Beer, face masks and a lot of releases

Dassault Systèmes, Azelis, STMicroelectronics, Rieter, MTU Aero Engines, TeamViewer, Exail, Steyr Motors, Adidas, SAP, Roche, Heineken, Crit, FlatexDEGIRO, L’Oréal, Fnac, Kering, Rovi, Icade

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

Note: given the length of the publication, the content in the email was cut. We refer to the website for full access.

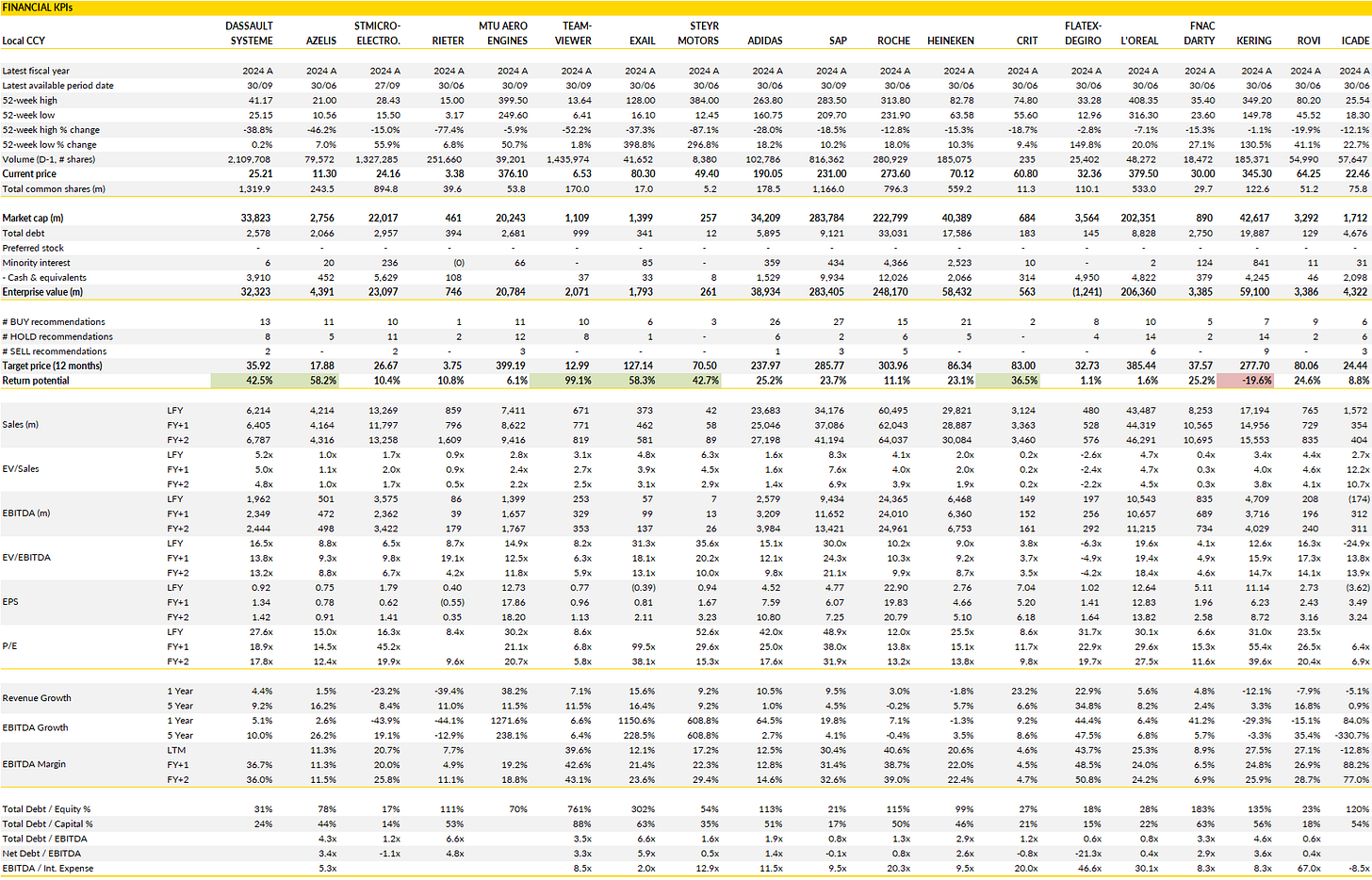

Financial KPI

Dassault Systèmes (DSY France): A mixed quarter as transition to subscription clouds near-term visibility

Dassault Systèmes’ recent release highlighted both the strength and the growing pains of its evolving business model.

Reported growth of 5% at constant currency fell short of market expectations, largely due to weaker license sales and ongoing softness in Medidata’s life sciences business. Centric PLM, once a reliable growth engine, also stumbled as it transitions to SaaS, adding to investor anxiety around the predictability of recurring revenue growth.

On the brighter side, recurring software revenue continued to accelerate, growing 9% at constant currency and outpacing guidance, a sign that the subscription pivot is gaining traction beneath the surface. The company also managed to hold operating margins above expectations, helped by tight cost control, though free cash flow fell meaningfully short as working capital demands absorbed cash.

