Payment solutions, semis and a lot of pressured share prices

easyJet, Prosus, Aixtron, Straumann, Soitec, Ubisoft, Bigben Interactive, Pfisterer, ElringKlinger, Intertek, Adyen, Eurocash

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

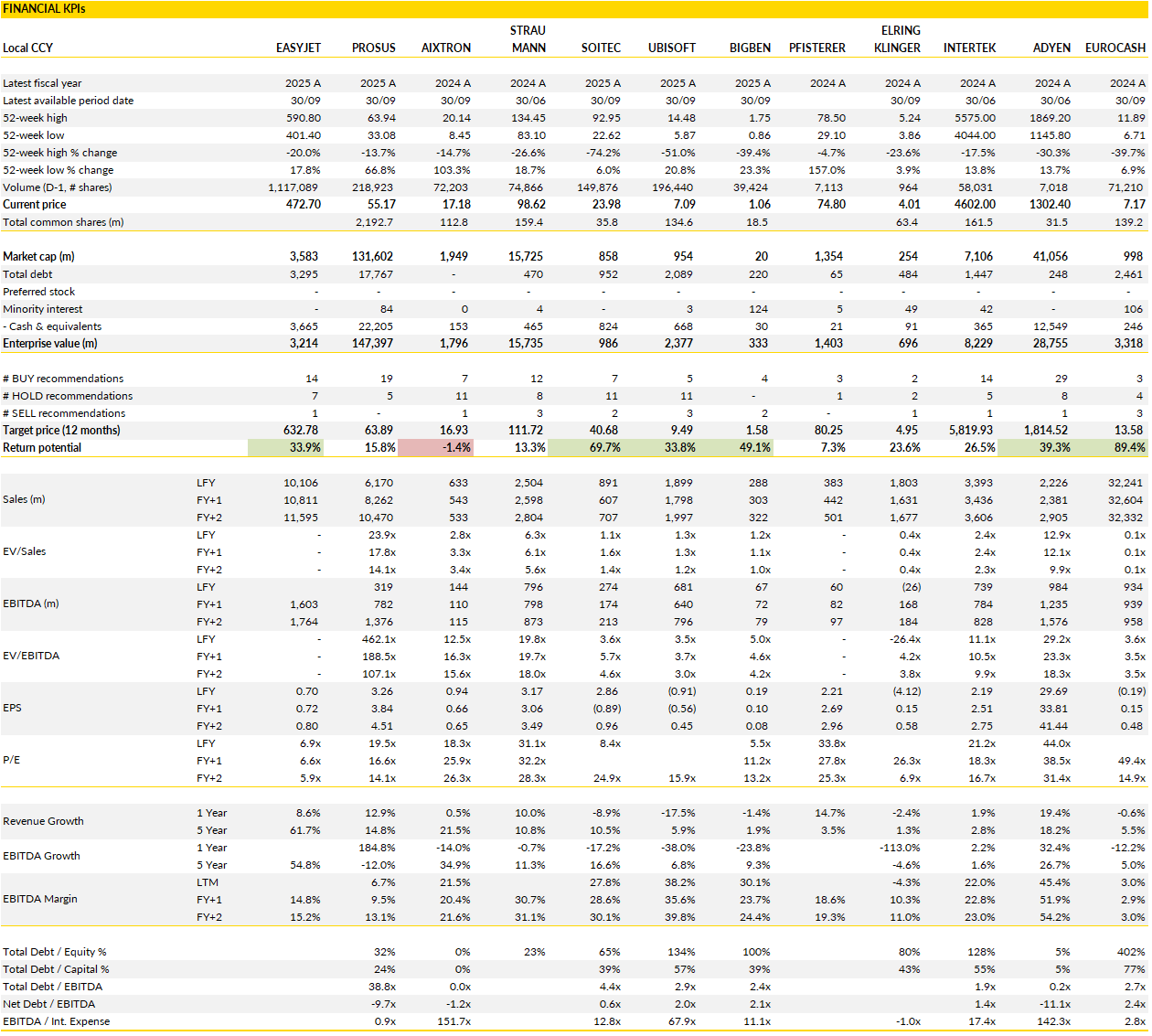

Financial KPIs

easyJet (EZJ UK): steady skies but little lift in the near term

easyJet closed its fiscal year broadly in line with market expectations, a respectable outcome given how volatile European aviation has been.

