Jewelry, soccer and music boxes

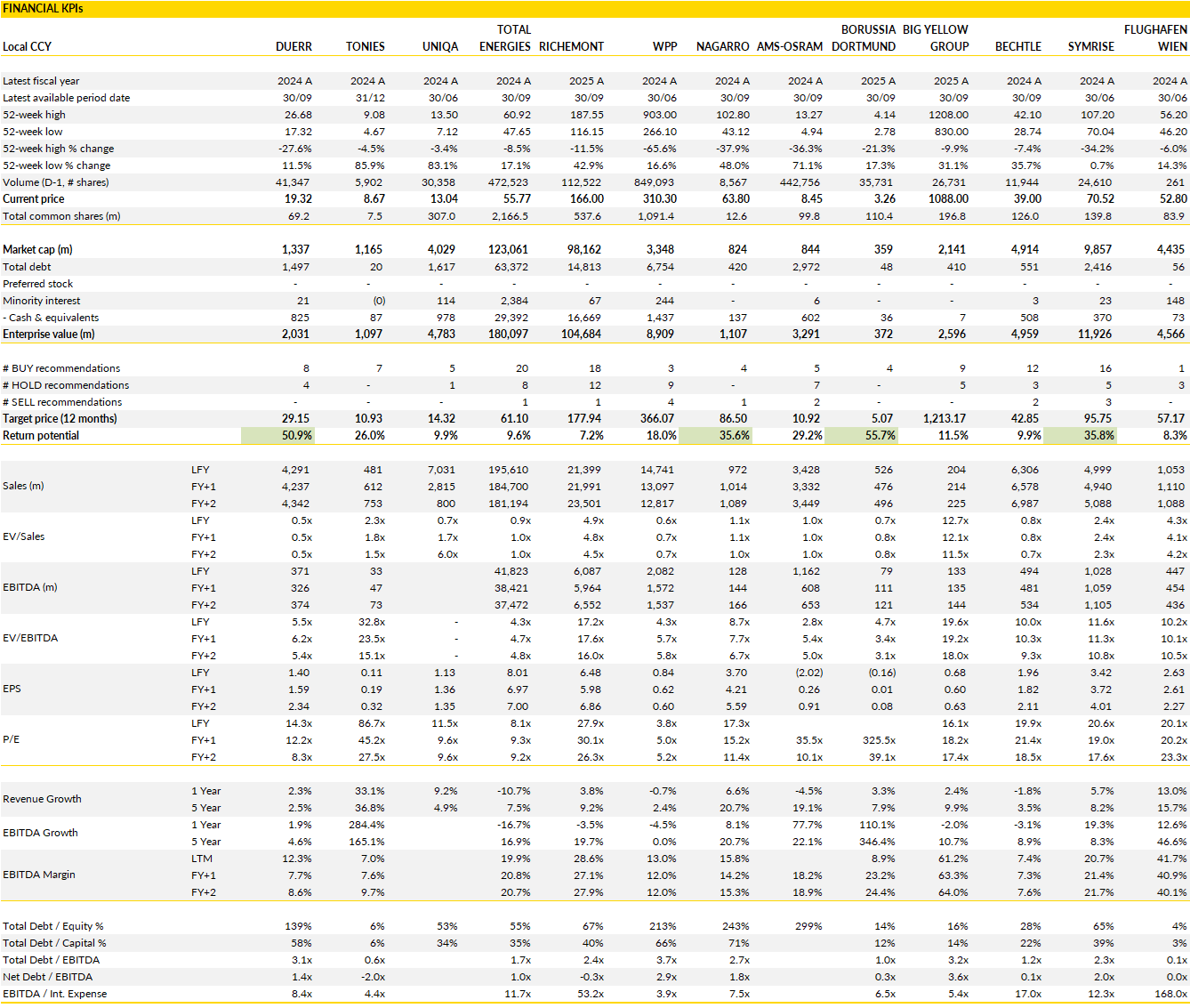

Dürr, Tonies, UNIQA Insurance Group, TotalEnergies, Richemont, WPP, Nagarro, ams-OSRAM, Borussia Dortmund, Big Yellow Group, Bechtle, Symrise, Flughafen Wien

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

Financial KPIs

Dürr (DUE Germany): efficiency lifts earnings, but order weakness clouds the story

Dürr’s recent results looked solid on paper, margins improved, earnings beat expectations, and cost control was visible across the group, yet the picture remains fragile.

