Music, transporting money and CEOs leaving

UMG, Puig, X-FAB, 2CRSi, dsm-firmenich, Imerys, Aixtron, Pluxee, Argenx, Prosegur Cash, Scout24, Saint-Gobain, Stellantis, TF1, WPP

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

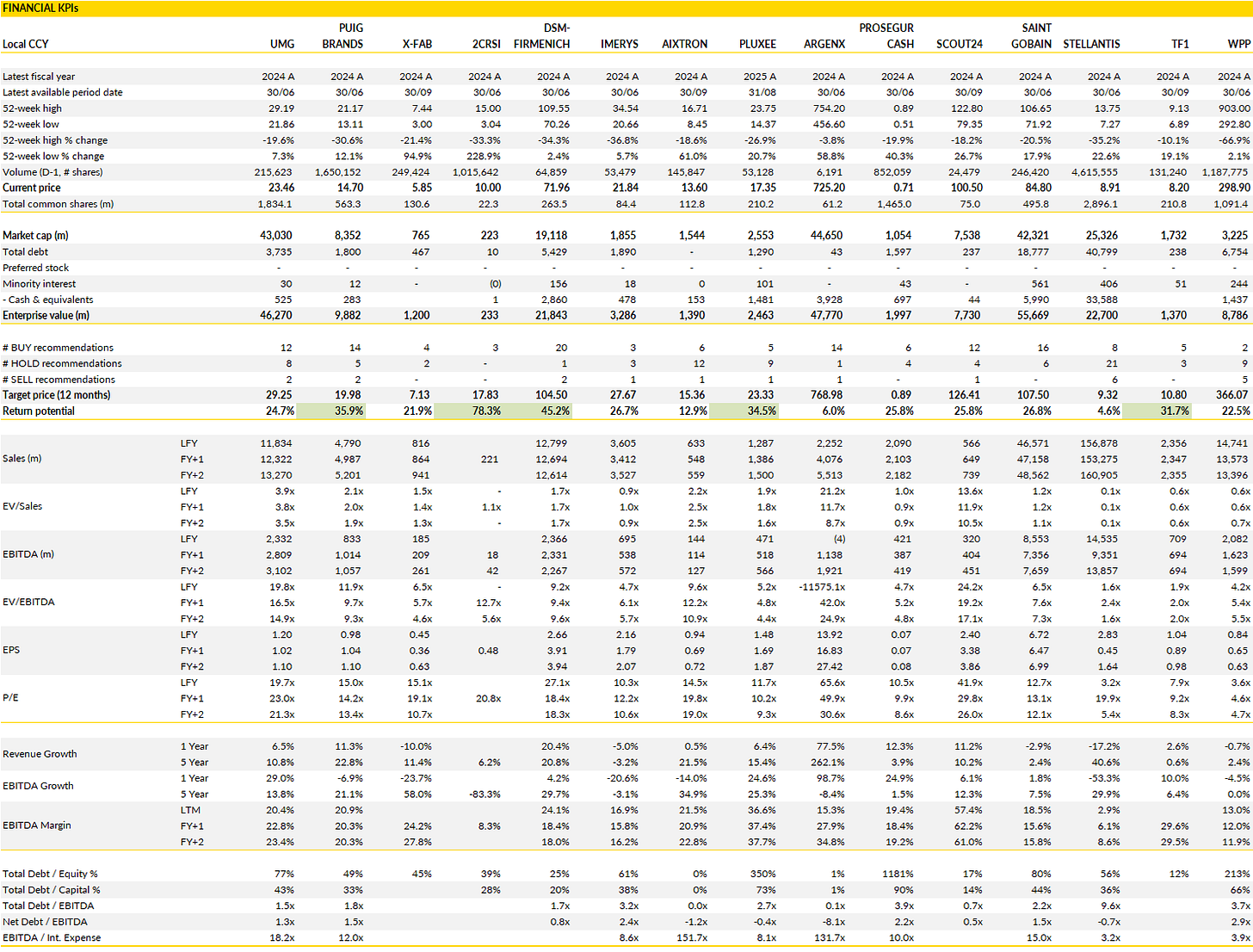

Financial KPIs

Universal Music Group (UMG Netherlands): streaming momentum builds as superfans reshape the playbook

Universal Music Group rolled into the back half of 2025 with a clean, reassuring quarter that reinforces the view that the business is settling back into its structural rhythm after a choppy macro period for digital media.

