Tech, quality companies and a lot of results

SAP, ASML, H&M, HighCo, Lonza, Logitech, Forsee Power, Givaudan, LVMH, Leonardo, Wacker Chemie, Compagnie des Alpes, KPN, ABB, STMicroelectronics

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

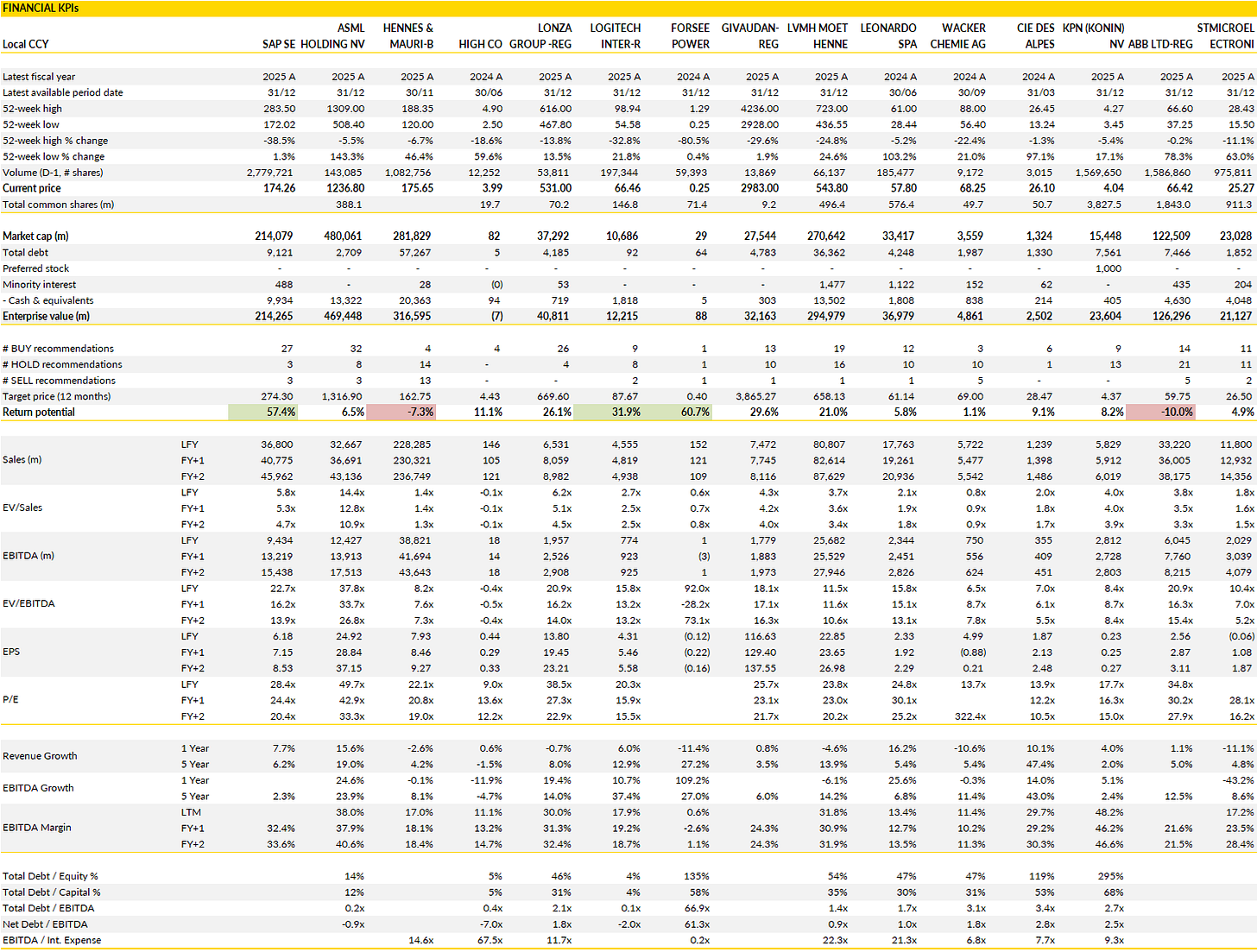

Financial KPIs

SAP (SAP Germany): cloud growth still doing the work

SAP’s Q4 read-through is one of those that looks cleaner the longer you look at it.

On the surface, the headline issue is familiar: cloud backlog growth (CCB) came in a touch lighter than expected and 2026 top-line guidance sits slightly below where the market was leaning. But underneath that, the story continues to be exactly as SAP wants it to. Q4 constant-currency revenue growth landed just above market expectations, cloud revenues grew close to 26% at cc, and the on-premise decline was marginally less painful than feared thanks to a smaller-than-expected drop in licenses.

