Defense, online retail and broken (e)dreams

eDreams ODIGEO, Answear.com, Rheinmetall, Soitec, Kapsch TrafficCom, Allegro, PORR, Flughafen Wien, Nokia, Pfisterer, CFE, UNIQA, Glanbia

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

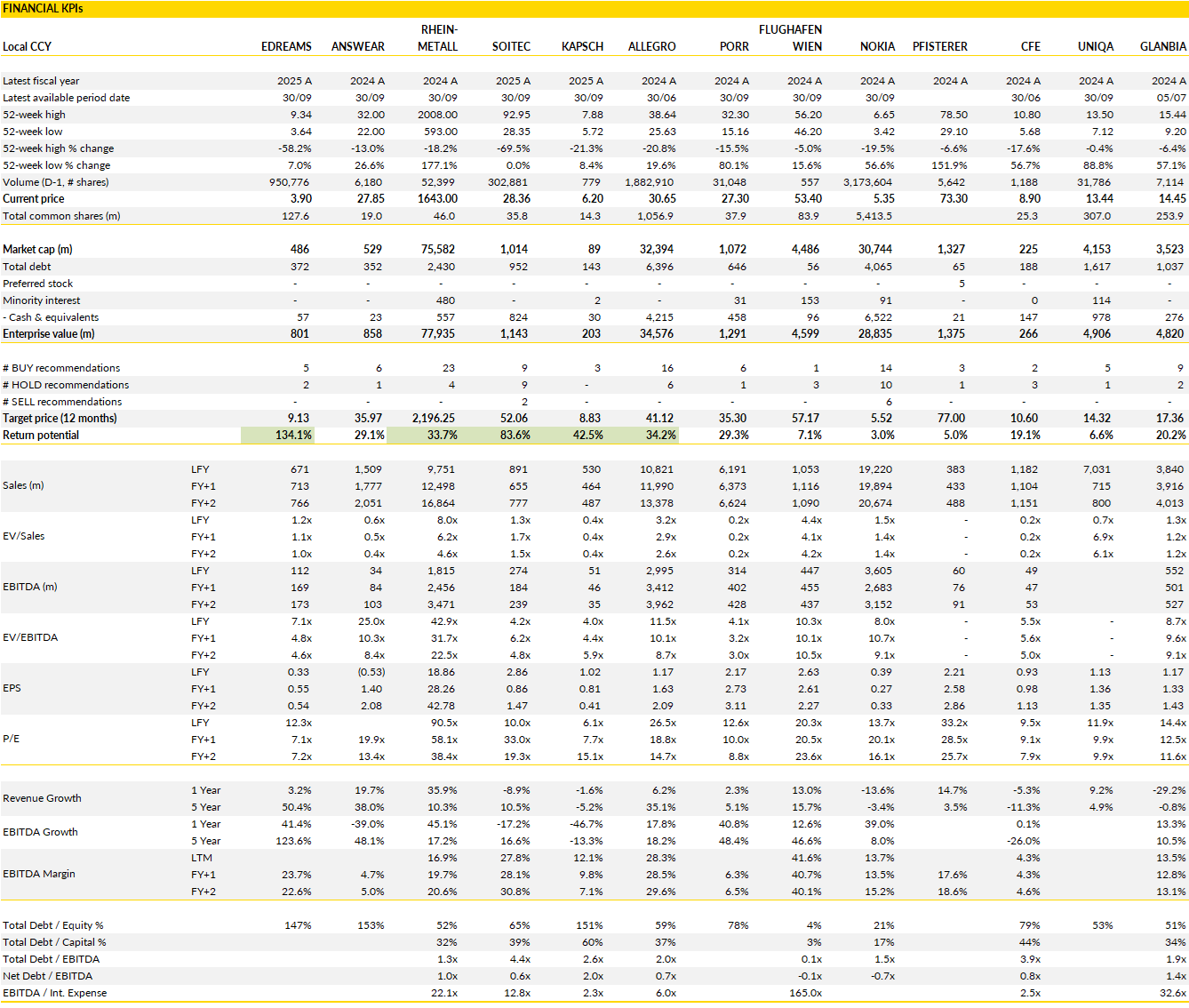

Financial KPIs

eDreams ODIGEO (EDR Spain): turbulence hits the Prime model as strategy resets for long-term lift

The first half of the year brought a brutal reality check for eDreams ODIGEO, as management’s tone shifted sharply from the optimism of January’s capital markets day to a message of basically retrenchment.

