Purses, robots and crashes

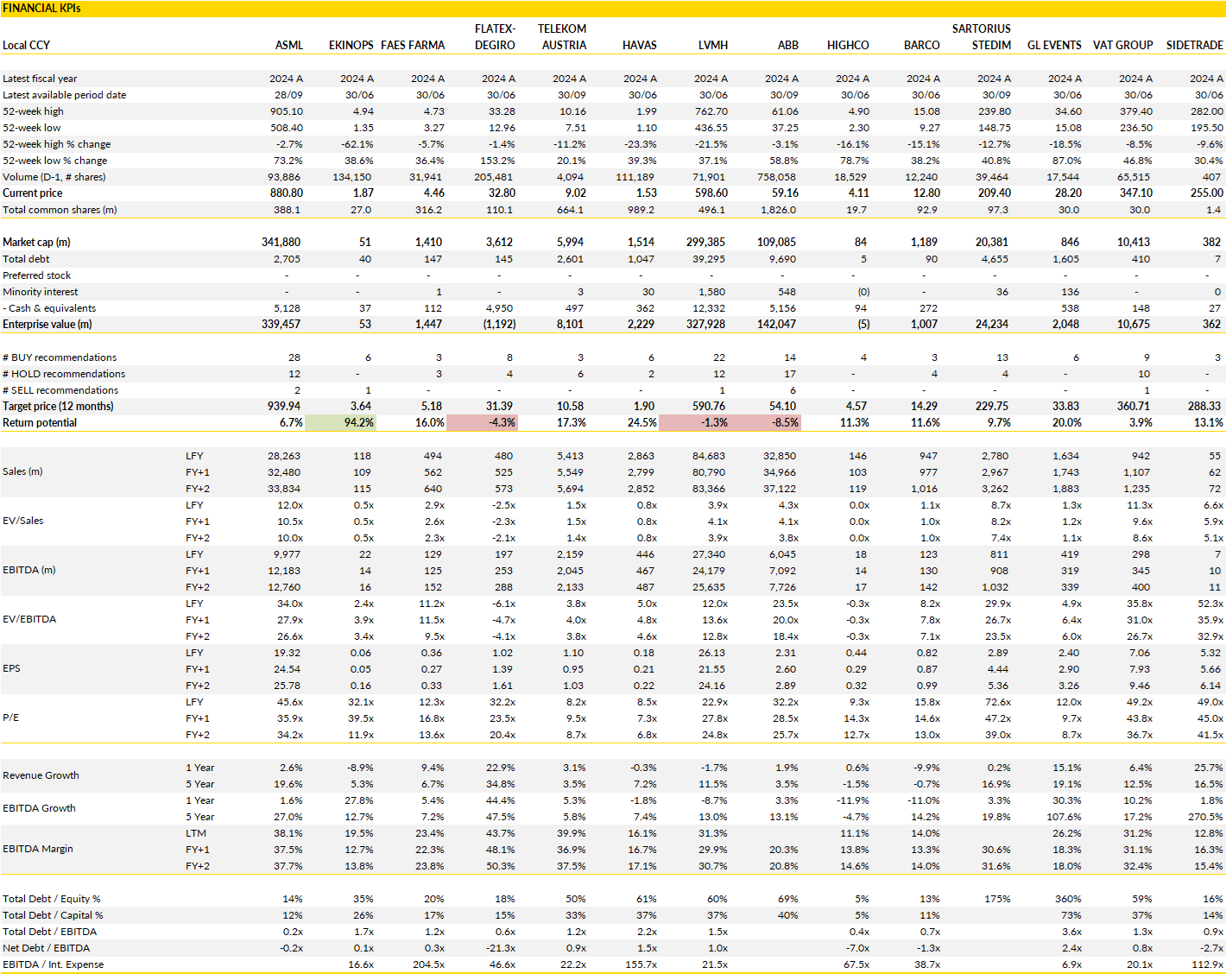

ASML, Ekinops, Faes Farma, FlatexDEGIRO, Telekom Austria, Havas, LVMH, ABB, HighCo, Barco, Sartorius Stedim Biotech, GL Events, VAT Group, Sidetrade

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

Financial KPIs

ASML (ASML Netherlands): Strength behind the next semiconductor cycle

ASML’s latest quarterly results confirmed not only the resilience of its model but also a renewed sense of momentum heading into 2026.

