Medtech, telcos and AI fears

Ferrari, Novo Nordisk, Wolters Kluwer, Trigano, Siemens Healthineers, Fresenius SE, Nexi, Nemetschek, Digi Communications, Gestamp, Vonovia, Grifols

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

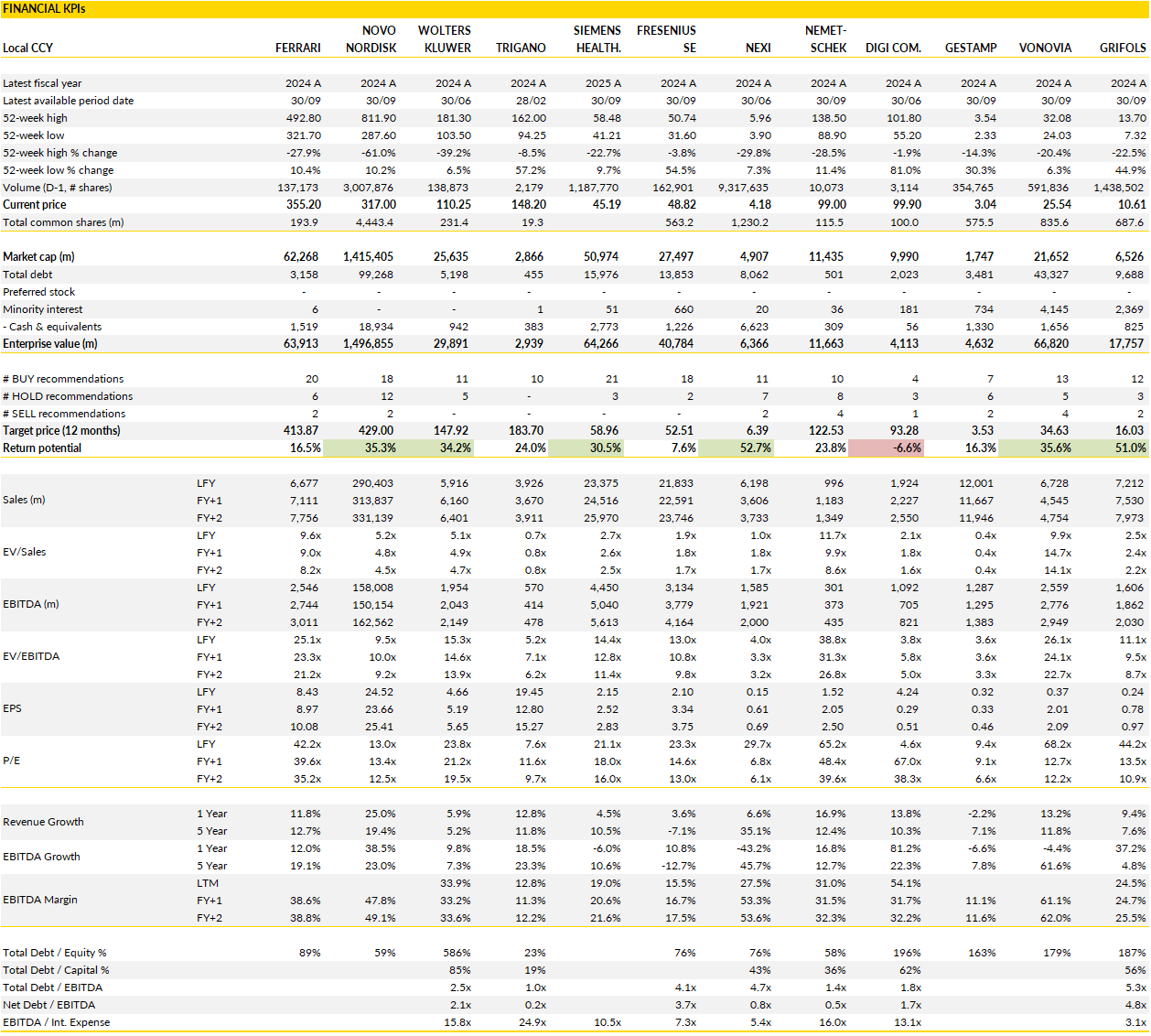

Financial KPIs

Ferrari (RACE Italy): Still defying gravity as pricing power and brand momentum accelerate

Ferrari continues to operate in its own financial orbit, delivering another quarter that exceeded expectations on nearly every key metric.

