Cars, defence and strong rebounds

Porsche, Diageo, Abivax, Ipsos, Rosenbauer, Geberit, Ekinops, Tubacex, Partners Group, Rheinmetall, Cicor, Mercedes-Benz, VAT Group

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

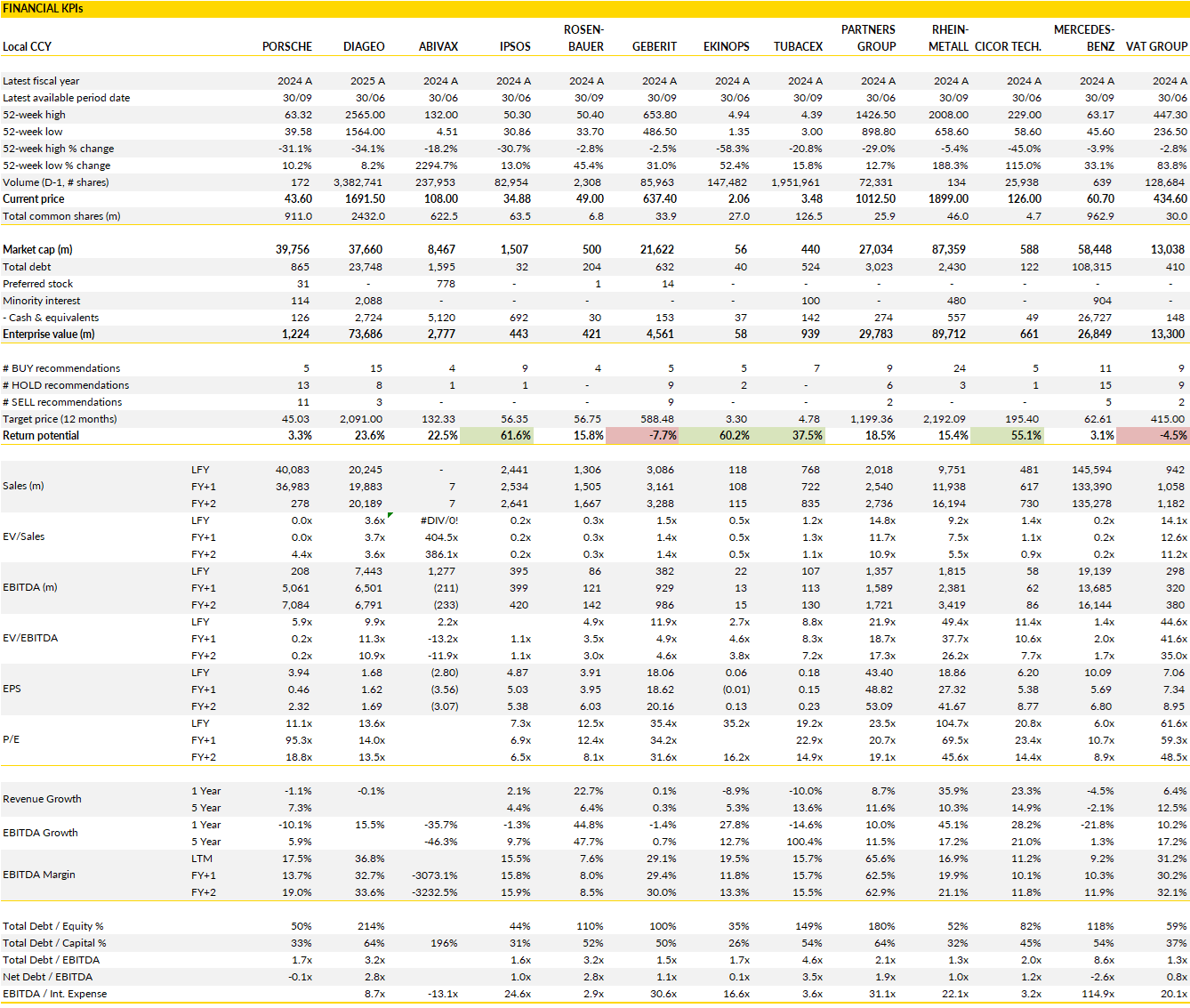

Financial KPIs

Porsche (P911 Germany): recalibrating expectations as restructuring meets a slower EV reality

Porsche enters 2026 in a far more complex position than many investors had anticipated at the time of the IPO.

