Spinning systems, steel & oil and ice cream

thyssenkrupp, Shell, Kaufman & Broad, BASF, Rieter, Unilever, Acciona, LDC, European Spirits, Valneva, Redcare Pharmacy, OMV

At Lux Opes, we break down the latest company news into quick takes that get straight to the point—what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

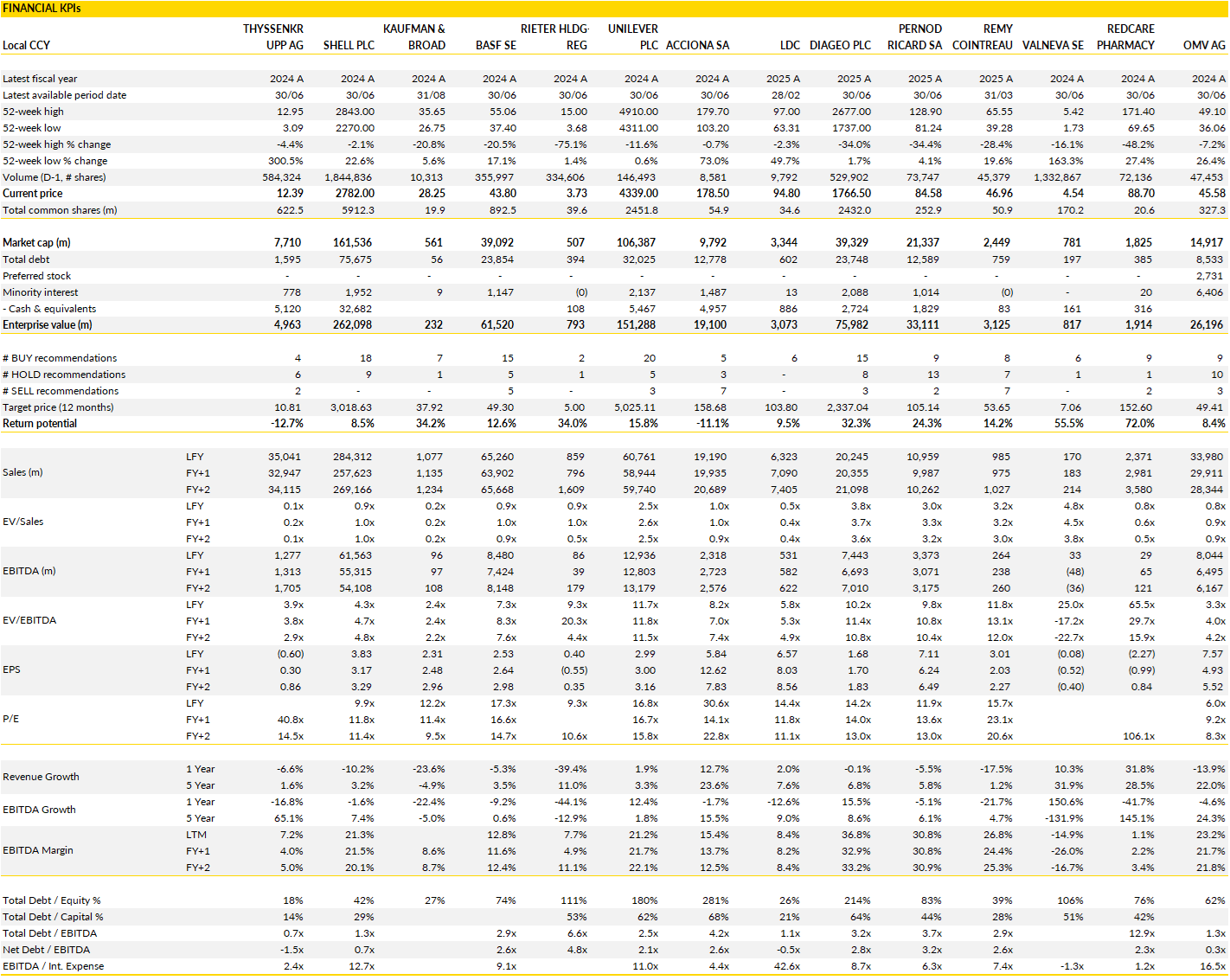

Financial KPIs

thyssenkrupp (TKA Germany): The Czech deal falls apart as India becomes the last card on the table

thyssenkrupp’s effort to offload its steel business has taken another unexpected turn.