Profit before tax landed at £665 million, roughly matching consensus, with about a third coming from the fast-growing Holidays segment. The airline’s cost discipline remains the quiet hero of the story: ex-fuel unit costs fell 1% and fuel CASK improved 7% year-on-year, cushioning the 3% decline in revenue per seat. The dividend, reinstated at 20% of earnings, signals management’s confidence in the balance sheet, which now shows a net cash position of £602 million, up sharply from last year’s £181 million. That cash generation and the Holidays profitability are the two bright spots in an otherwise unremarkable set of numbers.

The broader picture is that easyJet continues to operate a solid business in a crowded, capacity-constrained European market, good enough to deliver returns, but without a clear catalyst for re-rating.

Looking ahead to the upcoming year, easyJet’s guidance basically suggests more of the same: steady but unspectacular progress. Bookings for the December and March quarters are slightly ahead of last year, and early summer pricing looks firm, helped by maturing leisure routes and a shift to longer-haul European destinations. The Holidays division continues to grow rapidly, with 80% of first-half capacity already sold and prices up high single digits, a sign that the package model is resonating with consumers even as airfare competition intensifies. Cost inflation remains a watchpoint, with rising wages, maintenance, and environmental levies expected to offset most of the benefit from lower fuel. Still, the airline expects modest efficiency gains as it retires smaller A319s and takes delivery of 17 new A320neo aircraft, a fleet transition that will unlock meaningful unit-cost savings from 2026 onward.

The problem for investors is timing. The route network is still digesting the expansion into Milan Linate and Rome Fiumicino, and many of the operational and fleet benefits won’t show up until 2027.

For now, capacity growth will remain modest and the stock’s near-term narrative lacks obvious excitement. Yet valuation looks appealing on a multi-year view: easyJet trades at a deep discount to its pre-pandemic EV/EBITDA multiples, with a much stronger balance sheet and a higher-margin leisure arm than it had in 2019.

Prosus (PRX Netherlands): Tencent’s tailwinds meet structural limits

Prosus’ latest half-year results reinforce the case that the group’s sprawling e-commerce portfolio is finally becoming financially self-sufficient, yet the stock still trades like a derivative of Tencent rather than a standalone growth story.

Adjusted EBITDA for the six months came in at $530 million, comfortably ahead of forecasts, confirming that every major business line, from classifieds to payments and food delivery, is now profitable. The improvement in cash generation reflects years of portfolio pruning, tighter cost discipline, and a sharper focus on scale rather than diversification. Food delivery was a standout, posting significant margin gains as consolidation across its European assets and improved unit economics pushed the segment further into the black. Free cash flow surged to nearly $1.3 billion for the half, though almost all of that still came from Tencent dividends, a reminder how Prosus remains heavily dependent on its 23% stake in the Chinese tech giant.

The management tone was confident, reiterating 2026 EBITDA guidance of around $1.1 billion and hinting at renewed focus on India and Europe as next growth vectors. India is clearly the strategic centerpiece, with Prosus targeting long-term exposure to a $50 billion digital economy through its stakes in fintech and classifieds platforms, many of which could come to market over the next few years. In Europe, management sees opportunities in scaling online marketplaces and mobility ventures, though the focus remains firmly on improving returns.

The most notable shift came in capital allocation: Prosus suggested it will take a more flexible stance on buybacks, selling fewer Tencent shares and potentially financing repurchases via other assets. This seems a subtle but important change: it signals confidence in Tencent’s ongoing recovery while acknowledging that automatic share sales were starting to erode one of the group’s most valuable assets.

Still, the structural discount in Prosus’ valuation persists, and for good reason. The company’s governance complexity, cross-holdings, and Amsterdam-Johannesburg dual structure make the “sum-of-the-parts” story perpetually harder to close. Even with Tencent performing better, its advertising and fintech segments now firmly back in growth mode, Prosus’ shares already reflect that optimism, trading close to the group’s look-through NAV. The e-commerce profitability story is real, and the shift from cash burn to cash generation is an important milestone, but Prosus remains trapped between being an investment vehicle and an operator.

The long-term thesis is intact, i.c. monetising India and continuing buybacks at opportunistic levels could narrow the gap to NAV, but in the short term, the stock seems fairly priced for a holding company that still lives in Tencent’s shadow.

