AI, paint and shoes

AkzoNobel, Adidas, Swatch Group, Scatec, SAP, 2CRSI, Julius Baer, ATOSS Software, Ermenegildo Zegna, Norma Group, Rémy Cointreau

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

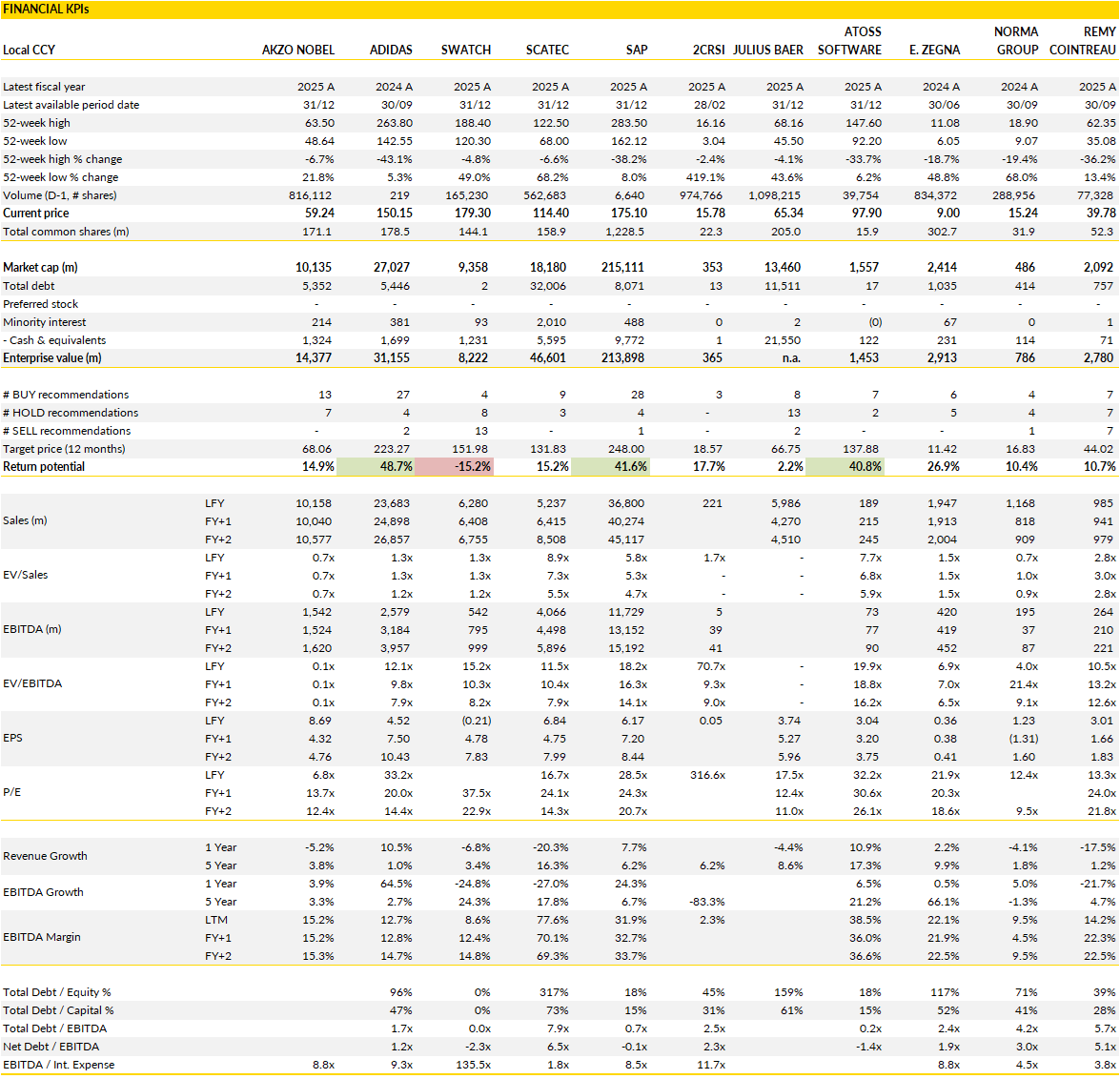

Financial KPIs

AkzoNobel (AKZA Netherlands): still no improvements in sight

AkzoNobel’s fourth quarter confirms that end markets remain difficult, with little sign of volume recovery heading into 2026. Group revenues in Q4 came in at €2.37bn, with volumes down 2% year on year and price/mix up 1%, while FX remained a heavy drag. Adjusted EBITDA reached €309m, slightly below market expectations. Both Decorative Paints and Performance Coatings posted negative volumes. Pricing held up better in Coatings, but not enough to offset weak demand. For the full year, adjusted EBITDA reached €1.44bn, slightly below the level previously indicated by the company, reinforcing the sense that 2025 ended with pressure still firmly in place rather than easing.

At divisional level, the picture remains not that much reassuring. Decorative Paints saw organic sales decline in Q4, with improvement in China offset by softer trends in Latin America and parts of Southern Europe. Even so, margins in the division improved to 13.5% in the quarter and reached 15.8% for the full year, helped by cost control and some gross margin recovery despite currency pressure. Performance Coatings continued to struggle more visibly. Organic sales fell again in Q4 as North American markets stayed weak, and adjusted EBITDA dropped to €190m from €230m a year earlier, with margins declining to 13.1%. Lower volumes and weaker gross margin more than offset savings, underlining how sensitive this division remains to demand. The sale of the India business closed in December and reduced adjusted net debt, leaving leverage at around 2x, which does improve balance sheet flexibility going into 2026.

Management continues to strike a cautious tone. Akzo does not expect any material improvement in market conditions this year, with volumes seen as flat overall, a weaker first half and some easing of comparisons later in the year. The focus therefore stays firmly on internal levers, with a €100m adjusted EBITDA improvement targeted in constant currencies, driven by efficiency measures rather than demand recovery. Adjusted EBITDA is targeted at above €1.47bn, a lowish hurdle it seems.

