Ice cream, AI tailwinds and bombed out sectors reviving

Novo Nordisk, Tonies, ARM Holdings, Swiss Prime Site, The Magnum Ice Cream Company, ArcelorMittal, EU chemicals, SCOR, OMV, Siemens Healthineers, Infineon Technologies, Carlsberg, Novartis, Melexis

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

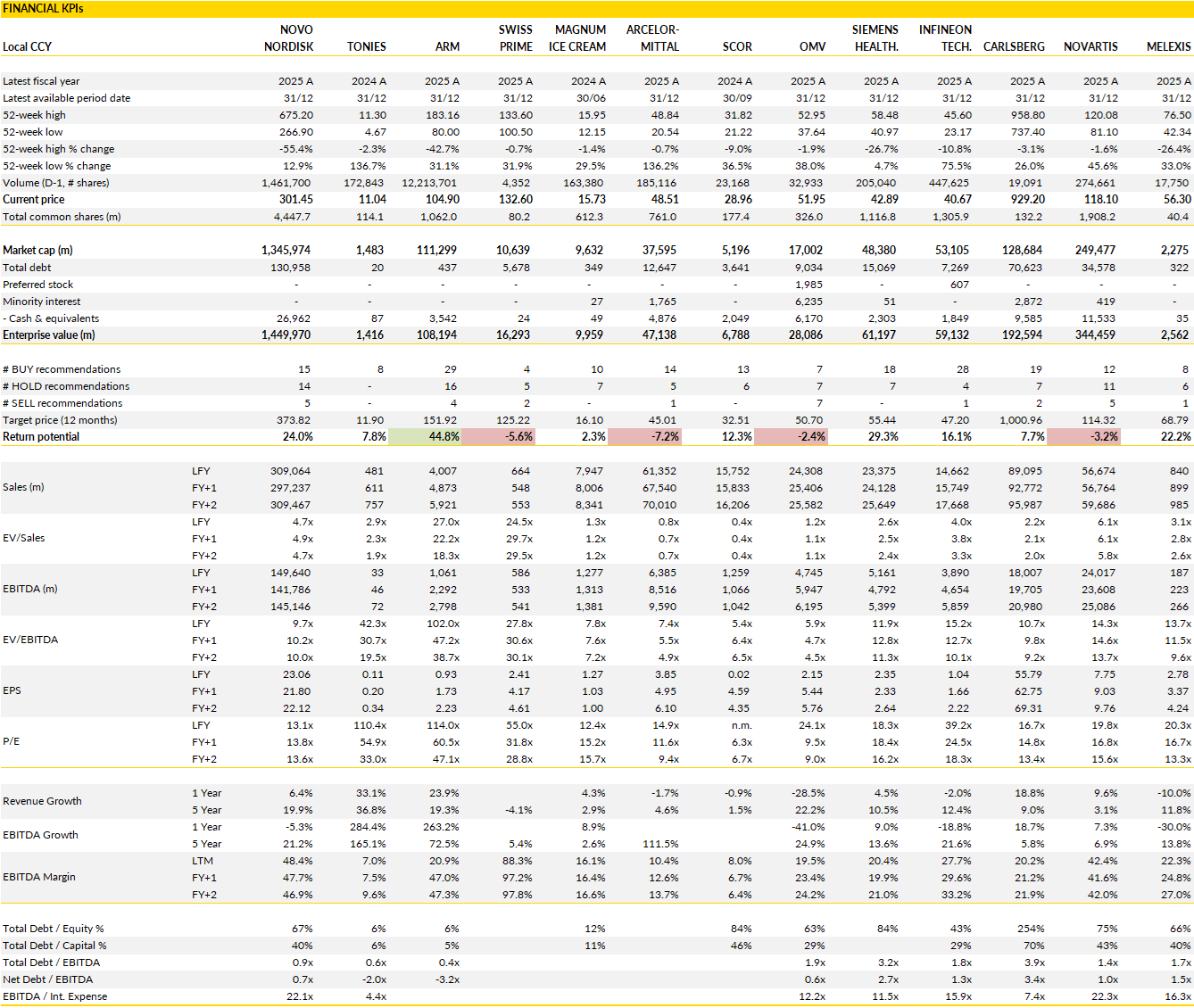

Financial KPIs

Novo Nordisk (NOVOB Denmark): ouch… the US resets the near-term care

Novo Nordisk delivered a fourth quarter that came out ahead on sales, but profitability was less convincing and the outlook quickly shifted the focus away from the print itself.

