Cruises, stock exchanges and major contract wins

TUI, PulluP Entertainment, Polytec, Figeac Aéro, Medincell, Carl Zeiss Meditec, Brunello Cucinelli, Deutsche Börse, Exosens, Puma

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

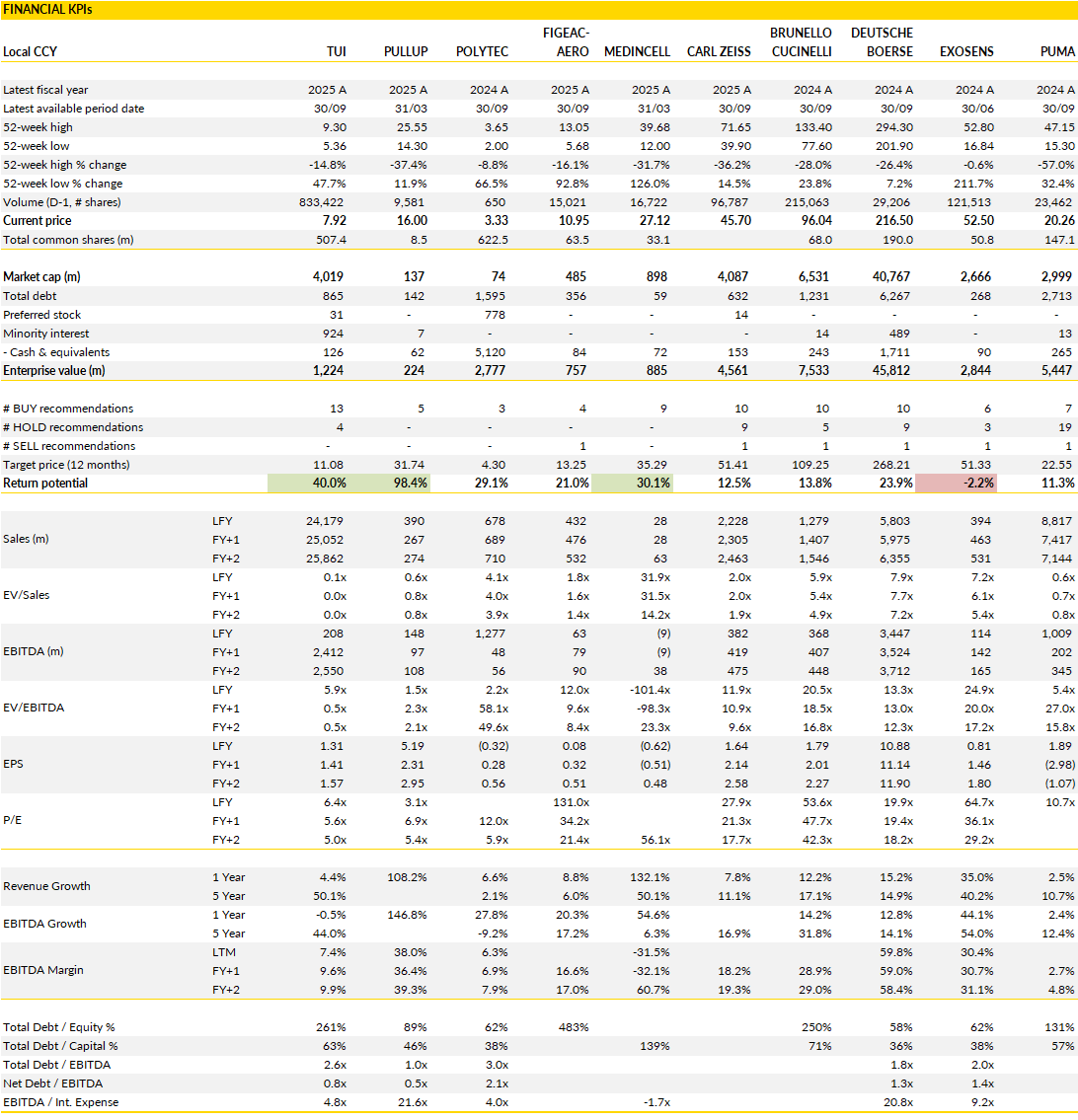

Financial KPIs

TUI (TUI Germany): dividends return as Europe’s travel engine normalises

TUI closed its fiscal year roughly as expected: solid delivery, cleaner balance sheet, and, most notably, the return of dividends.

