AI promises, rebound promises and take-outs

SAP, Sandvik, Sword Group, Sage Group, SRP Groupe, Ipsos, Azelis, Ericsson, Stabilus, Fnac Darty, Puma, Ryanair, ID Logistics, MBB, SFS

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

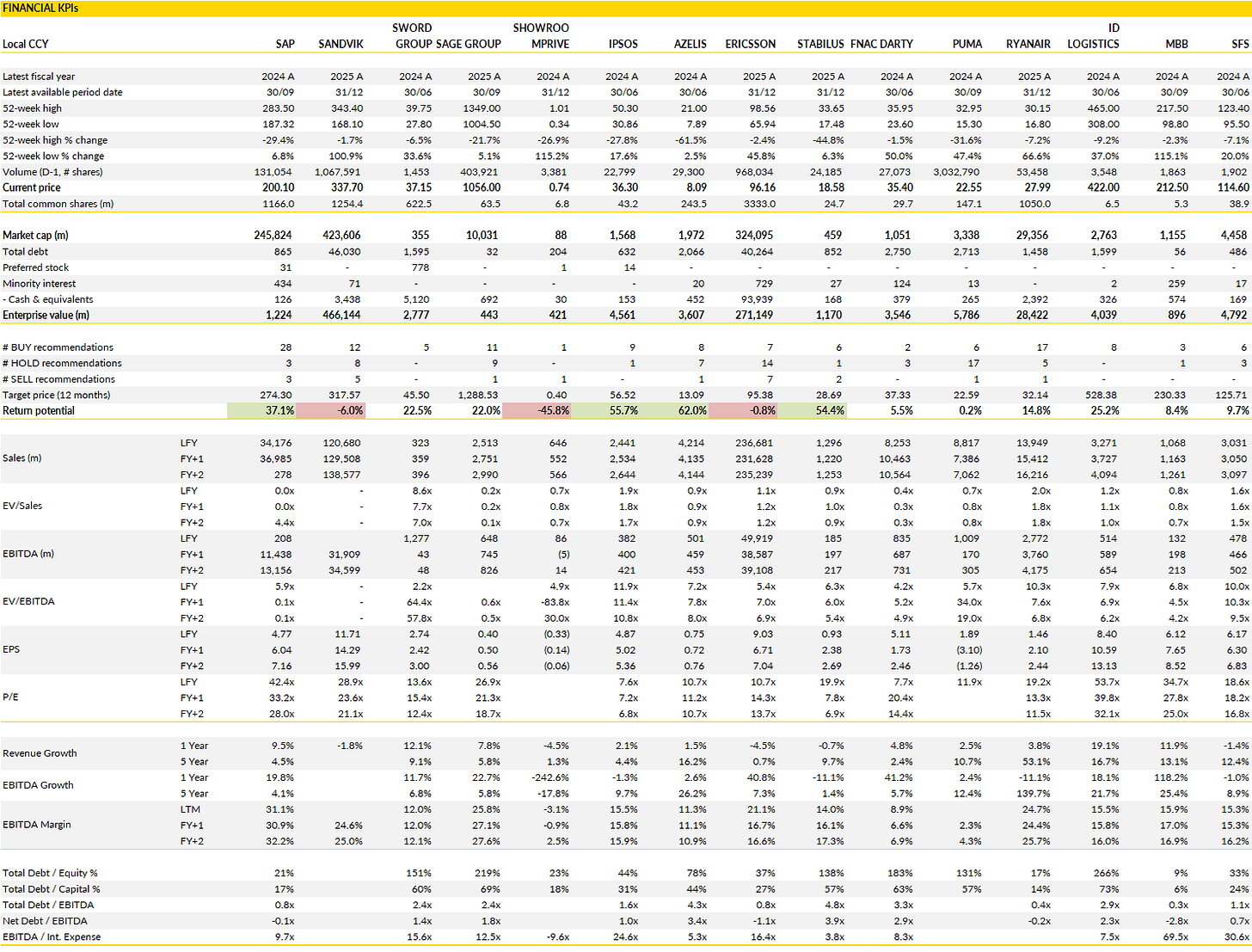

Financial KPIs

SAP (SAP Germany): cloud visibility is solid, but sentiment needs to catch up

SAP is heading into its Q4 print with expectations already tempered, which in many ways sets up a cleaner story for 2026 and beyond.

Growth should slow versus the first nine months, largely for mechanical reasons instead of any deterioration in fundamentals. License revenues remain in structural decline and weigh more heavily in Q4, while the support business faces a tougher comparison due to unusually strong activity a year ago. Against that backdrop, mid-single to high-single digit constant-currency growth at group level looks consistent with a business that is increasingly defined by recurring cloud revenues.

More importantly, cloud revenue growth is set to remain firmly in the mid-20s, with only a marginal deceleration, and margins should continue to expand meaningfully as operating leverage, lower stock-based compensation and the tail end of the restructuring program all come through. In isolation, not a dramatic quarter, but it reinforces the idea that SAP’s underlying engine remains robust even as headline growth normalises.

