LNG, funds and toilets

Fresenius Medical Care, Allfunds, Vicat, GTT, Prosegur, SCOR, Adtran, Nemetschek, AT&S, Geberit, Evonik, Coloplast, BioNTech SE, Atrys Health

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

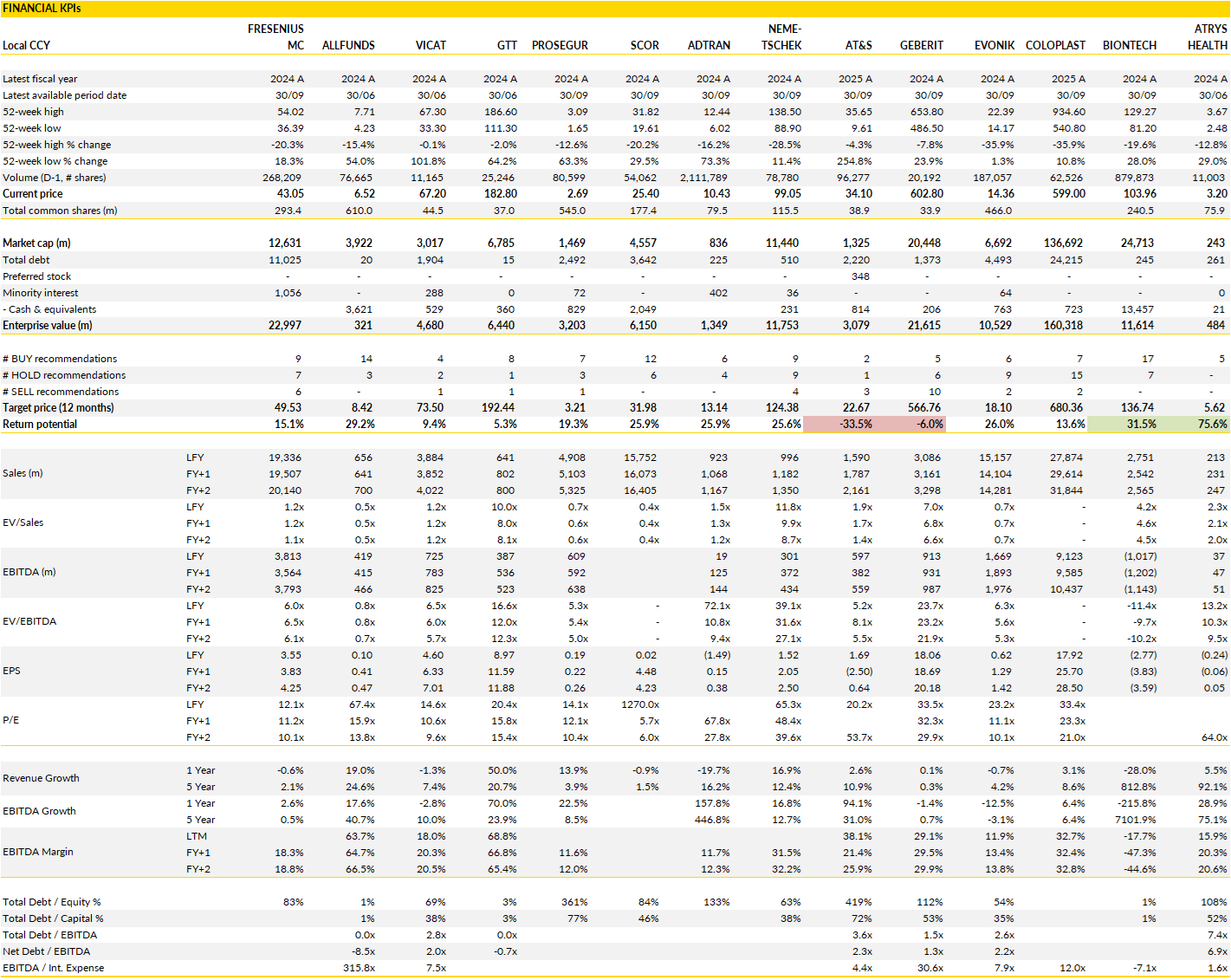

Financial KPIs

Fresenius Medical Care (FME Germany): efficiency gains and steady growth (re)shape the recovery story

Fresenius Medical Care’s third quarter marked another step in what seems has become a convincing operational turnaround in European healthcare.