Two developments are weighing heavily on near-term performance. First, Ryanair has effectively blocked its flight capacity from being listed on online travel agency (OTA) platforms, disrupting eDreams’ ability to access one of Europe’s most critical low-cost inventories. This move, beyond hurting short-term booking volumes, underscores how fragile the OTA model can be when airlines with pricing power pull distribution levers. Second, eDreams has chosen to overhaul its Prime subscription structure, moving from annual to monthly or quarterly payments. While the change will eventually broaden accessibility and attract more members, it temporarily depresses reported earnings due to the deferral of subscription revenue.

Together, these shifts have forced a rethink of the company’s short-term guidance, with cash EBITDA expectations for this fiscal year and next cut dramatically.

It’s an uncomfortable reset for a business that had, until recently, positioned itself as one of Europe’s few scaled digital travel subscription models. The Prime program remains at the heart of the strategy: a membership ecosystem that locks in repeat customers and reduces marketing dependency on search engines and affiliates.

Yet, the revised guidance reflects the painful arithmetic of transition. Instead of over €215 million in cash EBITDA this year, management now targets roughly €155 million, dropping even further next year before recovering. Growth investments in new product categories such as train bookings and new geographies will stretch the balance sheet and delay profitability improvements. Nonetheless, these moves underline a clear strategic intent; to build a more diversified, resilient platform that captures broader travel demand, rather than relying excessively on airfares and airline cooperation.

The disappointment lies mainly in the timing. eDreams’ long-term logic, a subscription-led model with recurring revenue and lower customer acquisition costs, remains sound, and the company still enjoys scale advantages across its European footprint. But near-term visibility has deteriorated sharply. Competitive dynamics in online travel are evolving fast, and regulatory scrutiny over airline distribution practices adds an additional layer of uncertainty.

Investors now face at least two “transition years” before meaningful recovery in cash flow, which will test confidence in management’s execution. Still, with the share price already heavily de-rated and trading at a fraction of its pre-guidance-cut valuation, eDreams stands as a high-risk but potentially high-reward turnaround story, one hinging on its ability to prove that Prime’s subscription economics can outlast today’s turbulence.

Answear.com (ANR Poland): steady operational recovery, but growth entering a more mature phase

Answear’s third quarter showed a company regaining its footing after a volatile 2024, with operational metrics largely tracking expectations and margin recovery continuing as planned.

Revenue rose 14% year-on-year to PLN 394 million, marking a solid balance between volume and pricing. Order growth of 8% and a 6% increase in average order value showed the brand’s ability to sustain customer engagement without over-relying on promotions. The premium PRM label, acquired in 2023, remains a standout, growing 52% year-on-year and gradually shifting the overall mix toward higher-margin categories. Marketing spend fell slightly as a percentage of sales, reflecting better efficiency and brand recognition gains in Central Europe, while the improvement in the conversion rate, now at 1.9% versus 1.8% a year ago, suggests customer acquisition efforts are paying off. EBITDA of PLN 14.8 million was roughly in line with market forecasts, confirming that the margin repair story remains on course, even if financing costs held back net income.

The quarter also demonstrated the nuances of running a fashion e-commerce platform in a more normalized demand environment. Returns, up modestly year-on-year but down sequentially, indicate that Answear’s pricing and assortment balance has stabilized after the post-pandemic overhang of discount-led volume. Active customers grew 13% to 2.6 million, and while web traffic only inched up by 3%, it reflected higher-quality engagement. PRM’s performance in particular points to a broader strategic ambition; to move upmarket in product mix, elevate average basket size, and gradually reduce dependence on heavy marketing outlays.

These efforts are visible in the margin trajectory: at 3.8%, the EBITDA margin may still look modest, but it represents a sixfold improvement from a year earlier. That progress, combined with better cost discipline, puts the company on track to hit its full-year EBITDA goal of PLN 80 million, especially as Q4 remains the strongest quarter seasonally.

Still, beyond this recovery year, Answear faces the familiar challenge of sustaining growth as the Central and Eastern European e-commerce market matures. Competition remains fierce from both international platforms and local players investing aggressively in logistics and brand visibility. Currency volatility and cost inflation could also reintroduce pressure on consumer sentiment and returns.

