Drugs, weights and more profit warnings

SUSS MicroTec, Banijay, PVA TePla, Basic-Fit, La Française de l’Énergie, Symrise, Novartis, BB Biotech, Sika, Siltronic, Hensoldt, Porsche, Palfinger, SIG

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

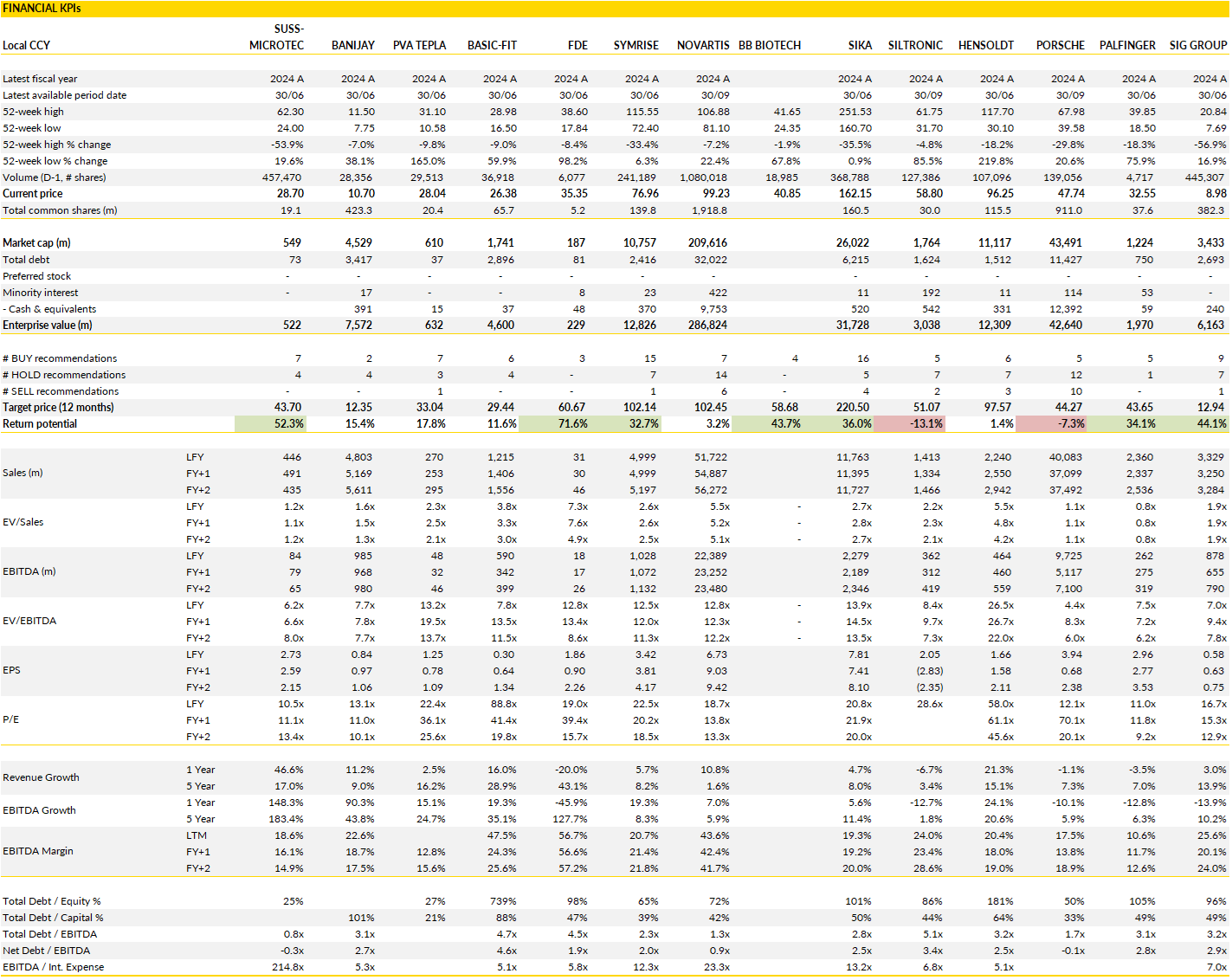

Financial KPIs

SUSS MicroTec (SMHN Germany): Margin pressure overshadows steady demand recovery

SUSS MicroTec’s latest quarterly update shows a company still caught in between the structural momentum of the semiconductor equipment cycle and the short-term drag of operational friction.

Revenue for the third quarter rose solidly year-on-year, beating expectations on the top line, but profitability lagged as mix effects and ramp-up costs ate into margins. The company’s new production site in Zhubei, Taiwan (meant to anchor future growth) has temporarily inflated expenses, while softer order intake and lower fixed-cost absorption weighed further on EBIT.

At the same time, the order environment, at €70 million, fell short of market hopes, confirming that demand across certain customer segments remains hesitant. This is more about timing: the normalization of the broader wafer-processing equipment cycle continues to unfold unevenly, and customers remain cautious in placing new commitments ahead of next-generation node transitions.