Revenue rose close to 10% organically, driven by pricing improvements, mix benefits, and disciplined execution across all business units. While reported growth was diluted by currency headwinds, the underlying momentum was unmistakable: the company is beginning to translate its cost efficiency program into sustained margin expansion. Adjusted EBIT climbed double digits year-on-year, supported by FME25-related savings and a sharper focus on profitable treatments.

After several years defined by inflation pressure and reimbursement uncertainty, the business now appears to be regaining control of its economics. The margin profile is improving steadily, and cash generation has become more predictable, i.c. a crucial development for a company that had struggled to convince investors of its operating leverage.

The Care Delivery segment, which represents the heart of Fresenius Medical Care’s global network, continues to see modest volume recovery but stronger pricing discipline. Organic growth in the U.S. was notably healthy, aided by improved reimbursement rates and a more favorable payor mix, while the impact of lower implicit price concessions added a small but important tailwind. Same-market treatment growth remained flattish, yet the segment’s profitability showed clear progress thanks to better cost control and higher-margin service delivery.

Meanwhile, the Care Enablement division, which produces the company’s dialysis products and related technologies, maintained its upward trajectory, benefiting from both pricing power and gradual normalization of supply chain costs. Even the smaller Value-Based Care arm, still loss-making, delivered rapid top-line growth as it scales toward breakeven.

What matters most now is the sustainability of this new margin profile. Fresenius Medical Care has been through years of structural change, and its current guidance implies it expects to hold margins near or above 11% even in a still-mixed reimbursement environment. That ambition feels credible. Cost savings are flowing through as planned, the product and service mix is improving, and the operational grip on its sprawling care network is tighter than it’s been in years.

The broader backdrop also helps; dialysis demand remains secularly supported by aging populations and rising chronic disease prevalence. If the company can pair this stable demand base with sustained efficiency gains, the story could evolve from cyclical recovery to durable compounding (again).

After a long phase of restructuring, Fresenius Medical Care looks increasingly like a business that has rediscovered its momentum.

Allfunds Group (ALLFG Netherlands): growth that flows faster than it monetises

Allfunds remains a curious study in scale without pricing power, a platform visibly winning assets yet earning less on each euro that passes through its pipes.

The latest quarter again highlighted this imbalance: strong net flows, broad participation across client types, and a stable operating backdrop, yet a squeeze on fees as product mix shifts toward low-margin categories. The move from rebate to non-rebate assets has been a structural theme for years, but the acceleration toward cash-like and fixed income strategies has sharpened the effect, leaving headline AuA growth far ahead of revenue momentum.

Management’s confidence in hitting the top end of its flow guidance speaks to commercial strength and distribution reach, but investors seem more focused on the slow bleed in take rates than the scale benefits underneath.

Strategically, the company needs now to make good on its promises. The alternative assets arm remains tiny in the mix despite impressive percentage growth, and until it reaches critical mass it cannot offset pressure in the core. Meanwhile the SaaS portfolio, once positioned as a margin-rich adjacency, is in the middle of a rationalisation phase that feels defensive.

The group’s ambition to push deeper into ETP infrastructure is sensible (passive flows are where the market grows) but the platform will need to show that it can monetise liquidity, data and technology services rather than just custody and routing. In that sense, the upcoming investor day arrives at a pivotal moment: the market will want to see innovation and profitability, not only scale and cost control.

Scale is unquestioned, operating leverage exists (on paper), and the balance sheet gives management freedom. But the equity story hinges on whether the platform can rebuild pricing power in a world increasingly transparent on fund economics. Until higher-value revenue lines truly scale, and fee margins stabilise rather than grind lower each quarter, the shares are likely to trade more as a proxy for industry currents than a self-determined compounding engine.

