management’s ambition to cross the $100 million revenue mark by 2027 looks increasingly realistic, and the company continues to operate with the discipline and focus of a founder-led business.

Tecan Group (TECN Switzerland): Weak guidance, strong value case

Tecan’s Q3 update may have underwhelmed the market, but beneath the surface, the story is improving.

Sales grew msd in local currencies, marking the second consecutive quarter of sequential recovery, though currency headwinds and potential US tariffs are clouding the near-term picture. The company reiterated full-year guidance but hinted that results will likely land toward the lower end of its range, which was a cautious tone that spooked investors more than it should have.

For now, the issue isn’t operations but optics: FX drag and tariff risks are temporarily masking genuine progress in orders, margins, and product mix. Operationally, Tecan is executing steadily. The backlog remains robust, with a book-to-bill ratio above 1, suggesting that order intake continues to outpace shipments.

The company is also streamlining its portfolio and improving efficiency, even as cost pressures from tariffs and the stronger Swiss franc bite into margins.

Adjusted EBITDA is now projected around CHF 141 million for 2025, a step down from prior estimates but still healthy given the circumstances. Management remains confident that demand will stabilise further in 2026 as lab automation spending resumes, particularly in diagnostics and life science research.

Nonetheless, the comapny’s valuation tells a different story than sentiment. At less than 10x forward EBITDA, well below its long-term average and peers, Tecan looks quite undervalued. The group’s fundamentals remain intact: recurring revenue from consumables, a loyal customer base, and leadership in liquid handling and diagnostics automation. The market’s pessimism seems excessive, especially given that FX and tariffs are temporary rather than structural drags.

With an improving demand backdrop and very low expectations baked into the share price, Tecan could offer a classic recovery setup: steady business, cyclical pressure, and an attractive entry point for patient investors.

If you appreciate this post, feel free to share and subscribe below!