AI, mining and skin creme

Stabilus, Steyr Motors, thyssenkrupp, thyssenkrupp Marine Systems, Wolters Kluwer, L’Oréal, Swiss Re, Derichebourg, Rio Tinto

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

If you want to make sure you always receive Lux Opes in your main inbox, please drag this email into your Primary tab or add this address to your contacts.

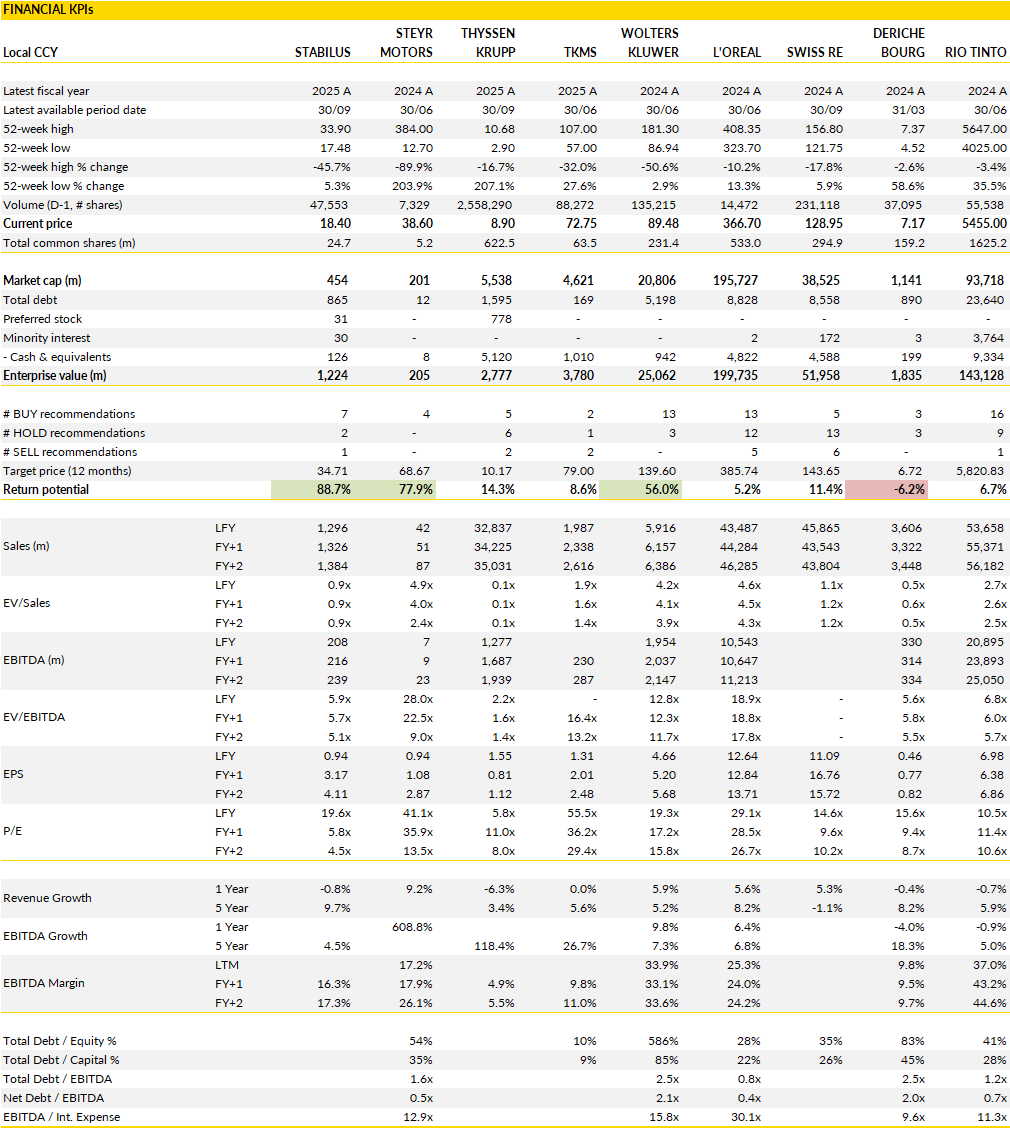

Financial KPIs

Stabilus (STM Germany): cautious guidance masks an undervalued recovery story

Stabilus wrapped up its fiscal year broadly as expected, with the final numbers offering few surprises beyond confirmation of what’s already known; a modest sales decline, a slimmer margin, and a much smaller dividend.

The more interesting part of the recent release was the new guidance for FY 2025–26, which landed at the cautious end of expectations. Management now sees revenue between €1.1–1.3 billion and an EBIT margin of 10–12%, a range that essentially repeats the current run rate rather than signaling a clear rebound. The guidance is another sign of the ongoing weakness in industrial and automotive markets. Stabilus remains focused on deleveraging (net debt to EBITDA at 3x and a target of below 2x within three years), managing costs, and preserving cash flow, which still looks solid at over €100 million pre-M&A.

That said, the business is steadier than the numbers suggest. Stabilus continues to operate in structurally attractive niches (motion control and mechatronic systems that power everything from car tailgates to industrial machinery) and its diversification across auto, industrial, and aftermarket channels provides balance in a choppy demand environment. The group is still digesting last year’s margin pressures, but the cost base is resetting, and energy and input prices have normalized.