The German industrial group recently confirmed that talks with Czech investor Daniel Křetínský’s EP Group over a 50/50 joint venture for Steel Europe have officially collapsed. What began as a potential strategic partnership last year-with EPG initially buying a 20% stake and planning to expand to half ownership-has ended in mutual retreat. thyssenkrupp will refund the purchase price to EPG, which in return will hand back its 20% stake, closing the door on what was once seen as the company’s most viable restructuring path for its struggling steel operations.

The breakdown of these talks leaves only one serious option on the table: India’s Jindal Steel International, which surfaced with an unsolicited bid for the entire Steel Europe division just a few weeks ago. Jindal’s interest shifts the focus away from the joint-venture model that thyssenkrupp had been promoting and toward a potential full sale.

For CEO Miguel López, who has spent months juggling multiple paths to streamline the conglomerate, the decision to prioritize discussions with Jindal signals a shift in urgency. The steel business has long been the group’s most politically sensitive and operationally complex unit-caught between global competition, Europe’s decarbonization demands, and domestic labor resistance to radical restructuring.

While a sale to Jindal could simplify thyssenkrupp’s corporate structure and inject much-needed capital, it is far from guaranteed. Regulatory, political, and labor hurdles remain considerable, and it’s unclear how the German government (historically cautious about foreign control of strategic industries) will respond.

For now, the termination of the Czech option is more a narrowing of possibilities. Steel Europe’s future continues to hang in the balance, and while the Indian route could finally offer an exit, the road ahead is likely to be complex and contentious. Investors hoping for a decisive simplification of thyssenkrupp’s portfolio may have to keep waiting.

Shell Plc (SHEL UK): Stable operations mask shifting industry currents

Shell’s third-quarter preview screens steady operational execution amid a more uncertain strategic backdrop for European oil majors.

Across its divisions, output and margins are largely tracking expectations. Integrated Gas volumes are steady with improved LNG output, boosted by the ramp-up of the massive LNG Canada project, while upstream production has crept higher on the back of asset expansions in the Gulf of Mexico and Brazil. Refining margins in the Chemicals & Products division have recovered sharply from the weak first half, while marketing volumes are seasonally strong. Shell is managing through a period of stable commodity prices and a disciplined capital framework.

Yet, beneath that stability, industry-wide questions linger. TotalEnergies’ recent decision to cut back its capex and share buyback program has put the spotlight on whether Shell might follow. For now, the company seems content to hold the line: annual capex guidance of $20–22 billion remains intact, and buybacks continue at roughly $3.5 billion per quarter, equivalent to about 6% of outstanding shares per year. Its gearing remains among the lowest in the sector, giving it the flexibility to maintain these shareholder returns even if oil prices drift lower. With dividends rising annually by at least 4%, the company continues to frame itself as a disciplined cash generator.

The broader context is more nuanced. The geopolitical environment (marked by a protracted Russia war and shifting U.S. energy policy) has tempered the brief re-rating seen among European energy names earlier this year. Shell’s decision to stay out of any potential U.S. listing action, at least for now, suggests management prefers stability.

At current oil prices, the company looks well-positioned to sustain strong free cash flow and a generous buyback program, but little in the recent update hints at a new catalyst.

For investors, Shell remains a resilient but steady hold in a sector caught between cash flow discipline and the long shadow of the energy transition.

Kaufman & Broad (KOF France): Steady profits amid France’s housing headwinds

Kaufman & Broad’s latest nine-month update shows a company quietly defying the broader slowdown in French housing.