Management’s decision to lower full-year revenue and operating profit guidance by around 2% reflects the slower conversion of new licenses and the operational complexity of the subscription shift. This is not a demand problem as much as a timing and transition one: customers are increasingly opting for subscription-based deployments, which defer revenue recognition but improve long-term visibility.

Still, investors have grown impatient with what feels like a never-ending normalization phase for Medidata, where growth has stalled amid industry-wide funding headwinds in clinical research. The combination of weaker top-line momentum and execution uncertainty has fed market skepticism, particularly after the stock’s recent rally.

Dassault remains a structurally strong business with deep moats in industrial design, engineering software, and simulation, but its near-term narrative has lost clarity. The pivot to subscription is strategically sound, yet operationally messy, and the company’s communication around that process has left investors cautious.

Over the longer term, Dassault’s 3DEXPERIENCE platform and its leadership in collaborative engineering software still anchor one of Europe’s best digital industrial franchises. But until visibility improves at Medidata and Centric stabilizes, the market will likely mark the shares down.

The business remains sound; the problem is timing.

Azelis (AZE Belgium): Still waiting for the cycle to turn

Azelis’ latest set of results once again highlighted just how difficult it remains to find traction in today’s chemical distribution market.

Although the group’s revenue came in broadly in line with market expectations, organic growth stayed firmly negative and profitability continued to slide, reflecting the same mix of soft end-market demand, FX headwinds and a stubbornly heavy cost base. The top line showed some support from acquisitions, a familiar buffer in a year when most industrial markets in Europe have failed to stabilize, but the organic picture remains weak across regions. Life Sciences offered a few bright spots, especially in Food & Nutrition in the Americas, yet these gains weren’t enough to offset the continued slump in Industrial Chemicals.

In short, Azelis remains in an environment cautious purchasing and limited pricing power. For a distributor like Azelis, whose growth engine depends on volume recovery and steady mix improvement, that combination keeps margins under pressure and investors on the sidelines.

The company’s performance also exposed the geographic divergence running through its portfolio. EMEA managed small reported growth thanks to M&A, but underlying demand stayed soft, particularly in industrial verticals. The Americas delivered a mixed bag; modest resilience in Life Sciences, ongoing drag in CASE and industrial applications, and currency translation adding to the pain. APAC remained the toughest market, squeezed by tariffs, weak confidence, and excess supply pushing prices lower across both Life Sciences and Industrial Chemicals.

Free cash flow conversion jumped to 87%, but not because of booming activity, though due to low demand forced inventory optimization. It’s the kind of efficiency that would normally speak to solid execution, though in this case it also serves as a reminder of how weak the underlying environment remains.

The near-term picture doesn’t offer much reason to expect a quick rebound. Management is sticking to cost reduction initiatives that should begin to show effect from the current quarter, but until industrial demand normalizes and organic growth turns positive, the market is unlikely to give the stock much credit. Leverage has ticked up slightly, a natural consequence of lower EBITDA, and while Azelis can comfortably manage its balance sheet, the optics won’t help sentiment in a sector where patience is already wearing thin.

The medium-term fundamentals of specialty distribution remain attractive: fragmentation, pricing power in niche segments, and secular growth. But until the cycle truly ends and volumes rebound, Azelis’ share price story will likely show little momentum.

Let’s see if a new CFO can bring some new elan.

STMicroelectronics (STMPA France): Gradual recovery signs amid a slow semiconductor cycle

After a long stretch of inventory digestion across the semiconductor industry, STMicroelectronics is showing the early contours of a recovery, even if the inflection remains slow and uneven by end-market.

The company’s latest quarterly update confirms that revenue momentum is still sluggish and mixed across divisions, with automotive and industrial normalising from recent highs while personal electronics picked up modestly. What matters more at this point in the cycle is the underlying directional signals: a book-to-bill ratio back above one, a visible reduction in inventory days and disciplined capital spending all point toward a business that is past the most difficult phase of the downturn.

Management also continues to highlight structural tailwinds from electrification, silicon content growth in vehicles and expanding demand for power electronics, themes that are cyclical in timing but strategic in magnitude. In that sense, STM’s positioning in wide bandgap technologies like SiC power devices remains central to its long-term relevance and competitive moat.

Near-term profitability remains under pressure, but the progression of gross margin this quarter suggests incremental improvement is underway. Although headline operating margin looked lighter due to an impairment, product mix and better utilisation drove gross margin expansion versus the prior quarter, helped by the gradual normalisation of capacity in automotive and industrial lines.

Pricing discipline has held up surprisingly well, and management continues to manage costs with restraint, bringing net capex down to preserve balance sheet flexibility. Cash generation remains decent despite weaker operating leverage at this point of the cycle, cushioning the company as it navigates what remains a demand environment full of hesitation from industrial clients and selective ordering patterns from automotive customers. While bookings in consumer and microcontrollers showed tentative health, the visibility remains limited and quarterly volatility should continue into early next year.

STM’s competitive position in power semiconductors and mixed-signal applications gives it leverage to long-term megatrends that persist through short-term cycles. The key question for investors is timing: how long until backlog starts to convert back into volume growth and operating leverage normalises?