Importantly, management provided a very concrete explanation for the softer CCB print, pointing to a handful of large transformational deals with revenue ramp-ups skewed further into the outer years and specific public-sector termination clauses that mechanically depress backlog metrics. In other words, this was a timing and mix issue rather than a demand problem, and the underlying cloud momentum remains intact.

Where SAP really leaned into the quarter was on profitability and cash. Non-IFRS operating profit beat expectations by around 3%, driven by continued operating leverage, tight cost discipline and a sharp decline in stock-based compensation. That theme is becoming structural rather than cyclical. Even with some gross-margin pressure from mix, the group still exited the year at the high end of its revised profit guidance, and free cash flow for Q4 and FY25 landed comfortably within, if not slightly above, expectations. IFRS numbers were temporarily distorted by litigation expenses, but that noise does little to change the underlying trajectory.

This is a business that is now very clearly prioritising margin expansion and cash generation as the cloud transition matures, and that intent is fully reflected in the 2026 guidance. Management guided to cloud revenue growth of 23–25% at constant currency and cloud & software growth of 12–13%, modestly cautious on the top line, but paired that with operating profit guidance that sits ahead of expectations and free cash flow of around €10bn, well above consensus. In short: growth may normalise gradually, but profitability and cash will accelerate.

SAP also announced a new €10bn share buyback program to be executed by the end of FY 2027, a material commitment that underlines management’s confidence in both the durability of cash flows and the valuation disconnect created by the recent software sector de-rating. Longer term, the company reiterated that total revenue growth at constant currency is expected to accelerate again through 2027 as the cloud mix deepens and backlog conversion continues.

Against that backdrop, it is hard to argue with the direction of travel: SAP increasingly looks like a cash-generative, margin-expanding compounder with optionality from AI embedded in its core ERP and business process footprint. That said, it might take time for the market to recognise.

ASML (ASML Netherlands): AI demand is pulling the cycle forward again

ASML closed 2025 with a quarter that reinforced just how tight the supply–demand balance has become at the leading edge.

Q4 revenues landed within guidance and broadly in line with market expectations, with a familiar mix shift across regions and product lines as customers manage delivery schedules. What really mattered, however, was the order book. Net bookings surged to €13.2bn in the quarter, dominated by EUV and increasingly tilted back toward memory, a clear signal that customers are no longer just talking about AI-driven demand but are actively committing capital. The EUV backlog alone now exceeds €25bn, and total backlog sits close to €39bn, giving ASML unusually strong forward visibility. Management was explicit that demand is being driven by both advanced logic and DRAM, with AI workloads forcing customers to expand capacity faster than previously planned. In DRAM in particular, ASML highlighted that supply could remain tight well into 2026 and beyond, which helps explain the urgency behind recent order patterns.

That tightening backdrop feeds directly into 2026, where ASML’s guidance was notably stronger than the market had expected. For the first quarter, revenue guidance already sits comfortably above prior expectations, and for the full year management guided to a wide but clearly elevated range of €34–39bn in sales. Even the lower end implies resilience; the upper end points to a sharp acceleration if customer execution stays on track. EUV revenues are expected to rise meaningfully, supported by both system shipments and upgrades, while non-EUV tools are seen as broadly stable, with strength in advanced logic and memory offsetting a more controlled China contribution, which management expects to represent around 20% of revenues. Installed base management is another quiet but important lever, benefiting from the rapid expansion of the EUV fleet and the fact that upgrades remain the fastest way for customers to add capacity. Margins may fluctuate with mix in the near term, but structurally the business continues to operate within its long-term framework, which management reaffirmed, including a gross margin ambition of the mid-to-high 50s over time.

ASML once again used the quarter to anchor the long-term narrative rather than optimise for a single year. The company reiterated its 2030 ambition of €44–60bn in revenues with gross margins of 56–60%, targets that look increasingly credible in a world where AI is not just another end market but a structural driver of semiconductor intensity.

While the stock has already rerated sharply on the back of improving sector sentiment, the strategic picture remains unchanged: ASML sits at the bottleneck of the most advanced capacity expansion the industry has ever attempted. Near-term numbers may ebb and flow with customer timing and mix, but the combination of record bookings, strong backlog and explicit confirmation of AI-led demand across logic and memory reinforces the view that the cycle has more room to run.

H&M (HMB Sweden): cost discipline buys time

H&M’s Q4 print looks worse the more you think about what it implies for the underlying business.

On the surface, the quarter was clean. Currency-neutral sales growth of around 2% landed broadly where the market expected, with October and November slightly better than feared after a flat September and some help from promotional activity around November sales events. More importantly, the gross margin improved meaningfully, benefiting from easing input costs, better inventory control and a more disciplined promotional backdrop than in prior periods. That margin uplift, combined with tighter-than-expected cost control, drove a sharp EBIT beat versus expectations. Part of that strength is mechanical (last year’s quarter still carried roughly SEK 200m of wind-down costs tied to the Monki exit) but even adjusting for that, opex discipline was clearly stronger than many had penciled in. In isolation, this was a reassuring quarter that shows H&M can still execute operationally when conditions are not actively deteriorating.