The tone has clearly shifted from fine-tuning to deeper recalibration. The central issue is not demand for the brand per se, but the intersection of product timing, geography, and an EV transition that has progressed more slowly than originally planned. Porsche is now effectively managing several transitions at once: a reworked product roadmap, a meaningful reset in China, and a cost base that still reflects a more optimistic volume and margin environment. Against that backdrop, management seems to be prioritizing stability and execution over growth, with 2026 shaping up as another transition year instead of a rebound.

On the top line, the product cycle is the main constraint. The phase-out of the 718 and the gradual wind-down of the Macan ICE create a natural volume gap, while China remains a structural drag. Unit sales in China are expected to fall again, reflecting both softer demand and intensifying competition, particularly in the EV segment where local players are far more aggressive on pricing and innovation cycles.

These headwinds are only partially offset by mix and pricing, notably in the US, where price increases and a richer 911 mix, including the introduction of higher-end variants, continue to provide support. The Cayenne BEV, expected from mid-year, is strategically important but unlikely to be a near-term panacea, given ramp-up dynamics and margin dilution typical of early EV cycles. In effect, Porsche is buying time with pricing power and mix, but volumes are no longer doing the heavy lifting they once did.

Profitability tells a similar story. Margins should mechanically improve versus 2025 as large one-off charges roll off, but the underlying earnings power remains under pressure. Lower volumes, unfavorable currency effects, tariff headwinds, and ongoing investments in batteries and product realignment all weigh on returns. Management has been explicit that pricing can only offset a portion of these pressures, particularly tariffs, and that restructuring benefits will take time to fully materialise. Free cash flow remains positive, but less abundant than the brand’s premium positioning might suggest, in part due to license payments linked to strategic decisions to reintroduce ICE options in certain segments.

Taken together, this leaves Porsche in an uncomfortable middle ground: the brand remains exceptionally strong, especially around the 911 franchise, but the industrial and strategic reset required to adapt to a more fragmented, slower-moving EV world is proving costly.

For now, the equity story remains about navigating a (hopefully controlled) transition without further erosion of structural profitability.

Diageo (DGE UK): portfolio discipline sharpens as China assets come under review

Diageo appears to be pushing its portfolio discipline one step further, with recent reports suggesting that the group has appointed Goldman Sachs and UBS to review strategic options for its assets in China.

The move comes shortly after the agreed disposal of the majority stake in East African Breweries (for $4.8bn enterprise value), a transaction that showed management’s willingness to simplify the group and recycle capital away from structurally more complex or lower-visibility assets. In that sense, China is the next logical chapter in a broader clean-up.

Diageo’s history in China helps explain why this moment matters. The initial investment in Swellfun nearly two decades ago was framed as a strategic beachhead into the world’s largest spirits market, anchored around baijiu rather than imported Western brands. At the time, the logic was compelling: baijiu dominates Chinese spirits consumption by value, Swellfun operated in the premium segment, and the asset offered Diageo local production, local brands, and a deep distribution footprint. Over time, Diageo increased its ownership, reinforcing its commitment. Yet the environment has shifted materially. Chinese consumer demand has weakened, premiumisation has stalled, and Swellfun’s earnings profile has deteriorated sharply versus peak levels. What once looked like a high-growth, high-margin anchor now contributes a small share of group sales while absorbing disproportionate management attention and country-specific risk.

From a capital allocation perspective, a potential exit would be consistent with where Diageo is heading. Swellfun represents only a low single-digit percentage of consolidated revenues, yet its valuation could still translate into a meaningful cash inflow if monetised, especially given the scarcity value of scaled premium baijiu assets. Importantly, divesting Swellfun would not amount to abandoning China. Diageo would retain exposure through its interests in the Moët Hennessy structures and its wholly owned Chinese whisky operations, which are arguably more aligned with its core strengths in brand building and premium international spirits.

More broadly, streamlining would simplify the portfolio, reduce earnings volatility, and free up resources for operational priorities such as supply chain execution and balance sheet repair. Diageo’s willingness to prune long-held assets reinforces the view that this time (year) might be different.

Abivax (ABVX France): 2026 a defining year for obefazimod and the broader platform

Abivax used its 2026 outlook to sharpen the investment narrative around obefazimod, positioning the year as a sequence of de-risking milestones across efficacy, safety, and regulatory execution.

Management reiterated that top-line data from the ABTECT-UC Phase 3 maintenance study remain on track for late Q2 2026, followed by a planned U.S. regulatory filing later in the year, while cash runway extends comfortably into Q4 2027.

