Booze, casinos and jewelry (transport)

Rémy Cointreau, Cirsa Enterprises, UBM Development, Safestore, Hugo Boss, CA Immo, Ferrari Group, Trigano, K+S, Infineon Technologies, Wallix, HBX Group

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

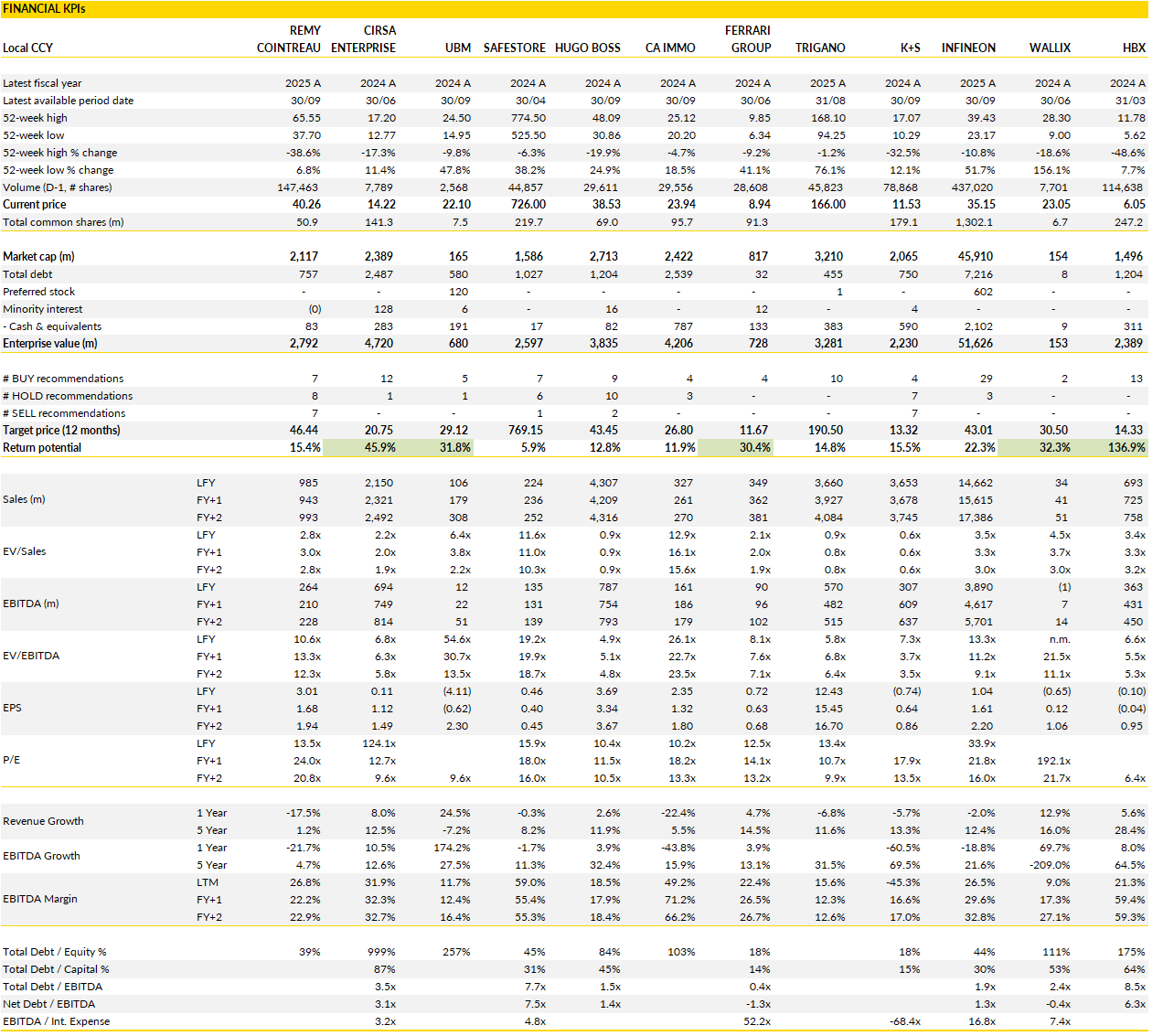

Financial KPI

Rémy Cointreau (RCO France): waiting for the hangover to fade before the next toast

Rémy Cointreau’s first-half numbers landed roughly where the market expected them to; painful, but not disastrous.