Q4 revenues reached DKK 79.1bn, around 3% above market expectations, despite an 8% reported decline driven by FX. EBIT came in at DKK 31.7bn, down 14% year on year on a reported basis, but still slightly above expectations. The operating margin ended the quarter at 40.1%, below what the market had hoped for, reflecting a less favorable price mix and higher industrial costs. Within the portfolio, diabetes performed better than expected, supported by Tresiba, while obesity was broadly in line, with pricing acting as a drag. EPS reached DKK 6.04, ahead of consensus, but the overall message from the quarter was mixed rather than strong.

The US business remains the main source of uncertainty. In diabetes, US sales declined 7% at constant currencies, driven by a 6% drop in GLP-1 diabetes sales. Lower volumes of Rybelsus, pricing pressure and market share losses for Ozempic all played a role, even as the underlying GLP-1 diabetes market continued to grow at a double-digit pace in prescription volumes. In obesity, US sales declined 4% at constant currencies, with price pressure outweighing volume growth.

This uneven mix underlines the challenge Novo faces in balancing access, pricing and promotional focus in an increasingly competitive and politically sensitive market. Outside the US, trends were more stable, but they do little to offset the weight of US pricing and policy dynamics on group performance.

That context explains the cautious tone of the 2026 guidance. Novo is preparing for a transition year, guiding to a decline in both sales and EBIT of between 5% and 13% at constant currencies, before FX. The key drivers are well understood: lower realised prices, the impact of US pricing frameworks such as MFN, loss of exclusivity for semaglutide in some markets, and the absence of favorable gross-to-net effects that supported 2025. FX is expected to remain a further headwind of 3–5%.

Taken together, this points to limited visibility on earnings in the near term, even for a company with Novo’s scale and franchise strength. The strategic focus now shifts to execution through this reset, including the rollout of new obesity formats and the defence of share in diabetes.

Until there is more clarity on how pricing, volume and competition settle in the US, Novo Nordisk looks set for a year where expectations are being reset (again).

Tonies (TNIE Germany): strong finish to the year, with momentum carrying into 2026

Tonies closed the year with another very strong quarter, and the sales numbers show a business that continues to scale cleanly across regions.

Q4 revenue landed slightly ahead of market expectations and grew more than 30%, helped by the launch of the Toniebox 2, a broader content and hardware lineup and deeper penetration in all major markets. DACH delivered an impressive result for a mature region, North America kept its rapid growth pace and the rest of the world accelerated sharply. Full‑year revenue growth of 31% came in right at the top end of guidance, which reinforces the sense that the company is executing well even as the base gets larger.

Profitability also moved in the right direction. Management indicated that the adjusted EBITDA margin for 2025 came in around 8.5%, which is the high end of the guidance range and ahead of where the market was sitting. The improvement reflects better efficiency and a favorable product mix, both of which should continue to help margins as the company scales. For a business still in expansion mode, hitting the top of the margin range is a meaningful signal that the model is maturing without losing growth.

Looking ahead, the long‑term story remains intact. Engagement within the ecosystem keeps rising, demand for the platform continues to broaden and the US remains a major growth engine with plenty of room to run. As margins expand and the company gains more operating leverage, the current valuation leaves space for a re‑rating, especially given the growth profile.

With the stock trading at single‑digit EBITDA multiples on 2027 estimates, the setup still looks attractive. The combination of strong Q4 momentum, guidance delivered at the high end and a clear path to further scaling supports staying constructive on the name.

ARM Holdings (ARM US): fundamentals still improving, sentiment did the damage

Arm’s fiscal Q3 delivered another solid operational quarter, even if the market reaction focused elsewhere.

