Parcel lockers, tires and potential multi-baggers

InPost, Sidetrade, Continental, Volkswagen, Burberry, Komax, Puma, Aryzta, Ubisoft, Deutsche Börse, Virbac

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

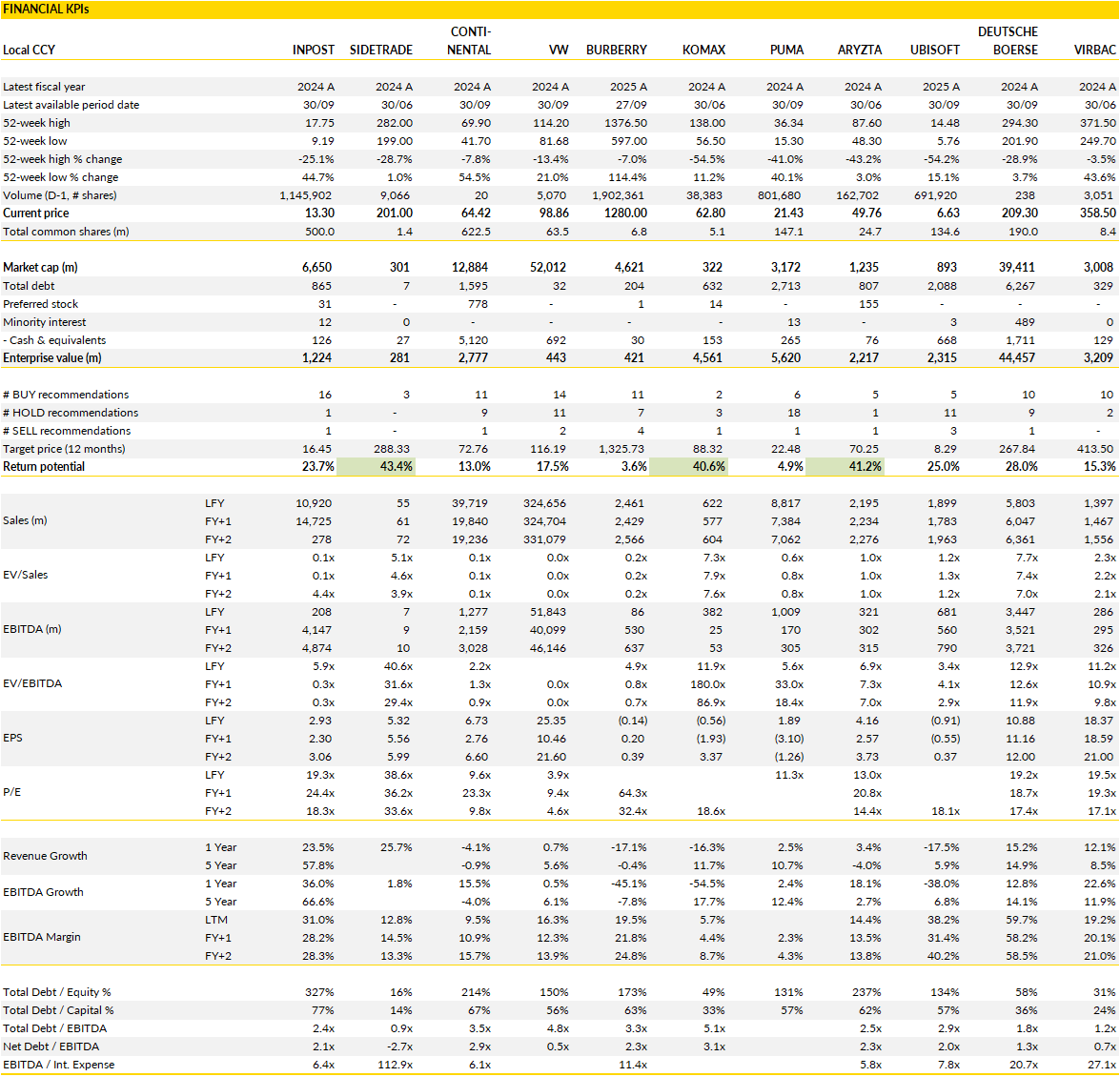

Financial KPIs

InPost (INPST Poland): scale, utilisation and optionality all moving the right way

InPost’s FY25 operational update reinforced the core thesis: this is still a business compounding at scale, with utilisation holding up remarkably well despite aggressive network expansion.

