Beer, drugs and busted stocks

TeamViewer, Brunello Cucinelli, Unite Group, BioNTech, ABB, Argenx, TFF, Soitec, Sodexo, Belimo, Tecan, Anheuser-Busch InBev, OVHcloud

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary folder or add this address to your contacts.

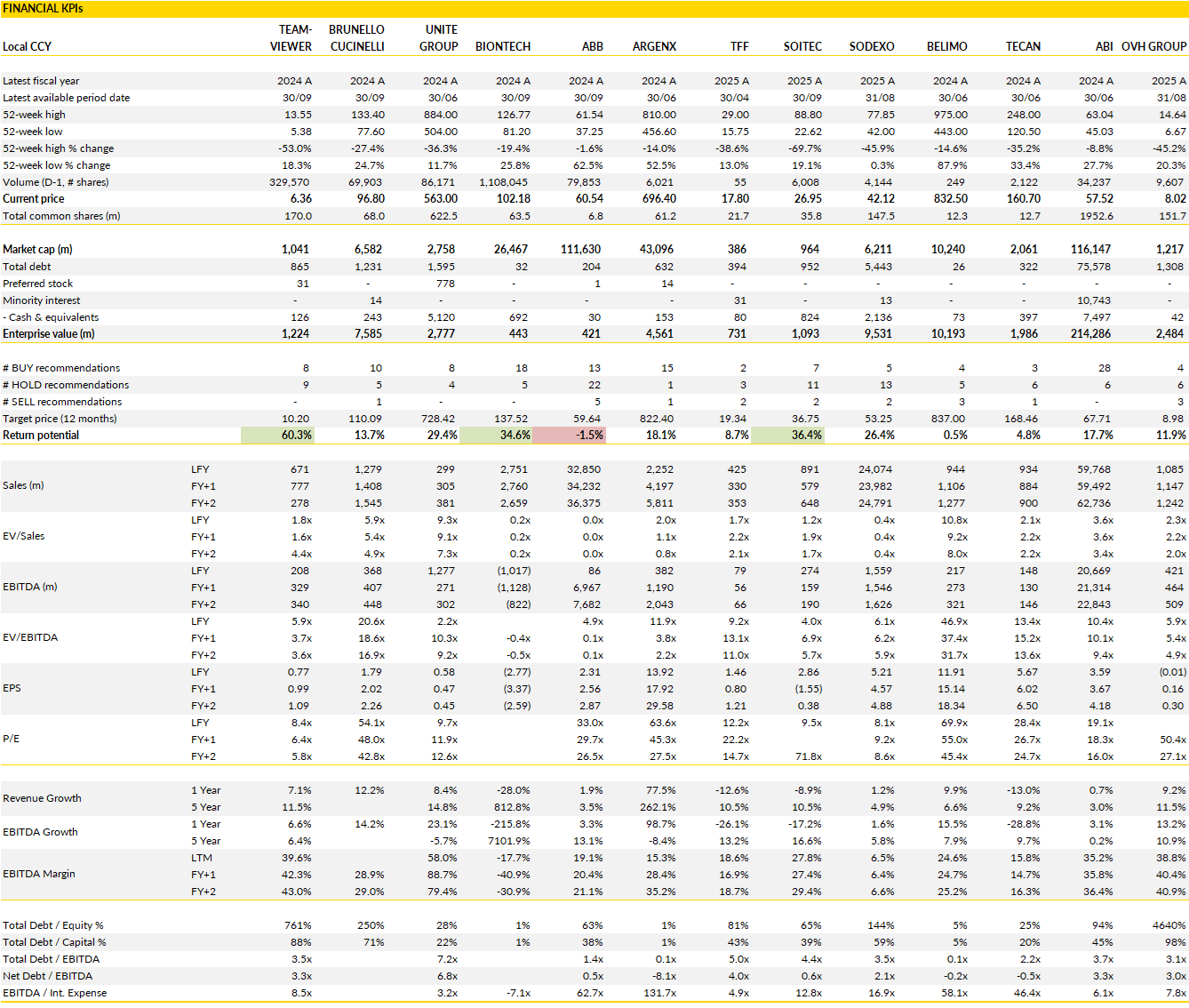

Financial KPIs

TeamViewer (TMV Germany): early signs of enterprise stabilisation emerge beneath a still-muted top line

TeamViewer’s brief trading update does not fundamentally change the story, but still seems to introduce a more constructive nuance (at the margin).

Full-year revenue landed at the lower end of the company’s revised guidance range, confirming that 2025 was another year of modest growth. Pro forma revenue grew at around mid-single digits on a constant-currency basis (€767m), while reported figures were held back by foreign exchange.