The company continues to execute on its restructuring program, with headcount reductions and leaner overheads delivering tangible benefits. That explains the better-than-expected profitability in Q3, though much of it also reflects easy comparisons from last year’s soft base.

The real issue lies in the order book. Automotive Systems, long the core engine of the business, saw order intake fall nearly 50% year-on-year to just €310 million, while the group’s book-to-bill ratio slid to a worrying 0.73x. That signals a revenue air pocket coming into 2026 unless new projects materialize quickly. Management insists that larger contracts are in advanced negotiation stages, but visibility remains thin, and investors have heard similar reassurances before. Even if Dürr meets the low end of its full-year order target, it would end the year with a ratio below one, an uncomfortable setup for a company whose business depends heavily on forward project flow.

The other challenge is that Dürr’s cost-driven recovery may have already done most of the heavy lifting. The company’s 2025 margin expansion (up roughly 60 basis points) is being achieved mainly through savings rather than stronger volumes, and the growth outlook for next year has been trimmed sharply. Automotive remains structurally challenged, particularly in Europe, where OEM investment discipline is intense. The Woodworking division, about four-fifths exposed to the sluggish furniture market, shows few signs of near-term acceleration despite solid construction-related demand. Industrial Automation, by contrast, could enjoy a modest tailwind if manufacturing stimulus measures gain traction in 2026, but that’s unlikely to offset weakness elsewhere.

The net result is a company keeping its profitability intact through discipline and cost control, but with little evidence yet of a growth rebound on the horizon.

Dürr sits between two cycles: still working through the late-stage benefits of its restructuring while waiting for capex momentum to reappear in its end markets. Its financial position and operational execution are sound, there’s no crisis here, but the top-line drag and thin visibility on order recovery limit re-rating potential.

Until automotive orders stabilize and Woodworking finds its footing again, cost savings alone are not enough to rekindle excitement.

Tonies (TNIE Germany): turning up the volume as Toniebox 2 powers a festive surge

Last week tonies delivered another upbeat quarter, showing that its playful model of storytelling boxes and collectible figurines continues to resonate far beyond its DACH roots.

The Q3 release reflected strong double-digit growth across all regions, with North America and the rest of the world the standout performers, expanding nearly 50% and over 80% respectively. Much of that came from the successful launch of the Toniebox 2, which triggered retailer restocking ahead of the key holiday season. Even as sales momentum accelerated, management refrained from upgrading full-year guidance, noting that the third-quarter strength was partly a phasing effect.

Still, the numbers suggest ample headroom for consensus upgrades: Q4 is expected to contribute roughly half of the year’s sales, a pattern that underscores how central the Christmas period has become to tonies’ growth narrative. With product range expansion and brand visibility both intensifying, the company enters its busiest quarter with clear momentum and unusually strong visibility on demand.

Under the surface, tonies’ operating model is quietly maturing. The company’s focus has shifted from top-line expansion at all costs toward driving operating leverage and profitability, a message reinforced by the upgraded EBITDA forecast. Gross margin stability, coupled with disciplined marketing spend, has set the stage for a meaningful step-up in earnings quality. Even with inventory build-up weighing temporarily on free cash flow, management sees this as a strategic move to fuel growth into 2026.

The resilience of demand in core European markets, together with the deepening penetration in the US and a still-nascent international footprint, suggests tonies is now entering the scale phase of its business model, where brand equity and recurring engagement become self-reinforcing. The expanded figurine ecosystem, increasingly tied to digital and licensing partnerships, adds a layer of optionality that could push average revenue per user higher over time.

Looking beyond this holiday season, tonies’ growth engine appears well-tuned for the mid-term. The Toniebox 2 is proving to be more than just an incremental upgrade: it is reinvigorating the user base, drawing in new households, and opening room for higher-margin accessories and content.

The brand continues to defy consumer slowdown concerns, supported by strong recognition and parent-friendly positioning. Execution will be key in maintaining this pace, particularly in the competitive US market, but the trajectory looks encouraging.

With margins set to expand as scale kicks in, tonies combines category leadership, operating leverage, and brand stickiness in a way few European consumer tech names do. A vibrant Q4 should confirm that the company’s growth story is intact.

