Fruit, GLP-1s and profit warnings

Mobilezone, Aryzta, BMW, Ypsomed, Gerresheimer, CTAC, Repsol, SEB, Voyageurs du Monde, Aston Martin Lagonda, Agrana

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

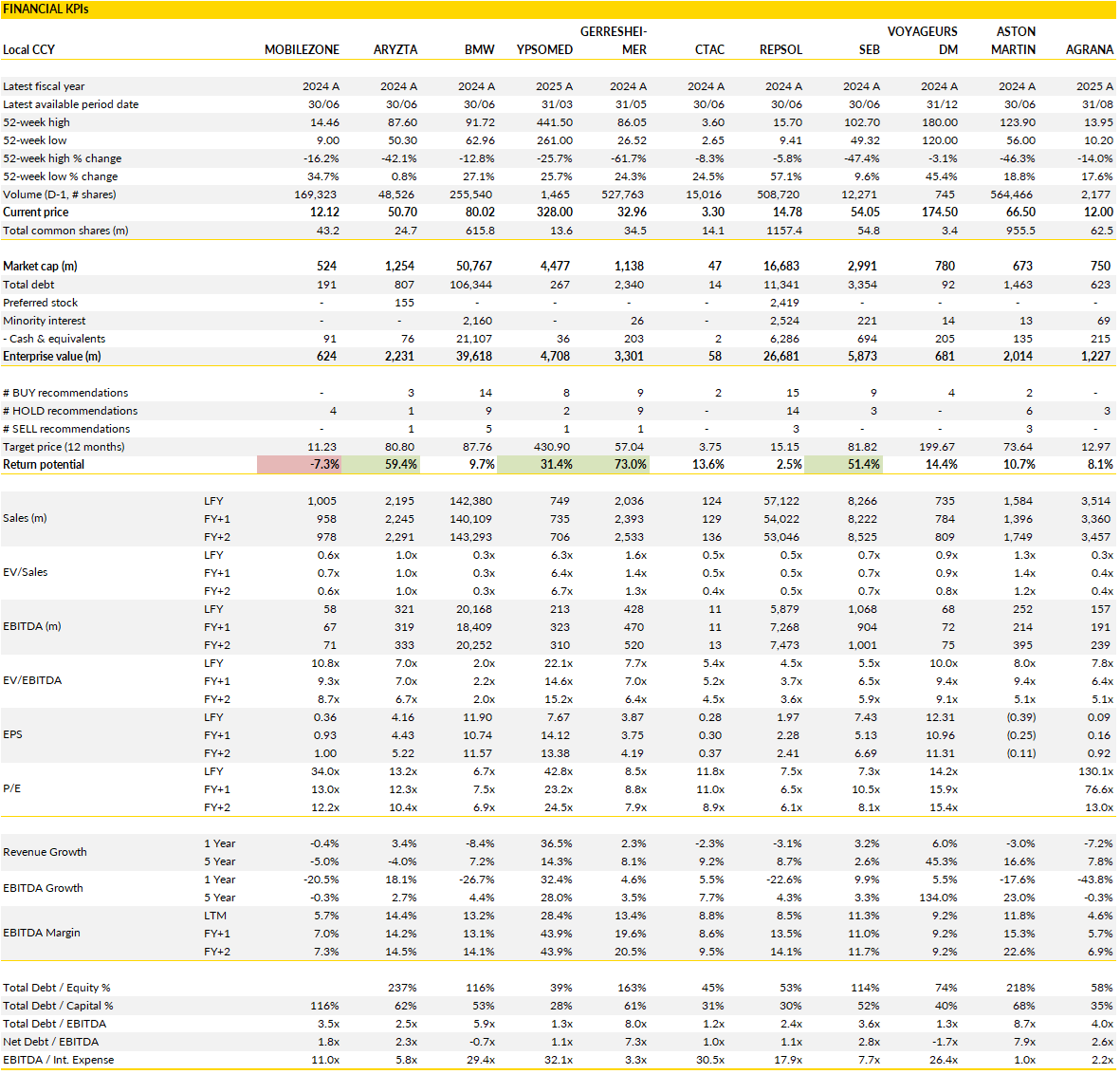

Financial KPIs

Mobilezone (MOZN Switzerland): A long-overdue retreat

After years of effort to build a meaningful presence in Germany, Mobilezone is finally walking away.

