Fitness, glasses and clouds

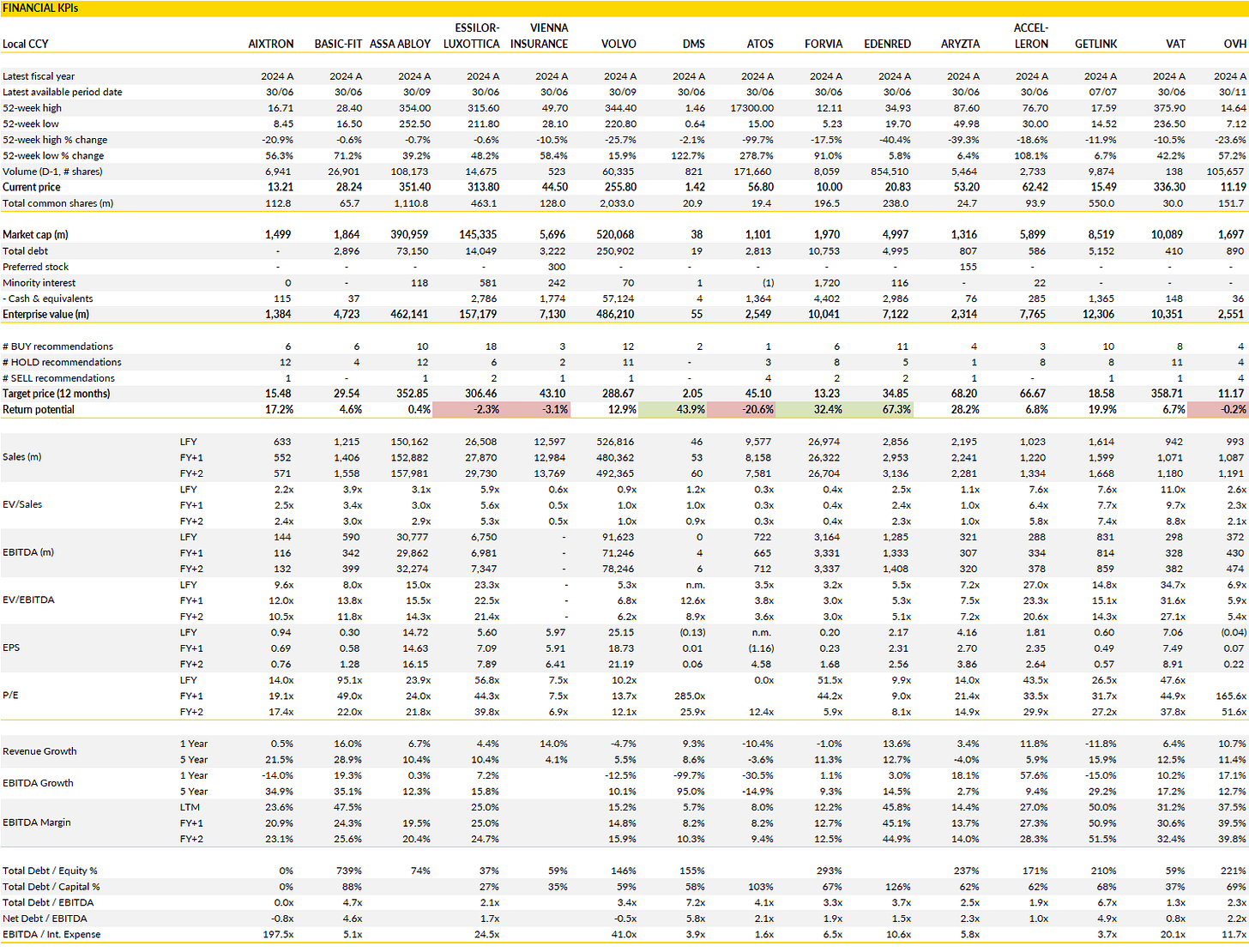

Aixtron, Basic-Fit, Assa Abloy, EssilorLuxottica, Vienna Insurance Group, Volvo, Diagnostic Medical Systems, Atos, Forvia, Edenred, Aryzta, Accelleron, Getlink, VAT Group, OVHcloud

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

Financial KPIs

Aixtron SE (AIXA Germany): waiting for the next cycle to light up again

Aixtron’s recent quarter reads like a moment in between two big waves: the current slowdown in power semiconductor equipment orders, and the coming resurgence once GaN and SiC adoption reaccelerate.

The company’s recent (preliminary) Q3 update showed what the market already suspected: demand across SiC and GaN tool markets has remained tepid as Chinese customers normalize purchases and Western players hold back on capacity expansions amid low utilization.