Operating profit fell 26% to €109 million, reflecting a double squeeze of weak demand and adverse currency effects, though the organic decline of 14% was marginally better than feared. The margin erosion was stark: 22.2% versus 27.6% a year earlier, dragged down by a sharply lower gross margin at 68% as the mix tilted away from high-end Cognac. The division’s margin fell by over four points, showing that the premium tier remains under strain, particularly in the U.S. where inventory normalization and subdued gifting continue to weigh on sales. The Liqueurs & Spirits segment, smaller but strategically important, was the lone bright spot, managing to lift margins thanks to cost control and better channel mix.

Overall, the results showed that this is still a rebuilding phase. The bigger story is what comes next. Management stuck to its full-year guidance, betting on a modest return to organic sales growth in the second half and an operating profit decline limited to the low double digits.

That’s an optimistic stance given the patchy global backdrop: China remains uneven, the U.S. recovery is slow, and global trade normalization continues to hurt high-value Cognac shipments. Yet the new CEO seems intent on resetting the playbook. His early remarks hint at a push for sharper resource allocation, brand focus, and operational agility, essentially trying to make a slower-growth spirits group behave more like a nimble luxury house. The five strategic levers he flagged (brands, valuation, investments, organisation and resource allocation) read more like themes than tactics for now, but they suggest a cultural pivot toward efficiency after years of chasing volume growth at the top end.

In short, Rémy Cointreau is still nursing the aftereffects of the Cognac hangover that followed its pandemic-era exuberance. The valuation already reflects much of this fatigue (shares trade near historical trough multiples) but visibility remains poor until the recovery in key end markets takes hold and the new leadership’s strategy gains definition.

The second half will likely bring modest sequential improvement, but without a clear narrative for reigniting (sustainable) premium growth, investors have little reason to refill their glasses just yet.

Cirsa Enterprises (CIRSA Spain): steady hand on the tables as digital bets pay off

Cirsa’s latest quarter showed not spectacular, but consistent growth, which is arguably the most valuable trait in the gaming business.

Revenue grew 5% year-on-year, a touch slower than the double-digit pace earlier this year, but that moderation came from foreign exchange headwinds and a normalizing perimeter rather than any loss of momentum. EBITDA rose 6%, keeping margins broadly steady, and free cash flow surged 19% as operational efficiency continues to compound.

Beneath the headline, the mix tells a reassuring story: the traditional casino business, still the profit anchor, expanded sales by 4% while maintaining its enviable 43% margin, and Spanish slots quietly improved profitability thanks to sharper portfolio management and the rollout of higher-yield machines. Even Italy, historically more volatile, held margins stable, suggesting the discipline embedded since the IPO is taking root.

Where the upside story really lives now is online. After a year of transformative acquisitions, the digital division posted 8% top-line growth in Q3, all of it organic, and improved margins as synergies from prior deals start to filter through. This steady scaling of the online platform is critical: it smooths out the cyclical swings of land-based operations and positions Cirsa for structural growth as regulated digital gaming gains traction in Latin America.

Management’s decision to slightly lift full-year revenue and EBITDA targets underlines that confidence. Just as important, €60 million in annualised interest savings already achieved from refinancing, with more expected from future maturities. That efficiency quietly adds several turns of earnings leverage without needing aggressive expansion.

The larger takeaway is that Cirsa is maturing into a genuinely diversified gaming group, balancing steady cash flow from physical casinos with scalable economics from online operations. The combination of disciplined execution, high cash generation, and a cleaner balance sheet means the company can continue funding growth and returning capital without stretching.

With the land-based business providing ballast and the digital arm supplying upside, its now all about execution.

