Payment solutions, drinks and sunrises

Adyen, Infineon Technologies, Diageo, Sunrise, Salzgitter, Tecnicas Reunidas, AUTO1, TKH Group, INWIT, United Internet Group, K+S, Hensoldt, Stabilus

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

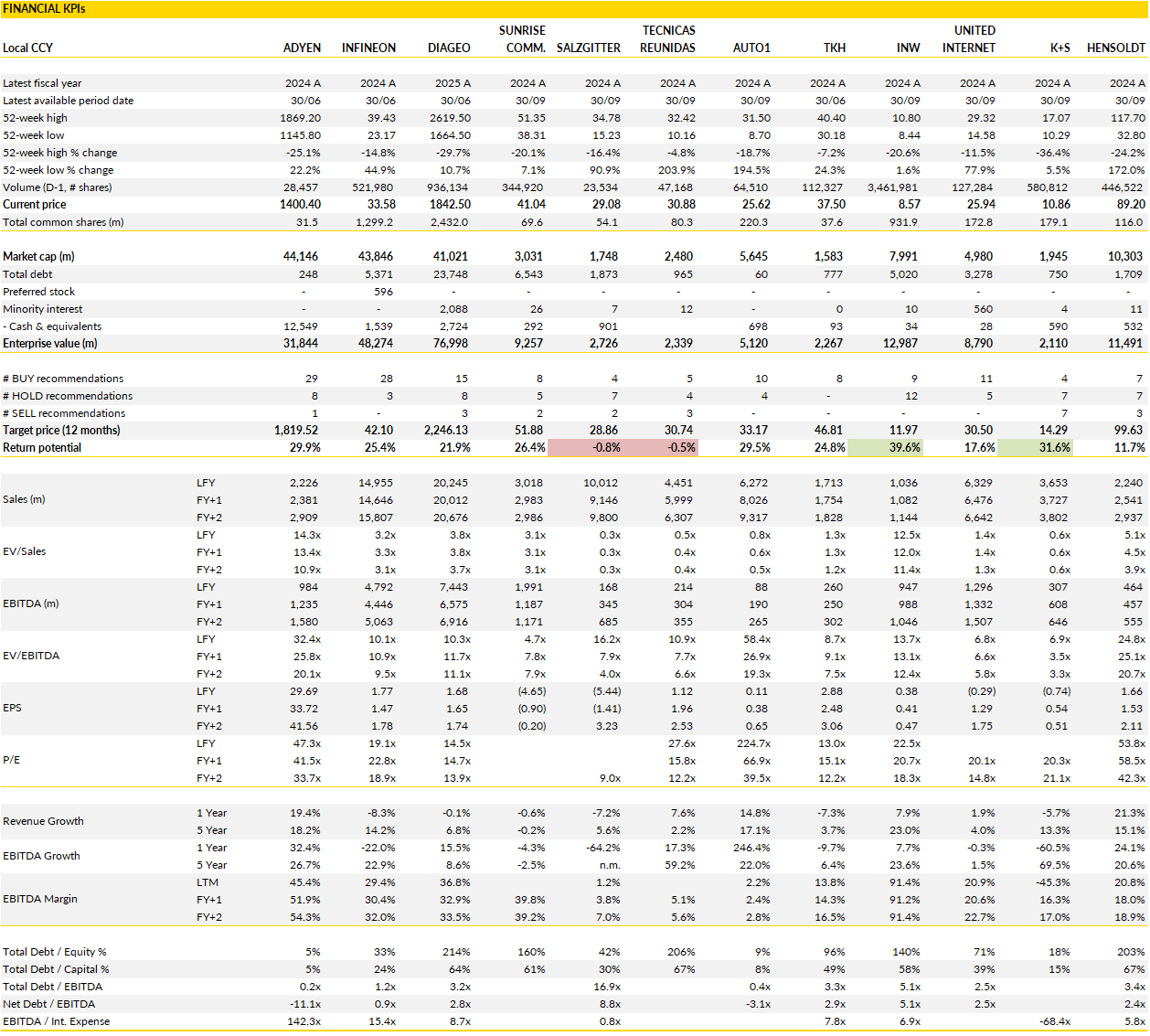

Financial KPIs

Adyen (ADYEN Netherlands): Clarity at the CMD

Adyen, one of Europe’s most closely watched growth stories, is holding a Capital Markets Day today.