Revenues reached $1.24bn, up 26% year on year, supported by continued strength in royalties, which rose 27% to $737m. This reflects a steady shift toward more advanced architectures, including Armv9 and CSS, alongside rising penetration in data centers, where Arm-based designs continue to scale rapidly. Licensing revenues came in at $505m, also up 25%, but with timing effects once again creating volatility versus expectations. The more stable indicator, annualised contract value, climbed to $1.62bn, up 28%, confirming that the pipeline of long-term licensing commitments continues to expand.

Profitability remained very strong, with a gross margin of 98.3% and non-GAAP EBIT of $505m, translating into a margin just above 40%. These numbers point to a business that is still compounding at a high rate, even as operating costs rise to support growth.

Guidance for the following quarter reinforced that story. Arm guided to Q4 revenues of around $1.47bn, ahead of prior market expectations, while acknowledging that operating expenses will continue to increase as the company invests in engineering and go-to-market capacity. Even with that cost growth, earnings guidance implies further margin resilience.

Management reiterated its confidence in medium-term demand drivers, particularly AI-related workloads. Data centre exposure remains a key pillar, with very rapid growth from a small base, while more complex architectures are lifting royalty rates across multiple end markets. The company also addressed concerns around memory shortages, indicating that the impact on smartphone royalties should be limited and temporary, affecting only a small portion of total royalties.

Stepping back, the disconnect between operating performance and share price reaction is mainly a sentiment issue rather than a fundamental one. Arm continues to benefit from several structural trends at once: rising compute intensity, broader adoption of its latest architectures, and expanding use cases in both cloud and edge AI. The licensing model still carries inherent lumpiness, but the growth in contract value provides a clearer view of forward demand. Cost growth remains elevated, but this is a deliberate choice tied to long-term positioning rather than a sign of margin erosion.

With fundamentals pointing to sustained growth and improving mix, the current debate is about how investors frame Arm within a volatile technology market. Operationally, the company continues to deliver on the trajectory it has laid out.

Swiss Prime Site (SPSN Switzerland): clean operational delivery

Swiss Prime Site delivered a solid set of FY25 numbers, and the operational side of the business continues to run ahead of market expectations.

Like‑for‑like rental growth came in at 2%, WAULT extended again and vacancy moved lower, all of which point to a portfolio that remains in good shape despite a softer macro backdrop. FFO per share held flat at CHF 4.22, which is a strong outcome given the temporary CHF 20m rent loss tied to the Jelmoli redevelopment. Revaluations were positive, helped by another 20bp of yield compression, and the balance sheet stayed stable with LTV just above 38% and the average interest cost still below 1 percent. None of this changes the broader picture: SPS continues to execute well on the operational side, and the fundamentals of the Swiss office and mixed‑use market remain supportive.

Asset Management remains the standout. AuM reached CHF 14.3bn, up 7.5% year‑on‑year, and inflows hit a record CHF 1bn. The revenue mix is shifting toward recurring fees, which adds more stability to the earnings base, and the outlook for 2026 points to another year of healthy organic AuM growth. With rates in Switzerland still extremely low, the environment remains favorable for both valuation support and refinancing. SPS’s incremental cost of debt sits below its current average rate, which means refinancing should add to FFO over time. That funding advantage is a key differentiator versus European peers, and it gives SPS more room to benefit from further yield compression if the rate backdrop stays benign.

The guidance for 2026 looks achievable, and consensus is already sitting at the top end of the range. The company’s ability to offset temporary rent losses, maintain high occupancy and grow its fee‑based AM business gives it a clearer earnings path than most listed real estate names.

Valuation screens rich versus European office peers, but that comparison matters less in a market where 10‑year government bonds yield close to zero. In the Swiss context, the premium looks justified. SPS remains a high‑quality, well‑funded platform with a visible growth engine in Asset Management and a portfolio that continues to deliver steady rental uplift.

The Magnum Ice Cream Company (MICC Netherlands): first results as a standalone arrive with little margin for noise

The Magnum Ice Cream Company will soon report its 2025 results, marking the first real test since its listing in December.