Q4 volumes reached roughly 418m parcels, up 30% year-on-year and marginally ahead of expectations, capping what was clearly a strong year operationally. Locker deployment remained high, with more than 4,400 APMs added in Q4 alone. While headline growth rates were higher than market expectations (~3%), the mix beneath the surface was arguably more interesting. Poland volumes were slightly softer than expected, largely due to a marginal slowdown in locker roll-out, but this was more than offset by stronger international volumes. Importantly, nothing in the data suggests a weakening of the underlying proposition.

Poland remains the cash engine, and the Q4 data underline how flexible the model has become. Locker volumes dipped modestly year-on-year, yet to-door deliveries surged by more than a third, driven by international marketplace flows. Locker utilisation in Poland remained north of 70% in Q4, down slightly year-on-year but still at a level most logistics operators would envy, especially given the scale of new capacity added over the past two years. On a full-year basis, utilisation sat comfortably above 60%, which continues to support strong incremental economics.

The Eurozone story, meanwhile, is increasingly central to the medium-term narrative. Volumes grew at a high-teens pace for the year, with Q4 accelerating into the low-20s, and the locker network expanded by more than 50% year-on-year. Management’s continued push away from cost-intensive PUDOs towards lockers remains a structural margin lever that should become more visible as density builds.

The UK is where the operational momentum looks most striking. Deployment hit record levels again in Q4, and volumes more than tripled year-on-year, benefiting from both peak season dynamics and the integration of the legacy UK network alongside Yodel. Utilisation has eased slightly from extreme levels, but that is a feature rather than a flaw, as it creates capacity headroom for further growth without immediate incremental capex.

Against this backdrop, no comments on the ongoing assessment of an indicative all-share offer. A consortium-led take-private would make strategic sense for a capital-intensive, long-duration infrastructure build-out, particularly in removing near-term noise around Allegro.

But even absent a transaction, the fundamentals are doing the heavy lifting. Scale is increasing, utilisation remains healthy, mix is improving, and the network is becoming harder to replicate by the quarter. If anything, FY25’s operational update strengthens the argument that 2026 could finally be the year when execution, rather than external overhangs, dominates the story.

Sidetrade (ALBFR France): waiting for the commercial engine to re-accelerate while the product stack matures

Sidetrade closed 2025 with a Q4 update that was broadly uneventful.

Full-year revenue reached about €61m, growing at a low-teens reported rate, with Q4 landing almost exactly where expectations sat. Organic growth in the quarter was effectively flat, which at first glance feels underwhelming for a software group that has historically positioned itself as a growth compounder. But this was largely telegraphed well in advance.

The drag continues to come from weaker new business generation earlier in the year, which then flows mechanically into slower Services activity. Against that backdrop, the more important datapoint is that SaaS subscriptions (now comfortably more than 85% of group revenue) still grew at a high-teens pace, with double-digit organic growth. That confirms that the installed base remains healthy, churn is under control, and pricing power has not disappeared. In other words, while the core is still running well, but the rate of new fuel injection that slowed temporarily.

What is also worth noting is the gradual stabilisation in commercial momentum through the second half. Bookings in Q4 were still down year-on-year, but the decline was less severe than in the first half, and the composition improved. Services bookings played a larger role, while subscription ARR additions remained modest.

This is not yet the clean inflection investors would like to see, but it does suggest that the trough in sales execution is likely behind us. Management has been clear that part of this period has been about absorbing acquisitions and reorganising go-to-market execution rather than pushing aggressively for short-term contract wins. The integration of ezyCollect fits squarely into that logic: it adds fast-growing, but initially dilutive, revenue streams and expands Sidetrade’s reach into adjacent customer segments. In the near term, that can mask organic acceleration, but it broadens the addressable base and strengthens the long-term platform.

The confidence from management in 2026 is centered on a handful of very specific levers rather than vague macro optimism. The first is the continued development and monetisation of Sidetrade’s agentic AI offering, with Aimie positioned less as a marketing gimmick and more as a functional productivity layer within the order-to-cash process. The second is the gradual ramp-up of the partner and channel strategy, which has taken longer than initially hoped but remains central to scaling beyond direct enterprise sales. The third is the contribution from ezyCollect, which is growing strongly in its own right and should progressively dilute less as it is integrated operationally.