Vicat (VCT France): a patient compounder

Vicat continues to do what it does best: navigate volatile construction markets with consistency, leaning on diversified geography and disciplined pricing instead of volume.

The latest quarter showed that blend again, with steady organic momentum despite currency drag and a familiar split in regional performance. France remains weighed down by residential softness, yet large public-works projects from Paris to the Lyon-Turin corridor are beginning to counterbalance that drag. The United States stays mixed, with strength in the southeast offset by California-specific issues, while emerging markets once again underlined their role as ballast, with India and Mediterranean territories supporting consolidated performance.

The company’s tone remains measured, steady price discipline, controlled capex, and pragmatic volume (expectations) as demand pockets normalise. Unlike peers who leaned aggressively into expansion during the last inflationary wave, Vicat remains structurally cautious rather trying to extract maximum upside in peaks.

That posture has implications: when the macro turns sharply positive, it tends not to lead the group higher, but in a world still adjusting to higher rates, sporadic infrastructure spend and inconsistent private-housing signals, discretion feels like a competitive advantage.

The market seems to continue to value the company as if it were simply a second-tier cyclical cement producer rather than a globally spread operator quietly improving its mix and managing leverage conservatively. If European residential construction finds a floor and U.S. activity stabilises, the story shifts from defence to recovery, with emerging-market resilience smoothing the path.

But Vicat remains committed to operational discipline and geographic balance, and the share price may only fully reflect that when the cycle narrative turns from ‘fragile demand’ to ‘steady growth’. Until then, it stands as a way to stay exposed to construction recovery without betting on a sharp inflection that may or may not arrive anytime soon.

GTT (GTT France): a structural LNG winner extending its runway

GTT keeps proving that it sits at the intersection of energy security and decarbonisation instead of the tail end of an over-heated shipbuilding cycle.

Recent trading again showed resilient growth from its core membrane-technology business, with newbuild activity supported by a still-expanding order book and project visibility stretching multiple years ahead. Even as comparisons get tougher, revenue momentum remains firm, reflecting infrastructure commitments made well before short-term spot price swings. The value here lies in owning the intellectual property that enables global LNG transport, an advantage that compounds with every new carrier that hits the water.

What has shifted is the contribution from digital and services, a once-nascent segment that is now becoming really relevant. With the integration of acquired capabilities and increasing penetration in fleet monitoring and efficiency optimisation, the company is laying the groundwork for a higher-mix portfolio over time. It does not replace the cyclicality embedded in vessel orders, but it meaningfully cushions it, potentially improving margin durability through the cycle. Meanwhile, the removal of U.S. project bottlenecks and fresh liquefaction commitments have extended visibility well into the latter part of the decade, suggesting this surge is not a spike but a structural plateau at a higher level.

The equity remains caught between investors worried about ‘peak LNG’ and those recognising that the capex pipeline still has years to run globally. For now, consistent execution, conservative balance sheet management and steady guidance upgrades are doing the talking.

Over time, the story becomes simpler: if the world keeps building LNG capacity to bridge the transition to renewables, and all current policy signals suggest it will, GTT stands near the front of that value chain with scarce technology, strong pricing power and growing service relevance.

Prosegur (PSG Spain): steady execution while macro crosswinds shift the narrative

Prosegur is one of those quietly emerging-markets operators where the story rarely feels spectacular quarter to quarter, yet the long-term levers keep compounding.

The latest update shows that pattern again: steady organic progress, even if the headlines look softer than earlier in the year on FX and a cooler Latin American backdrop. Organic sales were up mid-single digits in the quarter, with security and alarms again proving the most persistent contributors and newer tech-enabled offerings (cybersecurity and bank services) showing accelerating traction.

The strategy at work: gradually dial down the dependency on cash logistics cycles and rebuild the growth profile around security tech and recurring digital services. In markets like Argentina, where it earns a meaningful portion of profit, regulatory cleanup and falling sovereign spreads are creating a structurally healthier operating environment than the chaotic backdrop investors had priced in a year ago.

