Projectors, large asset sales and companies getting stolen

InPost, Barco, dsm-firmenich, X-FAB, TeamViewer, RENK, GN Store Nord, Coloplast, Novem, VINCI, Ørsted, Bénéteau, TUI

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

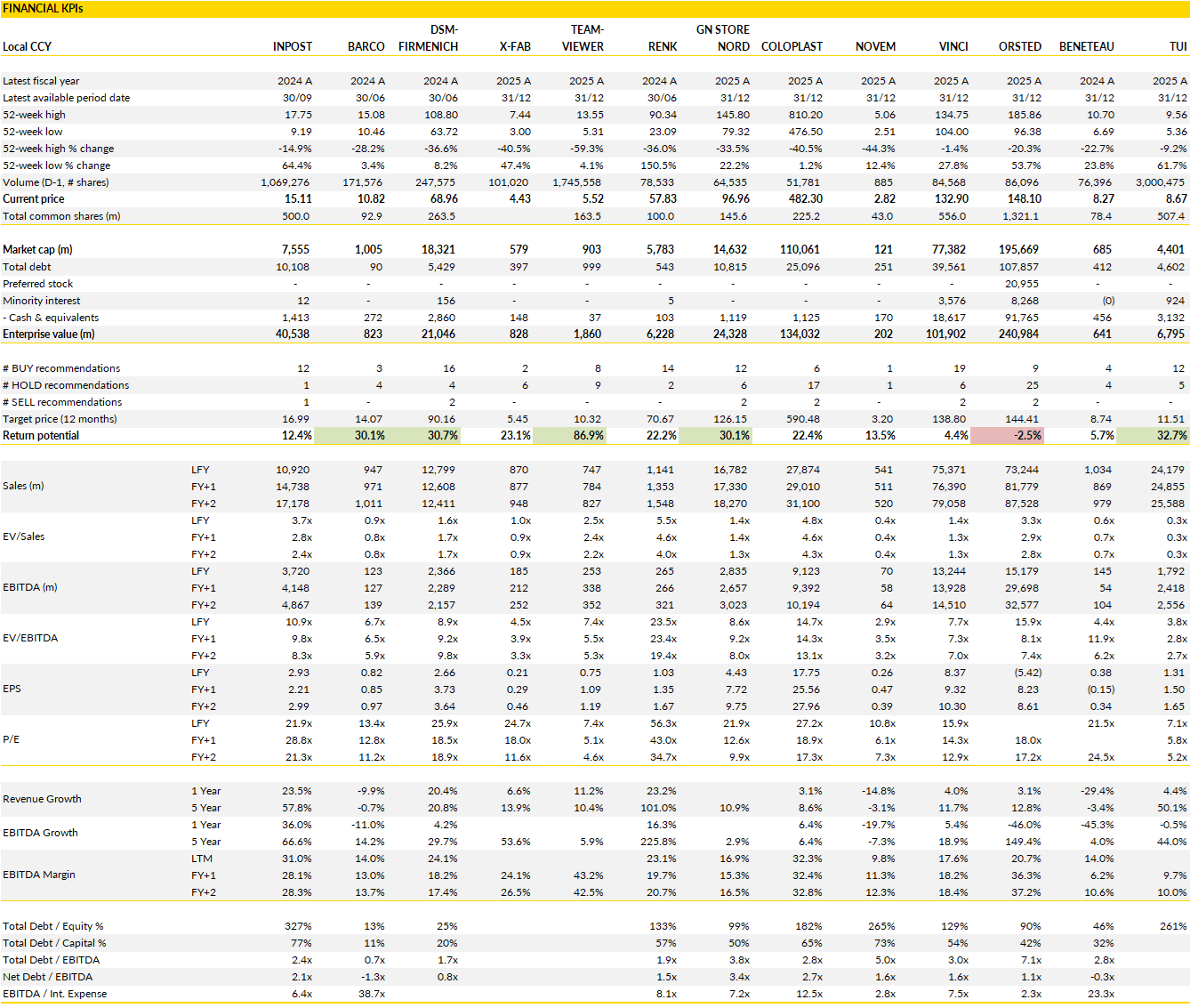

Financial KPIs

InPost (INPST Poland): a low price for control

InPost has agreed to a recommended all-cash offer at €15.60 per share from a consortium led by Advent, with FedEx joining alongside A&R and PPF.