Recurring revenue metrics tell a similar story: ARR edged up only slightly year-on-year (to €760m), again finishing at the bottom end of guidance. Taken at face value, this underlines that broader growth remains underwhelming, particularly when viewed against the company’s earlier ambitions. That said, the update does provide confirmation on one critical point of stability: profitability. Management reiterated a pro forma adjusted EBITDA margin of around 44% for the year, reinforcing TeamViewer’s position as a highly cash-generative software business despite its subdued growth profile.

Where the update becomes more interesting is in the underlying momentum within the Enterprise segment. After a sluggish first nine months, in which ARR additions were minimal, the fourth quarter appears to have marked a turning point. Management described Q4 as a “turnaround” period for Enterprise, supported by two strategic contract wins with a combined lifetime value of around €10 million, translating into roughly €3 million of incremental ARR.

This doesn’t transform the growth outlook, but it is directionally important. Enterprise has long been positioned as the key pillar for re-accelerating TeamViewer’s topline, offering larger deal sizes, longer contract durations, and lower churn than the SMB-focused legacy base. The fact that a meaningful share of full-year ARR additions came in a single quarter highlights how sensitive reported growth is to deal timing, and how quickly the narrative could shift if Enterprise momentum proves repeatable.

Stepping back, the investment case remains balanced. On the one hand, TeamViewer continues to demonstrate exceptional margin discipline and cash conversion, attributes that provide downside protection and strategic flexibility. On the other hand, overall ARR growth of around low single digits makes it clear that any recovery is still in its early innings. The Enterprise uptick is encouraging, but it needs to be sustained over several quarters before it can be considered a genuine inflection rather than a one-off catch-up.

For now, the business looks like one that has stabilised operationally but not yet back to sustained growth. The upcoming full-year results will therefore be about management’s commentary on pipeline development, Enterprise sales productivity, and confidence in converting recent wins into a broader trend.

Brunello Cucinelli (BC Italy): steady execution continues, but the valuation already reflects the quality

Lots of confirmations in Brunello Cucinelli’s preliminary 2025 revenue disclosures.

Growth in the final quarter came in just under 12% at constant currencies, broadly matching the trajectory seen through most of the year and in line with what management had already flagged in December. Given the tougher comparables in the final months of the year, that outcome still reflects a resilient underlying demand environment for the brand. Retail once again did most of the heavy lifting, with double-digit growth supported by an expanding store footprint and ongoing investment in flagship locations. The group ended the year with 136 directly operated stores, up meaningfully year-on-year, and that physical expansion continues to underpin brand visibility and pricing power.

From a geographic perspective, the Americas stood out with a clear sequential acceleration, while Asia maintained a strong but stable growth profile. Europe, by contrast, was more subdued, with growth largely concentrated in Italy, a dynamic that reflects softer tourist flows and less favourable currency effects rather than any deterioration in brand appeal.

What also emerges clearly from the update is how much of the recent growth has been consciously “built”. 2025 was an unusually heavy investment year for Brunello Cucinelli, with capital expenditure running at just over a tenth of revenues as the group completed ahead of schedule several major projects to expand its in-house production capacity in Solomeo, Gubbio, and Penne. That investment phase was deliberate, aimed at securing long-term control over craftsmanship, quality, and lead times, even if it temporarily raised capital intensity.

Management has been clear that this peak in spending is now behind the group. With the main projects completed, the capex ratio is expected to trend down over the coming years, allowing cash generation to improve and net debt to gradually decline from current levels. Importantly, none of this alters the group’s growth ambition. Management continues to target around 10% annual revenue growth in the near term, with a medium-term revenue ambition that implies a similar pace of expansion through the second half of the decade. In that sense, the strategy remains consistent: controlled growth, disciplined expansion of the retail network, and preservation of brand integrity over outright scale.

Brunello Cucinelli continues to execute extremely well, delivering high-quality growth across regions and channels while investing heavily to protect its long-term positioning. The brand’s aesthetic, values, and client loyalty remain powerful assets, particularly in a luxury market that is increasingly polarised between a handful of global icons and a long tail of weaker players.

At the same time, the business model is inherently more capital-intensive and structurally lower-margin than some of its closest peers, reflecting its vertically integrated approach and commitment to Italian manufacturing. That trade-off is well understood by investors and largely priced into the shares. As a result, the latest update reinforces confidence in the company’s operational execution but does little to shift the fundamental debate around valuation.

Brunello Cucinelli remains a high-quality, well-run luxury house with clear visibility on growth, yet at current levels clrealy reflected in the stock price.

Unite Group (UTG UK): steady leasing, disciplined capital allocation, and buybacks underline confidence

Unite’s latest trading update shows a business that is progressing largely as expected, but with an added element of balance-sheet confidence.