With inventory clearing, capex discipline and a book-to-bill above one, the company has laid out the preconditions for recovery. It may not be spectacular or fast, but the improvement appears tangible rather than theoretical, and that alone begins to shift sentiment from defensive caution to selective interest.

Rieter Holding (RIEN Switzerland): Transformation story facing macro headwinds but long-term levers intact

Rieter remains one of those cyclical industrial stories where sentiment can swing sharply on quarterly order flow, and Q3 did little to calm nerves.

The company reported another weak quarter with revenue sharply lower year-on-year as customers once again postponed machinery projects, pushing volume into next year and forcing a second sales warning in a row. This doesn’t change the long-term strategic direction of the business, which remains focused on automation, cost restructuring and a push into more resilient revenue streams, but it does highlight just how fragile investment appetite still is across the textile machinery market.

The decline in quarterly sales was driven by a sharp drop in new system installations, especially in regions where textile players are holding off major purchases amid delayed demand recovery and policy uncertainty. The weakness spilled over into components and after-sales services, which are ordinarily steadying forces during a downcycle, and this shows how broad the slowdown has become.

Management pointed to order delays rather than cancellations, which explains why the order book remains sizeable relative to current revenue, yet the deferrals hurt operating leverage now and will weigh on the second half of the year. This is the classic Rieter cycle: highly geared to investment momentum in yarn production, and when projects shift, reported numbers move fast.

The near-term problem is visibility rather than competitiveness. Rieter is still the reference supplier for spinning technology, especially in natural fiber machinery, and continues to invest in process automation and digital solutions to strengthen its value proposition. The upcoming acquisition of Barmag adds exposure to synthetic fibers and improves market balance, giving Rieter a stronger strategic position when demand eventually normalizes. The cost-efficiency program underway should also start to show better fixed-cost absorption once volumes return.

In short, this is still a painful part of the cycle, but not a broken equity story. The lowered sales outlook for the year signals that the bottom is stretching out longer than hoped, yet order intake excluding last year’s one-off contract still shows underlying activity holding up.

Rieter trades below industrial peers on operating metrics due to depressed profitability, but that gap could narrow when project phasing reverses and machinery deliveries accelerate again.

MTU Aero Engines (MTX Germany): Flying high through turbulence with steady aftermarket tailwinds

MTU’s third quarter was the kind of performance that investors like to see: solid operational delivery, strong free cash flow, and continued aftermarket strength.

The company posted EBITA well above expectations, supported by a favorable mix in its commercial OEM business and a robust showing in spare parts sales, particularly for legacy engine platforms like the CF6 and PW4000. While its maintenance, repair, and overhaul (MRO) division posted a slight margin dip, that reflected the growing weight of the GTF retrofit program, a lower-margin but strategically critical component of the group’s long-term positioning.

Free cash flow also exceeded expectations, signaling tight cost control and disciplined working capital management. Management’s decision to raise full-year FCF guidance to €350–400 million and confirm EBITA growth at the upper end of its range underscores confidence that the worst operational uncertainties are now behind.

The broader narrative, however, is about transition. MTU continues to benefit from a supportive macro backdrop; global air traffic has largely normalized, and airlines are prioritizing engine maintenance and overhauls, keeping the aftermarket busy.

Yet, growth in the OEM segment remains constrained by lingering bottlenecks across the aerospace supply chain and the ongoing execution of Pratt & Whitney’s GTF retrofit program, which continues to dominate headlines. MTU’s exposure to this platform means it must balance short-term profit dilution with long-term value creation, as the retrofit effort cements its role in the next generation of narrow-body engines. That’s where MTU’s structural advantage lies: it’s not just being a supplier; it’s being embedded in some of the world’s most important engine programs, which ensures recurring revenue streams through multi-decade maintenance cycles. Even with some near-term volatility, this remains an enviable position for a European aerospace supplier.

From a valuation perspective, MTU sits near its long-term average multiple, reflecting a fair balance between execution quality and modest growth visibility. While peers like Safran and Rolls-Royce may offer higher aftermarket leverage or more dramatic margin recovery stories, MTU represents a steadier, more predictable play on the same aviation recovery trend.

Investors seeking big surprises won’t find them here, but those looking for disciplined growth, strong cash generation, and enduring exposure to the commercial aerospace cycle have reasons to stay patient.

TeamViewer SE (TMV Germany): Wrestling with integration pains while core business steadies

TeamViewer’s Q3 update was… an example of contrasts (to put it nicely): the core remote connectivity business held up reasonably well, but the recently acquired 1E platform continued to underwhelm, dragging down momentum and forcing another round of guidance cuts.

On a standalone basis, TeamViewer’s Enterprise segment delivered strong double-digit ARR growth, proving that demand for remote monitoring, IT automation, and digital workflow solutions remains intact. However, that strength was overshadowed by higher churn in the SMB customer base and disappointing performance at 1E, where deal conversions lagged and renewal rates fell short.

The net result was a modest revenue miss, though profitability surprised on the upside, adjusted EBITDA margins climbed back toward the mid-40s, helped by cost containment and more disciplined spending. It’s a pattern that’s become familiar for TeamViewer: stabilizing the bottom line while struggling to reignite top-line acceleration.

