Parcel lockers, pills and steel

Alcon, thyssenkrupp, InPost, Trigano, Pluxee, Redcare Pharmacy, Hoffmann Green, Argan, Saint-Gobain, Aperam, Séché Environnement, NEXT

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

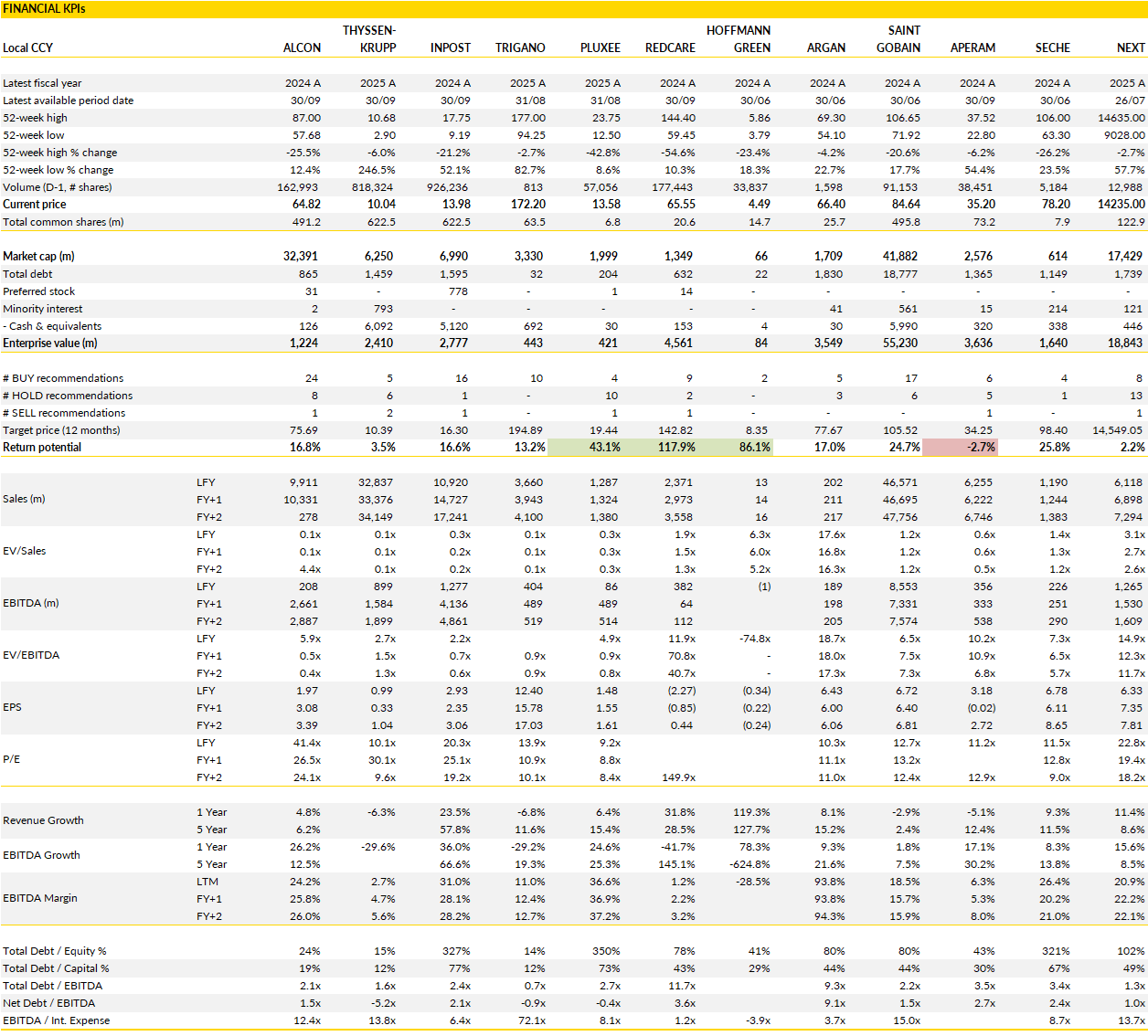

Financial KPIs

Alcon AG (ALC Switzerland): walking away from a contested deal leaves the strategic picture largely unchanged

The termination of the merger agreement with STAAR Surgical closes a chapter that was always more optional than essential for Alcon.

