Jewelry, games and turnarounds

Richemont, Afyren, Gerresheimer, Swissquote Group, Thermador Groupe, PulluP Entertainment, Puig, Belimo, Zurich Insurance, Diagnostic Medical Systems, Neinor Homes, Komax Group

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

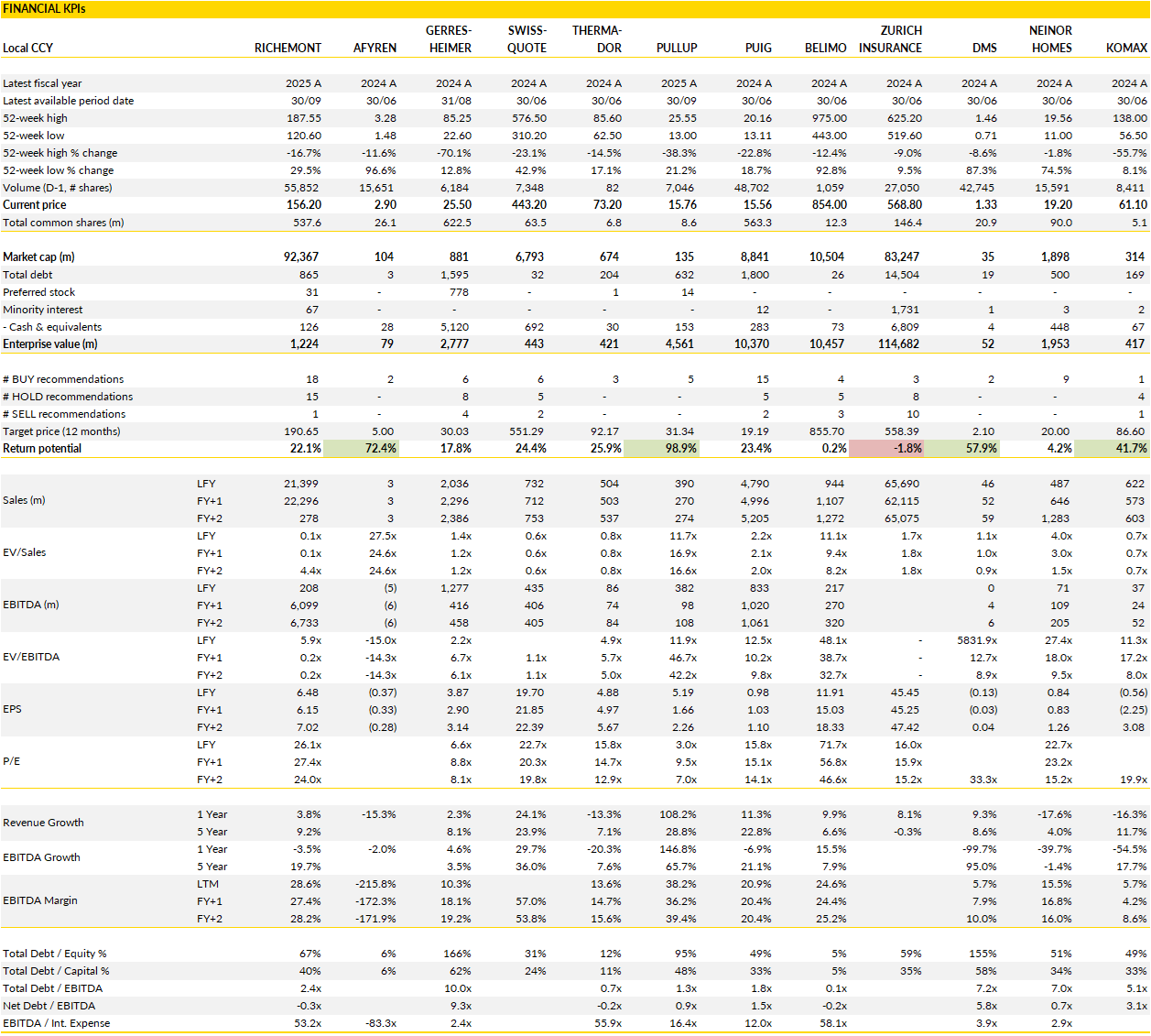

Financial KPIs

Richemont (CFR Switzerland): jewelry strength carries the group through uneven luxury terrain

Richemont’s third-quarter revenue landed modestly ahead of market expectations despite a material currency headwind.