The softness is real, and so is the cyclical setup. Management trimmed full-year guidance, with the reasons being mostly macro rather than structural, i.c. delayed investment cycles and currency headwinds. The stock’s muted reaction to this downgrade suggests the market already anticipated this cooling period, particularly given that Aixtron still trades well below its historical valuation multiples.

Beneath all the near-term noise, the longer-term story remains about technological leadership in the compound semiconductor transition, where Aixtron’s equipment remains essential to next-generation power and RF devices.

But for now, Q4 will likely still feel sluggish, with order activity staying cautious until utilization rates pick up again in 2026. The company’s Q3 order intake was broadly in line, but margins slipped as shipment timing pushed some volumes into Q4 and a stronger euro ate into profitability. This combination of temporary factors pushed the EBIT margin down to the low teens, which understandably disappointed investors used to the company’s mid- to high-teen performance.

That said the underlying operations remain healthy: Aixtron continues to build relationships with the most advanced chipmakers, particularly in GaN power electronics and SiC devices for EVs and data centers. The demand correction we’re seeing now is more about ‘digestion’; the industry overbuilt capacity during the 2021–2023 boom, and customers are simply waiting for demand in electric vehicles, renewable power, and AI hardware to catch up. Once that happens, Aixtron’s tool shipments should reaccelerate quickly given its strong competitive position and deep ties across the supply chain.

The real inflection likely sits around the first half of 2026, when new 800V GaN-based architectures for AI data centers (notably NVIDIA’s next-generation platforms) begin to scale. Those designs are expected to bring significant new equipment demand, potentially worth hundreds of millions in incremental orders through 2027. Combined with the gradual rebound of SiC adoption in EV platforms and industrial applications, Aixtron’s addressable market could expand sharply again after this digestion phase.

That sets the stage for a healthier and more balanced upcycle, one less driven by speculative Chinese demand and more by global structural adoption of wide-bandgap semiconductors.

In the meantime, Aixtron is effectively hunkering down, protecting margins, and waiting for customers to step back in. The lull may linger another few quarters, but the strategic setup hasn’t changed: this is still one of the few pure-play enablers of the next power electronics wave, simply caught in the quiet before the next storm of orders arrives.

Basic-Fit (BFIT Netherlands): steady club rollout and scaling effects strengthen the long-term model

Basic-Fit continues to execute its simple but powerful playbook: add clubs at a disciplined pace, drive steady membership per location, and let operating leverage do the heavy lifting.

The latest quarterly update reinforces that narrative. The group ended the period with over 4.7 million members, a strong step-up compared to earlier in the year, and confirmed that growth was broad-based across geographies. Club openings remain methodical (instead of rushed), with just over 1,650 gyms live. What matters more than the count itself is the maturing club base, which now demonstrates meaningful density with close to 3,200 memberships per mature location, i.c. proof that the model continues to scale even in markets that some doubted were close to saturation, like France and the Benelux.

The yield per member dipped modestly versus the prior quarter, but management clarified this is largely a timing issue linked to a strong inflow of new members late in the period, who take time to reach full revenue contribution through add-ons and tier upgrades. The company reiterated that yield expansion remains a firm pillar over the medium term thanks to pricing mix, digital upsells, and optional services.

Importantly, nothing in the quarter suggests weaker pricing power or competitive pressure; rather, the focus remains on balancing accessible headline prices with attractive monetization levers in areas like personal coaching and premium tier memberships.

Financially, Basic-Fit reaffirmed its full-year outlook with revenue growth supported by both network expansion and membership gains. The business is still on track to generate positive free cash flow this year, an important milestone that counters the perception that the model is overly dependent on external funding. Operating leverage is clearly coming through as overheads shrink as a share of revenue, showing management focus on self-funding future growth.

The longer-term plan to introduce franchising adds an additional strategic lever that could accelerate network expansion without overburdening the balance sheet. Expectations are for a formal update on that initiative before year-end, and it could provide a meaningful second engine of growth alongside the corporate-owned model.

In short, the flywheel of more clubs, more members, more yield, more scale is well in motion, and credibility is building around management’s ability to grow responsibly while improving economics. With category leadership, a clear runway in underpenetrated continental markets, and a disciplined rollout strategy, Basic-Fit remains one of the few scaled European consumer growth platforms with visibility and self-reinforcing economics.

Assa Abloy (ASSAB Sweden): operational discipline shines through a choppy macro backdrop

Assa Abloy delivered another demonstration of exactly why it is regarded as one of the strongest compounders in the European industrial universe: even in mixed markets, the group keeps grinding out organic growth while expanding margins.