Working capital discipline has been tightened further, and attention is increasingly shifting to the planned combination with Axalta, which remains the main strategic variable in the story. With end markets still soft, long synergy timelines and the risk of shareholder pushback, that transaction is likely to dominate the narrative.

Adidas (ADS Germany): momentum is real, but 2026 expectations will need careful framing

Despite what the share price seems to reflecting, Adidas has moved into 2026 with the kind of (brand) momentum it hasn’t enjoyed in years.

The Q4 prelims were broadly in line with what the market expected, but the underlying quality of the quarter was solid. The adidas brand grew 11 percent on a currency‑neutral basis despite a very tough comparison, and even including the last pieces of Yeezy, growth held at 10 percent. Gross margin moved up again, helped by cleaner inventory and a healthier mix, and operating profit more than doubled versus last year’s Q4. Full‑year EBIT landed above guidance with an 8.3% margin, which is a meaningful step forward given where the company was eighteen months ago. The decision to launch a €1bn buyback shows the strength of the balance sheet; cash generation is improving and management feels confident enough to return capital while still investing in the brand.

The attention now shifts to the 2026 outlook coming in early March. Expectations are high, but the company may choose to guide more cautiously than its long‑term ambitions suggest. Adidas has been clear about wanting to return to double‑digit revenue growth and a 10% EBIT margin, but the first iteration of guidance may sit a little below that, especially on the top line. High single‑digit revenue growth and a 9 to 10% margin would still represent progress, just not the kind of breakout guidance some investors might hope for after a strong 2025 exit.

That doesn’t change the underlying trajectory, but it does mean the initial reaction could hinge on how conservative management decides to be. The buyback announcement helps soften that, signaling confidence in the medium‑term path even if the near‑term guide is framed more cautiously.