UBM Development (UBS Austria): residential lift helps steady the ship, but offices remain stuck in limbo

UBM’s recent results showed a company slowly regaining its footing thanks to resilient apartment demand, even as the office segment remains a drag.

Revenue jumped 84% year-on-year to nearly €38 million, driven primarily by continued strength in residential sales (147 apartments sold this quarter versus 121 in Q2) with the Vienna and Prague projects doing most of the heavy lifting. This momentum, combined with solid construction progress across core sites, helped lift pre-tax profit to €1.9 million, up from just €0.5 million in Q2. That improvement flowed through to the bottom line, where UBM finally broke even after quarters in the red. Liquidity remains comfortable at €142 million, and NAV per share nudged up 1% to €30.6, modest but symbolically important after a long stretch of compression.

Still, the gains are confined to a narrow base. The commercial portfolio, particularly the high-profile Timber projects in Frankfurt and Vienna, remains largely frozen, with no meaningful leasing progress to report. Management’s silence on office take-up tells its own story: demand for prime sustainable office space hasn’t yet translated into hard leases, leaving capital tied up and margins under pressure.

The refinancing schedule is also tight. After repaying a €75 million bond in November, another €14 million in promissory notes comes due in December. Offsetting this are inflows from a new €27.5 million green bond and the refinancing of Timber Pioneer, but the higher cost of debt inevitably eats into the recovery pace. With net debt inching up to €583 million and the equity ratio steady at 30%, UBM is operating within its comfort zone, but not much above it.

The company remains confident it will post a profitable second half, expecting around 95 apartment sales in Q4, which seems achievable given the current pipeline. The residential rebound in Austria and parts of Central Europe is indeed helping, but the broader structural challenge persists: a business model once built on mixed-use urban projects now depends heavily on one buoyant segment to offset another in hibernation.

Until office leasing revives or asset sales accelerate, UBM’s results will look like incremental steps. The quarter confirms the group’s operational discipline and liquidity prudence, but also the limits of what can be achieved while one leg of the business refuses to move.

Safestore (SAFE UK): storage steady and expanding, but returns boxed in for now

Safestore’s fourth-quarter update showed operational strength in a still-uncertain macro environment.

Group revenue grew nearly 5% year-on-year to £234 million, just below consensus, with like-for-like revenue up 3.1% at constant exchange rates. The story was again led by the UK, which remains the company’s largest and most stable market. There, revenue climbed 3.3%, supported by both firmer rental rates and small but steady occupancy gains. The final quarter was particularly strong: rental rates rose 6.6% on a like-for-like basis, showing that underlying pricing power remains intact despite consumer belt-tightening. France, meanwhile, delivered modest 2.5% growth helped by higher occupancy, while the expansion markets (Spain, the Netherlands, and Belgium) were the clear outperformers, with revenue surging 27% as new sites continued to scale.

Altogether, these figures confirm that Safestore is managing its portfolio with precision, balancing rate and occupancy dynamics even in slower demand periods.

The company continues to expand aggressively but prudently. It opened four new stores in the quarter and two more after the period end, adding 0.7 million square feet of new space in fiscal 2025, with another million square feet still in the pipeline. This development drive underscores Safestore’s long-term confidence in Europe’s underpenetrated self-storage market, but it also explains why near-term earnings growth may remain muted. As new stores ramp up and debt costs rise, incremental EPS accretion could flatten in 2026 despite healthy underlying demand.

Management acknowledged this trade-off but reiterated that the development program remains on track and is the key medium-term driver for cash flow and net asset value growth. Importantly, occupancy is improving even as capacity expands, a sign that demand is absorbing supply without margin compression.

In many ways, Safestore is executing a familiar playbook: expand capacity, maintain pricing discipline, and let compounding do the rest. The strategy is working operationally, and the UK’s momentum through the fourth quarter bodes well for early 2026.

Yet with shares still trading at a discount to NAV but a premium on earnings metrics, the equity story feels balanced rather than compelling. The company has proven its resilience through inflation, rising rates, and patchy consumer sentiment, but investors may need to wait for a cleaner interest-rate backdrop or more visible profit leverage before the next re-rating.

