Ski resorts, restructurings and busted casinos

Compagnie des Alpes, SMCP, Sika, Xilam, Casino, Autoneum, Vivendi, LVMH, Transport Trade Services, Airbus, Bilfinger, Eurocash

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

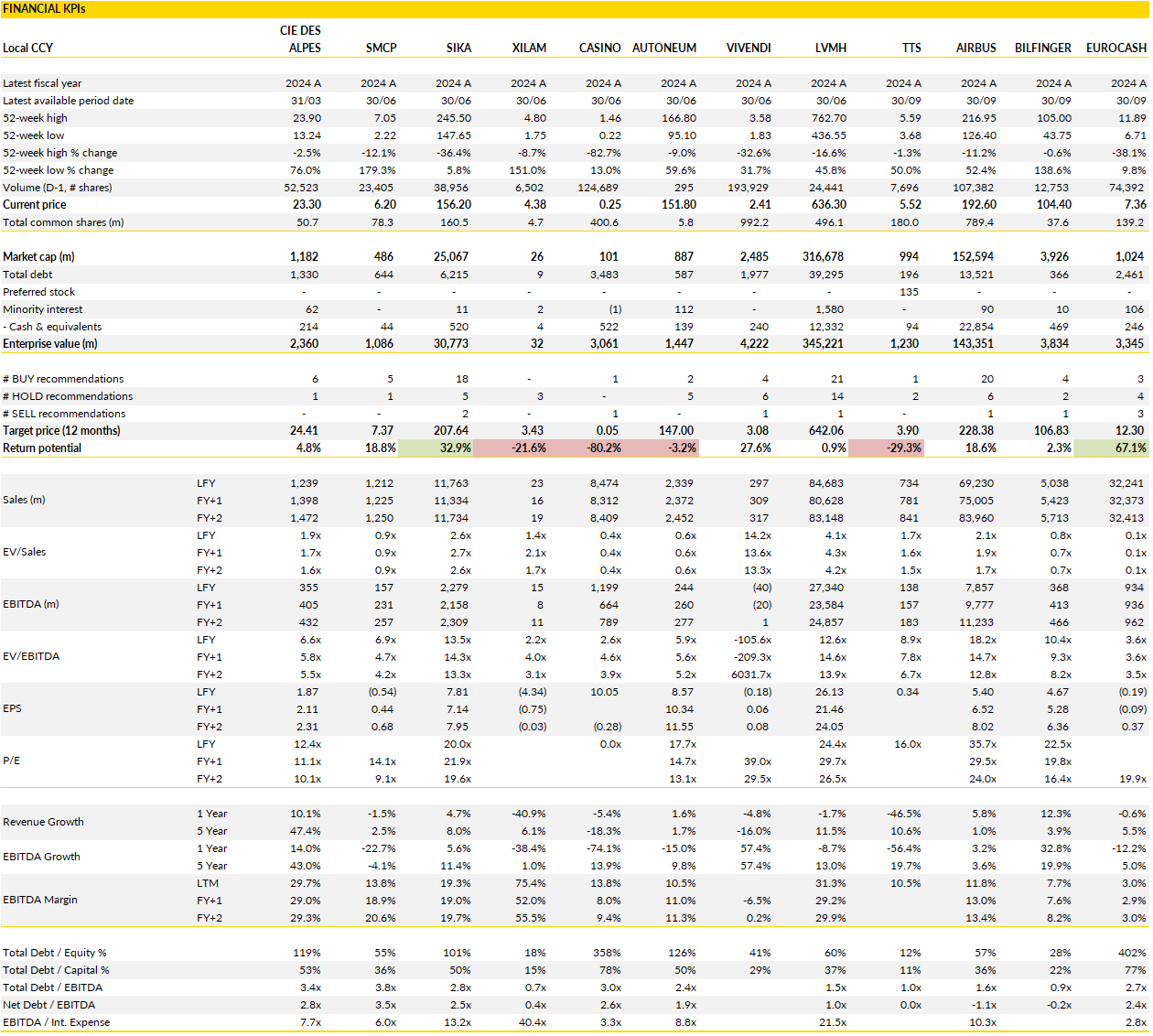

Financial KPIs

Compagnie des Alpes (CDA France): steady lift from strong slopes and resilient parks

Compagnie des Alpes delivered another confident set of numbers, showing its knack for turning reliable alpine demand and well-timed pricing power into consistent earnings growth.