Third-quarter revenue rose solidly despite the natural lull in the product cycle, showing again the brand’s unique ability to translate scarcity into pricing power. The company’s average revenue per unit climbed again, indicating that demand remains price-inelastic even as certain high-margin models like the Daytona SP3 near the end of their runs. Margins compressed slightly due to tariffs and mix effects, but the underlying profitability still reflects an almost unmatched operational discipline. Even free cash flow held steady despite softer working capital inflows, as capital intensity eased after recent investment peaks.

This is the Ferrari pattern the market has come to expect: disciplined production pacing, cost control, and a finely tuned balance between exclusivity and volume that keeps financial performance consistently ahead of plan. The company’s confidence in maintaining its 2025 targets, despite cost pressures and an evolving product lineup, highlights resilience. Management’s tone was upbeat on the call, noting robust order visibility and sustained demand well into next year.

The next leg of growth will likely come from the rollout of the F80 and the gradual normalization of production for newer hybrid and electric platforms. These models will be critical as Ferrari transitions toward its 2030 roadmap, which envisions a larger share of electrified vehicles without diluting the brand’s identity.

Beyond product, Ferrari’s sponsorship and lifestyle businesses continue to add incremental momentum, with the commercial and brand division posting double-digit growth thanks to stronger F1 performance and lifestyle expansion. It’s another reminder that Ferrari’s brand monetization engine (from merchandising to racing) increasingly complements its car sales, creating a diversified profit base that few luxury automakers can replicate.

Ferrari’s executional consistency and pricing discipline suggest the next few quarters could still hold upside surprises. The ramp-up of the F80 should offset the end-of-cycle impact from older models, and continued strength in sponsorship revenue will further cushion any cyclical softness in unit deliveries. While the debate around Ferrari’s 2030 ambitions continues, particularly regarding electrification targets and potential market saturation, the company keeps proving its critics wrong by overdelivering.

In an industry where most peers rely on volume to maintain margins, Ferrari remains strong, doing more with less: building fewer cars, charging more for each, and converting that exclusivity into a profits.

Novo Nordisk (NOVOB Denmark): A costly reset as momentum in obesity drugs slows

Novo Nordisk’s third-quarter results mark another moment of disappointment.

The numbers came in soft across the board, with revenue and operating profit both slightly below market expectations as restructuring costs, currency headwinds, and pricing pressure took their toll. The company is in the midst of a $9 billion restructuring program designed to streamline operations and fund next-generation drug development, but the near-term impact has been heavy. Margins slipped, impairments weighed on profit, and the group’s upgraded manufacturing and R&D infrastructure have yet to translate into visible upside.

While the diabetes and obesity franchises still posted respectable growth, with Ozempic up in the U.S. and Wegovy continuing to expand globally, the momentum is being tempered by lower pricing and mounting budget concerns among U.S. states, some of which are rethinking reimbursement for obesity treatments heading into 2026.

The company is ‘recalibrating’ at a delicate point in the cycle. After several years of outsized demand for GLP-1 therapies, the market’s focus is turning toward sustainability, both in pricing and access. Lower selling prices, rising healthcare scrutiny, and the natural normalization of stockpiling behavior among distributors are all converging to flatten growth trajectories. The company’s insulin franchise, long under structural pressure, continues to contract, further emphasizing the dependency on its newer products.

Against this backdrop, the restructuring plan is defensive, an effort to absorb near-term inefficiencies in order to protect long-term competitiveness. Novo’s capacity to generate substantial free cash flow and maintain an unmatched pipeline in metabolic disease remains intact, but the days of effortless margin expansion appear over, at least for now.

The guidance downgrade reflects this new reality: modest single-digit revenue and EBIT growth expectations for 2025 suggest a management team prioritizing stability over stretch targets. The company still commands enormous pricing power globally, yet its exposure to U.S. reimbursement trends and a maturing obesity-drug landscape creates a more volatile near-term outlook. Investors are now weighing whether this slowdown is cyclical or structural; a pause before another leg of innovation-driven growth, or the start of a more measured phase in Novo’s evolution.