Hugo Boss (BOSS Germany): new strategy, same challenge

Hugo Boss heads into next week’s capital markets day facing the same tension that’s defined its last two years: a strong brand, steady execution, but not enough growth to justify much excitement.

As a reminder, the company’s 2021 strategy originally envisioned €5 billion in sales and a 12% EBIT margin, targets that once seemed attainable before the macro tide turned. Since mid-2024, momentum has slowed sharply across key regions (the UK, the US, and China) and the brand’s previous outperformance versus peers has faded. Revenue this year is tracking around €4.2 billion with margins near 9%, a respectable result but well short of earlier ambition. Investors should therefore expect a shorter 2–3-year horizon and more conservative goals focused on low to mid-single-digit annual growth.

The issue isn’t brand heat so much as structural drag. In the US and China, both underpenetrated and strategically vital, consumer demand remains patchy and competition fierce. Even with upcoming price increases in the 2026 spring/summer collections, higher marketing intensity will likely offset much of the benefit.

Management has been trying for years to ignite the womenswear line, which remains just 8% of sales, and rumors suggest another leadership reshuffle to revive it. But barring a major breakout, organic growth alone probably won’t lift margins much beyond 10% by 2027, versus the original 12% goal. Analysts are already trimming EBIT forecasts for 2026 and 2027, and the company itself seems resigned to a more incremental profitability path; steady but unspectacular.

That leaves inorganic moves as the next logical lever. CEO Daniel Grieder has hinted repeatedly at selective M&A, and with slower organic expansion, the likelihood of bolt-on deals has risen. Such a shift could make strategic sense, especially to fill product or geographic gaps, but it would also add execution risk and potentially constrain dividends if financing gets stretched.

For now, the shares trade at just 10x 2026 earnings, a deep discount to their pre-pandemic multiple near 17x, but one that fairly reflects a business stuck between eras: too mature to excite on growth, too stable to be cheap.

The CMD may bring fresh slogans and a refined narrative, but until Hugo Boss finds a way to reignite demand in its key markets, the story looks tailored for more patience.

CA Immo (CAI Austria): solid rental core masked by disposals and shrinking footprint

CA Immo’s recent set of results confirmed that the underlying business is still performing well, even if headline numbers look weaker due to portfolio pruning.

Net rental income slipped 3.6% year-on-year to €49 million, entirely the result of a 28% smaller portfolio following the disposal of non-core assets. Strip out that effect, and the like-for-like picture looks quite healthy: rents rose 3.7%, occupancy improved sharply to nearly 94%, and the net rental income margin climbed above 90% thanks to lower vacancy costs. The company also managed to surprise positively on cash generation, with recurring FFO rising 10% above expectations despite the smaller asset base, mainly because of tight cost control. Operating expenses fell more than €4 million year-on-year, reflecting an organisation that has become leaner and more focused.

The other interesting story this quarter was liquidity and balance sheet strength. CA Immo closed €480 million of disposals in the first nine months, adding another €100 million in early Q4 and signing roughly €100 million more since. Altogether, the company has offloaded nearly €700 million of assets this year, at an average 5% premium to book value, a remarkable achievement in a still-fragile European office market. Those proceeds lifted cash reserves to €887 million and pushed loan-to-value down below 35%, creating meaningful room for further shareholder distributions.

Management has already returned about €130 million to shareholders this year through dividends and buybacks, and a renewed repurchase program in August suggests that capital returns will remain part of the playbook in 2026. A one-off gain from Germany’s announced corporate tax cut also boosted reported profit, though this doesn’t change the operational narrative.

Behind the disposals lies a more deliberate repositioning. CA Immo is shrinking to strengthen; exiting peripheral assets, improving portfolio quality, and focusing on its prime office and mixed-use properties in Germany and CEE capitals.

The downside is obvious: smaller footprint means lower short-term rental income and less scale efficiency. But the upside is a stronger, more liquid balance sheet and the flexibility to reinvest when valuations stabilise. The third quarter shows this trade-off clearly: leaner revenues, fatter margins, and a cash pile waiting for better deployment opportunities.