Aixtron (AIXA Germany): GaN emerges as the lever behind the AI power boom

Aixtron’s investment case has shifted decisively from cyclical semiconductor equipment maker to one of the most leveraged plays on the electrification of artificial intelligence.

The company’s long-dominant position in gallium nitride (GaN) epitaxy tools is suddenly in the spotlight after NVIDIA confirmed its next-generation server racks will adopt 800-volt architectures. That might sound like a technical detail, but it’s the kind of shift that could reshape hardware ecosystems. As AI data centers scale past the megawatt mark per rack, energy efficiency and heat management become existential constraints, and GaN offers roughly 10% higher power conversion efficiency than silicon.

With a roughly 90% global share in GaN metal-organic chemical vapor deposition (MOCVD) systems, Aixtron sits right at the inflection point. Its competitors in this space (Veeco in the U.S. and AMEC in China) have struggled to gain traction, leaving Aixtron as the clear beneficiary of what could be a once-in-a-decade adoption curve.

NVIDIA’s choice of GaN in its upcoming “Kyber” rack architecture means the material could move from niche to mainstream far faster than the market currently assumes. If just 15,000 Kyber racks deploy per year by 2028, the GaN opportunity in data centres alone could be worth over $400 million annually, and well above $1 billion if other hyperscalers follow. For Aixtron, that translates into demand equivalent to hundreds of millions in annual revenue that is still largely absent from consensus forecasts.

Management had hinted at a 50% upward revision to GaN market estimates by 2030, but the pace of adoption now looks faster. Importantly, the first meaningful orders tied to this AI buildout should land by mid-2026, setting up a multi-year volume ramp as power conversion architectures standardise around GaN.

It’s easy to dismiss Aixtron’s recent share rally as another AI-adjacent hype trade, yet the numbers tell a more structural story. The company’s growth visibility through 2027–2029 now rests on industrial physics rather than investor excitement; you can’t build 1MW AI racks without rethinking how power is converted. With roughly one-third of its current equipment sales already tied to GaN and the technology’s total addressable market set to double or even triple within five years, Aixtron has become a critical supplier to the AI supply chain’s energy backbone.

Its financial profile should improve accordingly: recurring service revenue is growing, balance sheet leverage is minimal, and margins are expanding with scale. The stock’s recent bounce barely scratches the surface of what could be a multi-year re-rating once the market begins to price in the data-centre-driven GaN cycle.

Straumann (STMN Switzerland): digital dentistry becomes the next growth implant

Straumann’s new 2030 roadmap signals a company that isn’t relying (only) on its premium brand in implantology but is positioning itself for the digital transformation of dentistry.

The Swiss group has spent the past few years quietly assembling a technology stack that redefines how dentists work, from 3D-guided surgeries and digital prosthetics to AI-powered orthodontic workflows, and its latest strategy doubles down on that integration. The goal is simple: make treatments faster, more predictable, and less invasive for patients while cementing Straumann as the backbone of digital dental care. The company’s strength lies in its ecosystem thinking, not just selling implants or aligners, but connecting diagnostics, planning, and restoration in one seamless workflow. With the global dental implant market expanding at a steady mid-single-digit pace and orthodontics growing at double digits, Straumann’s digital bridge between these segments could keep growth well above industry averages for years to come.

Management’s new medium-term targets reinforce that optimism. By 2030, Straumann aims for roughly 10% annual revenue growth and consistent EBIT margin expansion of 40-50 basis points per year, a trajectory that would take operating profitability toward the high-twenties range.

Efficiency gains are set to come from automation, leaner capex cycles, and better working-capital management, all of which should lift cash conversion in what is already one of the sector’s most capital-disciplined models. In practice, that means Straumann can reinvest more aggressively into innovation and selective M&A without stretching its balance sheet.

The company is also benefitting from renewed strength in North America, where digital adoption is accelerating fastest. The orthodontics business, often seen as a laggard against Align Technology, is being repositioned for scale, while advanced prosthetic and intraoral scanning technologies are opening new margin-accretive growth lanes.

This is a premium dental franchise turning itself into a digital platform business. Straumann has always commanded top-tier multiples, but the new plan provides the operating leverage and visibility to justify them (again). Market share gains across implantology, orthodontics, and dental equipment remain highly plausible as digital workflows become the industry norm.