Profit dynamics tell a similar story. EBITDA slipped a touch as FX and cost programs weighed, and there was a one-off charge in the cash division that distorted margin optics. But stripping that out and profitability effectively held flat despite softer reported sales; a decent outcome when you consider the inflationary and political noise in key geographies. Net income even grew double-digits, helped by easing financing costs.

Leverage remains anchored a little above 2x, steady versus last quarter, and the balance sheet feels sensible for a business juggling several investment cycles at once. The operating philosophy here remains measured: keep improving mix, lean into technology-adjacent adjacencies, protect pricing where possible, and ride the normalisation of monetary and political regimes in core Latin American markets.

The valuation case hinges on whether investors eventually price Prosegur as a structurally improved operator rather than a volatile LatAm macro proxy. Right now, shares still trade at a discount to global security peers and below where regional sentiment might justify, particularly with sovereign spreads in Argentina compressing sharply from extreme levels. The market still wants to see consistent organic performance and less reliance on cash-cycle dynamics (understandably) but the path is being built in that direction.

If the company continues compounding in alarms, cybersecurity and bank services while cash logistics stabilises into a more predictable earnings contributor, this could gradually re-rate to ‘operational compounder’.

SCOR (SCR France): solid underlying engine in reinsurance despite headline jitters

Beneath all the noise, the group delivered a fundamentally strong performance in its core property-and-casualty franchise, where underwriting discipline and improved pricing continue to show through.

Reported net profit was solid, helped by contained tax effects, and the combined ratio sat comfortably in the mid-80s range once you normalise for voluntary reserve strengthening and a quirky quarter in man-made losses. Natural catastrophe load was again unusually light, which always raises debate around sustainability, but even adjusting for that, the run-rate profitability signals resilience rather than fragility. Life reinsurance was slightly softer than hoped, but the carrier has been explicit about prioritising risk prudence over short-term optics, a stance long-term investors should appreciate in a regulatory and solvency-sensitive sector.

Capital remained robust with the solvency ratio north of 200%, broadly steady even after a slower contribution from market movements and some seasonal capital absorption. That matters because sentiment around European reinsurers often hinges on capital buffers and optionality.

While the quarter confirmed there’s no immediate catalyst for buybacks (something parts of the market had speculated on) the equity story here remains about maintaining an attractive yield and compounding book value through disciplined underwriting. Pricing tailwinds in P&C have not disappeared, and the industry retains bargaining power after several years of repricing cycles. SCOR’s ability to grow with discipline in that context still looks intact, even if quarterly datapoints sometimes cloud that view.

SCOR screens attractively valued, trading at levels that arguably over-discount cyclical fears and under-recognise the sustainability of earnings quality. Markets hate uncertainty around reserve releases and man-made losses, but this quarter showed nothing structurally alarming; more a normalisation after exceptionally benign conditions earlier in the year.

If SCOR keeps delivering mid-teens underlying returns with a capital ratio comfortably above regulatory comfort levels, it’s hard to justify the current discount to larger European reinsurers. Investor patience is required.

Adtran (ADTN US): recovery underway, but still proving durability in demand cycle

Adtran’s quarter continues the theme of a telecom equipment vendor gradually lifting itself off the bottom of a long industry digestion cycle.

Revenue grew well year-on-year, aided by normalising carrier capex patterns and improving traction in fibre and data-center-related deployments. Margins crept higher again as operating leverage from cost programs and mix helped, and non-GAAP profitability has clearly turned a corner even if the journey remains uneven. The company’s network solutions arm (its core economic business) saw healthy demand across both traditional broadband rollouts and newer AI-adjacent network upgrades, while services ticked along in a more modest fashion. For a sector still balancing vendor consolidation, geopolitical supplier rotation and sporadic (large) investments, this performance reflects genuine recovery momentum.