Following the special shareholders’ meeting, STAAR confirmed that it did not secure sufficient support to approve the transaction, triggering an automatic end to the agreement without any termination fees for either side. From Alcon’s perspective, this outcome removes a source of near-term uncertainty rather than creating a new problem. The group had already improved its offer in December, signaling a willingness to stretch to secure a strategically attractive asset, but shareholder resistance ultimately drew a line under the process. The absence of break-up costs means the failed transaction has no direct financial penalty, and management can refocus attention on executing its standalone growth strategy without distraction.

Strategically, it is easy to see why Alcon was interested in STAAR in the first place. STAAR is the global leader in phakic intraocular lenses, with its EVO family well positioned in a fast-growing segment of refractive vision correction that sits adjacent to Alcon’s existing intraocular lens portfolio. The amended offer, valuing STAAR’s equity at around $1.6 billion, would have added a differentiated technology platform and expanded Alcon’s exposure to younger, premium patients seeking alternatives to laser vision correction. At the same time, the economics of the deal had become increasingly demanding.

The higher bid implied a full valuation for an asset that, while attractive, would not have been transformational in scale. More importantly, the acquisition would have pushed Alcon’s net leverage meaningfully higher, reducing balance-sheet flexibility at a time when management continues to emphasise optionality for future investment and shareholder returns. In that context, the failure of the vote can be read as shareholders of both companies reaching different conclusions on value rather than a reflection of any strategic misstep by Alcon.

Looking forward, the absence of STAAR does not materially weaken Alcon’s competitive positioning. The group remains well placed in the intraocular lens market, supported by its broad portfolio, strong surgeon relationships, and ongoing product innovation across cataract and refractive solutions. Alcon has consistently framed M&A as a selective tool rather than a necessity, and the company’s balance sheet remains in a position of relative strength following the termination of the deal.

That financial flexibility matters. It preserves the ability to pursue smaller bolt-on opportunities, invest organically in pipeline development, or return capital to shareholders without taking on incremental risk.

thyssenkrupp (TKA Germany): a stepwise steel exit edges closer, but execution still matters

Renewed press speculation around the future of Steel Europe has put thyssenkrupp’s long-running restructuring story back into focus, even if little has changed in substance.

Recent reporting suggests that discussions with Jindal Steel may be converging on a phased transaction structure, potentially involving an initial transfer of control followed by one or more subsequent tranches. The contours of this scenario are familiar: Jindal has reiterated its industrial vision for the asset, including commitments around decarbonisation, the completion of the DRI project in Duisburg, and the preservation of steelmaking capacity in Germany.

For thyssenkrupp, the core objective remains the same as it has been for some time: removing a structurally dilutive business from the group perimeter while finding a long-term industrial owner willing to shoulder the capital intensity of European steel.

From thyssenkrupp’s perspective, a majority sale as a first step would already represent meaningful progress. Deconsolidating Steel Europe would materially change the group’s financial profile, simplify the equity story, and allow management to focus on the remaining industrial businesses with clearer earnings trajectories. Whether the remaining stake is sold in one or two further steps is arguably secondary, provided there is a credible path to full exit.

That said, the mechanics do matter. A staged transaction could be linked to milestones around restructuring, labour agreements, or investment commitments, particularly given the political and social sensitivities surrounding steel in Germany. Jindal’s stated willingness to invest in decarbonisation and complete ongoing projects helps address some of those concerns, but translating intent into binding agreements is the harder part. At this stage, the existence of a non-binding offer confirms seriousness, but it does not yet remove execution risk.

The broader context remains challenging. European steel markets are still operating against a backdrop of weak demand, high energy costs, and intense global competition, all of which complicate negotiations and valuation expectations. That reality partly explains why a clean, one-step sale has proven elusive and why alternative structures are being explored.

For investors, the key question is timing. A successful transaction, even if phased, would be a substantial catalyst by finally resolving the group’s most persistent strategic overhang. Conversely, prolonged negotiations without clear progress risk reinforcing scepticism around whether Steel Europe can be exited on acceptable terms.

Management’s preference is clear, and the logic of a separation remains compelling, but there is still work to be done before the outcome is locked in.