Sales landed broadly as expected by the market, while margins once again hovered above fifty percent, a figure that continues to defy the cyclical pressures facing much of the semiconductor industry. Bookings were solid and tilted back toward the memory segment, which had been the weak link earlier in the year.

More importantly, management’s tone shifted from cautious to quietly confident. After months of uncertainty over export limits, trade policies, and uneven chip demand, ASML now sees the next upturn forming sooner than most anticipated, driven by an industry-wide push to build out capacity for AI and high-performance computing.

Underneath it all lies the same structural advantage that has made ASML indispensable. Its extreme ultraviolet lithography systems, which no other company can replicate, are the gatekeepers of the most advanced semiconductor nodes. These tools are now driving a larger share of group sales, supported by the rollout of High-NA technology that should dominate the coming generation of chip designs. Even the older deep ultraviolet machines remain in high demand among foundries looking to extend existing fabs rather than build new ones from scratch. That dual positioning is what gives the business such stability, even in periods when semiconductor spending cools.

The company still guides for 2030 sales that could range anywhere between the mid-forties and sixty billion euros, a projection once seen as ambitious but now increasingly plausible given the scale of AI-related investment. Its monopoly in lithography at the most advanced nodes effectively secures its pricing power for years.

The valuation, though hardly cheap, reflects a business whose strategic importance has only deepened. ASML may not always surprise with its quarterly figures, but it consistently delivers.

Ekinops (EKI France): Leadership turbulence adds to a fragile transition

Ekinops reveals how hard it is for smaller telecom equipment players to balance growth ambitions with customer concentration.

The company’s latest quarterly update laid that out plainly. Revenue fell sharply as one of its largest clients drastically reduced orders. The decline in access products was especially severe, while optical transport (a steadier part of the portfolio) managed to soften the blow with modest growth in Europe and emerging markets. Only the smaller but fast-growing software and services division managed to hold up well, reflecting Ekinops’ long-term push toward recurring income and higher-value offerings.

That said the situation is very clear: growth momentum has temporarily broken down, and the company is now working to regain its footing in a more cautious investment environment.

The disruption comes at a delicate moment internally. After two decades at the helm, the long-time chairman and CEO unexpectedly stepped aside, with operational control handed to the chief operating officer on an interim basis. The move coincides with an ambitious strategic transition (the “Bridge” plan) aimed at moving Ekinops deeper into secure access, SASE and data-center interconnects. These are the right long-term bets, but they require execution discipline and time, something the market is rarely patient about.

The company suspended financial targets for the year, a logical consequence given the lack of visibility but one that inevitably unsettles investors. With growth likely to remain subdued into early 2026, Ekinops is focused on cost control, product integration, and protecting its cash position, which remains healthy by sector standards.

What somewhat tempers the pessimism is that this is not a company in structural decline. Ekinops still has a well-regarded technology base, meaningful traction in Europe, and a software business that should gradually reduce earnings volatility.

The shares, which are down 50% this year, now trade at a level that implies a far deeper structural problem than what the fundamentals suggest. If management can navigate the transition smoothly and demonstrate even modest operational improvement, sentiment could shift quickly. The next few quarters will be about rebuilding confidence.

Faes Farma (FAE Spain): Buying growth and credibility through smart consolidation

Faes Farma has taken a bold step to reinvent itself as more than just a domestic pharmaceutical player.

The acquisitions of SIFI in Italy and Edol in Portugal mark a transformation in scale and scope, bringing the group closer to its ambition of becoming a European mid-cap with a clear therapeutic focus. Together, the two companies add over a hundred million euros in annual revenue, but their value lies far beyond size. They give Faes access to manufacturing, research, and regulatory capabilities that the group previously lacked, anchoring it firmly in the fast-growing field of ophthalmology. For years, Faes relied heavily on Iberia and a stable but mature portfolio of allergy and primary care products. Now, it has a new growth engine in a therapeutic area expanding at double-digit rates globally; one supported by aging demographics, higher screen exposure, and rising demand for specialized eye treatments.

