Soccer, chems and 'warnings'

Adyen, Georg Fischer, Borussia Dortmund, NORMA Group, Vicat, ALSO Holding, Coca-Cola Europacific Partners, DKSH, Enagás, Foncière INEA

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

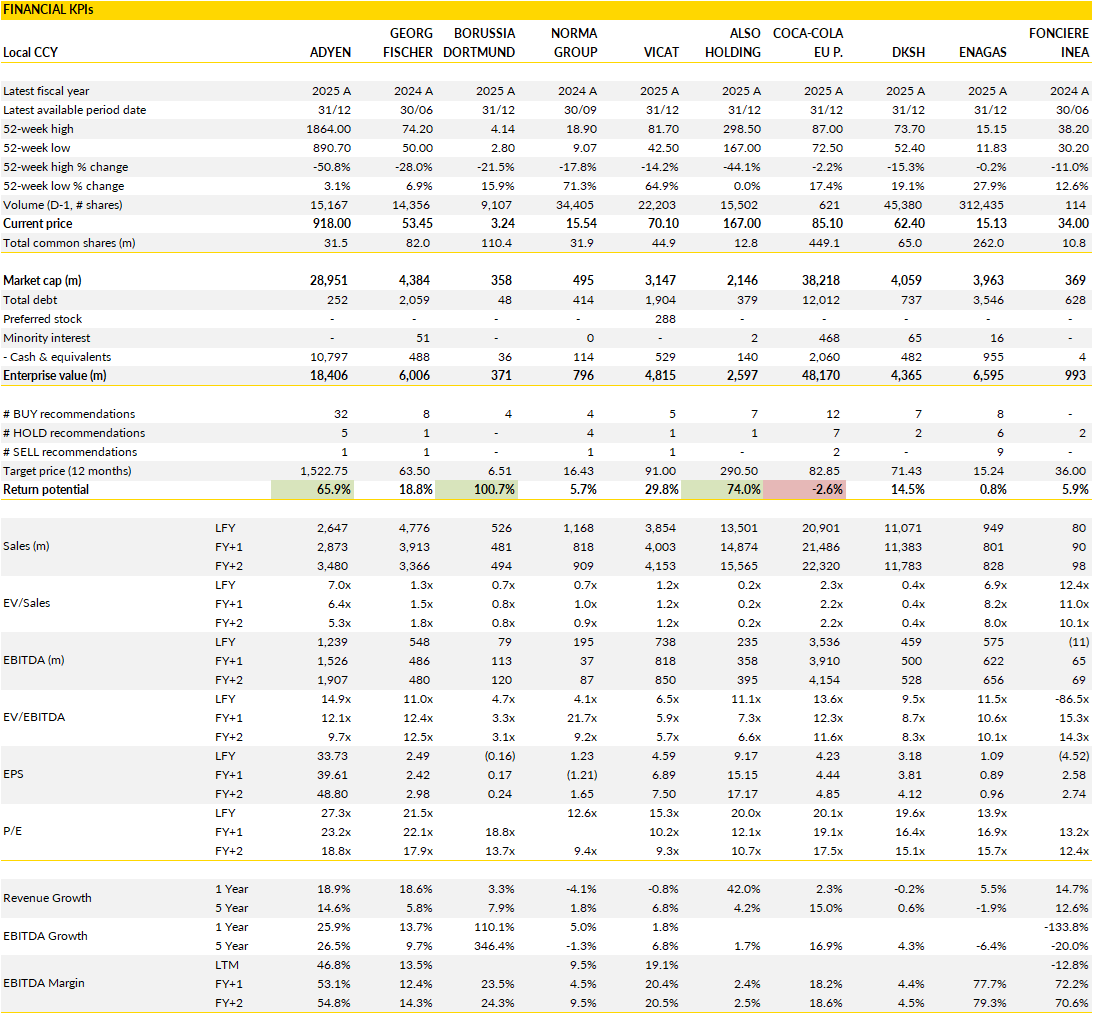

Financial KPIs

Adyen (ADYEN Netherlands): guidance reset dents confidence

Adyen’s second half print was operationally solid, but the market reaction was driven by guidance.