Yet the structural story, i.c. a digitally native fashion retailer with regional scale, improving unit economics, and growing brand equity, remains intact. With execution stabilizing and its motivation program aligned with profitability milestones through 2027, Answear is progressing from short-term recovery to a more disciplined, medium-term compounding story, even if the market now expects steadier, less spectacular growth from here.

Rheinmetall (RHM Germany): stretching the growth arc but execution now takes center stage

Rheinmetall’s Capital Markets Day reaffirmed the consensus narrative, i.c. this is a company in hyper-growth mode, but one whose next leg basically depends on flawless execution.

The group’s 2030 targets landed at the high end of expectations, projecting an extraordinary 36% compound annual growth rate in defence revenues between 2025 and 2030, helped by acquisitions such as NVL and a wave of new contracts across Europe. Rheinmetall’s civil business, long the awkward stepchild in its portfolio, is expected to be sold by mid-2026, freeing management to focus entirely on weapons, vehicles, and air defence. Margins above 20% are now formally embedded in the plan, credible given the product mix and vertical integration, but still ambitious. With capex expected to rise toward 10% of sales over the next two years, near-term free cash conversion may dip, though customer advances on large contracts should cushion the cash flow profile.

The overall message: Rheinmetall’s future will be larger, more automated, and increasingly digital, but also more operationally complex.

The presentation showcased how deeply the company is investing in automation and in-house production to sustain those margins. Its new ammunition factory, capable of generating €1.5 billion in annual sales with only 40 employees per shift, is emblematic of this transformation.

Vertical integration, from raw propellant to finished shell, gives Rheinmetall pricing resilience in an inflationary supply chain environment and locks in long-term profitability. The company’s scale also allows it to industrialize military production lines, applying robotics to vehicle chassis and turret assembly, a capability smaller peers cannot replicate.

On the commercial front, management remains confident that the next few quarters will deliver a new wave of orders, with €40 billion in potential contracts tied to the Boxer, Lynx, and medium-caliber ammunition programs. If even part of this pipeline materializes, Rheinmetall’s backlog could exceed €120 billion by mid-2026, a figure that dwarfs its pre-war order book.

Still, the equity story is now moving into a phase where investors will demand proof of execution, not just growth rhetoric. Much of the valuation already reflects the transformation narrative, with the stock trading at over 28x 2027 earnings and a modest free cash flow yield. Near-term revisions are unlikely, as the group’s heavier investment phase absorbs capital and margins plateau before expanding again later in the decade.

The real inflection may not come until 2027–2028, when the vehicle and air defence ramp-up kicks in fully. Rheinmetall’s ambition to evolve into a “digital system house” (integrating sensors, command systems, and autonomous technologies) could eventually justify its premium multiple, but for now, the story hinges on steady delivery rather than new promises.

In short, Rheinmetall’s long-term growth case remains exceptional, but the stock may already be pricing much of that promise, leaving limited room for error.

Soitec (SOI France): cash discipline becomes the core amid industry headwinds

Soitec’s first-half results laid bare just how brutal the cyclical downturn in its core end-markets has become, but also how disciplined management has grown in navigating it.

Revenue fell 29% organically, dragged by a collapse in Automotive & Industrial demand and deep destocking in Mobile Communications, where customers continue to unwind excess wafer inventory. Beneath the surface of those headline declines, there were a few signs of operational resilience. EBITDA dropped by roughly a third but still came in well ahead of market expectations, as the company kept its fabs running above the level justified by orders, cushioning the income statement at the expense of the balance sheet. That choice inflated inventories and pushed net debt slightly higher, but it also helped preserve margin discipline and capacity readiness for the eventual upturn.

For the first time in a decade, Soitec reported a net loss, largely due to non-cash impairments tied to SmartSiC assets and foreign exchange losses, showing how the transition year has forced a reset in both earnings and expectations.

The immediate challenge remains a fragile demand environment. The guidance for the third quarter, projecting only mid-to-high single-digit sequential revenue growth, fell short of market hopes and reinforced the message that the cyclical bottom has yet to pass. Mobile Communications, still the backbone of the business, remains under pressure as customers digest inventories, while Automotive and Industrial, once seen as the diversification pillars, are now adding to the drag. The Edge & Cloud AI segment, bolstered by the planned phase-out of legacy Imager-SOI lines, is proving more stable but too small to offset the broader slowdown.