The deals are also well timed. Both SIFI and Edol bring strong local brands and the kind of technical depth that is hard to build organically. SIFI, with its portfolio of surgical and prescription products, complements Faes’ existing lines and positions the company among the few integrated ophthalmology specialists in Europe. Edol adds leadership in Portugal and enhances contract manufacturing capabilities that can be leveraged across markets. This manufacturing scale is strategically important: it supports margin stability and opens opportunities for future partnerships or in-licensing agreements.

Meanwhile, the company has secured financing without stretching its balance sheet, combining available cash with moderate debt to maintain a net leverage ratio still within comfortable bounds.

All this results in a company that feels very different from the one investors knew just a few years ago. Ophthalmology now accounts for roughly a quarter of group sales and will likely grow from here, helped by new launches and the contribution of Akantior, a niche drug for a rare corneal infection that could reach meaningful peak sales later in the decade.

In short, Faes has turned two well-chosen acquisitions into a platform for the next decade. Faes now has credible exposure to innovation, recurring manufacturing income, and a more diversified geographic footprint. It still trades at a discount to its European peers despite faster expected earnings growth and improving margins.

FlatexDEGIRO (FTK Germany): Riding the trading wave, but valuation keeps expectations high

FlatexDEGIRO’s third quarter reminded the market how quickly momentum can return in online brokerage when trading volumes surge.

The company reported preliminary revenue of about €132 million, up more than 18% from a year earlier, and net income of €39 million, both comfortably ahead of market expectations.

The strong result led management to lift full-year guidance: revenue growth is now expected between 10% and 15% (previously 4–8%), with net income seen rising 34–43% instead of the earlier 15–25% range. That would put annual earnings in the €150–160 million band, a clear signal of regained profitability after a muted first half.

The beat was powered by a rebound in customer activity, especially on European exchanges, and a continued solid contribution from interest income, even as rates softened slightly.

The company’s model has once again proven highly scalable. Commission income from trading remains the main growth driver, supported by higher client engagement and modestly improving cash balances. Meanwhile, new revenue streams are slowly coming online: the launch of securities lending in the Netherlands and Spain now gives around 1.5 million customers the ability to earn yield on idle portfolios. Though small today, this initiative points to another way Flatex intends to deepen monetisation within its large retail base.

On the cost side, earlier efficiency measures are now paying off: personnel and marketing expenses have been contained, helping operating margins climb back near 30%. The firm is managing to deliver growth with discipline, which marks a notable contrast to the hyper-expansion phase of 2020–2021.

That said, the valuation leaves little room for disappointment. Trading near twenty times next year’s expected earnings, the stock already prices in continued double-digit growth and sustained trading enthusiasm, conditions that could prove volatile if markets quieten.

The company’s new guidance sets a higher bar for the detailed quarterly release later this month, and investors will want confirmation that this performance is not just a one-off rebound.

Flatex has earned credit for its execution and cost control, but at current multiples the market now expects excellence as standard. The story remains solid, but any stumble could quickly be felt in the share price.

Telekom Austria (TKA Austria): A steady hand amid mixed signals across markets

Telekom Austria’s third quarter did little to surprise but offered a dose of reassurance.

Revenue rose just over 3% year-on-year to roughly €1.4 billion, with EBITDA advancing at a similar pace, both broadly in line with expectations. The real standout came lower down the P&L, where EBIT and net income grew faster than consensus anticipated thanks to stronger cost control and a healthier financial result. Capital expenditure, excluding spectrum, also came in lighter than planned, supporting management’s updated guidance of “below €800 million” for the full year.

In other words, the quarter didn’t break new ground, but it did enough to keep the full-year picture intact and remove any lingering doubts over the company’s ability to deliver within its guided range.

Performance across the group remains uneven. Austria continues to underperform, with service revenues falling around 4% as inflation-linked price increases tapered off and competitive pressures intensified. That weakness was once again offset by robust growth in Central and Eastern Europe, where the international segment expanded service revenues by over 6%. These markets, particularly Bulgaria and Serbia, continue to play a stabilising role, proving that Telekom Austria’s geographic diversification remains its strongest defence against stagnation in its home market.