UNIQA Insurance Group (UQA Austria): steady execution in CEE keeps the story compounding

UNIQA has quietly become one of the more reliable compounders in Central and Eastern Europe’s insurance landscape, a regional niche player that continues to post steady growth, disciplined underwriting, and an improving capital profile.

The company’s latest updates confirm that its 2025–2028 strategic plan is on track, with profitability in non-life lines trending higher and strong momentum in health insurance in its home market of Austria. That combination gives UNIQA a mix of predictable core earnings and exposure to higher-growth markets, which helps it stand out in a sector still dealing with macro headwinds. Management’s current plan calls for around 5% annual premium growth and a return on equity above 12%, yet recent trends suggest it can do better. With claims discipline, tight cost control, and benign weather losses, the group looks capable of pushing its combined ratio below 94% and delivering a more robust 8% compound annual EPS growth rate, ahead of peers in the Austria and CEE region.

Capital strength remains one of UNIQA’s key strategic levers. With a Solvency II ratio well above 280%, the balance sheet offers flexibility that few mid-sized insurers can match. The recent redemption of subordinated debt barely dented that cushion, leaving the company with what looks like excess capital in the range of several hundred million euros. While management has not yet committed to returning that surplus, the mathematics argue in favour of shareholder distribution rather than idle balance sheet strength, particularly given the company’s steady earnings generation and limited near-term appetite for acquisitions.

The dividend policy, targeting a 50–60% payout ratio, already makes the stock one of the more attractive income stories in the region, with yields around 6–7% comfortably above the European insurance average. UNIQA’s roughly 15% stake in construction group Strabag also adds a layer of optionality, though this remains more a balance-sheet asset than a strategic driver.

The investment story today hinges on continued consistency. UNIQA is proving that its geographic positioning in the CEE markets, where penetration rates and income levels still have room to converge with Western Europe, gives it a structural growth tailwind that offsets the slower maturity of its domestic Austrian base. Its operational improvements, particularly in digital infrastructure and claims efficiency, are helping lift profitability without requiring top-line heroics.

That mix of modest growth, capital discipline, and strong yield creates a resilient total-return profile in an uncertain market. The shares have rallied sharply this year, but with execution momentum intact and capital deployment optionality still underappreciated, UNIQA’s story remains one of credible compounding.

TotalEnergies (TTE France): powering up Europe’s grid with a bold move into flexible generation

TotalEnergies’ latest €5.1 billion deal marks another decisive step in its reinvention from an oil major into an integrated energy company.

By taking a 50% stake in a 14 GW portfolio of gas and renewable assets from EPH, the group instantly scales its European electricity footprint, and crucially, strengthens its position in flexible power generation at a time when balancing renewable intermittency is becoming a strategic priority. The acquisition covers plants in Italy, the UK, the Netherlands, and France, all markets with supportive pricing and strong interconnection dynamics. These assets slot neatly alongside TotalEnergies’ existing 35 GW of generation, pushing it closer to its 2030 goal of around 100 GW of installed capacity. Roughly one-fifth of the newly acquired portfolio consists of renewables, but the greater value lies in the combined-cycle gas turbines (CCGTs), which will help stabilize the company’s expanding renewable load while providing an additional outlet for its LNG volumes.

With this move, TotalEnergies leapfrogs to become Europe’s third-largest CCGT operator, a milestone that underscores how aggressively it is positioning itself for a decarbonizing but still energy-hungry continent.

Financially, the acquisition looks smart. The €10.6 billion enterprise value equates to an EV/EBITDA multiple of roughly 7.6x, in line with peers and well below the cost of developing new capacity from scratch. TotalEnergies’ decision to fund the €5.1 billion equity contribution through newly issued shares (about 4% dilution) keeps leverage steady, while the expected $750 million in annual cash flow more than offsets the incremental dividend outlay. In parallel, the company trimmed its annual capex guidance by $1 billion, signaling that part of the deal’s value lies in capital efficiency.

The integrated logic seems clear: secure affordable generation assets that accelerate the profitability of the iPower division while reinforcing LNG monetization. Management expects this to bring the power business to positive free cash flow a year earlier than planned, and to lift its return on capital above 12%, i.c. exceptional for a sector still viewed as low-return compared to oil and gas.