The proposal values the company at around €7.8bn and comes with a meaningful premium to where the shares were trading at the start of the year, but it looks less compelling against more recent levels. Roughly 48% of the share capital is already locked up from key shareholders, including PPF and Advent, which immediately shifts the balance of power toward the bidders. Structurally, this feels like a pre-agreed transaction that has now moved into the open. From InPost’s perspective, the offer brings an end to a long stretch of share price volatility that has often felt disconnected from operating performance (mainly relating to Allegro).

Strategically, the logic is straightforward. The consortium plans to back the existing strategy rather than rewrite it, focusing on continued network expansion in core Western European markets and further development of the consumer-facing digital platform. FedEx’s involvement adds a new layer. While remaining a separate competitor, FedEx intends to work with InPost post-closing to link its global logistics footprint with InPost’s last-mile and locker infrastructure. This cooperation is positioned as mainly a commercial opportunity, but it highlights the strategic value of InPost’s network at a time when out-of-home delivery is becoming a critical part of urban logistics economics.

The price itself is the uncomfortable part. Relative to InPost’s long-term growth profile and capital intensity, the offer looks quite conservative, especially given how much investment has already been sunk into the network.

However, deal dynamics matter more than theoretical value in this case. With nearly half the register committed, financing fully underwritten, and structural mechanisms in place to reach full control even without 95% acceptance, the path to completion looks clear. A competing bid would need to clear a high bar, both in terms of price and certainty, and there is little sign of an obvious alternative buyer willing to step in.

As a result, while the offer does not capture the full value embedded in InPost’s platform, the probability of the transaction going through appears high.

Barco (BAR Belgium): entertainment carries the year, credibility still to be rebuilt

Barco closed 2025 with a second half shaped by continued headwinds and strict cost control.

Q4 revenues reached €282m, down 2% year on year, with a clear split across divisions. Entertainment accelerated again, while Healthcare and Enterprise both declined. Group EBITDA for H2 settled at a 15.1% margin, down from 16.7% a year earlier. The comparison is distorted by the absence of a €10m sale-and-leaseback gain booked in H2 2024, but tariffs and FX also weighed. Operating discipline remained tight, with indirect costs down both in absolute terms and relative to sales, limiting the downside in a difficult demand environment. Overall, EBITDA came in slightly ahead of expectations, which is notable given the lack of top-line growth.

Entertainment was once again the stabilising force. Q4 sales in the division rose 9% year on year, driven by continued strength in Cinema and solid demand for premium projection platforms such as QDX and I600, alongside HDR solutions. In H2, Entertainment generated €46.8m of EBITDA, up 33% year on year, with margins expanding to 18.2%. Higher volumes, a better mix and pricing actions offset tariff pressure. Elsewhere, conditions remained more challenging. Healthcare continued to suffer from tariffs, weaker US government spending and currency effects, leading to operating deleverage and a sharp margin decline. Enterprise sales fell 7% year on year in Q4, though sequential trends improved. Early shipments of the Microsoft-certified ClickShare Hub and better activity in software-heavy control room projects helped, particularly in Europe and parts of APAC, but competition and muted US demand kept pressure on margins.

Barco’s guidance for 2026 remains high level, pointing to revenue and margin growth at constant currencies, with improvement weighted to the second half. Long-term targets were reaffirmed, including €1.1bn of revenue and a 15% EBITDA margin by 2028, alongside a higher share of recurring revenues. For now, the business still feels transitional. Cost control and Entertainment are doing the heavy lifting, but Healthcare and Enterprise need to stabilise before confidence can return.

After several years of uneven delivery following an earlier growth phase, the group still has to prove consistency. At current levels, valuation reflects a great deal of scepticism. The question for the next phase is whether the apparent bottom in performance turns into steady execution.

dsm-firmenich (DSFIR Netherlands): the portfolio reset is now complete

dsm-firmenich has agreed to sell its Animal Nutrition & Health business to CVC Capital Partners for an enterprise value of €2.2bn, bringing a long-running strategic transition to a clear end point.