Taken together, these drivers drive management’s expectation of a return to mid-single-digit organic growth and the preservation of a double-digit EBIT margin in the mid-teens. While not a heroic scenario, it is credible, and importantly it is internally driven instead of dependent on a sharp rebound in IT spending.

Sidetrade is coming out of 2025 with a more diversified product stack, a heavier SaaS mix, and clearer monetisation vectors around AI. If commercial momentum continues to normalise as suggested in H2, 2026 might see a rebound.

Continental (CON Germany): strong tires, ContiTech remains the drag

Continental came into its Q4 preliminary update with expectations already fairly well anchored, and in many ways the release confirmed the existing split narrative inside the group.

At the headline level, the roughly 9% miss versus expectations on Q4 EBIT looks uncomfortable, but the composition matters far more than the aggregate number. Tires once again did what it has been doing for most of 2025: delivering solid revenues, resilient margins, and a reassuring sense that pricing discipline and cost tailwinds are offsetting a still-muted volume environment. By contrast, ContiTech underwhelmed materially, with margins collapsing far more sharply than anticipated and forcing management to announce additional cost-saving measures late in the year.

Free cash flow was one of the few offsets at group level, coming in stronger than expected in Q4, likely helped by working capital effects as raw material prices declined into year-end. Importantly for peers and for the broader tire space, there is little here that changes the read-across: end-of-year demand conditions were broadly robust, pricing held, and Tires behaved largely as expected.

The real issue, and the reason the market reaction has been muted, sits squarely with ContiTech. The division’s Q4 margin performance was not just weak, it was dramatically below expectations, reinforcing the sense that operational execution challenges are more structural than cyclical. This perhaps matters less for near-term earnings (Tires now clearly dominates the investment case), but it is a great deal for valuation as Continental progresses with the disposal of ContiTech, a process that has formally started and is still expected to conclude by the end of the year. Repeated earnings disappointments inevitably raise questions about what kind of multiple financial buyers will be willing to pay, especially in an environment where industrial assets with volatile margins are viewed cautiously. The fact that management is still having to push additional cost actions late in the cycle does little to strengthen negotiating leverage. While it is still early days, and more clarity is unlikely before Q2, the risk is that investors start to haircut their expectations for disposal proceeds, even if Tires continues to perform well.

Continental continues to frame itself as a future pure-play tire company, with medium-term targets that call for group sales of roughly €19.5–22bn and an adjusted EBIT margin in the 12.5–14.5% range once the transformation is complete. Within Tires, the 2026 setup still looks relatively stable: modest volume growth is plausible, but the heavy lifting should again come from price/mix, supported by premium positioning and a favorable raw material backdrop.

Management has previously indicated that margin expansion remains achievable in this environment, even after accounting for FX headwinds and tariffs, with lower input costs doing much of the work. That narrative is broadly intact after these prelims. The problem is that much of this is already well understood and largely reflected in the share price after the strong rebound seen through 2025. Without concrete progress on the ContiTech disposal (either on timing or valuation) it is hard to see a near-term catalyst that would push the stock meaningfully higher.

Volkswagen AG (VOW3 Germany): a much-needed cash reprieve, but the operating road ahead remains uneven

Volkswagen surprised positively with a very strong Q4 free cash flow, and the magnitude genuinely matters.

The group closed FY 2025 with roughly €6bn of automotive FCF versus prior guidance of around breakeven, driven by a combination of better-than-expected working capital management and lower capex, with the auto investment ratio landing at about 12%, at the low end of the guided range. As a result, net industrial liquidity climbed to above €34bn, materially easing near-term balance sheet pressure.

This is particularly important given mounting investor concerns around Volkswagen’s ability to fund its transition, absorb restructuring cash-outs, and still deliver a credible dividend. While management offered little granularity on how much of the FCF upside might be timing-related or pulled forward from 2026, the confirmation that 2026 FCF is still expected to be around €5bn provides reassurance that this was not simply a one-off accounting swing.

That said, the cash beat does not fundamentally change the underlying operating picture, which remains mixed and fragile across regions and brands. Q4 volumes declined mid-single digit year-on-year, with China still the dominant drag and premium exposure continuing to hurt, most visibly at Porsche. BEV penetration edged higher, which is strategically necessary but still dilutive to margins, and pricing dynamics remain tense in a highly competitive environment.