The more important takeaway was the continued resilience of Jewelry Maisons, which again posted double-digit growth. At constant currency, the division grew around the mid-teens, a deceleration versus the prior quarter but still an impressive outcome given the demanding comparison base from last year, when growth had already re-accelerated sharply into Q3. Both jewelry and watches at Cartier reportedly remained in double digits, suggesting demand remains broad rather than driven by a narrow subset of high-ticket pieces. Pricing contributed more meaningfully than earlier in the year, following additional increases, but volumes and mix were still positive, which matters in a luxury environment where elasticity concerns are never far away.

Outside jewelry, performance was more mixed but gradually improving: Specialised Watchmakers saw growth pick up sequentially, while the “Other” segment flattened after a stronger Q2, reflecting the still-patchy backdrop in softer luxury categories.

Geographically, the quarter was once again defined by a split between regions with clear momentum and those still working through a slower recovery. The Americas, the Middle East and Japan all delivered strong double-digit growth, underlining that high-end demand remains healthy in markets with wealth effects and tourism flows that are holding up well. Europe was solid but less dynamic, while Asia-Pacific lagged, dragged down by China. Management commentary suggests that Greater China remains barely positive overall, with Hong Kong driving most of the regional growth and mainland demand still subdued outside the very top end in tier-one cities.

This polarisation is an important nuance: Richemont continues to see encouraging signals among ultra-high-net-worth consumers, but the broader aspirational segment in China remains under pressure. Network adjustments in the region are ongoing, and the company appears pragmatic rather than aggressive in chasing volume in an uncertain demand environment.

From a financial perspective, the quarter should have prompted only modest estimate changes, and directionally supportive. Revenue forecasts should edge higher, driven by stronger-than-expected jewelry momentum, while margin assumptions will remain cautious. Management has reiterated that US tariffs will weigh more heavily in the second half of the current fiscal year, with an estimated annual impact of around €250m, largely concentrated in H2, while currency remains a headwind and higher gold prices continue to pressure gross margins. These factors imply some year-on-year margin compression in the near term, even as pricing actions help to offset input costs.

Stepping back, the bigger picture remains intact: Richemont’s jewelry portfolio is still growing above the sector average, providing a level of earnings visibility and brand strength that few peers can match.

AFYREN (ALAFY France): from proof of concept to industrial reality as Neoxy clears a key hurdle

Afyren has crossed one of the most critical thresholds for any industrial biotech story: proving that its technology actually works at scale, not just in theory or pilot mode.

The 2025 update from the Afyren Neoxy plant is mainly about de-risking the entire equity story. Producing close to 400 tonnes of bio-based acids over the year may sound modest in absolute terms, but it marks the successful transition of the plant into continuous industrial operation. Crucially, almost half of that volume was produced in the final two months of the year, following a series of technical shutdowns in the summer and early autumn to debottleneck the process. That acceleration late in the year is the real signal here. It suggests the core fermentation and downstream processes are now stable, repeatable, and scalable, exactly what sceptics have questioned since Neoxy first moved out of the lab and into the real world.

What stands out is how tightly the industrial ramp-up and the commercial traction are now moving in tandem. Every tonne produced in 2025 has found a home, translating into around €1m of revenue, with half already invoiced. More importantly, Afyren is not selling opportunistically; volumes are flowing into an already secured contract base that totals roughly €165m with around ten customers. Five existing customers are drawing from backlog, while four new clients have come on board, broadening the end-market mix and improving long-term pricing quality.

Winning a significant tender for 2026 with a leading Flavours & Fragrances player further reinforces the idea that Afyren’s acids are not just “green alternatives” but viable industrial inputs that buyers are willing to integrate into their formulations. That matters, because it shifts the discussion away from sustainability narratives and toward repeat business, qualification cycles, and switching costs.