The group posted c. €24 billion revenue, up 4% year-on-year, and a 13% increase in adjusted EBIT to just over €1.4 billion, matching its guidance range. Free cash flow came in stronger than expected at €358 million, helped by improved working capital management and the continued rebound in holiday demand.

Management confirmed the reinstatement of dividends earlier than anticipated, with a €0.10 payout already for FY2025 and a long-term target of 10–20% of underlying earnings. For a company that spent years repairing its capital structure this is a symbolic milestone, a signal that TUI sees itself firmly back in normal operating mode.

Management’s initial guidance for fiscal 2026 (low single-digit revenue growth and high single-digit EBIT growth) looks sensible given the operating environment, with higher cruise contribution offsetting more cautious assumptions for the core Markets & Airlines division. The lingering weak spot remains Germany, where cost inflation and competitive intensity continue to pressure margins, but even there, early booking data suggest some stabilisation.

Momentum heading into 2026 remains encouraging. Winter bookings are tracking modestly ahead of last year, and early summer reservations are running comfortably above prior trends despite a mixed macro backdrop. Pricing remains firm, particularly in the cruise division, where new capacity is set to drive another year of growth, while the airline segment continues to balance steady demand with selective capacity discipline.

With balance sheet leverage under control, positive cash flow, and rising customer prepayments underpinning liquidity, TUI’s strategic reset is largely complete. What remains is to prove the model can consistently deliver mid-cycle margins and returns without the tailwind of post-Covid pent-up demand.

The early dividend reinstatement and resilient forward bookings suggest the market’s confidence is gradually returning, even if visibility on earnings normalisation is still evolving. At current levels, TUI looks like a cyclical recovery play that has moved past its restructuring phase and back into value-creation mode; less about survival now, more about execution.

PulluP Entertainment (ALPUL France): a reset after the blockbuster hangover

After a year defined by the outsized success of SM2, PulluP Entertainment’s latest results mark a return to earth, and to something closer to normal.

First-half revenue fell 43% to €133 million, and operating profit dropped over 70%, a sharp decline that was entirely expected given the extraordinary base effect of last year’s hit. The company also faced higher financing costs and some working capital drag, pushing net debt to €85 million by September.

Yet, despite the brutal optics of the year-on-year comparison, the underlying message is stability: execution remains strong, the release schedule is intact, and management confirmed that full-year sales and EBIT should exceed pre-SM2 levels. In other words, the business has normalized rather than weakened.

The second half now carries the weight of the turnaround narrative. Management reconfirmed that Toxic Commando, its next major title, will be released in Q4 2025, with timing now firmed up after months of speculation. Early signs from Marvel Cosmic Invasion (the key Q3 release) are encouraging, and PulluP’s back catalogue continues to perform far better than expected, offsetting part of the decline in new titles.

The company expects total sales to fall roughly 30% year-on-year to about €277 million, but within that, recurring revenues from older games are growing more than 40%. That mix shift matters: it signals that PulluP’s installed base is still engaged and monetizing, which gives the group a smoother earnings profile even between major launches.

Viewed through a longer lens, 2025–26 is a bridge year, a pause before the next creative and financial upswing. With the pipeline anchored by Toxic Commando and at least one unannounced AAA project in early development, PulluP is quietly repositioning itself for consistency rather than volatility. The company’s focus on disciplined execution and brand leverage in a consolidating, less speculative gaming market looks increasingly sensible.

While the stock has lost some shine amid sector-wide fatigue, its valuation remains compelling relative to peers, and the fundamentals (a proven IP engine, loyal user base, and measured cost control) still stand out. This may not be a blockbuster year, but it sets the stage for a more sustainable franchise model in the years ahead.

Polytec (PYT Austria): trimming the fat

Polytec’s decision to divest its UK operations marks a long-awaited step toward simplification and focus. The business being sold, its painted exterior components unit serving customers like Bentley, had been structurally unprofitable for years, squeezed by fierce price competition and rising input costs in a crowded niche.

The sale to WHS Group, a UK-based specialist in injection-moulded and painted plastics, transfers roughly 9% of Polytec’s workforce and around €60 million in annual revenue, but more importantly, it removes one of the company’s most persistent drags on profitability. Combined with the earlier plan to close its Weierbach plant in Germany by April 2026, Polytec is finally exiting non-core, capital-intensive areas that have been weighing on returns since before the pandemic.