Beyond the numbers, the acquisition cements TotalEnergies’ claim as the European energy major most willing to walk the talk on diversification. While rivals have either slowed or reversed their renewables push, TotalEnergies continues to blend scale and pragmatism, anchoring its low-carbon growth in infrastructure that pays its way. The integration of flexible gas generation with renewable build-out creates a more balanced energy portfolio, and arguably, a more defensible investment case in a volatile commodity environment.

The transaction should also ease investor concerns over capital intensity in the power business and opens optionality for a future spin-off of iPower once profitability stabilizes.

Richemont (CFR Switzerland): jewelry brilliance keeps shining amid tariff clouds

Richemont’s first-half results reaffirm why its jewelry houses remain among the crown jewels of global luxury.

Cartier and Van Cleef & Arpels continue to drive the group’s story, holding pricing power and consumer appeal even as the broader luxury cycle normalizes. Group revenues rose solidly, led by 17% growth in Jewelry Maisons during Q2, confirming that Richemont’s mix of timeless design and brand heritage remains an unmatched moat. Margins also held up remarkably well: despite rising gold prices, a strong franc, and early tariff headwinds in the US, EBIT margin edged higher to 22.2%, supported by robust volumes and cost discipline. The contrast between high-margin jewelry and the more cyclical watch division has rarely been clearer, the latter still recovering from a tough base, but the group’s overall resilience showcases the structural shift in Richemont’s portfolio toward recurring, high-value categories.

Geographically, the picture has turned more balanced again. Asia, after several soft quarters, returned to positive growth with Greater China finally stabilizing and showing renewed strength in Q2, aided by returning tourist flows to Hong Kong and Macao. The Americas remained a bright spot, growing 20% despite tariffs, while Europe and the Middle East continued their steady expansion. That geographic spread gives Richemont flexibility to absorb regional fluctuations, a luxury its smaller peers often lack.

The company also benefited from operational leverage: while gross margin compressed modestly from higher input costs, operating expenses were held flat as a share of revenue, cushioning the impact and underscoring management’s ability to defend profitability without cutting into brand investment. With gold and currency volatility likely to persist, this cost control, paired with unbroken consumer demand, gives Richemont room to maintain its premium positioning through 2026.

The US tariff issue, while headline-grabbing, looks manageable in context. Management guided for a larger H2 hit to earnings (around €250 million versus €50 million in H1), but the strength of the underlying business easily offsets this temporary drag. In fact, the group’s pricing strategy, brand desirability, and balance sheet flexibility suggest that any weakness in one market will be offset elsewhere.

Richemont’s blend of secular growth, margin resilience, and exposure to jewelle’s expanding global demand still offers one of the cleanest stories in luxury. The market’s tendency to discount Richemont relative to LVMH seems increasingly hard to justify. As the company continues to execute, its consistency may earn it the re-rating it deserves.

WPP (WPP UK): a takeover rumor that makes strategic sense but remains hard to execute

The notion of WPP becoming a takeover target has been circulating for years, but the latest round of speculation, involving Havas alongside private equity giants KKR and Apollo, feels more credible than most.

On paper, WPP’s profile is almost textbook for a leveraged buyout: a depressed valuation, full free float, strong cash generation, and a share price down sharply over the past year. With a market capitalization hovering near £3.5 billion and trading at barely 5x 2026 earnings, it is no surprise the group is attracting attention.

Yet the story is not as simple as “cheap equals buyable.” The real complexity lies in the company’s structure, i.c. a sprawling portfolio of creative, media, and PR agencies that require substantial restructuring and integration to unlock value. Media, which contributes roughly 40% of net revenue, remains a relatively clean, scalable business with attractive margins. But creative operations, nearly as large a share, are struggling with secular headwinds, client fragmentation, and overlapping costs. Any buyer would face a long and expensive cleanup job before extracting synergies.

Private equity interest in the marketing and communications sector has precedent. Bain’s acquisition of 60% of Kantar (ironically, from WPP itself) and KKR’s recent move into agency networks show that investors see opportunities to streamline legacy structures and push digital transformation. In that sense, WPP’s current state (under-earning, under-loved, and asset-rich) fits the mould. For KKR or Apollo, the rationale would be to buy the group at distressed valuations, separate its higher-quality components, and gradually divest non-core businesses.