Overall, the setup for the stock remains interesting. The brand is clearly regaining relevance, the product pipeline looks healthier and the margin structure is moving in the right direction. The valuation is still depressed relative to history, with forward multiples sitting at levels the company hasn’t seen in over a decade. If the March outlook confirms that the margin rebuild is intact and that revenue growth can stay in the high single digits or better, sentiment should continue to improve.

Adidas doesn’t need to promise a perfect 2026; it just needs to show that the recovery is durable and continued operational discipline. If that holds, the stock has room to re‑rate as confidence returns.

Swatch Group (UHR Switzerland): volumes are stabilising, but margins remain the weak link

Swatch ended 2025 with a visible recovery in activity, particularly in the second half, but profitability remains stuck at a very low level.

Revenues in H2 grew close to 5% in constant currencies, a clear improvement after a sharp decline in the first half, and growth outside Greater China ran above 8%, with China turning positive again in the fourth quarter. This puts Swatch broadly in line with what has been seen at other watchmakers. The problem is that none of this showed up in margins. Operating margin in H2 stayed around 2%, unchanged from H1, despite higher volumes. Management points to its decision to keep production capacity intact and absorb under-utilisation costs. Whatever the rationale, the outcome is straightforward: the group delivered better sales without operating leverage.

That choice also shows up in cash. Swatch remains net cash positive, but net cash declined from CHF 1.38bn a year ago to CHF 1.20bn at year-end, highlighting the cost of maintaining excess capacity through the downturn. Full-year EBIT came in at CHF 135m on sales of CHF 6.28bn, well below what this revenue base would normally support. At this stage, the issue is no longer demand alone. Volumes are recovering, but the business is not converting that recovery into acceptable profitability. Compared with peers, Swatch remains more exposed to volume swings and requires a higher level of activity to unlock margin recovery.

For this year, management remains confident, pointing to continued momentum into January and a sharp reduction in production losses as volumes recover. Margins should improve mechanically from the extremely low level seen in 2025, but the scale of that improvement is still uncertain. Even a move to mid-single-digit margins would already imply a large step up year on year. Foreign exchange remains an additional headwind at the reported level, which limits visibility on how much of the underlying recovery will translate into earnings.

Swatch has a history of optimistic outlooks being met with slower-than-expected margin recovery. Until there is clearer evidence that higher volumes can deliver sustained operating leverage, the investment case remains about improving sales with (unresolved) profitability risk.

Scatec (SCATC Norway): operational resilience holds up, even as financial noise clouds the headline

Scatec’s 2025 numbers came in a bit softer than the market hoped, but the underlying operations told a steadier story than what the IFRS lines suggested.

Revenue and EBITDA landed below market expectations largely because of divestments and the ongoing drag from Ukraine, where a damaged plant and reduced payment levels continue to weigh. Strip out those factors and the core business held up reasonably well. Power production grew on an adjusted basis (helped by Grootfontein and Mmadinare), and PP revenues were broadly stable. D&C margins were actually stronger than expected, which points to solid project execution even in a year marked by portfolio reshuffling. Net profit was lower year‑on‑year, but again the gap was driven more by financial headwinds than by any deterioration in the company’s core operations. It wasn’t a clean quarter, but it wasn’t a weak one either; the noise simply drowned out the operational progress.

The 2026 guidance helps reset the focus. Management is pointing to Power Production EBITDA of NOK 3.8–4.1bn, which lines up well with where the market already sits. The message is that 2026 will be a more normalised year, with several 2025 tailwinds fading but new assets stepping in to fill the gap. Ukraine will contribute less, retroactive tariff adjustments won’t repeat, and hydrology in the Philippines and Laos is expected to be softer.

Against that, Scatec has a pipeline of assets coming online, including Obelisk, Mmadinare and Mogobe BESS, which should support a stable earnings base. The guidance doesn’t promise acceleration, but it does reinforce that the core PP business remains predictable and that the company has good visibility on the year ahead.