InPost (INPST Netherlands): a take-private approach reframes a bruised but intact growth story

InPost’s disclosure that it has received an indicative proposal for the acquisition of all outstanding shares has abruptly shifted the narrative around a stock that spent much of the past year under pressure. The company set up a special committee, signaling that the approach is being treated as credible, even though no financial terms have been disclosed. Press reports point to a consortium led by Advent, InPost’s former owner and still a shareholder, potentially alongside other large existing investors.

The market reaction was immediate and violent, amplified by elevated short interest that had built up during a difficult 2025 marked by tensions with Allegro and the operational drag from integrating Yodel in the UK. Yet the speed and scale of the share price move say as much about how negative sentiment had become as they do about the proposal itself. For months, the equity story had been dominated by fears around customer concentration and competitive threats, despite the underlying business continuing to execute broadly in line with its long-term plan.

Stepping back, the industrial logic of a take-private is easy to understand. InPost is in the middle of a capital-intensive phase, expanding and densifying its locker network while working through the complexities of turning the UK into a second growth engine. Doing that under the glare of public market scrutiny has been uncomfortable, particularly when near-term noise from the mud fights with ‘frenemy’ Allegro obscures the longer-term payoff.

A consortium-led structure anchored by existing shareholders (Advent, the CEO and PPF) would allow management to keep investing through the cycle, smooth out volatility linked to individual customers, and focus on network optimisation rather than short-term optics.

Such a structure would also materially de-risk execution, given the size of the stakes already held by cornerstone investors and the founder. The trade-off, of course, is that this is also the scenario most likely to result in a more measured premium, precisely because control could be achieved without a competitive auction.

Crucially, none of this changes the underlying industrial reality of the business. The concerns that weighed so heavily on the shares over the past year look increasingly overstated when examined closely. InPost continues to operate the only truly integrated, large-scale out-of-home locker network in its core markets, with density, locker size, and operational control that competitors struggle to replicate. Rival networks linked to Allegro are fragmented across several operators, smaller on average, and less optimised for peak volumes.

The indicative approach highlights underlying value. Whether or not a transaction ultimately materialises, the episode has served to reset the conversation around InPost from one of exaggerated downside risk to one focused again on network quality, execution, and long-term compounding.

Trigano (TRI France): production momentum rebuilds as the post-destocking phase fades

Trigano’s first-quarter update offers a reassuring snapshot, steadily emerging from the turbulence of last year’s destocking cycle.

Sales of just over €830 million came in broadly where the market expected, but the more important signal lies beneath the headline number. On a like-for-like basis, activity grew by just over 5%, driven primarily by leisure vehicles, where production is gradually being ramped up to meet distributor demand rather than pushed aggressively into the channel.

This distinction matters. The group spent much of 2025 absorbing the consequences of inventory correction across its distribution network, and management has been careful not to repeat past mistakes by forcing volumes before visibility improved. Deliveries to independent dealer networks rose at a double-digit pace, while sales through integrated distribution dipped slightly, largely reflecting limited availability of end-of-series vehicles rather than any underlying demand weakness. Motorhomes, which still account for the bulk of group revenue, delivered mid-single-digit growth at constant scope and currencies, a solid outcome given the cautious production stance that remains in place.

What shows confidence going into the rest of the year is the tone around order intake and capacity utilisation. Management has deliberately avoided setting explicit financial targets for the new financial year, but it has been clear that the order book is healthy and reflects strong reception of the 2026 product ranges. Just as importantly, the destocking seen in prior periods is not repeating itself, which removes a major headwind that weighed heavily on volumes and margins last year.

Against that backdrop, Trigano plans to continue ramping production through the second and third quarters, effectively normalising output levels after a period of under-absorption. That ramp-up is expected to translate into a meaningful improvement in operating leverage as fixed costs are spread over higher volumes.

The group’s recent margin performance was artificially depressed by targeted promotional activity and lower productivity linked to reduced production levels, rather than structural cost inflation or pricing pressure. As volumes recover, those effects should unwind naturally, supporting a return toward more normalised profitability.

Stepping back, the broader narrative for Trigano looks more constructive than it has for some time. Demand for leisure vehicles remains structurally supported by long-term trends around flexible travel and outdoor leisure, even if the sector remains cyclical in the short term. Network inventories are now described as healthy, suggesting that incremental production can translate into genuine sell-through rather than balance-sheet build-up at the dealer level. That gives management greater confidence to increase output without compromising pricing discipline.