The company’s decision to sell its German business marks the end of an ambitious but ultimately unprofitable chapter in its history. The German market, once expected to be a growth engine, became a drag on performance through 2024 and into 2025, weighed down by declining handset sales and shrinking margins in contract distribution.

For a group long known for its operational discipline in Switzerland, the persistence of underperformance abroad became increasingly untenable. The sale, while difficult given the years of investment, represents a necessary reset, a chance to cut loose from a business that had lost strategic relevance.

The deal also underscores a shift in focus toward the company’s domestic core, where profitability and brand equity remain intact. Management has already signaled that proceeds from the divestment will be used to reduce debt and pursue targeted acquisitions in Switzerland, ic a return to playing on familiar ground.

It’s a pragmatic move, reflecting an understanding that scale for its own sake does not guarantee success in a market as fragmented and price-sensitive as telecom retail. More importantly, it could restore flexibility to the balance sheet, creating optionality for future shareholder returns (i.e. buybacks) once stability is restored. What investors lose in top-line volume, they may gain in simplicity and cash clarity.

Of course, the immediate financial trade-off is unavoidable. Germany accounted for the majority of group revenue and nearly half of earnings, so the exit will leave a visible gap.

Yet, in stripping away the complexity of a struggling foreign unit, Mobilezone can refocus on what it does best; efficient distribution, customer service, and disciplined capital allocation. The sale marks the end of an overextended phase and the beginning of a more compact, more resilient version of the company. One that looks more like the steady Swiss cash machine it once was.

Aryzta (ARYN Switzerland): A painful stumble

Just as Aryzta seemed to be regaining (some) credibility, the company has found itself back in crisis mode. The abrupt exit of its CEO, only months into the job, coupled with an earnings warning, has reignited doubts about the group’s execution and internal alignment.

It’s a strong reversal for a company that had spent years rebuilding trust after its earlier missteps. The official explanation was vague, but the implications are clear: cost control, operational follow-through, and efficiency programs have not progressed as planned. The return of Urs Jordi, former CEO and current chairman, as interim leader is both a stabilizing measure and a sign of urgency. It suggests that Aryzta cannot afford another round of drift or delay in its turnaround.

What makes this episode particularly damaging is the timing. Only weeks ago, management had reiterated its guidance, signaling confidence that proved misplaced.

The subsequent profit warning, driven by wage inflation and cost overruns, undercuts the very narrative of recovery that had begun to take hold. Investors who had cautiously started to believe in the margin-restoration story are now forced to question whether the company’s cost base is as controllable as previously thought. Aryzta insists that its long-term ambition of mid-teens EBITDA margins remains intact, but credibility, once dented, is hard to rebuild. The sense now is that execution risk has moved back to center stage.

Yet, for all the near-term turbulence, Aryzta’s fundamentals are not broken. Debt has been reduced, core profitability has improved, and the portfolio remains sound. What the company lacks is consistency in delivery and management stability. Jordi’s return might not inspire excitement, but it does bring familiarity and accountability, the two things Aryzta needs most right now.

If he can steady the ship, execute the cost plan, and rebuild trust, the long-term upside remains real. But after this setback, Aryzta is once again in the uncomfortable position of having to earn back confidence the hard way — one quarter, and one execution milestone, at a time.

BMW (BMW Germany): Tempering expectations

BMW has had to temper expectations (once again). The company revised its 2025 outlook downward, pointing to a weakening backdrop in China and ongoing trade tariff uncertainty.

Neither issue is new, but both have deepened in ways that now visibly affect the bottom line. The Chinese market, long a pillar of BMW’s global profitability, continues to soften as dealers struggle with volumes and liquidity. At the same time, delays in tariff negotiations between the EU, the US, and Mexico have created both cost friction and cash flow delays, forcing management to account for an extra layer of disruption that probably won’t unwind until next year.

The net result is a meaningful downgrade in free cash flow expectations and a margin range that now leans toward the lower end of guidance.

The pressure is almost entirely coming from the macro environment closing in on what had been a resilient model. BMW’s cost structure, production flexibility, and product depth still outshine many peers, yet the group can’t escape the reality that global premium auto demand is entering a softer cycle.

China remains both the biggest opportunity and the biggest risk: it’s where scale, pricing, and partnership dynamics are now colliding with a sluggish consumer base and rising local competition. The group’s move to reaffirm its dividend and buyback program is, therefore, a subtle message, i.c. that it still has enough financial strength to absorb short-term turbulence without changing course (too soon).