The Amsterdam-based payments platform outlined a new long-term framework that sees net revenue growth of around 20% annually beyond 2026, a touch slower than what the market had come to expect, but paired with a higher margin ambition, targeting EBITDA above 55% by 2028.

The update effectively signals that : Adyen is prioritizing efficiency and scalability over aggressive top-line expansion. While the company’s reaffirmation of sustained double-digit growth keeps its structural narrative intact, the market may interpret the 20% figure as a ceiling rather than a floor, setting the stage for some underperformance in the near term even as the fundamental story remains solid.

The nuance here is important. Adyen’s revenue growth has historically been one of the cleanest indicators of its multiple, and a moderation from the mid-20s to low-20s range inevitably recalibrates expectations. Yet, management’s emphasis on operating leverage and platform maturity represents a natural evolution for a payments player of this scale. The company’s mix has tilted toward larger enterprise merchants and omnichannel clients, driving volume but with more stable take rates. At the same time, Adyen’s disciplined hiring freeze earlier this year and ongoing investment in proprietary infrastructure are already translating into margin expansion. The 55% EBITDA target by 2028 (up from “above 50% by 2026” previously) shows that profitability will accelerate even as growth steadies, given the inherent scalability of its single-platform architecture.

For long-term holders, the CMD message was about about maturation. Adyen’s ability to sustain 20% annual revenue growth on a high base remains exceptional in the payments landscape, especially when paired with expanding profitability and strong free cash flow. The company’s decision to provide annualized guidance, rather than multi-year promises, adds a welcome element of transparency after the turbulence of 2023–2024.

Adyen is choosing the path of maturation, of steady, compounding cash generation and durable network effects. The market may need time to adjust to this more grounded narrative, but the underlying trajectory (controlled growth, higher efficiency, and rising margins) reinforces Adyen’s position as Europe’s benchmark in digital payments.

Infineon Technologies (IFX Germany): Caution as a strategy amid cyclical fog and structural promise

Infineon enters the final stretch of its fiscal year with the market’s expectations carefully balanced between short-term caution and long-term conviction.

The company’s upcoming full-year results are unlikely to hold major surprises on the 2025 numbers, but all eyes are on the 2026 guidance, and rightly so. Management appears set to take a deliberately conservative approach, signaling discipline in the face of uncertain demand recovery across automotive and industrial end-markets. This tone should be welcomed by investors who have seen too many chip peers issue overly optimistic forecasts into cyclical softness. The group’s exposure to semiconductors for electric vehicles, renewable energy, and data centers provides structural growth, but near-term macro visibility remains murky. By anchoring expectations lower, Infineon effectively builds a base for potential upside surprises later in the year.

Operationally, Infineon continues to show resilience. Quarterly revenue trends have stabilized, with the power systems and industrial divisions (PSS and GIP) holding up better than automotive, which remains in a digestion phase after years of elevated inventory and pricing normalization. Margins have proven sticky in the high teens, reflecting solid cost control and a still-favorable product mix toward higher-value semiconductors in electrification and energy efficiency.

Even as 2025 annual sales are expected to decline modestly, cash generation remains strong, aided by disciplined capital expenditure. The upcoming year’s challenges are well understood, i.c. currency headwinds and EV market softness in China to destocking in industrial electronics, but Infineon’s diversified portfolio provides balance across cycles. Its acquisition of Marvell’s Ethernet business adds an incremental growth lever, positioning the company to benefit from the ongoing buildout of data center infrastructure tied to AI and cloud expansion.