The lowered guidance for 2025 and 2026 reflects a dose of realism after several quarters of overpromising. ARR growth expectations were trimmed, revenue targets nudged down, and management now sees only modest improvement next year, largely driven by core TeamViewer rather than the 1E acquisition. That deal, once billed as a step-change move into enterprise endpoint management, has so far failed to deliver the synergies envisioned, a reminder of how hard it is for smaller software firms to integrate adjacent platforms without losing focus.

Still, not all is bleak. The company continues to generate healthy margins and cash flow, and its enterprise customer base remains sticky. The challenge lies in execution: converting strong product usage and brand recognition into consistent ARR growth in a world where competition in remote support and device management has intensified.

Despite these growing pains, TeamViewer’s stock trades at a steep discount to its software peers, reflecting investor skepticism that management can turn operational improvements into sustainable growth.

That very discount offers leverage if sentiment stabilizes, particularly if cost control continues to underpin cash generation. For now, the narrative remains cautious: this is a company repairing execution credibility while digesting a misfired acquisition.

TeamViewer still commands a strong franchise in a structurally relevant segment of enterprise IT. If management can steady the 1E business and sustain enterprise momentum, the path to rebuilding confidence (and multiple expansion) remains open.

Exail Technologies (EXA France): Momentum builds as defence and robotics drive a new phase of growth

Exail Technologies continues to look like one of the more dynamic small-cap stories in European defence tech.

The company’s third quarter delivered another strong beat, with revenue up 18% year-on-year and broad-based strength across its navigation, maritime robotics, and photonics segments. The core defence-facing activities, particularly the BENL and SLAMF naval programs, are hitting key milestones, while new contracts in the Middle East and Asia add welcome diversification. The order book remains formidable at over €1.1 billion, with order intake up more than 120% year-to-date, underscoring sustained demand visibility well into 2026.

The company’s advanced technologies arm also stood out, with photonics and aeronautics benefiting from both catch-up effects and capacity expansion. For a business that not long ago was still proving its industrial scale, this quarter reinforced that Exail is now operating with the rhythm and reliability of a much larger group.

Management’s decision to refine full-year revenue guidance to +20–25% growth reflects that confidence. The operational momentum is clearly building: margins are improving, production efficiency is rising, and the backlog provides ample visibility for the next several quarters. H2 is expected to deliver a notable uplift in profitability, as higher-margin contracts kick in and scale benefits flow through.

Investors have been jittery about the volatility following Exail’s convertible bond issue, but the fundamental story hasn’t wavered; a defence and robotics specialist executing consistently on growth targets in a sector where demand is underpinned by geopolitical realities and government funding tailwinds.

Looking ahead, the investment case rests on visibility and compounding: a pipeline of high-margin defence contracts, a photonics business scaling into adjacent markets, and the potential simplification of its capital structure via buybacks of minority interests.

Exail is emerging as a distinctive player at the intersection of defence technology and advanced robotics, one whose growth is now backed by a growing record of delivery.

Steyr Motors (4X0 Germany): A softer quarter amid timing delays, but the long-term engine still runs

Steyr Motors’ latest quarter reminded investors that in defence and industrial supply chains, timing is everything.

The company’s Q3 results came in well below market expectations, with revenue of just over €11 million and a sharp drop in profitability as production ramp-up costs and customer-related delays took their toll. EBIT margins slipped into the low single digits, reflecting both the temporary mismatch between costs and deliveries and the heavier upfront investments in personnel and manufacturing capacity.

Despite this, Steyr’s order backlog remains robust at over €300 million, a figure that speaks to the enduring demand visibility underpinning the business, though it also underscores that new order momentum paused in the quarter. For a company still scaling into a broader defence-driven upcycle, this lull seems a reflection of project timing rather than structural weakness, but it raises the execution bar for the final quarter of the year.

Management shifted wording around the full-year 2025 guidance (now ‘achievable in principle’ but dependent on end-customer timing). The company still targets more than 40% annual revenue growth and a 20% EBIT margin, but the pressure is squarely on Q4 to deliver a disproportionately strong finish.

With government clients and defence agencies as key customers, Steyr operates in an environment where budget approvals and procurement cycles rarely follow calendar precision. That volatility is part of the model. What matters more is that the structural growth drivers remain intact: Europe’s defence rearmament, energy transition investments in hybrid propulsion, and demand for high-performance engines in specialized industrial and military applications. Those themes continue to justify patience, even if 2025 proves to be a transition year.

Overall the story hasn’t changed; Steyr is still positioned as a niche technology leader with a defensible role in critical supply chains. The backlog gives visibility through the next several years, and the company’s deep integration with OEM and defence partners ensures high barriers to entry.

Short-term fluctuations in earnings don’t alter that strategic footing. If anything, the company’s commitment to expanding capacity and retaining technical staff during a softer period reinforces its long-term growth intent.

Investors betting on the European defence and energy efficiency super-cycle could see Steyr’s current weakness as part of the volatility tax that comes with early-stage expansion, not as a break in the thesis. The execution in Q4 will matter, but the fundamentals, a full order book, supportive end markets, and a scalable operating model, remain squarely in place.