For investors, the appeal lies in Straumann’s ability to compound high-teens earnings growth through disciplined execution.

Soitec (SOI France): a forced reset in the silicon cycle

Soitec’s latest set of results has clearly rattled investors (again).

The company’s decision to prioritise cash generation and inventory reduction over short-term profitability marks a rare pivot for a business long viewed as a structural compounder in advanced silicon materials. After a decade of consistent profitability, Soitec reported its first net loss in ten years as it cleared balance sheet debris: impairments tied to SmartSiC assets, currency losses, and a deliberate factory underloading that will continue through the second half.

The near-term pain is palpable: automotive and mobile communications remain in destock mode, with no visibility on recovery, and even the RF-SOI business, once Soitec’s crown jewel, is trapped in a mature smartphone market. Yet management insists this is some kind of a controlled clean-up rather than a structural deterioration, maintaining R&D spend and signaling that innovation capacity remains intact despite the austerity drive.

Behind the grim optics, Soitec is reshaping itself for a cycle that now looks longer and flatter than most expected. The balance sheet has been stabilised, capex trimmed, and working capital is being released, an intentional retreat to preserve cash flow.

The company still has technological depth: its photonics-SOI, FD-SOI, and POI platforms are increasingly central to data infrastructure, optical interconnects, and next-generation sensors. SmartSiC, the high-potential but currently loss-making bet on power electronics, remains alive, with five customers still in qualification and potential crossover applications in data centers.

But Soitec’s problem is timing; the destocking phase in automotive and RF-SOI keeps dragging, and customers are reluctant to commit to new volumes while end markets remain sluggish. Management’s refusal to commit to revenue growth next year was pragmatic but painful for a market that had expected a recovery narrative by now.

The sharp share price correction (down big time on the day and 60% year-to-date) likely overshoots the fundamental risk. Soitec is not broken; it is entering a new phase of strategic restraint, where free cash flow and cost control take precedence over expansion. The company’s core technology moat remains deep, its net debt remains modest, and its innovation engine continues to run.

Once the destocking cycle eases, the same operating leverage that now hurts margins will swing the other way. In that sense, Soitec is a recovery story, one where patience will be rewarded once the semiconductor cycle and power device markets reaccelerate.

Ubisoft (UBI France): a fragile recovery masked by one-off relief

Ubisoft’s latest half-year report managed to calm nerves (a bit), but it doesn’t really change the underlying story: a company still trying to reassemble coherence after years of creative drift, uneven execution, and repeated restructurings.

Revenue for the first half rose 20% year-on-year, helped by better-than-expected partner deals and a resilient back catalogue, trimming operating losses to €120m versus expectations of a deeper hole. The headline relief came from the imminent Tencent transaction, which will erase Ubisoft’s €1.15bn in net debt and buy it time to stabilise its balance sheet. Yet beneath those positives lies a studio network still spread thin, an ageing pipeline of franchises, and a reliance on partnerships and licensing to fill financial gaps rather than new intellectual property to drive growth.

The strategic focus is now shifting from mere survival to slow rehabilitation. Management reaffirmed its fiscal 2026 targets of stable revenue and breakeven EBIT, with the promise of positive free cash flow only from 2027 onward. That improvement rests on a mix of cost discipline and franchise rotation: long-running series like Assassin’s Creed, Far Cry, and The Division continue to provide cash flow visibility, but innovation risk is growing as each iteration faces higher expectations and lower margins.

Ubisoft’s ambition to reduce fixed costs by €100m over two years is meaningful but unlikely to solve its deeper issue, i.c. maintaining creative velocity across a global studio base while managing live-service economics. The restatement of prior-year earnings under IFRS 15, which triggered a technical covenant breach, only underscores how tight the financial management has become.

Tencent’s deepening involvement, both as partner and shareholder, keeps Ubisoft alive in a strategic sense but also highlights its lack of independence. The Chinese giant’s cash injection removes immediate leverage risk, yet the trade-off is that Ubisoft increasingly functions as a platform content supplier rather than a self-determined publisher.