What distinguishes Infineon now is its willingness to resist the temptation of overpromising in a market that rewards buzzwords like “AI exposure.” The company knows it sits in the sweet spot of long-term electrification and computing themes, yet it seems to remain pragmatic enough to acknowledge near-term volatility.

While peers in the U.S. and Asia are valued at richer multiples on AI optimism, Infineon trades closer to its historical average, offering a measure of safety as investors recalibrate semiconductor expectations globally. The case here is of a disciplined operator pacing itself for the next wave of industry expansion.

Diageo (DGE UK): Short-term hangover, long-term resilience still intact

In what is now business as usual, Diageo once again trimmed its organic growth outlook.

The revision, sales now expected to be flat to slightly down, and operating profit growth limited to the low single digits, merely formalized what the market already suspected: consumer demand in key regions remains soft, and the near-term recovery in premium spirits will take longer to materialize.

Yet, Diageo’s underlying strengths (global scale, brand power, and pricing discipline) remain fairly intact, positioning the group to weather the sluggishness better than most of its peers, and perhaps particularly so under direction of new CEO Dave Lewis.

Regarding trading, the softness is primarily a geographic story. In the U.S., where spirits demand is stagnating, Diageo has seen its once-booming Tequila portfolio lose momentum as competition intensifies and consumers trade down. Price adjustments on Casamigos reflect this reset, even as Guinness continues to deliver standout performance with strong growth and brand resonance. In Asia-Pacific, China remains a drag, with volumes sharply lower and recovery prospects uncertain despite better inventory discipline. India is still expanding at a double-digit pace, but that alone cannot offset weakness elsewhere. Europe offers little relief outside of Guinness and Turkey, while Latin America (once a source of volatility) has emerged as a relative bright spot thanks to Johnnie Walker and the RTD portfolio.

The common thread across all regions is a consumer still cautious on discretionary spending, particularly in the premium and super-premium tiers where Diageo has the highest exposure.

While the short-term outlook is frustrating, the long game for Diageo remains credible. The company is methodically managing profitability through cost control and portfolio discipline, preserving margins in a challenging environment. The near-term earnings freeze is largely cyclical rather than structural: as consumption patterns normalize and inventory levels rebalance, the company’s pricing power and distribution reach should reassert themselves.

At the same time, Diageo’s defensive qualities, i.c. global diversification, strong cash flow, and a solid balance sheet, offer a buffer in a sector grappling with weak volumes and volatile geopolitics. The shares may remain range-bound until visibility improves, but the franchise is far from broken.

Let’s see what David Lewis can do.

Sunrise (SUNN Switzerland): Holding steady in a market that refuses to grow up

Sunrise’s third-quarter results landed roughly as expected by the market on profitability, but revealed yet another soft patch in top-line performance, now a familiar theme in the hyper-competitive Swiss telecom landscape.

Revenue slipped 1% year-on-year, a touch below market consensus, while margins held up thanks to cost discipline. The story here is grinding resilience: stable EBITDA growth and improving free cash flow offsetting a sluggish consumer backdrop.

Management reiterated full-year guidance but hinted at landing toward the lower end of the range, acknowledging that the drag from internet client losses and price competition remains stubbornly present. It’s not a surprise, but it does underline how saturated the Swiss telecom market has become, with growth increasingly reliant on defending share rather than expanding it.

Overall, Sunrise continues to do a few things right. The business segment is quietly emerging as a pillar of stability, growing 4% this quarter on the back of stronger fixed-line activity and new SME product bundles. Operational efficiency remains solid, with cost savings flowing through to EBITDA, keeping margin trends healthy despite muted revenue. Capex discipline is paying off as well, with investment intensity trending down to 15–16% of sales from last year’s 17%, supporting free cash flow growth in the mid-single digits. This incremental progress, while not headline-grabbing, is what allows Sunrise to keep improving its balance sheet and sustain attractive shareholder returns.