The decision to trim full-year profitability guidance while keeping sales targets intact reflects this operational tension. Management still expects roughly 10% top-line growth this year, suggesting steady execution and healthy backlog visibility, but the reset in gross and EBIT margin expectations acknowledges that cost normalization will take longer.

In essence, 2025 has become a transition year in which SUSS is scaling its manufacturing footprint just as the industry digests a pause in capital intensity. The shortfall in gross margin shows the challenge of managing product mix in an environment where high-value, high-margin tools are temporarily out of favor, replaced by a heavier skew toward lower-margin systems and customer-specific configurations.

Yet, the company’s fundamentals remain intact; it retains a strong position in advanced packaging and lithography equipment, both of which are leveraged to high-bandwidth memory (HBM) and 3D integration trends that are far from exhausted.

For now, the narrative hinges on whether these structural drivers, particularly the HBM cycle and next-gen AI-related semiconductor investments, can reignite order momentum in early 2026. The company’s exposure to the HBM ecosystem, roughly a third of its sales base, positions it well for that recovery as memory makers resume capex programs. In the meantime, margin pressure is likely to persist, and near-term sentiment may stay fragile as investors recalibrate earnings expectations.

But context matters: the industry as a whole has been signaling softness, and SUSS’s operational issues appear cyclical rather than structural. Once volume scales up and the new site matures, profitability should rebound more quickly than the market currently assumes.

Banijay Group (BNJ France): Betting on scale with transformational gaming move

Banijay has long been known for its global footprint in entertainment production (from television formats to live events) but its decision to take a majority stake in Tipico marks a strategic shift that materially changes the group.

The logic is straightforward: gaming is a structurally higher-margin, cash-generative business with strong recurring revenue characteristics and a growing digital footprint. Tipico brings exposure to regulated online sports betting and casino products in Germany and Austria (markets that reward scale and brand strength) while giving Banijay Europe’s largest footprint in continental sports betting when combined with Betclic. The combined platform now ranks inside the top five in the European gaming market and claims leadership in six geographies, including Germany, France and Portugal.

Behind the announcement is a clear strategic intent: diversification. Before the deal, Banijay generated roughly 70% of its revenue from content studios and live events, businesses with creative upside but inherently cyclical cash flow profiles. Post-transaction, gaming will account for nearly half of the group’s revenue mix, rebalancing the financial model toward stable recurring online consumer spending.

Tipico, which last year delivered over €1.6bn in revenue and an EBITDA margin close to 30%, brings high conversion of profits to free cash flow and strong operating leverage. This reshapes the financial profile of Banijay Gaming into a platform capable of funding future M&A, accelerating technology rollout and improving product localisation across markets. On a pro forma basis, the Betclic–Tipico combination generates more than €3bn in turnover and over €850m in EBITDA, giving Banijay a gaming unit that is, at least in size, comparable to the mid-tier European listed peers in the sector.

Economically, the acquisition is not just about combining scale but unlocking operational leverage through platform consolidation. Management targets around €100m in annual synergies by 2028 through shared marketing, unified trading systems and cross-licence efficiency on sports rights and platform costs. The financing structure is aggressive but manageable: Banijay will carry around 3.5x net leverage upon closing, with a stated path back below 2.5x within three years thanks to strong free cash flow generation.

Enterprise value multiples also sit comfortably relative to sector benchmarks: the implied valuation of Tipico at around 10x EBITDA sits below larger peers in the UK and Nordics, while the combined entity’s implied multiple near 11x pre-synergies falls into a reasonable consolidation range for a scaled gaming asset.

Integration risk remains (the gaming market is increasingly regulated, marketing inflation persists, and execution on technology migration can derail synergy roadmaps) but the pivot is clear. Banijay is no longer just a media group; it is constructing a dual-engine model that blends content, distribution and now direct-to-consumer monetisation at scale.

PVA TePla (TPE Germany): Temporary delivery setbacks mask long-term strategic momentum

PVA TePla sits in a structurally attractive niche of the semiconductor equipment chain, supplying crystal-growing systems and metrology solutions used in advanced chip manufacturing and power electronics.

The latest downgrade to full-year guidance looks ugly on the surface, but it says more about timing of deliveries than weakening demand. The group recently flagged logistical and regulatory delays affecting projects in the US and Asia, pushing scheduled shipments into early 2026.

The drivers behind these delays are external (export approvals, geopolitical red tape and stretched customer implementation timelines) rather than operational mishaps. Crucially, these postponements did not trigger cancellations, and the order book continues to grow, providing an important signal that the demand pipeline remains very much intact.

In short, the revenue slippage is frustrating but seems temporary, not structural.

The revised guidance lowers expected 2025 revenue to around the midpoint of €245m and EBITDA to roughly €27–28m, translating to a margin a touch above 11%. That compares to the earlier ambition of roughly €260m at the low end and margins north of 13%. While that reset trims near-term expectations, the Q3 order intake of c. €73m reinforces visibility into 2026.

