Cash transport, energy and best wishes

Prosegur, Virbac, STMicroelectronics, thyssenkrupp nucera, EXEL Industries, La Française de l’Énergie, CIE Automotive, Hoffmann Green, DEUTZ

This will be the last publication of the year. There generally isn’t much to report in the latter part of December, and, honestly, we’re due for some time off.

We will return on Jan. 6 with our regular publication schedule.

From the Lux Opes team, we wish you already all the best for Christmas and a happy new year!

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

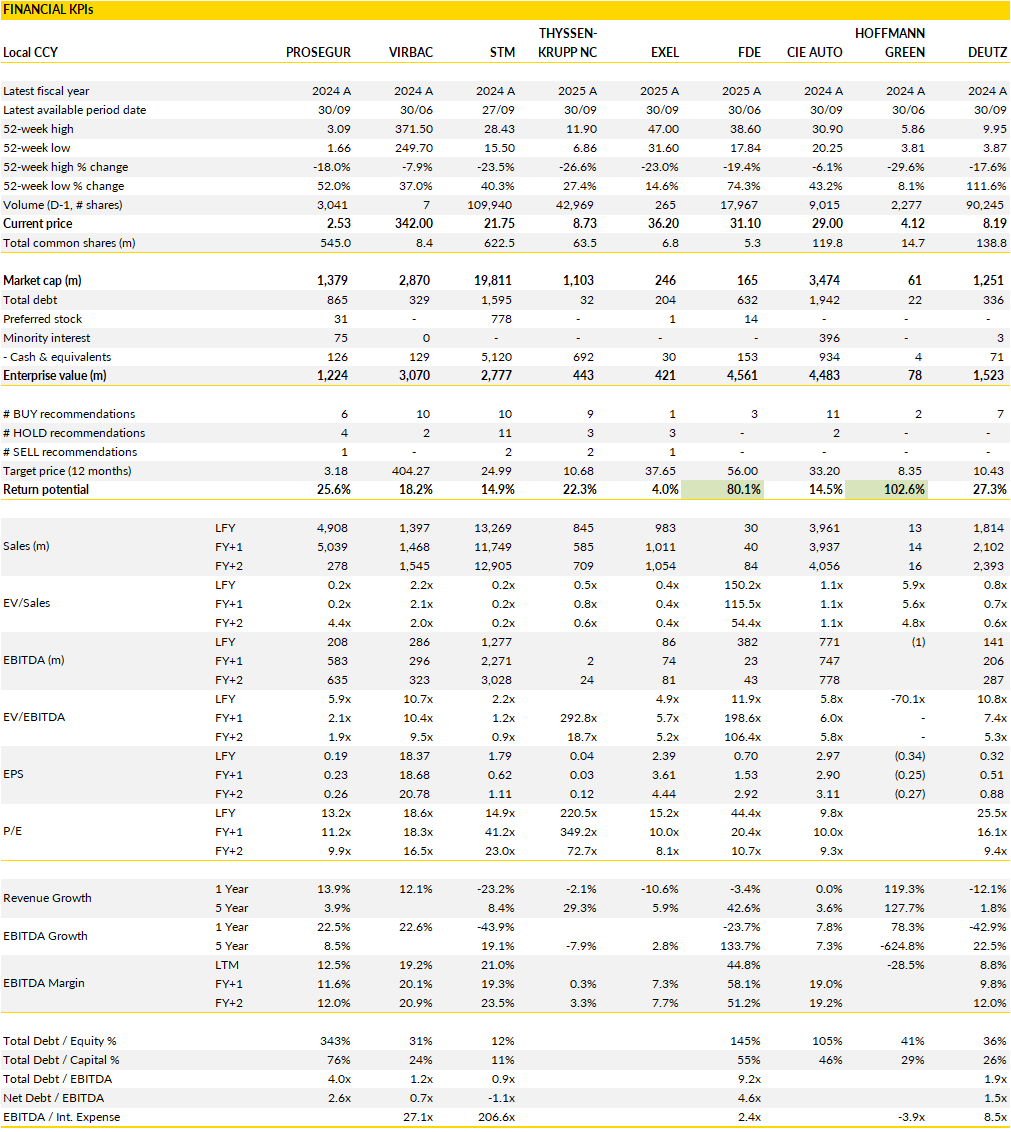

Financial KPIs

Prosegur (PSG Spain): alarms moves from recovery mode to a more durable growth engine