Looking further out, the investment case still leans on Scatec’s ability to compound through contracted assets while layering in growth from new geographies and technologies. The recent awards in Egypt and Tunisia add optionality that isn’t yet reflected in estimates, and the valuation remains undemanding relative to the sector. Even after a strong run in the share price, the stock still trades at a meaningful discount to peers on forward EBITDA, which leaves room for re‑rating if execution stays consistent and the project pipeline continues to convert.

The near‑term numbers may have been muddied by divestments and Ukraine, but the operational base is intact, and the 2026 outlook suggests a steadier year ahead.

SAP (SAP Germany): cloud nerves hit sentiment, but the long‑term story hasn’t changed

SAP’s Q4 sparked a lot of debate, mostly around the slowdown in Current Cloud Backlog growth. The company ended the year at 25% growth in constant currency, a few points below where investors hoped it would land and a bigger step down from 2024 than management had guided to.

That’s not ideal, but the context matters. The macro backdrop has been choppy for months, and SAP was already behind on this metric mid‑year. Q4 was also skewed toward large deals, which tend to slip and often ramp gradually, meaning only part of the contract value shows up in the 12‑month backlog. None of this points to a structural issue with cloud demand or with SAP’s AI positioning. It’s more a function of timing, deal mix and a tougher environment for big enterprise commitments. The market’s reaction, however, was far harsher than the fundamentals justify.

The softer CCB print naturally feeds into a more cautious cloud revenue guide for 2026, with SAP pointing to 23 to 25% growth. Given the company’s recent track record of landing close to its initial guidance rather than beating it, investors were hoping for a cleaner signal. Add in a small dip in gross margin outside the cloud businesses and a lower Net Promoter Score tied to forced migrations and price increases, and the narrative quickly turned negative.

But none of these points suggest a break in the cloud transition or a deterioration in competitive positioning. Cloud margins actually improved, the NPS drop is unsurprising given the scale of the ECC migration push, and switching ERP systems remains so complex that short‑term sentiment rarely translates into meaningful churn.

The sell‑off says more about the market’s current mood toward software than about SAP’s fundamentals.

As a consequence, setup looks more attractive than the share price implies. Even if consensus trims cloud and software growth by half a point, the impact should be offset by better margin guidance and a lower tax rate. Internal estimates are moving up, not down, with operating profit, EPS and free cash flow all nudged higher for 2026.

The stock now trades at a multiple below where it sat after the 2020 warning, when SAP was guiding to several years of low single‑digit growth. Today the company is growing cloud revenue in the mid‑20s, expanding margins and sitting on a far stronger strategic footing.

Timing the sentiment turn is always tricky, but from a long‑term perspective the current valuation looks disconnected from the fundamentals. The cloud transition is intact, the margin story is improving and the long‑term opportunity remains compelling.

2CRSI (AL2SI France): still an undiscovered AI play

2CRSI delivered an exceptional first half, with revenues exceeding €198m in H1 2025–26, compared with just €20.9m a year earlier.

That step-up reflects both strong demand from HPC and AI customers and the company’s ability to execute on large contracts that have moved quickly from signing to delivery. Activity has been driven mainly by AI-oriented server platforms, with the Godi range still accounting for a large share of volumes.

This is no longer a case of pipeline promise. Hardware has been shipped, revenue has been booked, and scale has arrived much faster than most expected. The balance sheet also shows early signs of improvement, with gross cash rising to €9m at the end of December from close to zero mid-year, suggesting that profitability in the first half has already moved above last year’s full-year level.

The more interesting part now shifts from growth to quality. Management has been clear that margins should improve as volumes ramp, helped by a more normal pricing environment and better absorption of fixed costs. That is an important change in tone after a period where growth came at the expense of profitability, driven by heavy discounts and a mix skewed toward lower-margin systems.

The company has also indicated growing confidence in its margin profile for the full year, which will be a key point to scrutinise when full H1 results are released. Given the scale of activity on AI servers, which tend to be more competitive and capital-intensive, the ability to sustain margin improvement will determine how durable this growth really is. The backlog, particularly in the US, remains strong, and the ongoing delivery of large contracts, including a sizeable US-based project scheduled for completion by mid-year, provides visibility on continued high activity levels.