For FY26, management revised its net revenue growth target from low- to mid-twenties at constant currency to 20–22%, and shifted its EBITDA margin ambition from a gradual move above 55% to a stable margin versus the 52.7% delivered in FY25. The change reflects a faster increase in headcount, with FTE growth of 550–650 in FY26, or roughly 13%, including more hiring in higher-cost US regions.

When combining slightly lower revenue growth with a flat margin profile, the implied EBITDA base for FY26 comes down by roughly 5% versus what was communicated three months ago. Q4 itself was not the issue. Revenue was marginally below expectations, but tighter cost control offset the shortfall and net profit for FY25 reached €1.1bn, underlining the earnings power of the platform.

The bigger debate is credibility and capital allocation. The CMD in November framed a path of sustained 20%+ growth and operating leverage through FY28. The February update introduces more caution just one quarter later. That does not change the structural story. Adyen is still growing revenue at around 20%, maintains an EBITDA margin above 50%, and operates with a single integrated technology stack that continues to win large enterprise clients globally.

However, the guidance reset increases uncertainty around the slope of margin expansion and the pace of operating leverage. At the same time, the company has chosen not to initiate share buybacks despite a materially lower share price and strong profitability. That decision keeps the balance sheet conservative but leaves investors without an explicit capital return signal.

At around 19x FY27 consensus earnings, the valuation no longer prices in perfection. The business remains highly cash generative, asset light and structurally exposed to secular growth in digital payments. The question is now mainly about execution discipline and communication. A cleaner, more consistent framework around revenue growth and margin trajectory would likely reduce volatility around results.

For now, the near-term reset weighs on sentiment, but the underlying business continues to compound at an attractive rate.

Georg Fischer (GF Switzerland): a transition year with messy optics, but the water‑pure‑play pivot is almost done

GF’s 2025 setup is complicated by the number of moving parts in the portfolio, and the year is best viewed as the final stretch of a multi‑year transformation rather than a clean read‑through on fundamentals.

In Flow Solutions, the core business should land close to its target of flat to slightly positive organic growth, but the mix remains unfavorable. The lower‑margin castings activities will still be fully consolidated until year‑end, and the machine‑tool business could already be divested in the first half. That makes consensus data difficult to interpret, since segment boundaries and contribution levels are shifting. Against a demanding market backdrop, Flow Solutions’ adjusted EBIT margin is likely to come in just below the old 10.5–12.5% target range, with an estimated ~10% driven by mix pressure and rising FX headwinds. The recently closed automotive castings disposal will also bring a CHF 166m non‑cash, non‑tax‑deductible impairment in the second half, which may not be fully reflected in market expectations.

Looking ahead to 2026, the transformation into a focused water‑technology specialist is close to completion. With EU approval secured, the automotive castings business will be deconsolidated from February. That leaves two remaining non‑core assets that could be sold in the coming months: aerospace castings and gas turbines, which represent roughly 3% of group sales, and the Biel real‑estate assets. Completing these disposals would finally give the equity story a cleaner profile and could help unlock the delayed re‑rating.

Market conditions also look a bit more supportive. Residential construction is expected to stabilise and return to modest growth in 2026, and the commercial and industrial segments show healthier momentum. Semiconductor‑related capex plans from Intel, Micron and TSMC point to a strong pipeline for high‑margin applications, while peers like Watts Water and Xylem are guiding to low‑single‑digit organic growth in 2026.

GF will present its full results and updated outlook on 25 February in Zurich, which should give a clearer view of the final steps in the transformation and the earnings profile of the streamlined group.

Borussia Dortmund (BVB Germany): transfers drive H1 rebound, targets within reach

Borussia Dortmund delivered a clear step up in profitability in H1 2025-26, largely supported by transfer activity.