Prosegur used its latest Alarms update to draw a clear line under the stabilisation phase that has defined the business over the past few years and to outline a more measured, profitability-aware growth path through the end of the decade.

Management framed 2024 as the inflection point, with the focus now shifting toward sustainable expansion rather than recovery. The ambition to reach 1.5 million alarm connections by 2030 across both its core markets and international operations is positioned less as a volume target and more as evidence that the underlying model is ready to scale again.

Central to this strategy is a marketing-led “push” approach, where demand is actively created through brand visibility and category education, supported by continued investment in operational excellence and technological modernisation, including the deeper integration of AI across the platform. The message was consistent throughout: growth is back on the agenda, but only where it reinforces cash generation and balance sheet discipline.

The strategic logic is driven by a sizeable and still largely untapped addressable market. Household alarm penetration in Spain stands at around 11%, with Portugal even lower at roughly 6%, well below levels seen in more mature markets such as the US. The contrast is even starker in Latin America, where penetration in countries like Colombia and Argentina remains in the low single digits. Against that backdrop, Prosegur estimates a potential market of around 20 million households in Iberia and more than 35 million across Latin America.

Rather than pursuing rapid subscriber growth through aggressive pricing, management is leaning into brand strength and visibility to raise awareness and drive adoption over time. This approach reflects a deliberate shift toward higher-quality customers, supporting premium pricing, lower churn, and more predictable recurring revenue, while preserving optionality for incremental services as the platform matures.

Execution is being driven through a series of initiatives aimed at optimising the entire value chain. Product strategy is centered on usability, video functionality, and smart-home integration, while technical partnerships are used selectively to balance in-house control with off-the-shelf flexibility. On the commercial side, revised marketing and sales processes are designed to improve subscriber acquisition costs and prioritise quality sign-ups. AI investment plays a structural role, spanning smarter alarm receiving centers, predictive churn models, and enhanced sales-quality monitoring, all intended to improve scalability and operating leverage.

The updated medium-term targets reflect this transition into what management describes as an “optimal growth” phase. For the core MPA business, the company is targeting recurring cash flow of €160 million by 2029 with a service margin of around 63%, while the international segment is expected to reach roughly 600,000 connections by 2030 at a margin just above 50%.

As churn continues to improve and cash generation becomes more visible, the alarms unit increasingly stands out as a structurally attractive, subscription-like business whose long-term value may not yet be fully reflected in how the group is perceived today.

Virbac (VIRP France): a targeted bolt-on adds a durable chronic care pillar

Virbac’s acquisition of the distribution rights to a feline hyperthyroidism treatment is a good illustration of how the group continues to deploy capital with a very specific strategic intent rather than chasing scale for its own sake.

The deal, priced at €114 million, gives Virbac control over Thyronom, a treatment addressing a chronic endocrine condition affecting more than 10% of older cats. While the transaction is modest in absolute terms, it is the company’s first acquisition since Mopsan and signals that management remains active and opportunistic when assets fit both the portfolio and the operating model.

Virbac will commercialise the product directly under the Thyronorm brand in the UK, Australia and New Zealand, and under Felanorm in the US, while distribution in parts of Europe will initially remain with existing partners before being progressively brought in-house. Management has been clear that the acquisition should be accretive to both growth and profitability from the first year, reflecting the fact that this is a marketed, revenue-generating product rather than an early-stage pipeline bet.