Looking into 2026, the investment case increasingly revolves around execution (vs existential risk). Management now talks about production in the several-thousand-tonne range, which, if delivered, would change the financial profile of the group meaningfully.

The balance sheet provides breathing room to focus on that execution, with roughly €35m of cash at year-end following the recent capital increase, and capex clearly directed at lifting capacity and smoothing operations rather than experimenting with unproven processes.

At this stage, Afyren is no longer a binary “does-it-work” story. The question has shifted to how fast and how efficiently Neoxy can be ramped, and how replicable the model ultimately becomes. With industrial validation in place, a contracted order book, and early evidence of pricing power from a better customer mix, the building blocks for a credible scale-up phase are (finally) aligned.

Gerresheimer (GXI Germany): turning the corner

Gerresheimer enters 2026 with a noticeably different tone than it carried through much of 2025.

The drag factors that dominated the narrative last year are finally losing force. Segments that had been persistent negatives (oral liquids, cosmetics and vials) are showing signs of stabilisation, suggesting that the worst of the volume and mix pressure is likely behind the group. Against that backdrop, the underlying pharmaceutical exposure continues to behave as expected, providing a more reliable growth anchor. Taken together, this supports the idea that Gerresheimer can return to modest organic growth in 2026, with management increasingly confident that a low single-digit trajectory is achievable rather than aspirational.

An important part of rebuilding confidence will come from reporting rather than growth alone. Management clearly signaled that improved transparency across the portfolio, including a clearer separation of moulded glass, should help investors better understand what is structurally attractive and what is cyclical or transitional. That distinction is important, particularly as speculation around a potential divestment of moulded glass has been a recurring overhang. While a sale at a low multiple could help with deleveraging, it would not maximise shareholder value if executed at the trough. With early signs of stabilisation now emerging, management appears willing to wait, making a transaction before the second half of 2026 increasingly unlikely. In other words, the optionality remains, but timing discipline has improved.

The close-out of 2025 itself looks set to be largely uneventful, with the company reiterating regularly its organic growth guidance of minus mid-single digits. The recent CFO change raises the possibility of some clean-up actions, including non-cash write-downs or “kitchen-sinking” exercises. At current valuation levels, the market appears to have already discounted this risk, as evidenced by the limited share price reaction even during periods of heightened short interest.

Now the focus has shifted decisively toward profitability and cash generation rather than chasing top-line growth. While medium-term revenue expectations have been trimmed, but margin assumptions have edged up, reflecting tighter cost discipline and a more selective growth approach. The valuation remains compelling. With stabilising end markets, better disclosure, and the prospect of moulded glass moving from drag to option value, the balance of risks now skews to the upside.

Swissquote Group (SQN Switzerland): guidance beat masks a more measured growth phase

Swissquote closed 2025 on a strong note, delivering a guidance beat that at first glance looks more impressive than the underlying picture.

Pre-tax profit came in close to CHF 420m, comfortably ahead of market expectations, supported by steady client growth, resilient core revenues and a meaningful contribution from one-off items. The most notable of these was the revaluation of Swissquote’s original 50% stake in Yuh following the acquisition of the remaining shares, which alone accounted for a large part of the roughly CHF 50m net positive exceptional impact. Stripping these effects out, underlying pre-tax profit is closer to CHF 370m, broadly in line with where the business was already tracking. Net revenues of at least CHF 720m confirm that the platform continues to scale, while client assets of around CHF 89bn underline the structural momentum in the franchise, keeping Swissquote firmly on track toward its longer-term CHF 100bn ambition.

Operationally, the building blocks remain solid, even if the pace has moderated somewhat. Net new money of CHF 8.5bn in 2025 was healthy, though the second half slowed versus the exceptionally strong start to the year, reflecting more normalised client behavior and softer trading activity.

This is important context heading into 2026, where management is expected to guide to a more subdued growth profile. Headwinds in leveraged e-forex activity and pressure on net interest income are likely to persist, meaning revenue growth is expected to slow to low single digits, with profitability progressing only modestly. That deceleration may feel underwhelming after several years of strong operating leverage, but it does not undermine the quality of the model. Swissquote has proven it can generate attractive margins even in less favourable market conditions, and the business remains highly scalable once trading volumes and interest dynamics turn more supportive again.