Management’s new CFO has therefore refocused priorities decisively on cash preservation: capex has been cut for the second time this year, and a major effort to shrink inventories is underway, even if that means lower near-term margins. In effect, Soitec is now running the playbook of a cyclical survivor: conserving liquidity, trimming investment, and defending operational leverage until demand returns.

After a 60% share price collapse year-to-date, much of the cyclical pain is arguably reflected in the valuation. Soitec’s technology base, the engineered substrates that underpin high-performance chips, remains strategically relevant, but the short-term narrative has shifted from growth to financial stability.

Investors are watching two things closely: first, the scale of the inventory cleanup in the second half, which will dictate the pace of cash flow recovery; and second, the identity and strategic direction of the next CEO, with the board’s search still underway. The long-term thesis, exposure to silicon-on-insulator technologies in AI, automotive, and 5G applications, hasn’t broken, but the timing of its reacceleration has.

For now, Soitec is in repair mode, focused on regaining the financial flexibility to be ready when the semiconductor cycle turns.

Kapsch TrafficCom (KTCG Austria): stabilising margins amid a contracting project base

Kapsch TrafficCom’s first-half results so far confirmed what had already been hinted in October: the company is shrinking to profitability.

Revenue fell sharply by more than a quarter year-on-year to €200 million, reflecting both the planned wind-down of legacy tolling contracts in Belarus and South Africa and the broader slowdown in project tenders across its key regions. Yet despite the contraction, reported EBIT swung from a small loss to a positive €10 million, sustained by a one-off settlement with the German government linked to the cancelled motorway tolling system. Strip out that €23 million compensation gain, and the underlying picture remains loss-making, a reminder that while the legal win provided breathing space, operational momentum is still subdued.

Every business line and geography saw revenue declines, with EMEA particularly weak, though the Americas held up slightly better thanks to ongoing service contracts. The company’s tolling division, which still makes up nearly three-quarters of revenue, suffered a near 30% drop in sales but showed nominal profit thanks to the settlement windfall. Traffic management fared little better, sliding 21% year-on-year as cities and infrastructure agencies delayed upgrades amid tight budgets.

While management has worked to improve efficiency, reduce overheads, and streamline its project execution model, the EBIT margin excluding exceptional items remains deeply negative. The global environment has not helped: new tenders are slower to materialize, and large infrastructure contracts in emerging markets, once a growth engine, have become harder to close given financing constraints. Against this backdrop, Kapsch’s focus has shifted to cost control, cash preservation, and selective bidding, prioritizing profitability over scale.

The turnaround is showing early signs of progress in working capital discipline, but execution risk remains high in a business dependent on lumpy government projects.

Looking ahead, the outlook for fiscal 2025–26 points to a transition year, with management guiding for around €450 million in revenue and €25 million in EBIT, a target that already assumes a subdued order environment. The group’s strategy appears to be one of consolidation: maintaining its core expertise in electronic tolling while trying to broaden its technology footprint into traffic analytics and digital mobility services, areas that could eventually smooth its cyclical exposure. However, meaningful recovery will depend on the revival of infrastructure procurement, especially in Europe and Latin America, where several tenders have been delayed rather than cancelled.

After years of restructuring, Kapsch TrafficCom has achieved operational breathing room and avoided financial distress, but sustainable growth still looks distant. For now, the story remains one of cautious recovery; a niche technology player retrenching while waiting for the next wave of transport digitalisation projects to reignite demand.

Allegro (ALE Poland): solid execution meets a fragile consumer backdrop

Allegro’s update shows a company executing well operationally but running up against a tougher retail environment as the year closes out.

The Polish e-commerce leader posted strong profitability metrics, with adjusted EBITDA up 24% year-on-year and margins expanding three percentage points, showing tight cost control and strong monetisation through higher take rates and booming ad revenue. The domestic marketplace remains the powerhouse, with revenues rising 20% and EBITDA topping PLN 1 billion, driven by both transaction fees and the continued scaling of Allegro Pay and Delivery. Even the international business, though still loss-making, narrowed its deficit meaningfully, suggesting that the integration and restructuring of legacy acquisitions are finally starting to stabilize.

Yet the management tone was cautious. After a year of steady progress, the company flagged a noticeably softer start to Q4 trading, signaling that even market leaders are not immune to the pullback in discretionary spending across Central and Eastern Europe.