Orders rose sharply both year-on-year and sequentially, and this resilience across customer segments suggests that investment plans in power semiconductors, wide bandgap materials and advanced wafer technology remain in motion despite macro noise. Even with a softer third quarter revenue print, the booking trends underline PVA TePla’s positioning on the right side of long-cycle semiconductor capex: electrification, silicon carbide, and high-end metrology continue to attract share of wallet as fabs prioritise yield and precision.

Management’s decision to reaffirm its 2028 roadmap after cutting near-term numbers is a key tell. The plan still calls for revenue to roughly double to €500m, supported by metrology (notably acoustic metrology for defect detection) and material solutions. Embedded in the plan is meaningful operating leverage, with a targeted EBITDA margin of 20–25%, almost double today’s level.

That confidence speaks to three structural pillars of the story: a demand shift toward higher-specification semiconductor materials, ongoing qualification at major Asian foundries and memory players, and a product mix shift toward software-rich metrology, which carries higher margins and stickier customer relationships.

Some investors will understandably focus on execution risk but the market backdrop gives PVA TePla more tailwinds than headwinds. Lead times remain manageable around three to four months, and booking conversion to sales in 2026 looks realistic if even a conservative portion of current orders ship as planned. With semiconductor capital expenditure expected to broaden in 2026 (beyond AI logic into power electronics for electric vehicles and industrial applications) the company is positioned in capacity bottleneck segments where precision equipment functions as a yield enabler rather than a discretionary purchase.

The reset to 2025 earnings expectations may weigh on the short-term narrative, but the medium-term thesis, i.c. growing metrology penetration, Asian customer expansion and structural semiconductor intensity, remains firmly intact.

Basic-Fit (BFIT Netherlands): Strategic leap into franchising reshapes the growth model

Basic-Fit has always positioned itself as Europe’s volume-driven fitness consolidator, but the announced acquisition of Clever Fit is an interesting change to the company’s strategic trajectory.

Rather than simply adding scale, this move signals the long-awaited shift toward a hybrid model that blends owned expansion with franchising, a mix that could unlock significantly higher returns on capital while accelerating Basic-Fit’s penetration across continental Europe. By acquiring Clever Fit’s network of nearly 500 gyms across seven countries, Basic-Fit not only enters new territories but also gains a functioning franchise infrastructure overnight, something it has never operated at scale before.

The deal expands the group from six to twelve countries, giving it a foothold in Austria, Switzerland and Central/Eastern Europe without having to build clubs from scratch. Roughly 450 of Clever Fit’s sites operate as franchises, with only a small minority directly owned, mainly in Germany.

This structure matters: it gives Basic-Fit a platform to test franchising under its own brand while minimising execution risk in unfamiliar markets. The company has already indicated it will explore rolling out a franchise proposition under the Basic-Fit brand in core growth markets like France, Spain and Germany. If successful, this shift could materially improve cash generation by reducing upfront capex per club and boosting the recurring royalty model.

The significance: Basic-Fit is effectively evolving from a pure operator into a platform company.

Financially, the acquisition is absorbable even with today’s higher interest rates. The €160m purchase price plus a small earn-out is funded entirely by new bank debt running to 2028, pausing the buyback programme and slowing new club rollout to preserve balance sheet flexibility. Management appears to be choosing strategic optionality over near-term financial cosmetics, accepting temporary leverage close to 3x before delevering in 2026. That’s a sensible trade-off, especially given that Clever Fit already generates positive EBITDA and brings close to a million additional members into the ecosystem.

The integration path is a key focus. Clever Fit’s average club density (roughly 2,000 members per gym) trails Basic-Fit’s by a wide margin, suggesting a long runway for operational uplift but also hinting at potential rebranding and refurbishment costs. Management has yet to confirm whether franchised sites will convert to the Basic-Fit brand, but that decision will shape both capex needs and member migration risk.

Still, the strategic logic is clear: this deal deepens Basic-Fit’s European moat, builds a second growth engine through franchising and increases pricing power through scale.

The market has long debated whether Basic-Fit could maintain high growth while improving returns. Clever Fit could provide the missing piece; expansion without heavy capital intensity. If execution is tight and churn stays under control, this acquisition can become transformational rather than just incremental.

La Française de l’Énergie (FDE France): Soft start to the year

La Française de l’Énergie opened its new financial year with a muted first quarter, reminding investors that this is still a developing energy platform in scaling mode rather than a mature producer with stable quarterly run-rates.

Revenue of just over six million euros was below market expectations, but the miss says more about timing than trajectory. The company continues to expand capacity, diversify energy streams and move closer toward a portfolio that blends near-term gas monetization with longer-term biomethane and distributed power. In that sense, Q1 was more a reminder of the mechanical volatility that comes from staged commissioning and external authorizations.