The medium-term framework remains the key anchor for the equity story. Management continues to target net revenues of around CHF 900m and pre-tax profit of roughly CHF 500m by 2028, implying a return to double-digit growth once cyclical pressures ease. These targets look credible given Swissquote’s positioning across brokerage, digital assets and banking services, as well as its ability to attract and monetise a growing client base.

The balance sheet adds another layer of optionality. With a capital ratio well above internal thresholds, Swissquote is one of the best-capitalised banks in Switzerland, carrying a sizeable excess buffer that could be deployed more assertively over time. While capital allocation has historically erred on the conservative side, this surplus provides flexibility for growth investments, selective M&A or enhanced shareholder returns.

In that context, the 2025 guidance beat may owe something to one-offs, but it reinforces the resilience of the platform and keeps the longer-term compounding story intact.

Thermador Groupe (THEP France): resilience through the downturn, with the recovery story quietly rebuilding

Thermador Groupe closed FY 2025 in a way that feels emblematic of the current industrial backdrop in France: not exciting on the surface, but far more resilient underneath.

Reported sales of €502m came in almost exactly where the market expected, down just 0.4% year-on-year and -2.9% on a like-for-like basis. Q4 followed the same pattern, with a modest organic decline offset by bolt-on acquisitions, underscoring how disciplined capital allocation continues to smooth the cycle. Pricing was a mild headwind over the year, with a negative price effect of around 1.4%, but volumes held up better than feared given the macro noise.

In a market where many peers are still struggling to find a floor, simply holding the line on sales already says something about the quality and diversity of the portfolio.

The split between end markets is remains interesting. The mass-market exposure clearly suffered, with DIY-related activities hit by cautious consumer behavior and delayed spending decisions. In contrast, the professional channel once again proved its value, posting only a marginal decline as volumes held steady despite softer pricing. Industrial-facing subsidiaries stood out in particular, benefiting from PMI levels hovering close to the neutral 50 mark in both France and Europe. Several of the group’s higher-margin units managed to grow despite the environment, reinforcing the idea that Thermador’s margin structure is anchored in segments with genuine pricing power and technical differentiation. Elsewhere, renovation-related activities were dragged down by uncertainty around public incentives, while new housing appears to have reached a trough, with early signs of stabilisation but little momentum yet. The common thread across divisions is not growth, but resilience, and that matters at this stage of the cycle.

What gives confidence for 2026 is less operational discipline. Gross margins are expected to remain broadly stable, helped in part by currency effects given the group’s purchasing exposure, while operating margins should improve sequentially as cost control continues and the sales mix normalises. Cash generation remains a key strength: inventory reductions, limited capex and cautious working capital management leave Thermador with a solid net cash position, preserving strategic flexibility.

Management’s tone for 2026 is deliberately cautious, with expectations dialed back slightly to reflect a still-fragile demand environment. Even so, the building blocks for a gradual recovery are falling into place: easier base effects, the return of selective price increases, renewed activity in energy renovation schemes and a slow but visible improvement in housing and industrial demand. Against that backdrop, Thermador does not need a sharp rebound to work, just a steady return to normality.

PulluP Entertainment (ALPUL France): normalization at work, but the Back Catalogue keeps doing the heavy lifting

PulluP Entertainment is once again delivering exactly what one should expect at this stage of the cycle: a sharp-looking year-on-year decline that is almost entirely optical, set against an underlying business that remains structurally stronger than it was pre-breakout.

Q3 sales came in at €64.8m, down 36% year-on-year, fully reflecting the absence of last year’s SM2 launch and therefore offering little in the way of surprises. This figure landed broadly in line with market expectations. Over nine months, revenues stand at €197m, down 41% year-on-year, but still comfortably above the group’s historical run-rate prior to the step-change triggered over the last two financial years. In other words, the comparison is brutal, but the absolute level of activity remains elevated.

