Tires, weapons and drugs

Nemetschek, Nacon, Thales, Michelin, Generali, CFE, Neinor Homes, Ørsted, Adidas, Formycon

Nemetschek (NEM) Knocking it out of the park with impressive 2024 results

Nemetschek revealed its preliminary results for 2024, and it’s safe to say they’ve knocked it out of the park. The company reported revenue hitting around €996 million, which is a solid 17% jump from the previous year and a few percent higher than what analysts were expecting. Organic growth, which strips away the effects of acquisitions and currency swings, was strong at 14%. This number not only smashes the guidance range of 10% to 11% but also leaves the consensus figures in the dust. The real magic seems to have happened in the fourth quarter, where the design and build segments really picked up steam.

So, what’s behind this stellar performance? A big chunk of it comes from Nemetschek's strategic shift in the design segment. They’ve been phasing out license sales, with Graphisoft no longer being sold under license in 2025, and have instead focused on moving customers to subscription contracts. This transition has been a game-changer, driving substantial revenue growth. Additionally, their acquisition of GoCanvas has been a steady contributor, adding around three percentage points to their growth, just as expected.

Nemetschek’s EBITDA margin is also looking healthy, clocking in at over 30% and again higher than consensus estimates. Even when accounting for the acquisition of GoCanvas, the fourth quarter saw year-over-year margin improvements. The company is set to release the final figures for 2024 along with its 2025 outlook in March, and it seems like they’re on a roll with excellent execution and strong momentum.

The market clearly liked what it saw, with Nemetschek's stock price getting a nice bump following the announcement. The shift to a subscription-based model is proving to be a wise move, driving consistent growth and setting the company up nicely for 2025.

While it’s true that some of the factors contributing to this year’s performance, like the exceptional license sales, might not be permanent, Nemetschek is still well-positioned for continued success. Their strategic decisions and execution have not only paid off this year but have also laid a strong foundation for the future.

Nacon (NACON) Mixed bag in Q3 but brighter days ahead

Nacon recently dropped its Q3 2024-25 revenue numbers, and they came in with a bit of a thud. Revenue was down 10% year-over-year, landing at €52.9 million, which was slightly shy of what analysts had forecasted. The main culprit? A pretty steep drop in their catalog sales. These took a nosedive, falling 53% from the same period last year. The quarter saw only one new game release, Racing, which didn’t quite have the oomph to make up for the lack of momentum from titles launched earlier in the year.

But there are some bright spots in their portfolio. The back-catalogue business, which makes up 30% of their Q3 revenue, actually grew by a solid 25% year-over-year. This segment seems to be humming along nicely, which is good news for the company. And let’s not forget about their accessories division, which accounted for nearly half of Q3 sales. This segment posted a respectable 5% increase, thanks in part to recent launches like the RIG headsets and PS5 handsets.

Looking ahead, Nacon is cautiously optimistic. They’re expecting a slight uptick in revenue for the full fiscal year, although EBIT might see a dip compared to last year. This was already in line with what the consensus had anticipated.

The good news is that the fourth quarter looks a little more promising. They have three new games slated for release: Rugby25, Dragonkin, and Ambulance Life. These titles should help inject some new energy into their lineup. Plus, the accessories business is expected to continue its upward trend, which should provide a nice boost.

While the Q3 results might not be the blockbuster performance that some might have hoped for, Nacon’s future is starting to look brighter. They’re gearing up for a stronger lineup of games and new accessory launches in the next fiscal year, which could lead to improved financial results.

For now, though, the company remains focused on enhancing its offerings and delivering long-term value to its shareholders. With a strategy centered around sustainable growth and innovation, Nacon seems poised to navigate through its current challenges and emerge stronger on the other side.