The group’s conservative guidance for the year (revenue growth of 2–3%) may appear cautious given year-to-date growth of nearly 4%, but management is likely guarding against tough comparisons in the final quarter and potential currency headwinds in Belarus.

The key question heading into 2026 is whether the Austrian unit can reignite growth or whether international expansion will have to do all the heavy lifting. For now, Telekom Austria’s mix of steady top-line expansion, disciplined capital allocation, and strong free cash generation keeps it on a stable footing.

The valuation leaves limited upside ioo, but the story here is about slow, consistent execution across a challenging patchwork of markets. Management’s conservative tone suggests little appetite for surprises, and after this quarter’s measured delivery, investors are unlikely to complain.

Havas (HAVAS Netherlands): Momentum builds as steady execution earns an upgrade

Havas delivered another solid update, underlining its progress within the global advertising rebound.

Third-quarter revenue reached roughly €656 million, up nearly 4% organically and ahead of expectations. North America once again led with growth above 7%, while Europe held steady and Asia posted gains of just over 8%. Latin America remained the weak spot, down a few points on softer demand in Brazil and Chile, but the group’s geographic mix more than compensated.

Following this performance, Havas nudged its full-year organic growth guidance higher to a range of 2.5–3%, from a prior view of above 2%, and now expects a modest margin expansion of around 50 basis points to roughly 12.9%. It’s a small but important signal that management’s cautious optimism is being matched by actual delivery.

Operationally, the healthcare segment continues to power North America, while Asia benefits from stronger local spending and new client wins. Havas also continues to integrate a string of small acquisitions and buybacks (over eleven million shares repurchased so far) which provide additional support to earnings and sentiment.

The group’s performance doesn’t yet reflect the full impact of its major LVMH media win, expected to show up in 2026, meaning current momentum is being driven entirely by the core business. This steady organic base, paired with selective M&A, makes Havas one of the more disciplined players in the European media space.

Havas still trades at a steep discount of ~35-45% to peers such as Publicis and WPP on 2025 earnings multiples. That valuation gap looks increasingly hard to justify given the group’s steady outperformance, rising margins, and shareholder-friendly actions. The path to higher growth in 2026 is already laid through recent account gains, while short-term visibility has rarely been better.

It’s a story of consistent execution, which for patient investors may be precisely what makes it appealing.

LVMH (MC France): A cautious revival takes shape across fashion and beyond

After several quarters of lagging sector peers, LVMH finally turned a corner, delivering a small but symbolic return to growth.

Group sales rose about 1% organically, a few points ahead of market expectations, marking a welcome reversal from the 4% decline seen in the previous quarter. The improvement was driven by Fashion and Leather Goods, where sales fell only 2% compared to a 9% drop previously; an encouraging sequential gain, particularly given stronger local demand in both the US and China. The recovery extended to other divisions as well: Watches and Jewellery returned to positive growth, Wines and Spirits edged higher, and Sephora continued its steady expansion with a 7% increase in Selective Retailing.

The improvement comes at a critical time. The group’s creative overhaul across most of its fashion houses is still in its early innings, but early signs suggest that new collections are resonating better with consumers. Dior and Louis Vuitton led the charge, supported by a gradual pickup in Chinese demand and improving sentiment among American shoppers.

Management also cautioned that the fourth quarter will face tougher comparisons, particularly in Fashion and Leather, but expressed confidence that 2026 will mark the first real year of reacceleration as the new creative direction takes hold. Margins are expected to dip slightly in the second half, reflecting investment in marketing and store refurbishments, but that spending should pay off in brand strength next year.

LVMH still trades below its pre-Covid valuation multiples despite its enduring dominance across luxury segments. The company’s long-term narrative, anchored in craftsmanship, pricing power and global brand reach, remains intact.

What the latest results proved is that beneath the noise LVMH’s structural advantages endure. The recovery will be gradual, but looks increasingly credible.