The focus, however, is on 2026, where management has already laid down some fairly explicit markers. SAP has repeatedly stated that growth should re-accelerate next year as the transition toward cloud and subscription revenues deepens and visibility improves. The company is targeting cloud and software growth of around the low-teens on a constant-currency basis, with cloud revenue itself growing in the mid-20s, broadly aligned with the current run-rate of the cloud backlog. Even if Q4 cloud backlog growth ends up at the lower end of recent quarters due to deal timing, that would be far more about calendar effects than demand, with delayed signatures expected to convert early in the year.

On profitability, SAP is aiming for a further step-up in operating margin in 2026, supported by the structural shift in mix and the benefits of cost actions taken in 2025. Free cash flow is also expected to rise materially, with management pointing to roughly €9bn-plus of annual FCF as the new normal as the business matures into a more subscription-heavy model. Importantly, SAP has also been clear that a gradual slowdown in backlog growth is a natural consequence of scale, and does not preclude accelerating revenue growth into 2027 as backlog converts into recognised sales.

SAP’s longer-term positioning increasingly revolves around its role in the AI stack, where it arguably has a more practical and defensible angle than many software peers. SAP’s core systems map the real operational workflows of enterprises across finance, supply chains and human capital, and they house the structured data that agentic AI systems need to automate decision-making rather than just generate content. That makes S/4 Cloud migration not just a technical upgrade, but a strategic prerequisite for companies looking to deploy AI at scale within their core processes. While AI monetisation is still in its early innings, this strengthens the strategic case for SAP’s cloud transition and supports management’s confidence in sustained medium-term growth and margin expansion.

The challenge today is about sentiment: the software sector has de-rated sharply as capital has rotated toward hardware and semiconductors tied to AI. For SAP, the fundamentals continue to move in the right direction, but the stock will only fully reflect that once investors regain confidence in software as a credible, long-duration beneficiary of the AI cycle.

Sandvik (SAND Sweden): momentum is real, but the bar is already high

Sandvik’s Q4 read was undeniably strong on the operational front, with the company delivering one of those quarters where almost every moving part comes in better than expected.

Orders accelerated meaningfully, revenues followed through, margins held firm and cash generation remained robust. Importantly, this was not a narrow or purely cyclical beat. Mining continued to fire on all cylinders, Machining & Intelligent Manufacturing surprised positively after a subdued period, and even Rock Processing (the laggard of the portfolio this year) showed signs of stabilisation beneath the headline miss.

Taken together, the quarter reinforces that Sandvik is exiting the year with tangible momentum and a healthier demand backdrop than many industrial peers. That said, the market already knows Sandvik is a high-quality operator with strong execution, and the real debate is about “how much of that improvement is already reflected in expectations?”

Drilling down into the segments, Mining remains the clear standout and the key swing factor for 2026. Order growth was boosted by a handful of large contracts, but even stripping those out, underlying demand remains clearly double-digit, supported by a strong original equipment pipeline and ongoing investment by miners in productivity, automation and electrification. This is not just a late-cycle spare parts story; it reflects continued confidence in longer-term mining capex, particularly in copper and battery-related commodities. Machining & Intelligent Manufacturing also deserves credit, as the division delivered a much stronger order performance than anticipated. Aerospace demand remains a structural tailwind, but what is more encouraging is the breadth of improvement, with powder solutions and software posting solid growth and general engineering starting to recover in parts of Asia. This suggests that the short-cycle industrial environment may be bottoming, even if visibility remains limited. Rock Processing was the only area to disappoint versus expectations, but here the explanation appears more about tough comps than a genuine demand issue. Aggregates demand is gradually improving, especially in Europe, and the underlying infrastructure picture looks incrementally better heading into the new year.

The order momentum exiting Q4 provides a solid ground for sales growth in 2026, and it would not be surprising to see consensus numbers drift higher in the coming weeks. The mix also remains supportive, with Mining and high-margin machining activities carrying more weight, which helps explain why margins held steady despite inflationary pressures and ongoing investments.

However, this is precisely where the investment case becomes more nuanced. Sandvik is doing almost everything right operationally, but the market is well aware of that. Expectations for next year already assume a continuation of strong growth and further margin expansion, leaving less room for positive surprise unless demand accelerates even more sharply.

In other words, the quality is unquestionable, the momentum is real, but the valuation increasingly reflects a business that is expected to keep delivering near-flawless execution. From here, incremental upside does not depend on operational delivery (which Sandvik has proven it can handle) and more on whether end-markets, particularly mining and short-cycle industrials, can exceed what is already a fairly optimistic set of assumptions.

Sword Group (SWP France): consistency

Sword’s Q4 print was (marginally) softer than market expectations, but nothing in the release really challenges the broader investment case.

Reported Q4 revenue landed slightly below consensus, yet organic growth remained firmly double-digit at just over 12%, entirely consistent with what the business has been delivering throughout the year. That is the key point: the apparent “miss” is largely a function of scope changes and FX noise rather than any deterioration in underlying demand.