While visibility is never perfect in a discretionary consumer segment, the current order book provides a degree of comfort around activity levels for the year ahead. In that sense, the first quarter is about about confirmation: confirmation that the trough is behind the group, that production is moving back toward demand rather than inventory management, and that margins should follow as operating conditions normalise.

After a year defined by correction and caution, Trigano is entering 2026 in rebuilding mode, with improving volume dynamics and a clearer path back to more sustainable earnings generation.

Pluxee (PLX France): solid operating momentum meets an unavoidable regulatory reset

Pluxee’s first-quarter update for FY 2025–26 delivered a familiar but important message: the underlying business is executing well, even as external regulation clouds near-term visibility.

Reported revenue for the September–November period landed broadly where the market expected, but organic growth came in slightly stronger than anticipated, underpinned by healthy activity in core Employee Benefits. Business volumes continued to expand, and take-up rates improved modestly, confirming that the company’s commercial engine remains intact despite a softer macro backdrop in parts of Europe.

The more notable upside came from float revenue, which benefited from higher interest rates in Brazil and showed a sequential improvement versus the previous quarter. Regionally, growth was driven by Rest of World and Latin America, while Europe lagged amid weaker economic conditions and a more constrained public benefits environment. None of this suggests acceleration, but it does reinforce that Pluxee entered the new financial year with operational momentum rather than fragility.

The bigger question, as expected, sits around Brazil. Management reaffirmed its full-year guidance, explicitly incorporating the impact of recently announced regulatory changes to the meal voucher framework. These include caps on merchant fees, shorter redemption timelines, and the introduction of interoperability, with implementation phased through calendar 2026.

For FY 2025–26, Pluxee continues to guide for broadly stable revenues on a like-for-like basis, a slight expansion in recurring EBITDA margins, and average recurring cash conversion of around 80% over the multi-year period spanning FY 2023–24 to FY 2025–26.

Beyond that, the company has been transparent in acknowledging that regulatory headwinds will continue to weigh into the first half of FY 2026–27, before conditions normalise in the second half as the system absorbs the new rules. This framing is important. It suggests that the impact is meaningful but finite, and that management is prioritising predictability and cash discipline over short-term growth optics. The group has not ruled out engaging with the regulatory process, but for now is focused on adapting its operating model to the new reality rather than assuming a reversal.

The investment case for Pluxee remains a balance between structural strengths and regulatory uncertainty. On the positive side, the business benefits from resilient demand for employee benefits, strong positions in faster-growing regions, and a cash-generative model that provides flexibility for investment or selective M&A over time. The early performance in FY 2025–26 supports the view that operational execution is improving, particularly in Employee Benefits, which remains the core value driver.

At the same time, Brazil represents a genuine near-term overhang. The market is still recalibrating to what the new regulatory framework means for economics, and that recalibration is likely to keep sentiment cautious until the earnings impact is fully digested.

In that context, the quarter reads as a steady start. Pluxee is doing what it can control (growing volumes, managing margins, and protecting cash flow) while accepting that part of its story over the next few quarters will be shaped by regulation rather than strategy. The key medium-term question is not whether growth resumes, but how quickly visibility improves once the Brazilian reset is absorbed.

Redcare Pharmacy (RDC Germany): Rx momentum offsets a softer non-Rx finish, shifting the focus to margins

Not a good start for Redcare. Q4 revenues grew at a healthy pace year-on-year, but the headline number came in modestly below market expectations, largely due to weaker-than-anticipated performance in non-prescription products.

The deceleration was most visible in the DACH region, where non-Rx growth slowed to mid-single digits, reflecting a more mature market, tougher consumer spending dynamics, and tougher comps after several years of elevated demand. International markets continued to grow at a faster clip, but not enough to fully offset the softness at home. On the surface, this creates the impression of a business losing momentum. In reality, it highlights an increasingly familiar dynamic for Redcare: non-Rx is normalising toward a more sustainable growth profile just as prescription volumes are becoming the dominant strategic driver.

That shift is clearly visible in the prescription segment, which was the standout feature of the release. Prescription sales in Germany grew sharply year-on-year in the quarter, comfortably exceeding internal expectations and allowing Redcare to meet its full-year guidance of at least €500 million in Rx revenue.