Importantly, a recent Data Safety Monitoring Board review found no new safety signals across the ABTECT program, with more than 80% of patients already having completed the full 44-week double-blind maintenance phase. In a therapeutic area where long-term tolerability often proves as decisive as induction efficacy, this update reinforces the durability of the dataset heading into the final readout.

What stood out most in this update was the way Abivax framed the commercial opportunity. New market research conducted after the earlier ABTECT readout suggests obefazimod could occupy a particularly attractive position in the ulcerative colitis treatment algorithm. The company highlighted that a large population of U.S. patients remains on conventional therapies, with a majority classified as moderate to severe but still not escalated to advanced biologics or novel agents. Physician feedback cited in the research points to safety, oral administration, and willingness to use obefazimod earlier in the treatment journey as potential differentiators.

This is a subtle but important reframing: instead of competing head-on with entrenched biologics purely on efficacy, obefazimod is being positioned as a bridge between legacy therapies and more aggressive options, addressing a well-documented hesitation among clinicians to escalate too quickly. If sustained maintenance efficacy is confirmed in mid-2026, this positioning could meaningfully expand the addressable market beyond the typical late-line refractory population.

Beyond ulcerative colitis, the pipeline cadence in 2026 adds further optionality. The ENHANCE-CD Phase 2b study in Crohn’s disease now targets a top-line readout toward the end of 2026, slightly later than initially expected but framed as a timing refinement rather than a delay. These data are intended to inform registrational trial design, keeping Crohn’s firmly in view as a second major indication.

At the same time, Abivax continues to broaden the scientific footprint of obefazimod through combination strategies across multiple mechanisms of action and through follow-on miR-124 enhancer programs. The planned presentation of a large number of abstracts at the upcoming ECCO meeting further underlines management’s intent to steadily build clinical and mechanistic credibility.

Taken together, 2026 looks like the year in which Abivax attempts to transition into a platform-level immunology company, with obefazimod as the anchor asset rather than the sole pillar.

Ipsos (IPS France): a necessary reset as the group searches for a credible path back to growth

Ipsos heads into its Capital Markets Day on 22 January with a clear credibility gap to close. After several years of underwhelming organic growth, the market is no longer debating whether Ipsos is operationally disciplined (that box has been firmly ticked) but whether the group can realistically re-accelerate the top line in a structurally changing research and data landscape.

The context is not flattering. In October, management was forced to lower its 2025 organic growth expectation, largely due to a sharp slowdown in government-related activity, which accounts for a meaningful share of revenues and has been hit by political uncertainty and delayed public spending. This weakness, particularly visible in the “citizens” segment, has weighed on growth for most of the year and is unlikely to reverse quickly. Against this backdrop, Ipsos has leaned on cost control to protect profitability, reiterating a 2025 operating margin target of roughly 13% on a like-for-like basis. That margin resilience has helped limit downside, but it also raises the central question for CMD: is Ipsos willing to sacrifice some short-term margin comfort to restore relevance and growth?

Management change is clearly part of the answer. The arrival of Jean-Laurent Poitou as CEO in September, with a background rooted in digital transformation and technology-driven change, signals an intention to rethink how Ipsos operates rather than simply fine-tune the existing model. The departure of the CFO shortly thereafter reinforces the sense that this is not a cosmetic reshuffle.

Investors should expect the CMD to frame a longer-term “horizon 2030” vision, built around faster, more automated data production, heavier use of digital platforms, panels and AI-enabled analytics, and potentially a rebalancing of the portfolio toward more recurring revenue streams. None of this will be cost-free. Ipsos has historically operated with margins closer to 10% before expanding to the current 13% level since 2021, so there is clear historical precedent for reinvesting profitability into capability upgrades. The balance sheet provides flexibility here, with leverage low and room for bolt-on acquisitions that could accelerate the shift toward higher-quality, stickier revenue, but management will need to be explicit about priorities, sequencing and return expectations.

The valuation backdrop gives Ipsos some breathing room as it goes through this transition. The shares trade on a multiple that already discounts a fair amount of skepticism around execution and medium-term growth, sitting well below long-term historical averages. In that sense, the CMD does not need to deliver an aggressive growth promise to work; it needs to deliver a believable one. Investors will be looking for concrete initiatives, measurable milestones and a realistic acknowledgement that margins could dip before improving again. Consensus currently assumes a gradual recovery in organic growth over the next few years and a broadly stable operating margin profile, but those numbers will only gain traction if the strategic narrative is convincing.

Ultimately, this CMD is about redefining Ipsos’ role in an industry being reshaped by speed, automation and AI. If management can articulate how Ipsos moves from a cyclical, project-based research model to a more scalable, technology-enabled information partner, the current valuation starts to look like an opportunity.