Havas’s reported involvement adds another dimension. The French group, itself part of Vivendi, could use WPP’s scale in media buying, particularly in the US, where Havas lacks critical mass, to close its competitive gap with Omnicom and GroupM. A joint bid between a strategic player like Havas and financial sponsors could make sense: private equity handles the carve-out and restructuring, while Havas cherry-picks assets that complement its portfolio.

Still, execution risk looms large. Breaking up WPP would require complex negotiations with hundreds of subsidiaries, clients, and local markets, not to mention regulatory and cultural hurdles. The company has already been through years of reorganization, and another ownership upheaval could unsettle both staff and clients.

For now, the speculation acts mainly as a psychological floor under the stock, preventing further capitulation in a year that has seen sentiment collapse across traditional agency groups. Whether or not a formal bid materializes, the attention itself highlights WPP’s predicament: a global leader struggling to prove its relevance in a digital-first world, now potentially more valuable as a collection of parts than as a whole.

Nagarro (NA9 Germany): momentum returns as digital demand and margin discipline align

Nagarro’s latest quarterly update marks another important step in its recovery story. After a subdued 2024, the digital engineering specialist has clearly regained its footing, delivering organic growth of over 8% in Q3 (twice the pace seen earlier this year) with all major regions contributing.

North America and Central Europe, which together make up the company’s core markets, showed broad-based improvement, while Asia and the Rest of World swung back to double-digit growth. Sector dynamics are also moving in Nagarro’s favour: the once-weak Horizontal Tech segment is stabilising, Life Sciences has returned to expansion, and the group’s industrial client base remains a consistent outperformer, benefiting from its offshore delivery model and tight operational control. This geographical and sectoral breadth, long one of Nagarro’s defining traits, is again visible in its numbers, as both top-line growth and profitability strengthen in tandem.

What sets this quarter apart is that Nagarro finally managed to translate growth into clean margin improvement. The EBITDA margin rose to 17.3%, up three points year-on-year and well above expectations, as the company optimised resource utilisation and improved gross margins. Management sounded increasingly confident on the earnings call, noting that while the global IT services environment remains “soft,” client behaviour is becoming more predictable. Companies are gradually reactivating projects around AI and digital transformation, no longer paralysed by macro or geopolitical uncertainty. Nagarro’s management sees especially strong potential in Asia, with Japan emerging as a growth frontier, and reaffirmed its ambition to push EBITDA margins toward 18% over the medium term. This mix of renewed demand visibility and disciplined execution marks a clear shift from the volatility that clouded its 2023–2024 period.

Despite the share’s sharp rebound following the release, Nagarro still trades at what looks like an unjustified discount to peers. Even with growth forecasts nudged higher and the planned cancellation of over 6% of its share capital, a tangible signal of balance sheet strength and shareholder focus, the valuation remains well below comparable European IT service names.

The market may still be discounting the group’s chequered trading history and inconsistent communication in past years, but the underlying story is one of normalisation: a high-quality digital engineering player steadily restoring growth, governance, and confidence. With demand stabilising, AI-related opportunities broadening, and management credibility improving, Nagarro looks increasingly well positioned for a sustained re-rating as investors regain trust in its execution.

ams-OSRAM (AMS Switzerland): fragile progress masked by a demanding cash flow narrative

ams OSRAM’s third-quarter results offered a glimmer of operational progress but also reinforced the market’s unease about the pace of recovery and the group’s financial flexibility.

Revenue of €853 million came in marginally above market expectations, reflecting seasonal strength in automotive lighting and solid semiconductor sales, though still down year-on-year as currency headwinds and portfolio pruning weighed. Profitability metrics looked decent (an EBIT margin of 11% stood well above forecasts) yet the story remains one of gradual recovery. Gross margin softness and subdued top-line growth highlight that the demand environment, particularly in automotive and industrial markets, remains far from robust. The company’s steady cost control and focus on high-value semiconductor content are stabilizing margins, but the rebound narrative is still more tactical than structural.

The main issue now shifts to guidance and balance sheet visibility. Management’s Q4 outlook implies a pullback in EBITDA, roughly 15% below market expectations, suggesting that recovery in key end-markets will stay sluggish through the end of the year. While automotive lamps and sensor content continue to provide some cushion, volume normalization remains slow and pricing power limited.