The environment remains supportive, with AI infrastructure spending still expanding and several large-scale projects moving from concept to execution. 2CRSI is positioning itself as a specialist supplier able to deliver customised, energy-efficient systems at scale, which resonates with customers building dedicated AI and HPC capacity. That positioning has already translated into tangible revenue growth, and the next phase is about proving that profitability can follow.

The company is entering this phase with momentum, a fuller order book, and improving financial flexibility. If margins do begin to normalise alongside sustained volumes, 2CRSI would start to be viewed as a scaled industrial player in a structurally growing market. The next set of results will therefore be about validating the earnings profile.

Julius Baer (BAER Switzerland): stable inflows, cleaner earnings, capital strength back in focus

Julius Baer closed 2025 with asset gathering and balance sheet trends broadly in line with what the business has delivered over the past two years, but with a cleaner earnings profile than many had expected.

Assets under management ended the year at CHF 521bn, up 4.7% year on year and essentially unchanged from the level reported after October. Net new money reached CHF 14.4bn for the year, including CHF 6.5bn in the second half, equivalent to 2.9% of starting AuM. Inflows were positive across all strategic regions, with Asia again standing out, alongside Western Europe and the Middle East.

This is not an acceleration story, but it does confirm that the franchise continues to attract net inflows despite a competitive environment and lingering reputational noise from past credit issues. The underlying message is one of stability rather than momentum, which is an important distinction at this stage of the cycle.

On the income statement, the quality of earnings improved. Adjusted revenues came in at CHF 3.86bn, flat year on year on a reported basis, but up 5.5% once credit losses and recoveries are stripped out. Credit recoveries of around CHF 66m provided a tailwind, but even excluding those, underlying margins were broadly stable at 82bp, compared with 83bp the year before. Recurring commission margins held steady, suggesting no structural erosion in pricing. Costs were better controlled than expected, with adjusted expenses of CHF 2.81bn translating into a cost/income ratio of 67.6%, down from 70.9% in 2024, despite currency headwinds from the stronger Swiss franc. Adjusted net profit reached CHF 878m, while underlying net profit was CHF 1.05bn, broadly flat year on year once a prior tax benefit is excluded. The key takeaway is that earnings volatility linked to the credit book has largely faded, allowing the core wealth management engine to show through more clearly.

Capital strength is again becoming a more visible part of the story. The CET1 ratio rose to 17.4% at year-end, supported by lower-than-expected risk-weighted assets, and comfortably above management’s operating range. The dividend was kept flat at CHF 2.60 per share, reflecting a cautious stance while discussions with the regulator continue. No formal announcement was made on share buybacks, but capital levels leave room for renewed distributions once regulatory clearance is obtained.

Strategically, Julius Baer appears to be moving into a more normalised phase, with fewer legacy distractions, a stable inflow profile and a cost base that is finally showing some leverage. The remaining question is pace rather than direction. Net new money growth is steady but not accelerating, and management has flagged that investments and restructuring costs could temporarily lift the cost/income ratio before savings emerge later in the plan.

Even so, the business now looks more predictable, better capitalised and less exposed to negative surprises than it did a year ago, which shifts the debate away from repair and back toward execution.

ATOSS Software (AOF Germany): cloud momentum is firm, margins remain the anchor

ATOSS closed the year with a strong fourth quarter, driven by continued traction in cloud subscriptions and steady execution across the business. Q4 revenues reached €49.9m, up 12% year on year, with software revenues rising to €37.5m. The cloud and subscription component stood out, growing 28% to ~€25m, while maintenance revenues held broadly stable at €9.6m. As expected, license revenues continued to decline to €2.7m as the business moves further away from upfront models. Consulting activity remained solid at ~€10m, showing that customer engagement levels stayed healthy, while hardware sales softened in a more cautious investment environment.