Lettings for the 2026/27 academic year are advancing in line with historical norms, with around two-thirds of rooms already reserved. While this is slightly below the unusually strong pre-letting levels seen in the past two cycles, it remains consistent with long-term averages and comfortably supports management’s expectations for occupancy in the mid-90s range and modest rental growth. In other words, demand for purpose-built student accommodation remains robust, even as the market normalises after a period of exceptional tightness. Importantly, Unite reiterated its earnings guidance for 2025, signaling that there has been no deterioration in underlying trading since the investor update late last year.

What stood out in this update, however, was not leasing momentum but capital allocation. Unite announced a £100 million share buyback program, funded by a deliberate slowdown in development activity. Two projects, Freestone Island in Bristol and the TP Paddington scheme in London, have been deferred or shelved, because they no longer meet the group’s return thresholds in the current cost and yield environment.

This is a meaningful signal. Rather than pushing ahead with marginal developments to maintain pipeline optics, management is opting to redeploy capital into buying back its own shares, effectively backing the view that the company valuation offers a more attractive risk-adjusted return. It also reflects a broader shift in mindset across UK real estate, where disciplined capital recycling and shareholder returns are increasingly prioritised over growth for its own sake.

The accompanying fund valuation updates reinforce the impression of stability. In Unite’s flagship joint ventures, portfolio values edged modestly lower in the fourth quarter, driven primarily by small outward movements in yields rather than any weakness in rental performance. In fact, rental growth across both major funds remained positive, partially offsetting yield expansion and resulting in broadly flat valuations over the year as a whole. Blended yields now sit in the mid-single digits, levels that are arguably more sustainable and transparent than those prevailing before the interest rate reset. Valuers expect Unite’s wholly owned and joint venture portfolios to follow a similar pattern, suggesting that most of the valuation adjustment from higher rates is now behind the sector.

Unite continues to be viewed as one of the highest-quality names in UK real estate. The fundamentals of the student accommodation market remain compelling: structurally undersupplied, supported by long-term growth in student numbers, and relatively insulated from short-term economic cycles. Unite’s portfolio is well located, operationally mature, and increasingly focused on cash generation rather than expansion. The decision to pause developments that do not clear return hurdles, while simultaneously initiating a sizeable buyback, sends a clear message about management’s confidence in intrinsic value and its willingness to act pragmatically.

While near-term share price volatility may persist alongside broader property market sentiment, the combination of resilient demand, stabilising asset values, and shareholder-friendly capital allocation strengthens the medium-term equity story.

BioNTech (BNTX Germany): a quiet revenue bridge year ahead of a defining oncology inflection

It was clear at BioNTech’s recent update that 2026 is going to be an important transition year.

On the top line, management struck a familiar and cautious tone. Cash reserves remain substantial at around $17 billion, providing the group with considerable strategic flexibility, and 2025 revenue guidance was reiterated without adjustment. For 2026, the company expects Covid-related revenues to edge lower, largely reflecting evolving vaccination recommendations in the US and the continued shift from government procurement to more fragmented, private-market supply arrangements. Importantly, BioNTech does not expect any material revenue contribution from its oncology portfolio during the year, underlining that the investment case for now remains anchored in balance-sheet strength (rather than earnings growth). Cash inflows from partnerships, including the collaboration with Bristol Myers Squibb, are expected to remain broadly stable, and there was no meaningful update on cost trends at this stage.

Taken together, the financial outlook reinforces that 2026 is unlikely to deliver much headline growth, but equally that BioNTech has ample resources to fund its ambitions without financial strain.

Where the story is much different is in the clinical pipeline. Management made it clear that 2026 is shaping up to be one of the most data-rich years in the company’s history, particularly for its oncology franchise. Multiple late-stage readouts are expected across a range of tumor types, including breast, lung, colorectal, and head-and-neck cancers. Several of these programs sit in phase III development and target large, competitive indications, raising the stakes of upcoming data. In parallel, BioNTech is preparing regulatory filings for selected assets, signaling confidence that at least part of the pipeline is approaching a level of maturity that could support commercialisation beyond Covid.

The breadth of this clinical agenda matters. BioNTech is entering a period where multiple shots on goal could redefine how the market views the company. Success across even a subset of these trials would materially shift the narrative from optionality to execution, while setbacks, though always a risk in oncology, would still leave the group with diversification across modalities and indications.

Since the pandemic, BioNTech has carried the label of a Covid-era winner searching for its next act. The company has consistently argued that its mRNA expertise and capital base could translate into a durable oncology platform, but until now that thesis has rested largely on early- and mid-stage data.