The free cash flow ambition for 2025 (to exceed €100 million) looks particularly challenging. With only minimal cash generation over the first nine months, the entire target now hinges on a single quarter, one likely supported by inflows from government incentives such as the European Chips Act rather than organic business performance. This dynamic underscores why investor confidence remains brittle: despite operational discipline, ams OSRAM still faces a structurally heavy capital intensity and working capital drag that make sustained free cash flow generation elusive.

Beyond quarterly mechanics, the balance sheet remains a lingering concern. Net debt sits near €2 billion, and potential obligations from OSRAM minority shareholder puts, estimated at over €500 million, could materially strain liquidity if exercised in full. Refinancing needs extending toward 2027 add another layer of uncertainty at a time when interest rates and credit spreads remain elevated for leveraged industrial names.

While management’s tone is cautiously optimistic, the gap between modest operational improvement and the scale of the financial challenge is difficult to ignore. In short, ams OSRAM is showing incremental progress in execution, but the structural headwinds, i.c. sluggish end-markets, capital intensity, and a still-fragile balance sheet, justify continued caution.

Until cash flow visibility improves beyond accounting optimism, the stock’s discount will remain.

Borussia Dortmund (BVB Germany): a solid financial kickoff built on transfer windfalls and consistent on-pitch form

Borussia Dortmund’s first quarter of the 2025–26 season highlights the dual nature of its business model: steady, recurring income from core operations complemented by the cyclical but lucrative boost from player trading.

Revenue excluding transfers held broadly flat year-on-year at €107 million, with modest gains in sponsorship and television income offsetting weaker matchday and event revenues, a reflection of fewer home fixtures and the absence of last year’s special events like the testimonial match and UEFA EURO 2024-related income.

The real swing factor came from transfers. Player sales pushed gross transfer proceeds to €68 million, double the prior year’s level and well ahead of expectations. This lift in transactional income, combined with tight cost control, sent EBITDA soaring to €54 million, more than twice the figure a year ago and a clear sign that Dortmund continues to execute well within its hybrid model of sporting ambition and financial discipline.

Beyond the numbers, the revenue mix underscores how Dortmund’s global appeal and consistent European presence continue to underpin stability. Advertising income rose slightly thanks to improved sponsorship terms, notably from Vodafone, and TV marketing revenues jumped nearly 22%, aided by FIFA Club World Cup bonuses and European exposure. Merchandising saw a predictable pullback following last year’s exceptional “Weiße Wiese” jersey campaign, while catering and conference revenues normalized after the one-off benefits from hosting EURO 2024 matches.

The commercial base remains resilient and, crucially, continues to grow in quality rather than just quantity, with more lucrative sponsorships offsetting fluctuations in matchday income. This evolution matters: it positions the club to smooth earnings across seasons that may differ in sporting outcomes.

On the field, Dortmund’s start to the Bundesliga season has been promising. European performance remains competitive too, with progress in the Champions League group stage still within reach, and with it, the prospect of meaningful performance bonuses. The combination of solid sporting execution, disciplined financial management, and renewed transfer-market strength gives BVB a strong platform for the rest of the year.

While volatility in player trading remains inherent to the model, the underlying commercial momentum and consistent continental presence continue to support the long-term narrative of Dortmund as one of Europe’s most sustainably managed clubs, one where sporting success and shareholder value are unusually well aligned.

Big Yellow Group (BYG UK): operational discipline and steady rental growth keep the storage engine running

Big Yellow’s first-half results show a business compounding value through operational execution, despite a softer demand backdrop.

Store revenue rose modestly, up 2% year-on-year, driven by a 4% lift in average net rent per square foot, as the group continued to push pricing ahead of inflation. Occupancy dipped 2.3 points on a like-for-like basis to 78.2%, reflecting broader market caution in consumer and SME storage demand, though management noted an improving trend post-period, with the gap narrowing to 1.6 points. This modest occupancy pressure was more than offset by tight cost control and efficiency gains — a theme running consistently through the update. Store EBITDA rose 5%, helped by a 2% reduction in like-for-like operating costs, largely from energy savings tied to solar and automation investments. Big Yellow’s push toward energy-efficient operations has meaningfully improved margins at a time when many property operators still battle cost inflation.