For a company that has spent years defying expectations, the challenge ahead is to prove that its science, scale, and discipline can again overcome external headwinds. Novo Nordisk remains one of the sector’s most formidable players, but after the last quarters, its ceratinly no longer invincible.

Wolters Kluwer (WKL Netherlands): Steady growth and digital resilience amid market overreaction

Wolters Kluwer’s nine-month update reassured investors that the business remains on solid footing, even as the stock has suffered from one of its sharpest deratings in years.

Organic growth accelerated to around 6%, confirming that the company’s model of combining must-have professional content with deeply integrated digital tools continues to perform. The momentum was broad-based across divisions, from health and tax solutions to corporate performance and ESG software. Particularly in healthcare, the adoption of new AI-driven tools such as UpToDate Expert AI demonstrates how Wolters continues to modernize its offerings without losing the trusted content backbone that defines its brand.

The consistency of margins and free cash flow (both up double digits at constant currency) shows how scalable the model has become, even as Wolters invests in innovation. In a year when sentiment has been tested, these results provide a reminder that the underlying business remains fundamentally strong.

Despite the macro noise, Wolters’ divisional performance underlines its structural resilience. The health segment held steady with mid-single-digit organic growth, while tax and accounting remained one of the strongest contributors thanks to ongoing digitalization among accounting firms and small businesses. Legal and regulatory solutions also continued to advance, albeit modestly, while corporate performance and ESG platforms outperformed on the back of rising demand for compliance and sustainability reporting tools.

Management reiterated the full-year outlook across all major metrics, keeping its guidance for margins, earnings, and cash generation intact. That continuity, coupled with disciplined capital allocation and the ability to sustain recurring revenues above 80% of the total, reinforces the predictability investors value most in Wolters.

Yet the market seems unconvinced, with the stock trading roughly a third below its February levels. Concerns about disruption from new AI entrants and leadership transition have overshadowed what is otherwise a textbook case of operational consistency.

In reality, Wolters has long been ahead of the curve in embedding AI and automation into its platforms, and the defensive nature of its client base makes real disruption unlikely in the near term. The recent sell-off seems a crisis of sentiment.

If anything, the latest update demonstrates that the company’s mix of content, workflow integration, and technology remains an enviable formula in professional information services. The long-term story (slow, steady digital compounding) remains fully intact, even if the market has temporarily lost sight of it.

Trigano (TRI France): Recharging for the next cycle as demand steadies and cash flow surges

Trigano’s latest update seems another pause.

After several years of elevated demand during and after COVID, dealers have been focused on normalizing their inventories, leading to a modest decline in revenue this year. But the company’s fundamentals remain remarkably resilient: free cash flow is set to exceed €450 million, margins are stabilizing after an inevitable correction from record highs, and the balance sheet is moving toward net cash.

This combination of capital strength and operational discipline is setting Trigano up well for the next growth leg. Early signs from autumn trade shows suggest a reacceleration for 2026, with double-digit order growth pointing to renewed momentum across Europe’s motorhome markets.

Structurally, the LT story remains compelling. The company’s core customer base (older Europeans with both time and disposable income) continues to expand, and the appeal of mobile leisure has proven remarkably sticky through economic cycles. Since 2000, the market for leisure vehicles in Europe has grown at a steady pace, and the demographic tailwinds show no signs of slowing. What 2025 represents, therefore, is more a normalization of channel dynamics: dealers clearing excess stock, financing costs resetting, and production aligning with sustainable demand.

The payoff comes in the form of strong working capital release and cash generation, allowing Trigano to consolidate its leadership position while competitors face tighter financial conditions. With margins already recovering in the second half of the fiscal year and operating efficiency improving, the stage is being set for both revenue and profitability growth in 2026.

The market, however, seems to remains cautious. Investors appear to be discounting cyclical fatigue, when in reality the fundamentals suggest renewed expansion. As 2026 approaches, visibility is improving thanks to a replenished order book and the rebound that follows a period of de-stocking. These are all ingredients for the shares to rerate towards historical multiples (8-9x).