The medium-term outlook therefore hinges less on near-term profits and more on whether the company can rebuild creative credibility. The next two fiscal years are about proving that its legacy franchises can coexist with a new generation of scalable IP and live-service formats. Until then, any optimism around better-than-feared results feels like a temporary respite in a longer process of reinvention.

Bigben Interactive (BIG France): refinancing buys time, not conviction

Bigben’s latest half-year results show a company that has found short-term financial oxygen but remains stuck in a structurally uninspiring operating cycle.

The headline news, i.c. the long-awaited refinancing of its €58m bond, now replaced with a six-year €43m credit facility, removes the most immediate liquidity threat. Yet the operational picture remains stubbornly flat. First-half revenue was stable at €135m, but profitability continues to disappoint: EBIT came in below expectations at €4.7m, a modest year-on-year increase flattered by easy comps. The gross margin improved by three points thanks to the Audio-Video division’s better mix, but the bottom line fell 16% to €3.7m as higher financing costs bit into results. Net debt ticked up to €183m, a heavy burden for a group whose core businesses, consumer audio accessories and mid-tier gaming, offer little visibility or operating leverage.

The outlook for the rest of the year is cautiously unchanged, though the underlying dynamics remain fragile. Bigben’s consumer electronics and Telco unit continues to face weak smartphone demand and pricing pressure, while the Nacon gaming arm (its main growth driver) is leaning heavily on a handful of upcoming releases to stabilise earnings. Management expects a stronger second half thanks to a broader line-up of titles (including GreedFall II and Styx) and modest recovery in accessories, but the catalogue’s ageing profile and the highly competitive mid-market gaming space limit upside.

Cost discipline helps, yet the group’s scale disadvantages and dependence on third-party licensing keep margins thin. The strategic narrative of diversification between hardware and software has never quite delivered on its promise; instead, both divisions seem to offset each other’s volatility rather than compound growth.

The secured refinancing is a relief, but it only extends the runway rather than alters the trajectory. Bigben’s valuation still looks stretched relative to its low-growth, high-debt profile, trading at 14.5x forward EBIT with no structural catalyst in sight. The group’s challenge is not just balance sheet management but strategic coherence; finding a way to turn Nacon’s modest gaming portfolio and its peripheral hardware roots into something more scalable.

For now, investors get financial stability but little reason to believe in renewed momentum. The bond deal prevents immediate distress, yet without a creative or operational breakthrough, Bigben risks remaining a slow-burn turnaround story.

Pfisterer (PFSE Germany): electrification tailwinds power a confident outlook

Pfisterer’s first months as a listed company continue to show why the market has quickly embraced its story: it sits right at the centre of Europe’s grid modernisation cycle.

The latest quarter came in stronger than what the market expected, with sales up 25% year-on-year and EBITDA boosted by lower costs and a one-off insurance payment tied to last year’s Wunsiedel factory fire. Beneath the noise, however, the real story lies in the order book: a 1.28x book-to-bill ratio and a backlog of €339m, giving roughly three quarters of forward visibility. That depth in orders, particularly in the Overhead Line (OHL) and Components segments, points to a business running at high utilisation as utilities ramp up capex for grid stability, renewable integration, and cross-border power links.

Management remains cautious in tone, keeping guidance qualitative, but it’s clear the company is leaning into a structural growth wave, one that extends beyond its European base.

The most striking growth driver right now comes from the Middle East and India, where sales jumped nearly 80% in nine months. Stripping that out, growth across other regions was a more modest 4%, but this is partly due to timing effects as Pfisterer transitions production from Wunsiedel to Kadan in the Czech Republic. Once that plant is fully operational in 2026, the numbers should normalise and the recurring insurance inflows will disappear, leaving cleaner, organic margins. Europe and Africa already showed sequential improvement in Q3, suggesting the relocation drag is easing. With the utility market booming, Pfisterer is well-positioned as a trusted supplier of critical grid components, from high-voltage connectors to complex cable systems, areas where reliability and technical know-how matter more than price.

Management’s commentary and updated assumptions suggest a company growing faster and more profitably than initially modelled. Analysts now expect roughly mid-teens sales growth through 2026, with EBITDA margins climbing towards 20% as operational leverage kicks in and insurance noise fades. That optimism seems justified: electrification and transmission upgrades are secular, not cyclical, themes, and Pfisterer has built a defensible niche at the intersection of engineering precision and energy security.