Still, the structural pressure on the consumer business cannot be ignored. Residential revenue continues to decline despite earlier price hikes, and subscriber churn on the broadband side remains frustratingly high. The launch of CHMobile, a new ultra-low-cost brand, illustrates both strategic adaptability and competitive strain, an acknowledgment that Sunrise must now defend share even at the low end.

It’s a necessary move in a market where Swisscom’s dominance and the rise of value-seeking consumers leave little room for complacency. Against this backdrop, Sunrise’s appeal lies not so much in its growth prospects but more in its cash flow reliability and valuation support.

It’s not an exciting story, but in Swiss telecoms, consistency and capital discipline can be good enough.

Salzgitter (SZG Germany): Leaner operations meet a stubbornly soft market

Despite a weakish share price reaction, Salzgitter’s third-quarter update offered a modest dose of optimism; not in the form of strong steel demand, but through (signs of) real progress on cost control and operational discipline.

EBITDA of €107 million came in a touch above market expectations, reflecting broad-based improvement across divisions and the absence of the hedging losses that plagued the previous quarter. The Steel Production and Trading units showed resilience, helped by firmer pricing and ongoing cost measures, while Technology again delivered steady performance. Even Industrial Participations managed to contribute positively, despite a weaker quarter from Aurubis.

Though below the encouraging quarter-on-quarter rebound lies the reality of an industry still battling soft demand, cheap imports, and a sluggish order intake. The company now expects 2025 sales just above €9 billion, trimming the top end of its prior range, and EBITDA between €300 million and €350 million, down from the previously guided €300–€400 million.

In effect, the decent third-quarter print only stabilizes a year defined by persistent headwinds: muted European construction activity, falling spot steel prices, and competition from imports keeping a lid on margins. Salzgitter’s near-term performance increasingly depends on its internal levers (chiefly cost savings and working-capital discipline) rather than any meaningful upturn in demand. Meanwhile, the heavy investment burden tied to the SALCOS decarbonization program continues to weigh on cash flow. The company has already disbursed nearly half a billion euros toward this flagship project, which will modernize its steel production and sharply reduce emissions, but investors must accept that tangible returns from this effort remain years away.

In many ways, Salzgitter is doing what it can in an environment beyond its control: tightening its belt, preserving balance-sheet strength, and waiting for the cycle to turn. But with little sign of near-term recovery and capital requirements still rising, the stock’s appeal remains limited at the moment.

Structural tailwinds, from the German green industry push to the EU’s tightening of trade defenses, are real, yet they play out over a longer horizon. For now, Salzgitter remains a cyclical recovery story that seems to be running in place. The company’s sharper cost focus deserves credit, but its outlook remains anchored by the same gravity affecting the broader European steel sector.

Tecnicas Reunidas (TRE Spain): Confidence returns as execution catches up with ambition

Tecnicas Reunidas has spent much of the past two years rebuilding investor trust, and the latest results confirm that the turnaround is (way) more than cosmetic.

The Spanish engineering and construction group delivered another strong quarter, with revenue up sharply and margins finally resembling their pre-2015 levels. Profitability reached 4.5% in the third quarter (not seen in over a decade!) driven by accelerating project execution and disciplined cost management.

The company also nudged guidance higher yet again, raising its 2025 revenue target to over €6.25 billion, more than €1 billion higher than what it projected just a month earlier. Such a rapid reset of expectations highlights both the scale of customer demand and Tecnicas’ restored credibility in delivering complex projects on time. The balance sheet, now boasting €427 million in net cash, underlines that the financial recovery is genuine rather than cyclical.