Rosenbauer (ROS Austria): execution, not demand, is now the core part of the story

Rosenbauer has been reinforcing the view that the next phase of value creation will be about translating a very strong commercial backdrop into sustainably better profitability and cash generation.

The starting point is clearly supportive. The order book stood at a record €2.43bn at the end of Q3, giving unusually good multi-year visibility, while end-market fundamentals remain intact. Firefighting and emergency response equipment is a structurally growing niche, driven by urbanisation, stricter safety standards, climate-related events and ongoing fleet renewal, with industry growth estimates in the mid-single-digit range through the end of the decade.

Against that backdrop, Rosenbauer’s addressable market continues to expand, particularly in value terms, as technology content and regulatory complexity increase. In other words, demand is not the bottleneck. The investment debate has shifted toward how efficiently the group can convert that demand into margins, cash flow and returns on capital. Margin progression is therefore the central topic. The step-down in the 2025 EBIT margin guidance to around 5.5% was clearly framed as non-recurring, linked to roughly €8m of one-offs earlier in the year, rather than a deterioration in underlying economics.

Looking forward, management is confident about an improvement in 2026, with the longer-standing internal margin ambition of around 7% still very much alive over the medium term. What matters more than the headline target is the pathway. Several concrete levers: tightening the order-to-cash process by reducing late specification changes, strengthening controlling to pinpoint where profitability leaks occur on complex projects, and stabilising industrial processes to limit inefficiencies. A particularly important structural lever is the US business, now representing roughly 30% of revenues, where contribution margins are improving as scale builds and execution becomes more consistent. In parallel, the service and spare parts activity (still only a high-single-digit share of sales) is increasingly viewed as an underdeveloped value stream rather than an ancillary add-on, with materially higher margins and more recurring characteristics.

The message is clear: margin expansion should be cumulative and operationally driven, not reliant on price alone.

Balance sheet and cash dynamics complete the picture. Rosenbauer has already extracted most of the easy wins on working capital, which is reassuring. Incremental gains are still expected, but the real improvement in cash conversion should increasingly come from higher profitability and a more disciplined project execution cycle. Net leverage remains manageable, with management explicitly targeting a move toward around 2x net debt/EBITDA as conditions normalise, alongside further optimisation of financing terms.

Geographically, growth optionality remains skewed toward the US and selected emerging markets, though management was careful to stress that success outside Europe often requires adapting product specifications and pricing to local realities rather than exporting a premium European model wholesale.

Taken together, Rosenbauer is clearly moving from a recovery phase into an execution phase. With demand visibility unusually strong, the next leg of the equity story will be judged on whether operational improvements translate into steadily rising margins, better cash flow and higher returns on capital.

If they do, the current valuation still leaves room for that improvement to be recognised.

Geberit (GEBN Switzerland): market share gains and margin discipline shine through a flat European backdrop

Geberit ended 2025 delivering a fourth quarter that once again underlines how structurally different the business is from its end markets.

Organic sales growth of 6.4% in Q4 and 4.8% for the full year comfortably exceeded both internal guidance and what the broader European construction environment would suggest is possible. Importantly, this was not a price-led outcome. Management indicated pricing contributed around one percentage point in Q4, meaning the bulk of the growth came from volumes, at a time when most European building markets were flat at best.

That dynamic allowed Geberit to upgrade its full-year EBITDA margin to just under 29.5%, despite absorbing one-off costs related to the closure of a ceramic plant in Germany. In other words, strong operational leverage from volumes and easing input costs more than offset restructuring noise, reinforcing the sense that Geberit’s margins remain highly resilient.

The regional and divisional mix explains much of this outperformance. Germany, accounting for close to a third of group sales, continued to deliver steady mid-single-digit organic growth through the year, finishing 2025 up around 5.6%. That is notable given Germany’s broader construction malaise and suggests Geberit is taking share rather than simply riding the cycle. Switzerland slowed sequentially in Q4 but still closed the year slightly positive, while the real stand-out remained Installation & Flushing Systems. Growth here accelerated again in the fourth quarter, supported by the ongoing rollout of the Duofix installation element, which continues to gain traction with installers. Bathroom Systems also surprised on the upside, with high-single-digit organic growth in Q4, likely helped by the increasing penetration of shower toilets such as Alba. Piping Systems lagged by comparison, reflecting its greater exposure to new build activity, but even here growth remained positive, which speaks to the defensive qualities of renovation-driven demand.