Over the full year, Sword delivered organic growth north of 12% with an EBITDA margin exactly on its long-stated 12% normative level, which is increasingly rare in the European IT services space. Free cash flow generation also held up well into year-end, even after factoring in cash outflows linked to recent acquisitions and the share-based incentive structure. Sword continues to execute with a level of predictability that stands out.

What really helps management’s confidence this year is visibility. Sword’s backlog increased by more than €150m during Q4, pushing it above €700m, equivalent to nearly 22 months of revenue. This materially de-risks the growth trajectory for the next couple of years. Management has reiterated a 12% organic growth target for 2026 alongside a stable 12% EBITDA margin, fully in line with its long-term business plan running through 2028.

Importantly, this outlook is supported by a pipeline that includes several large contracts expected to start ramping more meaningfully in the second half of the year. The phasing is important: H1 2026 is likely to look more subdued, with momentum building into H2 as new programs kick in, a dynamic that management has been very transparent about. Overlaying this is Sword’s incentive structure, where a meaningful portion of cash flow is redistributed to key managers via the 2028 share deal, reinforcing alignment but also modestly capping near-term free cash flow. Even so, the underlying cash generation remains solid and disciplined.

Sword continues to occupy an attractive niche within European IT services: defensive end-markets, strong exposure to regulated and mission-critical projects, and a delivery model that consistently converts growth into stable profitability. The group remains active on the M&A front, selectively rotating its scope to reinforce higher-value activities, which adds an additional lever for medium-term growth without diluting margins. Crucially, none of this relies on a cyclical rebound in IT spending or a sudden recovery in discretionary budgets. Sword is compounding steadily, backed by long-term contracts and a backlog that provides unusual earnings visibility for the sector.

While Q4 lacked a fresh upside surprise, it reinforced the story: this is a business that does exactly what it says it will do, quarter after quarter. For investors looking for exposure to European IT services without the volatility that characterizes much of the sector, Sword’s combination of predictable growth, margin discipline and long-dated visibility remains compelling.

Sage Group (SGE UK): steady cloud compounding, with subscriptions grinding higher

Sage’s Q1 FY26 update was about as uneventful as a software investor could hope for, and in this context, that is a positive.

Revenues grew 10% organically, in line with market expectations, but the quality of that growth continues to improve beneath the surface. Recurring revenues also advanced 10%, with subscriptions up 12% year-on-year and now accounting for 84% of group revenues. That mix shift matters far more than the headline number. Subscription penetration has been grinding higher quarter after quarter, and Q1 marked another small but meaningful step forward. Sage Business Cloud grew 14% organically, confirming that the transition away from legacy license-driven models is not only intact but still accelerating modestly. There was no sign of demand softening, no unusual churn, and no reliance on one-off items. In a software sector that investors currently treat with suspicion, Sage delivered exactly what it promised: consistent, repeatable growth driven by recurring revenue streams.

Geographically, the pattern remains familiar. North America continues to be the engine, with 13% organic growth driven primarily by Sage Intacct, which remains the standout asset in the portfolio. Intacct’s momentum is no longer just about mid-market wins; it is increasingly supported by attach rates, ecosystem depth and steady expansion into adjacent use cases. The UK & Ireland also accelerated to 10% growth, again with Intacct scaling rapidly alongside resilient performance in small business solutions such as Sage Accounting and Sage 50. Europe lagged somewhat at 7% growth, but even here the message was one of stability rather than weakness, with accounting, HR and payroll all contributing. Importantly, this was not a quarter flattered by pricing or temporary effects. Growth was volume-led, subscription-driven and broad-based, suggesting that Sage’s value proposition remains relevant for customers navigating a mixed macro backdrop.

For FY26, Sage continues to target organic revenue growth of more than 9% alongside an operating margin above 23.9%, implying further operating leverage as scale builds in the cloud base. That combination (high single-digit organic growth with expanding margins) remains relatively rare in European software, particularly among companies of Sage’s size.

While investors are clearly waiting for more tangible evidence around AI monetisation, AI is being embedded to enhance retention, productivity and pricing power rather than rushed to market as a standalone revenue story. The business is compounding through subscriptions. With accelerating cloud penetration, resilient regional demand and clear margin discipline, Sage continues to execute.

SRP Groupe (SRP France): shrinking the base

Showroomprivé’s FY 2025 full-year sales came in at €558.9m, down 14% year on year, broadly in line with what the company had been signaling and consistent with the trajectory seen through the year.

Q4 itself was still weak, with revenues down 17% to €166.6m, confirming that there was no meaningful inflection into year-end. The underlying picture remains one of sustained pressure across the core flash-sales model. GMV declined sharply across all traditional categories, with Fashion, Home, Beauty and Travel all posting double-digit declines, underlining that this is not a one-off category issue but a broad demand problem. The only real pockets of resilience came from activities that are either structurally different or still sub-scale: the marketplace, where volumes were up strongly, and SRP Services, which continues to build out its retail media offering. That contrast increasingly defines the group today: a shrinking legacy core alongside smaller, more modern initiatives that are not yet large enough to offset the decline.