The latest quarterly performance shows modest but steady organic revenue growth, with strength in commercial applications more than offsetting a sluggish residential backdrop, particularly in North America. What remains consistent across cycles is the group’s methodical shift toward higher-value, electronic and software-enabled access solutions, business areas that again delivered double-digit growth.

The regional pattern tells its own story about the company’s resilience. Europe, once a drag due to hesitant construction demand, showed signs of stabilization with a return to growth. The Americas remain a balanced engine, with non-residential categories holding firm while residential softness persists. Asia-Pacific is still the trouble spot, with China continuing to act as a brake on growth.

Yet despite this headwind, group profitability expanded. Gross execution, disciplined cost control, and pricing benefits gave the company strong operating leverage, a showcase of a leader able to flex margins even when volumes aren’t booming.

Strategically, Assa Abloy remains busy. The company completed several bolt-on acquisitions during the quarter, staying true to its M&A playbook of consolidating niches in access and security systems. These deals rarely move the needle individually, but over time, they build deeper market penetration and reinforce category leadership. Electromechanical products remain a key focus, and the strong growth in that area signals that the analogue-to-digital shift in building security is still in early innings. This secular tailwind should provide multi-year support even if macro conditions stay muted.

The investment case remains built on mix upgrades, pricing discipline, and recurring aftermarket exposure. As the installed base of connected and electronic solutions grows, so does the service and maintenance component—improving resilience and smoothing cyclicality.

Compared to industrial peers, Assa Abloy still deserves credit for its stability and ability to consistently protect margins. Even if top-line momentum isn’t spectacular, the strategic positioning and steady earnings profile remain compelling characteristics for long-duration investors.

EssilorLuxottica (EL France): connected eyewear gains traction as a second growth engine emerges

EssilorLuxottica has spent years being valued for its category dominance in lenses and frames, but the recent quarter signaled that the next act for the company has already begun.

Growth accelerated meaningfully, and not just because of easier comparisons. The unexpected development was how quickly connected eyewear (smart glasses developed with Meta) has gone from curiosity to material contributor. Management indicated that these products now represent a meaningful share of incremental growth, bringing in several hundred million euros per quarter already.

That early traction signals two important things: consumer adoption is real, and EssilorLuxottica has found a way to commercialize new technology without diluting its premium brand positioning through Ray-Ban and Oakley.

Traditional eyewear demand also reaccelerated, especially in North America, which returned to double-digit growth. Europe and Asia followed with solid momentum, helped by healthy lens demand and rising adoption of myopia-control products such as Stellest, especially in China. The performance highlights the company’s uniquely integrated model: combining lens technology, retail distribution, and power brands gives it near-unmatched control of pricing, product mix, and customer experience. This ecosystem advantage continues to widen as rivals struggle with fragmented business models or limited exposure to premium segments.

The strategic significance of connected eyewear deserves particular attention. Unlike past tech experiments in the wearables space that tried to force functionality into eyewear, EssilorLuxottica has leaned into design, fashion relevance, and real-world utility, bringing technology into eyewear rather than forcing eyewear into tech. That difference in approach explains why adoption is accelerating. Beyond sales, these products also lift lens attachment rates and upgrade mix due to prescription integration and photochromic options. Just as importantly, they open the door to recurring software and service revenue in the future.

Management sounded confident that growth momentum would carry into the final quarter and hinted that profitability in connected eyewear is already healthy. Combined with margin-accretive growth drivers like myopia management and hearing-enhanced glasses from Nuance Audio, the medium-term roadmap points toward both top-line acceleration and mix-led margin expansion.

Vienna Insurance Group (VIG Austria): Expanding its reach with a bold move into Germany

Vienna Insurance Group’s offer for Nürnberger Beteiligungs marks one of the company’s most ambitious strategic pushes in years, a calculated bet on growth through consolidation in one of Europe’s most competitive insurance markets.

For a group historically anchored in Central and Eastern Europe, this move signals a deliberate rebalancing toward mature Western markets that can add scale, diversification, and stability. The €120 per share offer for Nürnberger (a hefty premium by any measure) underscores VIG’s determination to secure a majority stake and build a stronger platform in Germany.

It’s not simply about buying market share; VIG is positioning itself to deepen distribution, gain product expertise in life and non-life segments, and broaden its presence across Europe’s largest insurance economy. The deal also carries symbolic weight: it reflects a regional player stepping confidently into the top tier of the continental insurance landscape, even if the short-term financial impact appears modest.

From a financial standpoint, the transaction looks well structured: conservative in leverage, with limited integration risk, and potentially accretive within the first year. VIG plans to finance the deal with a mix of existing cash and a moderate bond issuance, preserving balance sheet flexibility while keeping its solvency comfortably within regulatory thresholds.