Management guided for sequential moderation in the next quarter after two strong periods, reminding investors that large carrier procurement remains lumpy and inventory digestion isn’t fully behind the industry everywhere. Adtran still needs to prove that this nascent upturn can translate into sustained free-cash-flow consistency; historically a sticking point when working capital swings accompany hardware cycles. Leverage isn’t problematic, and cost actions have cleaned up the P&L, but the business still operates in a competitive, capital-intense, partner-dependent ecosystem where timing matters. Recovery yes, smooth trajectory no.

Valuation sits somewhere between ‘option on a multi-year fibre and AI-network expansion cycle’ and ‘show me sustained margins first’. If mid-single-digit EBIT margins can hold while revenue compounding continues, particularly via higher-value software-enabled network features and customer concentration reduces, the stock has room to re-rate.

But this remains a name where investors will want to see consecutive quarters of improvement and clearer cash dynamics before assigning a premium narrative. For now, the story is improving, but it’s still in the convincing phase.

Nemetschek (NEM Germany): business remains noisy

Nemetschek keeps reminding the market why vertical software with a true mission-critical footprint behaves differently from the rest of tech.

The company delivered another strong quarter, clearing top-line expectations with ~20% constant-currency growth and particularly powerful execution in its Build segment (the unit the engine tied most directly to digitisation of construction workflows). Even with a slightly slower cadence versus peak quarters, subscription revenues kept compounding at a high-40s pace and the mix shift away from licences continues to reshape quality of earnings. ARR growth in the mid-20s reinforces the stickiness of the model, and while Design growth moderated a touch as upfront multi-year licenses normalise, it still posted mid-teens expansion that outpaces the broader AEC software landscape.

The subscription transition is not just happening, it’s delivering margin and cash conversion upside faster than many expected, as shown by EBITDA margin above 32% and free cash flow conversion north of 100%, which is not common in a still-transitioning model. Build’s performance confirms that digitisation in construction remains structurally underpenetrated, especially in small and mid-sized contractor workflows, and Nemetschek is capturing that shift without compromising unit economics.

Management reiterated guidance for ~20–22% revenue growth and ~31% EBITDA margins, implying little anxiety about demand trends into year-end even as Europe’s real-estate market remains patchy. Investors will keep looking toward U.S. commentary, especially given cyclical softness in new build starts, but the cadence in ARR and subscription share suggests the subscription model is absorbing macro volatility rather than amplifying it. Meanwhile, the strategic AI narrative is emerging thoughtfully, i.c. less hype, more integrated workflow efficiency.

The market correction reset expectations and brought valuation back to a level where quality growth is attractive again. Nemetschek still trades at a premium to generalist software names, but for a company compounding double-digit top line with expanding recurring revenue and strong cash conversion, it fits squarely in the European high-quality compounder bucket.

With Build momentum running ahead of internal plans and the transition nearing its mature inflection, the next phase is about operational leverage and international expansion rather than subscription drag. It’s not immune to construction cycle noise, but the business model (and the pace of execution) make it more secular at this point.

AT&S (ATS Austria): operational beat meets a capital-intensity hangover

AT&S’ latest print delivered another reminder that operational beats don’t always shift equity narratives when balance-sheet and cycle questions loom large.

Revenue held up modestly year-on-year and improved sequentially, with volume strength offsetting pricing and FX pressure in high-end PCB and IC substrates. EBITDA margins surprised positively at over 23%, helped by utilisation and mix as AI-driven data-center demand and high-performance compute substrates continue to provide tailwinds. The multi-year capex cycle is starting to show operating leverage, with Kulim ramping and end-device markets like notebooks and smartphones showing incremental signs of recovery. Management nudged EBITDA expectations higher for the year, signaling confidence in the earnings power as advanced packaging demand remains robust across hyperscale and semiconductor customers.

But the equity debate remains dominated by financing needs and capital intensity. The company reiterated heavy capex again this year and continues to guide to a steep revenue ramp into fiscal 2027, yet leverage optics and liquidity concerns linger, especially with guidance implying positive EBIT and FCF only at the operating-level for now. A roughly €1bn estimated funding gap over the coming years keeps risk premia high, and the recent share price surge (almost doubling since prior results) leaves little room for execution hiccups.