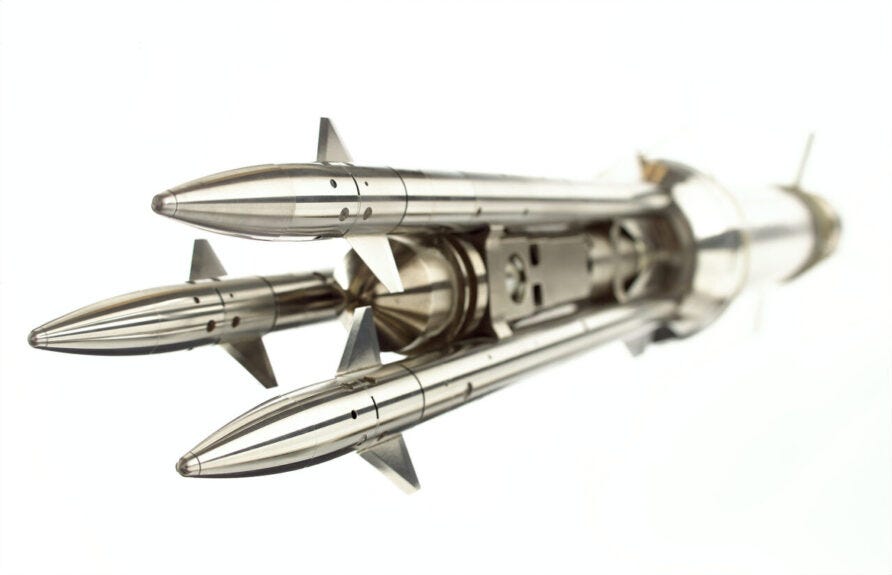

Thales (HO) Defense sector leads the charge for a strong 2024 finish

Thales is making some waves as it gears up to close out 2024 on a high note, with its defense sector leading the charge. The defense segment continues to be a powerhouse, driving the bulk of this growth. Despite some challenging comparisons from previous years, Thales is holding its ground, and cyber and digital sectors are also playing their part, although there’s been a bit of a slowdown in the banking segment due to longer-than-expected destocking.

The defense division is particularly noteworthy, with margins potentially hitting over 13% thanks to operational leverage. And let’s not forget about their impressive book-to-bill ratio, which is expected to be 1.2x for FY24. This is buoyed by some significant order intakes, including contracts for radar satellites and Rafale jets, which are adding to their already strong order book.

As Thales looks ahead to 2025, we’re expecting more of the same, ic organic sales growth between 5% and 7%. Thales is well-positioned to capitalize on growth opportunities, especially in the cyber and digital domains. The company’s order book is robust, and its market position remains strong, making it a compelling player in the defense sector.

The company is on a solid trajectory, with its strategic focus on defense and digital sectors paying off. The company’s ability to consistently deliver strong results, even in the face of challenging market conditions, speaks to its resilience and strategic acumen.

As they continue to navigate the complexities of the global defense landscape, Thales is poised to capture new opportunities and drive sustainable growth. Investors and industry watchers will be keen to see how Thales leverages its strengths in the coming year, and we believe there’s plenty of optimism that the company will continue to deliver strong performance and value. Thales definitely remains a name to watch in the defense industry.

Michelin (ML) Cruising through 2024 with an eye on steady growth

Michelin is wrapping up 2024 with some reassuring news for its investors. The latest data from December confirms that the end of the year has been pretty much in line with expectations. Global replacement volumes have been positive, although original equipment (OE) volumes are still a bit of a mixed bag—flat for light vehicles and slightly negative for trucks.

When it comes to the passenger car segment, Europe continues to be the growth driver in replacement tires, even though OE is still weak across both Europe and the U.S. December numbers showed a flat performance in passenger car OE, with declines in Europe and North America but a bump up in China, thanks to government subsidies for new energy vehicles. On the replacement side, the market was strong globally, with Europe leading the charge due to sell-in sales of winter and all-season tires. North America and China also saw growth, albeit for different reasons—easier comparisons in the U.S. and a smaller increase in China.

In the truck segment, OE remains weak, but replacement demand saw a slight uptick, primarily driven by Europe. It’s been a tough year with global declines in OE, especially in Europe and North America. However, South America saw a rebound following a significant drop in 2023 due to new anti-pollution regulations. Replacement demand in North America is normalizing after a surge in the first half, driven by Asian tire imports. Europe’s replacement market also saw positive growth.

But overall, things seem to be tracking well with what was anticipated, both by Michelin and market consensus, which was pegged at a 5.4% decline for the full year. The big story, however, is around free cash flow, where there’s potential for some upside thanks to better working capital management and lower capital expenditures. For 2025, Michelin could see earnings improve, despite flattish volumes, given a favorable mix, FX benefits and restructuring efforts.

Michelin remains a very interesting play in the sector. The volume hiccup in the second half of last year was largely due to temporary factors—economic headwinds, destocking, and some cyclical challenges.

Now the worst seems to be behind them. While a significant short-term recovery isn't expected, the SR3 segment is anticipated to bounce back over the next couple of years, improving overall volume momentum. The company’s strategic cost-cutting measures and strong exposure to the U.S. market compared to other European auto names add to its appeal.