On the positive side, restructuring measures are clearly feeding through, particularly on the cost side, helping to stabilise operating profitability despite softer volumes. Order intake showed some life late in the year, but the order book itself ended slightly lower, underscoring that demand visibility remains limited rather than convincingly improving. In short, Volkswagen is managing what it can internally in terms of costs, capex, etc., but remains exposed to external pressures it cannot easily control.

Regarding this year, management’s initial comments were broadly in line with what the market had already assumed: flat volumes overall, modest growth in parts of Europe and South America, offset by continued weakness in China and North America. Competitive intensity is not easing, BEV-related margin dilution is expected to persist (albeit at a slower pace than in 2025), and tariffs and restructuring cash-outflows remain meaningful constraints. There are, of course, incremental positives on the horizon: ICE initiatives to support mix, ongoing cost actions, selective asset disposals, and a gradual clean-up of governance with clearer separation between group and brand leadership.

But these are gradual fixes rather than step-changes. The Q4 cash flow surprise buys Volkswagen time and credibility, especially on dividends and balance sheet resilience. It does not, however, remove the structural challenges embedded in its geographic exposure, brand mix, and execution risk through the transition. For now, Volkswagen feels more financially secure, but not yet strategically de-risked, which might explain why the stock struggles to break out despite the headline-positive cash news.

Burberry (BRBY UK): the recovery still rests on a narrow base

Burberry delivered a Q3 trading update that, at first glance, reads more encouraging than what the market had become accustomed to, particularly on the Asian front.

Comparable retail sales grew 3% in the quarter, modestly ahead of expectations, with Asia the clear standout. Greater China accelerated from low-single-digit growth in Q2 to mid-single digits in Q3, while the rest of Asia moved from flat into positive territory, helped notably by South Korea where Chinese tourism drove double-digit growth. This is importnat because China had been the key source of skepticism around the Burberry story, and the data now point to a tentative re-engagement of local Chinese consumers rather than purely tourist-driven demand. That said, the picture elsewhere remains far less inspiring: EMEIA was flat, the Americas showed only marginal growth, and reported sales were held back by a slightly larger-than-expected FX headwind. In other words, momentum has improved, but it is still geographically concentrated and fragile.

Digging deeper, the quality of demand remains mixed and reinforces the idea that this is not yet a broad-based brand re-acceleration. Management highlighted persistently weak store traffic globally, offset by healthier spend per active customer. Existing clients are buying more and across a wider range of categories than Burberry’s traditional outerwear and scarf heritage, which does support the strategic narrative around brand repositioning and network productivity, particularly in China. However, this also underlines the absence of the more aspirational, entry-level customer who typically drives volume in a full luxury upcycle. Even within Asia, total Chinese customer spend grew only modestly in the quarter, with spending outside mainland China still negative despite the rebound in South Korea. This pattern mirrors what we are seeing across the luxury sector: growth increasingly depends on a relatively small, high-spending cohort rather than a broad recovery in footfall.

Overall, little has changed in the near-term outlook. The company reiterated its expectation to deliver FY 2025-26 EBIT broadly in line with the company-compiled consensus, around £150m, while again flagging that gross margins in the second half will be lower than in the first. That margin pressure reflects ongoing promotional activity and the cost of repositioning, even as top-line trends gradually improve.

Expectations still assume a gradual acceleration in comparable growth through Q4 and into FY 2026-27, with margins recovering only slowly from today’s subdued levels. While the improved Asian performance justifies some modest valuation relief, it does not yet convince that Burberry can sustainably match the longer-term growth trajectory of the luxury sector. The recovery remains too dependent on one region and too reliant on existing customers, leaving the franchise exposed if Chinese momentum wavers again.

Komax (KOMN Switzerland): fixing the cost base first

Komax Group has reached an important inflection point, not because demand has suddenly improved, but because the cost base has finally been reset to a level that makes the current trading environment workable.

Despite revenues falling to roughly CHF 580m and order intake declining modestly, the group now expects to report a slightly positive EBIT for 2025 even after absorbing around CHF 9m of restructuring charges. That is a meaningful step forward compared to prior guidance, which assumed breakeven only on an adjusted basis. Achieving this result against a backdrop of negative FX effects, residual tariff headwinds, and still-muted customer investment speaks to the effectiveness of the structural measures implemented over the past 18 months.