The acquisition price values Nürnberger at around 1.6 times book value, a premium to the European insurance sector average, suggesting that VIG sees more than just incremental earnings. Management appears to be buying future potential; improved profitability through ongoing restructuring, opportunities to streamline back-office operations, and synergies in product development and risk management.

While investors initially reacted with caution, pushing the share price slightly lower, the strategic logic of the deal becomes clearer when viewed through a longer lens: this is about planting a durable flag in Germany, not chasing short-term EPS gains.

The broader question is what this means for VIG’s positioning over the next few years. The company has spent the past decade building a unique regional network that spans from Vienna to Warsaw and beyond, offering exposure to faster-growing CEE markets. By adding a meaningful German presence, VIG can balance that emerging-market volatility with stable, high-margin business in Western Europe.

The decision not to pursue a domination or profit transfer agreement immediately gives the company time to integrate without overcomplicating governance. If executed well, this acquisition could mark a turning point, a shift from regional champion to truly pan-European insurer.

For now, the stock trades near its fair value (ioo), but the strategic narrative has deepened: VIG is no longer just a CEE growth story, it’s evolving into a continental consolidator ready to play on a larger stage.

Volvo (VOLVB Sweden): Diversification steadies the cycle as the truck engine cools

Volvo’s third-quarter results reinforced a theme that’s been building all year, the company’s diversification is cushioning it as the global truck cycle softens.

While the truck segment saw lower volumes, the strength in construction equipment, buses, and marine engines more than offset the decline. The group’s Q3 margin resilience was impressive given the headwinds: order softness in Europe and Latin America, a stronger krona, and normalizing demand in North America after years of fleet renewal. Volvo’s operating margin held above 10%, supported by solid execution and favorable product mix, while the divestment of SDLG added a one-off tailwind.

Overall, while the numbers don’t suggest a booming market, but they do point to a company managing its transition through the downcycle with discipline. That, in itself, speaks volumes about how much the group has evolved since the volatile truck cycles of the past decade.

The more interesting part of the quarter lies in the forward view. Order intake for heavy trucks dropped sharply, with book-to-bill ratios below one in most regions except North America, signaling that the correction phase is not over.

Management’s first indications for 2026 point to a flattish-to-slightly-declining global truck market, with Europe and North America both trending softer as fleets digest recent investments and financing costs stay high. But outside of trucks, the picture is brighter. Construction equipment and bus divisions are holding up thanks to infrastructure demand, electrification projects, and public sector replacement cycles. Volvo’s consistent profitability in these non-truck segments reflects how much the group’s portfolio diversification now matters, a structural buffer that allows it to keep margins in double digits even as its core truck business breathes out.

Volvo’s long-term story remains intact: a gradual, technology-driven shift toward zero-emission transport and connected vehicle solutions, underpinned by its unmatched scale in premium trucks. The transition to electric and hydrogen-powered drivetrains, alongside a growing services business, is redefining the company’s economic model, less cyclical, more recurring, and potentially higher margin.

The current period of subdued order intake appears a reset after several years of overheated demand. Investors watching for the next upturn will likely need patience through 2026, but the fundamentals (strong balance sheet, diversified revenue streams, and disciplined capital allocation) give Volvo the endurance to emerge stronger when the cycle turns again.

Diagnostic Medical Systems (ALDMS France): Finding new life through innovation and global reach

Diagnostic Medical Systems is quickly transforming from a niche European imaging manufacturer into a small but ambitious global player with clear momentum in the U.S. and emerging markets.

Its latest quarter captured this shift perfectly; double-digit growth in a year still defined by supply bottlenecks and regulatory delays. The group’s radiology business led the way, while bone densitometry remained constrained by component shortages.

Yet beneath those short-term issues, a deeper inflection is taking shape: North America has become a genuine growth engine, with sales nearly doubling year-on-year thanks to partnerships with Carestream and Fujifilm. The long-anticipated FDA approval earlier this year has unlocked the U.S. market just as demand for cost-effective, mobile imaging solutions begins to climb. Meanwhile, the ongoing delivery of mobile radiology units to Ukraine has provided both revenue visibility and global recognition for DMS’s technology and operational agility.

Momentum looks set to build further into year-end, with Q4 expected to show another round of double-digit growth. The ramp-up of deliveries under the Ukrainian contract adds a solid base, while U.S. commercialization through partner Medlink opens a new recurring channel in a market that could sustain over a thousand unit sales annually.

The product pipeline remains active: the Onyx mobile imaging platform (delayed slightly due to regulatory backlogs) and the development of a new surgical C-arm suggest that DMS is investing methodically to broaden its offering beyond traditional densitometry. These are the kind of targeted innovations that can compound growth over time, especially in a sector where compact, connected, and cost-efficient imaging systems are in high demand globally.