Adidas (ADS Germany): Brand momentum back in stride, execution finally catching up

Adidas’ Q3 results offered another strong validation that the brand’s turnaround is not just real - it’s accelerating.

The company reported double-digit growth for the Adidas brand, with performance broad-based across regions, categories, and channels. Profitability was robust, with EBIT up more than 20% year-on-year and margins expanding meaningfully to above 11%. Perhaps more importantly, this growth isn’t coming from a one-off product or geography, but the result of consistent demand for core franchises and disciplined execution in product, pricing, and distribution. The rebound in gross margin, despite currency and tariff headwinds, underlines the operating leverage that returns when inventory normalization and cost control align.

In short, Adidas now seems back to operating like a premium global brand, not a turnaround project.

The company upgraded in full-year guidance (EBIT now expected to reach €2 billion). Growth for the Adidas brand remains firmly in the double digits, supported by renewed consumer engagement and cleaner product flows, even as the one-off Yeezy comparison fades. The company’s cost discipline is also starting to show through, with opex flat year-on-year despite revenue growth.

There’s still work to do, particularly in North America where competition remains fierce, but the European and Asia-Pacific markets are pulling more than their weight. With a pipeline of high-profile product launches and event-driven tailwinds heading into 2026, Adidas looks positioned for continued operational momentum.

From a valuation standpoint, the market clearly remains skeptical on the turnaround, trading at around 15x forward earnings (well below its historical average). While macro volatility may continue to buffet discretionary names, Adidas’ mix of volume growth, margin expansion, and cost discipline looks unusually well-balanced at this stage. Let’s see.

SAP (SAP Germany): Cloud transition builds momentum as bookings regain strength

SAP’s latest quarterly update shows a company that has turned a ‘psychological corner’ in its cloud transformation.

For much of the past year, investor debates focused on whether slowing cloud bookings signaled fatigue in demand or simply timing issues in large deal cycles. The third quarter supports the latter interpretation.

Revenue landed broadly as expected, but what really matters is the improving commercial tone. Management noted that deal activity picked up meaningfully after a soft first half, with deferred decisions now converting. This is particularly visible in the public sector in the US, a market that had paused on procurement but is clearly re-engaging.

The demand environment hasn’t changed, customer buying cycles have just shifted, and those deals are coming through.

The business mix continues to tilt toward recurring revenue, with cloud once again the engine. Even though headline cloud growth eased slightly versus the prior quarter, the core subscription backlog maintained a growth rate in the high twenties year-on-year, signaling robust visibility into future revenue. This measure, now one of the best indicators of health for enterprise software vendors, reflects customer commitment to multi-year agreements in areas like S/4HANA migrations and business process transformation. SAP’s strategy of bundling artificial intelligence capabilities into its suite seems to be gaining traction, offering a credible monetization path rather than AI being a mere marketing add-on.

Profitability surprised positively again. Despite incremental restructuring costs related to sharpening focus around growth priorities, operating margin expanded thanks to better gross margin in cloud and solid discipline in operating expenses.

Stock-based compensation has also started to normalize, offering cleaner earnings that better reflect underlying economics. Free cash flow was another highlight, supporting the view that SAP’s business model is now generating consistent cash rather than consuming it. The balance sheet can easily absorb continued investment in R&D and targeted M&A without derailing shareholder distributions.

SAP’s guidance implies that the best of the current cycle may still be ahead. Management is now openly more confident in closing strong in the final quarter and hinted at a healthy pipeline conversion. Importantly, they signaled that 2026 should mark another acceleration as cloud migration continues and AI-enabled modules deepen customer wallet share.

In contrast to many enterprise vendors who struggle to shift legacy on-premise businesses to the cloud without sacrificing margins, SAP appears to be demonstrating operating leverage in the transition. If execution continues at this pace, converting backlog into recurring revenue, expanding margins, and delivering stronger cash generation, SAP could see stronger for longer momentum.

Roche Holding (ROG Switzerland): Big pharma reliability meets the limits of its own maturity

Roche’s third-quarter update reminded where the group now stands: a powerhouse of stability that’s finding it harder to surprise on the upside.

Sales came in a touch below market expectations, up 6% at constant exchange rates but slipping slightly in Swiss franc terms, with most of the company’s key growth engines missing consensus forecasts. Vabysmo, Ocrevus, and Hemlibra (drugs central to Roche’s narrative of post-patent rejuvenation) all underperformed, while legacy oncology blockbusters like MabThera, Herceptin, and Avastin managed to outperform, ironically softening the overall shortfall. Diagnostics, long a buffer for volatility in the pharma division, delivered in line with forecasts, growing modestly in local currency but weighed down by FX headwinds.

The broader story remains one of a company that’s executing competently within a constrained growth envelope, powerful franchises and consistent margins, but no real spark of acceleration.

Management raised full-year guidance for core EPS in constant currency terms, reflecting cost discipline and operational efficiency, but the optimism was tempered by an even larger FX drag, now expected to cut 8% from reported earnings. That contrast sums up Roche’s current predicament: fundamentals strong enough to grind forward, but with external factors (currency, pricing, and patent mix) conspiring to mute the result.