Full-year revenue rose 13% on the back of a solid ski season and a strong performance from its leisure parks, pushing EBITDA up 17% and margins near 30%. The mix was healthy across the board: ski areas benefited from robust ticket pricing and sharply lower energy costs, while leisure parks absorbed recent acquisitions with improving profitability. Distribution and hospitality continued to gain traction as the group refined its strategy around higher-margin travel services. Cash generation was particularly strong, aided by tight cost control and steady operations, bringing leverage to a modest 2.3x EBITDA. The dividend nudged up again to €1.10 per share, a sign that management is balancing growth investment with steady shareholder returns, a recurring theme in CDA’s post-pandemic recovery.

The outlook for 2026 looks (reassuringly) straightforward: more of the same, just slightly better. Early bookings for the ski season are on track, and the company expects another pricing-led lift in mountain resorts. The parks business remains the key growth lever, supported by the expansion of high-traffic attractions and a surprisingly strong start to the winter holiday period after a record Halloween season.

Management’s guidance for nearly 10% EBITDA growth this year sits comfortably ahead of consensus, suggesting that operational leverage is still working in its favor despite rising input costs and heavier capex. CDA also reiterated its mid-term ambition to exceed €500 million of EBITDA within four years and lift its margin above 30%, an achievable target given its current trajectory, though one that will rely on disciplined reinvestment and continued pricing strength in both segments.

CDA’s story continues to highlight the balance between growth and prudence. Few European leisure operators have managed to keep their margins expanding while still investing nearly a fifth of revenue back into their asset base. While the capex load remains high in the near term, the payoff is clear: higher pricing power, richer customer experiences, and stronger year-round utilisation.

With visibility stretching further out and the share still trading on modest multiples, CDA’s investment case remains attractive.

SMCP (SMCP France): the affordable luxury comeback that now looks like a takeover play

After months of speculation, SMCP finally confirmed that a formal sale process for the controlling 51% stake is underway. The move effectively sets the stage for a change of ownership in the coming months; a natural endgame for a group that has spent the past two years cleaning up its balance sheet, repatriating disputed shares from Asia, and re-establishing itself as one of the more credible names in European affordable luxury.

The shares in play include the 28% held by GLAS (the trustee that took over following European TopSoho’s bond default), the 15.5% recently returned to Europe from the same vehicle, and an additional 7.7% administered by Alix Partners. Together, they represent a controlling block that would trigger a mandatory takeover bid if acquired in full, meaning minority investors could finally see a liquidity event after years of uncertainty.

What makes SMCP interesting to potential buyers is the combination of strong brands and a still-recovering margin base. Sandro and Maje have maintained their urban-cool appeal and store footprint across global capitals, while Claudie Pierlot continues to add steady, profitable growth in Europe.

Despite a tougher backdrop for mid-market fashion, SMCP’s operating improvements (tighter cost control, a more disciplined retail rollout, and digital expansion) have begun to bear fruit. That recovery, coupled with a now much cleaner shareholder structure, makes the company a rare asset in its segment: global, profitable, and trading at undemanding multiples.

The list of potential acquirers spans from private equity to strategic buyers in Europe and Asia. A group like EPI or Maus could use it to scale its luxury and lifestyle portfolio, while Chinese fashion houses, eager to bring Western brands into their ecosystems, would find the SMCP portfolio both prestigious and accessible.

For investors, the story now shifts from operational recovery to deal speculation. At around €6 per share, the stock still trades at a notable discount to the sector. That figure implies a fair multiple in line with peers but doesn’t capture the potential takeover premium that a competitive bidding process could introduce.