DMS’s investment case rests on a simple but powerful narrative: a small-cap medtech company executing a global pivot. The operational turnaround achieved through cost control and improved margins in the first half of the year has given it breathing room to reinvest in growth. Execution in the U.S. and successful delivery on export contracts are now the key levers to scale beyond its European core.

If management continues to deliver on its Imaging 2027 roadmap, aiming to nearly double revenue over the next two years, DMS could emerge as one of the few French medtech names to have transformed regional expertise into international momentum.

Atos (ATO France): Restructuring progress overshadowed by revenue strain

Atos’s latest update shows a company still stuck in transition: making visible progress on restructuring and cost control, yet unable to reignite growth in its core IT services business.

The group’s Q3 showed a deeper-than-expected organic revenue decline of over 10%, reflecting both the fading tailwinds from the Jupiter HPC contract and persistent weakness across traditional IT infrastructure and outsourcing. Beneath the headline numbers, the regional picture was even more telling: steep declines in North America and the UK revealed that Atos continues to struggle to stabilize its client base in key developed markets. The group’s book-to-bill ratio, stuck below 70%, signals that new business generation remains sluggish, suggesting that the commercial reset has yet to translate into pipeline traction.

For a company trying to regain investor confidence after years of operational drift and portfolio confusion, the disappointing top-line performance is a reminder that fixing margins is the easy part, reigniting sustainable growth will take longer.

Still, there are genuine signs of operational progress. Atos’s liquidity position remains stable, cost discipline is clearly biting, and management reaffirmed its target of roughly €340 million in adjusted operating profit for the year, even after lowering revenue guidance. The margin trajectory, now seen slightly above 4%, shows that the restructuring is starting to yield tangible results, particularly in the core Atos division where unprofitable contracts are being phased out. This disciplined approach, while painful in the short term, is essential for restoring long-term profitability.

The problem, however, is perception: investors have grown skeptical after several rounds of guidance revisions, and another cut to revenue expectations inevitably undermines credibility. The group insists that 2026 will mark the return to positive organic growth, but for now that promise rests more on faith in a cleaner base and market normalization than on any visible demand uptick.

What remains to be seen is whether Atos can reposition itself as a relevant player in the evolving IT landscape dominated by cloud-native and AI-driven service providers. The Eviden division, which houses the group’s digital and high-performance computing capabilities, continues to perform strongly, ic a bright spot that hints at what the future could look like if Atos can focus and simplify. But the broader challenge is execution: transitioning from a cost-cutting story to a growth story in an industry that prizes innovation and scalability.

With the restructuring largely on track but the top line still under pressure, Atos now sits in a holding pattern, stabilizing operations while it tries to rebuild commercial momentum. The next few quarters will be about proving that this transformation isn’t just about financial engineering but about rekindling the company’s technological edge in a sector that’s moving fast and showing little patience for laggards.

Forvia (FRVIA France): Holding steady through the trough of the auto cycle

Forvia’s third-quarter results offered few surprises, which in itself is progress for a supplier that’s spent the past two years under constant restructuring and integration scrutiny.

The group delivered sales in line with market expectations, confirming that its performance, while subdued, is stabilizing in an environment that remains uneven across regions and product lines. Organic growth was flat, with solid results in electronics and clean mobility offsetting weakness in seating and lighting, two segments still digesting program phase-outs and lower volumes in China and premium European brands.

The geographic picture mirrored the same pattern seen across the industry: strength in North America and resilience in smaller Asian markets, offset by softness in Europe and China. Against this backdrop, Forvia’s decision to reaffirm its full-year outlook was reassuring, suggesting that the cost and efficiency programs launched under the ‘Forwards 2028’ plan are beginning to bear fruit.

The key to understanding Forvia’s trajectory lies in its steady operational cleanup. The company has already executed the majority of its European workforce adjustments and is pushing hard on SG&A simplification, while divestment processes (including for the Interiors division) are advancing as planned. These moves are critical to bringing the balance sheet under control after the leverage expansion that followed the Hella acquisition.

Q3 results also highlighted incremental progress on refinancing, with several successful bond issuances improving maturity profiles. None of these developments grab headlines, but together they add up to a clearer, leaner group emerging from a difficult integration phase. At the same time, product diversification is quietly paying off: electronics and lifecycle solutions, now meaningful profit contributors, are cushioning volatility in the more cyclical seating and lighting businesses.

Strategically, Forvia remains a work in progress, a supplier caught between the old world of combustion platforms and the new realities of electrification, connectivity, and regulatory pressure. Management’s focus on portfolio optimization and disciplined capital allocation suggests that the next stage of the story will be less about revenue growth and more about cash generation, deleveraging, and selective innovation bets.