Siemens Healthineers (SHL Germany): A steady operator adjusting to a tougher margin reality

Siemens Healthineers’ Q4 results confirmed resilience in demand but also exposed the limits of near-term profitability as the company absorbs normalization across its portfolio.

Revenue was essentially flat year-on-year, with 3–4% organic growth masked by currency headwinds and the fading tailwind of post-pandemic diagnostics. The imaging division continued to anchor performance, delivering mid-single-digit growth driven by strong demand in the Americas and Asia-Pacific, where high-end systems like photon-counting CTs are still gaining traction. However, other units (particularly Diagnostics and Varian) felt the impact of tougher comparisons and uneven order phasing. Despite these headwinds, the company maintained a healthy book-to-bill ratio above 1x, signaling that backlog strength remains intact even as quarterly mix and timing effects dampen margins.

What stands out in these results is not so much missed expectations, but rather the gradual recalibration of the company’s growth drivers. Imaging continues to demonstrate pricing power and steady expansion in advanced modalities, reinforcing Siemens Healthineers’ global leadership in premium diagnostic equipment. But Diagnostics, after years of pandemic-driven volatility, is settling into a slower rhythm, with revenue now essentially flat as China’s value-based purchasing pressures continue to reshape regional profitability. Meanwhile, Varian remains a work in progress: order phasing created temporary softness, but its long-term trajectory, as a key platform in precision oncology, remains central to the group’s strategy. The integration of software, AI-assisted image processing, and digital workflow tools across these segments sustain Healthineers’ push to evolve from a medical equipment maker into a broader health technology ecosystem player.

The new fiscal 2026 guidance reflects this reality: healthy top-line growth of around 5–6% but a more cautious earnings outlook as inflation, pricing dynamics, and investment in innovation constrain margins. The implied softness in EPS targets may disappoint investors hoping for faster profit normalization, but it also highlights management’s commitment to reinvest in future growth rather than chase short-term leverage.

The company’s fundamentals (strong installed base, expanding recurring revenue streams, and consistent innovation pipeline) still suggest a solid multi-year compounding story. For long-term investors, the current phase looks like an earnings digestion period before the next cycle of growth, especially as oncology and advanced imaging begin to scale globally.

Fresenius SE (FRE Germany): A cleaner structure and strong execution bring the turnaround into focus

Fresenius delivered another confident quarter, signaling that its long-awaited restructuring and strategic simplification are bearing fruit.

Group revenue grew steadily on an organic basis, but the real progress came through the operating line; EBIT and net income both came in ahead of expectations, supported by a notably strong showing from Kabi. The biopharma and nutrition franchises continue to provide the growth backbone for the group, showing double-digit expansion and confirming that Fresenius’ pivot toward higher-margin, innovation-driven products is working.

Biopharma in particular remains the standout, benefiting from new product introductions and strong demand momentum in the U.S. and emerging markets. While pharma volumes held up well and pricing discipline in Europe helped protect margins, the performance in nutrition reinforced Kabi’s growing strategic importance as a source of both profitability and defensiveness within the wider group.

The hospital division, Helios, also contributed to a stable overall picture despite seasonal softness. Germany and Spain both posted solid organic growth, with the Spanish operations continuing to stand out for their efficiency and patient volume recovery. The German business faced tougher year-on-year comparisons but still showed positive trends in admissions and pricing, a sign that the structural pressures of cost inflation and staffing shortages are being managed more effectively. Helios’ ability to maintain a stable margin profile while expanding capacity in select specialties underlines Fresenius’ growing operational discipline, a marked improvement from the volatility of recent years.

The group’s updated guidance, which nudges expected EBIT growth higher for the full year, suggests management now has greater visibility and confidence in its earnings trajectory.

Beyond the quarterly numbers, Fresenius looks increasingly like a company regaining its strategic coherence. The focus on Kabi and Helios as core pillars, combined with a leaner balance sheet and more predictable earnings profile, has made the group’s investment case now far clearer than during the post-pandemic restructuring phase. The turnaround in cash flow and margins is being achieved without sacrificing growth investment, and the mix is shifting decisively toward segments with pricing power and recurring demand.