The operational data offered some encouraging trends under the surface. Gross merchandise value (GMV) rose nearly 10% year-on-year, outpacing Polish retail sales, with the number of items sold up almost 12%. Active buyers inched higher, though the pace of new user growth has slowed, reflecting a maturing domestic market. Allegro is now relying more on spending per user (GMV per active buyer rose almost 6%) and on ancillary services to drive profitability. Advertising revenue surged 32%, highlighting how Allegro’s scale allows it to monetize its platform far beyond simple transaction fees.

Meanwhile, Allegro Delivery continued to capture a growing share of parcels, now handling over a third of shipments, while Allegro Pay financed more than 15% of GMV, both reinforcing the platform’s ecosystem moat. However, these gains come against a backdrop of waning consumer confidence and rising competition from global entrants such as Amazon and Temu, which are pressing price-sensitive customers with aggressive discounting.

Management reaffirmed full-year guidance for 8–11% revenue growth and a 13–17% increase in adjusted EBITDA, but the admission of softer Q4 patterns casts a shadow over near-term sentiment. Allegro remains the clear category leader in Polish e-commerce, with unmatched logistics integration and a scalable fintech layer that deepens customer loyalty.

Still, growth is becoming harder to extract from a saturated home market, while international operations remain in transition. The investment case increasingly depends on whether Allegro can balance profitability with renewed top-line momentum once consumer demand stabilizes.

PORR (POS Austria): earnings hold firm as infrastructure momentum builds but revenue pace cools

PORR’s recent update once again captured the company’s defining feature: earnings resilience amid a volatile top line.

While sales slipped 3% year-on-year and output fell 5%, operating profits still landed right in line with expectations, helped by one of the lowest material cost ratios on record. The construction group delivered a 20% jump in EBIT to €59 million despite subdued project execution, highlighting how disciplined procurement and selective bidding are offsetting softer volumes. The dip in revenue primarily reflects timing; large infrastructure projects, especially in Central and Eastern Europe, remain in the design or approval stages rather than in active build-out.

That dynamic prompted management to subtly rephrase its full-year outlook, lowering revenue guidance to roughly flat growth while reaffirming EBIT at €180–190 million. In other words, PORR expects to make as much profit as before, just on a slightly smaller base, a sign that operational control rather than top-line expansion is driving the investment case so far this year.

The order dynamics remain a bright spot. Third-quarter intake jumped 23% to €2 billion, roughly matching forecasts, with a string of railway and public works contracts in Poland and Romania underpinning the increase. The order backlog now sits at an all-time high above €9.6 billion, equivalent to well over a year and a half of output, a comforting buffer against near-term revenue volatility.

Management’s cautious optimism toward Germany’s long-awaited infrastructure stimulus plan also remains intact, even though PORR expects the first tangible orders only by late 2026. For now, Central and Eastern Europe continues to act as the engine of growth, both in terms of bid activity and profitability, helped by EU-funded transport and energy corridor projects. The German market, by contrast, still feels sluggish, weighed down by bureaucratic delays and slow public tendering.

Financially, PORR is holding steady. Despite a small cash outflow year-to-date, net debt remains manageable at just over €300 million, and the equity ratio sits comfortably near 20%. Margins are trending toward the upper end of guidance, showing that the company’s post-pandemic focus on project selection, risk management, and lean execution is paying off.

Still, the amended guidance for flat revenues in the final quarter hints at persistent phasing delays, a reminder that construction growth often comes in bursts rather than smooth trajectories. PORR’s near-term outlook may lack excitement, but its long-term setup looks sturdier than it has in years: a strong backlog, disciplined cost base, and early exposure to the next European infrastructure cycle.

Flughafen Wien (FLU Austria): smooth operations but turbulence ahead for margins

Flughafen Wien’s third quarter offered few surprises but revealed the limits of its post-pandemic recovery.

Revenue rose just over 5%, in line with market expectations, as passenger growth at Vienna Airport slowed to a modest 1.1%. The top line was flattered by a 4.6% tariff increase, but rising wage costs again eroded profitability, pulling the EBITDA margin down to 51.5% from last year’s 53.7%. After a stretch of strong quarters supported by pent-up travel demand, growth is now plateauing while inflationary pressures persist. Handling services and the retail & property segment both underperformed, the latter largely because the group is now lapping the boost from last year’s duty-free expansion in Terminal 2. Malta remained a bright spot with a 7.5% revenue increase, though even there profitability barely budged, suggesting cost creep across the network.