Fundamentally, SMCP has already done the hard work: it’s profitable again, deleveraged, and operationally sharper.

Sika (SIKA Switzerland): slow cure for a trusted compound

Sika’s latest “FAST FORWARD” plan seems clearly about repair work. At its Zurich presentation, management detailed a cost and digital transformation program aimed at keeping long-term ambitions alive despite a slower world.

The idea is straightforward: squeeze CHF 150–200 million of efficiencies by 2028 through a leaner workforce and smarter systems. Around 1,500 jobs will go globally, while new investment in automation and data-driven operations should lift margins back toward healthier levels.

The company is betting that this mix of discipline and digitalisation will offset the drag from weaker construction demand across Europe, the U.S. and China, the three regions that once fuelled its double-digit growth story. It’s a sober but realistic plan: steady gains, not sweeping breakthroughs.

China remains the most sensitive part of the narrative. Roughly a tenth of group revenue comes from there, and Sika’s heavy exposure to construction has been painful in a market still digesting its property slump. Management insists the local presence is strategic, and rather than retreating, it plans to consolidate from over 30 factories down to 25, a bet that China’s building slowdown will eventually stabilise and that local champions will expand overseas. That view isn’t far-fetched: Chinese construction and auto suppliers are indeed venturing abroad, and Sika’s deep relationships and product know-how could help it follow them.

Still, the short-term math is unflattering: lower volumes, modest pricing, and a trimmed medium-term growth target of 3–6% through 2028, half of what was once promised.

The FAST FORWARD plan at least restores a sense of direction. It shows a company trying to match its ambitions to reality while still investing to protect its long-term edge in adhesives, sealants and building solutions.

But after years of delivering outperformance, Sika now finds itself in the unfamiliar position of managing expectations downward. The fundamentals (market leadership, pricing power, disciplined capital allocation) remain intact, yet sentiment recovery will take time.

Xilam Animation (XIL France): testing the waters with a kid-safe streaming bet

Xilam has decided to make a small but symbolically big leap: the French animation studio behind Oggy and the Cockroaches is launching its own subscription streaming platform, ToonBox. The service, aimed squarely at children aged 3 to 10, debuts with over a thousand episodes drawn from Xilam’s deep catalogue and promises an ad-free experience at €4.99 a month.

For now, it’s available in 11 markets, including France, the UK, and the US, but limited to iOS devices, with Android expected next year. It’s a modest start, but in many ways a clever one: Xilam is using existing content to go direct-to-consumer at minimal cost, testing whether its global fan base on YouTube and social media (125 million followers across platforms) can be monetized more predictably than through volatile licensing deals with the big streamers.

In a market where the major platforms have sharply reduced animation spending, this experiment feels like both necessity and opportunity. The economics are small-scale (management estimates break-even at roughly 20,000 subscribers) but the logic is sound: Xilam already owns the rights, so incremental costs are low and upside could come quickly if even a fraction of its online audience converts.

The challenge lies in execution. Customer acquisition and retention in children’s content is notoriously tricky, as parents are choosy and churn is high once the novelty wears off. Still, by going subscription-only and keeping prices accessible, Xilam positions ToonBox as a safe, focused alternative to ad-driven kids’ content on YouTube; a niche that remains surprisingly underdeveloped despite the size of the audience.

The initiative won’t move the needle financially in the near term, but it does hint at a company adapting creatively to a rough market. Xilam has spent the past two years caught between falling commissioning budgets from streaming giants and slower linear TV recovery, forcing a rethink of its model. Going direct-to-consumer is a logical next step, even if it’s more about proof of concept than profits.

If successful, ToonBox could strengthen Xilam’s brand, deepen engagement with younger viewers, and offer a new outlet for its upcoming slate of series. For now, though, this is a cautious experiment rather than a new growth engine, a small, well-timed pivot in a sector still waiting for its next upturn.

Casino (CO France): a second restructuring that solves little

The Casino saga has entered yet another chapter, one that feels more like a rerun.