The coming year has the potential to change that. With no expectation of oncology revenues in the short term, management has deliberately lowered the bar on financial delivery, placing the emphasis squarely on clinical proof points. That approach may test patience, but it also clarifies what matters most over the next twelve months.

If the anticipated phase III results deliver, BioNTech could emerge as a multi-asset oncology player with a pipeline capable of supporting sustained growth well beyond Covid. If not, the company still retains a formidable balance sheet and the capacity to regroup.

ABB (ABBN Switzerland): execution continues as margins grind higher

ABB headed into the final quarter of the year with trading conditions that look remarkably similar to those seen in the third, and that consistency is very much the point. Order intake is expected to grow at a healthy pace (hsd%) on a like-for-like basis, supported by favorable comparisons in discrete automation and continued strength in Electrification, which remains the group’s most reliable growth engine. Process Automation is also holding up well, helped by demand in Marine & Ports, while more cyclical end-markets such as chemicals, mining, and pulp & paper continue to lag. Revenue growth is set to trail orders, reflecting a book-to-bill just below one in the quarter, but pricing is expected to remain modestly positive, an encouraging signal after several quarters of inflation-driven volatility.

Taken together, the quarter is expected to look solid (but not spectacular): no dramatic acceleration, but no sign of deterioration either, which is what ABB has been delivering with increasing regularity.

Profitability remains the strength of the story. Operating margins are expected to step up meaningfully year on year in the quarter, even after absorbing ongoing losses in the E-mobility business, which continue to act as a drag on group profitability. Seasonality will weigh sequentially on margins across divisions, particularly in Electrification and Motion, but that is well understood and does little to change the broader trajectory.

For the full year, ABB seems on track to meet the targets it set out for 2025, including a book-to-bill ratio above one, mid-single-digit organic revenue growth, and an operational EBITA margin at the upper end of its stated 16-19% range. Importantly, management has consistently framed these targets not as a peak but as a baseline, and the expectation is that they will be reconducted into 2026. Early indications suggest continued margin progression next year, underpinned by mix, operational discipline, and a growing contribution from structurally attractive areas such as data centers, electrification of industry, and automation tied to energy efficiency.

Overall, he strategic picture remains unchanged. ABB has deliberately positioned itself away from the most volatile parts of the industrial cycle, leaning into segments with longer investment horizons and stronger secular drivers. Electrification continues to benefit from grid upgrades, energy transition spending, and data center build-out, while automation demand is increasingly linked to productivity, safety, and lifecycle optimisation rather than pure capacity expansion. Residential end-markets, which have been a headwind over the past year, are showing tentative signs of stabilisation, offering potential incremental support rather than a central pillar of the growth story.

The result is a business that compounds steadily, with a margin profile that continues to edge higher even as growth normalises.

From an equity perspective, that predictability cuts both ways. The quality of execution and visibility on margins are clear positives, but they are also well recognised, leaving limited scope for surprise unless end-markets re-accelerate more meaningfully.

As it stands, ABB appears set to deliver another quarter that reinforces its reputation as a disciplined, high-quality industrial compounder, but unlikely to generate excitement without a clearer inflection in global industrial demand.

Argenx (ARGX Belgium): from blockbuster execution to platform ambition

Argenx move into the new year with a message that was confident and forward-looking. The preliminary disclosure of 2025 sales confirmed that VYVGART has firmly crossed into blockbuster territory, with full-year revenues of just over $4.1bn, nearly doubling year-on-year.

Momentum remained strong through the fourth quarter, driven primarily by continued uptake in generalised myasthenia gravis and CIDP, where the product is now well embedded in clinical practice. A key enabler of that acceleration has been the rollout of the prefilled syringe, which has meaningfully lowered friction for both patients and prescribers and broadened adoption across geographies and indications.

At this point, VYVGART no longer looks like a one-off launch success story, but rather a durable franchise with multiple levers still to pull. Importantly, management has been clear that while growth remains robust, the focus is shifting from proving demand to systematically expanding the addressable patient population.

That shift underpins Argenx’s articulated priorities for 2026: continue to expand VYVGART globally and across a widening set of indications. Beyond its established foothold in gMG and CIDP, the company is pushing into areas such as seronegative and ocular MG, immune thrombocytopenia, myositis, and Sjögren’s disease. Each of these represents incremental optionality rather than binary risk, building depth around a mechanism that is already well understood.

The second priority is to defend and extend Argenx’s leadership in FcRn biology. This goes beyond lifecycle management and into genuine innovation, with next-generation molecules, combination strategies such as empasiprubart add-on studies, and new delivery formats. The planned autoinjector, targeted for 2027, is emblematic of this approach: not a headline-grabbing event on its own, but a practical step that could further entrench VYVGART in chronic use settings.