Financially, the benefits should be visible almost immediately. While no transaction price was disclosed, management highlighted that the deal will significantly reduce net debt, and the “mechanical” uplift from removing a loss-making unit could be meaningful, potentially 20–30% relative to 2026 EBIT forecasts. That uplift comes not from growth, but from subtraction: Polytec keeps the land and buildings, leasing them back to WHS, which provides an incremental cash flow cushion and some retained asset value.

After a difficult stretch marked by volatile order flows and margin erosion in its automotive supply business, the company appears intent on rebuilding from a leaner base. The combination of lower leverage, higher operating efficiency, and a more rationalized footprint should give Polytec some breathing room to refocus on its core competencies in lightweight components and composite technologies.

The timing of this clean-up also aligns with an industry that is slowly stabilizing after years of supply chain and cost shocks. European automotive suppliers are still battling price pressure and shifting demand patterns, but the companies that emerge smaller and more focused will likely outperform in the next cycle. Polytec’s valuation (~0.3x book value) provides limited downside if execution holds.

The UK exit won’t transform the group overnight, but it marks a strategic inflection point: a pragmatic retreat from unprofitable complexity that could finally allow the company’s core operations to generate consistent, defensible margins again.

Figeac Aéro (FGA France): operational leverage returning as Airbus ramps up

Figeac Aéro’s first-half results confirmed what the market was already starting to see, that is, a business regaining its stride as aerospace production normalises.

The company reported a solid H1 with revenue of €215 million and EBITDA up nearly 19%, pushing margins back above 14% despite some headwinds from inflation and FX. The performance was driven by stronger volumes in key programmes like Airbus’s A320 and A350, along with steady progress in the Leap engine platform and a notable rebound in defence work. Mexico remains a drag but is narrowing its losses, and management’s ability to offset cost inflation through productivity and mix is evident in the 23% incremental margin. Free cash flow was weaker, down to €7 million, but largely due to deliberate stock-building ahead of an expected delivery surge in the second half, a front-loaded working capital move rather than a structural issue.

That delivery ramp now defines the investment case. The company reaffirmed full-year guidance and struck a more confident tone about reaching the upper end of its EBITDA range (~€83 million), a view supported by improving visibility from Airbus and a healthier supply chain. With Airbus set to accelerate narrowbody output and gradually resolve bottlenecks in its supplier ecosystem, Figeac should see higher absorption and better drop-through in H2.

The company is also benefiting from Airbus’s strategic reshuffling of its Spirit AeroSystems assets, particularly the decision to bring A320 pylon production in-house while still outsourcing significant work packages to trusted Tier 1 suppliers. Figeac’s footprint and quality track record at the former Spirit facilities position it well to capture a meaningful share of that future business. Even a modest allocation could move the needle for a group of Figeac’s scale.

Taken together, the picture is one of gradual but tangible recovery. The balance sheet is healthier following a bond refinancing that pushed maturities out to 2030, cash generation is improving, and the structural leverage to Airbus build rates remains strong. Figeac has spent years managing through volatility and deleveraging; now, as civil aerospace production normalises, the business looks set to translate higher volumes into real earnings growth.

For investors, it remains one of the few mid-cap aerospace suppliers offering both visibility and valuation appeal; a name still trading at a discount to peers but increasingly aligned with the sector’s upward trajectory.

Medincell (MEDCL France): execution on track as UZEDY gains traction and pipeline advances

Medincell’s latest results offered few surprises, but the business is steadily moving from promise to performance.

Revenue for the April–September period rose 35% year-on-year to €11.6 million, driven largely by royalties from UZEDY, the long-acting risperidone injection developed with Teva. That product is ramping up well in the U.S., where Teva now expects $190–200 million in 2025 sales — a solid validation of the long-acting injectable (LAI) platform that underpins Medincell’s broader ambitions. Other revenue streams, including AbbVie collaboration income and Gates Foundation funding, also contributed meaningfully. Operating expenses rose by 22%, mostly due to heavier R&D investment as the pipeline matures, but losses narrowed and the balance sheet remains healthy, with €53.5 million in cash providing runway through key upcoming milestones.