This week, Daniel Křetínský’s France Retail Holding (FRH) tabled an initial proposal to inject roughly €300 million of new equity in exchange for a controlling 68% stake, while asking creditors to accept a €600 million haircut on Term Loan B debt. On paper, it’s an effort to clean up a capital structure that’s long been unsustainable; in practice, it highlights just how unbalanced the group’s financial position remains. The dilution implied by FRH’s offer leaves creditors with only a third of the company in exchange for giving up almost twice as much value, an awkward starting point for negotiations. Meanwhile, Casino’s latest “2030 plan” paints a weaker financial picture than previously expected, with net debt projected to rise by €1.35 billion through 2028, roughly €350 million worse than prior forecasts. For a group that only recently restructured, this looks like déjà vu.

More concerning is the opacity around the numbers. Analysts estimate that nearly €250-290 million of the projected debt increase is unexplained, a gap that’s neither trivial nor easily ignored. It represents almost 90% of Křetínský’s proposed equity injection and around 45% of the total haircut sought from lenders. In other words, nearly a quarter of the plan’s balance sheet impact has no clear source. That makes it difficult to judge whether Casino’s new targets are conservative or simply incomplete.

Beyond the arithmetic, the operating backdrop remains challenging: fragile margins, stagnant sales around €8.3 billion, and limited levers left to pull after years of asset disposals. Even with improved supplier terms and a simplified store network, the turnaround case now hinges less on operations and more on how much debt can be written off, again.

Casino’s future now rests on what kind of compromise can be reached between FRH, creditors, and regulators. The retailer that once symbolized France’s suburban dominance has become a case study in how over-leverage can hollow out even the strongest brands. The proposed plan buys time, not necessarily stability, and much of the “value creation” depends on what’s forgiven rather than what’s earned.

With its equity capitalisation dwarfed by debt and another drawn-out restructuring ahead, investors have little reason to expect any rebound. For all the talk of a 2030 plan, Casino still looks trapped in the long shadow of its past financial engineering, and it’s hard to see that changing soon.

Autoneum (AUTN Switzerland): driving deeper into China’s acoustic core

Autoneum confirmed the closing of its acquisition of Chengdu Yiqi-Sihuan Automobile Interior, a supplier of acoustic and thermal insulation components with four plants close to major local OEMs like FAW-VW, FAW-Toyota, and Geely.

The business, generating around CHF 27 million in revenue last year, adds depth to Autoneum’s regional network and product coverage, while reinforcing its push to rebalance its global footprint. For a company that still earns the bulk of its sales in Europe and North America, this not about adding volume, but about embedding itself into China’s local supply chains, a long-term play on proximity, not scale.

The move fits neatly within Autoneum’s “Level Up” strategy, which targets 20% of sales from Asia by the end of the decade, up from about 8% in 2024. This follows its earlier purchase of Jiangsu Huanyu Group, both transactions helping Autoneum transition from an export-oriented supplier to a more regionally integrated partner for Chinese automakers. The Chengdu deal gives it a foothold in fast-growing segments where local brands are gaining traction, and in a market increasingly focused on noise, vibration, and harshness (NVH) performance for electric vehicles. Autoneum’s focus on these high-margin comfort solutions (think floor insulators, wheelhouse liners, and engine bay absorbers) plays to a structural trend that continues even as global car volumes plateau.

Financially, this is a bite-sized acquisition with no immediate impact on group metrics; the roughly CHF 16 million price tag can easily be absorbed by Autoneum’s conservative balance sheet. The deal doesn’t change near-term guidance, but it strengthens the strategic narrative: a disciplined manufacturer slowly retooling its portfolio toward growth regions and electric mobility platforms.

The company remains in the middle lane for now, i.c. executing well, but without catalysts powerful enough to re-rate the stock in the short term. Still, the continued delivery on its Asian ambitions signals a management team focused on durable, incremental value creation; a sensible strategy.

Vivendi (VIV France): the saga of Bolloré’s control drags on, with little clarity gained

France’s highest court has added another twist to the long-running legal tangle over whether Vincent Bolloré effectively controls Vivendi, and whether that should trigger a mandatory bid for the rest of the company.