The standout again was paid streaming, where growth was high single digits as subscriber additions and modest price uplift offset the normalisation in ad-supported platforms. It feels like the market had grown comfortable with the idea that streaming growth had structurally slowed, but if anything, the last few quarters hint we are in a kind of mid-cycle digestion phase.

Importantly, physical formats delivered another surprisingly strong showing, powered by vinyl and the cultural gravity of tent-pole releases like Taylor Swift’s album. That dynamic matters not because vinyl will ever drive the model, but because it signals the enduring pricing power of cultural IP and the willingness of passionate fans to pay more for tangible engagement.

More intriguing in the UMG story now is the superfan monetisation pivot. Management has been clear that around a fifth of subscribers represent an outsized share of lifetime value, and the push into premium tiers and exclusive content is effectively an ARPU expansion strategy wrapped in a fan-engagement narrative. The early blueprint coming out of Asia, especially the Tencent partnership in China, gives confidence this isn’t a theoretical exercise. Add to that a deepening relationship with platforms like YouTube around rights, monetisation, and AI-protection frameworks, and you can sense UMG stepping more assertively in the value chain.

The company is positioning itself not only as a rights holder but as a gatekeeper to premium artist access and authenticity at a moment when synthetic content threatens to blur lines. That strategy should resonate with creators and platforms alike, even if the monetisation roadmap remains (deliberately?) opaque until product is fully in market.

There will always be noise in a model tied to hit cycles and artist release timing, but the core logic of this business remains surprisingly simple: scale, catalog depth, and a balance sheet flexible enough to keep investing in repertoire and artist services.

Management reiterated capital allocation priorities toward investment rather than short-term optimisation, which aligns with the long-duration nature of the asset base. As the industry transitions into a phase where platform economics depend increasingly on differentiated content, UMG’s moat arguably widens rather than narrows.

With topline growth normalising back toward the high-single-digit range and margin discipline intact, the setup into 2026 feels constructive.

Puig (PUIG Spain): a mood shift in beauty as momentum steps back into the narrative

Puig’s latest quarter was a pleasant surprise that has been rare across global beauty this year: growth comfortably ahead of (cautious) market expectations and, even more notably, a management team sounding genuinely upbeat after months of defensive commentary.

It wasn’t long ago that consensus had mentally resigned itself to the bottom of the company’s 6–8% organic growth range, with softness in prestige fragrance and uneven demand in the US weighing on sentiment. Instead, Puig has come out suggesting higher growth looks achievable, helped by firmer-than-feared trends into the holiday period and healthier momentum in both fragrance and, critically, makeup. When management that typically errs on the side of caution begins sounding optimistic, markets tend to notice, and this feels like one of those turns.

The quarter itself tells a story of breadth rather than a single-product or geography-driven spike. Organic growth pushed above 6%, roughly double what many had whispered going in, with makeup surging at a pace that reflects both brand heat and smart channel decisions, including the Amazon listing for Charlotte Tilbury in the US. Fragrance, the engine room, held up better than industry chatter suggested, even in a backdrop of promotional noise, and management reiterated it is not chasing short-term volume in Latin America at the expense of brand equity. That stance is more luxury-house discipline than mass-beauty reflex and speaks to the long-term stewardship of franchises like Carolina Herrera and niche labels such as Byredo and Penhaligon’s, which continue to resonate, particularly in Asia. The APAC region remained a standout, with growth well into the double-digits as distribution resets and brand positioning efforts begin to bear fruit.

Taken together, it all feels like an early signal that the category’s pressures may be easing.

What makes Puig especially interesting at this moment is not just the print, but the setup. After a long stretch of derating, the stock trades at a marked discount to global beauty peers despite fundamentals that have held up and a model still capable of mid-single-digit to high-single-digit organic growth.

The company is signalling confidence into year-end, pointing to retailer appetite in fragrance ahead of holiday sell-through, sustained makeup vibrancy, and the progressive roll-out of hero launches, including the new Carolina Herrera line. Management also dialed up commentary on APAC marketing activations and brand momentum, which could help bridge investor nerves around China-exposed discretionary names.

Execution risk never disappears in beauty (launches can mis-fire, enthusiasm can fade) but Puig seems to be showing the right mix of discipline and opportunism at a moment when sentiment had swung far too pessimistic.