Revenue rose modestly, up just over 6% year-on-year, and operating margins held steady at a healthy 7.6%, with management keeping tight control over expenses despite some pressure on gross margins. The third quarter saw a mild dip in top-line growth, largely due to a softer housing segment, but the company’s profitability remained robust. A net cash position close to €395 million shows the strength of its balance sheet, giving Kaufman a level of resilience few developers currently enjoy.

Commercial momentum is equally encouraging. The company reported nearly 3,800 unit reservations over nine months, a 10% increase in a market where overall volumes are flat or declining. That growth helped it gain market share even as the sector grapples with economic uncertainty, higher rates, and the phasing out of France’s Pinel tax incentive for residential investment.

Kaufman’s order book remains well diversified and supported by disciplined cost management, allowing it to weather cyclical pressure better than peers. Management reaffirmed its full-year guidance for around 5% revenue growth and stable margins between 7.5% and 8%, consistent with market expectations.

Still, the macro backdrop limits enthusiasm. The French residential market remains constrained by affordability issues, shifting fiscal policy, and upcoming municipal elections, all of which make near-term acceleration unlikely.

Yet, Kaufman’s consistent execution and strong cash generation provide a defensive profile in an otherwise fragile environment. The company may not offer high-growth potential, but its solid profitability, clean balance sheet, and potential appeal as a takeover target keep it firmly on investors’ radar.

BASF (BAS Germany): Turning capital discipline into a cash-generation engine

BASF’s latest Capital Markets Day showcased a company leaning hard into financial discipline to unlock value after several turbulent years for Europe’s chemical sector.

Management reaffirmed its mid-term ambition of €10–12 billion in annual EBITDA by 2028 and a cumulative operating cash flow of more than €12 billion between 2025 and 2028. These numbers aren’t new, but what stood out was the detailed road map to get there. A tighter €16 billion capex plan (trimmed from previous guidance) will free up capital without sacrificing growth (is the plan/hope). Roughly half of that spending is earmarked for maintenance, while the rest leaves room for targeted expansion even in a subdued demand environment. BASF also revealed that its automotive catalyst business, ECMS, will remain in-house for now, serving as a steady cash contributor through 2030.

The company’s renewed focus on monetizing non-core assets is another clear theme. The divestment of its Brazilian decorative paints business has already closed, and a review of the coatings division is now underway, with strong interest reportedly from potential buyers. Management hinted that a decision on this front could come before year-end, and the resulting proceeds-along with compensation from German state guarantees on expropriated Russian assets-may create flexibility for an early restart of share buybacks as soon as 2026.

The market seems to increasingly view these disposals as a structural cleanup (rather than a fire sale): each transaction helps simplify the portfolio, strengthen the balance sheet, and potentially set the stage for renewed capital returns.

All this said, it’s impossible to ignore current trading which remains difficult, particularly in upstream chemicals, where global oversupply and sluggish demand continue to weigh on earnings. BASF acknowledged that 2025 won’t bring a major rebound, but expects gradual improvement in 2026 as cost cuts, capacity ramp-ups and the new Verbund complex begin to deliver.

Even so, the message from the CMD was clear: rather than chasing volume growth, BASF is prioritizing self-help measures and cash generation. The hope is that with a leaner cost base, visible monetization progress, and an intact dividend policy, the group can rebuild confidence, and perhaps setting up for the next phase of value creation once markets turn.

Rieter Holding (RIEN Switzerland): Strengthened balance sheet prepares the ground for recovery (is the hope)

Rieter’s capital increase marks a key step in reshaping its financial foundation ahead of a cyclical upturn in global textile machinery.

The company raised CHF 462 million through a two-part share issue that was almost fully subscribed, signaling strong backing from core shareholders Peter Spuhler and Martin Haefner. This fundraising drastically increases Rieter’s share base and injects liquidity into its balance sheet, reducing leverage and ensuring that the acquisition of Barmag (a push into higher-value segments) can be completed without jeopardizing financial stability. The introduction of a ‘Capital Band’ mechanism, allowing flexibility to issue up to 10% more capital until 2030, adds another layer of long-term security (for the company, less so for investors).