The Court of Cassation overturned parts of a previous appeal court ruling that had denied such control, stating that the lower court had misapplied the legal definition under French commercial law. Yet in the same breath, it declined to draw a final conclusion, instead sending the case back to a new Paris appeals panel for re-examination.

In short: the Supreme Court said the analysis was flawed but stopped short of saying Bolloré does, in fact, control Vivendi. This procedural reset means at least another half-year of legal limbo while the appeals court revisits the question, and potentially longer, given the likelihood of further challenges.

For investors, this means that the scenario of a mandatory takeover bid, which would normally be triggered if Bolloré were deemed to exercise de facto control, remains possible in theory but improbable in practice. The Cassation ruling explicitly notes that control has not been established, making it legally awkward for the AMF to force a bid unless new and stronger arguments emerge. The regulator and the courts will now have to assess “the consequences for minority shareholders,” a vague formulation that could allow some creative interpretation but offers little concrete visibility.

Meanwhile, Vivendi’s complex corporate structure and sprawling portfolio, including its stakes in UMG, TIM, and Mediaset, continue to trade at a heavy discount to net asset value, now estimated at roughly 45%.

In the absence of a clear judicial outcome or any decisive corporate action, both Vivendi and Bolloré remain stuck in a holding pattern. The group’s asset disposals, once touted as catalysts for unlocking value, are likely to be delayed until legal uncertainty subsides. Bolloré, sitting on over €5 billion in cash, appears equally cautious about deploying capital before knowing whether a forced bid might still materialize.

The result is stasis: a stock weighed down by legal overhang, limited strategic movement, and investor fatigue after years of governance intrigue. Vivendi’s story remains one of untapped value overshadowed by unresolved control, a slow-motion corporate chess game.

LVMH (MC France): back to growth mode

After a year of mixed signals for the luxury sector, LVMH is once again showing why it sits in a class of its own. As previously set out, the group’s latest update struck a more confident tone on the medium-term outlook, even if short-term trends remain subdued. Management still expects sluggish growth through the end of 2025, weighed by tough comps and lingering caution in the U.S. and China, but sees a clear inflection building from 2026 onward.

What’s changing is more about LVMH’s own renewal cycle: a new creative wave at its flagship fashion houses, a return to margin expansion in jewelry, and a long-overdue reset in Wines & Spirits. These elements form the basis of a broader recovery narrative, one that suggests the group’s multi-brand model still compounds earnings power when sentiment turns.

Fashion and Leather Goods, which account for over 70% of operating profit, are again becoming the engine of differentiation. Dior, Céline, and Loewe will all roll out fresh creative directions from 2026, following a quieter period in design leadership. That timing aligns with LVMH’s heavy investment in experiential retail, stores conceived less as points of sale than as temples of brand. New flagships in Milan, New York, Seoul, and eventually Paris’ Champs-Élysées are being designed as high-traffic showcases (rather than volume drivers).

This approach, blending fashion with architecture and culture, should reinforce pricing power while controlling store proliferation, the sort of capital discipline that keeps LVMH ahead of peers. If execution holds, margins could climb back toward the upper-30s for the division by 2028, restoring the structural profitability that briefly dipped during 2024–25’s retail overhang.

Meanwhile, the laggards are being fixed rather than ignored. Jewelry, long the underappreciated asset in the portfolio, is poised for a more material contribution as Tiffany’s flagship makeovers (Tokyo, Milan, Paris) and Bulgari’s U.S. expansion come online. Both brands are now entering the phase where upfront retail investment starts to flip into operating leverage.

In Wines & Spirits, the task is harder but achievable: the group is targeting a return to roughly mid-20s EBIT margins by 2028, versus sub-20% this year, helped by deep cost cuts and portfolio pruning. Taken together, these shifts suggest that LVMH’s long-term earnings power is far from peaking.

The stock still trades below 20x its 2028 earnings, hardly excessive for a high quality company rebuilding momentum across multiple engines of growth.