If Kabi’s biopharma and nutrition momentum continues and Helios maintains its steady expansion, Fresenius is emerging from 2025 in a stronger, more self-sustaining position than it has been in years.

Nexi (NEXI Italy): Steadying the ship before the next phase of growth

Nexi seems to be stabilizing after a challenging stretch but has definitely yet to regain its previous pace.

Revenue and EBITDA came in essentially in line with market expectations, reflecting modest organic growth of around 2%. The numbers themselves don’t tell the full story: Nexi continues to work through the lingering effects of portfolio losses and contract renegotiations in Italy, issues that were flagged early and are now largely contained. Stripping out those one-offs, underlying sales growth remains closer to mid-single digits, suggesting the core payments business remains fundamentally sound. Margin pressure, meanwhile, was modest and mostly linked to temporary cost phasing and mix effects that management expects to reverse in the final quarter.

The company has reiterated its full-year guidance, signaling confidence in both its cost trajectory and free cash flow generation. For 2025, Nexi still expects low- to mid-single-digit organic revenue growth, a modest uplift in margins, and over €800 million in free cash flow, a target that shows how cash generative the business has become even in a slower-growth environment.

The focus now turns to 2026, when the company will seek to reignite growth through partnerships with independent software vendors, the expansion of its direct sales force, and deeper penetration in e-commerce and integrated digital solutions. These efforts reflect Nexi’s long-term ambition to shift from being a traditional payment processor to a broader digital payments platform, better aligned with evolving merchant ecosystems and omnichannel trends.

Investor sentiment, however, remains cautious after a difficult two-year stretch marked by competition, integration noise, and the sector-wide derating that followed Worldline’s struggles. Yet this may be where opportunity lies. Nexi trades at valuation levels that imply little optimism for a recovery (around five times forward EBITDA) despite a cleaner operational outlook, improving free cash flow, and a shareholder return profile above 10% when dividends and buybacks are combined.

If management can demonstrate renewed organic growth momentum at its upcoming Capital Markets Day in March, it could help reframe the narrative from damage control to disciplined renewal. For now, Nexi looks like a company quietly rebuilding operational leverage.

Nemetschek (NEM Germany): Digital construction momentum reshapes the growth story

Nemetschek delivered another powerful signal that the company’s transformation toward a fully subscription-based, cloud-native model is hitting its stride.

Group revenue grew around 20% organically, with the Build segment once again driving performance thanks to exceptional demand for Bluebeam and GoCanvas. The strength of the U.S. construction market, where digital collaboration tools are increasingly becoming mission-critical, helped lift Build sales by more than 30%, while the Design division maintained double-digit growth supported by early renewals and the shift to multi-year contracts ahead of the 2025 license model sunset.

The only soft spot remained the Media business, still weighed down by cautious discretionary spending among smaller creative clients. Nonetheless, margins expanded meaningfully as the operational leverage from Build more than offset those temporary headwinds, showcasing the scalability of Nemetschek’s platform as the mix tilts further toward high-recurring software revenues.

Management’s tone on the conference call was upbeat, as Nemetschek now expects to finish the year at the upper end of its revenue guidance range. This confidence is based on sustained international expansion and steady customer conversion into its subscription ecosystem.

The company’s 2026 ambitions (mid-teens organic growth and a continued climb in margins) suggest that the current business model transition is not just smoothing earnings volatility but also structurally improving the company’s long-term economics. Build should remain the main engine, with robust momentum in Bluebeam and GoCanvas supporting growth above 20%, while Design is expected to show resilience even against tough comparisons. Management’s optimism about Media’s gradual recovery also signals that fears of AI-driven disruption in creative software may be overstated for now.

The broader narrative remains consistent: Nemetschek is evolving from a European niche design software group into a global digital construction ecosystem leader. With strong balance sheet discipline, high cash conversion, and expanding operating leverage, the group continues to combine quality growth with structural margin expansion.

As the transition to subscription and cloud matures, recurring revenues will increasingly dominate, smoothing performance and improving visibility. The company’s reaffirmed confidence in its growth path beyond 2026, supported by Germany’s infrastructure digitalization drive, reinforces the long-term thesis: a structural compounding model in one of the most under-digitized global industries.