The third pillar looks further out, with Argenx aiming to establish the next wave of immunology assets that can stand alongside, and eventually beyond, efgartigimod.

What gives credibility to this roadmap is the sheer intensity of pipeline execution already underway. Entering 2026, Argenx has around ten registrational studies in progress and is targeting ten molecules in clinical development by year-end, including several newly disclosed first-in-class programs.

Empasiprubart is emerging as the most closely watched of these next-generation assets, with a pivotal readout in multifocal motor neuropathy expected late in 2026. At the same time, new FcRn candidates and assets such as ARGX-121, advancing initially in IgA nephropathy, broaden the technological base of the company.

The bigger picture remains that argenx has successfully transitioned from a single-asset biotech into a platform-driven commercial organisation. VYVGART provides scale, cash flow, and credibility, while the expanding pipeline reduces concentration risk and extends the growth runway. If execution continues along this path, Argenx increasingly increasingly looks like a long-duration immunology compounder with multiple shots on goal.

TFF (TFF France): navigating a cyclical downdraft as end-markets work through excesses

TFF Group’s first-half results underline just how abruptly the operating environment has cooled for the cooperage sector.

Revenue for the May–October period declined sharply, reflecting a broad-based slowdown across both wine and spirits customers as producers adjust to weaker end demand and elevated inventories. The contraction was most visible in the second quarter, but the trend was already apparent earlier in the year, signalling that this is not a short-lived disruption but part of a wider cyclical reset. Operating leverage worked in reverse as volumes fell, compressing margins despite management’s efforts to contain costs. That said, profitability did not collapse.

The group maintained a double-digit underlying operating margin, a reminder that its business model retains a degree of resilience even in a downcycle. Below the operating line, financial charges were materially lower than a year ago, helped by easing interest rates and a far smaller foreign-exchange drag, which softened the decline in net earnings. The headline message from the first half is therefore one of pressure.

The split by division helps explain the dynamics at play. In wine, activity held up relatively better, even though sales still declined meaningfully. The US market was the weak spot, unsettled by the reintroduction of trade tariffs and a softer dollar, both of which prompted customers to delay orders and run down stocks. By contrast, France and Europe proved more stable, supported by limited harvest volumes that constrained supply but did little to lift pricing power in the current environment.

The spirits division was hit harder. Bourbon, which had previously benefited from years of robust growth, is now firmly in correction mode as consumption normalises and inventories remain elevated. Whisky followed a similar pattern, with producers cutting back production in response to slower sell-through and softer pricing.

Faced with this backdrop, TFF has moved decisively to protect margins, mothballing part of its production capacity and adjusting headcount to better align costs with demand. These actions will not offset the volume decline entirely, but they do limit the downside and preserve flexibility for when conditions improve.

Management has been explicit that the second half of the year is unlikely to bring relief. Customer behaviour remains cautious, with a clear wait-and-see attitude prevailing across most markets, and the rebalancing of inventories still incomplete. Against that backdrop, the group has slightly lowered its expectations for the full year, now assuming a deeper revenue contraction but still targeting an operating margin comfortably above break-even territory. This focus on cost control, inventory discipline, and debt reduction suggests that the priority has shifted firmly from growth to balance-sheet protection.

From a strategic perspective, little has changed. TFF remains exposed to structurally attractive long-term trends in premium wine and spirits, but those trends are proving highly cyclical in the short term. For now, visibility remains limited and momentum subdued, but the group’s ability to remain profitable through the trough should position it to benefit when producers (eventually) resume investment and production normalises.

Soitec (SOI France): new leadership arrives as the cycle appears to be bottoming

Soitec’s recent engagement with investors, reinforced the sense that the group is now firmly in a transition phase. The immediate focus remains cash generation. Management confirmed that factory utilisation was deliberately kept low in the second half to reduce inventories, a decision that has weighed heavily on margins but is intended to stabilise the business rather than chase uneconomic volumes.

The focus is now on delivering positive free cash flow in the current financial year, excluding any balance-sheet optimisation tools, and this is set to be supported by a sharp reduction in capital expenditure from FY 2026–27 onwards. This shift marks a clear change of emphasis after several years of investment-heavy expansion and signals that management is now more concerned with restoring financial discipline and optionality than with near-term growth optics.

On the commercial side, the tone was more balanced than upbeat, but notably more constructive than in recent quarters. Management stressed that trading conditions remain broadly in line with the most recent guidance, with no new negative surprises emerging. The outlook by end market remains differentiated. Photonics continues to be described in very positive terms, reflecting strong long-term demand drivers and Soitec’s technological positioning. Power-on-insulator and fully depleted SOI are seen as encouraging, while RF trends are broadly as expected. Automotive remains the most challenging area, still weighed down by weak end demand and inventory adjustments across the value chain.