Management’s tone on 2026 was measured, but constructive. The company expects the European sanitary market to move from stagnation to slight growth, without a meaningful cyclical recovery. Against that backdrop, Geberit’s implicit message is that it intends to continue growing faster than the market, as it has done consistently over the past few years. Margin-wise, the upgraded 2025 EBITDA margin guidance sets a solid base, and the combination of disciplined pricing, cost control and product-led volume growth suggests there is limited downside even if macro conditions remain subdued.

The investment case therefore remains about execution: continued market share gains, innovation-driven demand in higher-value systems, and the ability to translate modest top-line growth into robust profitability. In a flat market, that consistency is precisely what differentiates Geberit.

Ekinops (EKI France): working through the trough as software mix and innovation set the stage for recovery

Ekinops closed the year very much in line with the narrative management has been preparing investors for all year: this was a transition year, marked by customer-specific pauses rather than structural demand destruction.

Fourth-quarter revenue of €25.6m was still down year-on-year, but the 15% sequential rebound was the first tangible sign that the worst is likely behind the group. Both core divisions contributed to that improvement. Optical transport rebounded sharply quarter-on-quarter as investment activity resumed at two large North American customers, while the access business also improved after a very weak first half. For the full year, revenue of €105m was down double digits, but the underlying picture is more nuanced. A large part of the decline was concentrated in a handful of customers, notably one major French account where volumes swung from strong growth in 2024 to a sharp contraction in 2025. Excluding that specific effect, activity would have been broadly stable, which matters when assessing the sustainability of the franchise.

What increasingly stands out is the shift in the revenue mix. Software and services grew strongly again in 2025 and now account for roughly a quarter of group revenue, up materially from the prior year. This is not just an accounting detail but a strategic inflection. The ramp-up of SaaS offerings, combined with the integration of Olfeo, is translating into a growing base of recurring revenues, with ARR reaching around €15.8m by year-end. Management has been explicit about its medium-term ambition here: software and services are targeted to reach 30% of group revenue, with around half of that being recurring. That mix shift already had a visible impact in the second half, where gross margins improved thanks to a more favorable product and services contribution. In a business that historically lived and died by the capex cycles of a few telecom operators, this gradual increase in recurrence is central to stabilising earnings through the cycle.

For 2026 the tone is notably more constructive, but without promising a sharp rebound. Management is guiding for a gradual recovery, supported by structural demand drivers such as AI-related traffic growth, cloud interconnection and cybersecurity. Investment is continuing in two areas seen as particularly high potential: DCI transport and secure access via SASE. Both are core pillars of the group’s “Bridge” plan, which is progressing largely as expected, with new solutions under development and early commercial traction anticipated to build over the coming periods. Importantly, the focus is not just on technology but on execution, with renewed emphasis on go-to-market discipline, a better balance between direct sales and partners, and selective strategic alliances.

After a year spent absorbing the downturn and reshaping the mix, Ekinops appears to be approaching the low point of the cycle. If the end-market recovery materialises even modestly, the combination of improving recurrence, higher-value software and a leaner cost base could make 2026 a very interesting year for the stock.

Tubacex (TUB Spain): clearing the decks as strategy and credibility are put back under scrutiny

Tubacex surprised the market with the announcement of €50m in extraordinary impairments for 2025, a headline figure that is large relative to the group’s current earnings power and inevitably reframes the discussion around strategy, execution and medium-term targets.

Management has been clear that these adjustments are non-recurring and voluntary, with no impact on liquidity or dividend policy. While this matters, it does not remove the underlying message: the operating environment has proven tougher and slower-moving than previously assumed, particularly for long-cycle projects. The impairments will wipe out what would otherwise have been a modest net profit for the year. In parallel, the company has already flagged a Capital Markets Day in the first half of 2026, where it intends to reset its strategy with a sharper emphasis on cash generation and return metrics.

The largest component of the adjustment relates to inventories, with €31m written down to reflect a lower net realisable value. This is concentrated in long-cycle materials, notably in the nuclear segment, where Tubacex has deliberately positioned itself in high-alloy, large-diameter and heavy-wall products. The company continues to argue that these materials remain strategic and potentially high value, but order conversion has been slower than expected, pushing cash inflows further out. While the group operates a build-to-order model with cost pass-through mechanisms, the scale of the adjustment raises legitimate questions about how effectively those mechanisms function when project timelines stretch.