Investors recognize AT&S sits on the right side of structural semiconductor trends, AI server demand, advanced substrate penetration, diversification beyond mobile, but the capex overhang remains the primary valuation anchor. With the stock now trading above historical multiples and discounting a seamless execution curve, the risk-reward feels less asymmetrically attractive than the technology positioning suggests.

Strategically, AT&S sits in a compelling niche of the semiconductor supply chain, with enviable customer ties and exposure to the highest-growth silicon layers. Yet the financial profile still reflects a capital-hungry expansion that demands normalized profitability and consistent cash generation before the market will treat it like a structural AI beneficiary rather than a leveraged capex story.

The bull case is simple, i.c. scale into substrate leadership just as AI demand explodes, but the balance-sheet bridge needs more clarity before investors can simply underwrite the earnings glide path.

Geberit (GEBN Switzerland): residential stabilizes

Geberit delivered another reliably solid quarter, leaning into its reputation as one of Europe’s most defensive building-products names.

Organic growth of roughly mid-single digits again beat peers and consensus, proving that plumbing systems continue to behave more like essential infrastructure than discretionary building materials. Germany, its anchor market, remained resilient with mid-single-digit growth, while smaller European markets showed encouraging momentum as the worst of the residential slowdown seems to be passing. The uplift was broad-based across installation and piping systems, with product innovation like the upgraded Duofix line adding incremental pricing and share gain tailwinds. Even with continued cost inflation and the temporary drag from plant consolidation in Wesel, EBITDA margins north of 30% underscored manufacturing discipline and premium positioning.

This is a slow-and-steady story, but an important one: in a construction environment still dealing with high rates and patchy demand, Geberit continues to print free cash flow at scale (over CHF 450m this quarter) while lifting full-year growth guidance. Pricing remained positive, inventory dynamics look clean, and the mix continues skewing toward higher-margin installation systems, reinforcing the company’s premium pricing power and spec-in advantages. With minimal exposure to structurally tougher end markets like the U.S. and China, Geberit remains shielded from global construction volatility and can lean on its renovation bias as activity gradually normalizes across Europe.

Valuation reflects a quality premium, but in a European building materials universe where many peers are cycling flat-to-negative volumes, Geberit’s consistency merits the differential. The market rarely pays up for boring resilience during exuberant cycles, but in a higher-for-longer rate backdrop, boring looks more attractive, especially with strong cash returns.

The company is well placed to continue compounding quietly, supported by innovation, distribution depth, and a balance sheet built for downturns.

Evonik Industries (EVK Germany): cash discipline steadies the ship in a sluggish chemical cycle

Evonik’s third-quarter update captured the broader malaise running through Europe’s chemical sector: weak volumes, resilient but flat pricing, and a market still struggling to find direction after an extended period of destocking.

The company’s EBITDA landed squarely within its pre-announced range, confirming that the profit warning in late September had already done most of the damage. Revenue softness reflected subdued industrial demand across both Europe and Asia, particularly in Custom Solutions, where lower volumes weighed despite disciplined pricing. Advanced Technologies, meanwhile, continued to feel the impact of maintenance work and softer end-markets, though management expects Animal Nutrition to rebound into the year-end.

What stood out most this quarter, however, was operational cash flow: after a weak first half, Evonik managed a sharp catch-up, delivering one of its strongest cash conversion performances in recent quarters. That rebound was key, not only to reassure on dividend coverage but also to restore confidence that the company can navigate a prolonged demand trough without sacrificing financial resilience.

The story remains one of careful balance. Evonik is protecting price and safeguarding margins in an environment where volume growth is simply not available. The emphasis has clearly shifted from chasing expansion to defending profitability, and the results suggest that strategy is holding.