ABB (ABBN Switzerland): Solid execution and a clean balance of growth and discipline

ABB continues to perform after years of operational reshaping.

Order intake rose around 9% year-on-year, with a book-to-bill ratio just above one, a healthy signal of sustained demand across most end markets. Growth was particularly strong in automation and data centres, while building-related activity was more subdued, weighed by a weak residential sector in China. Revenue also increased at a similar pace, as all four divisions contributed positively, led by Electrification and Motion. Margins held firm at roughly 19%, reflecting the benefits of operating leverage in electrification and process automation, even as the Motion unit absorbed higher R&D and overhead expenses. Free cash flow rose sharply, underscoring ABB’s ongoing focus on efficiency and balance sheet strength.

What’s notable is how ABB continues to quietly extend its leadership in industrial electrification and automation. Electrification and Robotics now form the group’s growth core, powered by secular themes like grid digitalisation, factory automation and data centre infrastructure.

The company is not chasing volume growth at any cost but emphasising selectivity in order intake and disciplined pricing, i.c. a shift that has materially improved cash conversion. Process Automation, long seen as the laggard, is showing slow but visible improvement as demand in energy and marine markets recovers. Meanwhile, Robotics benefits from higher capital spending in logistics and e-mobility, confirming ABB’s potential in the coming automation wave.

Guidance for the year was reiterated: mid-single-digit organic revenue growth and margins at the upper end of the target range. That may sound unexciting, but it signals growing predictability, which is what investors have long wanted. The key challenge will be translating this newfound stability into sustained growth beyond 2025, particularly as industrial investment cycles normalise.

For now, ABB’s performance shows a business that is no longer defined by restructuring, but by operational control and a clearer sense of purpose. The upcoming capital markets day should confirm how it intends to convert that control into momentum.

HighCo (HCO France): The comeback of a small-cap innovator finding growth again

HighCo’s latest update offered a welcome return to form.

After several quarters of sluggish performance tied to its exposure to the Casino Group, the French marketing and digital promotion specialist finally posted solid organic growth of about 8%. The recovery was driven mainly by its Activation division, which includes its fast-growing couponing and loyalty platforms HighCo Nifty and Merely. These businesses continue to gain traction as retailers and brands shift their promotional budgets toward data-driven, omnichannel formats.

The rebound was most visible in France, where revenues jumped by more than 10%, while the international segment remained soft, still impacted by legacy coupon-processing operations in Belgium. In short, the domestic recovery offset external drags, putting HighCo back on a positive trajectory.

The quarter’s improvement matters because it signals a transition from restructuring to rebuilding. Management lifted its 2025 guidance slightly, now expecting modest like-for-like growth in gross profit and an operating margin above 12%. While not spectacular, this confirms that profitability remains resilient even as the group invests in digital solutions and absorbs higher personnel costs.

New acquisitions, including Sogec and BudgetBox, will be consolidated from the fourth quarter onward, expanding the group’s reach in digital couponing and retail media. Combined, they should accelerate the shift from traditional marketing services toward scalable SaaS-like models with better margins and recurring visibility. That strategic repositioning, from agency-style work toward platform-led engagement, is at the heart of HighCo’s comeback story.

The company’s challenge is now to translate momentum into consistency. The Casino headwind will fully fade in 2026, freeing resources and restoring confidence among retail clients. The mix shift toward activation tools gives HighCo a defensible niche in an industry increasingly dominated by large digital players.

Despite its small scale, the group’s valuation remains modest compared to European marketing tech peers, reflecting its micro-cap status rather than its fundamentals. As cash generation improves and growth stabilises, HighCo has a realistic path back to relevance.

Barco (BAR Belgium): Incremental progress, but the market needs more proof

Barco’s latest set was neither disappointing nor particularly inspiring. Group revenues rose about 2% year-on-year, roughly in line with expectations, but the divisional split told a more complex story. Entertainment once again carried the results, helped by the long-awaited recovery in cinema projector demand and steady uptake of new products. Healthcare, however, saw weaker activity, with orders and revenue both declining due to lower bulk orders in the Americas and softer demand in China. The Enterprise segment, which includes the ‘weird’ ClickShare as well as Control Rooms, continued to struggle, hit by postponed corporate and public-sector projects.