Top-line growth still looked strong year-on-year thanks to a favorable comparison base in gas, where last year’s volumes were capped by constraints in the GRTgaz network. Gas revenue rebounded from a negligible level a year ago as pipeline availability normalised, even if volumes are not yet at the structural run-rate management anticipates. Electricity revenue softened from last year’s highs due to both a normalisation in pricing and scheduled maintenance across several CHP units. That decline isn’t structural; rather, it reflects how LFDE manages assets in rotation to protect long-term efficiency and availability.

The biggest delta versus market expectations was the lack of contribution from Greenstat, which had delivered revenue in the prior year but has a more lumpy IFRS profile due to its joint-venture structure. Meanwhile, the acquisition of Altec did exactly what it was meant to do: broaden the perimeter and increase recurring energy output. That contribution helped offset weakness elsewhere and shows the strategy of bolt-on deals in regional energy infrastructure is working.

The real story is still to come. Four new cogeneration units have already been built but are still waiting on final administrative approval before energisation. Once connected, these assets will expand recurring production and cash flow without incremental capex. They also tilt the revenue mix toward long-term contracted sales and create better operating leverage on the existing cost base.

Management has been consistent in its message: 2026 is the first year in which scale will begin to show up meaningfully in financial results. That path is reinforced by a growing pipeline, progress in local energy partnerships and tactical acquisitions that reduce dependency on any single revenue stream. Implicitly, LFDE is transitioning from being a niche methane-from-coal-seams story to becoming a distributed low-carbon energy platform tied to regional industrial demand.

Valuation still leaves ample room for a re-rating ioo. The stock trades at a clear discount to peers in the renewable IPP universe despite a more resilient revenue mix tied to energy infrastructure near population centres. Yes, quarterly volatility is part of the package for now, but the commissioning schedule, underlying asset economics and long-life contracts continue to build intrinsic value.

Symrise (SY1 Germany): Aroma pressure, but structural strengths remain intact

Symrise delivered another muted quarter, and the market reaction was predictable; soft organic growth and a downgrade to full-year revenue guidance rarely inspire confidence.

But beneath the headline slowdown seems to lie a more nuanced story. The group still posted slightly positive volume growth, even as pricing flattened out, showing that end-market demand has not fallen off a cliff; it has simply normalised after two years of extraordinary pricing tailwinds.

The problem in Q3 sat squarely in Aroma Molecules, the more commoditised subset of the Scent & Care division. Here, aggressive competition and softer industry demand pushed volumes and pricing backwards, dragging down group performance. When one of your lower-margin upstream businesses turns negative, it can make a merely stable quarter look worse than it is.

Outside that troubled area, the portfolio proved resilient. Taste, Nutrition & Health again held up reasonably well, posting low single-digit organic growth despite a tough comparison base. Beverages grew firmly and Food & Nutrition stayed in positive territory. Pet food remained an area of mixed signals: palatability was solid and volumes improved, yet pricing in pet nutrition (cut earlier in the year) continued to weigh on headline growth. Still, flat performance in pet isn’t catastrophic and should normalise as pricing anniversaries. Meanwhile, Scent & Care excluding Aroma Molecules actually grew mid-single digit, helped by steady demand across fine fragrance and everyday consumer scents. Cosmetic ingredients even bounced back modestly after a soft first half.

In short, the parts of Symrise tied to innovation, formulation expertise and sticky customer relationships are still doing their job.

Management cut full-year organic growth expectations to a low single-digit range, reflecting the reality that pricing (once a tailwind) is now largely neutral, and that destocking persists in some categories. However, margin guidance remains unchanged, highlighting a key feature of the Symrise model: even with subdued revenue momentum, disciplined cost management and mix improvements can preserve earnings quality.

This is why the equity case hasn’t unraveled despite two guidance trims this year. Yes, investors are increasingly impatient for growth to re-accelerate, but the business retains enviable characteristics: diversification across food, fragrance, pet, and health, a stable customer base, and low cyclicality versus broader consumer staples.

Relative to peers in flavors and fragrances, Symrise now sits in a valuation middle ground: priced below the premium leader but still supported by solid cash generation and defensive end-markets. Closing the performance gap depends largely on stabilising Aroma Molecules, regaining modest pricing traction, and proving that pet nutrition can re-inflect next year.

For now, this is a ‘show me’ story rather than a broken thesis. Momentum is dull, but the fundamentals remain in place.

Novartis (NOVN Switzerland): Resilience in revenue, but margins feel the weight of reinvestment

Novartis delivered a third quarter that balanced operational resilience with rising reinvestment needs.

Revenue growth held up well, supported by a maturing innovation engine that is steadily shifting the company’s profile toward specialty and immunology-driven therapies. Yet profitability came under visible pressure, with R&D spend stepping up and eating into margins. This is not the kind of beat-and-raise quarter that turns sentiment, but neither does it expose structural cracks. Instead, Q3 reflected a company in controlled transition,absorbing patent headwinds while reinvesting behind growth assets that are only now beginning to scale.