With franchise strength intact, pricing power evident, and brand heat returning, this feels like a business approaching an inflection.

X-FAB (XFAB France): holding pattern amid soft orders and a leadership reset

X-FAB’s latest set of results is one of those prints that looks fine in isolation and still leaves you uneasy about the road ahead.

The revenue beat shows the business can deliver when demand materialises, specialty analog and power processes remain differentiated, and the automotive and industrial mix still has structural backing. But that strength is tempered by what didn’t show up in the numbers: conviction from customers. Order intake slid meaningfully as auto clients, facing sticky macro uncertainty and trade friction, continue to work inventories down rather than lean into fresh capacity. In a market where visibility is already fragile, that kind of order softness has a louder signal than a top-line beat.

There’s also a leadership transition unfolding just as the cycle wobbles. Long-time CEO Rudi de Winter stepping back is natural after more than a decade at the helm, and continuity remains in place via board presence and a successor already embedded operationally. Still, investors tend to discount during handovers, especially in capital-intensive manufacturing where strategic consistency and supply chain relationships matter. Add in the drag from customer prepayments sitting like latent leverage, and it becomes clear why sentiment stays cautious despite respectable margins and a reiteration of near-term guidance. Cash discipline and operational execution will have to do the heavy lifting while the demand pipeline resets.

Stepping back, the appeal of X-FAB’s positioning hasn’t changed; the company plays in nodes where electrification, sensing, and mixed-signal content keep inching higher per vehicle and per device. The debate is purely timing: how long do customers stay defensive, and when do utilisation levels and orders turn from digestion to build?

For now, it still feels like a pause, but pauses in semis can be uncomfortable stretches, especially when paired with management change. As the industry enters 2026, the tell will be backlog rebuild in auto and early signs of investment thaw in industrial and power markets. Until then, this name remains one to track for cyclical re-entry.

2CRSi (2CRSI France): ugly print, but eyes fixed on a scale-up inflection

If you glance only at the reported figures, 2CRSi’s year looks messy: EBITDA dropping to €5.6m on €221m of revenue, margin compressed to barely 2.5%, and a gross margin trough in the second half below 5% after a major delivery-timing mis-step forced the company to compensate a marquee client.

Normally this type of print forces a reset in investor confidence, particularly when market expectations had been for something closer to a mid-single-digit EBITDA margin and at least €15m of EBITDA. But headlines can obscure trajectory, and here the forward-looking story is key. Management remains confident about beating its €300m+ revenue target for FY25-26 and delivering €36m of EBITDA, a leap that implies meaningful operating leverage once the exceptional concession fades and mix shifts back toward higher-margin AI server deployments.

For a business that just stumbled on execution, such conviction would normally ring hollow, except the commercial pipeline now carries contractual heft that’s hard to ignore. Recent wins, including a $54m UK project, a $47m order in Malaysia, and the mammoth $290m US framework that looks likely to extend, give tangible shape to a hyper-growth runway.

Net debt has also softened to about €5m in October, removing a near-term balance sheet overhang, and the demand signal from AI infrastructure continues to broaden beyond hyperscalers into sovereign and enterprise workloads, where bespoke architectures play to 2CRSi’s strengths.

Put differently, this is a company that has tripped on execution at precisely the moment its structural opportunity is expanding, and the market now has to weigh whether a transient margin wound eclipses an emerging scale-up phase. With management guiding to top-line growth above 60% in FY25-26 and a path toward structurally higher mix, the debate shifts to ‘can they grow cleanly and profitably?’

The risk is clear: credibility in margin delivery needs to be rebuilt, and the gap between current and target profitability remains wide. But if execution stabilises and operational gearing kicks in as volumes land, the earnings curve could steepen sharply.

At current levels, the stock prices in a fair bit of scepticism, and the asymmetry starts to look interesting for investors willing to absorb volatility. The near-term newsflow should stay positive given contract conversion and the broader AI capex cycle still in expansion mode.

DSM-Firmenich (DSFIR Netherlands): steady quarter, but ANH exit still the real unlock

Every quarter with dsm-firmenich lately feels like watching someone dismantle an old machine while already fine-tuning the new one.