Despite this uneven picture, there was no doubt expressed about the relevance of Soitec’s technologies or the structural attractiveness of its markets. Revenue growth is expected to return over time, even if competitive intensity is likely to increase as the cycle turns. Importantly, management framed the recovery as a multi-stage process: first stabilising cash flow and inventories, then returning to growth, and only in a later phase allowing margins to recover meaningfully as factory underloading unwinds.

Against this backdrop, the timing of the new CEO appointment is noteworthy. Laurent Rémont will take over at the beginning of April, joining from Infineon where he most recently led the RF and Sensors activities. His background combines deep sector knowledge, exposure to global industrial structures, and hands-on experience with exactly the end markets that matter most for Soitec. Coming in from outside after a prolonged period of internal leadership continuity, his arrival coincides with what increasingly looks like a cyclical trough.

That combination matters. After multiple profit warnings, expectations are low, but the balance sheet remains solid and the valuation has compressed to levels well below book value. While uncertainty remains around issues such as the unresolved tax adjustment, management has signaled its willingness to defend its position if needed, backed by financial strength.

With cash discipline restored, capex coming down, and new leadership arriving at a moment of maximum scepticism, Soitec is entering a phase where the asymmetry between expectations and longer-term potential is beginning to look more interesting.

Sodexo (SW France): a steady start to the year with guidance intact and strategy still to come

Sodexo’s first quarter of FY 2025–26 did little to surprise, but that is arguably the point. Reported revenue for the September–November period came in essentially in line with market expectations (€6,260 million), with organic growth of 1.8% modestly ahead of consensus. The headline decline on a reported basis was driven by currency rather, and there were no obvious red flags in the numbers themselves.

Regional dynamics remained mixed, however. North America continues to lag, reflecting the hangover from past contract losses in education and business & administration, compounded by tough comparables in Sodexo Live! after an unusually strong prior-year events calendar. Europe, by contrast, delivered modest but solid growth, supported by new wins in healthcare and B&A, while the rest of the world once again stood out with double-digit organic growth, underlining the group’s exposure to structurally faster-growing markets.

The absence of detailed disclosure on pricing, volumes, or net new business does not materially change the read-across: this was a broadly stable quarter that confirms Sodexo is progressing, but without any early acceleration.

More importantly, management used the occasion to reiterate full-year guidance, which anchors expectations for the rest of the year. For FY 2025–26, Sodexo continues to target organic revenue growth of between 1.5% and 2.5%, with pricing expected to contribute at least two percentage points, volumes and net new business broadly neutral to slightly positive, and a one-off negative impact from the reclassification of a large North American B&A contract. EBIT margin is expected to be slightly lower year on year, reflecting ongoing investments and the drag from mix and contract dynamics rather than any deterioration in operational control.

In other words, nothing in Q1 suggests a need to revisit the framework management has set. The implication is that consensus numbers are unlikely to move meaningfully in the near term, reinforcing the sense that this is a year of execution rather than one of earnings surprises.

That leaves the investment case resting more on positioning and valuation. Sodexo remains a defensively skewed business, with more than half of revenues generated in sectors that are relatively insensitive to macroeconomic cycles, such as healthcare and education. The balance sheet is solid, with leverage comfortably below 2x, allowing the group to sustain dividends while retaining flexibility. At the same time, the operational improvement story is acknowledged as a medium-term one, not an overnight fix.

The market is therefore likely to remain cautious until there is greater clarity on how the new CEO intends to reshape priorities and execution. That moment is expected later in the year, with initial strategic views to be shared around the half-year results and a more comprehensive plan ahead of the summer.

Until then, Sodexo’s shares are likely to trade more on valuation support than on momentum. With the stock priced at a significant discount to its closest peer and offering a healthy free cash flow yield, the risk-reward still looks asymmetric for patient investors, even if the path to re-rating requires time and credible delivery.

Belimo (BEAN Switzerland): still executing flawlessly, but expectations leave little room for error

Belimo heads into its January sales release and February full-year results with momentum that most industrials would envy.

FY 2025 sales should once again land at the upper end of management’s long-standing 15–20% organic growth target, driven above all by the relentless expansion of the data center vertical. That business alone is expected to have grown close to 80% year on year and now represents roughly 17% of group revenues, a remarkable shift for a company that not long ago was still viewed primarily as a “pure” HVAC efficiency play.