That said, management flagged that group sales in December and January are down around 2% in local currencies, a clear slowdown versus last year and weaker than what the market had been modelling for the start of Q1. Some of this is explainable and arguably temporary. Black Friday was unusually strong this year and pulled demand forward into late November, leaving December softer in several key markets. There is also a negative calendar effect from the Chinese New Year falling in February, which distorts year-on-year comparisons across parts of Asia.

Even so, the takeaway is hard to ignore: momentum into the new year is not building. H&M is not seeing the kind of broad-based acceleration that would suggest the brand is meaningfully regaining share or that consumers are suddenly trading up within the value fashion segment. Instead, trading feels choppy, promotion-driven and highly sensitive to timing effects, all of which are manageable, but none of which point to a structurally stronger top line.

Zooming out, this leaves the bigger picture largely unchanged. H&M continues to show that it can protect profitability through cost control, sourcing improvements and tighter inventory management, but the growth engine remains underwhelming. With low single-digit currency-neutral sales growth, it is very difficult to sustainably lift operating margins to the company’s original mid-term ambition of around 10%, let alone beyond that.

The mass-market apparel space remains brutally competitive, with fast-moving online players and vertically integrated incumbents keeping pricing power thin. H&M’s brand still resonates, but not strongly enough to command higher prices without risking volume, and not consistently enough to deliver the kind of growth that would allow fixed costs to work harder.

Overall, the recent share price resilience seems a reflection of improved cost discipline and supportive shareholder dynamics. Relative to peers with faster growth and structurally higher margins, H&M still feels like a business doing many things better than before, just not yet enough to change the long-term story.

HighCo (HCO France): Activation momentum resurfaces

HighCo’s update does a good job of closing the chapter on what has been a messy and transitional year, while also laying out a more credible platform for growth into 2026.

The headline number was the Q4 gross profit of roughly €20m, modestly ahead of market expectations and representing a sharp rebound versus a very weak comparative in late 2024. On an organic basis, growth was strong, but the more important signal is that activity levels are now moving in the right direction again after a year that was distorted by portfolio reshaping. For the full year, gross profit came in slightly above initial internal expectations, even though the reported decline still reflects the sale of HighConnexion earlier in the year.

Stripped of that disposal and adjusted for recent acquisitions, the underlying business returned to low single-digit organic growth, which may not sound exciting in absolute terms but matters a great deal for a group that has spent much of the past 18 months repairing its commercial base. The message is not one of explosive growth, but of stabilization and gradual normalization.

Digging deeper, the recovery is clearly being driven by the Activation division, which continues to act as the group’s engine. This segment now represents the majority of gross profit and delivered solid growth both in the quarter and over the year, supported by a broad-based pickup across its French operations. The turnaround in Advertising Sales & Consulting is also worth noting. While full-year numbers still look weak, the second half shows a very sharp inflection, suggesting that client budgets and campaign timing normalized meaningfully as the year progressed. Mobile, by contrast, remains the laggard, with declining activity and limited signs of near-term recovery, reinforcing the sense that HighCo is increasingly a story about activation-led value creation rather than a balanced mix of promotional tools.

Geographically, France continues to dominate the group’s profile, both in scale and in momentum, while international operations remain a drag. Belgium and Spain have yet to show convincing signs of recovery, underlining that the investment case is still heavily tied to execution in the domestic market rather than a broad European upswing.

Management reiterated its target of achieving an operating margin above 12% in 2025, which implicitly confirms confidence in cost control, mix improvement and synergy extraction from recent acquisitions. Looking into 2026, the group is targeting gross profit of more than €78m, a step-up that assumes not only continued momentum in Activation but also a cleaner contribution from Sogec and BudgetBox. At the same time, the announcement of a restructuring at Sogec introduces a note of uncertainty. While details are scarce, it suggests management is not fully satisfied with the current operating setup and is prepared to take short-term pain to accelerate alignment and synergies.

That could mean one-off costs and some noise in reported numbers next year, but strategically it fits with the broader case: HighCo is prioritizing profitability and coherence over headline growth. If the Activation momentum holds and the legacy headwinds continue to fade, the group increasingly looks like a business transitioning to a more focused, margin-led growth phase; not without risks, but with a clearer internal logic than it had a year ago.

Lonza (LONN Switzerland): advanced synthesis steps into the spotlight as margins reset higher

Lonza’s full-year numbers confirm that 2025 was not just a recovery year, but a genuine inflection in profitability, with execution across key CDMO platforms materially ahead of what the market had been prepared for.