The setup is unusual. There is no consensus framework, no formal guidance for the year just ended, and limited historical disclosure outside the listing prospectus. That leaves investors relying mainly on what the group has already communicated while still part of Unilever. What is known is that trading held up reasonably well through 2025. Organic sales growth reached 5.8% in the first half and remained at mid-single-digit levels over the first nine months, with management indicating a balanced contribution from volumes and pricing. This puts MICC broadly in line with the underlying performance previously disclosed by Unilever’s ice cream division, even if the reporting perimeter is not identical. Currency effects are likely to weigh heavily on reported numbers given the strength of the euro through most of the year, which will cap headline growth despite decent underlying demand.

Margins will likely be the focal point of the release. In the first half of 2025, EBITDA margin slipped by 40bp to 18.9%, reflecting higher input costs, particularly cocoa, which were only partly offset by efficiency measures. Management had already flagged that the second half should look better, helped by pricing actions and cost discipline. Even so, the full-year outcome is unlikely to show a clean margin expansion, given the commodity backdrop and the operational complexity of the carve-out.

Below EBITDA, the financials may look noisy. The demerger materially altered the balance sheet in the second half, with leverage stepping up around the time of the listing. Pro-forma disclosures point to net debt above €3bn, a sharp change from the low leverage shown earlier in the year under the carve-out accounts. How clearly management bridges those numbers and explains the mechanics will shape confidence in the standalone reporting going forward.

Furthermore, the market will listen closely for how MICC frames its priorities as an independent business. Medium-term ambitions have already been outlined, centered on steady organic growth, gradual margin improvement and disciplined capital spending, but this will be the first opportunity to see how those translate into a standalone narrative. The ice cream category remains structurally attractive, with strong brands, pricing power over time and resilient consumption patterns, but it is also capital-intensive and exposed to commodity swings.

After a strong initial share price performance since listing, expectations are no longer anchored to a distressed carve-out story. The results on 12 February do not need to impress on every line, but they do need to establish credibility around reporting clarity, margin trajectory and balance sheet management. That will set the tone for how MICC is judged.

ArcelorMittal (MT Netherlands): solid quarter, but its about the quality of the beat

ArcelorMittal delivered a good Q4, although the upside versus expectations came from places that won’t necessarily repeat.

EBITDA was slightly ahead of consensus, helped mainly by minority‑owned investees in the India & JVs segment. The core steel and mining operations were broadly in line. Costs were well managed, which helped lift EBITDA sequentially despite softer volumes and weaker pricing across most regions. Brazil stood out with strong export activity offsetting a muted domestic market. Europe and North America were more subdued after a strong Q3, with Europe’s volume pickup largely tied to maintenance rather than underlying demand. Net income was held back by close to $300m of exceptionals, and net debt came in a touch better than expected thanks to a strong working‑capital inflow. The proposed dividend increase fits with the group’s capital‑return framework.

The outlook for 2026 is constructive even without formal guidance. Management expects shipments to rise across all regions, with Europe benefiting from a firmer trade‑defense backdrop. Apparent steel demand ex‑China is expected to grow around 2 percent, slightly below the industry’s broader forecast but still supportive. Capex remains unchanged at $4.5–5bn, including a new renewable project in India that should add to EBITDA after 2028.

The message is consistent: the company sees a more supportive environment for steel pricing and demand, helped by protectionist measures in key markets and the advantages of its backward integration into iron ore.

The investment case hasn’t shifted. The Q4 beat won’t drive major consensus upgrades because it came from investees rather than the core business, and Europe’s softer showing limits near‑term excitement. But the broader setup remains favorable. Europe is showing early signs of price improvement, Brazil is benefiting from new tariffs and the company’s raw‑material integration continues to be a strategic advantage as global supply chains tighten.

In short, the recent news flow still points to further upside if the macro backdrop holds.

SCOR (SCR France): disciplined renewals keep profitability broadly intact

SCOR’s January renewals show a group that continues to prioritise underwriting discipline over headline growth, and that approach appears to be paying off in a softer pricing environment.