The company’s latest print delivered an in-line outcome: low-single-digit organic growth in a choppy demand environment, roughly stable EBITDA against tough comps, and a reminder that vitamins (long a tailwind) are now slipping into headwind mode. Self-help levers and integration synergies do their job across taste and health, while macro and FX nibble away.

The interesting part is more in what the company signals: a business increasingly defined by the quality and momentum of its consumer-adjacent platforms, rather than by the legacy volatility of animal nutrition. That transition story is playing out in real time.

Beneath the surface, the operating cadence shows pockets of genuine strength. Perfumery and beauty continued to put up steady volume growth, taste and texture benefited from product synergies, and health nutrition held firm despite FX drag, signalling real demand resilience in the core wellness and fragrance ecosystems. Meanwhile, animal nutrition (ANH) didn’t wobble this time, but pricing pressure in vitamins has resumed, and future quarters will feel it more visibly.

It is exactly why the market seems to be waiting less for a quarterly beat and more for a structural exit of the animal business. The company adjusted full-year EBITDA to around €2.3bn (modestly trimmed to reflect weaker vitamin pricing and currency) and reiterated its commitment to closing the ANH process within the quarter.

Execution here matters more than fine-tuning guidance; sentiment simply won’t reset until that portfolio simplification arrives.

This leaves the stock in a curious but understandable holding pattern. Fundamentally, the new dsm-firmenich, powered by fragrance science, nutrition, and flavour systems, looks increasingly like a premium platform business with technology moats and pricing power. But optically, the drag from ANH keeps it screened as a chemical hybrid, weighed down by volatility rather than rewarded for defensiveness and innovation.

When the disposal lands, that gap between perception and intrinsic profile likely closes. Until then, patience remains necessary, with quarter-to-quarter data points serving more as confirmation that the underlying structure is intact than as accelerants to sentiment.

Imerys (NK France): quiet stabilisation, cost discipline and litigation clarity ahead

Imerys’ latest results didn’t deliver fireworks, but with a market that had braced for another shoe to drop, stability was the surprise.

EBITDA landed close to market expectations, margins compressed again but at a slower pace, and prices held up just enough to offset another soft patch in volumes. It’s incremental progress, but after a bruising reset earlier in the year, investors will take incremental.

The company has moved from defence to controlled repair mode: protecting price, trimming costs, and preparing industrial adjustments rather than swinging for dramatic disposals. That pragmatism suggests management sees a path to ride out the sluggish cycle rather than capitulate on portfolio breadth, and with the market bottoming cautiously across construction-linked materials, that tone matters as much as the numbers themselves.

Of course, structural levers are doing just as much work as cyclical ones. The accelerated cost-cutting program reflects a sober read of demand recovery timing, and it sets a clearer bridge to margin normalisation whenever volumes stabilise. Meanwhile, the lithium project continues to inch forward in the background, with diligence from a prospective strategic partner supporting the notion that Emili retains industrial and financial legitimacy even in today’s choppy EV raw-materials landscape. On the other major overhang, the asbestos restructuring remains on track for confirmation early next year, and the company’s confidence that litigation resolution is ultimately unavoidable adds a welcome degree of line-of-sight where uncertainty used to sit.

None of these storylines individually re-rate the stock, but collectively they rebuild the scaffolding for a more investable equity case.

With guidance reaffirmed and anti-dumping measures temporarily supporting a slice of the ceramics portfolio into year-end, Imerys enters the final stretch of 2025 with the narrative gently turning from damage control to repair. Execution over the next few quarters, particularly around industrial optimisation and the litigation calendar, will dictate pace, but sentiment has likely passed its capitulation point.

For investors who believe in the long-run cash-generation potential of engineered minerals and specialty materials, this looks like the early innings of a slow but credible recovery path. Not glamorous, not linear, but positioning that often precedes outsized returns when expectations have already been stripped down to the studs.

Aixtron SE (AIXA Germany): holding the line while the power cycle resets

After pre-releasing the numbers earlier in October, Aixtron simply confirmed what the market already digested: softer demand versus last year, clean operational execution, and a steady hand on full-year expectations.

Revenues slipped materially year-on-year as the power semi digestion phase continues, but gross margins held just shy of 39% and free cash flow flipped strongly positive, reflecting disciplined working capital and the episodic nature of capex patterns in this industry. The small swing factors, roughly €8m of system shifts into Q4 and a couple of million of FX drag, highlight how timing still matters quarter to quarter, but the underlying profitability profile remains intact. Management reiterated its 2025 range: sales around the mid-€500m mark, gross margins just above 40%, and EBIT margins around the high-teens. In a sense, predictability itself feels like progress.