So, while the third quarter should now land within the newly defined range, the tone from Munich remains distinctly cautious. The operational deterioration behind the free cash flow cut hints at structural strain that may not resolve quickly, particularly if Chinese weakness persists into 2026.

Still, BMW’s fundamentals (its engineering base, cost discipline, and brand equity) remain intact. The company seems to be outperforming the sector in execution but this does not help sentiment.

Ypsomed (YPSN Switzerland): Conservative guidance hides a confident long game

Ypsomed’s recent Capital Markets Day sent investors into a minor panic. Management unveiled medium-term targets that, at first glance, looked underwhelming compared to market expectations.

That said, the new guidance feels more like a baseline from a management keen to under-promise in an environment where peers are still over-promising. The lower sales and EBIT forecasts for 2029–30 reflect a more measured stance, not a shrinking opportunity set. In reality, Ypsomed’s pipeline and market exposure (particularly across diabetes care and injection delivery systems) remain exceptionally well-positioned to ride the next decade’s healthcare megatrends.

The investments case continues to mainly revolve around its Delivery Systems (YDS) segment, the core of the business and the future growth engine. With large-scale investments ramping up at Solothurn and new manufacturing footprints being established in the US and China, Ypsomed is building a production architecture that mirrors its increasingly global customer base.

GLP-1 drugs, the blockbuster category driving demand for self-injection devices, remain a central growth driver, but the company is at pains to highlight its diversification beyond Novo Nordisk. With over 40 ongoing clinical projects across dozens of customers, the story is one of balance and breadth. Ypsomed’s ‘local for local’ production model should also continuet to insulate it from much of the geopolitical noise affecting other medtech players.

The recent share price slump seems to have more to do with disappointment over communication than fundamentals. Investors were perhaps too optimistic going into the CMD, and Ypsomed’s prudence caught them off guard.

Yet, the long-term math remains compelling: double-digit growth in core systems, expanding international reach, and a robust margin trajectory as capacity utilization rises. The company may have reset expectations, but it hasn’t changed its trajectory. For those with patience, the CMD misstep may prove to be very interesting.

Gerresheimer (GXI Germany): Overpromising and underdelivering (yet again)

Gerresheimer has once again delivered a quarter that tests investors’ patience.

Preliminary results came in weak across the board, with both sales and earnings missing expectations. Management blamed slower market growth and subdued demand across several end markets, a familiar refrain for a company that has struggled to build consistent operating momentum.

Even more discouraging was the follow-up: another downward revision to full-year guidance, confirming that the hoped-for second-half rebound isn’t materializing. With organic growth now expected to fall rather than rise, the optimism that surrounded the company’s earlier cost and innovation initiatives looks increasingly misplaced.

This recurring pattern of overpromising and underdelivering has taken a toll. Investor trust, already fragile, eroded further after the announcement of a regulatory investigation, adding a layer of uncertainty just as the business needed stability.

Fundamentally, Gerresheimer still has the assets to perform: strong positions in pharmaceutical packaging, a growing exposure to injectable solutions, and a footprint aligned with long-term healthcare trends. But these positives are being drowned out by near-term execution risk and communication missteps that continue to surprise to the downside. The credibility gap has widened enough that even a low valuation isn’t enough to spark renewed interest.

Still, and we’re almost afraid to say it, the structural growth story remains valid. That said, management’s inability to show sequential progress leaves the market in wait-and-see mode.

The stock’s deep discount might tempt contrarians, but right now, it does not reflect opportunity, but the market’s exhaustion with disappointment… until Gerresheimer can prove it can convert its order book into dependable cash and margin growth.

CTAC (CTAC Netherlands): A small Dutch IT gem facing an undervalued bid

CTAC’s story has quietly evolved over the past few years from that of a cyclical ERP contractor into a steady, modernized digital services player. The company has worked hard to shed its legacy dependence on high-risk, one-off implementation projects, instead building a more balanced revenue base of cloud, software, and resourcing services. The balance sheet has been cleaned up, margins have stabilized, and growth (modest but steady) has returned.

Against that backdrop, the recent mandatory bid from Value8 is not an exciting takeover event but more like an attempt to buy control of a recovering niche player on the cheap. The €3.50-per-share offer represents a discount to what many long-term shareholders see as CTAC’s real potential.