Barco reiterated its full-year guidance for revenue growth and a higher EBITDA margin, targets that remain credible but hardly exciting.

The contrast between divisions shows a company caught between legacy exposure and emerging opportunities. Entertainment’s rebound confirms Barco’s ability to defend leadership in large-screen and cinema technologies, and the business should benefit further from the ongoing shift to laser projection. Yet Enterprise (once a pillar of growth) has become a drag. The upcoming launch of the ClickShare Hub system could help, but until corporate IT budgets loosen, visibility will stay limited. Healthcare’s softer quarter is less concerning given its long-term structural demand, but the division’s cyclicality remains an issue.

Still, Barco’s balance sheet strength gives it time and flexibility: another €30 million buyback underlines management’s confidence in the underlying cash flow.

The question is not whether Barco can grow, but whether it can grow reliably. At around seven times forward EBITDA, the stock still trades below historical averages. That valuation reflects years of overpromising, yet it also offers asymmetry if execution continues to improve.

Barco’s success now mostly depends on building a track record of consistency. The business has the technology, balance sheet, and markets to deliver, but the credibility must still be regained.

Sartorius Stedim Biotech (DIM France): Bioprocessing recovery gathers pace but confidence remains measured

Sartorius Stedim Biotech’s latest results reaffirmed that the bioprocessing cycle has turned the corner.

Revenue grew at a healthy double-digit clip in constant currency terms, supported primarily by the high-margin consumables business that remains the group’s economic engine. Demand for single-use components used in biologic drug manufacturing continues to accelerate as the industry shifts back into expansion mode after last year’s destocking lull. Systems and equipment, which had been a weak spot, showed the first signs of stabilisation, while regional performance was evenly balanced across markets. Operating leverage returned, with margins lifting back above 31%, driven by the mix shift toward consumables and tighter cost discipline.

The result was a clean beat on both revenue and earnings, marking another step toward normalisation.

Yet management’s decision to narrow its full-year guidance only toward the upper end of the previous range rather than lifting it outright reflects a degree of prudence. After several volatile years, the company appears intent on keeping expectations in check even as the recovery gathers pace. Growth of roughly 9% now looks achievable, aligning with the run-rate of the past three quarters, and the margin target implies continued cost efficiency without stretching assumptions.

What stands out is that the bioprocessing market’s rebound seems broad-based, not just restocking, as customers restart postponed capacity projects and new modalities such as cell and gene therapy drive incremental demand.

In short, Sartorius is once again benefiting from the structural expansion of biologics manufacturing that underpins its long-term thesis.

Today’s results might mark a turn in sentiment. The stock still trades at a relative discount to its pre-2022 multiples, a reflection of lingering uncertainty around the pace of recovery. But Sartorius’ position as a critical supplier of high-value bioprocess components gives it substantial leverage to the sector’s rebound.

If execution continues to match recent quarters, the narrative could shift decisively from cyclical repair to renewed structural growth as early as next year.

GL Events (GLO France): A temporary dip before another year of strong momentum

GL Events’ recent numbers looked underwhelming on paper, but the story behind them is more nuanced.

Reported sales fell sharply year-on-year, largely because of phasing issues and the tough comparison created by the Paris Olympics. The Live division, which provides event services, was most affected, while Exhibitions and Venues showed resilience given the soft macro backdrop.

Management reiterated that the quarter’s weakness was purely timing-related and maintained full-year targets, expecting a strong rebound in the final months of the year. That confidence seems justified, as several large contracts are due to be recognised in Q4, setting up a strong close to 2025.

The group’s visibility remains unusually high for an events operator, thanks to a dense global calendar and geographic diversification. Beyond the near-term phasing effects, growth drivers remain intact: expansion in the Middle East, ongoing investments in venue management, and the integration of recent acquisitions that expand its entertainment footprint. The upcoming Asian Games and the Winter Olympics are expected to sustain momentum well into 2026, offering rare predictability in a typically cyclical sector.