Combined with the earlier €1.5bn divestment of Feed Enzymes, the group has now realized €3.7bn of value from activities that no longer fitted its strategic direction. ANH had become a source of earnings volatility and margin noise, exposed to vitamin cycles and commodity dynamics that sat uncomfortably alongside the group’s focus on consumer health, nutrition and beauty. With this transaction, dsm-firmenich completes its move toward a simpler and more focused portfolio, centered on higher-quality growth categories and more predictable end markets.

dsm-firmenich will retain a 20% equity stake in ANH and an earn-out of up to €0.5bn. A long-term supply agreement for vitamins supports continuity in human and pet nutrition, while ANH itself will be split into two dedicated businesses under CVC ownership. One will focus on higher-value solutions and services, the other on essential products such as vitamins, carotenoids and aroma ingredients.

Financially, the transaction results in net cash proceeds of around €0.6bn and the transfer of roughly €0.5bn of debt and liabilities. This comes alongside a sizeable non-cash impairment booked in 2025, which is largely accounting-driven and does not change the underlying cash economics of the exit. Capital allocation is already clearly signposted. Management has confirmed a €0.5bn share buyback planned for the first quarter of 2026 and reiterated its commitment to a stable dividend of €2.50 per share, with gradual increases over time.

With ANH removed, dsm-firmenich is left with a cleaner earnings profile and less exposure to sharp swings in raw material and vitamin pricing. Near-term growth may still be moderate as end markets normalise, but the quality of the remaining portfolio is materially higher than before.

At current valuation levels, the group trades at a level that does not fully reflect this simplification. The strategic heavy lifting is done. The next phase is about execution and whether the market begins to focus on the more consistent profile of the streamlined business.

X‑FAB (XFAB Belgium): another weak quarter, and 2026 is already starting badly

X‑FAB delivered another soft quarter, with Q4 overshadowed by a $9m SiC‑related charge: $6m tied to a contract renegotiation and $3m from an inventory revaluation. Without it the quarter would have been roughly in line with market expectations.

Even so, the overall picture remains weak. Revenue fell 3% sequentially, driven mainly by automotive, which still accounts for 61% of the mix and continues to suffer from customer inventory adjustments in a backdrop of macro uncertainty, tariffs and trade tensions. EBITDA came in at $42m with a 19% margin, well below expectations and down from last year despite higher revenue. Net income barely broke even. Net debt ended 2025 at $285m, or 1.5x EBITDA, and that excludes roughly $250m of customer prepayments that will eventually need to be repaid, which makes the balance sheet look tighter than the headline leverage suggests.

The outlook is even more concerning. Management declined to provide full‑year 2026 guidance, citing poor visibility, and instead offered only Q1 numbers. They are well below where the market was positioned. Revenue is expected at $190–200m versus consensus at $213m, and the EBITDA margin guide of 18–21% sits far from the 24.5% the market had penciled in. Order intake remained weak at $164m in Q4.

Management argues that underlying demand is understated by $30–40m because of shorter production cycles, better yields and customers pre‑buying ahead of product discontinuations announced more than a year ago. Even if that’s true, the order book is still soft, and the company is responding with cost‑cutting measures worth $6m per quarter through Q4 2026, including staff reductions. That is a clear sign of pressure.

Strategically, the timing is difficult. X‑FAB has just completed a major investment cycle, but the demand environment is not cooperating. That leaves the company with high fixed costs, under‑utilised capacity and limited flexibility. The new CEO, Damien Macq, steps in at a moment when automotive demand needs to recover, the SiC business needs stabilising and the balance sheet needs careful management given the combination of debt and customer prepayment liabilities. The lack of guidance for 2026 shows how little visibility management has on the near‑term trajectory.

With demand soft, leverage elevated and visibility low, the setup remains challenging. The company needs a cyclical recovery in automotive and a clearer stabilisation in SiC before confidence can rebuild.

TeamViewer (TMV Germany): big deals land, core engine still soft

TeamViewer’s final Q4 numbers confirmed the January pre-release, and the picture remains mixed. Q4 revenue reached €194.6m, flat year on year on a reported basis and up 2% at constant currencies. Adjusted EBITDA came in at €87.0m, down 2%, with a margin of about 45%. For the full year, revenue grew 4% reported and 5% at constant currencies, while adjusted EBITDA increased to €340.3m, translating into a margin close to 44%.

On the surface, profitability is still solid and cash generation remains intact. The quarter also featured some headline wins, including two large 1E contracts with a total contract value of €10m and the largest frontline deal in the group’s history. These transactions helped support reported numbers and confirm that TeamViewer can still compete for complex, enterprise-grade deployments.