The company confirmed its full-year revenue target and reiterated its reduced margin outlook, effectively drawing a line under this year’s reset. Management continues to focus on working capital discipline and capex restraint, which helped drive the Q3 free cash flow improvement despite lower earnings. The maintenance impact in Advanced Technologies should fade in Q4, while seasonal strength in Health Care and better utilization in animal feed chemicals may offer some relief on the margin front. Although the full-year EBITDA will be down meaningfully from the prior cycle, Evonik’s ability to sustain cash generation in a depressed market shows a more robust cost structure than investors gave it credit for earlier in the year.

The broader context remains challenging. European specialty chemicals players are grappling with weak construction demand, hesitant industrial activity, and high energy costs, and Evonik is no exception. Yet its steady pricing discipline, improving free cash flow, and clear dividend visibility provide an anchor for investors in a sector still searching for stability. The portfolio’s diversity (spanning additives, nutrition, and specialty materials) offers some insulation from cyclical extremes, and the company’s financial flexibility leaves room for recovery when global industrial demand picks up again.

In that sense, Evonik is pacing itself prudently, consolidating its operational base, and preserving balance sheet strength. When the tide finally turns, the groundwork laid in this subdued phase should translate into faster operational leverage, a reminder that patience in chemicals often pays best when the market’s pessimism runs deepest.

Coloplast (COLOB Denmark): a steady close to the year as growth normalizes

After a year defined by operational challenges and uneven demand across product lines, the company managed to close 2025 with a reassuringly solid set of results.

Organic revenue growth of 7% showed that underlying demand for Coloplast’s core products remains healthy, even as reported figures were muted by currency and comparison effects. The performance was balanced across segments, with particularly strong showings in Ostomy Care and Continence Care, both of which benefited from successful new product launches and steady European demand. Voice & Respiratory Care also continued to grow in the high single digits, reinforcing its position as a stable, cash-generative pillar of the group. The main soft spot remained Wound & Tissue Repair, where weakness in the legacy wound care business offset the impressive 20% growth from Kerecis.

Taken together, the quarter demonstrated that Coloplast’s growth potential remains intact, though still constrained by pockets of underperformance.

The EBIT margin held up better than expected, landing close to 25% despite headwinds from cost inflation and product mix. This reflects disciplined cost control and gradual benefits from efficiency measures implemented earlier in the year. Importantly, the company’s ability to sustain such margins while investing in innovation and capacity expansion underscores the strength of its business model.

Coloplast continues to balance short-term margin pressures with the need to reinvest in growth categories, notably in the Luja and SenSura Mio product lines, which have driven much of the recent momentum. Regional performance was equally steady, with Europe leading the charge and the U.S. providing incremental growth, while other regions are contributing more meaningfully as distribution networks deepen.

After a year of macro uncertainty and sporadic operational disruptions, we could be seeing the early innings of confidence restoring that Coloplast can deliver predictable, mid-single-digit growth (without sacrificing profitability). The 2026 guidance, around 7% organic growth and a roughly 28% EBIT margin, signals continuity, which is exactly what investors wanted to see. The phasing out of certain headwinds, such as supply-chain costs and integration drag, should allow for smoother performance next year, while modest gains in pricing and mix should support margin stability.

What Coloplast now faces is a return to normalcy: less volatility, fewer one-offs, and a focus on leveraging its leading positions across chronic care markets. The company’s predictable cash flow profile, premium product portfolio, and solid execution remain its key strengths. Growth may not be spectacular, but it’s sustainable.

BioNTech SE (BNTX Germany): a measured pivot as oncology takes center stage

BioNTech’s latest quarterly update shows a company that has moved into the next phase of its evolution, not driven by vaccines but by oncology.

The third-quarter results showed stronger-than-expected revenue, largely due to milestone and collaboration payments from Bristol Myers Squibb, and marked another step in the transition from a Covid-era cash generator to a diversified biotech platform. While BioNTech still reported a modest quarterly loss, the operational picture is one of control and clarity: costs are contained, liquidity is immense, and the funding base for its clinical ambitions remains intact.