Michelin's earnings trajectory through 2026 appears attractive, positioning it as a defensive yet promising player in the auto sector. With a rock-solid financial standing, including robust free cash flow and a healthy balance sheet, Michelin is a standout in a competitive field.

Generali (G) Big moves in asset management with BCPE partnership

Generali has teamed up with BPCE in a major move that’s set to shake up the asset management world in Europe.

The two giants have signed a memorandum of understanding to combine their asset management businesses, creating a joint venture that will catapult them to the position of the second-largest asset manager in Europe, only behind Amundi. The joint venture will manage around €1.9 trillion in assets under management (AuM), pulling together €1.2 trillion from Natixis IM and €0.6 trillion from Generali Investment Holding (GIH). This venture is a big deal, as it merges the multi-boutique business models of both groups, creating a diversified platform with a hefty 61% of AuM based in Europe and 34% in the U.S.

The joint venture will have ownership and management evenly split between the two groups. The ownership will be split 50-50 between GIH and BPCE, with Cathay Life remaining a long-term partner through its stake in GIH.

In terms of financial impact, the partners expect cost synergies of about €170 million per year, which is roughly 10% of the addressable cost base. Revenue synergies are expected at ~€40 million by year five, excluding additional revenues from Generali’s commitment to pump €15 billion in seed money into the joint venture over five years.

The deal is expected to be accretive to earnings from year one, excluding restructuring costs and a preferential dividend paid to BPCE. In the medium term, the deal promises a 2-3% annual accretive impact on earnings, with no expected impact on Generali’s solvency ratio.

While this strategic move is a positive step for Generali, it’s important to note that the cost synergies are somewhat limited due to the multi-boutique model, which affects the overall accretive impact. Despite this, the venture is a significant strategic win, positioning Generali favorably for future growth in the asset management space.

New three-year strategic plan expected at the end of January.

CFE (CFEB) Ready for a rebound with new energy projects on the horizon

CFE is gearing up for a comeback, thanks to some exciting new energy projects in the pipeline.

They’re making waves with their latest big move, the D-STOR project, a major battery storage initiative. It’s a team effort between BSTOR and Duferco Wallonie, packing a hefty €70 million price tag. This project will roll out a 140 MWh battery park powered by 36 TESLA Megapacks, boasting a connection power of 50 MW. They’re aiming to have it up and running by summer 2026.

Eneco is on board as the buyer, locking in a long-term deal with D-STOR for flexibility purchase. The project’s funding comes from a mix of equity and a bank loan covering about 55% of the costs. This venture is part of BSTOR's ambitious plan to hit over 400 MWh of battery storage capacity by the end of 2026.

Even though CFE has faced some hiccups in the real estate markets in Belgium and Luxembourg, they’re feeling positive. They’re predicting a slight dip in revenue for 2024 but expect net income to stay close to this year’s figures. Things are looking up for them in Poland, with a big boost expected in the latter half of the year. Plus, their Multi-technics segment is picking up steam with a solid backlog of orders.

As the market gets better, CFE is all set for a rebound, with the possibility of earning more in 2025.

By the end of Q3 2024, CFE’s order backlog hit €1.42 billion, a 12% jump from last year, showing a promising lineup of projects. Although they’re dealing with tough project development conditions in 2024 and the removal of lucrative offshore wind subsidies, earnings should hit the low point this year.

Neinor Homes (HOME) Steady path with promising growth and dividends

Neinor Homes just dropped its early financial results for 2024, and everything's pretty much on target. They posted an adjusted net profit of €65 million, which hits the mark they and analysts were expecting. Sure, that's a 28.3% drop from last year, but it was on the cards due to a slimmer gross margin. We’ll get the full scoop on February 25.

On the sales front, Neinor crushed it with pre-sales of around 2,600 housing units in 2024, raking in about €840 million, JVs included. Their core build-to-sell biz alone hit pre-sales of about 2,100 units, marking a 47% jump year-over-year. By the end of 2024, their order book, JVs included, topped 3,600 units, valued at around €1.3 billion, reflecting a strong market and the quick growth of their JV operations.

Sticking to their big plan, Neinor is on track to dish out €450 million in dividends from 2023 to 2025, aiming for €600 million by 2027. By the end of 2024, they’ve already handed out €200 million, with another €125 million coming in Q1 2025. By early 2026, they plan to have doled out around €450 million since 2023.

