Telco towers, EV chargers and toilets

Cellnex, Whitbread, SGS-Bureau Veritas, McPhy Energy, Jerónimo Martins, Fastned, Rio Tinto, Esker, Geberit

Cellnex (CLNX) Shareholder distribution brought forward with €800m buyback plan

Cellnex, a major player in Europe’s telecom tower market, is making waves with its latest announcement. The company’s board has signed off on an €800 million share buyback program, which represents about 3.9% of its market value. This initiative will start once the sale of its Irish assets wraps up—expected in Q1 2025—and it’s set to run until the end of the year. The purpose? To reduce the number of shares on the market by canceling the ones it buys back. On top of that, Cellnex is increasing its Total Return Equity Swap Agreement from €150 million to €550 million and extending its maturity to mid-2026, all to make the most of current stock prices.

This move is a big deal for shareholders.

With Cellnex’s stock price sitting well below its potential, this buyback plan is a smart way to give value back to investors. The program’s size even beats the consensus expectations of €500 million, which shows just how confident the company is in its financial health. Importantly, this decision has been carefully coordinated with credit rating agencies, so there’s no risk to Cellnex’s investment-grade status. Even with the buyback, the company’s financial leverage is expected to stay within its target range of 5.0-6.0x net debt/EBITDA by the end of 2025.

This is more than just a financial move—it’s a statement.

Cellnex’s management promised to deliver on its new strategic plan, and this buyback is a big step in fulfilling that promise. It’s also a clear signal to investors that the company is focused on creating long-term value. Analysts are bullish, seeing strong growth potential and plenty of upside for the stock.

Whitbread (WTB) UK demand challenges persist, germany growth offsets impact

Whitbread, the parent company of Premier Inn, has had a bit of a mixed bag this quarter. In its Q3 2024-25 trading update, the company reported a 2% drop in group revenue compared to last year, with organic revenue slipping 1%. The UK market, in particular, has been tricky. Accommodation sales were flat, but on an organic basis, they were down 3%. RevPAR (revenue per available room) dropped 2.5%, with London seeing the steepest decline at 6.4%. The food and beverage segment also took a hit, with sales dropping 14% as the company continues to overhaul operations under its Accelerating Growth Plan.

But it’s not all bad news.

Whitbread’s operations in Germany are thriving, with revenues climbing 19% year-over-year, driven by strong demand in both hotel stays and food and beverage services. There’s also been a slight improvement in the UK in recent weeks. For the six weeks ending January 9, 2025, accommodation sales were up 2% year-over-year, and RevPAR seems to be leveling off. Whitbread hasn’t changed its guidance for the full fiscal year, staying on track with plans to manage inflation impacts, cut costs, and complete asset disposals.

Looking ahead, Whitbread’s long-term strategy is still promising. Germany is proving to be a key growth driver, and the company’s focus on streamlining operations in the UK should pay off in the future.

Analysts are optimistic and there should be plenty of room for growth.

SGS-Bureau Veritas (SGSN, BVI) A potential €32bn deal sparks industry debate

Big news in the testing, inspection, and certification (TIC) world: SGS and Bureau Veritas are in talks about a potential merger.

If the deal goes through, it would create a combined company worth about €32 billion. SGS would hold a 58% stake, while Bureau Veritas would have 42%. Both companies confirmed the discussions but were quick to add that there’s no guarantee this will actually happen.

One of the big concerns is execution risk. In the TIC industry, clients tend to split their business between multiple providers to manage risk. If one company loses its accreditation, clients need a backup. Merging two major players could disrupt this balance, as clients might look elsewhere for secondary providers.

There’s also the fact that SGS and Bureau Veritas are coming at this from different angles. SGS is focused on recovery, aiming for steady growth, while Bureau Veritas is in expansion mode with its ambitious Leap 2028 plan.

Shareholders like Wendel (which owns 26% of Bureau Veritas) and GBL (which owns 19.3% of SGS) are also key players in this drama. Their approval could make or break the deal. While the merger could reshape the TIC landscape, there are still a lot of unanswered questions, and the potential pitfalls are hard to ignore.