Consolidated revenue excluding gross transfer proceeds came in at €246.4m, broadly stable year on year. Including €70.1m of gross transfer proceeds, total operating proceeds reached €316.5m, up 12.3% versus last year. EBITDA increased to €81.7m from €58.7m, lifting the margin to 33.2% from 24.0%. Higher net transfer income more than compensated for rising personnel expenses, including bonuses linked to the 2025 FIFA Club World Cup. The first half once again shows how sensitive earnings are to player trading, but it also highlights the operating leverage embedded in the model when sporting and transfer outcomes align.

Looking at the recurring revenue lines, TV marketing and advertising were the main contributors. TV income rose to €104.6m, up 6.5% year on year, supported by international distributions linked to participation in the UEFA Champions League and the upcoming FIFA Club World Cup. Domestic TV income declined slightly as DFL distributions were lower, but this was offset by international exposure. Advertising revenue increased nearly 4% to €75.7m, reflecting improved sponsorship contracts. Matchday income was marginally lower at €24.6m due to the absence of a testimonial match that boosted the prior-year base. Merchandising declined 10.9% to €20.6m, as the prior period benefited from extraordinary shirt sales that did not repeat. Conference and catering income also fell due to the absence of UEFA EURO 24 related revenues booked in the previous year. The underlying commercial business remains stable, with incremental upside tied to European competition and global visibility.

For the full year 2025-26, management guides for revenue of €475m and EBITDA between €105m and €115m. After an €81.7m EBITDA in H1, the target range looks achievable provided sporting performance holds and no major negative surprises occur in the second half.

The equity case continues to revolve around three levers: consistent qualification for European competitions, disciplined wage management, and monetisation of player assets. The current valuation implies a muted view on these drivers despite a strengthened balance between operating income and transfer gains. Volatility will remain part of the story, but H1 confirms that profitability can recover quickly when the transfer window delivers.

NORMA Group (NOEJ Germany): prelims slightly better than feared, but the underlying picture is still weak

NORMA’s preliminary 2025 numbers confirm how tough the operating environment has been, even if a few line items landed a bit ahead of expectations.

Reported sales fell 7% to €822m, with a stark split between segments. Industrial Applications grew 8% year on year, but Mobility and New Energy dropped 12%, reflecting ongoing weakness in automotive and related supply chains. Regionally, the pattern was similar, with declines of 7% in EMEA, 8% in the Americas and 6% in APAC. Adjusted EBIT fell sharply from €33m to €6m, bringing the margin down to 0.8%. That is slightly better than expected but still highlights how little operating leverage the group currently has. Operating cash flow came in at €96m, down 9% year on year but above internal expectations, helped by the final contributions from the Water Management division before its disposal.

The balance sheet looks very different after the Water Management sale. Net debt at year‑end was €316m, or 2.5x EBITDA, but the roughly €650m in net proceeds from the disposal means the company now sits on a net cash position of around €70m after accounting for planned shareholder returns. That gives NORMA more breathing room, although it does not change the fact that the continuing operations are still small and operating at very low margins.

As expected, there is no guidance for 2026 yet. The company will provide full details with the annual report at the end of March. For now, the working assumption is a modest recovery, with sales up lsd-msd and adjusted EBIT improving to roughly €30m, which would lift the margin to about 3.5%. That would still leave the business well below historical profitability, but it would at least mark a step in the right direction.

The prelims show a company that is stabilising but still dealing with a difficult backdrop. The headline numbers are slightly better than feared, yet the absolute level of profitability remains very low. The disposal of Water Management has strengthened the balance sheet, but the core business still needs to demonstrate that restructuring measures can translate into sustained margin improvement.

For now, the setup argues for patience until there are clearer signs of recovery in the continuing operations.

Vicat (France): steady 2025 delivery and a cautious tone for 2026

Vicat’s 2025 EBITDA landed at €771m, essentially in line with market expectations and supported by a mix of operational improvements and regional contributions.