Transport Trade Services (TTS Romania): weathering low waters and low prices on the Danube

Transport Trade Services’ third-quarter rebound wasn’t enough to salvage a tough year for Romania’s logistics champion.

The company swung back to profit, with EBITDA nearly doubling year-on-year, but the recovery came in well below expectations as the strong agricultural harvest failed to translate into higher barge volumes. The culprit was twofold: the Danube’s erratic water levels once again constrained navigation during peak export weeks, and soft international grain prices dampened the incentive to ship. Even with revenues up 12% and costs tightly managed, the margin recovery could not offset the shortfall in agricultural throughput.

This shows TTS’s structural exposure to weather volatility and the cyclicality of bulk commodity flows, i.c. issues that can mask operational progress even when the underlying business executes well.

Breaking down the numbers, river transport, the backbone of TTS’s integrated model, rose a mere 3% year-on-year, hampered by a ten-day shutdown in July when drought conditions made navigation temporarily impossible. Port operations fared better, growing 10% and proving more resilient thanks to their relative independence from river levels. Overall tonnage handled increased only 1% to 2.6 million tons, with a telling shift in mix: mineral cargoes surged while agricultural shipments, traditionally the profit engine, fell by roughly 7%. In a year of bumper harvests, that reversal speaks volumes about the fragility of Eastern Europe’s inland logistics network when climate conditions and pricing both turn adverse. Management flagged the Port of Constanta as a partial buffer, its deep-water facilities offering more predictable throughput than Danube ports, but not enough to change the trajectory of group earnings for 2025.

Management has cut full-year guidance again, a clear admission that conditions remain stubbornly difficult. Turnover is now seen between RON 640–660 million, with EBITDA down to roughly RON 100 million at best, implying a far slimmer year than initially projected. The market for Danube freight remains oversupplied, rates are under pressure, and hydrological uncertainty shows no sign of easing.

TTS remains fundamentally well positioned as a regional logistics player with integrated port and barge assets, but 2025 will likely go down as a reminder that even a well-run transport group cannot fully hedge against nature and commodity cycles. The longer-term case still rests on structural advantages in efficiency and network scale, but for now, the river is running against them.

Airbus (AIR France): turbulence before takeoff

Airbus’ final stretch of 2025 is proving more eventful than expected. The group has hit a snag involving quality checks on a limited batch of A320 fuselage panels, temporarily slowing its delivery rhythm just as it races to meet the 820-aircraft annual target.

Reuters reports that November deliveries fell well short of plan (72 aircraft versus an expected 96) raising questions about whether the company can hit the finish line after a demanding ramp-up year. Still, management’s tone remains calm: the issue has been traced to a single supplier batch, recent production is unaffected, and most of the affected units can be reworked without major delays. Airbus insists the production system is not structurally compromised. In other words, this is a speed bump, not a stall, but it does make December’s delivery sprint more dramatic than Toulouse would have liked.

The math is tight. To reach the full-year goal, Airbus would need to match its all-time monthly delivery record from 2019. With fuselage inspections holding some aircraft on the tarmac, that looks ambitious, but the company suggests the backlog of ready-to-go planes will clear quickly once checks are complete.

The broader story remains one of incremental recovery across the supply chain after two years of bottlenecks in engines, electronics, and cabin interiors. Even if the 820 mark ends up being narrowly missed, the financial hit should be marginal and temporary, perhaps a few percentage points of EBIT and free cash flow, easily caught up in early 2026. For a group still guiding to around €7 billion in adjusted EBIT and working toward a steady ramp to 75 A320-family jets per month later this decade, the operational narrative remains solid.

Airbus still occupies the sweet spot of global aerospace demand: a duopoly market with persistent order visibility, structural undersupply, and a civil backlog that stretches for nearly a decade. The near-term headlines about panel defects obscure the bigger picture of gradually regaining the rhythm.

The company’s improved flexibility, supplier diversification, and balance sheet strength suggest it can absorb short-term noise without derailing the medium-term story. Investors may fret over year-end delivery math, but the underlying trajectory, expanding margins, rising free cash flow, and a return to shareholder distributions, remains very much on course.