Peeling back the tape, the cycle dynamics are still the main story. The SiC cooling period remains in place, U.S. and European power players continue to work through low utilization and delayed investment cycles, while Chinese capacity digestion hasn’t fully run its course. That’s kept automotive-linked demand subdued and investors cautious.

Yet underneath the noise, the seeds of the next wave are becoming more visible. Datacom lasers showed a clear step-up again, confirming the Q2 acceleration tied to AI datacenter architectures, and GaN traction continues to build as hyperscale power systems shift design assumptions. Early signals in niches like MicroLED and solar don’t move the model today, but they reinforce why Aixtron sits at the centre of multiple secular materials transitions. If the company executes into year-end and maintains near-40% gross margins into a volume trough, it strengthens the argument that this is a strategic supplier bridging several next-gen device ecosystems, not just a SiC bet cycling sideways.

The equity debate now naturally shifts to timing. With the shares trading around roughly ten times forward EBITDA versus the mid-teens average that characterized the last cycle, the setup is one where sentiment has already priced in hesitation and delay.

The next catalysts won’t come from another quarter of steady housekeeping; they will come from order recovery in 2026 as GaN gains volume adoption in AI-driven power architectures, with Nvidia’s higher-voltage platform buildout often cited as an early proof point. That doesn’t mean a straight line; Q4 likely still reflects muted power bookings and normalization pains across China and Western customers alike. But the slope into next year matters more than the quarterly noise, and with cash flow turning and capital intensity rationalizing, the risk-reward feels increasingly tied to patience rather than conviction on near-term beats.

Investors waiting for a cleaner demand upturn may get a clearer signal by mid-2026, and historically, Aixtron has tended to re-rate before the volumes physically land.

Pluxee (PLX France): grinding forward with efficiency while growth pauses for breath

Pluxee’s latest numbers offered a familiar mix of operational discipline and macro friction, and a reminder that platform leverage only matters if the top line keeps pulling its weight.

Full-year organic revenue growth around the low-teens run-rate came through a touch ahead of what the market penciled in, powered again by Latin America and emerging regions while continental Europe felt sluggish sentiment and some abrupt shifts in public spending contracts. Behind the scenes, the business continued the tidy post-spin clean-up: operating leverage, efficiency programs, and the fading of one-off spin separation costs combined to lift margins nicely. Free cash conversion remained strong, showing again the cash-generative mechanics of prepaid flows, and management wasted no time signaling confidence via a share buyback equal to roughly mid-single-digits of the market cap, i.c. a shareholder-friendly gesture at a moment the stock could use some support.

Still, the sting came from the forward-looking tone. Rather than double-digit momentum carrying smoothly into next year, Pluxee now frames its growth outlook as ‘high single-digit’. That caution reflects a cocktail of headwinds: a lacklustre labour backdrop in Europe affecting beneficiary numbers, fiscal tightening hitting social-program volumes, and some ongoing commercial repositioning in key scale markets like the U.S. and U.K.

The business feels structurally well-positioned, digitisation of benefits ecosystems continues across regions, but it’s hard to ignore that visibility has narrowed just when investors were hoping the spin-out phase would fade into a more confident acceleration narrative. Management did sweeten the message with an upgrade to profitability targets and reiterated strong free-cash expectations, leaning into the levers it can control while parts of the revenue line drift in the macro current.

The market’s lukewarm reaction feels fair. Pluxee remains a credible growth-and-cash story with room to compound through digital adoption and bolt-on M&A, and the operating model will almost mechanically throw off incremental margin as scale builds. But when a relatively young standalone company resets its growth stride this early, investors take notice, particularly with regulatory uncertainty still hovering over Brazil and the sector’s more seasoned peer trading at a discount.

With that context, we would not be surprised to see the the stock settle into a holding pattern: attractive medium-term fundamentals balanced by nearer-term hesitation and macro noise. Execution, clarity on government programme exposure, and stabilisation in Europe likely determine the next leg.