The board’s neutral stance on the offer reflects both legal restraint and quiet frustration. Bound by regulation, it cannot openly reject a bid deemed ‘fair’ under technical valuation metrics, yet the company’s operational momentum makes it clear that the price undervalues its trajectory.

CTAC has spent the past several years methodically improving its profitability and reestablishing credibility in the SME segment, a market where demand for tailored, localized IT support remains resilient despite macro uncertainty. With digital transformation accelerating among smaller firms that cannot access large-scale hyperscaler infrastructure, CTAC’s niche positioning is increasingly valuable. The steady mix of recurring cloud and software revenues offers earnings visibility rarely found in companies of its size.

The bid, then, is as much a test of patience as it is of price. Investors must decide whether to cash out early at a decent but uninspiring premium, or to stay the course with a business that seems to have finally turned the corner operationally.

With the macro environment stabilizing and internal execution improving, CTAC looks better positioned today than at any point in the past decade.

Repsol (REP Spain): Refining firepower keeps the story alive

Repsol’s third quarter update reinforced what the market had begun to suspect: the refining tailwinds that defined the summer are real and likely to persist. Margins rebounded sharply, utilization rates improved, and the company’s integrated model, often overlooked during downturns, is now proving its worth again.

The refining business, which makes up roughly half of group earnings, benefited from stronger diesel spreads and a well-timed recovery in European operations after temporary disruptions earlier in the year. While others are still talking about cyclical recovery, Repsol seeems to be already delivering it through the industrial cycle’s sweet spot.

This strength more than offsets softness in chemicals and a modest dip in upstream volumes. The production base remains robust, and the company continues to manage its natural gas exposure (primarily in the US) with discipline. Crucially, cash flow is improving faster than expected, helped by a reduced capex profile and better operational leverage.

The market’s skepticism earlier in the year about Repsol’s ability to sustain dividends and buybacks should now flip towards cautious optimism. The company’s €700 million share repurchase plan looks safe, and the dividend appears not just secure but possibly poised for incremental growth.

Repsol’s story at this stage remains about execution. The company has quietly become one of Europe’s more disciplined energy operators, finding a balance between decarbonization commitments and shareholder returns. With refining margins staying firm and the balance sheet strengthening, the stock still trades at a discount to peers despite its strong rally this year.

Investors may finally be rediscovering Repsol as a cash machine disguised as an integrated energy company; cyclical, yes, but currently running at full efficiency.

SEB (SK France): The slowdown catches up to the home appliance champion

The pressure building across global consumer markets has reached SEB’s results. The French maker of cookware and small appliances has issued a profit warning, trimming both its growth and earnings expectations for the year.

After a surprisingly resilient first half, momentum faltered as cautious consumers in North America and Europe pulled back and competition intensified. The company’s professional segment, once a growth bright spot, also hit turbulence due to tough comparisons and lingering tariff effects in coffee equipment. While Asia, and especially China, continues to hold up reasonably well, it’s no longer enough to offset weakness elsewhere.

SEB’s business model, a blend of strong consumer brands and professional kitchen equipment, remains solid, but its exposure to discretionary household spending makes it vulnerable to even mild slowdowns in confidence. Management’s tone has shifted toward realism: lower sales growth, slimmer margins, and a renewed focus on innovation to rekindle demand.

The market reacted strongly, pushing the stock down over 20% in a single session, but that may prove an overreaction. SEB has a long record of bouncing back from soft patches, and its innovation pipeline and international reach still provide meaningful long-term optionality.

The challenge now is to navigate the next few quarters of volatility. The group’s ability to manage pricing, maintain distribution partnerships, and continue product refresh cycles will determine how quickly profitability stabilizes.

SEB’s current weakness may offer an interesting entry point into a cyclical but fundamentally resilient consumer name. It remains one of the few European industrials that combine brand equity, pricing power, and long-term emerging market exposure; attributes that tend to outlast temporary demand dips.

Voyageurs du Monde (ALVDM France): Finding calm seas in a turbulent travel market

For a company built around exploration, Voyageurs du Monde is proving remarkably steady in uncertain times.

Its first-half results confirmed resilience across all key divisions, even as the broader travel market remains uneven. Revenue rose nearly 10%, driven by healthy demand in both tailor-made and adventure travel, the two pillars of its differentiated business model. While the cycling segment has matured after several years of outsized growth, profitability held up well thanks to strong gross margins and tight cost control. Voyageurs du Monde’s ability to sustain pricing power and service quality is what seemingly sets it apart from peers.