Tecnicas Reunidas has emerged from years of restructuring and pandemic-related turmoil as a leaner, more selective contractor. The company’s decision to reintroduce shareholder returns (something absent since its boom years) is symbolic of a management team confident that this cycle is not fleeting. Its pipeline of €86 billion in potential projects, dominated by energy transition and LNG work, suggests the next phase of growth will be driven by a mix of traditional hydrocarbon projects and low-carbon infrastructure. Notably, around one-third of new opportunities now come from North America, where Tecnicas has deepened its foothold through a partnership with Zachry, positioning itself to benefit from the region’s massive investment in LNG and petrochemicals.

The combination of execution discipline, geographic diversification, and a measured return to shareholder distributions makes Tecnicas Reunidas one of the few European EPC players to have genuinely re-rated. Yet, it remains attractively valued relative to peers, still trading below its historical multiple despite record quarterly earnings and a solid €11.5 billion backlog. The group’s focus on maintaining margins above 5% from 2026 onwards signals that management is prioritizing profitability over pure volume, a welcome change in a sector historically prone to chasing scale.

The road ahead still carries execution risk, but with the balance sheet repaired, visibility extended, and investor confidence restored, Tecnicas Reunidas has regained the credibility to be viewed as a structural rather than cyclical winner in global energy engineering.

AUTO1 Group (AG1 Germany): Scaling efficiency meets digital tailwinds

AUTO1 continues to prove that disciplined growth and scalability can coexist in the volatile used-car market.

The company’s third upward revision to its 2025 guidance underscores how far execution has come since its early, cash-burning days as Europe’s online car marketplace. Volumes are accelerating across both merchant and retail channels, and management expects the positive trend to extend well into 2026, with merchant unit growth in the low to mid-teens and retail volumes expanding close to 30%.

That combination, i.c. a balanced growth mix and a steady rise in gross profit per unit, is allowing AUTO1 to convert more of its operational momentum into sustainable profitability. The company now sees adjusted EBITDA growth of roughly 45% in 2026, a sign that its business model is maturing.

And this maturing is largely the payoff of years spent building scale and refining logistics. AUTO1’s merchant segment remains its profit backbone, but the faster-growing retail arm is what gives it strategic depth. Retail GPUs near €2,500 show how much value the company can extract once it owns the customer relationship directly, leveraging data and pricing analytics to expand margins. As digital penetration in Europe’s used-car ecosystem rises, AUTO1 stands well-positioned to capture market share from fragmented offline competitors still struggling with inventory turnover and capital efficiency. The balance between growth and discipline is also reflected in its cost structure; marketing expenses are set to rise modestly, but still leave ample room for operating leverage as the platform matures.

What makes AUTO1’s story compelling is how it embodies the broader digital transition in Europe’s car trade. The company has moved from being viewed as a cyclical proxy for car demand to an infrastructure player powering liquidity in the used-vehicle ecosystem. Its financing platform, data-driven pricing engine, and integrated logistics network create real competitive barriers that smaller peers can’t replicate.

While leverage and financing costs remain watch points, particularly as AUTO1 scales its inventory-backed lending, the company’s improving unit economics and consistent execution make those manageable.

Overall, growth feels repeatable.

TKH Group (TWEKA Netherlands): A messy quarter, but the bigger picture still holds

TKH’s third quarter was a reminder that even strong structural stories stumble in transition phases.

The Dutch technology group posted decent organic growth of 8%, yet operating margins once again failed to lift, coming in flat at 9.2%, the same level as the previous quarter despite easier comp base and better revenue traction. The disconnect between topline growth and profitability stemmed mainly from Smart Manufacturing, where order intake and execution lagged expectations, and from elevated costs within Smart Connectivity, which continues to digest its production reset and switch from long to short cables. While Vision’s 11% organic growth was an encouraging outlier, the mix wasn’t enough to offset margin drag elsewhere. The lack of sequential improvement will frustrate investors who had hoped Q3 would mark a clear inflection after the operational setbacks of early 2025.