Strategically, the acquisition of Barmag could prove transformational. It brings Rieter exposure to fast-growing, higher-margin markets in filament production technology and creates a business better balanced across product cycles. Management expects Barmag to deliver solid EBITDA margins above 10% and to start contributing meaningfully from 2026 onward, when full integration kicks in.

Meanwhile, the legacy Rieter operations are expected to remain subdued until global demand for spinning systems recovers, weighed down by trade tariffs and macro uncertainty. However, the synergy potential from integrating Barmag (estimated at CHF 20 million by 2027) along with expected cost efficiencies, point to a path toward improved profitability and positive free cash flow from 2027.

The near-term numbers still look heavy, with leverage temporarily peaking after the acquisition financing, but momentum seems to be improving. Rieter is entering this next phase with renewed financial strength, broader product reach, and an industrial logic that aligns better with where the textile market is heading.

The combo of a repaired balance sheet, (some) cyclical recovery, and operating leverage gives the company an opportunity to shift from survival to expansion mode. But for that we need a global textile investment rebound.

Unilever PLC (ULVR UK): Shedding ice cream to refocus on the core

Unilever’s long-awaited demerger of its ice cream business is finally taking shape, marking the company’s boldest structural move in years.

The demerger circular for The Magnum Ice Cream Company (TMICC) has been published: one TMICC share will be distributed for every five Unilever shares held, with Unilever retaining a 19.9% minority stake that it plans to sell down over time.

The move effectively detaches a cyclical, capital-heavy business from the broader group, allowing management to refocus on its higher-margin home and personal care (HPC) portfolio. The demerger vote is scheduled for late October, and TMICC is expected to list on Euronext Amsterdam and the London Stock Exchange in mid-November.

The transaction is designed to be economically neutral for shareholders through a share consolidation in the remaining Unilever entity, which should offset the value lost from spinning off ice cream. The aim is to preserve per-share earnings and dividends, minimizing short-term valuation disruption.

Yet, beyond the mechanics, the message is that Unilever wants to sharpen its identity as a focused HPC powerhouse, positioning itself among Europe’s most predictable consumer goods giants. The spin-off is therefore the first step toward a long-term transformation aimed at operational simplicity, brand consistency, and a higher quality of earnings. The eventual goal are (hopefully) a leaner Unilever trading on a premium multiple more in line with best-in-class peers.

Management’s tone suggests that this won’t be the last portfolio move, hinting at a continued pruning of non-core assets. If execution goes smoothly, Unilever could re-emerge as one of Europe’s purest consumer staples plays; steady, cash-rich, and focused squarely on everyday essentials.

Acciona (ANA Spain): Quietly setting the stage for a structural reshuffle

Acciona’s latest move may look technical on the surface, ic a request to bondholders to allow a guarantor substitution clause, but beneath it lies a potentially significant shift in the group’s long-term structure.

The proposal, which would let Acciona Energía transfer its guarantees to another wholly owned subsidiary, seems designed to enhance flexibility at a time when strategic options are clearly being weighed. In practice, it’s about giving the parent company more room to maneuver, particularly if a buyout or merger of its renewables arm were to move ahead.

The timing of this legal adjustment, following several equity swaps that have steadily increased Acciona’s stake in Acciona Energía, feels deliberate. The group now owns just over 90% of its energy subsidiary, the threshold where delisting becomes a realistic next step.

This maneuvering suggests a rahter carefully staged process. By creating legal and financial headroom first, Acciona ensures that any potential transaction can proceed without being derailed by technicalities such as debt covenants or refinancing hurdles.