Strategically, the appeal lies not so much in the immediate revenue contribution, but more in the nature of the asset. Thyronom currently generates sales in the region of €27 million globally, with Virbac set to take over roughly €14 million of revenue from 2026 in its core direct markets, followed by an additional tranche as European distribution rights revert in phases from 2027.

More importantly, management views the product as having meaningful development potential, particularly in the US where it was only introduced recently and is still in a ramp-up phase. Feline hyperthyroidism is a lifelong condition once diagnosed, making treatment structurally different from seasonal or episodic categories such as anti-parasitics. That chronic profile brings regularity and visibility to revenues, reinforced by the fact that pet owners tend to be highly captive once therapy is established. The liquid formulation further lowers barriers to adoption, offering easier administration than tablets or surgical alternatives, which matters in a condition that requires long-term compliance.

Taken together, these characteristics fit neatly with Virbac’s focus on specialist, vet-driven therapies where brand, formulation and relationships matter more than brute-force marketing.

From a broader portfolio perspective, the acquisition reinforces several long-running themes in the Virbac story. It deepens exposure to chronic pathologies, complements the existing specialty care range, and does so without introducing meaningful operational complexity. Management has framed this as a bolt-on acquisition with very limited incremental fixed costs, essentially a catalogue effect that can be leveraged through Virbac’s existing commercial infrastructure. Financing is also conservative. The group entered the transaction with a lightly leveraged balance sheet, leaving ample flexibility to absorb the deal without compromising financial discipline.

While Virbac remains structurally smaller than global animal health peers, this transaction highlights its ability to act decisively in niches where it understands veterinarians’ needs and can extract value through focused execution.

Over time, the addition of a chronic therapy with predictable demand dynamics should help smooth revenue profiles and support margin resilience, particularly as direct distribution expands. In that sense, Thyronorm is about strengthening the quality and durability of Virbac’s growth path.

STMicroelectronics (STMPA France): emerging from the inventory hangover with multiple levers into 2026

STMicroelectronics is approaching the end of a difficult downcycle with a setup that looks increasingly asymmetric as inventories normalise and internal restructuring begins to show through. Recent management commentary suggests that the final quarter of 2025 is tracking broadly in line with what the company had already communicated, with automotive growing at a mid-single-digit pace and industrial markets stabilising as STM continues to deliberately undersupply demand in order to flush excess stock from the system.

Personal electronics has been a relative bright spot, supported by stronger-than-expected momentum with key customers. The broader takeaway is not that demand has suddenly snapped back, but that visibility has materially improved versus this time last year, with order intake holding up and book-to-bill remaining supportive. That matters because the first half of 2025 was distorted by unusually severe seasonality and aggressive customer destocking, particularly in automotive, and management is now signalling a return to more typical seasonal patterns as the industry moves into 2026.

Looking ahead, the company frames 2026 as a year of sequential normalisation. Management expects the traditional first-quarter seasonal dip to reassert itself, followed by a gradual improvement as backlog rebuilds and inventory levels across both automotive and industrial customers return closer to normal during the first half of the year. The underlying growth drivers are not purely cyclical. STM continues to highlight structural momentum in microcontrollers, analogue products, and advanced power technologies, with silicon carbide positioned as a medium-term growth engine despite a slower-than-expected recovery in 2025.

Importantly, management has reiterated that the longer-term SiC trajectory remains intact, with new customer wins in Europe and China expected to support a return to higher activity levels by 2027. Beyond that, STM’s exposure to engaged customer programs adds a layer of optionality. Content growth across multiple Apple platforms, the ramp-up of photonics for hyperscale data centers, and expanding participation in satellite constellations beyond early anchor customers all provide incremental growth avenues that sit outside the normal seasonal cadence of the industrial cycle.