Despite this, TKH’s long-term case looks intact, and arguably even more attractive as the short-term noise plays out. Management reaffirmed full-year guidance, implying a stronger second half versus both last year and the first half of 2025. The Connectivity division’s offshore and onshore demand is showing robust momentum, and the statement that Subsea production has ‘stabilized further’ suggests the worst is behind them, even if analysts will want more proof.

Meanwhile, Vision continues to outperform expectations thanks to its exposure to industrial automation, machine vision, and inspection technologies; end-markets still enjoying secular tailwinds despite macro headwinds in European manufacturing. Manufacturing remains the soft spot, but TKH’s pivot away from lower-return segments and toward automation-heavy activities should gradually improve mix quality and earnings consistency.

The real value unlock, however, lies ahead. TKH’s plan to divest several non-core assets over the next 12 to 18 months, with potential proceeds exceeding €650 million, is poised to reshape the portfolio and simplify its equity story. That cash could fund sizable share buybacks or reinvestment in higher-margin automation businesses, particularly in Vision and Connectivity, where TKH has both technology leadership and pricing power.

The short-term margin wobble doesn’t undermine the structural thesis: a focused, automation-driven industrial tech platform emerging from a period of internal reconfiguration. The near-term optics may be disappointing, but for investors with patience, the pathway toward a leaner, higher-multiple TKH remains intact.

INWIT (INW Italy): Slower growth, same cash flow story

INWIT’s latest quarter was a reminder that, often, where there’s smoke, there’s fire.

The Italian tower operator delivered results broadly in line with market expectations at the operating level, revenues of €271 million and EBITDA of €247 million, yet the story was more nuanced. Organic growth slowed to 4.1%, its weakest pace in several quarters, as Telecom Italia revenues flattened and the Smart Infrastructure segment cooled from its torrid start to the year. The company’s expansion in other-operator leasing remained solid, but site additions and Points of Presence both eased sequentially, suggesting that network densification in Italy is progressing more gradually than initially hoped.

Despite this, INWIT maintained full-year guidance, with recurring free cash flow of €170 million in Q3 showing that its core cash engine remains healthy even as top-line momentum moderates.

That said, management again trimmed its mid- and long-term revenue outlook (a rather familiar ritual by now) bringing 2026 and 2030 targets to the lower end of previous ranges. That adjustment reflects more conservative assumptions around inflation and, more importantly, weaker discretionary mobile investments from key tenants, as operators like TIM and Vodafone focus on cost control amid ongoing network sharing. While the tower business remains fundamentally resilient, it has shifted from an era of near-automatic growth to one requiring more operational finesse and incremental innovation, such as the gradual expansion into “Smart Infra” and digital connectivity solutions. These areas still offer long-term upside, but the ramp-up looks slower and more back-end loaded than previously envisioned.

For (long-term) investors, the case for INWIT remains anchored in consistency and cash conversion. Margins north of 90% and disciplined capital allocation continue to underpin one of Europe’s more reliable free cash flow stories. With the balance sheet steady at around 5x net debt to EBITDA (including leases) and shareholder returns in the form of buybacks and special dividends now embedded in guidance, INWIT’s appeal lies in predictable compounding.

The company’s ability to sustain high profitability in a maturing domestic market, while gradually layering in new revenue streams like edge connectivity and infrastructure sharing, keeps it positioned as a quality defensive asset in European telecom infrastructure, particularly at these levels.

United Internet Group (UTDI Germany): Steady core, volatile edges

The third quarter from United Internet’s ecosystem of businesses, spanning 1&1, IONOS, and the group itself, was about operational steadiness mixed with episodic turbulence.

At the consolidated level, United Internet posted modest revenue growth of 2%, held back by a collapse in IONOS’s AdTech activity but offset by solid EBITDA progression (+5%), underlining the resilience of its subscription-led model. Management reiterated full-year guidance, showing confidence in the group’s capacity to absorb short-term shocks while maintaining healthy profitability.