Regionally, the picture remains consistent with what we have seen throughout the year: the Americas continue to deliver exceptional growth, supported by both commercial construction and data centers, while Asia-Pacific also sustains double-digit momentum. January’s release is unlikely to bring surprises on profitability, as Belimo typically reserves margin and cash flow disclosure for February, but from a top-line perspective the story remains one of exceptional demand visibility and execution.

When the full set of results arrives, the focus will naturally turn to margins, cash generation and capital intensity. Expectations here have already cooled somewhat, which reduces the risk of disappointment. Consensus EBIT margin assumptions have edged down toward the low 21% area, reflecting currency headwinds, seasonality in the second half and the lingering impact of tariffs, even if those turned out to be less punitive than initially feared following the reduction in US tariff levels late in 2025.

Management has been clear that capacity expansion remains a priority, with capex running at elevated levels, up to roughly CHF 90m, to support continued growth in data centers and other structurally attractive end markets. This keeps free cash flow growth more muted in the near term, but it is consistent with Belimo’s long-standing philosophy of investing ahead of demand rather than maximising short-term returns.

For 2026, Belimo is likely to strike its usual conservative tone. Despite very strong underlying demand indicators – including robust hyperscaler and colocation data centre capex plans and delayed price increases flowing through in the second half of 2025 – management is expected to guide for “only” mid-teens organic sales growth. Operating margins should at least be held flat year on year, balancing operational leverage and pricing against ongoing US dollar headwinds and higher-cost inventories.

None of this undermines the quality of the business. Belimo remains a textbook Swiss industrial compounder with outstanding returns on capital and exposure to long-duration growth themes such as energy efficiency and digital infrastructure.

The issue, as so often with Belimo, is valuation. At current levels, the stock still trades at multiples that imply near-perfect execution well into the future.

Tecan Group (TECN Switzerland): early signs of life, with orders pointing to a gradual recovery

After a difficult and uneven operating backdrop, Tecan’s preliminary 2025 figures read as a year that never quite found sustained momentum, but also one that may have marked an inflection point.

Group sales came in at CHF 882.5m, slightly down year on year in local currency terms and marginally below market expectations, reflecting the fact that the mid-single-digit growth achieved in Q3 did not carry through into the final quarter. In that sense, Q4 was a reminder that demand across many life science end markets remains cautious, with customers still disciplined on capital spending and instrument purchases. That said, the overall message is consistent with what management had already flagged in October: 2025 was about stabilisation rather than growth. The top line never deteriorated materially, but neither did it convincingly recover, leaving Tecan effectively treading water after the post-pandemic digestion phase that has weighed on the entire tools sector.

Where the tone becomes more constructive is when looking at order dynamics in the second half of the year. Full-year order intake reached CHF 900.9m and, while broadly flat in Swiss francs, grew close to 4% in local currencies. More importantly, H2 orders accelerated meaningfully, up almost 9% in local currencies, with book-to-bill above one in both divisions. This suggests that customer activity is slowly picking up again, even if it has not yet translated into reported revenues. For a company like Tecan, which sits early in customers’ investment cycles, this is often the first tangible signal that sentiment is improving.

Management has been careful not to overpromise, describing the outlook as a gradual market recovery rather than a sharp rebound, but the direction of travel is clearly more favourable than it was earlier in the year. With a solid installed base, a broad exposure to diagnostics, biopharma and applied markets, and recurring demand from consumables and services, Tecan is well positioned to benefit once purchasing decisions begin to normalise.

Looking to this year, expectations should remain measured, but the setup appears more balanced than the share price currently implies. The company has already indicated that it expects steady improvement in the broader environment, albeit without a full return to pre-slowdown conditions, and will provide more detailed guidance alongside its audited results in March. Crucially, there is no suggestion of structural issues with Tecan’s technology, competitive positioning or customer relevance; the past year has been quite cyclical.

Against that backdrop, valuation matters. The stock today reflects a high degree of scepticism, effectively pricing in a prolonged period of subdued growth. If the order momentum seen in the second half of 2025 feeds through into even a modest top-line recovery next year, that gap between expectations and reality could start to close. This does not require a boom scenario, merely a return to more normal purchasing behavior.

Anheuser-Busch InBev (ABI Belgium): grinding through a soft consumer backdrop as 2025 edges toward the low end of guidance

As 2025 closed, the picture at Anheuser-Busch InBev looks like a steady erosion of momentum across several core markets.