One of the more consequential elements of this release sits in how the company has revisited its past. Alongside the sales update, Showroomprivé announced a significant accounting revision to its 2024 results, reflecting a more conservative reassessment of asset values. The group booked substantial impairments, most notably on goodwill, alongside write-downs of deferred tax assets and advances made at the end of 2024. As a result, the reported 2024 net loss was restated materially lower than previously disclosed.

While these items are non-cash, the message is clear: management is drawing a line under an era where balance sheet assumptions were arguably too optimistic. This reset is painful, but it arguably improves transparency and credibility going forward. At the same time, it reinforces how much strategic and financial optionality the group has already burned through over recent years. The disposal of The Bradery at the end of 2025 fits into that same narrative. While that asset was still growing (with sales up mid-teens in 2025) it sat somewhat outside the group’s refocused perimeter, and its sale simplifies the structure at the cost of removing one of the few visible growth contributors.

The company is clearly entering 2026 from a smaller and less diversified base. Excluding The Bradery, the revenue run-rate is meaningfully lower, and management has acknowledged that the group remains in a transition phase, prioritising operational efficiency, cost control and the consolidation of a narrower set of growth drivers. There is no aggressive top-line ambition being put forward at this stage; instead, the emphasis is on stabilisation, execution and rebuilding the economics of the platform. Marketplace expansion and retail media remain the most promising levers, but both will need time and investment to move the needle at group level. In the meantime, the legacy flash-sales model continues to face structural headwinds from competition, consumer behaviour shifts and brand disintermediation.

The recent FY 2025 update does not change the story: Showroomprivé is a business in managed contraction, attempting to simplify, resize and redefine itself before it can credibly talk about growth again.

Ipsos (IPS France): ambitious reset meets a market that has already given up

Ipsos used its recent Investor Day to reset the narrative after a couple of frustrating years, and the message from management was unambiguous: this is meant to be a return to growth.

The new “Horizons” roadmap lays out a plan to rebuild organic momentum toward a 3–4% CAGR over 2026–2028, with management explicitly targeting at least 5% organic growth in 2028 after a run of anemic results. That is a sharp contrast with recent history, where growth barely cleared zero in 2025 and remained muted in 2024. The levers are familiar but ambitious: a heavier tilt toward faster-growing services, a push to scale global offerings rather than fragmented local ones, faster delivery cycles for clients, and a step-up in investment around AI, proprietary data and panels. Importantly, management is not retreating from the more problematic Citizens/Public Affairs activities, which represented a meaningful drag last year. Instead of divestment, the plan assumes stabilisation and gradual recovery, which raises the execution bar but also signals that this is a transformation agenda rather than a portfolio clean-up.

Profitability is meant to follow growth. Management is targeting operating margins of roughly 13.5% by 2028 and north of 14% by 2030, compared with just over 12% today. Achieving that implies a belief in operating leverage once growth returns, but also a willingness to invest heavily in the meantime. Over the next five years, Ipsos plans to deploy around €1.2bn into transformation initiatives, equivalent to the vast majority of expected free cash flow, with M&A clearly positioned as the primary tool. The focus is on technology-enabled and adjacent services that can both accelerate growth and improve the quality of revenues.

What is notably absent from the story is any suggestion of capital returns. There is no exceptional buyback program, despite depressed valuation multiples, and shareholder returns are framed as gradually improving rather than front-loaded. The commitment to raise the payout ratio over time is real, but it is incremental, reinforcing the idea that management sees reinvestment as the priority lever for value creation.

What makes the setup interesting is the disconnect between this ambition and how the market is currently pricing the business. Ipsos trades on valuation levels that historically have been associated with structural decline or disruption risk, particularly around AI disintermediation. In that sense, investors appear to be assuming that the company either cannot execute on its plan or will be permanently impaired by new technologies. The irony is that Ipsos is explicitly positioning AI as a tool to strengthen its competitive position. If they can execute… look out above.

Azelis (AZE Belgium): A quality franchise stuck in a prolonged digestion phase

Azelis is heading into Q4 results still navigating the same uncomfortable middle ground that has defined most of the past year(s): structurally sound, but still stuck.

The underlying split in the business remains the same. Life Sciences continues to do the heavy lifting, with Food ingredients in the US accelerating and Pharma holding up reasonably well, while Industrial end-markets remain soft and Asia Pacific is still dealing with excess supply spilling out of China. Customer behavior has not meaningfully changed either. Orders remain fragmented, smaller and more frequent, reflecting lean inventories and limited conviction to rebuild stock. Overlay that with ongoing tariff uncertainty and it is easy to see why price discovery remains messy across several chemistries. Against this backdrop, Q4 is unlikely to deliver any real relief on the top line, with organic revenues still trending modestly lower and margins under pressure, particularly in APAC where competitive intensity remains elevated.

Where the story becomes more constructive is on self help. Cost actions are now very tangible. Management has been tracking at least €20m of annualised cost savings in 2025, with a further step-up expected to be visible through Q4 and into 2026. Importantly, these are not heroic assumptions but the result of a more disciplined operating posture after several years of rapid expansion and integration. Working capital discipline has also tightened meaningfully, driving strong cash conversion despite the softer trading environment. That matters, because Azelis’ asset-light model gives it flexibility in downturns that many industrial distributors lack. There are also early, tentative signs that China may be bottoming in some sub-segments, particularly CASE chemicals, although it is far too early to call this a trend. But for now, these positives are doing more to stabilise profitability than to drive growth.