Bilfinger (GBF Germany): writing the next act in its industrial reinvention

Bilfinger enters its Capital Markets Day with confidence. The group’s new 2030 plan sketches an ambitious but believable roadmap: annual revenue growth of 8–10%, an EBITA margin near 9%, and consistently strong cash conversion north of 90%.

The targets are mainly about continuation of the “Back to Growth” agenda that already delivered higher margins, tighter processes, and a restored sense of discipline across its sprawling operations. The new plan extends those themes but with a clearer geographic focus and an appetite for bolt-on M&A, acknowledging that organic levers alone can’t carry the next chapter.

The industrial maintenance and engineering world Bilfinger inhabits is changing rapidly, shaped by energy transition investment, digitalisation, and decarbonisation of heavy industry, all areas where Bilfinger’s technical capabilities and regional presence are strong assets. The group’s real edge lies in execution discipline: standardising processes across projects, managing risk, and turning a historically cyclical portfolio into a steadier, higher-quality cash generator. Its pivot toward digital monitoring, efficiency solutions, and low-carbon retrofits positions it neatly in the flow of industrial clients trying to extend asset life while cutting emissions.

Management’s decision to simplify reporting into three regions (Western Europe, Central Europe, and International) signals a push to balance growth markets like the Middle East and North America with the stable cash engines of the DACH region. This simplification also hints at a company finally confident enough to scale rather than just repair.

The 2030 framework builds on the 2027 plan, raising the bar on both growth and margins. Free cash flow generation remains a central promise, with Bilfinger targeting over €300 million in 2025 and ample flexibility for buybacks or reinvestment.

With peers like Spie trading at richer multiples despite comparable growth and exposure, there’s still room for Bilfinger’s valuation gap to close as credibility builds. The market has often underestimated the quiet compounding potential in industrial services; this new plan is a reminder that, after years of restructuring fatigue, Bilfinger may finally be ready to play offence again.

Eurocash (EUR Poland): stuck between discounters and decline, waiting for a reset

Eurocash’s third quarter confirmed what’s been obvious for a while: the group is still fighting gravity in Poland’s food distribution market. Wholesale volumes are shrinking, retail is under restructuring, and the company’s mix remains heavily skewed toward segments losing share to discounters.

As a reminder, cash & carry revenue dropped 12% year-on-year, distribution fell 7%, and retail (already the problem child) plunged 17%, even after excluding the deconsolidated Inmedio chain. Management is now openly hinting at deeper restructuring to come. The upcoming December strategy update is supposed to mark a turning point, but so far there’s little clarity on how Eurocash plans to escape a market corner that keeps getting tighter.

The backdrop is brutal. Poland’s total FMCG market is still growing at a mid-single-digit rate, yet Eurocash’s relevant segment, small independent retailers supplied via its wholesale network, continues to contract. Discounters are expanding at nearly double-digit rates, pulling traffic away from traditional stores, while higher alcohol and tobacco taxes weigh on categories that make up over half of Eurocash’s sales base. In short, the group is competing in a structurally shrinking channel while carrying the fixed costs of an outdated model.

There are bright spots, e.g. online supermarket Frisco remains one, with sales up nearly 15% and rising customer counts, but initiatives like Duży Ben are sputtering, with fewer stores and declining revenue. Even when new projects break even, they’re too small to offset the broader erosion in wholesale profitability.

The question now is whether the new 2026–2027 plan can credibly shift the narrative. Management’s stated ambition to lift EBIT to PLN 600 million by 2027 looks optimistic given the current run rate and the scale of restructuring still required.

Execution risk is high, visibility low, and the balance of growth drivers remains thin. For now, the stock trades as a value trap: cheap enough to tempt, but not yet with a convincing path out of decline. The December strategy day will need to deliver more than incremental cost savings; it needs to show a real plan to reimagine the business before it’s boxed in for good.

If you appreciate this post, feel free to share and subscribe below!