The group continues to manage the decline of its vaccine franchise strategically, using it as a financial bridge to fund a deep and expanding oncology pipeline. With €16.7 billion in cash and near-term inflows secured from its new BMS alliance, BioNTech has the rare luxury of pursuing multiple large-scale oncology programs simultaneously without resorting to external financing.

The partnership with BMS marks an inflection point in that pivot. Pumitamig, a bispecific antibody targeting PD-L1 and VEGF-A, has shown promising efficacy data in early trials for small cell lung cancer and is set to advance rapidly into pivotal studies for colorectal and gastric cancers. The molecule is designed to act as a backbone therapy across tumor types, reinforcing BioNTech’s strategy to focus on pan-tumor immunomodulation platforms rather than isolated indications.

Meanwhile, its mRNA-based FixVac and iNeST programs are beginning to demonstrate proof of concept in melanoma, offering evidence of T-cell activation and durability that align with BioNTech’s long-term vision for personalized immunotherapies. These programs are still early, but they are starting to deliver the clinical validation that investors have been waiting for since the company reallocated its Covid windfall into oncology.

For investors, the key question is timing: when does this scientific progress translate into commercial momentum? Management’s upgraded full-year guidance suggests a smoother financial transition than feared, even as the Covid franchise continues to fade. Revenue from collaborations and licensing already provides meaningful ballast, and R&D spending is rising in a deliberate, measured way rather than exploding.

The company’s trajectory now hinges more on the clinical cadence of its oncology programs. BioNTech’s challenge is to convert its scientific edge into predictable value creation, but its positioning is enviable: capital-rich, technically sophisticated, and increasingly diversified.

Atrys Health (ATRY Spain): shedding weight to refocus on precision medicine

Atrys Health’s next strategic step could redefine its trajectory. The board is currently reviewing multiple offers for its occupational risk prevention division, a mature but capital-intensive unit that has long been a cash contributor without matching the growth potential of the company’s healthcare core.

The Prevention business, acquired in 2021, accounts for more than a third of group EBITDA, but it operates in a stable, low-growth environment serving tens of thousands of corporate clients with occupational health and safety programs. Its 210 care centers and extensive training network make it an operationally solid but strategically peripheral piece of the Atrys portfolio.

Recent press reports suggest that Echevarne, a private Spanish diagnostics player, has emerged as a likely buyer. Whether or not the final valuation matches the 2021 acquisition price, the logic of the transaction is clear: monetizing a mature, cash-generative asset to restore balance sheet flexibility and refocus the group around its higher-margin precision medicine platform.

The financial impact of such a divestment would be immediate and transformative. Atrys has been operating under the weight of a relatively high debt load; net leverage near 3.5x and a looming maturity in 2029 that limits strategic room to maneuver. Proceeds from a sale, even at a discount to the 2021 purchase price, would likely eliminate the group’s debt constraints in one move.

More importantly, it would free up capital for expansion in oncology diagnostics, radiotherapy, telemedicine, and pathology; areas that sit at the intersection of technology and personalized care, and where Atrys has already shown strong momentum. These are businesses with structural tailwinds: aging populations, rising demand for outpatient diagnostics, and the continued shift toward digital and molecular approaches in clinical decision-making. The company’s recent operational performance, showing steady organic growth and margin improvement, supports the case for doubling down on these higher-growth segments.

If the sale proceeds, Atrys would effectively swap a low-growth, regulatory-heavy business for the flexibility to scale its precision medicine operations across Europe and Latin America. It would also mark a milestone in its transition from a diversified healthcare services company to a more focused medical technology and diagnostics specialist. In a sector where scale and specialization increasingly determine survival, that shift could make Atrys both leaner and more attractive, not only to investors but potentially to larger strategic buyers looking for exposure to high-value clinical niches.

For now, the market’s attention will be on the price tag attached to the Prevention sale, but the broader takeaway is strategic clarity. Atrys appears ready to leave its legacy businesses behind and concentrate on where its competitive advantage truly lies: data-driven, technology-enabled precision care.

If you appreciate this post, feel free to share and subscribe below!