The near-term market outlook remains clouded by macro uncertainty, but the group’s ability to confirm its guidance and maintain margins near the midpoint of its range signals that the operational turnaround is gaining traction. Forvia is not yet a growth story, but it’s increasingly a survivor story; a reshaped automotive supplier proving that even in a stagnant volume environment, disciplined execution can still deliver progress.

Edenred (EDEN France): Growth consistency meets regulatory turbulence

Edenred continues to demonstrate why it’s one of the most resilient growth stories in European business services.

The group’s third-quarter results once again outpaced expectations, with organic revenue growth above 7% and broad-based contributions across geographies. Latin America (particularly Brazil) remains the star performer, but Europe is showing signs of recovery too, as the company navigates new fee caps in Italy and a cyclical lull in its French software solutions business. The Mobility and Benefits divisions are both delivering healthy double-digit growth, reinforcing Edenred’s position as a beneficiary of structural trends in digital payments, employee engagement, and mobility solutions.

The beat on financial revenues, even amid lower interest rates, underlines how efficiently the group manages its float, a core strength that provides a natural earnings buffer.

The company’s decision to reaffirm its full-year guidance for at least 10% EBITDA growth shows confidence in both operational momentum and margin leverage. While regulatory changes in Italy and potential taxation proposals in France have created near-term uncertainty, they haven’t dented the fundamental trajectory of the business.

Edenred continues to generate high returns on capital, strong free cash flow, and steady compounding earnings growth, characteristics that make it stand out in a volatile macro backdrop. And the combination of recurring, high-margin revenue and expanding product penetration provides a structural tailwind that few peers can match. For now, market skepticism about regulatory risk is keeping the share price subdued, but the fundamentals are doing the quiet work of building long-term value.

Looking forward, the company’s strategy (scaling its global platform, digitizing traditional voucher systems, and capturing cross-border corporate spend) is delivering, even if politics occasionally intrudes. Its valuation discount relative to peers looks more a reflection of investor caution than of business quality.

Over the medium term, continued innovation in mobility and digital benefits, combined with disciplined capital allocation, should reinforce Edenred’s standing as a compounder in disguise; a business where steady execution and strong market positioning can outlast the regulatory squalls that occasionally buffet it.

Aryzta (ARYN Switzerland): Rebuilding credibility as growth steadies

Aryzta’s latest quarter was more of a consolidation phase, and that’s not necessarily a bad thing for a company still in the midst of restoring investor trust.

Sales growth of just 0.4% might look modest on paper, yet it came against an unusually tough comparison base and within a volatile FX environment that continues to blur the underlying recovery. Organic growth held positive, reflecting steady pricing and resilient demand in Europe, even as volumes plateaued and international markets felt the drag of currency translation.

The result was broadly in line with expectations, suggesting that Aryzta’s operational turnaround, though slowed by external pressures, remains intact. After several years of retrenchment, portfolio cleanup, and internal repair, what matters most now is predictability, and the group’s reiteration of guidance hints at a management team increasingly in control of its narrative.

Behind the headline numbers, Aryzta continues to navigate the crosswinds that define today’s bakery sector: stubborn input cost inflation, rising labor expenses, and uneven consumer trends across geographies. The company’s response has been pragmatic rather than flashy: accelerate cost optimization, sharpen operational focus, and prioritize cash generation over volume chasing.

Its commitment to deliver at least €300 million in EBITDA and around €100 million in free cash flow this year signals confidence that efficiency gains can offset cost pressures. Europe, which remains the group’s anchor, held up well with modest organic growth, while Rest of World performance, once adjusted for forex effects, showed underlying resilience despite headline declines.

The strategy is clear: rebuild profitability first, let growth follow. It’s not yet a story of acceleration, but of gradual rehabilitation built on solid execution.

The real challenge for Aryzta lies less in numbers than in perception. Years of underperformance and restructuring fatigue have dulled investor enthusiasm, and it will take consistent delivery over several quarters to reestablish credibility as a reliable compounder.

But beneath that reputational overhang, the fundamentals look healthier than they’ve been in years: a leaner cost base, stronger balance sheet, and a portfolio focused on profitable, branded bakery products. Inflation headwinds are moderating, and cost savings should begin to show more clearly through margins. While near-term sentiment may stay muted, the direction of travel is positive.

Aryzta is rebuilding confidence through discipline, execution, and quiet consistency. That’s often how sustainable turnarounds take shape.

Accelleron (ACLN Switzerland): Climate politics cloud the view, but fundamentals stay intact

For Accelleron, the story of the quarter wasn’t about numbers but about policy.