Digi Communications (DIGI Romania): Gaining ground in Spain while deepening its convergence edge

Digi Communications enters the final stretch of 2025 as one of Europe’s more dynamic challenger telecom operators, leveraging its low-cost model and agile execution to expand market share across key geographies.

The group’s upcoming results are expected to show continued strength in customer acquisition and steady margin improvement, particularly in Spain, now a key growth driver within the portfolio. The recently implemented national roaming agreement with Telefónica, effective since July, provides a meaningful cost benefit that should bolster profitability over the coming quarters. This structural advantage allows Digi to sustain its characteristically aggressive pricing strategy without sacrificing returns, reinforcing its appeal to value-conscious consumers in a competitive Spanish market. The company’s lean cost base and operational efficiency remain its strongest assets as it deepens its foothold in one of Europe’s most contested telecom landscapes.

Back home, Digi’s Romanian business continues to consolidate its dominant position following the joint acquisition of Telekom Romania assets with Vodafone. The integration of new spectrum and tower infrastructure enhances the group’s convergence offering, a critical differentiator in a market where bundled fixed-mobile services drive customer stickiness.

The improved network depth also underpins steady growth in the subscriber base, with volumes projected to rise mid-single digits over the next few years. While average revenue per user remains stable, Digi’s volume-driven growth model continues to generate solid top-line expansion and healthy cash generation. The company’s ability to replicate this convergence blueprint in other European markets such as Portugal and Belgium could serve as a longer-term catalyst for scale and margin leverage.

The market’s focus has recently drifted toward speculation about potential consolidation in Spain, but regulatory constraints make any transformative transaction highly improbable for now. In the meantime, Digi is executing its own consolidation strategy, not through M&A, but through disciplined organic growth, cost optimization, and network expansion. The company’s formula of value pricing, superior network reliability, and increasingly integrated offerings continues to resonate with customers, particularly in Spain where growth momentum remains robust.

While the stock has already re-rated on the back of these expectations, Digi’s story remains about operational progress: an expanding European challenger that combines strong execution with a clear path toward convergence-led growth.

Gestamp Automoción (GEST Spain): Resilient margins but sluggish growth weigh on momentum

Gestamp’s third-quarter results highlighted a familiar split between solid operational control and soft top-line momentum.

Revenues came in below market expectations, reflecting both a tougher regional mix and weaker-than-anticipated production volumes in Western Europe, where the group remains heavily exposed. With global light vehicle production once again led by China, a market where Gestamp remains underrepresented, the company’s relative growth lagged industry averages by around five points.

Still, the profitability profile showed resilience: margins held up better than feared, supported by disciplined cost control and the ongoing optimization of manufacturing footprints. EBITDA margins of roughly 11% showed a level of efficiency that partly offsets revenue softness, though free cash flow weakened due to higher seasonal working capital needs and elevated capex levels.

Following the results, management trimmed its 2025 growth ambitions while slightly raising its margin outlook, essentially conceding slower momentum in Europe but reaffirming that profitability remains on track. The group now expects to land below its previous target of low single-digit outperformance versus global auto production, but aims to finish at the upper end of its margin range, implying further operational discipline even as sales growth moderates.

The strategy remains one of incremental progress; protecting returns while positioning for better cash generation next year, aided by lower investment intensity. The recent sale-and-leaseback transaction with Santander has also modestly improved the balance sheet, reducing leverage and providing flexibility ahead of a likely normalization of capex in 2026.

Structurally, however, Gestamp still faces the challenge of geographic imbalance and constrained free cash flow. Its underexposure to Chinese OEMs and ongoing reliance on mature European markets limit growth optionality at a time when global production shifts toward Asia and electric platforms. That said, the company’s engineering expertise and customer entrenchment among global automakers provide some cushion against macro headwinds.

The near-term setup looks more to be like a holding pattern: steady margins, muted top-line, manageable debt, and modest valuation support. For now, Gestamp continues to execute well within its constraints, but sustained re-rating will likely require more evidence of geographic diversification and stronger structural growth beyond Europe’s slow-moving automotive cycle.