The topline held firm with mid-single-digit growth at constant currency, another reminder that Novartis is now much less dependent on any single franchise. Oncology momentum continued to impress thanks to Kisqali, which has clearly broken through in early breast cancer and has emerged as one of the group’s most durable growth engines. Kesimpta also maintained a strong upward trajectory in neurology, taking share in multiple sclerosis treatment due to its efficacy and convenience.

These two franchises alone provided meaningful cushion against the first quarter of generic pressure on Entresto in the US. The erosion there has so far been controlled (international demand largely offset US declines) but the competitive wave is now underway, which means the portfolio must continue to deliver elsewhere. Cosentyx, the long-standing immunology pillar, faced a softer quarter due to pricing pressure, but prescription trends remain resilient and the drug continues to defend share in dermatology and rheumatology.

The pressure point this quarter was clearly margins. While revenue grew at a healthy pace, the core operating margin slipped versus expectations due to stepped-up R&D, a theme management flagged earlier in the year as late-stage programs enter weight-bearing clinical phases. This isn’t unwelcome spending, pipeline velocity now matters as much as commercial executio, but it does dampen operational leverage in the near term.

The company reiterated full-year guidance, suggesting this cost profile is intentional and already embedded in internal plans rather than reactive. That message stabilizes expectations for now, but Novartis is unlikely to see meaningful earnings momentum again until productivity from these investments begins to show.

From a market standpoint, the investment case remains evenly balanced. The stock trades roughly in line with large-cap pharma peers on forward earnings, with a modest discount to its own historical average. There is no valuation stress, but also no obvious near-term catalyst to re-rate the shares.

Without major upcoming readouts or transformative approvals slated for late 2025, the stock trades more as a defensive compounder than as a catalyst-driven growth story. Execution remains solid and the balance sheet disciplined, but to rekindle investor enthusiasm, Novartis now needs evidence that pipeline acceleration can offset patent erosion, not just support the base.

BB Biotech AG (BION Switzerland): Portfolio recovery gathers momentum as biotech sentiment turns

After nearly two years of grinding volatility and capital flight from high-beta healthcare, Q3 marked a proper inflection for BB Biotech.

With biotech sentiment finally thawing, helped by Fed rate cuts, improving funding markets and a visible pickup in market transactions, the Swiss-listed investment vehicle delivered a strong rebound in portfolio net asset value.

The quarter showed what happens when macro stops working against the sector: the portfolio advanced more than 20% in local currency, translating into net income of roughly CHF 450 million, a dramatic swing from last year’s negative result. Importantly, this wasn’t just a beta-driven bounce. The recovery was backed by tangible clinical and regulatory catalysts across holdings, validating BB Biotech’s concentrated, high-conviction approach in mid-cap biotech innovators.

What stands out is the discipline of portfolio rotation. Management didn’t treat the Q3 rally as a reason to sit still. Instead, it continued to recycle capital aggressively, exiting names where conviction had fallen (Moderna, Black Diamond and Blueprint Medicines) and redeploying into areas with asymmetric upside. Moderna’s exit makes sense: the fading Covid vaccine boost, rising political scrutiny, and an increasingly crowded respiratory market all dilute the original thesis. Likewise, the sale of Black Diamond and the monetization of Blueprint after its Sanofi takeout reflect a pragmatic stance on opportunity cost.

Those proceeds were redirected to reinforce high-belief positions such as Revolution Medicines and Scholar Rock, both sitting on pipeline catalysts that could still unlock step-changes in valuation. The addition of Avidity Biosciences, an early leader in antibody-oligonucleotide conjugates, signals continued willingness to lean into platform innovation rather than chase late-cycle safety.

The portfolio today is more focused than ever on validated biology with near-term readouts. Ionis remains a foundational position, and Q3 brought meaningful progress with Donidalorsen’s approval and Phase 3 success for Olezarsen. Rivus Pharmaceuticals showed compelling data in metabolic disease, while Agios inches closer to commercial expansion with Mitapivat in sickle cell disease, data that could reset consensus on its long-term revenue potential. Even Revolution Medicines, whose RAS-targeting programs were once seen as too complex, is now entering a clinical window where differentiation can be proven.

In other words, BB Biotech isn’t just surfing a macro tailwind: it sits on a stacked catalyst calendar that spans both binary events and line extensions.

BB is a geared play on biotech normalization with cleaner positioning than ETFs and a management team willing to make hard allocation calls rather than drift with benchmarks. The shares still trade at a discount to NAV, offering a margin of safety while the news cycle stays busy across holdings.

With sector flows improving, capital returning to innovation themes and M&A activity heating up again, BB Biotech is one of the more direct ways to express a conviction that biotech’s winter may finally be over.