For 2026, expectations need to stay grounded. Even with clearer tariff parameters and some eventual inventory rebuild from already very low customer stock levels, the recovery looks gradual and back-end loaded. Cyclical industrial demand is not snapping back, and APAC pricing pressure is unlikely to disappear overnight. As a result, earnings momentum is set to remain subdued, with limited near-term catalysts to force a rerating.

That said, the longer-term investment case has not fundamentally changed. Azelis remains an asset-light, specialty-weighted distributor with exposure to structurally attractive niches, outsourcing tailwinds, a proven bolt-on M&A playbook and an increasing focus on cost discipline. The issue today is not franchise quality but timing and visibility. Until organic trends stabilise and growth becomes more predictable, the stock is likely to remain range-bound.

For patient investors, however, the disconnect between near-term frustration and long-term earnings power remains the core of the opportunity.

Ericsson (ERICB Sweden): solid execution masking a growth vacuum

Ericsson’s Q4 numbers were clearly better than expected, but the underlying message remains unchanged: this is still a story dominated by execution and cost control rather than genuine growth.

Revenues came in meaningfully ahead of expectations, driven almost entirely by Networks, with Europe, the Middle East and Africa benefitting from project deliveries in mission-critical networks and Southeast Asia supported by 5G rollouts in Vietnam and cloud-related projects in India. These regional pockets of strength more than offset continued weakness in the Americas and a sharp decline in Northeast Asia, where operators remain cautious on 5G capex. Margins also surprised on the upside, helped by a combination of favourable mix, disciplined project execution and lower operating expenses, partly supported by forex.

On paper, this was one of Ericsson’s cleaner quarters in some time, with Networks delivering margins well within its guided range and Cloud Software & Services also coming in more profitable than feared.

Dig a little deeper, however, and the quality of the beat looks less convincing from a forward-looking perspective. A meaningful share of the upside was driven by project timing rather than a broad-based improvement in demand, and the reliance on opex reductions remains obvious. Ericsson has been executing firmly on cost cuts, particularly in Sweden but increasingly elsewhere, and this is clearly cushioning earnings in a flat market. That said, the growth engines are still struggling to gain traction. Enterprise remains loss-making, with margins deeply negative, and Cloud Software & Services, while profitable this quarter, continues to face sub-seasonal demand patterns and limited visibility.

Management itself is not painting an upbeat picture for the year ahead. For 2026, Ericsson continues to anchor expectations to a broadly flat global RAN market, in line with external industry forecasts, and near-term guidance points to a typically weak first quarter for Networks and below-normal seasonality in Cloud Software & Services. In other words, the company is not signaling any imminent inflection in demand.

This is where the investment debate really sits. Ericsson is showing that it can protect margins and generate acceptable earnings even in a stagnant market, but the equity story increasingly hinges on how much more efficiency can realistically be extracted without top-line support. Cost cutting is not a substitute for growth, and with the RAN market expected to remain flat, upside increasingly depends on flawless execution and continued discipline rather than structural tailwinds.

At the same time, valuation no longer looks obviously distressed relative to its own history, suggesting that much of this “better than feared” narrative is already priced in. As a result, while the quarter may trigger a short-term positive reaction, it does little to change the broader picture: a company managing decline well, but still lacking a clear catalyst for sustainable growth.

Stabilus (STM Germany): soft start, but a recovery seems imminent

Stabilus’ first quarter of FY 2025/26 was going to look messy on the surface, and in that sense the print did little to surprise.

Group sales were down sharply year-on-year, margins compressed, and reported earnings took a hit, largely reflecting the same cocktail of headwinds that have defined the last few quarters: weak automotive volumes, especially in Asia, and a meaningful currency drag. APAC was once again the main pressure point, while Europe and the Americas were broadly flat, highlighting just how uneven end-market conditions remain. That said, beneath the headline decline, the quarter had a slightly more constructive tone than the raw numbers suggest. Free cash flow improved materially, working capital discipline held up well, and profitability landed broadly where management and the market had expected. This is important, because it suggests the earnings base has stabilised at a lower level instead of than continuing to deteriorate quarter by quarter.

Management reiterated full-year guidance across all key metrics, implicitly signaling confidence that Q1 represents the trough. The path to improvement is not dependent on a macro recovery but on a set of internal and contractual levers that are already visible. Volume ramps on door actuator solutions for OEM customers such as BMW and Xiaomi are expected to kick in from mid-year, providing a tangible revenue tailwind even if broader auto production remains subdued.

At the same time, structural cost-saving measures announced last autumn are beginning to flow through the P&L. These initiatives are designed to offset lower pricing and volumes and should progressively support margins as the year unfolds. Importantly, these savings are not one-offs but structural in nature, with a meaningful portion recurring beyond this fiscal year, which improves the quality of any margin recovery.