While growth may look flat in the short term, its operational discipline and financial headroom set the stage for value creation once the real estate cycle finally turns.

Ferrari Group (FERGR Italy): steady as she ships, with a luxury logistics twist

Ferrari Group’s recent news in one work: resilient. The logistics and transport specialist, focused on high-end goods, delivered another solid performance, keeping its post-IPO record of consistency intact.

Revenues rose 3.5% year-on-year to €83.8 million, matching internal forecasts to the euro. Stripping out currency effects, growth reached 6.1%, a sign of resilient demand for secure, high-value transport even as broader luxury markets remained choppy. Europe, which makes up well over half the business, continued to drive the engine, posting a 5% increase thanks to strong contributions from France and Germany following management changes earlier this year. North America and Brazil also grew 9%, slightly ahead of expectations, as shipment volumes and unit values accelerated in the quarter. Asia was the only soft spot, down 12% year-on-year amid China’s continued luxury slowdown, a headwind that management flagged but says is offset by solid growth in other Asian markets.

Beyond the regional picture, the business mix is about disciplined diversification. Domestic services grew 6.6% thanks to route expansion in Europe, while International Services, the company’s core cross-border segment, managed a modest 1% gain. The standout this quarter was the Special & Other Services unit, up more than 20%, helped by strong demand for event logistics and the opening of a new flagship store for a major client. Warehouse and logistics operations held steady, reinforcing Ferrari’s reputation for consistency and cost discipline.

Margins remained robust despite muted global trade volumes, supported by stable pricing and an increasingly asset-light operating model. Management once again reiterated full-year guidance for 2025: revenue growth broadly in line with last year, a 26.5% adjusted EBITDA margin, and continued moderation in capital spending, all signaling confidence in the group’s trajectory.

The quarter may not have moved the needle much fundamentally, but it underlined why investors have come to value Ferrari’s reliability. In an end-market prone to volatility, the company continues to grow methodically, return capital (with a payout ratio above 40%), and strengthen its balance sheet. The drag from China remains a risk, but the group’s geographic spread and exposure to the resilient luxury supply chain help insulate earnings.

Trigano (TRI France): what ‘in line’ just can do

Trigano’s numbers itself were nothing spectacular, but solidly reassuring after a year that tested patience.

Revenue was down on a like-for-like basis as motorhome distributors worked through excess stock, but margins held near guidance, and the company showed remarkable financial discipline. The highlight: free cash generation reached over €500 million, driven by a sharp reduction in inventories and tight working-capital management. Net cash rose to nearly €280 million, restoring a balance sheet that now looks pristine for a cyclical manufacturer.

After the destocking hangover that dragged on profitability, the numbers suggest a business that’s stabilized operationally and is already set up to benefit from any recovery in demand.

Management’s tone on the year ahead was upbeat, and for once, the optimism looks grounded. Order books are healthy, the new 2026 model ranges have been well received, and the painful clean-up of dealer inventories is behind them. That sets up a clear path for revenue to return to growth, roughly mid-single digits, and for operating margins to regain lost ground as production normalizes and promotional pricing fades. The group’s smaller mobile-home unit should also contribute positively as European leisure demand remains resilient.

In short, the pieces are in place for a rebound year: higher volumes, better pricing discipline, and operating leverage kicking back in. Even if Trigano chooses to stay conservative on acquisitions, its financial flexibility gives it options; whether that’s capex to improve productivity or renewed shareholder returns once visibility improves.

Trigano is a market leader navigating the down-cycle with discipline. The company’s scale, brand portfolio, and long distribution relationships have always given it an edge when the tide turns. With the European motorhome market showing early signs of restocking, the company’s leaner cost base and cash-rich balance sheet leave it well placed to capture renewed growth in 2026.

Investors tend to underestimate how quickly Trigano’s earnings can recover when volumes come back.