The next set of catalysts will test how quickly the LAI platform can scale across therapeutic areas. Teva’s FDA submission for long-acting olanzapine has now been accepted, kicking off a roughly 10-month review window, and the phase III data were particularly encouraging; no incidents of post-injection delirium/sedation syndrome over 56 weeks and a safety profile consistent with oral olanzapine. Meanwhile, UZEDY continues to build commercial momentum, helped by the recent FDA approval extending its indication to bipolar I disorder. That label expansion, along with approvals in Canada and South Korea, broadens the product’s global reach and supports a more durable royalty stream for Medincell. On the partnership front, work continues with AbbVie on preclinical and chemistry, manufacturing, and control programs, targeting a clinical entry in 2026 that could further validate Medincell’s technology base.

In essence, Medincell is doing exactly what it said it would: executing on UZEDY, advancing its next-generation formulations, and maintaining a disciplined cost structure while funding growth internally. The group’s value proposition remains compelling, i.c. a proven delivery platform, multiple pharma partnerships, and a growing royalty line from commercialized assets.

With the regulatory path for olanzapine now clear and the UZEDY rollout accelerating, Medincell is quietly consolidating its position as a key enabler of the LAI segment, where technological know-how and reliability matter as much as pipeline breadth. The short-term upside may be limited after the strong share price run, but strategically, the company is well placed for the next phase of growth.

Carl Zeiss Meditec (AFX Germany): strong top line, but margins still searching for momentum

Carl Zeiss Meditec’s latest quarter reflected a familiar theme for the German medtech group: solid demand, particularly in ophthalmology and microsurgery, offset by margin pressure that continues to weigh on earnings quality.

Revenue in the fourth quarter climbed 8% year-on-year to €627 million, comfortably ahead of expectations, as equipment sales in ophthalmic devices improved and premium intraocular lens volumes stayed firm. Microsurgery also showed encouraging traction, helped by the rollout of the new Kinevo 900 S system, which drove double-digit revenue growth late in the year. Yet despite the top-line strength, profitability disappointed. EBITA margins fell short of expectations, landing at just over 13%, constrained by mix effects, regional pricing dynamics, and ongoing investment in growth initiatives. The bottom line, while positive, lagged market estimates, a reminder that Zeiss Meditec’s growth engine still runs on modest operating leverage.

The geographic breakdown continues to highlight the company’s twin-speed reality: steady momentum in Europe and the U.S., but lingering volatility in China. The ophthalmic segment benefited from solid global procedure volumes, yet refractive surgery activity in China remained flat, tempering overall growth. Microsurgery was a rare bright spot, with strong sequential improvement throughout the year as the upgraded Kinevo line gained adoption among neurosurgeons and hospitals reopened capital budgets.

Still, the company’s product mix remains tilted toward high-end equipment sales rather than the faster-growing recurring revenue streams (consumables, service contracts, and software) that competitors increasingly rely on to smooth earnings. Management’s mid-single-digit revenue growth guidance for FY2026 (roughly €2.3 billion in sales) highlights that expansion will remain steady but unspectacular, with margins expected to edge only slightly higher to around 12.5-13%.

For investors, Zeiss Meditec remains in a transition phase. Its technological edge in ophthalmology and microsurgery remains undeniable, and its exposure to secular healthcare themes, i.c. aging demographics, minimally invasive surgery, and digital diagnostics, provides a sturdy long-term backdrop. But near-term execution risks persist, especially given the slower-than-hoped recovery in China and continued cost inflation.

The group’s ability to lift recurring revenues and restore EBITA margin momentum will determine whether it can re-rate back toward its historical multiples.

Brunello Cucinelli (BC Italy): steady growth and calm execution, but valuation leaves little room to breathe

Brunello Cucinelli ended 2025 much as it began, outperforming in a luxury market that has otherwise turned cautious. Management’s December update confirmed that growth momentum held firm into the fourth quarter, with sales up roughly 12% at constant currency, led again by strong retail demand.

Despite a tougher comparison base, that figure beat both internal and external expectations and suggests the brand continues to attract steady demand across regions, from Asia to the Americas to Europe. Wholesale growth slowed modestly after an exceptionally strong nine-month stretch, reflecting timing effects rather than weakening orders. Currency headwinds offset some of the operational strength, but Cucinelli maintained full-year guidance for around 10% reported growth and a modest uplift in EBIT margin versus 2024, essentially signaling another textbook year of disciplined, profitable expansion.