Profitability is where the inflection becomes more visible, albeit with some near-term noise. Gross margins in 2025 were heavily impacted by high under-utilisation charges and capacity reservation costs, which management has already flagged will decline meaningfully in 2026. The first quarter of the year is expected to remain pressured by seasonality, pricing effects, and currency, but the setup improves as the year progresses. A more favorable product mix as industrial and MCU volumes recover, underpins management’s confidence in margin improvement into the second half of 2026 and beyond.

At the same time, STM is executing a multi-year cost-reduction program targeting meaningful savings by 2027. While operating expenses will still reflect start-up costs for new capacity in the near term, the absence of these costs in later years creates clear operating leverage.

Taken together, STM enters 2026 with inventories largely reset, multiple secular growth vectors re-engaging, and a cost base that is finally aligned with a normalised demand environment.

thyssenkrupp nucera (NCH2 Germany): holding the line through a hydrogen downturn while order optionality builds

thyssenkrupp nucera’s full-year release for FY 2024-25 did not change the narrative, but it did reinforce it. After pre-releasing most key figures in November, management essentially used the final publication to confirm that the business is navigating a difficult phase in green hydrogen with discipline rather than denial.

Group sales edged down slightly year-on-year to €845 million, reflecting the sharp slowdown in large-scale green hydrogen project awards, while EBIT moved back into marginally positive territory at €2 million after a loss the year before. That improvement, modest as it looks, is symbolically important: it shows that cost control and execution discipline are working, even as demand in the core gH2 segment remains under pressure. The order intake picture was weaker at the group level, down materially year-on-year, but this largely reflects timing and customer hesitation rather than structural loss of relevance. Nucera is operating in a market where investment decisions are being delayed, not cancelled, and the company’s results reflect that pause.

The split between segments is key to understanding the current setup. While sales in green hydrogen declined meaningfully during the year, the chlor-alkali business continued to grow at a double-digit pace, acting as a stabilising anchor for the group. This segment benefits from a very different demand profile, with customers driven more by industrial replacement cycles and regulatory requirements than by energy-transition subsidies or project financing.

That contrast explains why management has been able to maintain operational balance despite the near standstill in large gH2 awards. Importantly, nucera ended the year with an order backlog of around €0.6 billion, providing a degree of revenue visibility even as new orders remain lumpy.

Management has also sharpened its external communication by formally adding order intake as a guided KPI, an implicit acknowledgement that near-term performance will be driven as much by project timing as by execution capability. For FY 2025-26, the company is guiding for group sales of €500–600 million and EBIT between minus €30 million and break-even, a cautious stance that reflects conservative assumptions on project conversion rather than any deterioration in competitive positioning.

What makes the outlook more nuanced is the unusually wide range management has provided for order intake in FY 2025-26, guided at €350–900 million. The lower end is already largely secured through a recently announced chlor-alkali order from the Middle East combined with recurring service activity, effectively putting a floor under the year. The upper end, however, assumes the award of several large new-build projects, particularly in green hydrogen, which would signal a thawing of customer decision-making.

This framing captures the current reality of the hydrogen market: visibility is poor, but optionality is high. Nucera remains positioned as a technology leader in alkaline electrolysis, with a reference base that few peers can match, and it continues to be leveraged to the long-term emergence of a green hydrogen economy.

The shares have come under significant pressure over recent months, reflecting frustration with the pace of market development, but operationally the company is doing what it can in a difficult environment.

EXEL Industries (EXE France): navigating a cyclical trough with limited near-term visibility

EXEL Industries’ full-year results concluded a second consecutive year of materially weaker profitability driven by a sharp downturn in its core agricultural end-markets.

Revenue for the year fell close to 10% organically, and that volume pressure flowed directly through to margins, with EBIT down by roughly a third and the operating margin slipping below 4% from just over 5% a year earlier. This was not a surprise outcome, but it does underline how exposed the group remains to the agricultural cycle, particularly in periods when farmers and distributors simultaneously retrench. Lower volumes, rather than any structural cost blowout, were the dominant driver of the earnings decline, while net profit was further weighed down by unfavorable currency movements.