Around two-thirds of the P&C portfolio was renewed at the start of the year, representing roughly half of total P&C premiums. Within that perimeter, estimated gross premium income for traditional business increased by 4.7% to €4.49bn. Growth was concentrated in P&C lines, where premiums rose 7.4%, supported by selective deployment of capacity and a degree of client rotation toward higher-quality reinsurers. Specialty lines were broadly flat, while Alternative Solutions stood out with an 80.5% increase in premium income, reflecting transactions aimed at capital optimisation rather than pure risk transfer. Portfolio mix shifted modestly, with a slightly lower share of non-proportional business and higher exposure to US natural catastrophe risks, though without increasing the group’s catastrophe budget thanks to retrocession.

Pricing conditions were softer, but not as challenging as feared. Average prices on renewed business declined by 1.9% in gross terms, driven mainly by a sharper drop of 7.8% in non-proportional lines where additional market capacity has intensified competition. Proportional business remained broadly flat on price, with a marginal increase of 0.1%.

Beyond pricing, terms and conditions were largely stable, including attachment points, which limits the erosion of risk quality. SCOR also benefited from improved conditions in the retrocession market, allowing it to secure protection on more favourable terms. This translates into an expected increase of around 2 points in the subscription ratio for 2026, slightly better than anticipated. Based on a normalised combined ratio in the low-80s range exiting 2025, this suggests that newly underwritten business should still sit below the mid-80s on a combined ratio basis.

Taken together, these renewals indicate that SCOR has managed to contain the deterioration in profitability that typically accompanies this phase of the reinsurance cycle. Growth has been selective, pricing pressure has been absorbed without a material loosening of terms, and capital efficiency has improved through alternative solutions and retrocession. This does not point to an acceleration phase for the sector, but it does highlight SCOR’s relative agility compared with peers that rely more heavily on volume to defend earnings.

With reserve strength still being rebuilt and underwriting discipline intact, the group enters 2026 with a more stable risk profile than many competitors. The near-term outlook remains dependent on claims experience, but on the evidence from January renewals, SCOR looks positioned to navigate a more competitive market without sacrificing balance sheet resilience.

OMV (OMV Austria): steady Q4 and strong cash returns

OMV closed Q4 with a solid set of clean results that broadly matched what the market was looking for.

The clean CCS operating result came in at €1.15bn, essentially in line with consensus and ahead of internal expectations. Energy and Chemicals both delivered better‑than‑expected earnings, while Fuels lagged due to unplanned refinery outages. Even with roughly €700m of one‑offs tied to abandonment obligations in Romania and upstream impairments, the group still posted a positive bottom line. Cash generation remained strong, with €0.8bn of operating cash flow before working capital in the quarter and €4.5bn for the full year. Net debt ended slightly below expectations thanks to a sizeable working‑capital inflow, and the proposed dividend of €4.40 per share came in ahead of both consensus and internal estimates, implying an attractive yield.

The 2026 outlook is steady and slightly better than feared on capex. In Energy, OMV is assuming Brent at $65/bbl and TTF above €30/MWh, which is broadly consistent with current forward curves. Production is guided below 300 kboe/d, close to where the market already sits, and unit opex should remain below $11/boe. Refining margins are expected to normalise to around $8/bbl, down from last year’s elevated levels, but utilisation should remain high and fuel sales are expected to grow. Chemicals is not expected to see margin improvement, which aligns with the cautious stance across the sector.

The standout element is capex: management guided to €3.2bn for 2026, well below consensus and down from 2025. That lower spend gives the company more flexibility on cash returns and reduces the risk of negative free‑cash‑flow surprises.

The investment case remains supported by the upcoming integration of OMV’s and ADNOC’s petrochemical assets into Borouge Group International, which should reshape the portfolio and improve medium‑term earnings visibility. The balance sheet is in good shape, cash generation remains robust and the dividend increase reinforces confidence in the underlying cash flow.

While the Q4 beat was not broad‑based, the overall picture is one of a company entering 2026 with a cleaner capex profile, stable operations and a meaningful catalyst in the BGI merger. The valuation still looks reasonable relative to the cash yield and the strategic upside.

Siemens Healthineers (SHL Germany): diagnostics stays heavy

Siemens Healthineers opened the year with a mixed but ultimately solid first quarter, shaped by a familiar split across divisions.