This matters far more than the modest top-line miss elsewhere. The company has been explicit for some time that electronic prescriptions represent the structural growth engine of the platform, and the fourth quarter confirms that Redcare is capturing that opportunity at scale. The acceleration in Rx reflects both increasing consumer adoption of e-prescriptions and Redcare’s operational readiness, particularly around fulfilment and integration.

Importantly, this growth is not confined to a single channel: the Mediservice operation also delivered solid momentum, reinforcing the breadth of the Rx proposition. As Rx continues to scale, it changes the revenue mix, customer lifetime value, and ultimately the economics of the platform, even if it brings short-term pressure on margins during the ramp-up phase.

Tthe conversation is likely to move away from pure revenue growth and toward margin development and quality of earnings. With non-Rx growth in DACH cooling, expectations for that segment in 2026 may need to become more modest, but that is not necessarily a negative if it coincides with improved profitability and more disciplined marketing spend. Management commentary around the normalisation of non-Rx demand will therefore be critical, as will guidance on how quickly Rx can move from a growth drag on margins to a contributor.

Redcare’s strategy has always implied a transition period in which scale is prioritised over near-term profitability, particularly in prescriptions, and the fourth-quarter figures are consistent with that path. The key question for investors is whether the company can balance a maturing consumer business with a rapidly expanding, structurally attractive Rx franchise.

Hoffmann Green (ALHGR France): industrial scale finally arrives as volumes triple and ambitions rise

Hoffmann Green’s 2025 volume disclosure marks a genuine inflection point in the group’s development, shifting the story from promise to proof of industrial execution. Selling 50,700 tonnes of low-carbon cement over the year (more than three times the prior year’s level) is not just a statistical milestone, but a validation that the production platform is now operating at meaningful scale.

In a French construction market that remains challenging, the group supplied more than 330 construction sites across the country, translating into roughly 145,000 cubic metres of concrete delivered. This performance reflects the successful ramp-up of the H1 and H2 plants in the Vendée region, which are now able to absorb materially higher volumes without friction.

Just as importantly, it shows that demand is broadening beyond early adopters, with low-carbon cement increasingly embedded across a range of applications including building construction, structural works, civil engineering, property development, and renewable energy projects.

For a company that spent years investing ahead of demand, 2025 stands out as the first year where industrial capacity, commercial traction, and market readiness meaningfully converged.

The drivers behind this acceleration are both operational and strategic. On the industrial side, the plants are no longer the bottleneck, allowing management to focus on filling capacity rather than proving it can run. Commercially, the diversification strategy launched at the end of 2024 is clearly bearing fruit, reducing reliance on any single segment and smoothing order flow. Equally important has been the steady accumulation of strategic partnerships over the year, which has helped anchor volumes and improve visibility. These agreements do not necessarily come with headline-grabbing individual tonnages, but collectively they build a more resilient order book and reduce execution risk as volumes scale.

The result is that Hoffmann Green exits 2025 having crossed an important psychological threshold: low-carbon cement is no longer a niche experiment for the group, but a repeatable industrial product with growing acceptance across the value chain.

For this tyear, management is deliberately leaning into that momentum. The stated objective to double production volumes again to 100,000 tonnes is ambitious, but it is grounded in a clearer set of enablers than in previous years. The customer base has expanded, partner networks are deeper, and certifications obtained in France and internationally are opening access to a broader pipeline of projects.

At the same time, the international dimension of the model continues to take shape. Licensing remains a central pillar of the strategy, allowing Hoffmann Green to export its technology without replicating capital intensity abroad. New licence discussions in Europe are ongoing, while the partnership with Shurfah in Saudi Arabia is moving from concept to execution, with the first plant already under construction. This dual approach, proprietary growth in France combined with capital-light international licensing, highlights the group’s longer-term ambitions, including its 2030 targets of around one million tonnes of production capacity and €150 million in revenue.

After years of groundwork, Hoffmann Green is entering a phase where execution, not credibility, is the main variable.

Argan (ARG France): rental growth does the heavy lifting as asset values hold firm

Argan’s 2025 update once again shows the resilience of its logistics-focused real estate model in an environment that has been anything but supportive for French property valuations.