The first effects of the new kiln in Senegal helped lift performance in Africa, exports from Egypt remained strong, and pricing continued to offset cost inflation across most markets. The full‑year forex drag of €46m was significant and masked part of the underlying progress. Free cash flow reached €324m, ahead of market expectations, and net debt closed the year at €1.15bn, which keeps leverage at 1.5x. The dividend remains unchanged at €2.0. The group also published updated climate metrics, showing a modest reduction in CO₂ intensity and continued progress on alternative fuels, which now represent 37.4% of the mix.

The guidance for 2026 is more cautious than the market had hoped. Management expects slight like‑for‑like growth in both sales and EBITDA. Visibility in the United States remains limited, and the company continues to flag political uncertainty in France, although a gradual recovery is expected from 2026 onward. Emerging markets should remain supportive, even if forex remains a headwind. Switzerland is set to continue its recovery path. Industrial capex is expected to normalise to about €290m after two years of elevated investment. The group reiterated its leverage ambition of below 1.0x by the end of 2027 while maintaining an EBITDA margin above 20%.

Consensus should adjust to reflect the slightly softer tone for 2026. The broader equity story remains tied to a set of medium‑term catalysts: a rebound in the French residential market supported by the TELT project, the full contribution of the new Senegal kiln, and continued strength in emerging markets such as Brazil, Turkey and Egypt. Even with near‑term caution in the United States, the underlying fundamentals in non‑residential and infrastructure remain constructive.

Vicat’s share price has been under pressure alongside the broader sector due to uncertainty around potential changes to the European carbon market. While this may weigh on sentiment in the short term, the company’s operational momentum, balance sheet trajectory and regional diversification continue to support the medium‑term outlook.

ALSO Holding (ALSN Switzerland): acquisition growth masks margin softness

ALSO closed FY25 with strong reported growth but a softer bottom line than expected.

In H2, revenue increased 44.9% to €7,574.5m, largely driven by the consolidation of WestCoast in the UK. On a pro forma basis, revenue was broadly in line with internal expectations and 2.5% below consensus. EBITDA in H2 reached €160.4m, up 14.6% year on year, but around 11% below expectations due to acquisition-related one-offs and vendor adjustments that weighed on profitability. For the full year, EBITDA came in at €286m, up 22.2% and at the lower end of the €285–325m guidance range. ROCE reached 16%, slightly below the >17% target, while cash increased 14% to €830m, giving the group significant financial flexibility.

The key question is how quickly margins normalise after the WestCoast integration. The H2 EBITDA margin of 5.6% reflects scale benefits from consolidation, yet underlying profitability was diluted by integration effects and cost phasing. Net income in H2 declined 9.5% to €66.6m, highlighting that operating leverage has not fully materialised yet.

Management guides for FY26 EBITDA of €300–340m and ROCE above 20%. The midpoint of the EBITDA range implies mid-single-digit growth from FY25 and sits modestly below prior expectations. The longer-term ambition remains unchanged, with EBITDA targeted at €425–525m and ROCE above 25% by 2027–2029. Execution on integration, working capital discipline and margin recovery in the UK will determine how credible that path appears over the next few quarters.

Strategically, ALSO continues to position itself as a consolidator in European IT distribution, combining volume scale with value-added services and platform capabilities. The €830m cash position provides capacity for further bolt-ons or capital returns.

After a period dominated by M&A-driven growth, the focus now shifts to extracting synergies and improving capital efficiency. The current valuation reflects integration risk and a cautious near-term outlook, but if ROCE trends towards the >20% target in FY26, the equity story could regain momentum.

Coca‑Cola Europacific Partners (CCEP Netherlands): a steady 2025, modest beats on volumes, and a guidance update

CCEP’s 2025 numbers were broadly in line with market expectations, with a few small positives but nothing that shifts the story in a meaningful way.