Sika (SIKA Switzerland): Transition years test patience as China drags and restructuring resets expectations

Sika has long enjoyed market admiration for its disciplined expansion, resilient margins and enviable execution in construction chemicals. But the company’s latest update is another mark that Sika now finds itself less defined by growth and (much) more by repair.

The weak Q3 confirmed what had already been filtering through the market – China is not just a soft spot but an outright drag, with revenue exposure of roughly mid-teens now meaningfully offsetting healthier trends in Europe and the Americas. Within China, the split is telling: construction accounts for the majority of Sika’s activity, and this is exactly where the cyclical damage is deepest. The weakness in roof tile adhesives and waterproofing (roughly three quarters of Chinese sales) is tied to the prolonged slump in residential construction, while tariffs on imported inputs have compressed competitiveness. Automotive demand remains a bright spot locally, but it is not large enough to compensate for the broader construction slowdown.

In response, Sika has reset expectations and acted decisively on costs. The newly launched ‘Fast Forward cost program is designed to address operational bloat that built up over the last investment cycle. It includes restructuring charges in the region of CHF 80–100 million this year, with around CHF 16 million already booked in Q3 and a larger chunk due in Q4. Roughly a quarter of these charges are non-cash asset write-downs, while the rest will fund footprint rationalization.

Management has also signaled CHF 120–150 million of incremental spending, mostly capex, to improve productivity and supply chain efficiency across regions. In return, the company expects recurring annualized savings of CHF 150–200 million from 2028 onward, meaning Sika has chosen to absorb a year of financial pain to restore operating agility.

The CFO also reassured investors that the dividend remains intact, a signal that Sika intends to preserve financial flexibility without overreacting to short-term turbulence.

Still, the path back to form will take time. Management has already guided that China will remain challenging through at least the first half of 2026, and organic growth next year is likely to hover closer to the lower end of the typical 3–6% range. Western Europe continues to face subdued renovation activity, while parts of Central Europe and North America offer steadier (but unspectacular) order books.

After the guidance reset, the market now probably views 2026 as a consolidation year, with most of the recovery effort back-weighted. Valuation does not look distressed, but it certainyl no longer reflects a premium execution story either. That may prove fair: this is now a show-me story again, where credibility has to be re-earned gradually through delivery on costs and stabilization in Asia.

For long-term holders, Sika still retains the strategic qualities that made it a compounder (i.c. strong pricing power, technology leadership in adhesives and sealing systems, and a disciplined acquisition playbook) but execution must do the talking.

Siltronic (WAF Germany): A late-cycle semiconductor supplier waiting for the turn

Siltronic sits in an awkward part of the cycle: demand in the broader semiconductor market has stabilised but not yet recovered, and wafer producers like Siltronic tend to feel the upturn last.

The latest quarter did little to change that narrative. Revenue declined at a mid-teens rate year-on-year as customers continued to work through elevated inventories, and the company faced a temporary volume dip from scheduled deliveries shifting into the final quarter of the year.

Yet more importantly, beneath the top line remains operational resilience. Despite muted pricing and higher ramp-up costs from the new Singapore fab, Siltronic still held EBITDA margins above twenty percent, demonstrating discipline during a trough phase.

The cost headwinds are understandable. The Singapore fab is a long-term strategic investment designed to position Siltronic for the next wave in wafer technology, especially for advanced nodes and larger diameters. But its early ramp phase is margin-dilutive, as depreciation kicks in before full utilisation improves plant economics. The company also carried heavier capital expenditure again this quarter, in line with its expansion strategy, and this pushed net debt slightly higher.

Management expects leverage to peak around current levels before easing as cash generation improves. This is consistent with a company preparing for a heavier demand environment while weathering the final stages of industry digestion.

Importantly, Siltronic maintained its full-year revenue outlook and only narrowed its EBITDA margin guidance range, opting for a realistic midpoint rather than a reset. That signals confidence that the demand softness is temporary rather than structural. The wafer market historically trails chip demand by several quarters, and memory producers are already signalling higher volumes into 2026 as AI-related investment spills over into broader compute and storage. Once memory restocking begins in earnest, wafer demand tends to move quickly due to long production lead times and limited short-term capacity flexibility. This should support Siltronic’s utilisation and pricing mix through late 2026 into 2027. Management has pointed out that despite weak order patterns today, order books have not deteriorated further and some regions are turning more constructive.

Siltronic’s multiples reflect market caution toward late-cycle suppliers and the drag from its heavy capex programme. But the setup increasingly resembles a classic cyclical bottleneck: depressed earnings, underappreciated operating leverage, and an asset base being modernised just before demand tightens supply.

The coming quarters will still be bumpy (industrial end-markets are slow to clear and logic demand is only stabilising) but the inflection is becoming visible in memory.

For investors patient enough to wait for utilisation to recover, Siltronic represents a quietly attractive way to participate in the next leg of semiconductor capital intensity, particularly as the AI build-out becomes increasingly supply-chain diversified.