Rental income reached €212 million for the year, up 7% and essentially spot on with what management had guided, driven by two familiar and highly visible levers: the full-year contribution from assets delivered in 2024 and the contractual rent indexation applied at the start of 2025. Operationally, the numbers remain exceptionally clean. Portfolio occupancy stayed above 99%, extending a track record that now spans a full decade, and the average age of the warehouse portfolio remains relatively young at just over 12 years. This combination of long leases, modern assets, and near-full occupancy continues to insulate Argan from the volatility seen elsewhere in the property market, particularly in more cyclical or discretionary segments.

Beyond the recurring rental base, value creation through development remains a quiet but important contributor to the story. In 2025, Argan delivered around €55 million of new investments, representing roughly 70,000 square metres, which already contribute around €4 million of additional annual rent. On management’s assumptions, this corresponds to a yield north of 7%, comfortably above portfolio averages. Even allowing for slightly more conservative post-delivery capitalisation rates than the existing portfolio, these projects are expected to generate meaningful value uplift.

This development-driven growth is a key differentiator for Argan. Rather than relying on market-driven yield compression, the group continues to manufacture value through controlled, pre-let developments tailored to tenant needs.

At the earnings level, recurring net income is expected to grow at a double-digit pace in 2025, fully in line with management’s guidance, while the dividend policy remains unchanged, with a payout ratio that balances shareholder returns and balance-sheet discipline. The option for part of the dividend to be paid in shares continues to act as a modest but effective lever to manage dilution and funding needs.

Perhaps the most reassuring element of the update, however, sits on the balance sheet. At the end of 2025, the portfolio was valued at just over €4.0 billion, reflecting modest growth versus mid-year and stability on a like-for-like basis despite a tougher investment backdrop in France. Capitalisation rates excluding rights were unchanged over the second half, an outcome that contrasts favourably with broader market trends and highlights the defensive nature of Argan’s asset base.

This valuation stability sustains the group’s deleveraging trajectory, even as attention turns to the refinancing of a €500 million bond maturing in late 2026. Management has been transparent that refinancing will come at a higher coupon than the legacy debt, but the impact on earnings appears manageable given the strength of rental cash flows and the pipeline of secured investments already in place for 2026.

Argan is not a high-beta property story, but it remains a highly predictable compounder: steady rental growth, disciplined development, stable asset values, and a balance sheet that absorbs higher funding costs without compromising strategy.

Saint-Gobain (SGO France): defending margins through a muted finish

Saint-Gobain is heading into the final stretch of the year with little in the way of excitement, but plenty of evidence that the strategic reset of recent years continues to do its job.

The year-end trading backdrop remains uneven, most notably in North America, where destocking intensified into the fourth quarter as distributors and contractors stayed cautious amid a softer housing environment. Volumes have remained slightly negative, continuing the trend seen earlier in the year, while pricing has eased sequentially as the group prioritised margin protection over chasing volumes. Working-day effects provided a modest technical tailwind, but the overall picture for the quarter is one of stability rather than acceleration. That tone is reflected in expectations for a broadly flat operating margin versus last year, a respectable outcome given the macro headwinds and a clear indication that management is sticking to its discipline on price and cost rather than sacrificing profitability for short-term growth optics.

Regionally, the picture is nuanced but coherent. Europe appears to be stabilising after a prolonged period of weakness, with early signs of recovery beginning to emerge in certain markets, albeit gradually and unevenly. The Americas remain the key swing factor. Activity levels are still decent overall, but new business in North America has continued to soften, particularly in residential-related categories, reinforcing management’s cautious stance for the first half of the coming year. Asia-Pacific stands out as the relative bright spot, supported by structurally stronger demand in India and South-East Asia, alongside a more constructive environment in Australia.

What ties these regional dynamics together is Saint-Gobain’s consistent emphasis on defending margins through pricing discipline and operational efficiency. The group has shown repeatedly over the past two years that it is willing to accept modest volume pressure if that is the price of protecting profitability, a mindset that marks a clear break from earlier cycles.

Looking into 2026, management is expected to reiterate its familiar but increasingly credible ambition of sustaining a double-digit operating margin, with particular attention on maintaining a favorable price–cost spread. This is where the longer-term transformation of the group becomes more relevant than any single quarter’s trading. Saint-Gobain today is structurally different from the business investors remember from earlier downturns. The portfolio has been reshaped through targeted acquisitions and disposals, tilting the group toward higher value-added, more differentiated solutions with better pricing power and lower cyclicality.