For bondholders, the proposed clause keeps credit protection intact, while for management, it adds a layer of operational freedom that may prove crucial if it decides to simplify the group’s structure. The incentive fees being offered to secure bondholder consent hint at the urgency of locking in this flexibility before broader changes unfold. Whether or not a buyout of minority shareholders materializes, Acciona is clearly preparing its balance sheet and corporate framework for a more streamlined future.

Strategically, though, the question remains: what does the company gain from bringing its energy arm fully back under one roof? Owning 100% would remove public-market distractions and allow tighter coordination between infrastructure, energy, and financing-a more integrated model that fits Acciona’s long-term DNA. Yet it would also reduce transparency and potentially strain leverage in the short term.

For now, the group seems content to keep options open. The message from Madrid seems clear: the next phase in Acciona’s evolution will be about simplification, control, and readiness for a new cycle in renewables.

LDC (LOUP France): Steady leadership and quiet strength behind the growth

LDC continues to do what it does best: deliver steady, disciplined growth in a sector where volatility is pretty much the norm.

The latest trading update confirmed solid progress, particularly across its international operations, which are benefiting from a broader product mix and stronger market positioning. While much of the food sector still feels the pinch of cost pressures and uneven demand, LDC’s integration along the poultry value chain gives it an edge. Its ability to manage sourcing, processing, and distribution internally means it can adapt pricing and maintain margins even in tougher conditions. The resilience of this model has long been the company’s calling card, and it shows again in the way it has sustained double-digit top-line growth while holding profitability steady.

What’s striking is how international expansion has quietly become a more important driver of performance. Markets like Poland and Hungary, which once required patience and capital, are now contributing meaningfully as operations normalize.

The company’s move to strengthen its processed and ready-meal segments, particularly after the integration of new acquisitions, is also paying off, helping offset seasonal fluctuations in poultry volumes.

In France, meanwhile, the business remains a benchmark in both retail and food service channels, supported by trusted brands and strong relationships with supermarkets. While consumption patterns continue to evolve, LDC’s positioning in affordable proteins and convenience products leaves it well aligned with prevailing consumer trends.

Management’s tone remains steady. The focus is on executing the current strategy; improving efficiencies, maintaining financial discipline, and expanding selectively where synergies are clear. The longer-term plan to surpass €7 billion in sales and solidify profitability seems achievable given the current trajectory.

In a food industry often defined by disruption and price wars, its slow-and-steady approach looks more like a competitive advantage than a constraint.

European Spirits Majors (Diageo, Pernod Richard, Rémy Cointreau): Searching for stability in a cooling US market

After years of robust post-pandemic growth, the spirits industry is facing a hangover of its own, particularly in the United States, with seemingly no light at the end of the tunnel.

Depletion data for the summer months shows a market losing momentum, with volumes slipping and value growth softening. Even once-buoyant categories like tequila and bourbon have started to flatten, while traditional segments such as vodka, rum, and gin continue to decline.

The slowdown reflects a combination of consumer fatigue, higher shelf prices, and shifting drinking habits, ic the aftereffects of inflation meeting a more cautious household budget. For the global spirits giants, the challenge remains normalization: the sharp rebound of 2021–22 is giving way to a slower, more selective phase of growth.

In this environment, diversified players are faring better. Diageo, with its wide footprint across categories and regions, remains the best positioned to weather the dip in US consumption. Its strength in ready-to-drink beverages and premium whiskey provides balance against weaker white spirits. Pernod Ricard, while still healthy, has more exposure to segments that are currently under pressure, particularly vodka and gin, and less to the fast-growing US tequila scene. For Rémy Cointreau, the issue is timing; a gradual stabilization in cognac exports has yet to translate into consistent retail demand.

Across the board, pricing discipline and brand equity are cushioning the blow, but volume softness suggests that pricing power alone may no longer be enough to drive growth.

Overall, spirits companies are now leaning harder on emerging regions and innovation to offset slower North American growth. Premiumization remains the long-term anchor, consumers are still trading up, just more selectively.