The €19m write-down on fixed assets is linked to the US plant in Oklahoma. The facility suffered construction delays during the pandemic and has since experienced a slower-than-planned ramp-up. Although long-term prospects for the site remain intact according to management, the revised profitability assumptions warranted a reset of its carrying value.

Together, these items do not signal a liquidity problem, but they do highlight the execution risk embedded in Tubacex’s strategy of targeting complex, capital-intensive niches. That said, the impairments should be seen as a line-in-the-sand moment rather than a simple accounting clean-up. They come shortly after changes at the top of the organisation and ahead of a broader strategic update, suggesting a willingness to confront reality and recalibrate expectations. Nonetheless, they also cast some doubt on the credibility of previously communicated medium-term ambitions, including longer-dated profitability targets that assumed smoother project execution and faster market normalisation.

What continues to underpin the investment case is Tubacex’s positioning: it operates in highly specialised segments such as seamless stainless steel tubes, corrosion-resistant OCTG, umbilicals and premium connections, where barriers to entry are high and customer relationships are sticky. The firm backlog of around €1.3bn provides tangible revenue visibility into 2026 and 2027, offering a degree of earnings support once the current digestion phase passes.

The upcoming Capital Markets Day will therefore be critical. Investors will be looking for a more conservative, cash-focused framework that aligns capital allocation, project selection and return thresholds more tightly.

Partners Group (PGHN Switzerland): fundraising strength masks the growing pains of a maturing evergreen engine

Partners Group ended 2025 with a trading update that reads as reassuringly solid.

Assets under management climbed to roughly $185bn, translating into double-digit growth year-on-year, helped by robust net inflows and a modest contribution from M&A. Fundraising reached $30bn for the year, landing towards the upper end of management’s own range and accelerating meaningfully in the second half.

That H2 momentum matters: it suggests that institutional and wealth clients are once again leaning into private markets allocations after a hesitant 2023–24 period. At the same time, investment and realisation activity both picked up pace, each running at around the high-$20bn level, with exits increasingly skewed toward direct assets. Those direct realisations were achieved at prices modestly above recent marks, which quietly reinforces the longer-term performance fee narrative that has been under pressure over the past two years.

The more nuanced part of the story continues to sit within the evergreen platform. On the positive side, Partners Group is clearly succeeding in broadening its evergreen product suite. Inflows into these vehicles reached record levels in 2025, with a growing share directed toward newer strategies rather than the three original flagships. That shift speaks to a client base that is both larger and more sophisticated, actively reallocating across private equity, private credit and infrastructure sleeves. However, the flip side is becoming harder to ignore: redemptions remain structurally higher than in the past, running at around low-double-digit percentages of end-period AuM versus mid-single-digit levels historically.

Management frames this as a function of market maturity and client switching rather than stress, but from an earnings perspective it is still a headwind, particularly for near-term management fee growth. In other words, gross inflows look healthy, yet net growth in evergreen assets is increasingly contested.

Looking ahead, management’s tone on 2026 is notably constructive. The firm is guiding to another year of strong fundraising, with $26–32bn of inflows expected, implying continued double-digit growth despite a still-complex macro backdrop. Tail-downs are also set to rise, partly reflecting exits that slipped from 2025, while performance-related earnings are expected to remain a meaningful contributor after a one-off boost in 2025 from a large direct investment realisation. Importantly, Partners Group reiterated its expectation that performance fees should structurally account for a sizeable share of revenues over time, even if 2026 temporarily lands toward the lower end of its stated range due to timing effects.

With a Capital Markets Day scheduled for March, investors will be looking for greater clarity on how the firm intends to balance evergreen scalability with redemption discipline. The core takeaway is that while growth is very much alive, the business is entering a phase where capital rotation, rather than pure accumulation, will increasingly define results.

Rheinmetall (RHM Germany): defence supercycle visibility collides with a fully priced execution story

Rheinmetall is entering 2026 with a level of order visibility that would have seemed almost implausible just a few years ago.

The company has been regularly flagging just how sharp the acceleration has been, particularly in the final quarter of 2025, when roughly €11bn of new orders were signed split between Germany and international customers. That surge lifted the defence-only order book to around €70bn already, excluding civil activities, while cash conversion moved above 50% thanks to customer advances.

For 2026 , the company has sketched out a preliminary operating framework that is very confident: defence revenues of roughly €15–16bn, an EBIT margin in the high-teens to around 20%, and cash conversion potentially exceeding 100%. This last point is critical. The scale and structure of recent contracts increasingly front-load cash, meaning Rheinmetall could generate more operating cash than accounting earnings as production ramps, even while capacity investments remain elevated.