Argenx (ARGX Belgium): executing like a market leader while widening the clinical moat

Argenx delivered a quarter that reinforces why it sits at the centre of the autoimmune therapy conversation: blockbuster-grade uptake, expanding patient reach, and a commercial machine that keeps defying the typical biologics launch curve.

Revenue surged sharply as uptake broadened across both established indications and newer ones, marking the first billion-plus revenue quarter and signaling that demand momentum in myasthenia gravis and chronic inflammatory demyelinating polyneuropathy is still early in its arc. Operating leverage snapped into focus too, meaningfully positive operating profit underscored that scale benefits are now flowing through the model rather than sitting theoretical. With a multi-billion-dollar cash balance, Argenx enters the next stage of its story with enviable resource optionality and minimal strategic constraint.

What made this print more than just another beat was the story underneath. The pre-filled syringe rollout is changing prescribing patterns and lowering friction, drawing entirely new patients rather than just shifting them inside the treatment ecosystem. Early signs in CIDP show not only steady switch dynamics but a nascent base of naïve starts, a hint that the product may gradually push higher in the treatment cascade.

Meanwhile, management’s steady hand on competitive messaging, particularly around a rival head-to-head trial designed more for marketing than clinical translation, suggests confidence. In short, a company leaning into pragmatism: long-duration response, tolerability, and prescriber trust are where the fight will be won.

If anything, the bar seems to continue to rise. Execution strength feeds expectations, and that means each subsequent indication and each incremental cohort of autoimmune patients needs to carry weight. The clinical calendar ahead is dense, spanning neuromuscular and inflammatory categories and quietly expanding into thyroid autoimmunity.

The broader takeaway is unchanged: Argenx has built a platform that works, understands the nuance of specialty markets, and is still early in monetising a potentially broad mechanism. The equity story is no longer about proving the model; it is now about pacing expansion and sustaining leadership in the face of brewing competition.

For now, momentum remains firmly in Argenx’s hands, and the cadence of execution gives little reason to doubt its trajectory.

Prosegur Cash (CASH Spain): when FX and cycle volatility collide with a slow-burn turnaround

Prosegur Cash’s quarter served as a reminder that emerging-market cash logistics doesn’t move in neat lines, even when strategic progress is underway.

The business saw revenue contraction as the strong start to the year in Latin America tapered into a flatter patch and currency effects turned meaningfully adverse. New-generation services continued to grow (a small but strategically important piece of the mix) though not enough to counter the combined drag of FX, macro softness, and a tougher comparison base. Profitability also absorbed pressure, with restructuring charges weighing on margins and tax rates remaining uncomfortably elevated, compounding the operational shortfall. For a company seeking to reshape its earnings profile and prove consistent improvement, trading like this slow sentiment.

Beneath the surface, though, the long-term reform story seem to remain intact. The balance sheet held up well, with leverage stable and net debt continuing a quiet, incremental downtrend. That matters when macro volatility hits and liquidity confidence becomes the silent vote of confidence investors price.

The regional picture also carries nuance: Argentina, historically the wild card, is finally benefiting from policy shifts and reduced financial market stress, a dynamic that arguably carries more strategic weight than one quarter’s FX-pinched P&L. And the steady improvement in new product contribution, even against choppier demand patterns, reinforces that the shift toward tech-enabled, value-added services is real, not just a PowerPoint case.

Prosegur Cash remains a value-driven turnaround with macro torque. That means equity patience will be mixed with occasional headline frustration. When sovereign spreads narrow and regulatory clarity improves, investors tend to re-rate the resilience premium; when FX hits and organic momentum pauses, the market hesitates.

What today’s setup offers is asymmetric potential: a business cleaning its capital structure, modernising its offering, and operating in markets where structural cash usage declines are slower than the headlines suggest. The execution burden remains high; cost discipline, product mix uplift, and regional commercial intensity have to keep delivering, but for those comfortable navigating volatility, the rebuilding cycle could pay off.

Scout24 (G24 Germany): compounding through consistency in a still-tight housing market

Scout24 continues to demonstrate that in European classifieds, consistency and operational discipline remain underrated competitive edges.