Comparable adjusted volumes grew +0.2%, which is slightly better than the small decline the market had penciled in. Europe was marginally negative at -0.2%, while APAC South delivered +1.0%, both a touch ahead of expectations. Revenue of €20.9bn was essentially flat versus consensus, with Europe a fraction below and APAC a fraction above. Operating profit of €2.8bn came in just ahead of expectations, and underlying EPS of €4.1 was also slightly better. The dividend of €2.0 was a shade below what the market expected, but the €1bn buyback announcement aligns with prior communication and sits close to consensus.

The 2026 guidance is unchanged in tone and structure. Management expects revenue growth of 3% to 4%, helped by calendar effects in Q1 and offset by the loss of Suntory alcohol distribution in Australia and New Zealand, which creates a roughly 0.5% headwind for the year. Operating profit is expected to grow around 7%, with a tax rate near 26%. Capex should remain around 5% of revenue, and comparable free cash flow is targeted at at least €1.7bn.

In other words, the company is signaling another year of steady, predictable progress rather than acceleration.

The results show a business that continues to execute well, with volumes holding up better than feared and profitability tracking in line. At the same time, the absence of a guidance upgrade and the lack of a more aggressive capital‑return announcement leave the equity story without a clear catalyst.

The company remains a stable compounder with strong cash generation, but the near‑term setup does not offer much to re‑rate the shares.

DKSH (DKSH Switzerland): steady execution with asia carrying the mix

DKSH closed 2025 with numbers that broadly met market expectations and, more importantly, showed a business that continues to grind forward in a difficult macro backdrop.

Sales reached CHF 11,070.6m, down 0.2% reported but up 2.9% at constant exchange rates and 2.5% organically. Growth accelerated in the second half, with H1 like-for-like at 1.8%, pointing to some improvement in momentum as the year progressed. Currency remained a 3.1% drag, largely due to the strong Swiss franc. Core EBIT came in at CHF 349m, up 1.7% year on year and 6.7% at constant exchange rates, with the core EBIT margin improving 10bp to 3.2%. Free cash flow amounted to CHF 215.5m, supported by disciplined working capital management and capex of just 0.3% of sales. The dividend was raised 6.4% to CHF 2.50, underlining balance sheet stability.

Divisional trends reflect the portfolio logic. Healthcare delivered 4.6% growth at constant exchange rates with a 3% margin, supported by structural demand and ongoing mix improvement. Consumer Goods grew 1.2% at constant exchange rates, but the key point is the H2 acceleration to 2.8%, with margin up 10bp as cost control and pricing discipline took hold. Performance Materials increased 1.4% at constant exchange rates and expanded margin to 8.2%, driven by Asia Pacific, which represents around 60% of divisional sales and continues to outperform a generally soft global market. Technology declined 1.4% at constant exchange rates and saw a 30bp margin contraction, reflecting delayed customer investments in a more cautious environment.

Taken together, the earnings profile is stable, with gradual margin progression and no signs of operational stress.

Fir 2026, management guides for core EBIT to be higher than in 2025, consistent with its medium-term roadmap. The assumptions are straightforward: ongoing economic growth in Asia Pacific, stable currencies and no major external shocks. The group remains positioned as the leading market expansion services platform across Asia, active in healthcare, consumer goods, performance materials and technology.

With solid free cash flow and a healthy balance sheet, DKSH retains flexibility for bolt-on M&A in a consolidating landscape. The investment case rests on steady mid-single-digit organic growth, incremental margin gains and continued execution in Asia, which remains the structural engine of the model.

Enagás (ENG Spain): positioned for the hydrogen build‑out

No surprises with Enagás’ 2025 results.