Revenues reached €5.40bn, down 1.5% year on year on a reported basis, as FX remained a sizeable drag, but comparable growth of 3.8% was broadly in line with the underlying run-rate the company has been pointing to. Equipment demand held up well, with a book-to-bill of 1.12x, supporting visibility for the coming quarters. The more notable feature of the print was at the bottom line. Adjusted EBIT reached €809m, with a margin of 15.0%, and adjusted EPS came in at €0.49, comfortably ahead of what the market had been expecting. This reflects a mix effect across divisions rather than a broad-based improvement, but it does show that earnings delivery remains resilient even when parts of the portfolio are under pressure.

Imaging once again did much of the work. Comparable sales grew 5.7%, driven by strong momentum in the Americas and steady progress in Europe, with Asia Pacific and China returning to modest growth. Molecular Imaging stood out within the segment, and profitability held up well, with segmental EBIT of €605m. Precision Therapy also delivered, with comparable growth of 5.9%, led by Varian. Within that, Varian itself posted comparable growth of 9.2%, supported by strong demand in the Americas and a sharp rebound in Asia Pacific Japan, while China recovered from a very weak prior-year comparison. Margins in Precision Therapy came in well ahead of market expectations, helping to offset the continued weakness in Diagnostics. Indeed, Diagnostics remained the clear laggard, with comparable revenues down 3.1% to €985m. China was again the main issue, where volume-based procurement and softer demand weighed heavily, and segmental EBIT dropped sharply to €21m. Europe also softened slightly, while the Americas delivered modest growth, but not enough to compensate.

Management confirmed full-year guidance, which implies a gradual improvement as the year progresses rather than a front-loaded recovery. Imaging and Varian are expected to continue growing at mid- to high-single-digit rates, with broadly stable margins, while Diagnostics is seen stabilising after a difficult start, helped by easier comparisons later in the year. Advanced Therapies remains a smaller but steady contributor.

The underlying setup remains unchanged. Siemens Healthineers continues to rely on its higher-quality franchises to absorb pressure in Diagnostics, particularly in China, while FX continues to obscure reported progress. Q1 does not change the broader story, but it does reinforce that earnings delivery remains robust even in a choppy operating environment.

The next checkpoints will be whether Diagnostics shows signs of stabilisation and whether order momentum in Imaging and Varian continues to translate into backlog conversion as the year unfolds.

Chemicals (Europe): slower CO₂ phase-out would ease pressure

European chemicals stocks could get some relief if current discussions around the EU Emissions Trading System translate into policy change.

Reports suggest the European Commission is reviewing the pace at which free CO₂ allowances are phased out and the timeline for ending auctioning, with a proposal expected later this year. If implemented, this would soften a key structural headwind for energy- and emissions-intensive producers that have been operating at a cost disadvantage versus non-European peers.

The backdrop remains difficult, with weak demand, margin pressure and frequent plant closure announcements underlining how stretched the sector has become. Against that context, even incremental relief on carbon costs would help stabilise cash generation and improve planning visibility, particularly for companies with large fixed asset bases in Europe.

The news aligned with positions long advocated by industry groups. These include extending free allocation beyond current deadlines, flattening the reduction curve toward the 2050 climate target, and avoiding the cancellation of unused allowances during cyclical downturns. There is also growing skepticism around the near-term effectiveness of CBAM, both in terms of implementation risk and its ability to level the playing field from day one.

None of this is settled policy, and any proposal would still require approval from member states and the European Parliament. That said, the tone is less rigid than in previous years and reflects a growing awareness that competitiveness has become a political issue rather than a purely environmental one.

Exposure across the sector is uneven. Companies with a high share of emissions covered by the EU ETS would benefit most from any extension of free allocation or a longer auctioning phase. Wacker Chemie stands out on this metric, followed by Lanxess, Solvay and BASF, although compensation mechanisms already offset part of the burden for some players. Scenario analysis that assumes a high CO₂ price and no free allocation highlights how material this cost could become relative to operating profits, especially for more Europe-centric producers. Any move that delays or smooths this transition would therefore support earnings resilience at the margin.