The issue sits with the underlying customer base. ARR growth slowed materially, rising only 0.3% reported to €759.7m, and net retention slipped to 96% from 97% in Q3. Upselling within the SMB segment stayed weak, and expansion from existing customers failed to offset churn. This dynamic explains why larger contracts, while strategically important, did not translate into broader momentum across the portfolio. The business increasingly depends on episodic deal flow at the top end, while the recurring growth engine shows limited traction. That imbalance continues to weigh on confidence in the medium-term trajectory.

Guidance for 2026 reinforces this cautious setup. Management expects constant-currency revenue growth between 0% and 3%, with FX headwinds of around 3pp pushing reported growth into a range of -3% to flat. Adjusted EBITDA margin is guided to roughly 43%, slightly below last year.

The company still talks about a return to mid-to-high single-digit growth beyond 2026, but after several resets, that ambition carries little weight today. With leverage still elevated and no aggressive capital return in sight, credibility remains fragile. Until ARR growth reappears through better retention and expansion, TeamViewer looks set to remain a transition story rather than a compounding one.

RENK (R3NK Germany): solid delivery, clean cost control and a constructive setup for 2026

RENK’s 2025 performance was broadly in line with market expectations, which is notable given the number of external headwinds the company had to absorb.

Sales growth of roughly 19% reflects strong execution across the portfolio despite the export embargo to Israel that lasted until November, a weaker dollar, sluggish industrial activity and ongoing tariff noise. VMS was the clear growth engine with revenue up 23% to about €861m, helped by a sharp acceleration in Q4 as the new modular line ramped. M&I likely grew around 16% on the back of naval programs and the consolidation of Cincinnati Gearing Systems. SB was essentially flat after a strong December. Adjusted EBIT should land near €231m, up almost 22%, with a margin around 17%. That margin resilience, even with an unfavourable Q4 mix, highlights RENK’s tight cost discipline.

Cash conversion was the one soft spot. A few large orders slipped by a matter of months, including main battle tank programs at VMS and two frigate contracts at M&I. These delays pushed the book‑to‑bill ratio down to roughly 1.16x and reduced prepayments by close to €30m, which weighed on free cash flow. FCF is now expected around €71m, or a 50% conversion rate. The timing issue does not change the underlying demand picture, and the delayed prepayments should lift FCF in 2026 as those orders are signed and advance payments flow in.

Management’s tone on 2026 was reassuring. Despite limited visibility on deliveries to Israel, currently budgeted at about €80m for the year, and a still uncertain macro backdrop, the company signaled comfort with the current consensus for adjusted EBIT of roughly €277m. That implies close to 20% growth and suggests that RENK sees no structural bottlenecks in its ability to ramp production. The message is already clear: the operational momentum remains intact.

So RENK enters 2026 with strong demand drivers, improving production capacity and a cost base that has proven resilient through a volatile period. The temporary softness in cash conversion looks timing‑related rather than structural, and the order delays should reverse as contracts are finalised.

The valuation remains attractive relative to the company’s growth profile, especially given the long runway in defence and naval programs and the continued scaling of VMS.

GN Store Nord (GN Denmark): reset year behind, execution year ahead

GN ended 2025 with a mixed fourth quarter that reinforced the split between solid product momentum and a weaker-than-expected finish.

In Hearing, organic growth reached 7% in Q4, supported by the Resound Vivia launch, which continued to drive market share gains in an otherwise soft market. Competitive intensity remained manageable, with no major rival launches expected in the first half of 2026, while further product activity is anticipated later in the year. Even so, the softer exit from 2025 and a higher FX headwind have led to a more cautious revenue profile for 2026. Underlying demand trends in Hearing remain intact, but translation effects and a slower start weigh on near-term reported growth.

The Enterprise division remains the key swing factor for the group. Q4 organic sales declined 3%, reflecting a tough market backdrop and channel inventory reductions in EMEA, partly offset by growth in North America and APAC.

Looking into 2026, management is positioned for a turnaround driven by broader uptake of the Evolve 3 headset and a more normalised demand environment after several volatile years. Expectations have been tempered, but the direction is clearer than it has been for some time. A return to mid-single-digit organic growth would mark a meaningful shift after a prolonged period of instability, even if FX limits the pace of reported recovery. Gaming, meanwhile, should move back into growth in 2026 after a weak Q4, helped by easier comparisons, new launches and a gradual improvement in the US market, with premiumisation continuing to support pricing.