EBITDA landed at €676m and recurrent net profit at €266m. The year‑on‑year decline in EBITDA reflects two known factors: the regulatory adjustment on continuity‑of‑supply remuneration and the deconsolidation of Tallgrass Energy and Soto la Marina, which together represented about €30m of EBITDA in 2024. Revenues include €126m related to the sealing of the Castor storage site, with offsetting effects at the EBITDA line. Operating costs fell slightly, showing tight cost discipline and outperforming the company’s own multi‑year cost targets. The divestments also reduced PPA amortisation, and the debt restructuring following the Tallgrass sale lowered financial costs. Net debt stands at €2.5bn with an average cost of 2.1%, and FFO of €636m highlights the resilience of the cash flow profile.

Strategically, 2025 was a year of meaningful progress. The company resolved several legacy items, including the GSP arbitration in Peru, and benefited from a supportive regulatory backdrop ahead of the next regulatory period starting in 2027. Natural gas again demonstrated its strategic role in the Spanish system, with demand up 6% and gas‑fired power generation up 33% following the blackout. Exports rose 17%, underscoring Spain’s importance in the European decarbonisation pathway.

The bigger story is the positioning for hydrogen. Enagás will provide 2026 targets during today’s call, but the long‑term picture will only be updated once the new regulation is fully disclosed. The company is preparing for the development of the Spanish hydrogen backbone and the H2Med corridor, both of which could materially reshape its growth profile from 2027 onward. The expected regulatory framework for hydrogen, including favorable returns and mechanisms to recognise work in progress, should allow Enagás to pursue this expansion without compromising its dividend policy. With operating cash flow of around €500m excluding hydrogen and a strengthened balance sheet, the group appears well placed to capture this opportunity.

Enagás exits 2025 with stable operations, a cleaner financial structure and a clear strategic direction. The near‑term numbers are steady, but the medium‑term potential tied to hydrogen infrastructure is increasingly visible.

Foncière INEA (INEA France): stabilising cash flows while waiting for offices to reopen

Foncière INEA closed 2025 with recurring net earnings per share of € 2.58, up 5.4% year on year, which reflects a business that is holding up in a regional office market still characterised by corporate caution.

Rental income reached € 81.5m, up 4.5%, with 2.5% like-for-like growth driven mainly by indexation of 3.5%. Vacancy increased to 11.6%, up 130bp over 12 months, largely linked to the expiry of rental guarantees on recently delivered assets rather than a structural deterioration in demand. Leasing activity remained active with 68 leases signed in 2025 representing 32,000m². This is below 2024 levels but still solid given the market backdrop. More than 40% of leases were signed with firm terms above six years, which supports visibility. The regional focus continues to differentiate INEA from Paris-centric peers, with corporates still showing appetite for modern, energy-efficient assets outside the capital.

Portfolio values were broadly stable at € 1,210m including transfer taxes, down 0.7% over 12 months excluding the 0.5% transfer tax increase recorded in H1. The average capitalisation rate moved to 6.50%, up 9bp year on year. Offices, representing 79% of the portfolio, saw yields expand to 6.67%, while business parks at 21% compressed to 5.87%. EPRA NTA per share stood at € 48.8, down 3%.

Balance sheet metrics improved slightly, with EPRA LTV at 50.9% at year-end versus 52.2% mid-year. € 18m of disposals were completed in 2025 at or above appraisal values, with proceeds used to reduce debt. The average cost of debt is 3.6%, 78% of exposure is hedged, and no major maturities fall due before mid-2027. The debt profile is therefore manageable even if the rate environment remains elevated.

Cash flow per share reached € 4.7 in 2025, up 53%, exceeding earlier guidance and supporting a maintained dividend of € 2.70. For 2026, management guides to cash flow per share between € 4.6 and € 5.0, underpinned by continued asset rotation and improving occupancy.

The strategic objective remains clear: increase the share of resilient assets, lift occupancy back toward structural levels, and gradually reposition the portfolio mix. The investment case hinges on execution. If leasing momentum continues and regional supply remains constrained, operating leverage can reappear quickly.

Until then, the story is one of disciplined balance sheet management, solid cash generation and a dividend yield that compensates investors while waiting for a clearer recovery signal in regional offices.

If you appreciate this post, feel free to share and subscribe below!