Overall, the quarter showed steady, controlled operations, but also the end of the easy growth phase.

The company continues to generate solid cash flow and sits on a comfortable net cash position of roughly €440 million, helped by €145 million of free cash flow year-to-date. Still, capital expenditure has ramped up sharply, nearing €200 million for the year as Flughafen Wien presses ahead with its Terminal 3 south extension and new investments in Malta. This capex cycle is meant to future-proof capacity and improve retail exposure, but in the short term it tightens free cash flow conversion just as cost inflation remains stubborn.

Management left its full-year guidance unchanged (about €1.08 billion of revenue and €440 million of EBITDA) though the wording of the release suggests little scope for upside surprises. October traffic rebounded slightly, up 3.7% in Vienna and 6.7% for the group, but those gains are unlikely to offset the slowdown expected into winter as budget carriers trim capacity.

Looking into next year, two headwinds are already in sight: the gradual easing of leisure travel momentum in Central Europe and the reinstatement of Vienna’s pre-Covid tariff formula, which will cut passenger charges by roughly 5%. Combined with rising staff and energy costs, that adjustment could pressure margins even if traffic volumes hold up.

Flughafen Wien remains a model of operational discipline with a strong balance sheet and a near-monopoly position in its region, but the growth story has turned defensive. The next phase will be about managing yield rather than volume, extracting efficiency from existing infrastructure and maintaining pricing power in a softer aviation cycle.

For now, the stock trades as a mature infrastructure play, steady but lacking a clear catalyst until passenger growth re-accelerates or the next wave of tariff adjustments offers relief.

Nokia (NOKIA Finland): steady strategic reset, but expectations already priced in

Nokia’s capital markets day in New York offered a dose of realism beneath the AI headlines.

The Finnish group unveiled a leaner two-division structure and set out 2028 profit targets that look sensible but hardly transformational. The reorganisation merges its network and mobile units into two clearer pillars, Network Infrastructure, which now includes the recently acquired Infinera optical assets, and Mobile Infrastructure, which combines mobile networks, core operations, and the patent business.

The idea is straightforward: make Nokia more agile and align resources around its core strength in network technology. The new setup aims for EBIT of €2.7–3.2 billion by 2028, implying a healthy double-digit CAGR, but these numbers land almost exactly where consensus already stood.

After the recent rally driven by enthusiasm around NVIDIA’s minority investment and AI partnership, investors were left wanting more, and the stock promptly gave back some of its gains.

The growth mix shows why the market’s enthusiasm has cooled. The bulk of incremental profit is expected to come from the optical networking and IP divisions within Network Infrastructure, areas that are high-margin but still modest in scale compared to the broader mobile business. That latter segment remains sluggish, with limited growth and only gradual margin recovery despite the promise of AI-native networks and future 6G development.

Nokia’s leadership talked up AI integration, cloud connectivity, and automation as the next performance frontier, but the transformation will take time and investment. The newly created “Portfolio Businesses” bucket (a collection of lower-priority or loss-making operations) proves this point, signalling a focus on pruning and simplification before any meaningful acceleration. The target to decide the fate of these activities by end-2026 reflects both discipline and the slow grind of restructuring in a legacy tech player.

Strategically, Nokia is doing most of the right things: consolidating operations, doubling down on R&D, and positioning itself to benefit from the long AI and data traffic cycle. Yet from an investor standpoint, the timing works against it. After a 50% share price surge and valuation multiples near 12x next-twelve-month EBIT (well above the company’s average over the past years) the story no longer looks underappreciated. Growth remains incremental, and execution risk persists as network capex cycles remain uneven globally.

In essence, Nokia is rebuilding a more focused, more profitable version of itself, but it’s certainly not the sudden AI-driven reinvention that some hoped for.

Pfisterer (PFSE Germany): strong margins but lofty expectations leave little room for error

Pfisterer’s third quarter showed the kind of operational momentum investors like to see: robust earnings, resilient margins, and steady conversion from backlog to sales. But it also highlighted that expectations are running hot.