The recurring theme remains the balancing act between legacy broadband pressures, heavy 5G investment, and the still-evolving performance of IONOS’s digital assets. Founder-CEO Ralph Dommermuth continues to quietly reshape the group for the next phase, streamlining the portfolio, improving capital efficiency, and positioning the telecom arm for a potential structural move in a consolidating German market.

IONOS’s quarter was the most dramatic within the group, swinging from record momentum in Q2 to a sharp 10% revenue decline in Q3. The culprit was the AdTech division, whose revenues plunged 66% following algorithmic changes at Google; an abrupt reminder of the dependency such digital businesses carry. The decision to sell this volatile unit makes strategic sense, allowing IONOS to refocus on its more predictable cloud and hosting segments, which continue to grow steadily.

Despite the revenue hit, profitability held up well, with EBITDA up 12% thanks to operational discipline. The broader narrative here remains positive: IONOS continues to gain customers, expand its European presence, and build credibility in sovereign cloud solutions, even if near-term growth visibility has dimmed.

For 1&1, the picture is steadier, if uninspiring. Revenue edged up slightly, customer migrations off Telefónica’s network are finally complete, and mobile net additions returned to growth, early signs that the costly 5G build-out phase may start paying off from 2026 onward. The near-term drag from start-up costs still outweighs the savings from network independence, but management’s reiterated guidance and hints at future market consolidation underscore longer-term optionality. Should structural synergies with Telefónica or another peer materialize, the economics of 1&1’s network could change meaningfully.

For now, United Internet remains what it has long been: a collection of solid, cash-generative digital infrastructure assets temporarily weighed down by transition costs and digital volatility, but still one of the more strategically interesting mid-caps in European telecoms.

K+S (SDF Germany): Holding steady through the trough

K+S continues to quietly grind through a sluggish fertilizer cycle with discipline and resilience.

The German potash and salt producer posted a solid third quarter, delivering EBITDA of €111 million, essentially flat quarter-on-quarter but slightly above market expectations. That stability, unusual for a seasonally weaker period, reflected firm agricultural prices, with average selling prices rising marginally to €338 per tonne, and a disciplined focus on optimizing product mix rather than chasing volume. Sales grew modestly by 2% year-on-year despite a 5% decline in agricultural tonnage, underscoring the company’s ability to defend margins even in a subdued demand environment. After the wild swings of recent years, this kind of consistency may be precisely what investors were hoping for.

Operationally, the tone was equally reassuring. Free cash flow of €28 million in the quarter was slightly below last year but notably solid given the absence of a large working-capital release that had flattered prior results. Through nine months, K+S has now generated €42 million in operating free cash flow; modest, but achieved despite heavy capital spending linked to ongoing efficiency and sustainability projects.

Management reiterated its guidance for full-year free cash flow to remain “slightly positive,” suggesting a disciplined finish to the year despite the usual Q4 capex ramp-up. The balance sheet remains healthy, helped by firm cost control and restrained expansion, which is allowing K+S to self-finance strategic initiatives without leaning on external capital. The company also narrowed its full-year EBITDA guidance range to €570–630 million, keeping the midpoint unchanged at €600 million, comfortably within reach of market expectations.

That stability, along with a cautious approach to volume management and currency hedging, reflects a business that has regained operational balance after several volatile seasons. With potash pricing stabilizing, demand normalization underway, and the potential for a strong de-icing season providing optional upside, K+S looks positioned to exit 2025 on a steadier footing.

The case remains one of a cyclical recovery story slowly building momentum through operational execution and a renewed focus on free cash flow discipline.

Hensoldt (HAG Germany): Ambition delayed but direction intact

Hensoldt’s Capital Markets Day in Ulm reaffirmed the company’s long-term vision, though investors hoping for an acceleration in growth may find the near-term message underwhelming.