Recurring revenues continued to build, with cloud ARR reaching €101m and cloud backlog rising to €109m by year-end, both up more than a quarter year on year. Demand improved notably in the second half compared with the first, suggesting that customer decision-making normalised as the year progressed.

Profitability once again did much of the talking. EBIT reached €20.0m in the quarter, translating into a margin of 40%, well above the full-year average and confirming the operating leverage embedded in the model. This was driven by the growing weight of cloud revenues and tight cost control rather than one-off effects. The cloud transition continues to scale cleanly, with incremental revenues dropping through at a high margin once implementation capacity is in place. That dynamic allowed ATOSS to deliver a clear step-up in earnings in Q4 without any visible strain on the organisation.

Overall, the result reinforces the company’s reputation as one of the most consistently profitable software businesses in the DACH region, even while undergoing a structural shift in its revenue mix.

ATOSS enters the new financial year with good visibility from its recurring base, a growing cloud backlog and demand that appears broadly in line with last year’s levels. The strategic direction is unchanged, with subscriptions continuing to replace licenses and cloud revenues taking an ever larger share of the mix.

The main question for investors is not demand, but how much further margins can run from here as cloud penetration increases. After a quarter like Q4, expectations naturally rise, yet management has historically preferred to guide conservatively and let execution do the work.

Ermenegildo Zegna (ZGN US): brand momentum is improving, margins still constrained by mix and FX

Zegna closed 2025 with a fourth quarter that confirmed a clear improvement in underlying momentum, driven by its core brand.

Group revenues reached €1.92bn for the year, with Q4 sales of €591m, broadly in line with expectations. The more relevant signal came from organic growth at the Zegna brand, which accelerated to 7.4% in Q4 from 5.6% in Q3 and 2.6% in the first half. Retail continued to do most of the work, with direct-to-consumer growth running above 10% in the quarter. This reflects the ongoing repositioning of Zegna toward the very top end of the market, where demand has held up better. The US and the Middle East remain the strongest regions, while Europe is starting to contribute more consistently. Greater China remains the weak spot, with sales to Chinese customers still down close to 5% in Q4, although trends improved sequentially.

At group level, the picture is more mixed. Tom Ford Fashion saw a clear slowdown in retail growth compared with the previous quarter, and wholesale remained a drag across all brands, with total wholesale sales down double digits in Q4. As a result, total organic growth for the group was limited to 4.6% in the quarter, despite the strength of the main brand.

Still, the direction of travel is improving. Group organic growth moved from a decline in the first half to mid-single-digit growth by year-end, which supports the idea that the worst of the demand slowdown is over. Foreign exchange continued to weigh heavily on reported numbers, with a negative impact of more than 4% in Q4, leaving reported growth close to flat. This FX pressure is also the main reason margins remain under strain despite better operating momentum.

Looking into 2026, management is stricking a balanced tone. Early trading in January was described as broadly in line with Q4 outside China, which is encouraging given the recent improvement in the US. China remains difficult to read due to calendar effects, although Hong Kong trends have improved. The group expects wholesale to continue shrinking this year, particularly at Thom Browne and Tom Ford, which keeps the focus firmly on retail execution. At the same time, currency effects are expected to limit margin progression in the near term, even if volumes improve.

Overall, the investment case continues to rest on the same pillars. Zegna as a brand is gaining traction in the high-end segment, with retail momentum clearly accelerating. Tom Ford and Thom Browne remain more work-in-progress stories, with room to improve but still weighing on the overall mix. The result is a group that is showing better top-line quality quarter after quarter, while profitability remains a lagging indicator rather than a driver of the story.

Norma Group (NOEJ Germany): balance sheet reset completed, operating story still unclear

Norma has now closed the sale of its Water Management business to ADS, removing the largest strategic uncertainty around the group and materially reshaping the balance sheet.

The transaction implies an enterprise value of around €850m and results in net cash proceeds of roughly €650m for Norma after deductions. Management has laid out a clear use of funds. Around €300m will be applied to debt reduction, while about €70m will be retained to support the remaining core operations. This leaves the group close to net cash and with ample liquidity.