K+S AG (SDF Germany): early China deal sets a firmer floor for potash prices

K+S got an unexpected boost from China this month, and for once it’s not about demand weakness but timing, and price. The Chinese consortium struck its 2026 potash import deal with Uralkali much earlier than usual, locking in a price of $348 per tonne, a modest but important increase over last year. For context, China typically drags its feet on these negotiations until mid-year, but this time urgency won out. Domestic inventories had sunk well below the government’s 3-million-tonne target, and spot prices were already trading over $450, giving buyers little leverage to delay.

That early settlement now effectively sets a global price floor for 2026, reinforcing a sense that the potash market, while not exuberant, is tightening again. For producers like K+S, it’s confirmation that the worst of the pricing downdraft is likely behind them, and that Chinese restocking will help sustain volumes into next year’s northern hemisphere planting season.

The broader potash backdrop has been quietly improving. Global shipments are projected to rise to around 75 million tonnes next year, with China, India, and Latin America all contributing incremental growth. Russian and Belarusian exporters, despite political and logistical hurdles, have kept rail exports flowing at healthy levels, hinting that supply chains are stretched but functional.

For K+S, the mix shift toward higher-value products and stable costs should translate into steady profitability even without a surge in prices. The company expects its cost base to remain flat in 2026, with production at the Bethune mine returning to normal after major maintenance. That should support slight volume growth and lift EBITDA back above €640 million, in line with the market’s mid-cycle expectations.

What makes this early China deal more meaningful is its signaling power. It restores some confidence in potash pricing discipline and provides visibility into the 2026 season just as sentiment was wobbling. The combination of low inventories, constrained global logistics, and K+S’s more optimised sales mix suggests that margins can hold up even if volumes only grow modestly.

With shares still trading well below the sector average on forward earnings multiples, K+S doesn’t need a rally in fertilizer prices to outperform, just a stable market and some patience. The early settlement out of China may have given both.

Infineon Technologies (IFX Germany): powering the AI era from the grid to the chip

Infineon’s recent investor call didn’t reveal anything radically new, but it did hammer home a point the market still hasn’t fully absorbed: the company’s Power AI segment is becoming the core of its growth story. Management’s confidence was palpable as it reiterated that this business, which bridges power conversion from the grid all the way into AI servers, will double in size by 2026 and keep expanding at a strong clip beyond that.

In essence, Infineon isn’t chasing AI the way semiconductor designers are; it’s supplying the electricity backbone that allows GPUs and TPUs to run. That makes its opportunity both more tangible and more defensible. The company expects Power AI to reach €1.5 billion in sales by 2026 and potentially represent around a fifth of group revenue by the decade’s end. With margins higher than group average and growth limited only by capacity, not demand, this is a business that’s still underappreciated by investors who price Infineon like a cyclical auto-chip supplier rather than a structural enabler of AI infrastructure. And that could mean upside.

The underlying technology stack is what makes this positioning so compelling. Infineon is one of the very few companies that can cover every layer of the power conversion chain; from high-voltage transmission right down to the final power modules sitting next to AI accelerators. Its mix of silicon, silicon carbide, and gallium nitride components allows it to address everything from industrial transformers to the ultra-efficient 1 MW data-center racks expected by the end of the decade. Each of those steps carries increasing content per unit and, more importantly, higher profitability. The company’s portfolio touches data centers, EVs, robotics, and renewable grids, all markets converging around the same problem: moving and managing massive amounts of electricity more efficiently.

Management noted that near-term growth is constrained only by production ramp-ups, not by order visibility, hinting at a backlog that stretches well into 2026.

What’s emerging is a narrative shift. Infineon may have built its reputation on automotive and industrial semis, but it’s morphing into a critical supplier to the global AI build-out, i.c. far higher-quality, longer-duration growth cycle. Power AI is accretive, capacity is tight, and Infineon’s 30–40% share in this emerging market gives it real pricing power.

As hyperscale data centers chase energy density and governments push grid modernisation, Infineon sits in a rare sweet spot between power and intelligence. The market still values it on old multiples, but the company’s technology base and visibility suggest it could deserve a place among the true infrastructure beneficiaries of the AI wave.