While reported CDMO sales were broadly in line with expectations, the interesting part sits at the margin level. Core EBITDA came in well above both internal guidance and consensus, pushing group profitability into territory that very few large-scale CDMOs currently occupy. This is particularly notable given that 2025 still absorbed dilution from Vacaville and ongoing softness in selected end markets. Instead of masking the earnings power of the core business, the year demonstrated that Lonza’s operating model is capable of absorbing complexity while still expanding margins. That is important, because it reframes the debate away from short-term revenue phasing and toward the sustainability of structurally higher returns as new capacity comes online.

The most striking feature of the year was the performance of Advanced Synthesis, which is really transforming from a growth option into a core earnings driver. Sales growth accelerated sharply, but more importantly, profitability expanded at an even faster pace as multiple growth projects ramped up in parallel across small molecules and bioconjugates. This simultaneous scaling is hard to execute operationally, yet Lonza delivered it with little visible friction, underscoring the depth of its technical platform and project management capabilities. Integrated Biologics also continued to perform well, benefiting from strong underlying demand and the contribution from Vacaville, even as margins were modestly diluted by the integration. By contrast, Specialized Modalities remained the weak spot, with Cell & Gene still subdued, although trends improved in the second half and microbial activity returned to growth. The divestment of Capsules & Health Ingredients further simplifies the story, sharpening the group’s focus on CDMO activities where Lonza has clear competitive advantages and pricing power.

For 2026, management is guiding to continued double-digit growth in constant currencies and further margin expansion, with core EBITDA expected to move meaningfully above prior assumptions. The main drag comes from foreign exchange, which mechanically caps reported growth, but does little to change the underlying operational trajectory.

What stands out is that margins are still moving up despite a more normalized growth environment and lingering softness in Cell & Gene. That suggests the mix shift toward higher-value modalities, improved asset utilization and tighter cost discipline are doing real work. In that context, Advanced Synthesis increasingly looks like the swing factor for upside surprises, while Integrated Biologics provides scale and visibility.

After several years of portfolio reshaping and heavy investment, Lonza now appears to be entering a phase where operational leverage finally asserts itself.

Logitech (LOGN Switzerland): peripherals decouple from the PC cycle

Logitech’s fiscal Q3 print landed comfortably ahead of market expectations. Gross margins again surprised on the upside, pushing profitability meaningfully above what both management and the market had been guiding for. That is the result of deliberate pricing actions, tighter cost control and a product mix that increasingly favors higher-value peripherals. In a still weakish market, Logitech continues to show that it can protect margins even as growth normalises. The stock’s muted reaction post-results says more about sentiment than fundamentals; operationally, this was a strong quarter that raises confidence in the durability of the earnings base.

What stood out operationally was the breadth of growth across core categories. Keyboards, pointing devices, video collaboration and tablets all delivered solid momentum, underscoring that demand is not narrowly concentrated in one niche. Gaming remains more uneven, reflecting a softer macro backdrop and a lighter content release schedule, but even here the business is holding up better than many had feared. Importantly, management directly addressed what has become the central concern for investors: the sharp rise in memory prices and its potential knock-on effect on PC demand. The message was clear and consistent with historical patterns. Peripherals are driven far more by penetration of the installed base than by new PC shipments, and have historically grown faster than the underlying PC market. That dynamic appears intact, helping explain why Logitech continues to grow even as parts of the PC ecosystem look increasingly constrained. The resilience of demand across regions, particularly strong trends in Asia, market share gains in China and a return to growth in the US despite price increases, further supports the view that Logitech’s brand and ecosystem still carry real pricing power.

Going forward, management is not promising acceleration, yet it continues to guide to healthy margins and steady growth, even as memory inflation and macro uncertainty linger in the background. Structural actions taken over the past two years (from supply chain reconfiguration to a sharp reduction in China exposure for US-bound products) are now clearly feeding through into more stable profitability.

That is important because it reframes the Logitech story from a cyclical hardware name into something closer to a cash-generative platform with recurring replacement demand and disciplined capital allocation. If peripherals continue to outgrow PCs, even modestly, Logitech does not need a booming end market to compound earnings. Instead, the focus shifts to execution, pricing and mix, i.c. areas where this quarter suggests the company is firmly in control.

Forsee Power (FORSE France): shrinking volumes and fading visibility push the recovery story further out

Forsee Power remains firmly in contraction mode, with little in the numbers to suggest that the trough is close.

Quarterly sales collapsed to roughly €16m, marking another steep year-on-year decline and leaving full-year revenues at the bottom end of the already reduced guidance range. The trucks segment, which still accounts for the vast majority of group activity, continues to bear the brunt of the downturn. The loss of Iveco volumes, the move to dual sourcing at Wrightbus and a generally sluggish demand environment for electric heavy vehicles have combined into a near-perfect storm. New vehicle launches are being pushed out, customers are adopting a wait-and-see approach to fleet electrification and Asian competition is intensifying at precisely the wrong moment. Light vehicles held up marginally better, but remain too small to offset the collapse in the core trucks business.