Revenue of €113 million was essentially flat versus the prior quarter and matched forecasts, while the book-to-bill ratio of 1.25x still indicates healthy forward visibility despite a slightly softer order intake than expected. The real standout was profitability: adjusted EBITDA surged to €21.5 million, translating into a 19% margin that blew past market projections and underscored how pricing discipline and mix in overhead line (OHL) components continue to drive near-term strength. This is particularly noteworthy given management’s earlier comments that the OHL segment’s gross margins were likely to normalise. The company appears to be executing well across its core product lines, balancing volume growth with cost control and still posting nearly double-digit EBIT margins even as order inflows cool slightly.

What’s missing, however, is a more granular sense of how sustainable this level of performance is. The company’s guidance remains qualitative, talking about “strongly increasing” sales and orders without providing numerical anchors. Management expects a solid Q4 driven by conversion from the existing backlog, but there are hints that the extraordinary profitability seen this year will moderate toward more typical high-single-digit EBITDA margins over time.

The near-term dynamics remain solid, i.c. growing order books, disciplined project delivery, and strong customer relationships across grid infrastructure, yet visibility into 2026 is somewhat cloudier. The broader electrical components market, especially in transmission hardware, remains supported by grid expansion programs across Europe, but pricing competition and raw material costs could reassert themselves once the current order momentum fades.

The valuation, meanwhile, already prices in a continuation of this strong run. Pfisterer trades ~20x next year’s consensus EBIT, a rich multiple for a capital goods company whose growth is cyclical and largely dependent on infrastructure spending. That leaves little margin for disappointment, especially if order intake growth slows further.

Still, the company’s operational delivery has been impressive since listing, showing it can convert the surge in grid investment into tangible profit improvement. The next few quarters will be about proving that this isn’t a temporary high-margin phase but rather a sustainable shift in profitability. Until management provides clearer quantitative guidance or evidence of durable structural tailwinds, the story looks solid but fully priced.

CFE (CFEB Belgium): building through the bottom of the cycle

CFE’s latest set of results showed a familiar picture of a company grinding through the bottom of its construction cycle, holding profitability steady even as revenue softens.

Group sales fell 16% year-on-year in Q3, bringing nine-month revenue to €769 million, down 11% overall. Yet the tone from management remained constructive, with net income expected to stay roughly flat versus 2024 despite the contraction in top line. That resilience reflects a more disciplined approach to project selection and cost management after several years of restructuring. Net debt, now at an “all-time low” of just €33 million, shows how much leaner the balance sheet has become. In an environment where many peers are stretched by working-capital needs or exposure to loss-making contracts, CFE is emerging from the slowdown with flexibility intact and a pipeline that is beginning to rebuild.

Across segments, the picture is mixed but improving. Construction & Renovation (the largest division) saw revenue decline 15% in the quarter, but underlying trends diverged by geography. Belgium remains a patchwork: solid growth in Flanders, underpinned by landmark projects like Antwerp’s Oosterweel ring and Ineos’s Project One, offsets weakness in Brussels and Wallonia. Luxembourg, through subsidiary CLE, continues to outperform with 32% growth, and management expects this momentum to continue. The Multitechnics segment showed the first flicker of stabilization, with Q3 revenue up 3% year-on-year as Building Technologies gained ground and rail project completions weighed less heavily. Meanwhile, Real Estate Development remains volatile as project completions ebb and flow, though the order book here, too, points to renewed activity once the pipeline turns over.

The company’s long-term outlook hinges on two key levers: disciplined capital allocation and potential corporate actions. CFE’s order backlog rose 16% year-on-year to €1.65 billion, with notable strength in Multitechnics and Construction. That provides visibility into 2026, even if short-term volumes stay subdued. The ongoing divestment of non-core assets (notably a possible sale of its stake in Vietnam’s Deep C industrial park) could be a catalyst for value realization and potentially a buyout of minority interests.

While near-term earnings momentum remains constrained by the weak construction market in parts of Belgium and Poland, the combination of financial stability, improving backlog quality, and latent portfolio optionality gives the story a more constructive bias. For now, CFE remains a cyclical recovery case.

UNIQA (UQA Austria): steady growth, clean execution, and a quietly compounding story

UNIQA’s latest update highlighted why the insurer has become one of the success stories in the Central and Eastern European market.

The third quarter delivered another solid beat, driven by disciplined underwriting, steady investment income, and the absence of major weather-related losses. Insurance revenue rose 7% year-on-year to €1.8 billion, in line with expectations, but the real highlight came from the technical result: up sharply to €199 million, well ahead of forecasts. That reflects UNIQA’s continued strength in its international and reinsurance portfolios, as well as the benefits of tight cost control and favourable claims experience.