Taken together, GN enters 2026 as a group in transition rather. Estimates have come down across the board, reflecting FX, financing costs and a more conservative view on the speed of recovery, but the strategic setup is improving. Hearing continues to gain share, Gaming is set to stabilise, and Enterprise has a clearer path back to growth than at any point in recent years.

With valuation still reflecting a high degree of scepticism, the investment case increasingly rests on delivery in Enterprise. If that turnaround materialises as expected, the current reset year could mark the low point before earnings begin to rebuild.

Coloplast (COLOB Denmark): a soft start puts pressure on credibility

Coloplast opened the year with a weaker-than-expected first quarter, and the miss came on a base that was already set cautiously.

Revenues reached DKK 7.0bn, up just 0.2% year on year on a reported basis, with organic growth of 6% broadly in line with market expectations but FX erasing most of the progress. The shortfall was more visible at the operating level. Adjusted EBIT came in at DKK 1.92bn, with a margin of 26.7%, falling short of expectations despite the relatively modest growth ambitions baked into Q1.

The impression from the quarter is not one of deterioration, but of a business that has little buffer left after a series of resets over recent years. With growth already back-end loaded by design, any stumble early in the year immediately raises questions about execution and phasing discipline.

At divisional level, performance was mixed and again highlighted China as the main swing factor. Ostomy Care delivered organic growth of 5%, weighed down by continued weakness in China, while underlying trends in the US remained solid. SenSura Mio and Brava continued to drive growth, with Europe once more acting as the main engine. Continence Care grew 7% organically, supported by Luja, and Voice & Respiratory Care delivered 8% growth, in line with its recent run-rate. Wound & Tissue Repair posted organic growth of 5%, though the picture here was split. Advanced dressings declined due to a product return in China, while Kerecis continued to grow at a double-digit pace. Interventional Urology stood out positively, with organic growth of 8%, driven by strong demand for penile implants and a return to growth in women’s health. The underlying portfolio therefore continues to show healthy demand in several areas, but the uneven regional mix and specific issues in China keep blunting the overall outcome.

Management reiterated full-year guidance, with organic revenue growth around 7% and EBIT growth also around 7%, implying a margin close to 28%. The main adjustment was on reported growth, reflecting a higher FX headwind than previously assumed.

Strategically, the announced merger agreement with Uromedica fits well with the direction of travel in Interventional Urology, broadening the male health offering beyond penile implants and strengthening the US platform. That said, the immediate focus remains on delivery. After a Q1 miss on both revenue and EBIT, Coloplast no longer enjoys much benefit of doubt around momentum.

The year is still set up for improvement as phasing normalises, but the group now needs to demonstrate that the recovery story can translate into cleaner quarterly execution. Until that happens, the stock is likely to remain range-bound, with confidence rebuilt only gradually through evidence rather than intention.

Novem (NVM Germany): cash generation helps, but the operating picture stays weak

Novem’s third quarter of FY 2025-26 underlined how difficult the operating environment remains for automotive suppliers tied to premium interior content.

Group sales fell 5% year on year to €118m, well below expectations, with FX compounding already soft end-market demand. Adjusted EBIT dropped to €7m, leaving the margin at 5.8%, down sharply from last year and again below what the market had hoped for. The mix continues to work against the group. Series production revenues were broadly stable, but Tooling collapsed by nearly 40%, reflecting delayed or cancelled OEM programs. Regionally, Europe remained weak, Asia deteriorated further, and only the Americas showed some resilience. On the P&L, there is little sign yet of stabilisation.

The one clear positive in the quarter was cash. Free cash flow reached €21m, a sharp improvement versus last year and well ahead of expectations, driven by working capital discipline rather than operating leverage. This matters for balance sheet comfort, but it does not change the underlying earnings trajectory. Novem still lacks volume support from its core markets, and consultant data continues to point to a subdued light vehicle production outlook in the regions where the group is most exposed.

Management again refrained from giving formal guidance, but the message was consistent with recent quarters. The near-term environment remains tough, and visibility on a demand recovery is limited.

Stepping back, the story has not changed. Novem is managing through another difficult year with cost control and cash discipline, but the conditions required for a meaningful margin recovery are not yet in place. A return to double-digit EBIT margins would require a clear pickup in OEM volumes and program launches, which does not look imminent.

The improved cash flow provides some downside protection, but without a clearer path to top-line recovery, the shares are likely to remain anchored around current levels. For now, Novem paitence continues to be needed.