For 2025 Neinor's all about boosting earnings with an equity-efficient game plan. They’re leveraging existing JVs, inking new deals, and restarting their land-buying spree with a goal of €140 million in equity investment.

Even with the slight wiggle in net income, Neinor's in a good spot to take advantage of its growth strategy, especially through JV partnerships. Their dedication to dividend payouts and continued growth makes this one pretty interesting to keep an eye on.

Ørsted (ORSTED) Navigating new challenges with strategic adjustments

Ørsted just shared some early results, and they're dealing with some big write-downs tied to their U.S. operations. These losses add up to DKK 12.1 billion mostly due to higher interest rates, a fresh look at seabed lease values, and more delays for the Sunrise Wind project, which now won’t be up and running until the second half of 2027. Still, Ørsted hit their 2024 EBITDA target at DKK 24.8 billion, which is a bit better than what consensus was expecting.

The write-downs come from a few hits all at once: a 75 basis point bump in the weighted average cost of capital (WACC) because of rising U.S. interest rates, a DKK 3.5 billion smack from revaluing seabed leases, and extra costs and holdups with the Sunrise Wind project. These have made Ørsted rethink project costs, especially for monopile foundations, leading to this hefty impairment charge for Q4 2024.

The way their portfolio reacts to interest rate changes shows they need to keep reassessing things. Even though the seabed lease impairments cut down their book value, Ørsted still sees these assets as strategically valuable because of the long-term promise of the U.S. offshore market.

The Sunrise Wind project, now aiming for a mid-single-digit IRR, underscores the hurdles in making these projects profitable. The recent write-downs and the ~5% IRR forecast for Sunrise Wind suggest it’s time to re-evaluate assumptions in our opinion.

Adidas (ADS) Sprinting ahead with strong quarter and promising outlook

Adidas has turned heads with its recent Q4 2024 preliminary results, showcasing exceptional growth and performance. The company reported a 19% yoy increase in currency-neutral revenues, reaching €5,965 million, significantly surpassing the consensus. Excluding Yeezy sales, the growth still impresses at 18% yoy.

Adidas also improved its gross margin by 520 basis points to 49.8%, and turned a previous operating loss into a profit of €57 million for the quarter. Full-year operating profit came in at €1,337 million, which is about 9% above consensus expectations.

The company attributes this success to growing consumer and retailer interest in both its Lifestyle and Performance divisions, with strong growth across all regions. Despite macroeconomic uncertainties, Adidas is committed to double-digit growth for its brand and aims to continue improving its operating profit, targeting a 10% margin.

2025 is shaping up to be a big year for Adidas, where it could hit DD% revenue growth and further strong margin expansion. We believe €2 billion EBIT is reachable, making it a ~50% increase yoy. This strong outlook, coupled with Nike’s statements about a potential sequential deterioration, suggests that 2025 could be a standout year for Adidas. The brand's popularity seems back on a growth track and market share gains indicate a solid competitive position.

We like this name into this year. The brand's momentum, coupled with strategic initiatives, positions Adidas as a key player in the sportswear industry, poised for more success.

Formycon (FYB) Making strides with new product approval and growth potential

Formycon just got a big win with the European Medicines Agency (EMA) giving the green light to FYB203/AHZANTIVE, a biosimilar to Eylea. It’s used for treating age-related macular degeneration (AMD) and other serious eye conditions.

This is Formycon’s third product to snag EMA approval, which is great news for their expanding lineup. It's already approved in the U.S., and now TEVA will be rolling it out across Europe (except Italy) and Israel. Formycon will also get a cut from payments due to Klinge and earn money for supplying the market through a commercialization deal for the MENA region.

Various estimates are floating out there, but FYB203 could hit peak sales of over €600 million by 2028. This estimate is based on a potential market worth €5-6 billion and taking into account a significant price cut (~50%) compared to Eylea’s sales.

Formycon’s got a promising future, with potential peak sales for its top four products (FYB201, FYB202, FYB203, and FYB206) possibly hitting over €2 billion by 2032. We should be eyeing an EBITDA margin over 50% over the next few years. The rollout of FYB203 and a possible U.S. marketing deal are expected to boost their share performance in the short term.

The recent EMA approval really boosts their market position and growth outlook. Their strategy of focusing on biosimilars and partnerships is setting them up for future success. As Formycon keeps growing its product range and exploring new market avenues, it’s definitely a standout player.

If you appreciate this post, feel free to share and subscribe below!