The result is a business that has seen profitability reset to a significantly lower level over two years, testing both management credibility and investor patience.

The weakness was concentrated where it was most expected. Agricultural Spraying, which accounts for just over 40% of group revenue, suffered a near 20% organic decline as distributors in key markets, notably North America, continued to aggressively reduce inventories amid a difficult farm income environment. Beet Harvesting also remained under pressure, reflecting reduced acreage in Europe and sugar prices hovering near cyclical lows. These two segments alone explain most of the revenue contraction and the sharp operating leverage effect seen at group level.

The seasonality of the business added another layer of volatility, with a particularly weak first half followed by a more resilient second half that nevertheless failed to offset the earlier damage. While orders showed some improvement later in the year, the backlog entering the new financial year does not yet point to a meaningful recovery. That lack of visibility is central to the current debate around EXEL: the business is clearly capable of generating solid margins when volumes normalise, but it remains highly sensitive to prolonged demand weakness in agriculture.

Management’s tone on the outlook reflects that uncertainty. Rather than signaling a decisive inflection, the message is one of caution and control. Capacity adjustments and cost measures have already been implemented to better align the organisation with lower activity levels, helping to stabilise profitability despite the revenue decline. For the coming year, expectations are deliberately conservative, with only modest revenue growth assumed and margins expected to remain broadly flat. Management has reiterated its intention to pass on the impact of tariffs through pricing, but this is unlikely to be a material earnings lever in an environment where volumes remain constrained.

From a longer-term perspective, EXEL still retains attractive strategic positioning in specialised agricultural equipment, supported by established brands and a global footprint. However, until there is clearer evidence of a sustained recovery in agricultural demand, particularly in North America, earnings momentum is likely to remain muted.

The shares already reflect a degree of cyclical pessimism relative to the group’s own history, but without a visible turn in the order book, EXEL will like remain in a holding pattern.

La Française de l’Énergie (FDE France): a controversial option falls away, leaving the core strategy intact

The cancellation of the Bleue Lorraine concession initially looks like a negative headline, but in practice it removes an option that had long been peripheral to La Française de l’Énergie’s investment case.

The concession, granted in late 2023 and covering around 190 square kilometers in Lorraine, would have allowed the exploitation of coal bed methane until 2040. Its annulment follows a legal challenge from local heritage and environmental groups and brings a definitive end to a project that had always faced regulatory and societal hurdles. Importantly, this was not a producing asset, nor one that had ever contributed to group earnings. The ruling does not touch FDE’s existing operations, and the financial penalty itself is immaterial. In that sense, the decision is better seen as the formal closure of a high-friction, low-visibility option.

While disagreeing with the decision and reserving the right to defend its interests, FDE has been quick to stress that its current activities are unaffected. Ongoing mine gas recovery in the Hauts-de-France continues as before, as does the research program into natural hydrogen, including drilling work at the Pontpierre site in Moselle. Just as importantly, management has reiterated its medium-term ambitions and confirmed that its 2030 targets remain unchanged.

The Lorraine coal seam gas project was never embedded in those targets, and its removal does not alter the trajectory management has laid out for growth in low-carbon energy, gas valorisation, and emerging natural hydrogen opportunities. The company has also indicated that it will seek compensation for investments already capitalised on the balance sheet related to the cancelled concession, reflecting a desire to protect shareholder interests even as it moves on operationally.

Stepping back, the episode arguably simplifies the equity story. The Lorraine gas option always carried disproportionate regulatory and reputational risk relative to its economic contribution, particularly in a context of normalising gas prices and a finite concession life. Its removal sharpens the focus on FDE’s core activities, which combine existing cash-generative operations with longer-term upside linked to decarbonisation themes. Recent support for the natural hydrogen research programme, including public funding, reinforces the strategic pivot toward areas where FDE sees differentiated expertise and policy alignment.