The company also reiterated its 2026 target of approximately 10% growth and a further margin increase, underscoring management’s confidence in the resilience of its high-end positioning.

The story remains one of steady execution. Cucinelli has carved a niche in what could be called “slow luxury”, i.c. timeless, understated products that appeal to a clientele less sensitive to macro volatility or price escalation. This has allowed the brand to sustain double-digit organic growth long after peers in more fashion-driven categories have cooled.

Still, the broader context for luxury is shifting. Demand normalization in China, softer U.S. wholesale dynamics, and increasing scrutiny of brand exposure to sanctioned markets have collectively weighed on sentiment. The stock’s underperformance in the second half of the year reflects these pressures, compounded by investor unease over the allegations related to its Russian business links, even if operationally immaterial.

For now, the company’s execution remains unimpeachable: inventories are well managed, margins are expanding, and growth visibility into 2026–27 remains intact.

Yet valuation remains the constraint. Cucinelli commands one of the highest multiples in the European luxury space, leaving little cushion for even minor disappointments. Its relative discount to Hermès has narrowed to mid-teens percentages, which feels modest given Hermès’s broader pricing power and scale. Compared to peers like Zegna, whose growth runway and re-rating potential look stronger, Cucinelli’s investment case feels more mature. The company continues to execute flawlessly, but investors are paying premium prices for that consistency.

Deutsche Börse (DB1 Germany): building scale and digital depth for the next phase of growth

Deutsche Börse’s latest capital markets day highlighted the strength of its operating model, a business that combines predictable cash generation with strategic optionality across Europe’s financial plumbing.

Management reaffirmed the “Horizon” strategy target of €3.8 billion EBITDA in 2026 and extended visibility to 2028, aiming for €4.4 billion. That implies an 8% compound annual growth in EBITDA and around 10% growth in cash EPS, supported by tight cost control, modest buybacks (€500 million per year), and an expanding product mix. What stood out in the update was not the headline growth itself but the mix: a company still anchored in trading and clearing but increasingly powered by fund services, data, and technology platforms. The addition of Allfunds, if completed, would add roughly a percentage point to structural EPS growth, a reminder that M&A remains an accelerator, even within a disciplined capital framework.

The group’s revenue mix continues to shift toward more diversified, fee-driven businesses. Trading and clearing are set to benefit from strength in commodities, while Investment Management Solutions will see a steadier, albeit slower, trajectory as currency, ESG, and proxy headwinds persist. Fund Services and Software Solutions, on the other hand, are emerging as the real growth vectors, each expected to compound at double-digit rates through 2028. Meanwhile, Securities Services will likely face softer net interest income but should see offsetting volume gains as assets under custody and settlement activity rise.

Together, these segments underpin a 6% group-level revenue CAGR through 2028 (solid if not spectacular) with operating leverage expected to lift margins by roughly 270 basis points to around 61%. The treasury result, which has been a source of tailwind over the past two years, is projected to normalize slightly in 2026 but remain a meaningful contributor under a steady rate environment.

Beyond the numbers, Deutsche Börse’s growth agenda increasingly leans on long-cycle themes: Europe’s push for capital markets integration, the expansion of retail and pension savings channels, and the digitization of financial infrastructure. Management’s plans to incorporate tokenized assets, stablecoins, and other blockchain-enabled products into its clearing and settlement ecosystem show how the exchange is positioning itself at the intersection of regulatory credibility and technological disruption. These initiatives are still nascent but could eventually redefine the group’s role within European capital formation.

For now, the stock trades on a fair multiple for a franchise with dependable growth, high margins, and structural tailwinds.

Exosens (EXENS France): major OCCAR win cements Europe’s night-vision leader

Exosens secured another milestone contract this week, reinforcing its standing as Europe’s go-to supplier for night-vision technology. The €500 million award from OCCAR (the European defence procurement agency) covers 100,000 Mikron binoculars for the German army, supplied through the Theon/Hensoldt consortium. Exosens will deliver the 200,000 image-intensifier tubes that sit at the heart of those systems, a critical, high-margin component that remains ITAR-free, and therefore strategically appealing to European buyers seeking autonomy from U.S. export controls.