Financial discipline was equally evident below the line. Adjusted profit before tax rose 9%, supported by falling finance costs, as the group’s blended debt cost dropped to 4.8% from 5.1% a year ago. Roughly 40% of borrowings are fixed, allowing Big Yellow to benefit from recent rate cuts without compromising interest coverage or funding flexibility. Capitalised interest rose to £5.5 million, reflecting the expanding development pipeline, now at 13 active sites plus one replacement, representing about 16% of total capacity. These projects are expected to contribute £36 million of net operating income once stabilised, implying strong incremental returns of roughly 17% on £465 million of total capital spend.

With net debt at just 3.3x EBITDA and a conservative loan-to-value of 14%, the group retains ample balance sheet capacity to fund growth without raising equity. A 5% increase in the interim dividend underscores confidence in cash flow resilience.

Strategically, Big Yellow remains well positioned to capture long-term urban storage demand across its high-barrier London and South East markets. The development pipeline offers visible embedded growth, while the existing portfolio benefits from pricing power and continued cost efficiency gains.

Though short-term investor focus remains coloured by bid speculation from Blackstone, the underlying fundamentals already justify renewed optimism. At a 10+% discount to forward EPRA NTA and with a low double-digit total return profile, the shares look attractively priced even on a standalone basis.

Bechtle (BC8 Germany): steady recovery gains traction as international momentum returns

Bechtle’s recent results mark a clear turning point after a sluggish first half, showing that Europe’s largest IT reseller and systems integrator is regaining operational rhythm.

Group revenue rose just over 5% year-on-year to €1.59 billion, with business volume expanding a more robust 8.4%, highlighting solid underlying demand and the benefit of recent acquisitions. Importantly, organic growth, which had been negative earlier in the year, came in at 6.2%, showing the company’s resilience even as macro headwinds and sluggish enterprise IT spending persist across Europe.

Growth was broad-based geographically, led by strong performances in the Benelux region, Spain, and the UK, while core markets like Germany, France, and Switzerland also returned to positive territory. Profitability held up well, with earnings before tax rising modestly to €80.5 million, keeping margins just above 5%, only slightly below last year’s level despite ongoing cost pressures.

The quarter’s results underline that Bechtle’s diversified business model, spanning IT e-commerce, managed services, and systems integration, continues to provide a natural hedge against cyclical swings in corporate IT spending. Hardware distribution remains under pressure, but software licensing, cloud migration, and infrastructure modernisation projects are offsetting this softness, particularly in the public sector where digital transformation initiatives remain a tailwind.

Management reaffirmed full-year guidance and expressed cautious optimism about maintaining the current momentum into Q4, although the CEO acknowledged that achieving the upper end of the earnings target range will require a strong finish. That guidance implies roughly 25% EBT growth in the final quarter, which, while ambitious, is not unattainable given the seasonal uplift from government and enterprise procurement cycles in late-year spending.

Bechtle’s steady return to organic growth and its disciplined cost structure keep it well positioned for 2026. The company’s ongoing international expansion, both through targeted acquisitions and organic scaling in Western Europe, continues to diversify earnings away from Germany’s more saturated corporate IT market. The integration of recent purchases in Southern Europe and the UK has been smooth, adding incremental growth without diluting margins. Bechtle remains a high-quality operator with a conservative balance sheet, healthy cash generation, and a long track record of profitable growth.

While the shares already price in much of the near-term recovery and valuation multiples look fair versus peers, the gradual return of top-line momentum and consistent execution reaffirm Bechtle’s status as one of the sector’s most dependable compounders in European IT services.

Symrise (SY1 Germany): balancing growth ambitions with structural headwinds in pet food and aroma molecules

Symrise’s latest management update reinforces its long-term growth vision but highlights near-term friction points that are tempering investor enthusiasm.

The company remains anchored around its four strategic growth engines (Food & Beverage, Fragrance, Pet Food, and Cosmetic Ingredients/Probiotics) with the “OneCare” initiative now acting as the connection between these domains. This cross-sector integration aims to capture synergies between nutrition, wellness, and beauty, effectively positioning Symrise at the intersection of consumer health and sensorial innovation.

The CEO reiterated the ambition for 5–7% annual sales growth, supported by continued investment in premium fragrance capabilities and potential bolt-on M&A. Yet, he acknowledged that external visibility remains limited, especially as competitive intensity rises in certain business lines and customers recalibrate post-pandemic procurement.