Hensoldt (HAG Germany): Orders surge ahead of schedule, but valuation leaves little room for impatience

Germany’s defence rearmament cycle continues to reshape the European industrial landscape, and Hensoldt has been one of its main beneficiaries.

The company, which specialises in high-end defence electronics (radar, sensors, electronic warfare systems) has upgraded its full-year order guidance far earlier than the market expected.

The new book-to-bill target of roughly 1.6–1.9x versus 1.2x previously signals a major acceleration in order inflow, driven above all by Germany’s procurement decisions under the ‘Zeitenwende’ defence agenda. Berlin’s budget committee has begun releasing large contract packages, particularly around land reconnaissance and air combat systems, which are now translating into higher-than-anticipated program allocations for Hensoldt.

This early pull-forward of order activity does not immediately change revenue for this year, but it extends visibility into the second half of the decade and underscores the political priority assigned to rebuilding Europe’s defence capabilities.

However, investors expecting this upgrade to change 2025 profitability dynamics may need to keep expectations grounded. Management only narrowed revenue guidance slightly to around €2.5bn and nudged the adjusted EBITDA margin outlook to ‘18% or higher’, which remains firmly within the original range.

The reality is that defence manufacturing ramps do not convert orders into cash overnight; complex system contracts need engineering phases and long integration cycles, and cash conversion typically improves only once platforms enter full-rate production. That said, the medium-term setup looks increasingly attractive. Hensoldt continues to sit at the heart of programs that are politically untouchable even in a fiscally constrained Europe: Eurofighter upgrades, ground sensor networks, and electronic intelligence packages tied to NATO modernisation.

The company is also leveraging its long-standing relationship with Airbus Defence & Space to stay embedded in strategic programs that run into the 2030s. While management is vague on contract names until formalised by primes, the shift in tone suggests order awards are coming sooner than anticipated, giving Hensoldt greater operating leverage potential from 2026 onward.

On valuation, even with today’s upgraded order outlook, the shares are already trading at levels that imply a flawless execution path. Compared to other European defence peers still trading at mid-teens earnings multiples, Hensoldt commands a premium multiple on the promise of structurally higher growth, but it lacks the free cash flow profile to justify that gap yet. Cash generation remains modest as working capital absorbs ramp costs and investments, and the margin profile is solid rather than exceptional relative to peers.

In other words, the long-term story is intact (European defence rearmament is a decade-long structural cycle) but the entry point matters.

With enthusiasm already priced in, investors may need to wait for either a pause in share momentum or signs of operating leverage translating into accelerating profit at scale. The fundamentals look strong; the patience required to own it from here looks even stronger.

Porsche AG (P911 Germany): Restructuring clouds near-term optics, but fundamentals stabilise into 2026

Porsche’s latest quarter was never going to look pretty, and management telegraphed that months ago.

The company is grinding through one of the most complex product transition phases in its history while simultaneously facing exogenous shocks in two of its key markets: a prolonged collapse in China and sustained import tariffs in the US.

Against that backdrop, the third quarter headline numbers looked brutal, declining revenue, a deep operating loss, and another wave of restructuring charges. But beneath, the underlying earnings power of the franchise is beginning to re-emerge, and that is precisely what the market is watching for.

Volumes were once again under pressure as Porsche continued to destock dealers and phase out ageing combustion models like the Macan and the 718 ahead of their electric successors. Unit deliveries fell at a double-digit pace and revenue slipped accordingly.

Yet Porsche flexed one of its structural advantages: pricing power. Average revenue per vehicle increased again, supported by a richer product mix and pricing discipline across key Western markets. The financial services division also remained resilient, helping revenue land broadly in line with market expectations. More importantly, when stripping out the latest restructuring programme (which included around €2 billion in provisions tied to product cycle realignment) Porsche generated an underlying double-digit operating margin in the quarter. That is notable progress given that margin troughed earlier this year.

Free cash flow was another bright spot. Although working capital and lower capex contributed unusually strongly this quarter, the cash generation shows that Porsche isn’t burning liquidity to fix its problems. It is repositioning, albeit under pressure.

Management has reiterated full-year guidance, which now looks achievable given the sequential improvement in the quality of earnings. The commentary on 2026 also sounded more constructive than at any point this year: pricing should remain positive, mix will improve as high-end 911 derivatives reach full availability, and US tariff pressure has likely peaked. However, management is refreshingly realistic; a return to double-digit margins next year is unlikely. The drag from the China reset, the sunsetting of key internal combustion models, and continued FX headwinds all limit upside velocity.

Porsche is no longer the compounder story investors bought at IPO. It is navigating a structural reset, i.c. strategically necessary, but costly and risky. Execution risk remains high as multiple EV launches converge within a tight development window. China volumes remain structurally impaired.

And while the company is stabilising, the stock already discounts a recovery looking into 2026, trading around a mid-teens earnings multiple that sits slightly above its post-IPO median. Until the redesign of the product lineup visibly translates into sustained volume momentum and margin rebuild, the market is unlikely to re-rate the story further.