VINCI (DG France): cash keeps surprising on the upside

Vinci closed 2025 with results that were broadly in line with consensus on earnings but once again stood out on cash generation.

Group revenues reached €74.6bn, up 4.2% year on year, with Q4 growth driven by Cobra IS, VINCI Energies and Airports. International activities continued to outperform France, reflecting the group’s diversified footprint. Recurring EBIT for the year came in at €9.56bn, in line with market expectations, while net income edged up to €4.9bn.

None of this was particularly eye-catching on its own, but it confirmed the underlying stability of the model across concessions, energy services and construction, even in a mixed macro backdrop. The order book was broadly flat year on year, which points to steady activity, but also no signs of a slowdown.

Where Vinci really differentiated itself again was cash. Free cash flow reached €7.0bn, far above what the market had been expecting and comfortably ahead of the prior year. This was driven by strong customer cash inflows across the group, especially in construction, alongside disciplined capital expenditure. Net debt fell to €19.1bn by year-end, lower than anticipated, reinforcing balance sheet strength. The dividend was raised to €5.00 per share, exceeding expectations and underlining management’s confidence in cash sustainability rather than a one-off release.

This pattern has become familiar, but it remains central to the investment case. Vinci continues to convert earnings into cash more effectively than most large-cap peers, which gives it flexibility across dividends, investment and balance sheet management.

Looking into 2026, the outlook remains constructive without being aggressive. Management is targeting further growth in revenue and profits, with traffic at airports and motorways expected to track economic activity. Energy services should continue to grow at a healthy pace, with margins improving further, while renewable capacity under construction increases to 6 GW. Construction revenues are expected to remain broadly stable, with margins holding up. The group is guiding to free cash flow of around €6bn for 2026, well above current market expectations.

At current valuation levels, this implies a clearly attractive cash yield for a business with long-duration assets, diversified earnings and a track record of conservative delivery. Vinci does not need a strong macro tailwind to work. As long as it keeps doing what it has done in recent years, cash remains the key driver of the story.

Ørsted (ORSTED Denmark): balance sheet repaired, pipeline funded and early signs of a more stable long‑term trajectory

Ørsted enters 2026 in a far stronger financial position after the DKK 60bn capital increase and the partial divestment program worth DKK 46bn.

FFO to net debt has rebounded to 43% from 13% a year earlier, which gives the group the flexibility it lacked during the most difficult phase of its offshore reset. A large share of the cash inflow from divestments will be booked in 2026, so the balance sheet should remain solid even with capex of DKK 50–55bn. That spend will support the commissioning of Borkum Riffgrund 3, Changhua 2b & 4 and Revolution Wind, and advance three more projects scheduled for 2027: Sunrise Wind, Hornsea 3 with its associated BESS, and Baltica 2. These six assets form the backbone of Ørsted’s organic earnings growth through 2028.

Beyond 2028, the company sees a supportive tender pipeline. Denmark, the Netherlands, Belgium, the UK, Taiwan, Korea and Australia all have auctions scheduled for 2026, and Ørsted has advanced projects in each of these markets. The group is being more selective after the setbacks of the past two years, with a clear emphasis on value creation rather than volume. To improve competitiveness, Ørsted is reducing its workforce by 25% to about 6,000 FTEs, with DKK 2bn of cost savings expected. Strategically, Europe remains the preferred growth region, and the recent announcement of a major offshore rollout of roughly 15 GW per year is viewed internally as a meaningful long‑term catalyst. The company also confirmed that dividends will resume from 2026, giving it flexibility to adjust capital allocation depending on tender outcomes.

In the United States, execution remains complicated but manageable. The second stop‑work order created further delays and triggered an additional impairment of MDKK 600 in Q4, on top of the MDKK 500 booked previously. Even so, both Revolution Wind, now 87% complete, and Sunrise Wind, at 45% completion, have resumed work and reaffirmed their commissioning timelines. Political uncertainty remains a factor, but the operational teams appear to be keeping the projects on track.

Ørsted’s profile is becoming more balanced. The company is still navigating execution risks on 8.2 GW of projects under construction, but it now has the financial strength to absorb volatility and the flexibility to pursue tenders selectively. The combination of a funded pipeline, a clearer cost base, and a more disciplined approach to growth gives the group a more stable foundation than it had a year ago.