The composition of revenues continues to tell the more interesting story. The Catalogue segment, which is inherently more volatile and tied to the timing of new releases, saw a steep decline in Q3, down more than 70% year-on-year. This is largely mechanical, yet even here the quarter was not devoid of positives, with recent launches such as Marvel Cosmic and Absolum providing evidence that the pipeline remains active and commercially relevant.

Much more encouraging, however, is the sustained strength of the Back Catalogue, which grew more than 40% year-on-year and now represents roughly two-thirds of quarterly revenues. This performance reflects not only the long tail of SM2, but also the cumulative effect of several successful titles released over the past two years. Strategically, this is important: a heavier back-catalogue mix brings greater visibility, smoother revenue phasing, and structurally higher margins, all of which reduce earnings volatility compared to a pure hit-driven model. The current sales mix increasingly resembles that of a more mature publisher, rather than one dependent on one-off launches.

Looking ahead, management has not changed its stance, and that consistency is reassuring. For the full 2025–26 financial year, guidance remains anchored above the levels achieved in 2022–23, both in revenue and current EBIT, despite the sharp year-on-year contraction implied by the SM2 base effect. The final quarter should be relatively busy, with Toxic Commando scheduled for release in mid-March and Memories in Orbit launching earlier in the quarter.

While expectations for late-cycle releases should remain measured, even a moderately successful launch could act as a useful sentiment catalyst given how low expectations currently are. More importantly, the group is entering the next financial year with a significantly enlarged back catalogue, which provides a solid earnings floor while new IPs and sequels rebuild the front-end of the release slate.

The current valuation continues to look disconnected from the underlying earnings power of the business. The market appears to be extrapolating peak-to-trough dynamics too mechanically, overlooking the fact that PulluP has structurally moved onto a higher plateau. Normalization, in this context, is a pause before the next phase of growth.

Puig (PUIG Spain): steady execution into year-end as growth normalises, not fades

Puig is heading into the FY 2025 results with a setup that looks far more stable than recent sentiment around the sector might suggest.

Based on the latest checks, full-year organic growth is tracking at around +7% like-for-like, comfortably within management’s reiterated +6–8% guidance range and slightly ahead of where the market has been anchored. This implies Q4 growth of roughly +7% as well, in line with Q3, and reinforcing the idea that demand has not rolled over into year-end despite persistent macro and category-specific noise. Importantly, this is not a one-off quarter driven by easy comparisons or channel fill; rather, it reflects a fairly balanced contribution across divisions, with fragrances growing at a mid-single-digit pace and make-up and skincare sustaining high-single to low-double-digit momentum. In that sense, the exit rate into 2026 looks controlled and predictable, not stretched.

The divisional picture remains coherent. Fragrances, which naturally attract the most scrutiny given broader market fears, are expected to land at the lower end of the group’s growth range for FY 2025 (implying around +6% in Q4). This is hardly exciting, but it is resilient, particularly when set against ongoing concerns around category saturation and promotional intensity. More importantly, these concerns have been around for well over a year and are increasingly reflected in expectations rather than emerging as new information. Make-up continues to be the standout, with FY growth expected to be within or slightly above the group range, even after normalisation effects in Q4 following the Amazon launch of Charlotte Tilbury in Q3. That adjustment from sell-in to sell-out was anticipated and does not change the underlying trajectory. Skincare also remains solid on the top line, but with management explicitly signaling slightly lower operating margins as incremental investment is channeled into innovation. This trade-off feels deliberate and strategic rather than defensive, especially given the longer-cycle nature of skincare brand building.

Overall, from a profitability and quality-of-earnings perspective, FY 2025 is shaping up broadly as guided. Management continues to target a modest EBITDA margin improvement of around 20bp at constant scope, although this will not fully translate into operating margin expansion due to higher depreciation and amortisation. Tax is another moving part, with the effective rate expected to rise to around 25% from 23.8% last year, reflecting a more conservative stance rather than any structural deterioration.

Stepping back, Puig looks to be executing to plan: delivering high-single-digit organic growth, keeping margins broadly stable while reinvesting selectively, and entering 2026 without obvious cracks in demand.