The only caveat is valuation; the shares have already doubled since the IPO, leaving limited short-term upside. Still, as a clean infrastructure play with credible execution, Pfisterer remains one of the more compelling new entrants among Europe’s industrial names.

ElringKlinger (ZIL2 Germany): halfway through the reinvention, but the hard part lies ahead

ElringKlinger’s capital markets day felt like a quiet milestone in a long transition. The German auto supplier, best known for its traditional gaskets and engine components, is now roughly halfway through a self-imposed decade-long transformation into a supplier of electrified mobility systems.

Management reiterated its ambition to have half of total sales come from non-ICE products by 2030, a goal that looked ambitious even before the sector’s recent slowdown. To get there, ElringKlinger has been pruning its portfolio, divesting non-core and unprofitable product lines, and tightening its manufacturing footprint to focus on areas like battery cell contacting systems and lightweight components.

The shift is painstaking but methodical: management is playing a long game in an industry still caught between the old combustion order and an electric future that remains unevenly distributed across regions and customers.

The financial targets presented were steady and not that exciting, signaling cautious confidence rather than acceleration. Medium-term guidance calls for a gradual margin lift from around 5% today toward 7–8%, driven by €50m in cost savings and operating leverage from new e-mobility contracts ramping in the back half of the decade. Capital intensity is expected to fall sharply (capex is planned at just 2–4% of sales versus double-digit levels recently) freeing up cash for balance sheet repair. Management aims to bring leverage back below 2x as free cash flow normalises.

Yet the near term remains flat, with 2025 guidance implying no revenue growth and only modest progress in profitability. Much of the expected improvement depends on large-scale contracts that have yet to fully materialise and on the aftermarket, which management wants to expand geographically.

The biggest open question is how much more restructuring remains before ElringKlinger reaches a “clean” earnings base. Management hinted that further provisions are likely as it trims exposure to underperforming technologies, particularly fuel cells, which have lost some strategic luster compared to battery systems.

While the company deserves credit for discipline and transparency, investors are still being asked for patience. The margin bridge is credible, the strategy consistent, but the timing and capital market reward remain uncertain. ElringKlinger has laid the groundwork for a more resilient, electrification-aligned business; it just needs to prove that its reinvention can deliver profits.

Intertek (ITRK UK): steady growth and firmer margins keep the story intact

Intertek’s July–October period brought 4.1% organic growth, a touch below the market’s expectations, with total sales rising nearly 3% to £1.18bn. The highlight came from the Industry & Infrastructure division, which finally showed signs of life after several flat quarters. Growth there accelerated to around 6%, supported by a rebound in North American construction testing and healthy mineral inspection activity. The core Consumer Products business, still the group’s profit engine, held steady with mid-single-digit growth, while Corporate Assurance continued its robust run thanks to strong demand for sustainability and quality audits. Weakness lingered in Health & Safety, where Chemicals and Pharma remain soft, and World of Energy, where transportation technologies once again underperformed.

Even so, Intertek’s divisional mix keeps margins resilient. The company reaffirmed full-year guidance for mid-single-digit organic growth and a further margin uptick led by Consumer Products and Corporate Assurance, together accounting for roughly two-thirds of group EBITA. The group also nudged up expectations for Industry & Infrastructure, now guiding to mid-single-digit growth, partially offset by trimming its World of Energy outlook to flat.

In effect, the stronger industrial testing recovery is balancing out the ongoing slump in transport-related activities. The constant focus on cost control, pricing discipline, and mix improvement continues to support incremental profitability across most units. Currency headwinds shaved a couple of points off reported numbers, but underlying trends remain consistent with the mid-term goal of driving EBITA margins above 18.5% in 2026.

While organic growth lags slightly behind peers, yet Intertek’s margin trajectory looks firmer, the consequenxce of its long-term focus on high-return categories and operational efficiency. The company’s exposure to regulatory, compliance, and quality testing ensures structural resilience even as industrial cycles ebb and flow.

The valuation already prices in much of this stability, but with cash generation healthy and visibility improving, the risk/reward still seems to tilt positively.

Adyen (ADYEN Netherlands): back to compounding mode as growth normalizes above 20%

Adyen’s capital markets day reaffirmed what most long-term holders wanted to hear: that the hypergrowth story isn’t over, it’s just maturing into something steadier and more predictable.