The heavy lifting has clearly been done on costs. Headcount reductions initiated in 2024 and accelerated through 2025 have removed roughly 450 positions in total, complemented by a meaningful reconfiguration of the production footprint. The shift of manufacturing from Europe toward China is particularly important, not just as a cost lever but also strategically. Producing and engineering machines closer to the Chinese market improves competitiveness locally, while still allowing Komax to export simplified, attractively priced equipment to other regions.

This is especially relevant given the current product mix, which has tilted toward services, spare parts, and simpler wire-processing machines for industrial, infrastructure, and transportation applications. These segments have proven far more resilient than automotive, cushioning the downturn and supporting margins. While demand for larger, more complex machines linked to automotive investment cycles remains weak, the current mix has bought Komax time and earnings stability.

The setup for 2026 is improving. Even without a material recovery in sales volumes, the lowered breakeven point creates meaningful operating leverage, which should become visible once end-markets stabilise even modestly. Automotive remains the key swing factor and continues to face structural and cyclical challenges, while competition from Chinese players is undeniably intensifying.

Still, at the current level, the market appears to be pricing Komax as if the business were structurally impaired rather than cyclically depressed. With the balance sheet intact, costs structurally lower, and earnings sensitivity now skewed more to the upside than the downside, the risk-reward has become asymmetric. The next real test will be the full-year results and outlook in March, where management should be in a position to demonstrate that Komax no longer needs a strong cycle to generate acceptable profitability.

Puma (PUM Germany): clearing the decks before any real reset can begin

Puma’s final quarter of the year is set to look brutal on the surface, with sales likely down sharply year-on-year and profitability collapsing deep into the red.

This is not primarily a demand story, but a deliberate clean-up exercise. Management has taken the decision to pull product back from wholesale partners, prioritising inventory discipline and brand reset over short-term revenue preservation. That move alone is expected to wipe a meaningful chunk off the top line in Q4, with the impact most visible in Europe and the US, where wholesale exposure is highest. Layered on top are adverse FX effects and sizeable inventory write-downs, which together drive a dramatic compression in gross margin.

At the full-year level, the picture remains ugly but conceptually consistent. Revenues for FY 2025 are set to be materially lower than last year, while EBIT swings deeply negative as restructuring costs, write-downs and margin pressure all hit at once. Importantly, this is not a surprise. Inventory clearing started as early as Q3, and Q4 simply concentrates the pain.

The reset also spills into 2026, where consensus expectations for a swift rebound now look too optimistic. Even assuming some gross margin normalisation, the earnings base Puma is carrying into next year remains fragile, with profitability only gradually improving from deeply depressed levels. The near-term story, therefore, is not about growth, market share wins or brand momentum, but about stabilisation: getting inventories right, resetting wholesale relationships, and rebuilding a cleaner cost and margin structure.

Where the case becomes more interesting is beyond the immediate trough. From the second half of 2026 onwards, comparisons start to ease meaningfully as the inventory purge rolls out of the numbers. At that point, Puma should finally be in a position to grow again without leaning on discounting or channel stuffing.

The transition phase, however, demands patience. Management is effectively trading near-term earnings visibility for a chance to rebuild the brand and wholesale economics on more sustainable footing. For investors, this means the stock is unlikely to respond strongly to Q4 figures themselves (those are already well understood) but rather to any credible signs that the reset is nearing completion.

Aryzta (ARYN Switzerland): operational delivery regains credibility

Aryzta enters 2026 in a markedly different position from where it stood just a few quarters ago.

The latest trading update confirms that the group has met or slightly exceeded all of its FY 2025 targets, an interesting feat. Management now expects low-to-mid single-digit organic growth for the year, EBITDA above €305m and free cash flow in the €115–120m range. Financing costs are also set to come in materially lower than previously anticipated, at €42–44m including lease interest, a meaningful improvement versus earlier expectations closer to €57m.

Taken together, these figures signal that the operational clean-up of recent years is translating into tangible financial outcomes. After a long period where execution missteps and leadership upheaval had eroded (read, destroyed) confidence, the business is once again doing what it said it would do, and that alone changes the tone around the investment case.

The forward-looking commentary is equally important. Despite a still cautious consumer backdrop, Aryzta expects further organic growth and additional improvements in business performance in FY 2026. Recent customer negotiations have been successfully completed, removing a key source of uncertainty, while newly built production lines in Germany, Malaysia and Switzerland are gradually ramping up. At the same time, group-wide efficiency initiatives continue to focus on organisational simplification, cost discipline and further optimisation of the fixed-cost base.