At this stage, the headline trend remains unmistakable: Forsee is shrinking fast, and the rate of decline remains severe.

What is even more concerning is that the outlook offers little near-term relief. Management has confirmed that 2025 will close with a negative adjusted EBITDA result, broadly in line with expectations, but provided no concrete guidance for 2026. Instead, the story leans heavily on medium-term cost savings and a hoped-for rebound further out. The group continues to point to a targeted €20m reduction in its cost base by 2027 and expresses confidence that its commercial pipeline could eventually translate into renewed growth. That may be true in theory, but in practice the company is heading into 2026 facing the full-year impact of lost Wrightbus volumes, subdued customer demand and structurally weaker momentum across the electrification value chain. With fleet operators deprioritizing battery-electric investments and OEMs delaying production schedules, visibility remains extremely poor. In this environment, even maintaining a stable revenue base looks challenging, let alone staging a meaningful recovery.

The strategic issue is that Forsee’s investment case has effectively shifted from one of execution to one of survival (and patience). The company is asking investors to look through another year of sharp decline in the hope that 2027 marks an inflection point, supported by cost savings and a reactivated order pipeline.

However, that bridge looks increasingly long and uncertain. Cash remains tight, losses are set to continue and the business has limited levers to pull in the absence of a broader recovery in demand for electric trucks and buses. While management’s confidence in a longer-term rebound may ultimately prove justified, the near-term reality is one of ongoing erosion, minimal visibility and elevated risk.

Until there is tangible evidence that volumes are stabilising or that new contracts can meaningfully offset lost customers, Forsee Power remains a story dominated by downside protection instead of upside optionality.

Givaudan (GIVN Switzerland): quality intact, but normalization still clouds the timing

Givaudan’s full-year readout is solid in absolute terms, yet it does little to resolve the central question hanging over the shares: when does the pressure truly ease?

On an operational level, the company continues to demonstrate why it sits at the top of the global flavor and fragrance hierarchy. Local-currency growth remains positive, profitability is still robust, and the portfolio once again shows resilience across geographies. However, the second half of the year made it increasingly clear that momentum is normalising. Growth slowed sequentially, margins edged down, and foreign exchange effects masked what would otherwise have been a modest improvement in underlying profitability.

The absence of a concrete outlook for the coming year reinforces the sense that management sees the environment as manageable, but not yet sufficiently predictable to anchor expectations. For a stock that has historically traded on confidence and visibility as much as on quality, that caution is telling.

The internal picture is increasingly bifurcated. Fragrance & Beauty remains the engine of the group, driven by continued strength in Fine Fragrances, where demand from premium and luxury customers remains remarkably resilient despite a challenging consumer backdrop. This part of the portfolio continues to benefit from innovation intensity, long product cycles and close customer relationships that are difficult to replicate. Consumer Products also continue to grow at a healthy pace, underlining the defensive characteristics of everyday applications. That said, Fragrance Ingredients are becoming a more visible drag, with competition intensifying and pricing pressure more evident, in part from Asian players. This is not yet a structural problem, but it does mark a change from the benign competitive environment Givaudan enjoyed for several years. Margins in the division have come under pressure, partly due to higher input costs and continued investment, but also reflecting this more competitive dynamic. The result is a business that still performs well, but no longer feels insulated from the broader industry cycle.

Taste & Wellbeing tells a similar story of resilience giving way to normalization. Growth remains positive across most categories, supported by sustained demand in snacks, dairy, sweet goods and health-oriented solutions, and contributions are broadly balanced across Europe and North America. Asia Pacific, however, softened after a strong rebound in the prior year, highlighting that the post-pandemic recovery phase is now largely behind the group. Margins in the division have edged lower as cost pressures persist and mix effects turn less favorable.

None of this undermines the long-term investment case (Givaudan’s scale, customer intimacy and R&D capabilities remain formidable) but it does explain why the shares struggle to re-rate meaningfully at this stage. The company continues to execute well, yet growth rates are converging toward long-term averages while uncertainty around competitive pressure and input costs lingers.

For the market to regain conviction, it will likely need clearer evidence that these headwinds are either easing or being structurally offset. Until then, Givaudan remains a high-quality compounder navigating a transition phase.

LVMH (MC France): the next leg of growth needs clearer signals

LVMH closes the year in better shape than many feared, with the group showing that even in a sluggish luxury backdrop it can still defend margins and coax out pockets of growth.