The most acute pressure point lies within the Aroma Molecules division, roughly 8% of group sales, where the combination of Chinese competition and falling prices in menthol and terpene products has eroded profitability. Management is pursuing a strategic carve-out of the lower-margin Terpene unit, seeking a majority partner to de-risk exposure while keeping the menthol operations in-house for vertical integration benefits. This step signals a pragmatic willingness to prune weaker assets, though it also underscores the structural challenges of competing in commoditised ingredients.

Meanwhile, the pet food segment, once a key margin driver, faces uncertainty over 2026 pricing following a major rebalancing of protein-based inputs earlier this year. Those renegotiations, designed to normalise inflated prices from the post-Covid years, may continue to weigh on top-line momentum into early 2026. The good news is that volumes are back to mid-single-digit growth, suggesting that demand elasticity is intact and category fundamentals remain healthy despite pricing adjustments.

On profitability, management’s confidence in maintaining a roughly 21.5% EBITDA margin this year reflects disciplined procurement and energy cost control, even if the CEO described the target as aggressive. Cost savings remain modest (about €40 million this year) but the focus on efficiency through growth and portfolio refinement may prove more effective than large-scale restructuring.

The broader narrative for Symrise thus remains one of cautious transition: an innovation-led ingredients group navigating a cyclical lull in parts of its portfolio while methodically repositioning toward higher-value, less volatile segments. Its mid-term growth ambition is credible, but lingering opacity around 2026 earnings drivers and the lagging recovery in Aroma Molecules are likely to keep investor sentiment muted in the near term.

Flughafen Wien (FLU Austria): solid quarter but cost pressures and traffic normalization weigh on outlook

Flughafen Wien’s third-quarter results came in broadly in line with market expectations, showing that Europe’s most efficiently run mid-sized airport continues to navigate a maturing post-pandemic recovery cycle.

Revenue grew 5.6% year-on-year to €321 million, perfectly aligned with consensus, supported by modest passenger growth of 1.1% at Vienna and a 4.6% increase in tariffs. The group’s EBITDA of €165 million reflected only a 1.3% increase, as higher personnel costs more than offset incremental revenue gains. That margin squeeze, down 2.1 percentage points to 51.5%, encapsulates the key challenge for European airports in 2025: stable volumes but sticky cost inflation.

Vienna’s traffic growth slowed sharply from nearly 3% in the prior quarter, and while pricing discipline helped stabilize revenues, operational leverage faded. Across divisions, the Airport segment benefited from the absence of last year’s one-off incentives, while Handling saw pressure from rising labour costs. Retail and Properties, a key profit driver in prior quarters, also softened after lapping the duty-free expansion at Terminal 2.

Malta, the group’s international bright spot, continued to perform well with sales up 7.5%, roughly in line with passenger growth, but its EBITDA barely moved, signaling the same cost headwinds spreading across the network. Despite those pressures, free cash flow generation remained robust at €145 million year-to-date, lifting the net cash position to €438 million, even as capital expenditure rose sharply to nearly €200 million due to the ongoing T3 South terminal expansion and investments in Malta.

The company maintained its full-year guidance for around 32 million passengers in Vienna and 42 million across the group, alongside roughly €1.08 billion in revenue and €440 million in EBITDA. Encouragingly, October traffic data showed a short-term rebound, with passengers up 3.7% at Vienna and 6.7% group-wide, a sign that holiday demand remains resilient despite reduced low-cost capacity.

Looking ahead, the picture becomes more complex. The company’s steady financial position and controlled investment approach provide comfort, but structural earnings growth looks constrained. Personnel expenses are unlikely to ease materially, while the reactivation of Vienna’s tariff formula in 2026 (expected to lower passenger charges by roughly 4–5%) could trim airport revenues just as traffic plateaus. Management will need to lean on efficiency initiatives and ancillary revenue streams to defend margins.

While Flughafen Wien remains a high-quality infrastructure asset with a conservative balance sheet and predictable cash generation, the combination of slowing volume growth and margin compression suggests limited near-term upside. The focus now shifts to whether the group can sustain double-digit returns on capital through 2026 in an environment that increasingly rewards cost agility over scale.

If you appreciate this post, feel free to share and subscribe below!