This combination of modest top-line growth on a structurally leaner platform is exactly what the company needs at this stage of the cycle. It is also notable that management is actively looking to diversify its funding base to exploit attractive interest rate arbitrage in Swiss credit markets, suggesting a more proactive and financially sophisticated approach to balance sheet management than in the past.

Capital allocation is starting to re-enter the discussion as well. The announcement of a €40m investment in a new bun bakery near Lisbon, expected to be commissioned in 2028, is a good illustration of how the group is thinking about growth. Paired with the existing bun facility in Spain, the new plant is designed to optimise supply chains and service levels across Iberia rather than simply add volume for volume’s sake. It is a targeted investment, aligned with customer demand and operational efficiency, and it fits with the broader narrative of disciplined expansion.

At current share price levels, the market still appears skeptical that Aryzta can sustain this trajectory. Yet if the company continues to deliver steady organic growth, improving margins and robust cash generation, as its own targets imply, there is a clear path for valuation to normalise over time.

The scars from past execution errors have not fully healed, but with guidance achieved, costs under control and a more coherent strategic direction emerging, Aryzta is gradually rebuilding credibility.

Ubisoft (UBI France): a hard reset that pushes the recovery far into the future

In one word: ouch!

Last night’s profit warning was not incremental; it was foundational. Management has slashed FY 2026 expectations to €1.5bn of revenue versus the previous €1.85bn, with underlying operating profit now expected at a deeply negative €1bn and free cash flow of minus €400–500m. This deterioration is not just cyclical softness or one slipped title, but the cumulative consequence of years of overinvestment, underperforming pipelines, and overly optimistic assumptions about monetisation and live-service durability. The numbers embed €650m of accelerated depreciation tied to the discontinuation of six games and the extension of development timelines for seven others, which underlines how much capital has been sunk into projects that will never see daylight or will see it on a far less ambitious commercial footing.

Just as importantly, management has scrapped all previously communicated FY 2027 guidance, including the promise of a return to positive operating profit and cash generation, with an update only promised in May. That says a lot about visibility.

Alongside the financial reset comes a structural one. Ubisoft is reorganising around five “creative houses” grouped by genre and franchise logic, supported by a central creative network that provides shared production capacity and expertise. The intent is clear: decentralise accountability, shorten decision loops, and stop the diffusion of responsibility that has plagued Ubisoft’s sprawling studio network. The major franchises will sit in Vantage Studios, in which Tencent already owns 26%, while other houses will focus on shooters, curated live experiences, immersive narrative worlds, and casual/family titles. Each unit will have its own management team responsible for results, but notably Ubisoft does not plan to disclose financial performance by creative house, which limits external transparency at a time when investor trust is already fragile.

In parallel, the cost base is being attacked aggressively. A €100m cost-cutting programme originally earmarked for FY 2027 is being pulled forward into FY 2026, and a further €200m plan has been announced for FY 2028. Combined with earlier measures, this implies a reduction of €500m in fixed costs by FY 2028 versus FY 2023, bringing the cost base down to roughly €1.25bn. On paper, this is decisive; in practice, it carries material execution risk, especially given the creative and talent intensity of Ubisoft’s business.

The balance sheet adds to complexity. Non-IFRS net debt is expected to stand at €150–250m at the end of March, despite a sizeable cash balance of €1.25–1.35bn, and refinancing discussions are already underway. While the 2028 convertible bonds are not an immediate concern, the €675m bonds due in November 2027 loom large, making asset disposals a near certainty rather than an option. The most obvious lever is a further sale of equity in Vantage Studios to Tencent, ideally without ceding control, but this would also underline how dependent Ubisoft has become on monetising its crown jewels to fund restructuring.

Overall, this reset feels necessary but long-dated. Management is implicitly admitting that it will take at least three years for the new organisation to consistently deliver successful launches and restore sustainable cash generation.

Even at a share price down more than 90% over five years, the path back to normalised profitability is long, uncertain, and heavily front-loaded with risk. Caution thus remains warranted: the reset may stabilise Ubisoft, but it does not yet make the equity attractive.

Deutsche Börse (DB1 Germany): a strategically logical but regulator-dependent step deeper into fund services

Deutsche Börse has now formalised the long-anticipated acquisition of Allfunds, moving from proposal to agreement and, in doing so, putting a clearer framework around what this deal is really about.