The Stabilus case more and more looks like one of delayed rather than derailed earnings power. The company remains exposed to cyclical automotive demand, but its positioning within motion control and actuator solutions gives it leverage to secular trends such as vehicle electrification, increased automation and comfort features. The order book in these areas is long-dated, and once programs move from development into series production, they tend to provide relatively stable volumes over multiple years. Combined with a leaner cost base, this creates the conditions for operating leverage to re-emerge even on modest revenue growth.

In that context, the current year feels like a transition phase, where reported numbers still reflect a weak industry backdrop, while the building blocks for better profitability are being stacked. For investors willing to look beyond the next quarter or two, the setup increasingly hinges on execution: deliver the contract ramps, lock in the cost savings, and allow the P&L to normalise over time.

Fnac Darty (FNAC France): a steady business meets a timely exit

Fnac Darty’s preliminary FY 2025 numbers show a group that is still holding its ground, but not quite delivering the upside that would normally justify patience as a listed equity.

Sales of just over €10.3bn imply modest like-for-like growth in a difficult consumer backdrop, with France predictably softer and the rest of Europe marginally more resilient. Operating profitability edged up slightly, with an underlying margin of 2%, in line with guidance and a touch better than last year, but still well short of what would be considered structurally attractive for a discretionary retailer. The decision to launch an active disposal process for Nature & Découvertes is logical: the asset has been a clear drag, and its reclassification under IFRS 5 effectively acknowledges that management capital is better deployed elsewhere.

Overall, the print confirms the picture of a business that is defensively managed, operationally disciplined, but constrained by a consumer environment that offers little in the way of near-term upside.

That backdrop makes the timing of Daniel Křetínský’s proposed €36 per share takeover bid particularly important. The offer, which has been unanimously welcomed by the board, puts a clean and credible valuation on a business whose long-term plan is sound but distant. Management’s 2030 roadmap centres on increasing the weight of services, improving customer experience and lifting the operating margin towards 3% over time, a reasonable ambition but one that requires several years of stable execution and a more supportive demand environment.

In the meantime, 2026 is shaping up as another year of limited momentum, with no obvious consumption rebound and inflation pressures only slowly easing. Against that reality, the offer provides minority shareholders with immediate certainty at a valuation that looks fair in relative terms, especially when compared with recent sector transactions.

From a deal-dynamics perspective, the bid appears well structured to achieve its primary objective without stretching economics. The €36 price implies a meaningful premium to recent trading levels and values Fnac Darty at multiples that already bake in a degree of operational improvement. Achieving the 50% acceptance threshold looks realistic even without full visibility on how all major shareholders will vote, while the scope for a higher bid seems limited given the lack of competing interest and the absence of obvious strategic pressure points.

In that sense, the situation feels like a controlled transition from public to anchored ownership. For investors, the stock has effectively converged with the offer price, leaving little residual upside but also limited downside risk.

Puma (PUM Germany): an anchor arrives, but the operating story still needs time

The announcement that Anta will acquire a 29.1% stake in Puma from the Pinault family marks a clear inflection point in the company’s ownership structure, even if it does not fundamentally change the near-term operating outlook.

At €35 per share, the transaction puts a meaningful control-style valuation on a minority stake and crystallises a reference point well above where the stock has been trading. Importantly, Anta has been explicit in framing the deal as a long-term strategic investment rather than the first step in a takeover. The Chinese group has emphasized respect for Puma’s independent governance and management culture, while signaling an intention to gain board representation and explore deeper cooperation over time. In that sense, the transaction seems the introduction of a patient anchor shareholder with industrial logic, funded entirely from Anta’s balance sheet.

Strategically, the most obvious angle is China, where Puma remains structurally under-represented, with the region still accounting for a relatively small share of group sales. Anta’s domestic scale, distribution expertise and brand-building track record could, in theory, help Puma accelerate its positioning in a market that has been difficult for many Western sportswear brands to navigate independently. That said, this should not be over-interpreted in the short term. China has been a challenging and volatile market, and simply having a local partner does not automatically translate into growth or margin recovery.

Beyond geography, Anta’s involvement may also bring discipline around product focus, sourcing and speed-to-market, areas where Puma has historically oscillated between ambition and execution risk. Still, any tangible benefits are likely to emerge gradually, and management has been careful not to promise quick wins or transformational synergies at this stage.

Importantly, the deal does not remove the need for Puma to fix its own operational issues. The group remains in the middle of a transition, with recent periods characterised by heavy inventory actions, pressure on margins and uneven brand momentum across regions. While the presence of a strong strategic shareholder provides external validation of Puma’s long-term brand value, it does not change the fact that earnings visibility remains limited and that the recovery path will be measured rather than dramatic. Anta has also been clear that it has no current plans to increase its stake or launch a broader offer, which caps the immediate optionality for investors.

In that context, today’s news is best seen as supportive: it puts a credible floor under the equity story, improves sentiment and adds strategic depth, but it does not, by itself, resolve the underlying execution challenges.