The International Maritime Organization’s decision to delay a key global carbon pricing agreement (under U.S. pressure) cast a shadow over one of the main structural catalysts for cleaner shipping technology. For a company whose turbocharging systems and retrofit solutions are tightly linked to the pace of maritime decarbonization, that delay means visibility just got murkier.

The logic is straightforward: without regulatory momentum, ship operators are less likely to rush into fuel conversion or dual-fuel retrofits, at least in the near term. Still, the overall impact on Accelleron’s business should be limited; the vast majority of its revenue stems from service contracts and high-speed applications, which remain unaffected by the regulatory pause.

The short-term setback may cool enthusiasm in one corner of its business, but the company’s structural positioning in efficiency and emission-reduction technologies remains sound.

The broader issue is psychological rather than operational. Investors had come to view decarbonization mandates as a tailwind for Accelleron’s growth story; now, with the IMO kicking the can into 2026, that narrative looks less urgent.

Yet the fundamentals haven’t changed much: the service business continues to generate steady cash flow, newbuild activity remains solid, and retrofits (while smaller in scale) represent a long-term structural opportunity rather than a quarterly swing factor. The company’s exposure to marine decarbonization initiatives accounts for only a fraction of total revenues, so the financial hit should be marginal.

The bigger question is whether markets will recalibrate expectations for the pace of transition across the marine industry, a sector notoriously slow to adapt, even under regulatory pressure.

For Accelleron, this episode reiterates both the opportunity and the frustration of being tethered to policy-driven markets. Climate politics may delay some projects, but they rarely derail them permanently. The long-term need to improve vessel efficiency and reduce emissions is not going away, and as fuel prices and environmental scrutiny rise, so will the economic logic for Accelleron’s technologies.

In the meantime, the company’s valuation already reflects a rich premium for its quality and predictability, leaving little margin for policy disappointment.

Until regulatory clarity returns, investors may need to accept that progress in marine decarbonization will come in fits and starts rather than smooth acceleration, even if the underlying business engine keeps humming.

Getlink (GET France): A steady ride through near-term noise

Getlink’s third-quarter update offered precisely what long-term holders value most in this name: predictability.

Sales came in almost exactly as expected, marking a modest 0.9% year-on-year increase, with strong passenger car traffic offsetting softer freight and electricity transmission revenue. The group’s core Shuttle business remains the backbone, showing resilience despite broader logistics volatility, while Europorte and ElecLink each continue to play their part in smoothing group-level earnings. With the ElecLink interconnector normalizing as energy prices stabilize, the mix is shifting back toward transportation, a return to the company’s natural balance.

There was nothing spectacular in the results, but equally nothing alarming, and in a market prone to overreact to short-term noise, that steadiness counts as quiet strength.

The more interesting angle lies in the company’s strategic positioning for 2026 and beyond. The rollout of new border formalities under the European Entry/Exit System (EES) has been carefully prepared and could actually enhance Getlink’s competitive advantage once implemented, reinforcing its efficiency edge over alternative cross-Channel routes. Meanwhile, the ElecLink cable (though subject to the ebb and flow of power prices) remains a valuable strategic asset that deepens Getlink’s diversification beyond transport.

Management reaffirmed EBITDA guidance of €780–830 million for 2025, a range that reflects the normalized energy backdrop but also confidence in operational resilience. The group’s balance sheet remains solid, providing the flexibility to invest in maintenance and digital infrastructure upgrades that underpin long-term capacity and service quality.

In the market Getlink sits as a lower-volatility infrastructure play quietly positioned to benefit from a stronger European economy. Freight and travel demand are both gradually normalizing, and the structural bottlenecks that limit alternative crossings ensure durable pricing power over time.

The share price has lagged broader industrials, partly because the company’s narrative lacks excitement, but that’s also what makes it appealing in a jittery environment.

Getlink isn’t about explosive growth; it’s about steady, inflation-linked cash generation with built-in optionality through its energy assets. The fundamentals remain quietly attractive, and as sentiment rotates back toward stable cash flow names, investors may rediscover the appeal of this underappreciated transport and infrastructure hybrid.

VAT Group AG (VACN Switzerland): Waiting for the next semiconductor upcycle to open the valves

VAT Group’s latest update felt more like a holding pattern than a setback: disappointing on short-term orders, yet still pointing toward a cyclical inflection just a few quarters away.

The third quarter showed softness in both orders and revenue, undershooting expectations and reflecting a semiconductor market that remains hesitant to commit new capital while utilization rates languish below 70% on mature nodes. The semiconductor division, which still represents the core of VAT’s business, suffered from lower investments at major customers like Intel and geopolitical noise that continues to cloud capital spending visibility.