The market will remain cautious until a steady equilibrium of brand building, supply alignment, and pricing balance (in a more cautious world) is found.

Valneva (VLA France): Reshaping its foundations

Valneva recently solved one of its biggest headaches: short-term debt pressure.

The biotech has struck a refinancing deal that completely reshapes its balance sheet and buys it years of breathing room. Instead of juggling repayments due within months, the company now has a smoother, longer timeline that stretches well into the next decade.

That shift allows management to redirect its focus where it belongs -execution. The move effectively clears the runway for Valneva’s vaccine portfolio, which has been steadily maturing but weighed down by the financial overhang. It’s a clear sign that the company is no longer in survival mode but instead preparing to deliver on its scientific pipeline.

The centerpiece of that pipeline remains the Lyme disease vaccine, developed with Pfizer. It’s a program that has carried immense expectations, and the latest update shows the finish line just a little further out. The trial is running well, but final data will arrive slightly later than expected, now slated for the first half of next year. Beyond Lyme, Valneva continues to advance its candidates in areas such as Zika and shigellosis, quietly building a diversified base in the field of travel and emerging-disease prevention.

What makes this moment significant is that financial clarity and scientific progress are finally aligned. With the debt issue resolved, Valneva can move into 2026 without the same uncertainty that once clouded every update.

The coming year could be a pivot from cautious optimism to tangible validation, as key trial results and new regulatory milestones begin to materialize. For investors and partners alike, this marks the company’s return to a steadier rhythm.

Redcare Pharmacy (RDC Germany): Proving the strength of a digital-first health model

Based on Redcare Pharmacy’s latest update it looks like the company’s momentum continues.

Growth remains robust across the business, with the mix a stand out; the steady expansion of prescription medicine sales alongside continued gains in OTC and wellness categories. In an environment where European consumers are increasingly comfortable managing their healthcare digitally, Redcare’s model, blending e-commerce with pharmacy-grade credibility, seems to be clearly resonating. The company’s ability to grow in both Germany and its international markets shows that the digital pharmacy concept has moved beyond niche adoption and into the mainstream.

Importantly, scale is increasingly translated into operational efficiency. The company has guided to stronger profitability as volumes increase, suggesting its investment in logistics and technology is paying off. Margin improvement is not yet spectacular, but it speaks strongly on the underlying strength and potential of the platform.

Redcare’s is still expanding rapidly, and with the infrastructure to sustain it. The company’s continued momentum in Switzerland and the DACH region highlights how regional integration can serve as a strategic advantage.

The investment case continues to evolve as the traditional pharmacy experience is being redefined (not replaced) by digital platforms that offer convenience without compromising trust. With strong customer loyalty, a growing product mix, and increasing efficiency, Redcare is quietly becoming a reference point for what modern pharmacy retail can look like in Europe.

Meanwhile the valuation is increasingly becoming more attractive.

OMV (OMV Austria): Turning its dividend into a strategic weapon

OMV’s new dividend framework signals a subtle but important transformation in how the company views its role as both an energy producer and a capital allocator.

The revised payout structure ties dividends to both operational performance and the cash flow coming from its petrochemical partnership with Borouge Group International, ensuring that investors benefit more directly from the underlying cash engine that supports OMV’s strategy. It’s a sign that the company is trying to shift the model towards consistency and predictability, in a contrast to the cyclical swings that have long defined the company and sector.

The change also reflects a broader maturation in OMV’s portfolio. After several years of heavy investment in chemicals and downstream integration, the company is entering a phase where capital intensity can ease and returns can normalize. That creates room for a more flexible distribution approach, one that rewards shareholders without compromising long-term growth.

The relationship with ADNOC through Borouge adds another layer of stability, ic a partnership designed not just to share risk, but to deliver recurring cash flow across market cycles. By formalizing this connection within its dividend policy, OMV is effectively translating a strategic alliance into a tangible benefit for investors.

If you appreciate this post, feel free to share and subscribe below!