Wallix (ALLIX France): planting the AI flag in cybersecurity’s next frontier

Wallix’s latest acquisition may look small on paper, but it fits neatly into a larger story the market is only starting to appreciate: the company’s deliberate pivot toward AI-driven cybersecurity.

The purchase of Rennes-based start-up Malizen, a spin-off from France’s leading AI research institute Inria, brings Wallix a team of specialists in behavioural analytics, a field increasingly critical to anticipating cyber threats rather than merely reacting to them.

At €1.6 million enterprise value, it’s hardly a balance-sheet event, but strategically it’s exactly the kind of bolt-on Wallix has used before to build new product layers. Malizen’s engineers and its user-behaviour analysis technology will feed directly into Wallix’s Bastion platform, setting up a 2026 product refresh that should make it more competitive with large-cap peers focused on enterprise-scale identity and access management.

What Wallix is doing here is building capability. The company has been quietly constructing a modular ecosystem through a series of small, technology-driven acquisitions such as Trustelem and Kleverware. Each brought a specific functionality (cloud identity, compliance, analytics) that was later folded into Wallix’s broader “platformisation” roadmap. Malizen extends that logic into the AI realm, positioning Wallix to compete in a market that increasingly rewards proactive detection over perimeter defence.

By embedding AI into its stack, Wallix can start offering predictive user-behaviour monitoring, a capability larger cybersecurity vendors have been rushing to develop internally. Even if this weighs slightly on 2026 earnings due to integration costs, the longer-term implications are far more important: Wallix is signalling it intends to play in the upper tier of the European cybersecurity market rather than stay confined to niche PAM solutions.

The timing of this step couldn’t be better. Wallix’s balance sheet is stabilising, the share price has more than doubled this year, and profitability is within sight. That gives management room to pursue selective M&A without straining resources. The acquisition also opens the door to deeper collaboration with Inria and to the creation of a dedicated AI R&D centre, a move that could accelerate time-to-market for new features while strengthening France’s domestic cybersecurity ecosystem.

The company still has to prove it can monetise these technologies at scale, but the intent is clear: Wallix wants to be a European champion in identity and access security powered by AI.

HBX Group (HBX Spain): cautious optimism returns as trading momentum picks up

After a bruising year marked by profit warnings and volatility, HBX Group’s latest update finally brought a dose of stability. Not perfect results, but a tone of control and visibility that had been sorely missing.

The company’s fourth quarter came in mixed: total transaction value held steady, but revenue slipped slightly due to a weaker take rate, pulling full-year sales to the low end of guidance. Yet, EBITDA landed broadly in line, with a near-60% margin, a notable improvement over last year and a sign that management’s cost discipline is starting to bite. Cash conversion was strong, comfortably above 100%, suggesting a more efficient operating model despite the choppy top line. Adjusted earnings per share came in above market expectations, though comparability remains somewhat murky. Still, the underlying message is one of resilience; HBX managed to hold profitability even as booking momentum cooled, a feat that positions it better heading into 2026.

The more encouraging piece lies in what’s happening now. Management noted a “strong improvement” in booking trends since the start of the new fiscal year, pointing to double-digit TTV growth in the first quarter and mid-single-digit revenue expansion, both well above the market’s conservative assumptions. Guidance for 2026 implies a return to healthy top-line growth, with total transaction value up 12–18% and revenue climbing modestly despite currency headwinds. Margins are expected to hold, with another year of solid cash conversion.

In short, HBX seems to be signaling that the business model remains intact, and that the worst of the near-term volatility may be over. What investors will want to see next is delivery; consistency across quarters rather than one good update following a rocky summer.

HBX still carries a credibility discount, largely because of its uneven forecasting track record. But this update starts to rebuild that trust. The group’s mix of scale, technology infrastructure, and improving operational leverage gives it plenty of upside if travel demand stays stable.

With trading stabilizing and margins proving resilient, the business finally seems to be re-emerging from its transition phase. For a stock still trading near depressed levels, the setup looks better balanced: the numbers were not spectacular, but the direction towards steadier growth, healthier cash flow, and regained confidence, is precisely what is needed.

If you appreciate this post, feel free to share and subscribe below!