The macro tone remains uneven, but the company’s Q4 performance hints at a business that is stabilising rather than slipping, helped by a firmer contribution from hard luxury and the continued strength of Sephora. Fashion & Leather Goods remains soft, yet the division’s profitability barely budged, underscoring the structural power of the model even when volumes are not cooperating. Watches & Jewellery finally showed a pulse, and Selective Retailing continues to behave like a growth engine in its own right. The group’s ability to keep full‑year F&L margins around 35% and improve profitability in most other divisions (despite currency headwinds and a weaker top line) reinforces the idea that LVMH can manage through turbulence without sacrificing long‑term positioning. With net debt trending lower and cash discipline intact, the financial architecture remains as robust as the brand portfolio.

The more cautious note comes when looking to this year, where management’s tone reflects a world still lacking clear demand visibility. Growth is expected to be uneven, and the currency drag that weighed heavily on 2025 is set to persist, creating a mechanical headwind before any operational improvement can show through. The company is signaling another year of tight cost control, but margin expansion will require a healthier top line, particularly in Fashion & Leather Goods, where brand momentum and product cycles need to re‑accelerate. Yet within this caution sit a few encouraging signals: jewellery appears well positioned for another year of structural growth, with Bulgari and Tiffany benefiting from favorable category dynamics, and Dior’s early creative refresh under Jonathan Anderson is beginning to surface in stores. These are not immediate fixes, but they point to the kind of brand‑level catalysts that typically precede a broader inflection in the group’s earnings trajectory.

Medium term, the investment case still leans on LVMH’s ability to compound earnings through brand elevation, retail excellence and category mix. Even with a slightly softer organic growth profile for 2026 and a higher domestic tax burden weighing on net profit, the underlying EBIT path remains intact, with the outer years supported by operational leverage and a normalisation in Watches & Spirits assumptions.

The group’s scale, creative depth and global retail footprint continue to offer advantages that few peers can replicate, and the expansion of Sephora provides a secular growth pillar that is less exposed to the volatility of high-ticket discretionary spending.

Valuation remains reasonable relative to the sector’s premium positioning, especially for an asset with this level of brand equity and balance sheet strength. The near-term picture may be clouded by currency and macro noise, but the longer arc still bends toward renewed earnings momentum once category cycles and creative rotations begin to align.

Leonardo (LDO Italy): optionality is building, but the market still wants proof of execution

Leonardo heads into the February results with a backdrop that feels more constructive than it did a year ago, helped by a late‑2025 surge in orders and a defence spending environment that continues to broaden rather than peak.

The company appears set to deliver a good Q4, with aircraft, defence electronics and helicopters all showing the kind of operational rhythm that investors are expecting to see sustained. Order intake has been buoyed by a series of program wins across Europe, and the group’s industrial plan (long criticised for its uneven delivery) now looks more coherent, with defence electronics emerging as the anchor of near‑term performance. Free cash flow should land comfortably above the upper end of the target range, reinforcing the sense that the balance sheet is moving in the right direction and that the business is regaining some financial flexibility. The picture is not flawless, but the tone is one of a company that is stringing together consistent operational beats.

The more interesting part of the story sits just ahead, with the March strategy update expected to stretch Leonardo’s planning horizon to 2030 and clarify how the next wave of initiatives will translate into financial outcomes. The group has outlined a suite of optionalities (the Italian LEO constellation to the Rheinmetall joint venture, the Baycar drone platform and a hypercomputing push) that collectively represent meaningful long‑term revenue potential, even if their maturity levels vary widely. Investors will want to see how these projects are sequenced, funded and integrated into the broader industrial plan, especially as the company targets sizeable efficiency gains over the 2024–28 period. The pending Iveco Defence transaction adds another layer of strategic complexity: accretive on paper, but still subject to structural decisions at Iveco’s end. Meanwhile, the unresolved future of the aerostructures division remains a lingering question, with the long‑promised partnership agreement yet to materialise.

Looking further out, the investment case hinges on whether Leonardo can convert this expanding set of strategic options into a cleaner, more profitable growth profile. The company trades broadly in line with European defence peers, suggesting the market is willing to acknowledge the improving fundamentals but not yet ready to price in the full upside of the optionalities. For that to change, investors will need evidence that the industrial plan is delivering measurable savings, that the new ventures are progressing beyond early‑stage ambition, and that the core businesses can maintain momentum without periodic resets.

The building blocks are there: a healthier order book, a more disciplined operating model, and exposure to segments (electronics, space, drones) aligned with long‑duration defence spending trends. What the market wants now is confirmation that Leonardo can turn that optionality into results, and that the next strategic chapter will be more by scalable execution.

Wacker Chemie (WCH Germany): waiting for demand to turn

Wacker’s preliminary numbers for the year tell a fairly straightforward story. The company is still dealing with a weak backdrop, and the Q4 lift in EBITDA mostly reflects the usual CO₂ compensation rather than any real change in market conditions. Utilisation stayed low, which kept the Others line under pressure, and that alone explains why the quarter landed below what people were hoping for.