For Puma, the heavy lifting still lies in restoring consistent sales growth, rebuilding profitability and proving that the brand can sustainably compete in a crowded global sportswear market, with or without a powerful new partner on the register.

Ryanair (RYA Ireland): cost discipline and cautious guidance

Ryanair’s Q3 FY26 results was one of those quarters where the numbers are less important than the underlying mechanics.

Net income before exceptional items came in well ahead of expectations, not because demand suddenly inflected or yields surprised meaningfully, but because costs behaved far better than feared. Unit costs ended the quarter broadly flat year-on-year, a clear upside versus the low-single-digit increase most had penciled in, and that alone explains most of the earnings beat. Yields were up modestly, reflecting the continued normalisation of the OTA effect, while ancillary revenue per passenger lagged a little versus prior trends, pointing to a consumer that is still price-sensitive at the margin. Operationally, this all fits neatly into the Ryanair playbook: push volume, protect load factors, and let ruthless cost control absorb whatever volatility the demand side throws up.

What is arguably more interesting than the quarter itself is the tone of management’s full-year commentary. Despite the clear Q3 beat, Ryanair chose to frame FY26 guidance conservatively, tightening the range for profit after tax before exceptional items rather than lifting it meaningfully. Passenger numbers are now expected to exceed 208 million, supported by stronger demand and slightly earlier aircraft deliveries, and fare growth for the full year is set to land above prior assumptions, albeit still modest. At the same time, unit cost guidance remains disciplined rather than aggressive, with management flagging modest increases as higher ATC charges, environmental costs and the roll-off of last year’s delivery delay compensation offset efficiency gains from newer aircraft and fuel hedging.

The message is clear: Ryanair sees a supportive operating backdrop, but not one that justifies exuberance. In that sense, the guidance feels measured.

Stepping back, the broader investment case remains intact and consistent. Ryanair continues to demonstrate that, in European short-haul aviation, structural cost advantage still trumps almost everything else. Even in an environment of uneven demand, regulatory noise and rising input costs, the group is generating industry-leading margins and strong free cash flow, which in turn underpins its ability to return capital while still funding growth.

The near-term story may lack obvious catalysts (guidance is pretty steady), and fare growth is normalising rather than accelerating, but that is precisely what makes the story resilient. Ryanair does not need a booming macro or a pricing spike to deliver; it needs volume, aircraft, and discipline.

As long as management continues to execute on those fronts, incremental beats will keep appearing, even if they are accompanied by characteristically cautious outlooks.

ID Logistics (IDL France): scale keeps compounding as growth visibility extends into 2026

ID Logistics closed 2025 with another quarter that underlines just how resilient and structurally attractive its growth potential has become.

Q4 revenues came in modestly ahead of market expectations, but organic growth remains firmly in the mid-teens despite currency headwinds and a tough comparative base. France, often seen as the more mature leg of the story, continues to deliver steady growth as contracts signed in prior years ramp up and consumer demand proves more resilient than feared. More importantly, international operations once again did the heavy lifting, reinforcing the group’s positioning as a genuinely global contract logistics platform rather than a domestically anchored player with bolt-on exposure abroad. The operational momentum is strong enough to absorb FX impoacts without disrupting the broader trajectory.

Regionally, the picture remains encouraging and well balanced. Europe excluding France continues to compound nicely, driven by large, sticky customers in e-commerce and retail logistics, with the UK, Spain and Germany all contributing meaningfully. The repeated success with global accounts such as Amazon is particularly telling, as it highlights ID Logistics’ ability to execute complex, multi-country rollouts at scale, something that remains a real barrier to entry in the sector. North America is arguably the most exciting part of the story, with growth well ahead of group average as US commercial traction accelerates and Canadian operations ramp up. This business is clearly past the proof-of-concept stage and moving into a phase where scale effects and network density should increasingly work in its favour. Elsewhere, performance is more mixed, but even there the underlying organic trends remain positive once volatile currencies are stripped out.

Visibility into 2026 remains unusually good for a contract logistics operator. Management continues to point to a healthy pipeline of new site openings, with a high number of contract start-ups already identified for the coming year. This supports the assumption that organic growth can remain comfortably above 10%, even without any heroic macro assumptions. At the same time, the margin narrative is slowly but steadily improving.

As is typical for ID Logistics, new contract wins are initially dilutive, but as volumes ramp and operational efficiency improves, incremental margin should start to emerge. Management has been clear that margin expansion will be gradual rather than dramatic, but the direction of travel is firmly positive. In that context, 2025 looks very much like a consolidation year in margin terms, setting the base for progressive leverage from 2026 onwards.

Taken together, the investment case remains intact and, if anything, increasingly de-risked. ID Logistics continues to combine rare attributes in the sector: sustained double-digit organic growth, strong customer retention, disciplined capital allocation and improving profitability over time. The business is not dependent on a cyclical rebound or a sudden inflection in consumption; it is driven by structural outsourcing trends, the complexity of modern supply chains and the ability to execute at scale across geographies.