At the same time, sustainability and energy efficiency have moved from peripheral considerations to central demand drivers, underpinning volumes even in a softer construction environment. The result is a business that is more resilient, more selective, and arguably more predictable than in past cycles.

While investor attention remains fixed on the trajectory of the US housing market, the company’s ability to hold margins steady through a period of destocking and muted demand speaks to the quality of the underlying model.

Aperam (APAM Netherlands): trading remains heavy as policy relief arrives later than hoped

Aperam’s latest trading update confirms that the operating backdrop remains difficult as the group closes out the year, with fourth-quarter profitability set to come in below the prior quarter as previously flagged.

Management has reiterated that seasonality in Europe, continued price pressure, and elevated imports are still shaping near-term performance, partially offset by more resilient conditions in Brazil. There is no sense yet that demand in the core European stainless market has meaningfully turned, and order books remain thin, particularly in construction-linked applications. The group has been clear that this is not a new deterioration but rather a continuation of trends already visible at the end of the third quarter.

One reassuring element is balance-sheet discipline. Despite softer earnings, net debt is expected to decline sequentially, reflecting working-capital management and cash discipline that help cushion the impact of a weak pricing environment. This ability to protect financial flexibility remains a defining feature of Aperam’s profile at this point in the cycle.

Operationally, there are few immediate catalysts for a sharp rebound. The alloys business has now returned to full production following unplanned maintenance earlier in the year, but demand from oil and gas, which represents a meaningful share of that segment, remains subdued. In Europe, stainless continues to lag carbon steel, weighed down by weak construction activity and persistent import pressure, particularly from Asia. While the introduction of the carbon border adjustment mechanism has attracted attention, management has downplayed its near-term impact, noting that it does little to change competitive dynamics at this stage.

More meaningful trade defence measures, including tighter import quotas and higher out-of-quota duties, are now expected to take effect only from July. Until then, import pressure is likely to remain elevated, limiting the scope for sustained price recovery. Recent increases in European stainless prices provide some encouragement, but these moves largely reverse prior declines rather than signalling a clear inflection in demand.

As a result, expectations for a sharp sequential improvement at the start of the year appear optimistic, with any rebound more likely to be driven by technical factors such as the absence of inventory valuation effects rather than a genuine acceleration in underlying volumes.

Looking beyond the immediate quarter, the investment case rests increasingly on Aperam’s structural positioning rather than short-term trading momentum. Over the past two years, the group has deliberately rebalanced its geographic exposure, reducing reliance on Europe in favour of Brazil and, to a lesser extent, the US, where macro conditions remain comparatively supportive. This diversification is complemented by a broader strategic shift away from pure stainless steel, with growing exposure to alloys, recycling, and forestry activities that add resilience and reduce earnings volatility.

Cost focus remains another differentiator. Aperam continues to run with a leaner cost base than many peers, allowing it to generate cash even in challenging markets. Policy support could become more visible later in the year, particularly if large-scale infrastructure and defence spending in Germany translates into tangible orders from the second half of 2026 onward.

Until then, the coming year still looks transitional, marked by subdued demand, delayed regulatory relief, and gradual rather than dramatic improvement.

Séché Environnement (SCHP France): international bolt-ons reinforce a high-margin, capital-disciplined growth path

Séché Environnement has started the year by accelerating its international expansion, adding two assets that neatly reinforce both the geographic reach and the profitability profile of the group.

The acquisition of Hidronor in Chile is the more substantial of the two and represents a meaningful strategic step. Hidronor is a leading player in hazardous and non-hazardous waste treatment, serving more than 2,500 industrial customers across sectors such as mining, energy, and chemicals. Its three treatment sites offer combined capacity of roughly 350–400 thousand tonnes, and the business is characterised by a high level of recurrence, with around 90% of revenue recurring. In 2024, Hidronor generated €42 million of revenue, growing at around 10%, with a favourable pricing environment and profitability well above Séché’s group average.

Alongside this, Séché is strengthening its Italian footprint through the acquisition of La Filippa, a non-hazardous industrial waste storage site with around 100 thousand tonnes of capacity. While smaller in scale, La Filippa stands out for its exceptional margin profile, highlighted by a customer base that delivers roughly 70% recurring revenue.

Together, these transactions underline Séché’s preference for assets that combine regulatory protection, pricing power, and cash visibility rather than chasing volume for its own sake.