The key question remains execution against the group’s stated 2030 objectives. With management reaffirming its targets and operational momentum elsewhere intact, the withdrawal of the Bleue Lorraine concession are like the pruning of a non-core branch. The story going forward is cleaner: fewer regulatory distractions, clearer capital allocation priorities, and continued leverage to energy transition niches where FDE believes it can compound value over the remainder of the decade.

CIE Automotive (CIE Spain): disciplined M&A returns with a high-margin bolt-on

CIE Automotive’s announced acquisition of Aludec fits neatly into a pattern the group has refined over many years: patient capital allocation, selective dealmaking, and a clear bias toward businesses that enhance quality rather than simply add scale.

Aludec is a Spanish-based manufacturer of decorative automotive components such as badges, hubcaps, and front grilles, an area where CIE historically had limited exposure. The group operates ten production sites across Europe and the Americas and employs around 1,300 people. Management expects Aludec to generate roughly €160 million of revenue in 2025, making it a relatively small addition in revenue terms, but one with outsized profitability. With EBITDA margins around 25%, Aludec sits meaningfully above CIE’s already healthy group margin profile. The agreed enterprise value of €200 million implies a purchase multiple that looks conservative relative to the quality of the asset, particularly given that the transaction is expected to close in early 2026 and be financed entirely in cash without stretching the balance sheet.

Strategically, the logic of the deal is compelling. Decorative exterior and interior components occupy a niche that benefits from OEM differentiation trends, where branding, aesthetics, and perceived quality matter increasingly to end customers. Market growth in this segment is expected to outpace broader automotive production over the medium term, supported by higher content per vehicle and the need for visual differentiation across platforms.

Aludec’s current revenue mix is still heavily skewed toward Europe, which gives CIE a clear opportunity to do what it does best: internationalise a strong industrial platform using its existing global footprint. The group has repeatedly demonstrated its ability to take regionally strong suppliers and scale them across emerging markets such as Latin America and Asia, without disrupting operational culture or margin discipline.

Aludec also operates with a margin-focused, cash-generative mindset that aligns closely with CIE’s long-standing operating philosophy, reducing integration risk and increasing the likelihood that profitability can be sustained rather than diluted post-acquisition.

From a capital allocation standpoint, after a period of relative quiet on the M&A front following several large acquisitions in 2019, management has clearly remained selective rather than inactive. The automotive supplier landscape remains fragmented and, in many cases, weakened by successive industry shocks, creating opportunities for well-capitalised operators to acquire quality assets on attractive terms.

Pro forma leverage following the deal is expected to remain around one turn of EBITDA, a level that preserves ample financial flexibility while allowing CIE to continue investing organically and opportunistically.

More broadly, the Aludec acquisition strengthens the narrative around CIE as a compounder rather than a cyclical trade. The group combines exposure to structurally growing markets, ongoing market share gains, and a proven ability to deploy capital into bolt-on deals that enhance margins and cash generation.

Hoffmann Green (ALHGR France): partnerships multiply as the low-carbon cement ramp gathers pace

Over the past months, the Hoffman Green has significantly accelerated the pace of partnership announcements, particularly across western France, where it is steadily building density around its Vendée production sites. These agreements span construction, civil engineering, property development, and infrastructure-related applications, all centered on the group’s 0% clinker cement technology.

The common thread is not the size of any single contract, but the cumulative signal they send: low-carbon cement is moving from pilot use cases toward broader adoption by regional players willing to embed it into standard construction processes. Management’s stated objective is to progressively fill capacity at its H1 and H2 plants, and the recent flow of partnerships suggests that this ambition is becoming more realistic as market awareness increases and proof points accumulate.

What makes this phase particularly important is that it shifts the narrative from technological validation to commercial execution. While no individual volumes have been disclosed, management has been clear that the order book should gradually build and provide better visibility over the coming quarters. That visibility highlights the company’s stated target of doubling volumes by 2026 to around 100,000 tons, a level that would mark a clear step change in operational scale.