In the Americas, the tone remains subdued. North America continues to struggle with a weak beer category, and there is little evidence of a late-year rebound: volumes and revenues are still expected to contract in Q4, while cost pressures per hl and brand investment intensity both tick higher. Mexico is hardly offering relief, with Middle Americas facing a more stretched consumer and tougher comparatives, compounded by currency-driven cost inflation. South America tells a similar story. Brazil, which has been a swing factor in prior cycles, is not showing signs of improvement, with volumes under pressure and input costs rising again on FX. Even the sizeable soft drinks business is feeling the same macro drag. Argentina remains difficult, too, with inflation still running at levels that continue to squeeze consumption and limit any meaningful recovery in volumes.

Against that backdrop, EMEA stands out as the relative stabiliser rather than a growth engine. Europe is holding up reasonably well, with modest revenue growth supported by pricing, even if volumes remain slightly negative. This is not a buoyant environment, but it is at least predictable. Elsewhere in the region, the challenges are more familiar than alarming: South Africa is cycling a tough base after favourable phasing earlier in the year, while Nigeria remains constrained by high inflation, keeping the consumer under pressure. Asia-Pacific, meanwhile, is offering little near-term excitement. China is seeing only limited sequential improvement off a softer comparison base, and South Korea is up against difficult comps on both volumes and revenue per hl.

Put together, this geographic mix explains why momentum has progressively slowed through the year, even as management continues to execute broadly in line with expectations.

Management continued to guide for 2025 organic EBITDA growth in a 4–8% range, with a clear acknowledgement that cost inflation is more heavily weighted to the second half and particularly to Q4. Interest costs, tax and pension assumptions remain unchanged, while deleveraging is being approached cautiously given higher dividends, share buybacks and currency effects. Forecasts have edged closer to the lower bound of that EBITDA growth range, reflecting the deceleration seen as the year progressed, but this is partly offset at the reported level by a weaker US dollar.

Strategically, the longer-term story remains intact. ABI’s valuation already reflects a high degree of skepticism about near-term growth and consumer confidence, while its portfolio continues to evolve toward higher-margin segments and alternatives. The increasing emphasis on no-alcohol beers, near-beers and adjacent categories is not a cosmetic tweak but a deliberate response to shifting consumption patterns, and one that could prove more important if moderation trends persist.

OVH (OVH France): growth deceleration meets a moment of strategic reckoning

OVHcloud entered the new financial year with a first-quarter update that broadly confirmed what investors had already started to fear: growth is slowing, and the deceleration is no longer confined to one corner of the business.

Q1 revenue grew organically by 6% to €275m, landing squarely in the middle of management’s full-year guidance range of +5–7%, but also marking a clear step down from the roughly 9% organic growth delivered over FY 2025. Importantly, the slowdown is visible across all segments. Private cloud growth softened to low single digits as some large customers exited and others focused on optimisation, public cloud remained solid but no longer exceptional, and Webcloud continues to grind along at a modest pace.

Geographically, the picture is equally consistent: France and the rest of Europe are growing in the mid-single digits, while the rest of the world is still faster but not enough to offset the broader trend. In isolation, none of this is disastrous. Taken together, however, it underlines that OVHcloud is not immune to the same digestion and optimisation cycle currently affecting enterprise IT spend more broadly.

Management has unsurprisingly reiterated its FY 2026 guidance. The group continues to target organic revenue growth of 5–7%, an improvement in EBITDA margin, and a return to positive free cash flow after a cash-consuming FY 2025.

Those objectives matter more now than ever. OVHcloud has been explicit that part of the growth slowdown stems from internal frictions rather than purely macro effects, particularly in the small-customer segment, where customer support quality, pricing architecture and product simplicity have become limiting factors. Fixing these issues is operationally unglamorous but strategically essential if the company wants to stabilise its base before re-accelerating.

At the same time, the company briefly referenced a long-term ambition of reaching €2bn in revenue, albeit without attaching any timeline. That absence of a time horizon is telling: it signals intent and scale ambition, but also reflects the current lack of visibility on how quickly growth can be re-ignited in a market increasingly dominated by hyperscalers.

The leadership change announced in October adds another layer to the story. Founder and chairman Octave Klaba stepping back into the CEO role was framed as a response to geopolitical uncertainty and the strategic importance of cloud and AI, with vision and execution needing to sit closer together. In practice, this move reads as both an opportunity and an admission. It brings founder-led decisiveness back to the forefront at a time when the equity story has lost momentum, but it also highlights that OVH has yet to carve out a truly compelling alternative narrative to US hyperscalers, despite persistent European sovereignty debates.

The recent share price weakness reflects this tension. Valuation looks optically undemanding, but the burden of proof has shifted firmly back to management. Until there is clearer evidence that growth can stabilise and then re-accelerate, while delivering on the promised margin and cash flow inflection, OVH remains a company in strategic transition rather than being a clean recovery story.

If you appreciate this post, feel free to share and subscribe below!