The company’s next wave of innovation, centered on ophthalmology, neurology, and targeted oncology, is advancing, but the read-through from the quarter suggests these assets are ramping slower than hoped. Ocrevus, for instance, remains the cornerstone in multiple sclerosis but is nearing maturity, while Vabysmo’s competitive positioning in eye care faces tougher comparisons and pricing constraints.

In short, Roche is navigating a post-blockbuster transition with admirable balance, yet the near-term growth cadence feels more defensive than dynamic.

At current valuation levels, the market’s skepticism is understandable. The stock trades on a mid-teens earnings multiple (modest by sector standards) reflecting both its predictability and its limited growth outlook. The group’s 5–6% expected earnings CAGR through the next few years pales beside peers growing closer to double digits.

Roche offers resilience, yield, and scientific credibility, but little momentum. The company’s scale and pipeline still make it a cornerstone of European healthcare exposure, yet the investment case has shifted from offense to defense.

Unless new products deliver faster uptake or diagnostics achieves a meaningful technology-led inflection, Roche risks remaining caught in this middle ground: steady, capable, and frustratingly unexciting for a market that increasingly rewards growth over stability.

Heineken (HEIA Netherlands): A necessary pause in the long game of premiumization

Heineken’s update was more of the same: volume pressure persists, but the broader strategy remains intact.

Organic beer volumes fell 4% year-on-year, while revenue held flat on a comparable basis, showing how pricing and mix continue to offset weaker consumption. The headline numbers might look uninspiring, yet the underlying dynamics reflect a brewer managing through cyclical headwinds with measured discipline. Regional performance followed familiar lines, i.c. growth in Africa and the Middle East, softness in the Americas, and mild contraction in Europe, with Asia-Pacific showing resilience thanks to recovering demand in Vietnam and incremental progress in China.

The result is a business that feels operationally stable, even as its core markets wobble under inflation and shifting consumer preferences.

The company modestly lowered its volume outlook for the year but maintained guidance for operating profit growth toward the lower end of its 4–8% range, a move that signals realism rather than retreat. The beer industry is in a phase of recalibration: after several years of price-led growth, consumption elasticity is returning, particularly in mature markets where affordability and lifestyle trends are pressuring mainstream brands.

Heineken, to its credit, is managing this reset without panic. The group continues to gain share in key markets such as Mexico, Brazil, and Nigeria, while pushing premiumization and productivity initiatives to preserve margins. The balance between volume discipline and pricing power remains the tightrope for global brewers, and Heineken’s execution suggests it’s walking that line more carefully than most.

The Q3 numbers won’t ignite excitement, but they should reinforce confidence in the long-term trajectory. The company’s cost savings program, digitalization efforts, and brand consolidation strategy continue to underpin earnings visibility.

The valuation still sits at an attractive discount to consumer staples peers, and with a resilient balance sheet, Heineken retains optionality for both organic expansion and disciplined M&A. The short-term narrative may be one of stagnation, but structurally, this remains one of the few European consumer names with both defensive characteristics and credible growth levers once macro conditions normalize.

Crit (CEN France): Quiet consistency in a fragile employment cycle

Crit’s third-quarter performance was about resilience.

Revenue landed just shy of market expectations but confirmed the company’s ability to hold ground in a weakening French staffing market. Organic sales were down slightly, but that represented an improvement from earlier in the year, reflecting stabilizing trends in temporary staffing and ongoing strength in airport services. The group’s airport division continued to expand at a healthy clip, benefiting from solid air travel demand and public infrastructure projects, while the core staffing arm weathered a domestic market that remains under structural pressure. Crit’s focus on industrial, logistics, and business services clients (areas that have seen cyclical softness) continues to weigh on top-line momentum, but relative to peers, the company’s performance looks commendably steady.

Management’s tone remains cautious, acknowledging that visibility beyond year-end is still limited, particularly in France where macro uncertainty and labor cost inflation cloud the outlook. That said, the reaffirmation of full-year targets signals confidence in operational discipline and cost flexibility. Internationally, momentum looks better: growth in Spain and Switzerland remains in double digits, and the U.S. business (long a drag) is finally showing signs of stabilization, with a return to growth expected in the coming quarters. The integration of Openjobmetis continues to provide scale benefits and a modest cushion against domestic weakness.

Valuation remains the underappreciated part of the story. With shares trading at deep discounts to both historical averages and peers (and backed by a solid net cash position) Crit offers investors a conservative, cash-rich play on European employment recovery.

It’s not a flashy story, but of a disciplined operator in a cyclical business, keeping leverage low and execution tight while waiting for the cycle to turn. Indeed, the next leg of upside will require real volume recovery in staffing.

FlatexDEGIRO (FTK Germany): Trading resilience meets the limits of market excitement

Flatex’s delivered across the board.

Revenue up nearly 20% year-on-year, commission income surging more than 30%, and profitability comfortably beating consensus. A stronger-than-expected performance in trading activity (usually subdued during summer months) combined with strict cost discipline drove operating leverage back to levels last seen during the retail trading boom. EBITDA margins climbed above 50%, showing that the platform can translate volume spikes directly into earnings. Even interest income, expected to fade as rates eased, held up better than anticipated thanks to continued customer deposit inflows.