The underlying demand drivers appear increasingly structural. Regulatory pressure on embodied carbon, combined with growing ESG requirements from developers and infrastructure sponsors, is pushing contractors to seek credible alternatives to traditional cement. Hoffmann Green’s positioning as a pure-play low-carbon solution gives it a clear (narrative) advantage, particularly in regions where logistics favor local sourcing. The growing breadth of applications, from building construction to renewable energy infrastructure, also helps diversify demand and reduce reliance on any single end-market, an important consideration as the group moves into a more volume-driven phase.

During the second half of the year, Hoffmann Green raised close to €14 million through a combination of a convertible bond and a capital increase backed by long-term institutional and strategic shareholders. Accelerating volumes in France requires working capital and operational flexibility, while the next wave of capacity expansion, including the planned H3 plants in the Rhône-Alpes region, will require financial headroom. Beyond France, management continues to frame international licensing as a key value lever.

The group has reiterated its 2030 targets of producing around one million tons across three sites and generating roughly €150 million in revenue, with profitability expected to follow scale. EBITDA could turn positive as early as 2025 if additional licenses are signed, but the more meaningful inflection is expected in 2026 as domestic volumes accelerate and international projects, such as the Saudi license where the first plant is already under construction, begin to gain momentum.

Taken together, Hoffmann Green now looks better equipped than before to convert strategic intent into tangible growth. The combination of a strengthening commercial pipeline, improved financial flexibility, and clearly articulated medium-term targets suggests that the coming years will ‘only’ be defined by execution risk.

DEUTZ AG (DEZ Germany): expanding the energy footprint with a targeted European bolt-on

DEUTZ’s acquisition of Frerk Aggregatebau marks another deliberate step in the group’s effort to rebalance its portfolio toward structurally growing energy solutions.

Frerk is a German-based system integrator specialising in emergency power systems and decentralised energy supply, with a customer base that includes data centers, operators of critical infrastructure, and industrial clients requiring highly customised, mission-critical installations. This profile fits neatly with DEUTZ’s strategic ambition to move further up the value chain in energy applications, away from pure component supply and toward integrated solutions. Just as importantly, Frerk brings established relationships in Europe, a region where DEUTZ has been actively looking to scale its energy activities. The decision to retain Frerk’s existing management team underlines the group’s intent to preserve operational know-how while using DEUTZ’s broader platform to accelerate development.

From a financial perspective, the transaction appears measured, but strategically significant. Frerk is expected to contribute around €100 million of annual revenue at healthy, low double-digit EBIT margins, immediately lifting the scale and profitability of DEUTZ’s Energy Solutions unit. Management has previously outlined an ambition to grow energy-related sales to around €500 million by the end of the decade (from roughly €165 million in 2025), and Frerk provides momentum toward that objective. The purchase price was described as being in the upper double-digit million-euro range with a mix of fixed and performance-linked components.

Financing the deal through debt looks manageable given DEUTZ’s balance sheet, which retains sufficient headroom to absorb the transaction without constraining operational flexibility. Closing is expected in the first quarter of 2026, allowing the contribution to be felt relatively quickly.

More broadly, the acquisition reinforces the credibility of DEUTZ’s strategy, which seeks to combine the resilience of its traditional engine business with exposure to new growth vectors in energy and services. The energy segment is particularly attractive in the current environment, as demand for reliable back-up power and decentralised energy systems continues to rise alongside data centre expansion, grid instability, and higher resilience requirements across infrastructure. By adding Frerk’s system integration capabilities, DEUTZ enhances its ability to offer end-to-end solutions rather than individual components, deepening customer relationships and improving value capture.

While integration execution will matter, the cultural and operational fit appears sound, with complementary product portfolios and aligned customer profiles. Taken together, this transaction is about building a platform that can compound over time.

If you appreciate this post, feel free to share and subscribe below!