Financially, the appeal of these deals lies as much in their quality as in their immediate contribution. Combined, the Chilean and Italian acquisitions add around €55 million of revenue and approximately €22 million of EBITDA, a disproportionate contribution relative to their size given the high margins involved. The implied valuation, at just over ten times EBITDA for the package, looks consistent with Séché’s historical discipline on capital deployment, particularly given the strong recurrence and regulatory barriers embedded in these activities. Importantly, the group intends to finance the transactions from existing cash resources, preserving balance-sheet flexibility and avoiding dilution. Management has also highlighted the potential for commercial and industrial synergies over time, although these have not yet been quantified.

In parallel, Séché continues to prepare the acquisition of Groupe Flamme in France, one of the last independent operators in hazardous waste incineration. That transaction would further consolidate Séché’s domestic position, lifting its market share to around a quarter and reinforcing its role as a key national player alongside larger incumbents such as Veolia. The sequencing of these moves points to a coherent strategy: consolidate leadership at home while selectively building scale in international markets where regulation and industrial demand support long-term returns.

These acquisitions strengthen the visibility of Séché’s growth trajectory into 2026 and beyond. The group has already guided to solid EBITDA progression on a standalone basis, and the incremental contribution from recent deals adds further momentum, even before accounting for synergies.

More broadly, the pattern of transactions highlights what has become a defining feature of the Séché story: a willingness to expand internationally, but only where it can replicate its core strengths in hazardous waste treatment, long-term customer relationships, and high barriers to entry. With Chile offering exposure to structurally resilient industrial demand and Italy adding a high-margin, capital-efficient asset, the risk profile of the expansion remains controlled.

Management has indicated that a capital markets presentation will follow to outline an updated roadmap, suggesting that these deals are not isolated but part of a broader plan to scale the platform.

NEXT (NXT UK): strong trading confirms resilience, but expectations are already demanding

NEXT remains one of the most consistently executed models in UK retail, even in a choppy consumer environment.

Over the nine weeks to late December, the full-price business (which still accounts for roughly four-fifths of group sales) grew by just over 10%, comfortably maintaining the momentum seen earlier in the year. The split beneath that headline is telling. UK performance was solid, with modest growth in physical stores and stronger progress online, while international online sales again stood out, rising sharply and underscoring how important this channel has become to the group’s growth mix.

The update also highlighted improved performance through third-party platforms, notably following operational changes that allowed better stock sharing across European channels.

Taken together, the message is about consistency: growth has not slowed as the year progressed, and execution through the critical trading period has been clean.

Management paired the trading commentary with modest updates to its near-term outlook, lifting guidance for the year ending January 2026 and laying out expectations for the following financial year. For the current year, NEXT now expects full-price sales growth comfortably into double-digit territory and a corresponding uplift in pre-tax profit, broadly in line with where the market was already positioned.

Looking further ahead, the initial outlook for FY 2026-27 assumes a more normalised pace of growth, with mid-single-digit expansion in full-price sales and a further, measured increase in profits. There is nothing aggressive in this framing, but that is precisely the point. NEXT has long preferred to under-promise and deliver, and the tone of the update suggests management remains confident in the underlying demand profile without assuming a re-acceleration in consumer spending. Importantly, the group continues to demonstrate its ability to flex costs and inventory effectively, allowing it to protect profitability even as growth rates moderate.

The broader takeaway is that NEXT’s investment case is working well. The model is resilient, capital-light, and increasingly international, with online and platform-based sales providing structural support that many traditional retailers still lack. The collaboration with partners such as Zalando illustrates how incremental operational improvements can unlock meaningful growth without significant capital deployment, reinforcing the scalability of the platform.

At the same time, this quality is well understood. The market has grown accustomed to NEXT delivering steady growth, strong cash generation, and reliable shareholder returns, which means there is little element of surprise left in the story. As a result, the shares increasingly trade on durability rather than upside optionality.

The latest update does nothing to challenge that perception: it confirms that NEXT is executing well and remains a benchmark for the sector, but it also underlines why the equity is often viewed as a steady compounder rather than a catalyst-driven opportunity.

In short, the business continues to do exactly what it says it will do, and the market appears to be pricing it accordingly.

If you appreciate this post, feel free to share and subscribe below!