The 2030 targets were reiterated rather than upgraded; revenues of around €6 billion including acquisitions, a 20%-plus EBITDA margin, and roughly 50% cash conversion, all broadly in line with consensus. What disappointed was the slower path to get there: 2026 guidance implies only about 10% revenue growth, well below prior hopes of 15%, suggesting a more back-end-loaded expansion than initially expected. Management now foresees a gradual ramp-up, with double-digit growth resuming in 2027–28 before accelerating toward the decade’s end. This delay partly reflects execution realism amid extended defense procurement cycles and the pacing of major European defense programs, but it nonetheless tempers expectations in the short run.

That said, the underlying narrative remains compelling. Hensoldt is at the heart of Europe’s defense electronics renaissance: radar, sensors, and electronic warfare systems that underpin NATO’s modernization push. Roughly 70% of its business still comes from Germany, a position that gives it enviable visibility as Berlin continues to expand its defense budget and the European Union advances cross-border defense integration.

Management also devoted part of the CMD to “software-defined defense,” a still-small but promising segment that could scale from about 1% of group sales today to nearly 8% by 2030, driven by digitalization and autonomous system integration. These initiatives will require upfront investment, particularly in R&D, which is expected to remain at 5–6% of revenue, but they position Hensoldt at the frontier of European defense innovation, blurring the line between hardware and software.

The company’s updated framework sends a mixed message: growth remains credible, but the reward will come later. In a sector flush with optimism and revaluation, Hensoldt’s valuation already embeds much of that long-term promise, leaving little margin for disappointment.

The shares have corrected (a bit) recently but still trade at rich multiples relative to earnings and free cash flow, which limits upside until momentum visibly reaccelerates. Still, for investors with a longer horizon, the story might remain interesting; Hensoldt is building a defense technology powerhouse with deep domestic roots and an increasingly digital future, but its evolution will be more marathon than sprint.

Stabilus (STM Germany): Steady execution amid a rough patch

Stabilus has delivered a set of preliminary full-year numbers that, while unexciting, show its capacity to perform predictably through what has been one of the most difficult market backdrops in years.

Full-year sales came in at €1.3 billion, down 1% year-on-year, with an organic decline of 4.6% as weak industrial demand and automotive destocking weighed on volumes. Profitability was slightly lower, with adjusted EBIT down 9% to €143 million and margins easing to 11%. In this context, “in line with expectations” reads as a small win, confirming that the company is navigating cyclical pressure without losing control of its cost base or balance sheet. Free cash flow at €119 million was solid, even slightly above market estimates, and debt remains manageable despite leverage ticking up to just below 3x EBITDA.

The real focus now shifts to the company’s transformation program, which has been moving ahead since September and is designed to structurally reset Stabilus’ cost base for the next cycle. Management booked an €18 million restructuring provision this quarter, setting the stage for recurring annual savings of roughly €32 million by 2028.

This remains a story about about discipline and patience. Stabilus is consolidating sites, reducing personnel, and simplifying its structure, the kind of hard but necessary housekeeping that tends to pay dividends when demand eventually normalizes. The company’s ability to protect cash flow through this process, even as it invests in streamlining, reinforces its position as one of the more conservatively managed mid-cap industrials in Europe.

New guidance for FY 2025–26 will arrive in December, and investors will be watching closely for early signs of margin recovery. Consensus currently expects a modest top-line rebound and around a 100-basis-point improvement in EBIT margins, achievable if the cost savings begin to filter through and volume trends stabilize.

After a year defined by macro headwinds and automotive softness, Stabilus is entering the next fiscal period with expectations low and valuation compressed. At around 6-8x forward earnings, the market seems to be discounting a far bleaker scenario than the numbers suggest.

The broader story remains intact: a well-managed niche supplier, resetting its foundation for the next phase of profitable growth once industrial sentiment and mobility markets regain momentum.

If you appreciate this post, feel free to share and subscribe below!