In essence, the business has adapted well to a normalized market, maintaining its cost edge while adding selective growth levers such as crypto trading and securities lending in new markets.

Operationally, management has been careful to build a more diversified revenue base without drifting from its core proposition. The rollout of crypto trading across continental Europe and the launch of securities lending are both incremental but strategically meaningful steps, evidence of a company evolving beyond pure brokerage into a broader transaction ecosystem. With volatility returning in late Q3 and into October, trading volumes likely started Q4 on a strong footing, reinforcing the guidance upgrade to 10–15% revenue growth for the year. Profitability is also improving faster than expected, with net income now projected to rise more than one-third year-on-year.

For a business overall accused of being very cyclical, Flatex is proving that a disciplined cost base and steady client growth can make for a resilient model even as market conditions fluctuate.

Still, from a market perspective, much of that success already seems priced in. The shares trade roughly in line with peers on forward earnings, despite having delivered stronger operational improvements in recent quarters. Investors appear hesitant to assign a premium until they see whether trading activity (especially from retail clients) remains elevated once volatility cools.

The underlying fundamentals, however, are solid: customer growth continues, the deposit base remains sticky, and incremental services are broadening monetization opportunities.

The investment case here is about consistency. Flatex may no longer be the retail trading phenomenon it once was, but it’s emerging as a quietly well-run European fintech with stable margins and credible mid-teens growth potential.

L’Oréal (OR France): Still beautiful, but the mirror reflects slower growth

L’Oréal’s third-quarter update was kind of a reality check to those expecting a swift return to pre-2023 momentum.

Organic growth of just over 4% missed both internal and market expectations, underscoring that the global beauty market’s recovery remains fragile. The company’s commentary painted a complex picture: robust sell-out trends in China and Europe offset by slower North American demand and a cooling Latin American market. The professional products division continued to outperform, but key engines like luxury and dermatology fell short, weighed down by inventory adjustments and softer category dynamics.

The result was not disastrous (far from it) but it highlighted that the recovery path is uneven, particularly in high-margin segments. For a stock long treated as a defensive growth icon, ‘below expectations’ carries an outsized emotional weight.

Yet, despite the market’s reaction, we wouldn’t be surprise to see the focus shift more on the slowing macro pulse: beauty demand in North America remains patchy, and emerging market growth no longer fully compensates. Investors accustomed to 5–6% organic growth are now adjusting to the idea that 4–5% might be the new normal, at least near term. That might not sound dramatic, but for a company priced as a structural compounder, it shifts the multiple narrative. The group’s medium-term fundamentals remain intact, but the short-term picture looks more muted, with no clear catalyst until the 2027 strategic refresh.

L’Oréal is still a premium stock, and justifiably so, but the gap between quality and growth has widened. This quarter reinforces that while the beauty market is stable, it’s not immune to cyclical moderation, particularly in discretionary segments.

The company’s long-term compounding story hasn’t broken, but its momentum has clearly cooled. Investors may need to wait for 2026–27, when innovation cycles and emerging-market demand could reaccelerate. For now, the stock sits in an in-between zone: high-quality, fully priced, and treading water as the market digests the slowdown.

Fnac Darty (FNAC France): Grinding through stagnation with quiet operational discipline

Fnac Darty’s third-quarter performance was about as uneventful as they come, and that’s precisely what the market hoped.

Revenue grew modestly by 0.9% (1.6% like-for-like), driven by strength in cultural and editorial products, resilient small appliances, and continued expansion in Southern Europe. Large appliances remained soft, reflecting subdued French household demand, but the company still managed to outperform the broader domestic retail market, which remains in slight contraction. International operations provided a welcome boost, particularly in Portugal and Switzerland, where like-for-like growth exceeded 7–10%. With total nine-month revenue now flat year-on-year, management’s ability to hold margins steady amid weak consumption looks increasingly like a quiet victory in an unforgiving retail landscape.

The company reaffirmed its target for a 2% operating margin in 2025, a modest but credible goal that signals stability rather than ambition. Services, from after-sales to subscription-based models, continue to lift gross margins, and online sales are growing at a healthy pace. That shift toward higher-value activities, while gradual, is helping to offset the structural drag of subdued consumer electronics demand.

Fnac Darty’s management remains cautious on the near-term outlook, acknowledging that household spending in France is still fragile, with savings rates high and replacement cycles lengthening. But the group’s operational playbook (tight cost control, selective international expansion, and omnichannel investments) continues to deliver incremental progress.

Valuation remains reasonable, supported by a clean balance sheet and credible cash generation. Fnac Darty isn’t a growth story right now, but it’s becoming a model of disciplined execution in a tough market. This is more about slow, methodical improvement.

The next leg up depends on a broader consumption rebound in France and Southern Europe, which could unlock operating leverage in what is, for now, a steady-state business.

Kering (KER France): A tentative rebound meets a market already looking ahead

Kering’s latest update marked a subtle but meaningful turn in the group’s trajectory.