Belimo (BEAN Switzerland): growth still exceptional, but it’s no longer about demand

Belimo once again delivered a set of numbers that underline just how powerful its growth has become.

Full-year 2025 organic growth came in at +23.3%, slightly above the company’s already ambitious 15–20% target range and well ahead of what most had penciled in at the start of the year. While data centres and liquid cooling remain the most visible driver, this was not a one-trick story. The second half showed broad-based strength, with EMEA benefitting from a combination of restocking and the company’s own RetroFIT+ renovation initiative, and Asia-Pacific surprising on the upside thanks to demand from semiconductors, battery production and electronics manufacturing. Even with FX acting as a meaningful headwind and pricing less of a contributor than earlier in the year, Belimo still managed to outperform expectations across most regions, reinforcing the sense that demand is deeper and more diversified than the market often assumes.

What stands out is that the data centre narrative, while still central, no longer explains everything. H1 and H2 growth rates of roughly +81% and +71% in data centre–related activities confirm that liquid cooling and hyperscaler investment remain very strong, but the incremental upside in H2 came largely from areas that sit outside that core theme. EMEA growth was helped by renovation demand and inventory rebuilding, while Asia-Pacific benefitted from industrial capex tied to chips and batteries. This is important because it supports management’s long-held view that Belimo’s addressable market is structurally expanding, not just cycling through a temporary spike. Pricing power remains evident, with price levels still up mid-single-digit year on year, and operational execution continues to look disciplined.

Management has been cautious historically when it comes to formal targets, but the consistency of delivery increasingly raises the question of whether longer-term EBIT margin assumptions need to move higher over time, especially as mix continues to shift toward higher-value applications.

That said, the conversation around Belimo is no longer about whether the business is performing (it clearly is) but about how much of that performance is already reflected in the share price. Even after rolling valuation assumptions forward, the stock trades on multiples that imply very little room for disappointment. At around 40x forward EV/EBIT, Belimo sits well above both Swiss quality industrial peers and most data centre–exposed names, despite consensus earnings not moving materially higher after this update.

Management will provide full-year profitability figures and an initial 2026 outlook in February, and while the operational backdrop suggests further growth, expectations are already demanding. Belimo remains an exceptional compounder with high ROCEs and enviable structural tailwinds, but at current levels the investment case hinges less on execution and more on whether the market is willing to look even further out.

Zurich Insurance (ZURN Switzerland): leaning into specialty with a bold move on Beazley

Zurich Insurance Group has made its strategic intentions unmistakably clear by submitting an improved all-cash proposal to acquire Beazley, offering 1,280 pence per share and valuing the transaction at roughly CHF 8.2 billion.

In size terms, this is not transformative for Zurich (the consideration equates to around 10% of its own market capitalisation) but in strategic terms it is far more meaningful. Zurich has been explicit since 2025 that specialty insurance is a priority growth area, offering structurally higher returns, deeper underwriting moats and less exposure to the violent pricing cycles seen in more commoditised commercial lines. Acquiring Beazley would accelerate that ambition overnight, creating a global specialty platform with roughly USD 15 billion of gross written premiums, strong data assets and deep underwriting expertise. The persistence shown by Zurich, after having an earlier 1,230p proposal rejected, underlines how central this asset appears to management’s long-term plan.

The headline number is the premium. The 1,280p offer represents a roughly 56% uplift to Beazley’s undisturbed share price and sits comfortably above both recent trading levels and prior analyst targets, even exceeding the company’s previous all-time high. That will inevitably raise eyebrows, particularly given that the proposal lands at a moment when parts of the specialty and reinsurance markets are seeing early signs of pricing pressure. However, when framed against Beazley’s underlying economics, the valuation looks less egregious than the headline premium suggests. On consensus numbers, the offer implies low-teens earnings multiples and a price-to-book below 2x, against a business delivering returns on equity in the mid-20s. In other words, Zurich is paying up for quality, but not in a way that looks obviously detached from fundamentals. Management has also been careful to stress that the deal would be accretive to its 2027 financial targets, funded through a mix of existing cash, new debt and an equity placing, suggesting balance-sheet discipline remains intact.