Leverage is trending below two times EBITDA, and cash flow generation remains robust enough to support both dividends and selective M&A. GL Events may not match the glamour of the global advertising or media groups, but its mix of recurring venue income and cyclical event exposure provides a steady earnings base.

Valuation remains undemanding. The shares trade at less than 10 times forward earnings and offer a prospective dividend yield north of 5%, a level that seems conservative given the improving fundamentals. The market appears to underestimate how effectively GL Events has diversified its revenue streams and reduced volatility over the past decade.

The group’s operational consistency, combined with recurring international contracts, positions it to deliver sustained growth even after the post-Olympic normalisation.

VAT Group (VACN Switzerland): Short-term softness, long-term thesis intact

VAT’s third-quarter orders and sales came in slightly below market expectations as chipmakers maintained cautious capital spending, keeping capacity utilisation low across mature nodes.

Sequential declines in the semiconductor division contrasted with continued growth in industrial applications and services, which now provide a more stable revenue base. The book-to-bill ratio stayed just under parity, indicating subdued order inflows but not a structural downturn. Management guided for another soft quarter ahead, reflecting the industry’s lingering digestion phase, yet reiterated its full-year targets and confidence in outgrowing the market over time.

What matters more is story beyond the next two quarters. VAT remains deeply embedded in the industry’s structural transition to advanced nodes, gate-all-around architectures, and higher vacuum complexity, trends that play directly into its expertise in high-end valves. As logic and memory investments resume, particularly with the rollout of 2-nanometre and high-bandwidth memory technologies, VAT’s content per tool should rise materially.

This visibility, coupled with disciplined cost management, supports a medium-term recovery path even if the near-term cadence remains choppy. The company’s service business, now contributing more than a fifth of sales, also cushions volatility and enhances profitability.

If industry orders pick up as expected in 2026, VAT’s high operating leverage could quickly restore earnings momentum. The story remains unchanged: a world-class niche supplier navigating a short-term trough before the next upturn in silicon intensity.

Sidetrade (ALBFR France): Transition year sets the stage for a stronger 2026

Sidetrade’s Q3 update confirmed that 2025 is shaping up as a transitional year, marked by slower organic growth but early signs of reacceleration ahead.

Quarterly revenue edged up modestly, with SaaS subscriptions still expanding at a healthy pace while professional services continued to shrink; a mix that, while weighing on the top line, reinforces the group’s strategic pivot toward higher-quality recurring income.

Order intake, however, rebounded meaningfully after a weak first half, suggesting that new business momentum is gradually returning. The improvement was modest but encouraging: bookings rose double digits quarter-on-quarter, a sign that customer confidence in Sidetrade’s offering is stabilising after several months of hesitation. In other words, the lull in activity appears cyclical rather than structural, as demand for intelligent order-to-cash solutions continues to recover.

The acquisition of Australia-based ezyCollect marks an important milestone in Sidetrade’s evolution. Beyond its direct contribution to scale (roughly equivalent to more than 15% of group sales) it opens up a new geography in Asia-Pacific and strengthens the mid-market reach of Sidetrade’s platform. More importantly, it provides a local distribution channel for Aimie, the group’s new “agentic” AI product that automates complex credit management tasks. With this integration, Sidetrade effectively adds a second growth engine alongside its large-enterprise SaaS franchise, positioning itself to tap into faster-moving markets outside Europe. The expansion of the partner network, which now includes new system integrators and financial platforms, should amplify this effect in 2026 as Aimie reaches commercial scale.

These moves, while still in the investment phase, show that management is building the next leg of growth instead of relying on incremental gains from its existing client base.

Looking beyond 2025, Sidetrade’s investment case rests on a few simple but powerful dynamics: an increasing share of recurring revenue, expanding addressable markets, and AI differentiation that is tangible rather than theoretical.

The company has kept profitability intact throughout the slowdown, a rare feat for a SaaS player in expansion mode. With demand for automated cashflow management rising and the business model tilting toward scalability, the groundwork is being laid for a step-change in earnings from 2026 onward.

After a pause for consolidation, Sidetrade looks set to resume its climb with stronger, more diversified foundations.

If you appreciate this post, feel free to share and subscribe below!