McPhy Energy (ALMCP) Lower expectations as the hydrogen sector faces headwinds

It’s been a challenging period for McPhy Energy as the company revised its sales forecast for 2024, and the news wasn’t great. The management has now set its sights on around €11 million in sales, a big drop from the previous target of €18–22 million.

So, what happened? For one, the Djewels project—a promising green hydrogen initiative in the Netherlands—hasn’t been included in the numbers yet. This 20 MW electrolyser project is still waiting for a final investment decision, which was originally expected by the end of 2024. On top of that, McPhy also deducted indemnities related to a partially terminated contract for charging stations, which further weighed on their outlook. The result? Hydrogen-related sales for the first half of 2024 plummeted to €1.5 million from €11.8 million in the same period last year.

Unfortunately, it’s not just McPhy feeling the pressure; the entire hydrogen sector seems to be stuck in a rut.

Take NEL, a Norwegian competitor, for example. They’ve hit the brakes on production at their alkaline electrolyser plant because of weak orders over the last two years, and they’re cutting their workforce by 20%. Then there’s the GTT Group, which just announced a major rethink of its hydrogen subsidiary, Elogen, to manage costs.

Meanwhile, McPhy has been pushing forward with its ambitious gigafactory project, a €100 million endeavor heavily backed by government subsidies. While some investors welcomed this move, the ongoing losses in the hydrogen segment—like Elogen’s annual -€20 million EBITDA—highlight the uphill battle the industry is facing.

With few new orders coming in and a backlog of €21.6 million for electrolysers as of mid-2024, McPhy is navigating uncertain waters. Cash flow is another sticking point, with €34 million burned in the first half of the year and a total of €85 million expected by year-end. Although management has lined up €60 million in financing to keep things running through early 2026, this doesn’t erase concerns about the company’s longer-term prospects. Unsurprisingly, McPhy’s stock has taken a hit, reflecting market doubts about its ability to turn things around anytime soon.

Jerónimo Martins (JMT) Sales improved like-for-like growth hints at recovery

Jerónimo Martins wrapped up 2024 on a positive note, delivering preliminary Q4 sales that came in stronger than expected. Total sales reached €8.7 billion, marking a solid 7% year-over-year increase. What really stood out, though, was the return to positive like-for-like (l-f-l) growth at 2%, after two consecutive quarters of declines. This was largely thanks to Biedronka, the Polish retail powerhouse and the group’s main revenue driver. Biedronka saw its sales climb 7% to €6.1 billion. While currency benefits slowed compared to Q3, the chain managed to improve its l-f-l numbers, with volumes picking up despite continued price deflation.

Other parts of the business held their own too. Hebe, the group’s health and beauty brand, grew sales by 15% to €161 million, even though it faced tougher comparisons to last year. Pingo Doce, the company’s Portuguese supermarket chain, posted a 4% increase in sales to €1.4 billion, as it began to recover from deflationary pressures. In Colombia, Ara saw its sales rise 6% to €724 million, with like-for-like growth turning positive after struggling for a while.

It wasn’t just about numbers, though—Jerónimo Martins’ ability to adapt to tough conditions, especially in Poland’s competitive market, is a big part of the story here.

The results are encouraging, but let’s not forget that the environment remains tricky. Rising costs and pricing wars have been a challenge, especially in Poland, where the company is focused on holding onto its market-leading position. Still, the Q4 rebound in l-f-l growth is a promising sign, showing that things might be starting to turn around. While the company isn’t out of the woods yet, this performance suggests it’s heading in the right direction.