Looking ahead, the pace of bookings for the second half suggests a softer period, but not a reversal. Growth is moderating from exceptional post-pandemic levels to a more sustainable rhythm. Management’s calm execution and focus on high-value niches, bespoke experiences and premium adventure travel, continue to underpin its long-term visibility. New product launches, particularly in domestic adventure and cycling itineraries, are cleverly designed to tap into inbound tourism and capitalize on France’s appeal as a destination for experiential travelers.

The group’s balance sheet remains pristine, offering the flexibility to pursue acquisitions, which management views as a key growth lever in an increasingly consolidated market.

The stock’s current valuation feels relatively low for a company that has proven both its resilience and pricing discipline. Voyageurs du Monde is not immune to cyclical swings in consumer sentiment, but its model (asset-light, customer-focused, and culture-driven) provides an enduring buffer against volatility.

Where most travel operators are chasing volume, this group continues to sell experience and authenticity. That quiet strength, coupled with potential for selective M&A, makes its outlook brighter than the market seems to imply.

Aston Martin Lagonda (AML UK): Another detour on the long road to recovery

For Aston Martin, the comeback story has once again hit a pothole. The company’s latest profit warning underscores both an unforgiving luxury market and its own persistent execution flaws.

Weak demand in North America and China, coupled with delays to key model launches like the Valhalla, have forced management to slash its 2025 guidance across the board, from volumes to cash flow.

The recurring theme is liquidity. Despite previous capital raises and shareholder support, the brand continues to burn cash faster than expected, reigniting fears of another funding round. A new CEO, Bentley veteran Adrian Hallmark, has barely had time to take the wheel, but already faces the daunting task of restoring credibility and resetting expectations.

The most likely near-term outcome is financial triage: cost cuts, reduced capex, and tighter control of model cycles. But while are logical steps, but they won’t address the deeper challenge, i.c. translating Aston Martin’s timeless brand appeal into consistent profitability.

The company still enjoys the backing of the Yew Tree consortium, which has repeatedly stepped in to prevent a liquidity crisis, and could again if capital becomes tight. Yet that support, while reassuring, has also masked the fundamental reality: without operational discipline and sustainable margins, each new funding injection only buys time, not transformation.

There is still a powerful brand at the heart of this story, one that resonates with enthusiasts and investors alike. But luxury auto is a brutal business where prestige alone doesn’t pay the bills.

Aston Martin remains a company oscillating between promise and pressure, brilliance and breakdown. Until it can prove that its product roadmap and cost base are finally aligned, caution remains warranted.

Agrana (AGR Austria): Fruit strength can’t sweeten the starch and sugar hangover

Agrana’s latest quarterly results confirmed the group’s pre-announced figures, showing a clear divide between its thriving Fruit & Beverage Solutions (FBS) business and the continued malaise in its Sugar and Starch divisions.

On the bright side, FBS remains Agrana’s star performer, benefiting from stable demand, solid pricing power, and an ability to protect margins even in a sluggish consumer backdrop. EBIT in that segment rose sharply, helped by effective cost pass-throughs and pricing discipline, proving once again that the fruit and beverage operations are the strategic core of the group.

Unfortunately, the rest of the portfolio continues to weigh down the overall picture. The structural problems in Starch and Sugar are hard to ignore. Ethanol prices remain depressed due to persistent US imports, dragging down starch profitability to near breakeven, while sugar continues to struggle with weak regional pricing and soft volumes. The company’s decision to close unprofitable plants has brought some relief but not yet enough to restore meaningful margin traction.

With both commodity-driven segments now reduced to survival mode, Agrana’s future growth depends heavily on its ability to deepen the higher-margin FBS footprint and extract efficiencies from its industrial operations. The upgrade to full-year guidance, calling for significant EBIT growth rather than stability, reflects that partial rebalancing, but it still rests largely on one leg.

Management expects a strong rebound in Q3 profitability, helped by cost control and a more favorable mix, though the macro headwinds facing starch and sugar will not vanish overnight.

Agrana’s challenge remains the same: to evolve from a cyclical processor of agricultural commodities into a more resilient, branded ingredients player anchored in specialty food and beverage solutions. The group is moving in that direction, but progress is slow and uneven.

For now, the company continues to look like two businesses in one: one healthy and growing, the other still stuck in the mud.

If you appreciate this post, feel free to share and subscribe below!