Still, it’s worth noting that the company is coming off an extraordinarily strong prior year and has been navigating through one of the toughest stretches of this cycle with margins largely intact. That resilience, alongside continued strength in Advanced Industrials and Global Services, speaks to the structural diversification that has quietly been strengthening VAT’s business model.

Management’s cautious tone on Q4 was understandable. The order environment remains fragile, and the group guided for another sequential decline, acknowledging that recovery momentum is not yet visible in the data. Yet beneath the near-term weakness, the setup for 2026 is beginning to take shape. Utilization rates in advanced logic nodes are hovering around 90%, and the transition to 2nm gate-all-around architectures will meaningfully lift valve intensity per tool set, a technical tailwind that directly benefits VAT’s precision control systems.

On the memory side, the brewing supply-demand imbalance, amplified by high-bandwidth memory demand for AI data centers, looks set to unleash a powerful capex cycle from the middle of next year. This is exactly where VAT’s exposure shines: its components are mission-critical to the vacuum environments required for next-generation chip manufacturing. If anything, the group’s subdued guidance may simply reflect prudent risk management ahead of what could be a steep upward curve once semiconductor investments restart in earnest.

The narrative here is familiar to anyone who follows semiconductor equipment names: endure the lull, keep capacity ready, and position for the rebound. VAT is doing exactly that. The company reiterated its longer-term growth ambitions, keeping capex plans largely intact and reinforcing its commitment to both technology leadership and service expansion. China remains a relative bright spot, expected to grow mid-single digits even through the downturn, helped by VAT’s ability to win share from local competitors in a market that still values Western precision.

While the next couple of quarters may test patience, the thesis hasn’t changed: VAT is a pure-play on the next wave of semiconductor capital intensity. The combination of logic migration, memory recovery, and sustained industrial demand sets the stage for renewed momentum by late Q1 or early Q2 2026.

Until then, investors will have to tolerate a quiet stretch; but when this market finally turns, VAT’s valves will be among the first to open.

OVHcloud (OVH France): Searching for growth in a maturing European cloud landscape

OVHcloud’s latest full-year results feel both reassuring and concerning at once; profitability is improving, but growth momentum continues to fade.

The French cloud provider delivered results broadly in line with expectations, confirming another year of high single-digit organic revenue expansion and solid margin improvement, yet the deceleration through the quarters was hard to miss. Public Cloud remains the growth engine, posting mid-teens expansion, while Private Cloud and Webcloud lagged, underscoring the challenge of sustaining competitiveness as the broader market matures.

The company’s 40% EBITDA margin is an undeniable achievement, proof that its cost control and operational leverage are paying off, but the slowdown in topline growth shows how tough it is for OVH to capture scale in a space dominated by hyperscalers and saturated by price competition.

The financial story is becoming steadier, but strategically, the question remains: how does a sovereign European cloud carve out durable growth in a market increasingly defined by global giants and AI-centric workloads?

The guidance for FY 2025–26 suggests management isn’t expecting a rebound anytime soon. Organic growth is now projected at just 5–7%, roughly half the pace of the year just ended. That downgrade speaks volumes about both the macro environment and OVH’s current position within it. Europe’s cloud demand remains resilient but uneven, and while geopolitical tailwinds around data sovereignty and digital independence have boosted visibility, they haven’t yet translated into meaningful revenue acceleration.

What’s striking is that, even with this slowdown, the company continues to invest heavily (capex still represents over 30% of sales) in building infrastructure to support future AI and compute-intensive services. It’s a necessary long-term play, but one that tests investor patience in the near term.

Against this backdrop, the unexpected return of founder Octave Klaba as CEO adds a new dynamic. His deep technical vision and entrepreneurial drive could bring sharper strategic focus, especially as the group prepares its next long-term roadmap, “Step Ahead.” The move signals that OVHcloud knows it needs more than cost discipline, it needs conviction, innovation, and identity in a market moving faster than ever.

From a broader perspective, OVHcloud sits at a crossroads that mirrors Europe’s digital ambitions: profitable, strategically important, yet lagging the speed and scale of global competitors. The company has built a solid operational foundation, with strong cash generation and a manageable leverage ratio, but reigniting organic growth will depend on carving out niches where its European credentials and hybrid cloud expertise truly differentiate it. Areas like sovereign AI, edge computing, and specialized hosting could play that role if executed decisively.

For now, though, the stock’s recovery over the past year feels ahead of its fundamentals, investor enthusiasm around European digital sovereignty has outrun the pace of actual revenue conversion.

OVHcloud remains a capable, disciplined operator with improving margins, but its next chapter will hinge on rediscovering growth, not just defending relevance.

If you appreciate this post, feel free to share and subscribe below!