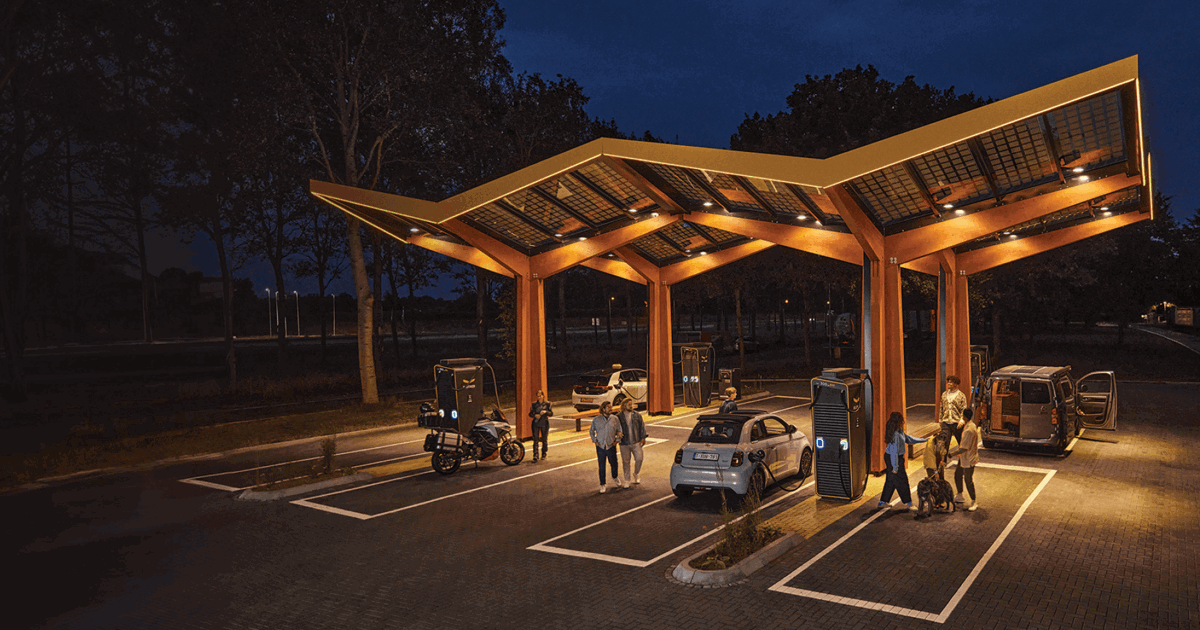

Fastned (FAST) Challenges in EV infrastructure reshape company goals

Fastned is hitting the brakes on its growth targets for 2025, reflecting the challenges of scaling up EV infrastructure across Europe. The company now expects to have 400–425 operational charging stations by the end of 2025, down from its earlier forecast of 420–450.

This isn’t about a lack of ambition, though. The delays come from complex permitting processes and grid issues, which have slowed station development in key regions. Another adjustment? Fastned has lowered its revenue per station guidance by 18% to over €325,000, acknowledging that EV adoption, particularly in Germany, isn’t growing as fast as anticipated.

But the real kicker is the revised operational EBITDA margin guidance. Fastned now expects margins of 35–40%, down from the previous target of over 40%. Rising staff expenses, especially for new growth regions like Denmark, Italy, and Spain, are one of the main reasons. Higher grid fees and other start-up costs are also adding to the pressure. To offset some of these challenges, the company recently raised its retail charging tariffs by 6%, which could help stabilize revenue even as growth slows.

Despite the hurdles, Fastned isn’t losing sight of its long-term vision. The goal of operating 1,000 stations by 2030 is still firmly in place. In the short term, though, these revisions highlight the complexities of building out EV infrastructure in a market that’s still finding its footing.

While the updated guidance might temper expectations, Fastned remains a key player in the push for greener transportation across Europe.

Rio Tinto (RIO) Steady performance highlights strength in copper and ongoing investments

Rio Tinto wrapped up 2024 with a solid Q4 production report, showcasing the company’s strength in its core operations. While iron ore production dipped slightly—down 1% year-over-year to 85.7 million tonnes—this was largely due to higher-than-usual rainfall. The full-year output of 328.6 million tonnes came close to the midpoint of the company’s guidance, though the mix showed a higher proportion of low-grade ore, reflecting challenges in replacement projects. The aluminum segment posted steady gains, with bauxite up 2% and alumina up 4%, thanks to improved productivity and recovery from earlier pipeline issues. However, aluminum production itself slipped by 1%, despite additional contributions from recently acquired smelter shares.

The standout performance came from Rio’s copper division, where mined output soared by 26% to 202,000 tonnes in Q4—well ahead of forecasts. This impressive growth was driven by the rapid ramp-up at Oyu Tolgoi and higher grades at Escondida. Kennecott, however, faced setbacks due to geotechnical challenges.