The latest quarter carried the familiar shape: healthy low-teens organic revenue growth, driven by both professional and private listings, and another high-60s operating margin. While Germany’s property market remains structurally supply-constrained and sentiment patchy, Scout24 has leaned further into subscription and value-added services for agents and landlords, which continues to be the engine behind this durable expansion. The platform’s recurring revenue tilt has quietly shifted the narrative from cyclical traffic patterns to predictable monetisation, i.c. a feat not many digital platforms in Europe have executed at this scale. Cash conversion remains strong, reinvestment disciplined, and the group’s tech and pricing stack increasingly resembles a software business more than a traditional classifieds site.

Agent tools and data-driven pricing services are increasingly sticky, and the private market, once considered less monetisable, is proving fertile as more individuals opt for paid positioning and convenience tools rather than navigating opaque rental markets alone. Even one-off tax effects this quarter merely reinforce the underlying point: this is a business where incremental efficiency, automation, and platform power translate cleanly into earnings.

When volumes or sentiment soften, Scout24’s model has shown an ability to lean on elasticity in service adoption rather than pure listing flow, and that resilience is what the market continues to reward. The long-term structural reality, i.c. limited housing supply, digitisation of landlord workflows, and increasingly regulated rental markets, ultimately plays to the company’s strength as the trusted discovery and compliance hub.

The next leg of the story is steady expansion of SaaS-like functionality, deeper ecosystem integration, and growing wallet share across both ends of the marketplace. If European equities broadly remain under-owned, platforms with this level of earnings durability and visibility eventually find gravity working in their favour.

Scout24 doesn’t need a roaring housing cycle to win, it just needs to keep executing the way it has been.

Saint-Gobain (SGO France): discipline and pricing power take the lead as Europe finds its footing

Saint-Gobain has entered an interesting phase of its cycle, one where the benefits of years of portfolio pruning, operational tightening, and decentralised decision-making remain visible even as volumes only begin to stabilise.

The latest quarter reflected that tension: modest slightly negative volume trends globally, offset by a positive pricing dynamic that continues to hold in a relatively benign cost environment. Europe, still digesting a prolonged downturn in residential renovation activity, showed pockets of recovery, with Southern Europe and Central & Eastern Europe moving first while France gradually stabilised after a painful stretch. North America, by contrast, showed a sharper volume drop as the group prioritised pricing over chasing marginal growth, a stance that has been central to Saint-Gobain’s margin preservation playbook in recent years.

There is confidence coming through management commentary: not exuberance, but a sense that the inflection in Europe is real, and that 2026 should show more broad-based improvement.

The operating model, now proven through multiple macro cycles, gives local teams pricing autonomy and the ability to adjust product mix in real time, something competitors still struggle to replicate. Building chemicals, insulation, and distribution each continue to show their strategic relevance as energy efficiency and sustainability remain high on policy agendas despite cyclical noise. Meanwhile, long-term initiatives like industrial footprint optimisation and targeted bolt-ons in high-value materials continue to reshape the earnings profile toward more resilient and specialised segments.

Valuation still embeds scepticism, trading at a clear discount to global building materials peers despite meaningfully higher margins than the group delivered pre-transformation. That may reflect investor muscle memory from older cycles; commodity exposure, France overhangs, and a period where pricing was reactive, not proactive.

But the company today is structurally different: returns more disciplined, capital allocation sharper, ESG positioning credible, and portfolio complexity meaningfully reduced. As macro momentum in Europe slowly shifts from headwind to mild tailwind, Saint-Gobain feels well-placed to compound through pricing discipline, mix upgrades, and productivity.

Stellantis (STLAM Italy): waiting for clarity while the reset unfolds

Stellantis remains in the uncomfortable middle chapter of a transformation, the part where progress is visible in places, but conviction is still hard to anchor.

The most recent update showed stabilising revenue trends after several quarters of contraction, helped along by favorable comparisons but nonetheless signaling some early traction. Yet equity markets reacted negatively, reflecting how fragile confidence remains in the turnaround narrative.

With a new chief executive prioritising North America, there is an acknowledgement that the group’s brand positioning, product cadence, and capacity footprint require re-wiring for a market still digesting electric transition costs, incentive normalisation, and tariff uncertainty. Those are heavy lifts, and communication from leadership remains (intentionally) cautious until the strategic plan formalises next year.

Financial noise adds complexity: restructuring charges, warranty cleanup efforts, and potential asset write-downs are weighing on reported numbers and muddying the picture of underlying run-rate earnings. Cash flow commentary remains guarded, and investors have little appetite for ambiguity in a sector where capital intensity and strategic missteps can linger for years.