Strategically, the fit makes sense. Beazley brings a specialty-heavy book, a strong presence in areas such as cyber and specialty lines, and a culture that is already aligned with data-driven underwriting. For Zurich, this would tilt the group more decisively toward segments where pricing power, analytics and scale matter more than sheer volume. There are also clear opportunities for cost and revenue synergies through shared platforms, reinsurance optimisation and broader distribution.

The risk, as ever, is timing. Property pricing and reinsurance conditions can turn quickly, and paying a full price late in the cycle has historically been a dangerous game for insurers. That said, Zurich appears willing to accept near-term cyclicality in exchange for building a structurally stronger, higher-return specialty franchise.

Diagnostic Medical Systems (ALDMS France): mobile imaging traction cuts through a hesitant market

Diagnostic Medical Systems finished 2025 with a clear acceleration in momentum that stands out against an otherwise cautious backdrop.

Full-year revenues reached roughly €50m, translating into high single-digit organic growth, but the more important signal came from the exit rate. After a softer first half, the business re-accelerated meaningfully in Q4, with revenues up sharply year-on-year, showing that demand was deferred rather than lost. Radiology remains the backbone of the group, accounting for the bulk of sales and growing steadily, while bone densitometry also returned to a healthier growth trajectory toward year-end after a sluggish start.

Geographically, the picture remains bifurcated: Europe continues to feel the weight of budget constraints and elongated purchasing cycles, while North America is increasingly doing the heavy lifting, supported by OEM and white-label partnerships that provide scale without requiring a commensurate increase in the group’s commercial footprint.

The centrepiece of this recovery is mobile radiology, and in particular the !M1 platform. Adoption has continued to build through 2025, benefiting from hospitals’ and imaging providers’ preference for flexible, deployable solutions that require lower upfront infrastructure investment. This dynamic has been especially visible in North America, where partnerships with established distributors and imaging service providers have translated into strong volume growth.

At the same time, DMS has been quietly expanding its international exposure beyond its traditional European base, with activity picking up in regions where healthcare systems are leapfrogging directly to mobile and decentralised imaging solutions. Bone densitometry, while smaller in absolute terms, has also contributed positively, with a clear rebound in the second half suggesting that replacement demand is re-emerging after a period of postponement. Importantly, none of this appears to be driven by aggressive discounting; rather, it reflects a product mix increasingly aligned with current purchasing priorities in healthcare systems under cost pressure.

Fir 2026, the overall setup feels more constructive than it has for some time. Management is guiding toward another year of solid growth, with international markets again expected to be the primary engine. Deliveries of mobile systems into Eastern Europe, continued momentum in North America via existing partnerships, and the gradual ramp-up of longer-standing collaborations in South America and Africa all point to a broader geographic base than in previous cycles. The framework agreement in Denmark, which provides multi-year visibility for !M1 deliveries, adds a layer of predictability that has historically been lacking in DMS’s order profile.

The next product catalyst is the Onyx mobile system, still slated for launch in the first half of the year, although regulatory bottlenecks under the new European framework mean timing remains a risk factor.

Taken together, the picture is of a company that is executing well on its Imaging 2027 plan, using mobile solutions and partnerships to grow even as the wider medical imaging market remains uneven. While regulatory and geopolitical uncertainty has not disappeared, the 2025 exit rate and early 2026 visibility suggest DMS is increasingly shaping its own growth trajectory rather than being dictated by the cycle.

Neinor Homes (HOME Spain): scale, visibility and execution come together at the top of the cycle

Neinor Homes closed 2025 largely exactly where management said it would, and that in itself is worth emphasizing.

Preliminary figures show revenues coming in at around €700m, right at the top end of the company’s €600–700m guidance range, while adjusted EBITDA also landed toward the upper end of the €100–110m target. In other words, Neinor is not just growing, but doing so while keeping a tight grip on profitability in a market that is often accused of being cyclical and margin-fragile.