For now, this remains a policy discussion rather than a catalyst, but it is one of the few external factors that could improve the medium-term setup for European chemicals. Until concrete decisions are taken, the sector is likely to trade on fundamentals, with balance sheet strength and cost flexibility remaining the key differentiators.

Infineon Technologies (IFX Germany): a clean Q1, steady FY guidance and a bigger swing at AI‑power demand

Infineon opened FY26 with a solid quarter that landed slightly ahead of market expectations across all key lines.

Revenue came in at €3.66bn, down sequentially as expected but up 7% year‑on‑year and a touch above consensus. Margins were the real bright spot: the segment result margin reached 17.9%, comfortably above guidance for “mid‑teens” and ahead of where the market was positioned. Adjusted EPS also beat.

The quarter didn’t change the case, but it reinforced the idea that Infineon is managing the cycle better than most peers, with stable pricing, disciplined cost control and a product mix that continues to skew toward structurally growing end‑markets.

The Q2 outlook is broadly in line with expectations. Sales should land around €3.8bn, with segment margins again in the mid‑to‑high‑teens. ATV and CSS are expected to be stable, GIP should see a modest lift and PSS is set for a more meaningful sequential increase.

The full‑year guide is unchanged: moderate revenue growth, high‑teens margins and a mixed picture across segments. Automotive remains softer on the e‑mobility side, but software‑defined vehicles are offsetting part of that weakness. Power & Sensor Systems remains the standout, driven by surging demand for AI‑data‑center power solutions. Currency headwinds will weigh on reported revenue, but the underlying trajectory is intact.

The most interesting update sits beyond FY26. Infineon is now targeting €2.5bn of Power AI revenue in FY27, up from roughly €1.5bn in FY26. That’s a 66 percent jump and a clear signal that the company sees sustained, not temporary, demand for high‑efficiency power components tied to AI infrastructure. To support that growth, capex is being lifted to €2.7bn, well above prior expectations. Free cash flow will be lower as a result, but the trade‑off is straightforward: Infineon is leaning into a multi‑year structural opportunity where it holds a strong competitive position.

The investment case remains centered on the company’s ability to outgrow the broader semiconductor market through exposure to power, automotive and industrial applications. The new Power AI target strengthens that argument.

Valuation is no longer cheap relative to its own history, but the premium reflects a business with clearer structural drivers than most European peers. The Q1 beat won’t move estimates dramatically, but the medium‑term growth signal should help sentiment as the year progresses.

Carlsberg (CARLB Denmark): solid 2025 delivery

Carlsberg’s 2025 numbers were decent overall, even if the top line came in a touch softer than hoped. Volumes fell 2% organically, slightly worse than internal expectations but broadly in line with consensus. Organic revenue slipped 0.6%, again just a shade below forecasts. The more encouraging part of the release was profitability: organic operating profit grew 5%, ahead of both internal and market expectations, and the underlying margin expanded to 15.7%. Adjusted EPS also beat, helped by tight cost control and a cleaner mix. The Britvic acquisition pushed leverage up sharply, but the increase was fully anticipated and sits right where the market expected. Cash flow was strong, and the proposed dividend of DKK 29 matches expectations.

The sticking point is the 2026 guidance. Management is calling for 2-6% organic operating profit growth, which effectively places both internal estimates and consensus at the very top of the range. That framing tends to dampen sentiment because it implies limited room for upside surprises.

Ahead of the release, expectations were already leaning toward a mid‑single‑digit earnings trajectory, supported by a rebound in volumes and a more normalised cost environment. Carlsberg’s guide doesn’t contradict that view, but it doesn’t add much confidence either. With FX expected to be a mild headwind and the Britvic integration still in its early stages, the company is signalling a year of steady progress rather than acceleration.

Stepping back, the operational performance in 2025 was respectable. Margins expanded, cost discipline held, and the company managed to deliver earnings growth despite softer volumes. The Britvic deal complicates the near‑term picture but should strengthen the portfolio over time. The challenge for 2026 is that expectations were already high, and the guidance doesn’t leave much room for positive surprises.

That said, the long‑term story remains intact: Carlsberg is a disciplined operator with a strong cash‑return profile, improving mix and exposure to markets where premiumisation still has room to run. The stock’s valuation remains reasonable relative to its quality and cash generation, even if the near‑term guide feels a bit cautious.