Deliveries are scheduled from 2027 to 2029, with an additional €20 million tranche for 8,000 tubes destined for Belgium. The contract roughly matches the pricing level seen in 2025 and further extends Exosens’s production visibility. It also consolidates the company’s position with Theon, now not just its largest customer but also a soon-to-be 9.8% shareholder, strengthening both the commercial and industrial relationship underpinning future defence programs.

This deal materially improves Exosens’s forward-order visibility, locking in more than one-third of expected revenues for its Amplification division through 2029. It comes on top of the 66,000 binoculars already supplied to the German army under earlier contracts, proof of the customer’s satisfaction and growing ambition to equip every soldier with a night-vision device by 2029. That one-to-one ratio is fast becoming a new standard across NATO’s European members, and it offers a structural growth tailwind for Exosens well beyond replacement cycles. Outside Europe, management continues to target expansion in Asia-Pacific, where procurement tenders remain active, while the U.S. still represents untapped optionality.

The combination of operational scale, leading sensor performance, and strategic neutrality leaves Exosens well positioned to capture the next wave of defence modernization programs.

While the new contract was already anticipated in Exosens’s capacity-expansion plans, its confirmation removes a key uncertainty around medium-term visibility. The company’s decision to deconsolidate its electronic-amplification unit and invest in new manufacturing capacity reflects a focused portfolio strategy aimed at preserving margins while supporting volume growth. W

ith an adjusted EBIT margin near 25% and steady cash-flow generation, Exosens remains one of the higher-quality names in Europe’s defence-electronics space. The valuation discount to peers appears unwarranted given a projected high-teens to 20-plus percent earnings growth profile.

The upcoming February results and updated guidance should further clarify how the group intends to balance expansion, capacity discipline, and shareholder returns, but the underlying message is clear: Exosens has evolved from niche component maker to indispensable European champion in the rapidly expanding night-vision ecosystem.

Puma (PUM Germany): simplifying North America while questions linger on growth and ownership

Puma’s latest move to convert its U.S. and Canadian partnership with United Legwear into a pure licensing arrangement marks another step in its ongoing effort to streamline North American operations.

The agreement, effective November 2025, covers socks, underwear, and select children’s apparel, categories that collectively generated about €430 million in 2024 revenue but came with a complex joint-venture structure. By exiting direct participation in that business, Puma aims to reduce operational friction and refocus resources on its core footwear and apparel lines, where competition and brand perception remain its most pressing challenges.

The deal also aligns with broader industry norms, where major sportswear groups increasingly rely on licensing for non-core categories to preserve brand reach without tying up working capital. The trade-off is a mechanical drop in reported revenue and EBIT, as Puma United will now be treated as a discontinued operation, but it simplifies the business model and sharpens execution in a region that has lagged peers.

Near term, however, visibility remains limited. Puma faces a tough 2026 backdrop shaped by wholesale channel uncertainty, higher takebacks, and intensifying competition from Adidas and Nike, both of which are refocusing on their own retail networks and, in Adidas’s case, launching more aggressive mid-tier product lines. Puma’s own rebranding effort, centered on cleaner assortments and renewed emphasis on performance credibility, will take time to bear fruit. Management expects revenues to decline modestly in the first half of 2026 before stabilizing later in the year on easier comparatives. But margins will likely stay under pressure, with the company still absorbing inventory clean-up and a normalization of discounting patterns.

The near-term narrative, in other words, remains one of rebuilding credibility and profitability rather than accelerating growth. Puma’s valuation reflects this execution risk, and there’s little immediate catalyst for re-rating until the North American turnaround shows tangible progress.

The more speculative layer to the story concerns ownership. Recent media reports have revived discussion around the Pinault family’s 29% stake, with suggestions that a sale could unlock value or attract a strategic buyer. While a blue-sky scenario posits substantial upside under stronger earnings assumptions, the practical barriers remain considerable. Potential buyers would need to offer a meaningful premium to entice the family to sell, yet at current profitability levels, it is hard to justify a takeout a major premiums.

For now, Puma sits in an awkward middle ground, not broken, but not quite compelling either. The group’s simplification steps, including the United Legwear shift, are strategically sound, but the brand still needs to prove it can reestablish sustainable momentum in a crowded global sportswear market before any larger narrative, strategic or financial, gains traction.

If you appreciate this post, feel free to share and subscribe below!