Importantly, these numbers exclude any contribution from the Aedas Homes acquisition, which only closed late December, meaning the underlying Neinor platform delivered this outcome on a standalone basis. Management has already flagged that the Aedas deal is expected to generate a positive non-cash impact on net income of roughly €65m versus the targets laid out in the 2023–27 strategic plan, setting the stage for a step-change in reported earnings once consolidation kicks in.

What continues to sustain the story is commercial traction. Pre-sales in 2025 exceeded 2,800 units with a total value of roughly €1bn, comfortably ahead of the prior year and a clear signal that demand in Neinor’s core Spanish markets remains resilient despite higher mortgage rates and affordability debates. Within the fully owned portfolio, more than 1,900 units were pre-sold at an average selling price just shy of €340k, translating into over €650m of future development revenues already locked in. The asset management arm, which now accounts for close to 30% of pre-sales, also delivered strongly, with around 900 units pre-sold at a higher average price point. By year-end, Neinor was sitting on an order book of more than 3,500 pre-sold units, representing in excess of €1.2bn in future revenues. That level of forward visibility is not only reassuring from an earnings standpoint, it also provides management with flexibility on pacing, capital allocation and pricing as projects move from development into delivery.

The strategic logic of the Aedas acquisition becomes increasingly central to the investment case. With control of roughly 43,000 units in land bank terms, of which around 27,000 are fully owned, Neinor now emerges as the clear scale leader in Spanish residential development. This matters mainly for operational leverage, purchasing power and the ability to smooth the cycle through a broader geographic and product footprint.

Combined with a proven track record of hitting guidance and a business model that blends development with asset management, the group enters the next phase with unusually strong visibility for a homebuilder.

Komax Group (KOMN Switzerland): stabilisation achieved, but the recovery path remains uneven

Komax Group comes out of 2025 having done something that was far from guaranteed twelve months ago: it stabilised the business operationally, met its own revenue guidance, and avoided slipping back into deeper losses despite a very difficult demand backdrop.

Full-year sales landed at roughly CHF 580m, exactly in line with company guidance and modestly ahead of market expectations, helped by a visibly stronger second half. Revenues improved sequentially from around CHF 280m in H1 to roughly CHF 300m in H2, which matters because it suggests the trough in activity may now be behind the group.

That said, the demand picture underneath remains fragile. Order intake for the full year came in at CHF 565m, down slightly year-on-year and below expectations, reflecting continued caution among customers, particularly in European automotive, where investment decisions remain slow and highly selective.

The contrast between revenue resilience and soft order intake is the central tension in the Komax story heading into 2026. On the one hand, the company benefited in 2025 from a supportive product mix and a higher contribution from services, which helped offset weak new equipment demand. This mix effect, combined with structural cost actions, allowed Komax to keep EBIT slightly positive for the full year despite restructuring expenses of around CHF 9m. In that context, delivering a positive EBIT at all is an achievement. The group reduced its cost base by roughly CHF 25m through structural adjustments implemented over the year, with the full benefit expected to flow through in 2026. On the other hand, management is clear that the order book has not yet reset to a level that would support a strong cyclical upswing. Automotive customers, still facing muted global car production, tariffs, and geopolitical uncertainty, remain reluctant to commit to larger capex programs.

Looking forward, the picture is therefore mixed rather than outright negative or positive. The industrial, infrastructure and transportation markets showed healthier momentum in 2025 and continue to provide some diversification away from automotive. At the same time, the subdued order intake exiting the year points to a cautious start to 2026, rather than a sharp rebound.

Importantly, the cost actions taken in 2025 materially lower the break-even point of the business, meaning that even a modest recovery in volumes could translate into a disproportionate improvement in profitability. However, there is also a trade-off: a future recovery driven by higher new equipment sales would likely dilute the favorable product mix that supported margins in 2025.

In short, Komax has clearly navigated through a challenging year better than feared, but the outlook remains one of gradual normalisation. Stability has been restored, cost discipline has improved, and operational leverage is in place, yet visibility on demand, especially in automotive, is still limited.

That balance explains why the shares can look optically attractive on paper, while conviction on the timing and strength of the next leg up remains restrained.

If you appreciate this post, feel free to share and subscribe below!