Novartis (NOVN Switzerland): cost control cushions the blow, but growth visibility fades

Novartis started the year with a quarter that exposed the growing tension between revenue pressure and disciplined execution.

Fourth-quarter sales slipped 1% at constant currencies, even as reported growth edged positive, with the main drag coming from Entresto in the US. Sales of the drug fell 45% year on year, reflecting a sharp increase in generic competition alongside pricing pressure. Volumes still grew, but this was more than offset by generics and price effects, leaving a clear hole in the top line. Other franchises delivered a more mixed picture. Cosentyx continued to perform well, while Kisqali, Kesimpta and Pluvicto fell short of expectations.

The result was a quarter where demand trends looked uneven and the reliance on a shrinking set of growth drivers became more apparent.

Operationally, the group did a better job. Core EBIT increased 1% at constant currencies and reached a margin of 37%, higher than the prior year. This was driven by lower general and administrative costs and higher government subsidies, which more than offset increased R&D spending. Core EPS came in at $2.03, broadly stable year on year.

These numbers confirm that Novartis remains tightly managed and capable of protecting profitability even when revenues disappoint. That strength, however, is defensive rather than offensive. The quarter shows a company absorbing pressure rather than generating fresh momentum, with earnings stability coming from cost control rather than from a broad-based expansion across the portfolio.

That backdrop explains the cautious tone of the 2026 guidance. Management is preparing for a year of modest sales growth and a small decline in core EBIT, even before considering currency effects. The drag from generics is no longer confined to Entresto, with further pressure expected from Tasigna and Promacta as exclusivity continues to erode. While foreign exchange should offer some support on reported numbers, it does little to change the underlying trajectory.

Novartis remains a high-quality pharmaceutical business with a solid balance between mature cash generators and newer assets, but the growth profile is flattening at a time when competition is intensifying. Until there is clearer evidence that newer franchises can offset the loss of exclusivity across several large products, the story looks set to revolve around stability and execution.

Melexis (MELE Belgium): recovery keeps slipping

Melexis closed 2025 with a fourth quarter that was clearly weaker than hoped at the operating level.

Q4 revenues reached €214.5m, broadly flat sequentially and up 9% year on year, but slightly below expectations and still weighed down by FX. Automotive remained the core of the business at 89% of sales, with motor drivers and inductive position sensors again the best-performing product lines. The disappointment came from margins. Gross margin slipped to 38.4%, and EBIT fell to €31.5m, translating into a margin of 14.7%, well below what the market had pencilled in. For the full year, sales came in at €840m, down 10%, with a gross margin of 38.6% and an EBIT margin of 16.0%, broadly in line with the company’s own guidance but offering little comfort after a difficult year. The board maintained the dividend at €3.70 per share, signaling confidence in cash generation despite the cyclical pressure.

The outlook for early 2026 added to the cautious tone. Management expects Q1 and the first half of the year to come in at roughly the same revenue levels as last year, implying a much slower recovery than many had assumed. Gross margin is expected to move back toward 40% in the first half, helped by actions taken during 2025, but operating leverage will remain limited as volumes stay subdued.

The company reiterated that the automotive recovery remains uneven and difficult to time, with demand patterns distorted by changes in EV regulation, incentive schemes and customer pricing negotiations at the start of the year. Seasonal effects such as Chinese New Year also weigh on visibility. Growth is expected to return in the second half versus the first, but the message was clearly one of patience.

Stepping back, the update reinforces that Melexis is facing a slower normalisation cycle than some of its automotive peers, rather than a structural issue with its positioning. Content per vehicle trends remain intact, and the company continues to invest selectively while keeping capex under control.

The near-term reset is painful, and expectations for 2026 will need to come down, but the business is still operating well within its historical cycle framework. The key variable is timing. With margins already set to improve modestly even on flat sales, a turn in volumes would quickly feed through to earnings. Until that becomes visible, the stock is likely to trade on patience and valuation, with recovery pushed further out.

If you appreciate this post, feel free to share and subscribe below!