Management guided for net revenue growth in the low to mid-twenties for next year and expects to sustain roughly 20% annual expansion beyond that. After last year’s operational wobble and questions around competition and take-rates, the tone this time was quietly confident; a company that has digested its cost base, reset expectations, and is now focused on compounding again. The shift toward annual guidance signals discipline and transparency, while the framework behind the +15% to +28% medium-term range shows how management wants investors to think: growth driven by a mix of share gains, new product rollouts, and the natural ramp of existing merchant cohorts.

Perhaps the most striking ambition from the CMD was the scale of volume expansion Adyen is planning. Management sees total processed volume (TPV) growing four- to sixfold over the next decade, even without assuming exposure to China or other restricted markets. With just ~5% share of global non-China payments today, there’s plenty of room to climb toward the 10–15% range where the largest players sit. That’s the central logic of the Adyen story: the company’s unified global tech stack still offers efficiency, reliability, and data visibility that few competitors can match, and as merchants consolidate payment partners, Adyen tends to win. On top of that, its entry into banking services (treasury, lending, card issuing) opens entirely new monetisation layers on the same client relationships, effectively deepening its moat rather than broadening its footprint.

The other dimension of Adyen’s advantage, and one management leaned into more directly this year, is its readiness for the AI revolution sweeping financial infrastructure. With a single, integrated technology stack and real-time data visibility across millions of transactions, Adyen can apply machine learning for risk, pricing, and customer analytics in ways fragmented legacy processors cannot. The AI angle isn’t just a buzzword; it enhances fraud detection and operational efficiency, allowing Adyen to maintain margins even as it scales.

After a bruising reset period in 2023–24, the company seems to have found its balance between ambition and execution discipline. Growth in the mid-twenties may sound pedestrian for an old Adyen, but in payments infrastructure, a sector now dominated by scale, trust, and integration, it’s exactly what a mature compounding engine looks like.

Eurocash (EUR Poland): wholesale slump deepens as store pruning weighs on scale

Eurocash’s third-quarter update was a reminder of how fragile Poland’s wholesale and independent retail ecosystem remains when consumer demand softens.

The group’s numbers missed expectations across the board, with revenue falling 6.6% year-on-year and both wholesale and retail under pressure. The core cash-and-carry business, still the backbone of Eurocash’s distribution model, posted a brutal 12% drop in sales, hit by weak consumption in drinks and alcohol categories and compounded by poor weather. Distribution, another key contributor, slipped 7% as independent retailers remained cautious in restocking. While the service arm managed modest growth, largely due to tobacco sales after an excise hike, the mix shift offered little margin relief. Group EBITDA fell 4.7% and the overall margin stayed thin at 2.9%, underscoring the limited operational leverage in the current environment.

Retail, meanwhile, continued to feel the impact of Eurocash’s store rationalisation strategy. The group has been closing underperforming Delikatesy Centrum outlets (119 over the past year) which drove retail revenue down 17% but helped to stabilise profitability. Excluding one-offs, retail EBITDA actually grew 8% as the segment margin improved to 5.1%. The result hints at underlying progress in the remaining store base, even if volumes are shrinking. Online grocery platform Frisco once again stood out, growing nearly 15% year-on-year, while convenience banner Duży Ben saw a slight decline. Importantly, the “new projects” segment returned to positive EBITDA, showing early signs that the digital and convenience bets could eventually offset legacy drag. Still, with nine-month revenue down 4% and a small net loss, Eurocash’s near-term picture remains one of restructuring.

The broader market backdrop hasn’t helped either. While Poland’s total grocery market grew around 5% in the quarter, driven almost entirely by discounters, Eurocash’s addressable wholesale market shrank by 3%, reflecting a structural share shift toward large-format and private-label players. The company’s franchise chains held ground, but the wholesale segment’s relevance continues to erode as consumers trade down and small retailers lose volume.

Management now faces a critical reset moment: its new 2026–2027 strategy, due in December, will need to show how Eurocash can rebuild growth in a market increasingly dominated by integrated discount formats. For now, the group is in defense mode, i.c. preserving cash, streamlining its footprint, and hoping that a leaner structure can eventually restore scale efficiency once demand returns.

If you appreciate this post, feel free to share and subscribe below!