For now, Porsche is turning the corner operationally, but the burden of proof for a full recovery still lies ahead.

Palfinger (PAL Austria): tariff headwinds blur near-term earnings, but strategy remains intact

Palfinger has spent the better part of the last decade transforming itself from a cyclical crane manufacturer into a more resilient lifting solutions platform with growing service revenues and an expanding footprint beyond Europe. That structural story remains valid, but the latest quarterly update serves as a reminder that macro politics can still derail quarterly momentum.

The company was hit by an unexpected external shock in its largest profit pool outside Europe: the United States. Washington’s extension of trade tariffs this summer, particularly those tied to steel-related imports under Section 232, has quickly filtered through to Palfinger’s North American operations. Not only did tariffs inflate input costs, but they also froze customer sentiment, leading to postponed orders and a squeeze on margins. The result was a weaker-than-expected third quarter and a downward revision of full-year guidance.

Management’s updated commentary suggests that 2025 will still be a solid year but no longer a record one. Revenue held up reasonably well given the tariff shock, and demand in Palfinger’s core European region remains firm. Order intake in Europe picked up, supported by infrastructure spending, heavy logistics, and recovery in the construction value chain. Asia also delivered growth, with APAC remaining an important long-term expansion market. Marine cranes performed well, helped by energy and offshore spending.

These trends confirm that Palfinger is not facing a broader cyclical downturn; this is a regional tariff disruption rather than a collapse in end markets. Still, the US drag was significant enough to pull the group EBIT margin below prior expectations and erase some of the operating leverage Palfinger had built across the service network.

The guidance reset now implies full-year profitability settling close to last year’s level rather than exceeding it as originally targeted. While disappointing versus initial ambition, the market had already begun pricing this risk after the summer tariff announcement. Importantly, the company is not signalling any deterioration in structural trends. The service business continues to scale from a higher base. Pricing discipline in Europe is holding. Supply chain efficiency programs and footprint optimisation remain on track. The recently communicated 2027 and 2030 targets around growth and margin expansion were not withdrawn. Palfinger has been transparent that North America is a strategic priority long term; tariffs may delay, but are unlikely to derail, the investment case.

The tariff headwind limits near-term upside ioo, but it does not impair the multi-year thesis. For investors willing to tolerate temporary geopolitical noise, the risk/reward appears to remain constructive as long as order trends outside the US continue to compensate and Palfinger executes on its operational roadmap.

SIG Group (SIGN Switzerland): Stabilising margins while strategy reset shifts focus to execution

SIG entered the third quarter under a cloud following its summer profit warning, and the results confirmed what management had already flagged: top line deceleration has set in as customers digest excess inventory in a softer consumer environment.

Revenue declined mid-single digits at constant currency, a clear reversal from the modest growth earlier in the year. The slowdown was broad-based, with all regions posting lower volumes, suggesting a cyclical pause rather than an isolated geographic issue. Demand in India and the Middle East weakened, Europe struggled under weak packaged goods volumes in Germany, and Asia suffered from softness in China’s chilled carton market. Even the Americas, previously a stronghold thanks to a low comparison base and new business wins, slipped slightly.

Yet, despite the weaker top line, profitability held up better than feared. The adjusted EBITDA margin landed just under 24%, within the full-year guidance range and supported by disciplined cost control and early operational benefits from portfolio simplification. Resin prices (a key input) have been broadly stable, shielding gross margins.

Management reiterated its full-year outlook, signalling confidence that Q4 can deliver a stabilisation in sales to roughly flat organic growth for the year. That implies another mildly negative quarter for revenue, but no sharp deterioration. Crucially, the company has been upfront about the drag from one-off charges linked to prior acquisitions, mostly concentrated in bag-in-box and spouted pouch assets, as well as chilled carton. These impairments, north of €300 million already booked year-to-date, do not affect cash flow but show that SIG is cleaning up legacy balance sheet items before presenting a refreshed strategy.

That strategy reset is now the key catalyst. Investors awaiting the upcoming capital markets day are looking for clarity on capital allocation, simplification, and a realistic mid-term growth algorithm after a period of underwhelming execution. The group has hinted at a sharper performance focus and an aim to improve returns on invested capital, which were diluted by the acquisition spree of the last cycle.

The balance sheet remains manageable, and the business model still benefits from structural exposure to aseptic carton packaging, a niche within sustainable food and beverage packaging that retains secular tailwinds. However, SIG must now reprove its ability to grow consistently while integrating past deals and protecting margins without financial engineering.

Sentiment has arguably overshot the fundamentals, but this is now a show-me story. The near-term setup is one of stabilisation, with execution risk tied to portfolio pruning and selective recovery in end-markets. Longer term, if SIG can demonstrate pricing discipline, operational efficiency, and credible cash generation, a re-rating is plausible.

If you appreciate this post, feel free to share and subscribe below!