In parallel, Norma confirmed shareholder returns of up to €260m, broadly in line with earlier communication. This will be executed through a combination of share buybacks under the existing 10% authorisation and a planned capital reduction via share redemption, subject to AGM approval. From a capital structure perspective, the transaction does exactly what it was meant to do: it simplifies the group and restores financial flexibility.

Alongside the disposal update, the company also disclosed a sizeable non-cash impairment under German accounting standards. The write-down amounts to around €102m and relates to investments in certain EMEA entities, mainly in Germany, following revised revenue assumptions for the period from 2028 to 2030. Management stressed that this impairment has no impact on IFRS operating EBIT, cash flow or the planned return of capital.

FY 2025 IFRS guidance was reiterated, with group sales targeted between €810m and €830m and an adjusted EBIT margin of 0–1%. While the accounting distinction is important, the impairment still serves as a reminder that the underlying outlook for parts of the remaining business remains challenging, particularly in Europe. The reset of expectations at the statutory level highlights the distance still to travel before the core operations regain a more robust earnings profile.

With the Water Management sale now completed, attention shifts fully to execution in the continuing businesses. Visibility here remains limited. The restructuring program is still in its early stages, end markets remain difficult, and management has not yet provided guidance for 2026, with more detail expected only after the full-year results at the end of March.

The balance sheet is no longer the problem, and shareholder returns are clearly defined. The open question is whether the streamlined group can translate this cleaner setup into a sustainable recovery in profitability.

Until there is clearer evidence of improving operating performance and delivery against the restructuring plan, Norma is a company that has fixed its financial structure but is still searching for momentum in its core business.

Rémy Cointreau (RCO France): stabilisation is visible, but…

Rémy Cointreau’s latest update was received positively by the market, reflecting a sense that the worst of the volume downturn may be behind the group (or these might be the famous last words).

Q3 marked a return to growth across most divisions and regions, including China, where performance was close to flat when stripping out calendar effects linked to Chinese New Year. Management emphasised that trends have become more stable after a prolonged period of volatility. That said, the environment remains fragile. Demand is improving, but unevenly, and pricing pressure is still present in several categories. The message was not one of a clean recovery, but of a business that has stopped deteriorating and is trying to regain control of its operating trajectory.

Regionally, the picture is mixed but no longer uniformly negative. In China, cognac held up better than feared in a still difficult market, while the liqueurs and spirits division faced sharper pressure due to aggressive pricing by competitors. In the US, the group delivered a fourth consecutive quarter of positive organic growth, helped by easier comparisons and early signs of improving momentum. Within cognac, mix played a role, with higher-end brands, particularly Louis XIII, supporting performance. The Americas more broadly posted low- to mid-single-digit growth, with Latin America standing out as a clear bright spot, including very strong growth in cognac off a smaller base. Europe returned to mid-single-digit growth across both divisions, driven by market share gains in several countries, although the UK and Nordic markets softened again due to tougher comparisons.

Overall, Rémy continues to outperform its end markets, even if those markets remain subdued.

Since the arrival of the new CEO, management has been working on a revised strategic framework, with early indications pointing toward a more balanced approach between growth, margins and cash generation. There is a clear sense that the group is reassessing how aggressive it wants to be on operating margins, particularly given the volatility this has introduced into returns over recent years. Return on invested capital has fallen sharply, and improving cash conversion and balance sheet stability now appears to carry more weight than pushing margin percentages back to prior peaks. This shift may prove sensible over the medium term, but it also introduces uncertainty around the shape of the recovery.

Until there is clearer visibility on how margins, gross profit and capital intensity will be managed together, the investment case remains one of stabilisation. The tone has improved, demand is no longer collapsing, but the new equilibrium Rémy is aiming for has yet to be clearly achieved (and believed!)

If you appreciate this post, feel free to share and subscribe below!