Investment income also surprised on the upside thanks to solid returns from its long-held stake in construction group Strabag and modest mark-to-market gains. With profit before tax of €128 million and net profit of €100 million, both around 9% above expectations, UNIQA once again showed that stable, boring execution can be a winning formula in a turbulent sector.

While management kept full-year guidance unchanged, aiming for profit before tax between €490–510 million, the tone of the update suggested confidence in finishing the year at the upper end of that range. The mild catastrophe season and strong underwriting trends point to upside potential even without new strategic announcements.

Still, investors will have to wait a little longer for visibility on the next strategic phase: the company plans to unveil its 2026–2028 targets next week. The focus will likely remain on expanding the health and life business, growing its regional footprint in CEE, and extracting further efficiency gains through digitalisation. UNIQA’s earlier plan targeted around 5% premium growth and a sub-94% combined ratio, but execution since then has been ahead of schedule, suggesting room for upgraded ambitions. Reinsurance, which has quietly become an important growth engine, could also feature more prominently, given its ability to enhance returns without tying up much additional capital.

UNIQA remains a steady compounder in a market that rarely rewards flashiness. Its solvency ratio remains among the highest in the region, dividend payouts are consistent, and earnings momentum has steadily improved despite a challenging macro backdrop. At roughly €13 per share, the stock still yields a healthy 6–7% and trades modestly below peers, even after a strong run this year.

The investment case remains about disciplined execution, stable cash generation, and measured growth rather than bold transformation. With profitability rising and capital returns underpinned by a robust balance sheet, UNIQA continues to look like one of the few European mid-cap insurers quietly delivering on everything it promises.

Glanbia (GLB Ireland): flexing its muscle in performance and health nutrition

Glanbia’s new medium-term targets highlight a business that has been evolving from a commodity dairy processor into a focused nutrition specialist with genuine structural tailwinds.

The company’s performance nutrition division, anchored by its flagship brands Optimum Nutrition (ON) and Isopure, remains the main growth engine, and management is now targeting 5–7% annual organic growth from 2026 to 2028 alongside a 250bp improvement in margins. That ambition is not unrealistic given how well the brands have scaled internationally, helped by both stronger retail penetration and an increasingly balanced channel mix across e-commerce and traditional distribution. In the U.S., where household penetration for ON and Isopure remains below 6%, there’s still ample room for growth as protein-based functional foods move further into the mainstream. Behind the brand story sits operational discipline; the company has locked in whey input supplies for much of the next year and is expanding in-house production, both of which should underpin profitability as marketing investments ramp up.

The health nutrition arm, which has become the second strategic pillar, looks set to continue compounding steadily with organic growth of 4–7% and margins hovering near 18%. Here, Glanbia is capitalising on its strengths in flavour systems, micronutrient blends and ingredient formulation, areas that are becoming increasingly critical to both sports nutrition and the broader wellness food market. Expansion in China, Europe, and the U.S. is designed to position Glanbia as a full-service supplier for consumer brands seeking cleaner labels and science-backed claims.

The group’s transformation plan, now targeting more than $60 million of annualised savings by 2027, is freeing up capital for reinvestment, while its flavour platform continues to deliver operating leverage. Although the dairy nutrition segment remains tied to volatile milk prices, management’s focus there has shifted toward cash discipline, with steady EBITDA generation and minimal capital intensity expected.

Perhaps the most encouraging takeaway from Glanbia’s update is how balanced the growth algorithm looks. Management is guiding for EPS growth of 7–11% per year, underpinned by robust operating cash flow of $1.5 billion over three years, enough to fund both selective M&A and an increasingly shareholder-friendly capital return policy. With leverage below 2x and a rising payout ratio of up to 40%, the group is now positioned to deliver growth without stretching its balance sheet. The macro tailwinds around protein consumption, functional foods, and wellness are firmly in its favour, while even the rise of GLP-1 drugs could ultimately expand demand for high-protein meal replacements and supplements rather than erode it.

After several years of operational simplification and brand consolidation, Glanbia seems to be finally emerging as a focused, cash-generative growth compounder; not flashy, but well set to keep delivering steady gains.

If you appreciate this post, feel free to share and subscribe below!