The more eye-catching part of the medium-term narrative, however, is the implied backlog trajectory. Commercial momentum is expected to remain exceptionally strong through 2026, with up to €80bn of new nominations anticipated. The bulk of this is expected to come from Germany, including long-duration programmes tied to vehicles, naval platforms and ammunition, complemented by a meaningful pipeline of international orders from countries such as Romania, Italy and Ukraine.

If these nominations convert as expected, Rheinmetall’s defence backlog could reach around €135bn by the end of 2026. Within that, the Boxer vehicle program stands out as strategically important, not just for its headline size but for what it enables operationally. Greater standardisation across variants and higher volumes should allow for increased automation, supporting margin expansion in Vehicle Systems over time.

In parallel, management continues to articulate an unchanged capital allocation hierarchy: first, fund the industrial ramp-up; second, pursue bolt-on M&A of €1–2bn per year, particularly in electronics and naval technologies; and only then consider shareholder returns such as buybacks.

None of this suggests that execution risks have disappeared, but the company appears increasingly comfortable with the main pressure points. Supply chain resilience has improved, helped by a high degree of vertical integration in ammunition, while operational delays on vehicle programs have so far been measured in months rather than years. Human capital is framed as a competitive advantage rather than a bottleneck, with recruitment momentum and in-house training infrastructure scaling alongside production.

The reason for a cautious stance today is not the industrial story but the valuation context. Much of this extraordinary growth and visibility is already reflected in the share price, leaving limited margin for error. With peers offering similar exposure to defence spending tailwinds at more attractive entry points, Rheinmetall is a case of exceptional fundamentals meeting a stock that already discounts them.

Cicor Technologies (CICN Switzerland): growth story intact after a messy detour

Cicor Technologies enters 2026 with an increased focus on execution after a frustrating, but ultimately contained, episode.

The failed acquisition of TT Electronics was clearly a disappointment, both strategically and optically. Cicor has spent the last few years repositioning itself toward structurally attractive end-markets (notably aerospace & defence, industrial electronics, and medical technology) and that repositioning remains firmly in place. The group’s expansion strategy, initiated in 2021, has already reshaped its footprint and customer mix, and management continues to frame external growth as a core pillar, supported by a balance sheet that still offers meaningful flexibility. In that context, the collapse of the TT transaction is an unfortunate pause, accompanied by one-off costs rather than structural damage.

The recent downgrade to 2025 expectations needs to be read through that lens. Management was explicit that the more cautious guidance issued late last year was not a sudden reassessment of underlying demand, but rather a conservative scenario imposed by the UK Takeover Panel during the bid process. Currency headwinds from a stronger Swiss franc, alongside softer conditions in parts of the German industrial and medical markets, provided a convenient basis for that prudence. The failed transaction itself carries a defined and finite financial impact, with advisory and financing costs now largely behind the company.

Importantly, the revenue outlook for 2025 remains intact, and the revised profitability range still reflects a business that is meaningfully larger and more diversified than it was just a few years ago. From an operational standpoint, there was no sense in discussions that customer relationships, project pipelines, or long-term contracts had been impaired by the aborted deal.

Looking into 2026, aerospace and defence continue to stand out as a key growth engine, with two new customer wins expected to begin contributing from 2026 onward and scaling further into 2027. Industrial electronics appears to be stabilising after a softer period, while medical remains the laggard, with management acknowledging that recovery there is likely to be slower and more uneven.

On M&A, expectations have been reset to something far more realistic and sustainable. Rather than chasing transformational deals, Cicor is targeting bolt-on acquisitions in the CHF 80–100m range, with growth contributions more in line with its historical average of around 15%.

Taken together, the picture that emerges is a company that has tightened its messaging and returned its focus to steady, multi-year value creation in markets where its capabilities and scale are increasingly relevant.

Mercedes-Benz AG (MBG Germany): a holding pattern year before the next growth chapter

Mercedes‑Benz enters 2026 still very much in transition, with the year clearly framed as (another) one of consolidation.

Volumes are likely to be broadly flat, pricing is no longer the tailwind it once was, and the external environment remains challenging. China continues to weigh on the narrative after a difficult 2025, with unit sales undershooting earlier ambitions and competitive intensity eroding pricing discipline more than initially hoped. While Europe should benefit from an active launch calendar and the US retail backdrop looks stable after last year’s dealer destocking, neither region is expected to deliver enough momentum to offset China’s drag. Add to this a less favourable FX backdrop and a heavier tariff burden, and it becomes clear why 2026 is another year where execution and cost control matter more than top-line growth.