The chemicals businesses continue to move unevenly. Silicones remain soft because of mix, pricing and low plant loading, while polymers held up a bit better thanks to tighter cost control and a more supportive environment in Europe. Polysilicon is still split between a healthy semiconductor market and a solar market that remains oversupplied and unprofitable. Even so, Wacker managed to get close to breakeven free cash flow for the year, which is not insignificant given the scale of restructuring charges and impairments that ran through the accounts.

The bigger question now is what the company will say in March when it lays out the full-year outlook. The restructuring program announced late last year suggests Wacker is preparing for a longer period of subdued demand rather than banking on a quick rebound. The impairments across Siltronic, tax assets and fermentation assets show how much the company is resetting expectations for parts of the portfolio. Chemicals should improve somewhat in 2026, but the recovery looks modest, and the solar polysilicon market still faces structural issues that won’t resolve quickly. CO₂ compensation, which helped 2025, may also come down if production stays low.

All of this means the path back to stronger earnings depends on a mix of cost discipline, better capital allocation and a clearer focus on the parts of the portfolio that can deliver more stable margins.

The investment case therefore remains about patience. Wacker has the balance sheet and operational discipline to manage through a slow cycle, but the near-term catalysts are limited until order intake improves and utilisation starts to move higher. The chemicals businesses should benefit once industrial demand picks up, but visibility is still poor, and the solar polysilicon segment remains weighed down by global oversupply.

Investors will be watching the March guidance for signs of how quickly the company expects earnings to normalise, how the cost savings will flow through, and whether the specialty chemicals and semiconductor-grade polysilicon businesses can take on a larger role in the earnings mix.

Compagnie des Alpes (CDA France): steady momentum and a business model that keeps compounding

Compagnie des Alpes starts the new financial year with the same steady rhythm it carried through most of last year.

Q1 revenue landed well ahead of market expectations, which is notable given the tough comparison base and the fact that the group didn’t rely on any one-off distortion to get there. Leisure parks held their ground despite a softer Halloween season, helped by strong Christmas traffic. Ski areas delivered the standout performance, with higher attendance and a favourable holiday calendar giving the division a clean boost, but even stripping that out, underlying growth was solid. Distribution and hospitality continued to benefit from strong demand for mountain accommodation, especially through MMV.

The common thread across all three divisions is that demand remains healthy and pricing power is holding, which is exactly what investors want to see heading into the core winter season.

The broader outlook hasn’t changed much, and that’s a positive in itself. The company reiterated its expectation for a meaningful EBITDA increase this year, and the margin trajectory still looks constructive. There is also the possibility of capital gains from the sale of Tignes assets, which would flow directly into EBITDA, though the timing remains uncertain.

What matters more is that the operational levers are working: parks continue to show room for margin improvement, ski areas are benefiting from disciplined pricing and stable demand, and the hospitality segment is scaling in a way that complements the rest of the portfolio. The strategy remains consistent, focused on incremental improvements rather than big swings, and the upcoming quarters should give a clearer view of how much of the margin uplift is structural rather than seasonal.

Looking ahead, the investment case still leans on the same strengths that have supported the stock over the past few years. Organic momentum remains intact, and management continues to explore bolt‑on acquisitions, with a particular interest in expanding its padel activities internationally. These deals won’t transform the group in the near term, but they fit the company’s preference for low‑capital, adjacent opportunities that can broaden the customer base without stretching the balance sheet.

Valuation remains reasonable relative to the growth profile and the improving margin mix, and the dividend adds another layer of appeal for investors looking for stability in a cyclical sector.

KPN (KPN Netherlands): solid execution continues, even if the 2026 bar feels a bit low

KPN closed the year with another steady quarter, showing the same operational rhythm that has defined the past few reporting periods.

Revenue and EBITDA growth landed right where the market expected, and free cash flow came in slightly ahead of guidance. Consumer broadband kept adding customers at a healthy pace, business services benefited from strong SME demand, and wholesale remained a reliable contributor. Nothing in the Q4 print suggested a change in trend. The company is still growing service revenues in the low single digits, still expanding margins gradually and still converting a high share of earnings into cash.

Where investors might pause was the guidance for 2026, which felt a touch cautious relative to the momentum exiting the year. The company is pointing to service revenue growth of 2 to 2.5 percent and EBITDAaL of around €2.67 billion, which is essentially in line with where the business already stands. Capex remains elevated as the fibre rollout continues, and free cash flow guidance is unchanged at above €950 million.

None of this signals a problem, but it does suggest management prefers to guide conservatively even as it reiterates its mid‑term ambitions. The announced dividend increase and new share buyback underline confidence in the cash profile, yet the near‑term targets may still lead analysts to trim estimates slightly. The underlying message seems to be that 2026 is another year of steady progress rather than acceleration.