Bénéteau (BEN France): clearing the backlog before new launches

Bénéteau closed FY 2025 with revenue of €849m, down 17.1% at constant currencies and modestly below market expectations. The final quarter looked weaker on the surface, with Q4 revenue of €274.2m down 6.5% at constant currencies, but the headline number masks a timing issue in the US. Around €20m of sales were pushed out by customs clearance delays, and stripping that out leaves Q4 activity broadly flat at constant currencies. That detail matters when looking at the underlying trend, as it confirms that the sharp correction seen earlier in the year eased as 2025 progressed.

The year itself was defined by a deep reset. H1 revenue fell more than 27%, driven by dealer destocking and weak end demand, while Q3 already showed a much slower pace of decline. By Q4, activity had stabilised, even if reported numbers did not fully reflect it.

The split between divisions continues to show where the pressure has been and where stabilisation is coming from. Motorboats, which accounted for 54% of group sales in 2025, ended the year down 9.8% at constant currencies. The key point here is the shift within the year, with H2 returning to growth of about 1% after a near 20% drop in H1, helped by a rebound in European motorboat demand. Sailing, representing 44% of sales, remained the weak spot, with revenue down 26.6% at constant currencies. Demand for monohulls stayed soft and charter operators continued to cut back sharply, leaving this segment exposed for longer.

At the group level, profitability also reflected this uneven mix. Management has already indicated that the group returned to profit in H2, partially offsetting the H1 underlying operating loss of €20.6m, which points to a full-year underlying operating loss of roughly €10m. A year-end cash flow hiccup linked to a service provider error briefly clouded the picture, but 96% of the misallocated funds have already been recovered and the issue does not change the balance sheet trajectory.

Looking into 2026, visibility is still imperfect, but improved. Order intake rose 24% over the year and now slightly exceeds sales over the past 12 months, which is a clear shift from the inventory-driven correction phase. Management has not given formal guidance, yet it expects a return to top-line growth, with momentum building early in the year and new product launches supporting the recovery. Inventory levels across the dealer network are more normalised, and promotional intensity should ease as volumes stabilise.

That said, the environment remains uncertain, especially in sailing, and the pace of recovery is unlikely to be uniform across regions or product lines. After a year spent clearing excess stock and absorbing demand weakness, Bénéteau enters 2026 with a cleaner base.

TUI (TUI1 Germany): solid winter execution keeps the year on track

TUI’s Q1 2026 numbers came in better than the market expected on earnings, but the data shows challenges.

Group revenue reached €4,861m, close to last year and only marginally below forecasts, but underlying EBIT rose to €77.1m from €50.9m a year ago. The improvement was driven by Holiday Experiences, which continues to do the heavy lifting. That division delivered revenue growth of 3% year on year and lifted EBIT to €213.7m, up 9%. Cruises stood out within the segment, with EBIT of €82.3m versus €48.2m last year, reflecting stronger load factors and pricing discipline. Hotels were more mixed, with EBIT down to €131.0m from €150.3m, while TUI Musement edged closer to breakeven. Markets & Airline remained loss-making in the quarter, but the EBIT loss narrowed to €115.3m from €125.2m, confirming that cost actions are feeding through as planned.

That said, booking data points to a tougher volume backdrop, particularly looking ahead to the summer season. Winter is largely sold, in line with normal patterns, with revenue down 1% year on year following weaker weather in parts of Europe. The UK is stable, Germany is slightly lower. For summer 2026, around one-third of capacity is sold so far, with 4.8m bookings taken. Revenue is currently down 2% versus summer 2025, which reflects lower volumes in line with planned capacity rather than pricing pressure.

Management has been clear that the growth mix this year is expected to lean more on margin improvement than volume expansion, especially in Markets & Airline, where the strategic cost program remains a key lever. Importantly, pricing appears resilient, which supports profitability even in a softer demand environment.

Full-year guidance was reiterated, with revenue growth of 2–4% and adjusted EBIT growth of 7–10% for fiscal 2026. Given the Q1 delivery and the visibility on winter trading, that looks achievable, even with a more cautious summer volume outlook.

The message from this release is one of execution, but not acceleration. TUI is showing that it can protect earnings through pricing, mix and cost control when volumes soften. After a strong share price run over recent months, the update does not change the broader thesis, but it does reinforce confidence in the earnings trajectory for the year.

If you appreciate this post, feel free to share and subscribe below!