The economics themselves are no longer the story. The consideration remains unchanged at €8.80 per Allfunds share, but the structure has been tilted more heavily toward cash, with €6.0 now paid in cash and the equity component reduced accordingly. Deutsche Börse is clearly prioritising deal certainty and shareholder acceptance over balance-sheet optimisation. With close to half of Allfunds’ share capital already locked up via irrevocable undertakings, the transaction now looks far more executable than it did at the proposal stage, at least from a shareholder-approval perspective. The implied enterprise value of roughly €5.3bn firmly anchors Allfunds as a core strategic asset instead of a bolt-on acquisition.

Strategically, the rationale remains straightforward and consistent. Deutsche Börse has spent years building out Clearstream as a critical piece of the post-trade plumbing in European funds, and Allfunds fits neatly into that ecosystem by adding scale, distribution reach, and data-rich client relationships upstream. Management has outlined targeted pre-tax cost synergies of around €60m annually, alongside roughly €30m of recurring capex savings, with around half of these benefits expected to be realised by the end of 2028. These are not heroic numbers; they largely reflect infrastructure rationalisation, technology overlap, and procurement leverage.

Importantly, Deutsche Börse has been careful not to oversell revenue synergies at this stage, implicitly acknowledging that cross-selling and platform monetisation will take longer and depend on execution rather than integration mechanics. The company has also stated that, on an annual run-rate basis, the deal should deliver high single-digit accretion to cash earnings per share within the first full year post-completion, signalling confidence that integration costs will not swamp near-term financial performance.

The uncertainty now shifts from valuation to regulation. By combining Clearstream Fund Services with Allfunds, the market structure in fund platforms becomes far more concentrated, effectively leaving two dominant operators in Europe. That alone makes competition authority scrutiny inevitable, and remedies should be expected.

While Deutsche Börse appears confident that the transaction can close in the first half of 2027, the timeline is clearly subject to regulatory negotiation rather than operational readiness. From a longer-term perspective, however, the deal reinforces Deutsche Börse’s strategic direction: doubling down on structurally growing, fee-based, capital-light data and services businesses that reduce reliance on cyclical trading revenues.

Virbac (VIRP France): medium-term story intact

Virbac closed 2025 with another quarter that shows again why the group continues to be viewed as one of the more dependable compounders in animal health.

On the surface, reported Q4 sales growth of just under 2% looks modest, but organic growth of 7.1% in the quarter and 7.9% for the full year sits comfortably within, and in fact toward the upper end of, management’s long-standing growth ambitions. Foreign exchange was a meaningful drag, shaving more than €40m off reported sales for the year. Pricing contributed roughly 2.5–3% in Q4 and about 3% for the full year, signaling a healthy but clearly normalising pricing environment after the stronger inflation-driven tailwinds of 2024. Importantly, volumes and mix continue to do the heavy lifting, which speaks to the underlying robustness of demand rather than financial engineering.

From an operational standpoint, the split between companion animals and livestock remains supportive. PetCare once again led the way, growing close to 11% at constant currency, while livestock delivered a solid mid-single-digit expansion despite a tougher comparative and more uneven regional demand patterns. Geographically, growth was broad-based, with the notable exception of East Asia, where timing effects weighed on Japan. In the US, distributor destocking appears to be largely behind the group, removing a lingering overhang that had complicated visibility earlier in the year.

On profitability, management confirmed that the 2025 adjusted operating margin target of around 16% at constant currency has been achieved, even before factoring in the FX headwind. That alone highlights the degree of operating discipline embedded in the model, particularly given the continued investment behind launches and geographic roll-outs.

The tone of the 2026 guidance is confident. Virbac is guiding for constant-currency sales growth of 5.5–7.5%, including roughly one percentage point from the Thyronorm acquisition, and an underlying operating margin of around 17%. This implies about 100bp of operating leverage at constant currency, even after absorbing roughly €4m of trade tariff costs. Management was clear that growth will be driven by a combination of modest pricing (around 2%) and a steady cadence of launches and extensions alongside continued geographic expansion.

What also stood out was the firm stance on M&A: acquisitions remain selective, but the intent to keep building the portfolio in a programmatic way is unchanged.

Overall, Virbac continues to execute in a structurally attractive market, increasing medium-term visibility and gradually building operating leverage.

If you appreciate this post, feel free to share and subscribe below!