Group sales fell 5% at constant currency, a clear improvement from the 15% drop in Q2, as performance steadied across all regions. The U.S. returned to modest growth, Europe’s decline softened sharply, and even Asia showed early signs of bottoming.

For a house that’s spent the better part of two years battling weak traffic and brand fatigue at Gucci, these numbers were a psychological win. The early days of the De Meo era (with a renewed focus on execution, brand clarity, and creative overhaul) seem to be restoring internal momentum. The company’s tone was more confident than at any point this year, hinting that the worst might be behind it.

The group’s flagship label, Gucci, continues to define the investment narrative, and the upcoming creative reset under Sabato De Sarno will be the ultimate test of Kering’s cultural and commercial revival. For now, incremental improvements, smaller declines in retail, steady trends in the U.S., and healthier sell-through at entry-level price points, are being taken as green shoots. Saint Laurent held up better than feared, and Bottega Veneta remained a steady anchor. Meanwhile, smaller brands like Balenciaga and the jewelry houses delivered the quarter’s quiet strength, helping the group outperform muted expectations.

The company is still early in its cost-savings and margin-rebuilding program, but the operational reset looks increasingly tangible. Management’s new mid-term scenario, targeting margins above 17% by 2028, feels credible if growth normalizes in the mid-single digits. What matters most, though, is whether Gucci’s next creative phase can reignite desirability and pricing power without repeating the cyclical hype model that burned out in 2022–23.

Kering is certainly no longer cheap. The story today is about confidence in a gradual turnaround rather than immediate acceleration. Investors will likely need to see concrete traction in Gucci’s relaunch and proof that cost discipline can coexist with creative reinvention before sentiment can fully shift.

Laboratorios Rovi (ROVI Spain): Quiet execution turns into strategic credibility

Rovi’s new manufacturing partnership with Roche may not move near-term numbers, but it signals something more important: the quiet transformation of the company into a trusted European contract manufacturer with global reach.

The deal, centered on producing a novel drug in Roche’s cardiometabolic portfolio, will use Rovi’s high-speed filling line at its Madrid facility and is expected to lift CDMO revenue by up to 25% by 2030. On the surface, it’s another incremental agreement; in context, it’s a validation of the company’s operational reliability and technical capability. Coming just months after a similar expansion with Bristol Myers Squibb at the Phoenix plant, the Roche contract reinforces the idea that Rovi is steadily becoming part of big pharma’s outsourced manufacturing fabric.

The agreement also strengthens visibility on the group’s mid-term capacity utilization, which had been hovering around 50%. As large pharma companies increasingly diversify their fill-finish and biologics manufacturing bases, Rovi’s combination of flexibility, cost efficiency, and regulatory track record positions it well.

The company’s fundamentals remain underpinned by a dual-engine model: its growing CDMO business and the continued success of Okedi, its long-acting antipsychotic treatment. Both pillars offer resilience and optionality, the former through recurring revenue and the latter through product-driven growth.

Investors have long discounted Rovi for its smaller scale compared to peers like Lonza or Catalent, but the execution gap has narrowed. The Roche deal adds another layer of credibility to management’s strategy of building a differentiated, high-quality European CDMO platform without overextending its balance sheet.

From a valuation standpoint, Rovi still trades at a substantial discount to global peers despite delivering comparable profitability and visibility. The stock’s current multiples imply limited confidence in sustained CDMO growth.

Yet with capacity expansion now backed by tier-one clients, that skepticism may gradually fade. The market is likely to reassess Rovi not as a small-cap pharmaceutical firm but as a scaled, integrated manufacturing partner in a structurally growing niche.

Icade (ICAD France): Disposals progress, but fundamentals remain fragile

Icade’s nine-month update showed (again) a company that remains hostage to a weak property cycle.

Group revenue fell 9% year-on-year as both commercial property and development activities slowed, though leasing dynamics improved slightly. The renewal of KPMG’s lease at the La Défense Eqho Tower, its single largest tenant, was the clear positive of the quarter, shoring up visibility on future cash flows. Occupancy ticked up modestly to 84%, and asset disposals, including over €400m of transactions year-to-date, continue to strengthen liquidity and validate book values.

Yet the core challenge remains: muted rental reversion, sluggish demand in residential development, and limited catalysts for earnings growth in 2026. The near-term macro and political backdrop in France adds another layer of uncertainty for a sector already coping with tighter financing and slower capital recycling.

Management reaffirmed its full-year NCCF guidance, helped by disciplined cost control and the supportive impact of disposals, but its tone was unmistakably cautious on next year. The company acknowledged that residential property development remains under strain, with individual investor activity collapsing following the end of the Pinel scheme.

Institutional demand continues to provide partial support, but it’s unlikely to offset the drag from weaker household formation and higher mortgage costs. On the commercial side, Icade’s focus is shifting toward improving occupancy and recycling capital from mature assets into more resilient segments, yet execution will take time.

Structurally, the investment case hasn’t changed. Icade remains a capital-intensive, cyclical business in a challenging sector, with few near-term levers beyond asset rotation. The balance sheet looks solid, but without a broader recovery in development volumes or clearer progress on healthcare asset divestments, upside remains limited.

If you appreciate this post, feel free to share and subscribe below!