Overall, the investment case remains anchored in the same themes: a rational Dutch market, the ability to pass through price increases, and the long runway in fibre. KPN continues to target around 3 percent annual growth in service revenues and EBITDAaL through 2027, with free cash flow compounding faster as capex begins to step down. By 2027, the company expects at least €250 million less capex than in 2026, and all free cash flow is set to be returned to shareholders.

That combination of predictable growth, improving capital intensity and disciplined capital returns keeps the story attractive for long‑term holders. The 2026 guidance may look a little soft, but the operational backdrop remains firm, and the structural drivers behind the business have not changed.

ABB (ABBN Switzerland): strong order momentum sets the tone, but the margin story still needs to firm up

ABB closed the year with strength that tends to reset expectations, especially on the demand side.

Orders were the standout, rising sharply across every major region and giving the company a book‑to‑bill comfortably above one. Short‑cycle activity picked up, large projects landed at the right moment and data‑centre demand continued to build. Revenue growth followed through, and the group delivered an operational margin broadly in line with what the market was looking for. Electrification and Automation both posted solid profitability, while Motion lagged a little due to integration effects and some inefficiencies. Free cash flow was strong, net income moved higher and the proposed dividend increase fits with the company’s steady capital‑return profile.

Taken together, the quarter shows that ABB is entering 2026 with healthy commercial momentum and a broad set of end‑markets that are still expanding.

The guidance for 2026 leans more on the top line than on margins, which is where the market may hesitate a bit. Management is calling for revenue growth of 6 to 9 percent and another year with book‑to‑bill above one, which looks credible given the order intake exiting Q4. The margin outlook is more measured, with only a slight improvement expected relative to last year. That is not a downgrade, but it does suggest that cost inflation, mix and the ongoing integration of recent acquisitions will keep the pace of margin expansion modest. A capital gain will lift Q1, but stripping that out, the message is that ABB sees another year of solid growth rather than a step‑change in profitability.

The focus is shifting to how the company sees demand evolving across automation, electrification, data centres and construction as the year begins. The strong order intake gives ABB room to navigate any lingering destocking, but investors will want clarity on how much of the growth is volume‑driven versus price‑driven, and how inflation and cost‑efficiency programs shape the margin profile.

So the long‑term story remains intact: ABB is exposed to structural themes like electrification, industrial automation and digital infrastructure, and the portfolio is well balanced across geographies and cycles. The near‑term question is whether the company can translate the current order strength into a cleaner margin trajectory. For now, the top‑line guidance looks well supported, and the operational backdrop remains solid, even if the margin outlook still needs a bit more conviction.

STMicroelectronics (STMPA France): early signs of a turn, finally supported by guidance

STMicroelectronics delivered a cleaner Q4 than many expected, helped by a stronger contribution from personal electronics and a better product mix that lifted margins.

Revenue came in ahead of market expectations, and while automotive was softer, the rest of the portfolio showed enough resilience to offset it. Gross margin held up well, operating profit surprised positively and inventory days edged down, which is a small but welcome signal that the supply chain is normalising. The only real blemish was the EPS line, weighed down by tax items rather than anything structural. Cash generation improved again, leaving the company with a stronger net cash position heading into 2026. For a business that has spent the past year navigating a difficult demand backdrop, this was the first quarter that felt more like a stabilisation than a grind.

The more interesting development is the Q1 guidance, which lands above typical seasonality and above where the market was sitting before the release. A sequential decline is normal for the first quarter, but the company is signalling a smaller drop than usual and a gross margin that holds up better than feared. That alone is enough to shift sentiment, because it suggests the trough may be behind the company even if the recovery is still uneven across end markets.

STM is not giving full‑year guidance yet, which is standard practice, but the capex plan and strategic priorities point to a company preparing for a more constructive phase. The focus remains on accelerating innovation, reshaping the manufacturing footprint and tightening the cost base, all with the aim of improving free cash flow as the cycle turns. Consensus still expects a meaningful improvement through the year, with margins rising into Q4, and today’s guidance at least doesn’t contradict that trajectory.

Looking ahead, the investment case hinges on whether STM can convert these early signs of stabilisation into a broader recovery. The company is exposed to several markets that should improve as 2026 progresses, from industrial to parts of consumer electronics, and the long‑term drivers around electrification and embedded processing remain intact.

Valuation sits below its own historical range and below key peers, which gives the stock room to re‑rate if the newsflow continues to improve. The Q1 outlook is the first real indication that the worst of the cycle may be behind the company, and investors will now look for confirmation that margins can rebuild and that automotive demand finds a more stable footing.

For now, the tone has shifted from defensive to cautiously constructive, and STM finally has a quarter that supports that shift.

If you appreciate this post, feel free to share and subscribe below!