MBB (MBB Germany): a compounder flexing its earnings power

MBB’s revenues rose by roughly 10% to about €1.17bn, broadly in line with the company’s own guidance range, but the real surprise was profitability. Adjusted EBITDA margins expanded to 18%, comfortably above the 15–17% range previously communicated by management and well ahead of what most observers had pencilled in. That margin outcome is not the result of accounting noise or one-off portfolio effects, but reflects a very strong finish to the year across several core subsidiaries. Q4 clearly mattered, with project execution, operating leverage and cost discipline all coming together at the same time.

For a holding company structure like MBB, this kind of broad-based operational delivery is exactly what you want to see: not one hero asset masking weakness elsewhere, but multiple businesses pulling in the same direction.

Friedrich Vorwerk once again stood out as the main earnings engine, and its 2025 performance exceeded even its own recently updated targets. Revenues came in above €700m, well ahead of the previously guided €650–680m range, while EBITDA margins reached just over 23%, surpassing the 20–22% margin ambition. This was driven by a combination of favorable weather conditions, timely project completions and strong contributions from joint ventures, all of which amplified profitability in the final quarter. Importantly, this suggests that the earnings profile is not purely volume-driven but benefits meaningfully from execution quality and operating leverage when conditions align. Aumann, by contrast, illustrates the other side of the MBB playbook: revenues declined materially year-on-year as end-markets remained challenging, yet margins improved to around 14%, some 250bp higher than in 2024. That margin resilience, achieved through tighter cost control, structural optimisation and better project completion dynamics in Q4, reinforces the idea that MBB’s portfolio companies are being managed for returns, not just for growth optics. Delignit also contributed positively, rounding out a picture of portfolio-wide improvement rather than isolated strength.

Net liquidity increased sharply over the course of 2025 to roughly €760m by year-end, far above prior expectations and giving MBB significant strategic flexibility. This cash generation is a direct consequence of the earnings uplift, but it also reflects disciplined capital allocation and a reluctance to chase growth for its own sake. Management has historically been clear that excess liquidity is there to be deployed opportunistically, whether through selective acquisitions, organic investment at subsidiary level, or shareholder-friendly measures when appropriate.

Against that backdrop, the fact that profitability came in above guidance while revenue merely met expectations is arguably the best possible combination: it signals conservative planning, upside surprise on execution, and room to maneuver going forward. With key subsidiaries demonstrating both earnings power and resilience, and with liquidity building, MBB enters the next phase of its development from a position of strength.

This remains a holding company steadily compounding value as operational discipline translates into structurally higher margins and optionality for the years ahead.

SFS (SFS Switzerland): edging back toward margin normality

SFS delivered a better-than-expected second half in 2025, and while this was not a dramatic inflection, it does reinforce the sense that the worst of the earnings compression is now behind.

Organic sales growth in H2 came in stronger than anticipated by the market, driven primarily by Distribution & Logistics and Engineered Components, both of which benefited from steadier end-market demand and a gradual normalisation of customer ordering behavior. Distribution & Logistics grew organically at a mid-single-digit pace, reflecting resilience across industrial and MRO channels, while Engineered Components surprised on the upside with organic growth north of 6%, supported by customer-specific programs and better capacity utilisation. Fastening Systems, still more exposed to construction-related demand, remained the laggard with slightly negative growth, but importantly did not deteriorate further. That mix matters, because SFS’s earnings power is highly sensitive to volume and mix, and the improvement in the higher-quality segments sets the stage for margin recovery even before any explicit cost actions are taken.

While the company has not yet disclosed segment-level profitability, the group-level implications are fairly clear. SFS historically exhibits strong operating leverage once volumes stabilise, and with H2 sales momentum better than feared, adjusted EBIT margins in 2025 should at least have matched, and likely edged above, the prior year’s level. Management has already flagged a performance improvement program, including restructuring measures with one-off costs largely front-loaded, but with cash outflows limited relative to the headline charges. Against an estimated starting margin just below 12% in 2025, even a partial realisation of planned savings in 2026 would be enough to bring the group back into its long-standing 12–15% adjusted EBIT margin target. That target is company-stated and has been part of SFS’s strategic framework for years, lending credibility to the idea that the current margin level is cyclical instead of structural.

Importantly, management has also indicated that portfolio fine-tuning will continue, with lower-margin revenues gradually phased out over the coming years. This may weigh slightly on reported sales growth, but it should mechanically improve margin quality and capital efficiency, which is ultimately the more relevant variable for SFS’s equity story.

Looking into 2026, sales growth is unlikely to be the headline, particularly as Fastening Systems awaits a clearer recovery in construction activity, but modest organic expansion combined with cost discipline and mix improvement should be enough to drive further earnings progression. There is also optionality from the macro side: SFS has meaningful exposure to Germany, and any incremental benefit from fiscal stimulus or infrastructure-related spending would most likely show up in volumes from the second half of the year onwards rather than immediately.

The more important point is that SFS appears on track to re-enter its targeted margin range without heroic assumptions, relying instead on operating leverage, self-help measures and portfolio discipline. After a period where margins drifted below what long-term shareholders had come to expect, the business is reasserting its underlying earnings power.

If you appreciate this post, feel free to share and subscribe below!