For the year, copper production hit the upper range of guidance at 697,000 tonnes, a strong finish for this crucial segment. Meanwhile, the minerals business showed mixed results; while titanium dioxide slag production dropped 14% due to maintenance, iron ore concentrate and pellet production at IOC held steady.

Looking ahead, Rio confirmed its 2025 production goals, which include stability in iron ore, modest growth in aluminum, and further gains in copper as Oyu Tolgoi continues its expansion. Major projects remain on track, including the Western Range iron ore project, which is now 90% complete, and Simandou, where the first ore was crushed in January. These investments highlight Rio’s commitment to future growth, particularly in high-demand materials like copper and lithium that are key to the energy transition.

Rio’s consistent execution and long-term potential make it a standout in the mining sector. Despite headwinds in some areas, its attractive valuation—trading at just 6x 2025 EBITDA—adds to its appeal.

Esker (ALESK) Solid revenue growth fuels optimism for 2025

Esker ended 2024 on a high note, reporting Q4 revenues of €55.1 million, a 17% increase year-over-year (16% at constant currency). This performance slightly exceeded expectations and capped off a strong year, with total revenues reaching €205.3 million, reflecting organic growth of 15%. The company’s annual recurring revenue (ARR) intake grew by an impressive 22%, providing a solid foundation for continued growth into 2025. Operating margins also improved, with Esker now projecting a range of 13–15%—up from its initial guidance of 12–13%—highlighting a strong recovery in the second half of the year.

Looking ahead, management has provided encouraging guidance for 2025, targeting organic growth of 13–15% and maintaining margins in the same range. These projections suggest that Esker could once again exceed its targets, as it has consistently done in the past. The company’s performance has led to an upward revision of earnings estimates for 2024, further supporting its outlook for the years ahead.

Meanwhile, the ownership landscape has shifted significantly. Following a successful takeover bid, the Bridgepoint/General Atlantic consortium now controls 74.6% of Esker’s capital and voting rights. While this outcome was anticipated, the remaining free float of over 25% means Esker will stay listed for now. However, speculation persists about its long-term market status. The new majority shareholders may choose to prioritize growth over margins, potentially exploring acquisitions or partnerships in the medium term. For now, management remains in place, continuing to steer the company into its next phase.

Esker’s consistent growth and operational improvements make it an interesting player to watch. While uncertainty around its future ownership structure lingers, the company’s strong fundamentals and robust outlook ensure it remains a standout performer in the tech space.

Geberit (GEBN) Mixed performance as sales hold steady amid challenges

Geberit closed 2024 with Q4 sales of CHF 685 million, down 1.3% year-over-year but slightly better than expected on a constant currency basis, with growth of 0.7%. This modest improvement was in line with internal expectations and outperformed consensus forecasts, which had anticipated a decline. For the full year, Geberit posted growth of 2.5%, surpassing its guidance range of 1–2%. The stronger-than-expected finish was helped by a rebound in markets like Italy and Benelux, which grew by 6.2% and 4.8%, respectively, during the fourth quarter. Germany and Switzerland also posted steady gains, though some regions, like the UK and France, saw declines.

The EBITDA margin for 2024 came in slightly below expectations at around 29.5%, compared to 29.9% in 2023. Management cited higher raw material costs and foreign exchange impacts as key factors, though the outlook for 2025 suggests stabilization. While the new construction market remains under pressure, especially in Europe, Geberit’s significant exposure to the renovation segment—accounting for 60% of sales—provides a buffer against broader market challenges.

Looking ahead, Geberit is forecasting organic growth of around 3.6% for 2025, with an EBITDA margin of 29.7%. While these numbers are largely in line with consensus estimates, the company is optimistic about its position in the renovation market, which is expected to remain more robust than new construction. The conference call scheduled for later today will offer more insights into management’s expectations for pricing and demand trends across key markets like Germany, Switzerland, and the Nordic region.

Despite a challenging environment, Geberit’s resilience and focus on the renovation market leave it well-positioned for the year ahead. While macroeconomic uncertainties persist, the company’s steady performance and strategic positioning offer a solid foundation for future growth.

If you appreciate this post, feel free to share and subscribe below!