The product story, however, is far from quiet. Mercedes-Benz is preparing one of the busiest launch schedules in its recent history, spanning both combustion and electric platforms. New models and refreshes across the core range, including key BEV launches and updates to flagship nameplates, are intended to fill important gaps in the portfolio, particularly in China where the absence of certain electric variants has been keenly felt.

That said, the timing matters. Many of these vehicles will only start to ramp meaningfully in the second half of the year, meaning their full earnings contribution is pushed into 2027. In the near term, the product mix may even be slightly unfavourable, as certain high-margin derivatives are phased out before replacement models gain traction. Management remains confident that the offensive will ultimately reinforce the brand’s positioning and support margin recovery, but 2026 is best seen as a bridge year.

Against this backdrop, cost discipline is the primary lever available to defend profitability. Management is again leaning on fixed-cost reductions and tighter variable cost control to counterbalance tariffs, softer pricing and ongoing weakness in China. Some of the more structural efficiency measures, such as deeper localisation of sourcing, are expected to deliver their full benefit later in the cycle rather than immediately.

Cash generation reflects the same transitionary profile. Industrial free cash flow is expected to step down versus 2025, partly due to restructuring cash outflows and some working capital drag ahead of the product ramp-up, even as capital expenditure eases modestly. To smooth this trough and sustain shareholder distributions, Mercedes-Benz is relying on portfolio actions, including asset disposals and selective monetisation of non-core holdings.

Taken together, 2026 looks set to be (again) about patience, discipline and preparation rather than visible growth.

VAT Group (VACN Switzerland): early-cycle signals turn decisively positive as orders surge into year-end

VAT Group ended 2025 convincingly changing the tone around the cycle.

Preliminary fourth-quarter orders of CHF 305m came in far ahead of market expectations and marked a sharp inflection versus the subdued demand environment seen earlier in the year. Sequentially, orders jumped close to 30% quarter-on-quarter at constant FX, pushing the book-to-bill ratio to 1.19x from below unity in Q3. Even stripping out roughly CHF 30–35m of customer pre-orders ahead of January price increases, order intake would still have exceeded expectations by a comfortable margin. Sales held steady at CHF 257m, slightly above guidance, and full-year revenue reached CHF 1.07bn, up 14% reported and around 20% at constant FX.

Most important is what this all signals about positioning in the semiconductor upcycle: VAT is once again seeing broad-based re-engagement from customers, particularly among Western equipment makers and Chinese fabs, at a point when many investors were still debating whether the recovery would meaningfully materialise.

The composition of demand is arguably even more important than the headline growth. Management pointed clearly to leading-edge logic and memory as the primary drivers of the Q4 acceleration. HBM and DRAM capacity is now understood to be largely filled for 2026, and capex momentum among memory manufacturers appears to have strengthened meaningfully toward the end of 2025 in precisely those vacuum applications where VAT’s valve intensity is highest.

In parallel, the transition toward 2nm and GAA architectures in logic continues to lift content per tool, reinforcing the structural growth component of the story. This is not limited to the Semiconductor division either. Global Service also benefited from the improved activity backdrop, while Advanced Industrials remained more muted, as expected at this stage of the cycle. Importantly, despite the sharp pick-up in orders, profitability discipline has been maintained.

Preliminary figures suggest an EBITDA margin of around 30% for 2025, broadly in line with prior expectations, and free cash flow comfortably above CHF 225m. In other words, VAT is entering the upturn with margins and cash generation intact, not in a position of operational stress.

The order momentum at year-end strongly supports the case for a robust upswing in 2026 rather than a shallow, stop-start recovery. Management has not yet provided formal guidance for the new year, but the underlying signals are increasingly hard to ignore. Memory manufacturers are ramping capacity against sustained AI-driven demand, logic customers are pushing forward with more complex nodes that structurally favour higher valve intensity, and China continues to contribute incremental demand despite ongoing geopolitical noise.

Against this backdrop, VAT appears well placed to deliver a material step-up in activity, with orders already pointing to a healthier revenue run-rate as the year progresses. The valuation premium relative to history reflects this positioning: the market is clearly paying for visibility and operating leverage into the next phase of the cycle. Given the strength of the Q4 order intake and the clear alignment with company-specific and industry-wide drivers, VAT increasingly looks like one of the cleaner ways to express confidence in a semiconductor recovery.

If you appreciate this post, feel free to share and subscribe below!