While peers in Europe have offered clearer roadmaps and earlier operational proof points, Stellantis has opted for deliberate pacing, consolidating decision-making, revisiting nameplate strategies, and prioritising U.S. recovery even if that means European optimisation comes later in the cycle. The question is how quickly and how confidently those improvements show up in profitability rather than solely in rhetoric.

For now, it feels like a holding pattern. The valuation reflects execution risk and the need to rebuild trust before re-rating. Patient investors may eventually be rewarded if the North American push lands and margin normalisation follows, but the burden of proof clearly sits with the company heading into a critical strategy unveiling in mid-2026.

Until then, it’s hard to frame Stellantis as more than a ‘wait and see’ story.

TF1 (TFI France): resilience on the screen, caution in the ad breaks

TF1’s third quarter reads like a reminder that execution can still outmuscle a soft market. Profitability held up better than feared, with EBITA ahead of expectations even as core TV advertising dipped slightly.

The cushion came from two places: a disciplined grip on programming costs and the accelerating shift of attention (and euros) to TF1+, where revenue growth remains rapid. That digital cadence matters. It’s not just incremental income; it’s proof the group can move audience, data and product in tandem, and convert that into cash flow without overextending the schedule. Add in a solid quarter from Studio TF1, where release momentum supported margins, and the P&L looks sturdier than the headline ad trend suggests.

Still, you can feel the caution creeping into the outlook as France’s political and fiscal backdrop clouds year-end visibility. Management has tightened the 2025 margin guidance lower, noting weaker retail advertising through November and December and a more hesitant tone from clients.

The near-term playbook is pragmatic: keep a tight lid on content costs, lean into what’s working digitally, and let Studio TF1’s pipeline do some heavy lifting while the linear market catches its breath. Crucially, TF1+ is starting to act more like a growth engine in its own right, with audience build, product iteration, and monetisation running on faster clock speed than the linear grid. That mix shift, while gradual, is exactly what protects EBIT when the ad cycle wobbles.

Step back and the strategy seems coherent: protect profitability, compound in digital, and keep optionality high with a strong balance sheet.

Management signaled continued dividend friendliness over time, underpinned by net cash that still represents a meaningful slice of the market cap. If the macro fog lifts even modestly into 2026, TF1 is positioned to let operating leverage work on both sides of the house, linear stabilising from a lower base, digital scaling from a higher one. Until then, the investment case hinges on resilience.

WPP (WPP UK): stuck in the penalty box while the pitch is being relaid

WPP: another mid-single-digit organic revenue decline, broad-based across the US, UK and Europe, and a guidance cut that bakes in an even tougher Q4.

The company faces a double bind, visible net-new business losses and existing clients trimming or deferring spend, that peers haven’t flagged to the same extent. That gap in trajectory is now persistent, and markets are treating it less as a blip and more as a structural warning. Media, historically a stabiliser, is where the drag is heaviest, especially in tech and autos across Germany and the UK. When the engine room is sputtering, it’s hard for creative, commerce, or PR to carry the group print.

Management isn’t hiding from the problem: the message is debt discipline first, operational streamlining second, and a pause on transformational M&A while execution resets. Senior departures (many framed as part of simplification) keep the organisation in motion at a time when clients want continuity, not churn. The plan leans on partnerships with the big platforms to refresh capability, and on cost actions to protect margins from sliding further.

But the real test isn’t cost, it’s confidence. Agencies win on credibility in complex, multi-platform briefs, and that credibility is built pitch by pitch. With guidance now assuming an even weaker fourth quarter and early 2026 still looking soft, the turnaround will need visible net-new wins and cleaner delivery in media to change the narrative.

There is, however, an eventual path out. WPP still commands scale, data assets and global reach that matter when performance and brand budgets converge. If the house can be put in order, stable leadership at operating units, sharper proposition around data-driven media, and tighter country execution, the operating model can extract more from the footprint it already has. The uncomfortable truth is that peers have been faster at that pivot, widening the comparison set’s performance spread.

For now this is more about rebuilding commercial momentum in the largest markets, stemming client churn, and showing that partnerships translate into durable, margin-accretive briefs. Until those proof points arrive, investors should expect volatility, and judge progress by the cadence of wins, client retention, and stabilisation in media.

If you appreciate this post, feel free to share and subscribe below!