Vonovia (VNA Germany): Steady fundamentals reinforce the long-term rental growth story

Vonovi delivered figures which were broadly in-line with consensus, confirming the resilience of its rental operations and the gradual strengthening of its balance sheet. Rental income rose just over 3% year-on-year, supported by like-for-like growth of more than 4%, reflecting the embedded pricing power of its German residential portfolio and the tailwinds from index-linked leases. The improvement in the loan-to-value ratio, now under 46%, and the stable interest coverage at 3.8x highlight the company’s effective balance-sheet management despite the higher-rate environment. While adjusted earnings before tax were marginally softer year-on-year, Vonovia’s underlying cash generation remains robust, enabling it to sustain investments in portfolio upgrades and energy efficiency while maintaining financial discipline.

Beyond the headline stability, the company continues to execute on its longer-term strategy of enhancing profitability through portfolio optimization and an expanding non-rental business. The latter, covering energy services, smart metering, and property-related services, now represents over 13% of total EBITDA, up from around 9% a year earlier.

This steady growth underscores Vonovia’s shift toward a more asset-light, service-oriented model that can supplement traditional rental income and support higher returns on capital. Importantly, management raised its organic rental growth outlook for 2028 to around 5%, signaling confidence in both pricing and occupancy dynamics in its core German markets. The combination of strong fundamentals, disciplined financial metrics, and the gradual reweighting toward service revenues positions Vonovia for solid operational momentum even if the property market recovery remains uneven.

Vonovia is weathering the macro drag of higher financing costs without compromising its growth algorithm. Its fundamentals (predictable rent growth, a diversified portfolio of modernized assets, and improving leverage) remain intact and even strengthening. As the refinancing landscape normalizes and regulatory pressure eases, the company’s intrinsic growth in rental income and the strategic broadening into adjacent services should continue to compound value.

Grifols (GRF Spain): Soft finish to a fragile recovery as leverage concerns linger

Grifols’ third quarter offered a mixed picture; operational improvement on the surface, but with the familiar structural issues still lurking.

Revenues grew modestly, helped by strong performance in the core immunoglobulin franchise, where subcutaneous IG volumes surged and demand in the U.S. remained firm. This strength, however, was largely offset by weakness in albumin, particularly in China where price competition remains fierce, and by sluggish trends in the diagnostics and biosupplies units. Currency headwinds further dampened the headline numbers, masking what was otherwise a decent sequential improvement in underlying growth.

Margins held up slightly better than expected, with adjusted EBITDA coming in just above consensus, helped by cost discipline and the normalization of plasma collection expenses. Yet beneath that operational progress, free cash flow generation remains anemic, and deleveraging momentum continues to disappoint.

The company’s leverage ratio remains stubbornly high at over five times EBITDA, with net debt barely moving quarter-on-quarter despite improved free cash flow (before acquisitions). This weak cash conversion reflects both structural working capital rigidity and ongoing capital intensity, leaving little room for meaningful balance-sheet repair. Management reiterated its leverage target under its credit agreement and made a modest upward tweak to free cash flow guidance, but the incremental progress does little to change the bigger picture.

The new EBITDA guidance cut, driven partly by foreign exchange but also implying a weaker Q4 performance, suggests that profitability will likely finish the year below earlier hopes. Even excluding FX, the implied trend in Q4 points to stagnation at best, which reinforces concerns about Grifols’ ability to generate sustained earnings growth while carrying its heavy debt load.

The tension between near-term operational resilience and long-term financial fragility remains unresolved. Grifols continues to prioritize dividends and minority buyouts at a time when its balance sheet would benefit more from deleveraging, leaving investors skeptical about capital allocation discipline.

The company’s 2027 debt maturity ‘cliff’ looms large, and options to address it (through disposals or structural changes) have so far been deferred or dismissed. Governance concerns also persist following a series of credibility hits earlier in the year.

While the core plasma business remains fundamentally sound, Grifols’ execution risk and financial leverage continue to overshadow that strength. The recovery story, for now, still feels cosmetic.

If you appreciate this post, feel free to share and subscribe below!