More importantly, the product mix is tilting toward higher-value mechatronic applications, which over time should support both revenue growth and structural margin expansion. Management’s decision to underpromise on FY 2025–26 likely reflects both the uncertain macro backdrop and a desire to rebuild credibility before aiming higher again.

The market’s fatigue on Stabilus seems to have gone too far. The share price has been under steady pressure, trading well below historical valuation multiples and effectively pricing in a flat earnings profile indefinitely. Yet the balance sheet is improving, cash generation remains healthy, and the company’s exposure to automation and lightweighting trends in both vehicles and machinery is intact.

The FY 2025–26 outlook may lack sparkle, but the underlying setup looks like a base.

Steyr Motors (4X0 Germany): short-term turbulence in a long runway of growth

Steyr Motors’ recent profit warning was nothing more than a derailment.

The company pushed back two key defence and industrial projects (auxiliary power units for Hyundai Rotem’s K2 battle tank and large locomotive APUs for Siemens’ Vectron line) from 2025 to 2026, trimming near-term earnings but leaving the long-term thesis intact. The new guidance calls for more modest sales growth of 15–25% this year, down from an earlier target of at least 40%, with EBIT margins now expected in the 13–16% range rather than above 20%.

It’s a meaningful adjustment in optics, but fundamentally a timing issue: the order backlog of more than €300 million running through the decade tells a different story, one of strong structural demand and credible multi-year visibility, particularly as European defence and energy security priorities continue to shift.

This softer 2025 setup reflects the growing pains of a business scaling into a complex customer base. Steyr is ramping production capacity and adding headcount to meet a pipeline of large, technically demanding programs, the kind of work that inevitably comes with uneven delivery patterns. While that means margins will temporarily dip, it also shows the company investing ahead of a major growth phase.

Management reaffirmed its 2027 targets of €140 million in revenue and roughly €40 million in EBIT, an ambitious but believable goal given the mix of defence, rail, and marine applications where Steyr’s diesel-electric hybrid systems are increasingly the go-to solution. The company’s position as a single-source supplier to several OEMs offers both high customer stickiness and pricing leverage once production normalizes.

The bigger picture remains appealing: Steyr sits squarely in the slipstream of a European industrial and defence renaissance, supplying the silent power systems that make modern fleets more efficient and autonomous. A softer 2025 is a reminder of the project-driven volatility inherent in this niche, but not a reason to doubt the trajectory. The production ramp, capacity investments, and backlog visibility all point to significant operating leverage once the delayed projects convert to revenue.

With the shares still reflecting uncertainty rather than optionality, Steyr’s story continues to look interesting.

thyssenkrupp (TKA Germany): steady operational progress meets heavy restructuring headwinds

thyssenkrupp’s latest results show a group that is finally stabilising operationally but still fighting structural gravity.

Fiscal 2024–25 revenues were down modestly to €32.8 billion and adjusted EBIT up 13% to €640 million, helped by better execution in Steel Europe and Decarbon Technologies. Free cash flow improved markedly to €363 million, showing real traction on working capital discipline, while reported net income swung back into positive territory largely thanks to a non-cash revaluation of its TK Elevator stake.

It was, on paper, a “good” year: solid performance across most divisions, cash generation restored, and a modest dividend maintained. But behind those headline gains, the business still reads like a patchwork of cycles, legacy liabilities, and ongoing portfolio surgery.

The new 2025–26 guidance underlines that mix of progress and pain. thyssenkrupp expects flat to slightly higher sales, but adjusted EBIT between €500–900 million, softer than the market had hoped, and a heavy hit to reported earnings due to €600–700 million in restructuring costs tied mainly to the long-overdue overhaul of Steel Europe. The free cash flow guide, between -€600 and -€300 million, shows just how front-loaded those restructuring outflows will be.

The problem is not execution but momentum: even as the company’s operational measures are delivering, the macro environment (from weak steel pricing to muted industrial demand) leaves little room to offset the cost of transformation. It’s a frustratingly familiar thyssenkrupp pattern: doing the right things operationally, but in markets that refuse to cooperate.

Still, the long-term logic remains intact. Management is continuing to narrow the group’s focus, ringfencing the steel division for deeper restructuring, while letting faster-growing, capital-light businesses like Marine Systems and Decarbon Technologies take a bigger strategic role. The company now has a cleaner balance sheet, better internal discipline, and arguably the most realistic management team it’s had in years. But until the steel restructuring is fully digested, and external demand for core industrial products recovers, the story remains one of patience.

thyssenkrupp is no longer the chronic underperformer it once was, but it’s not yet a growth story either. It’s a company in transition; stable, solvent, and still searching for a narrative that isn’t just about fixing itself.

thyssenkrupp Marine Systems (TKMS Germany): solid year behind, but visibility still clouded ahead

TKMS wrapped up its fiscal year on a strong note, comfortably beating market expectations on profitability and cash flow, but left investors underwhelmed with a muted outlook for 2025–26.

Adjusted EBIT jumped 50% to €131 million, helped by a sharp improvement in submarine margins and a high-margin service mix, while free cash flow doubled to €784 million thanks to upfront payments on new contracts. The order backlog remains immense at €18 billion, providing multi-year visibility, and divisional performance was broadly encouraging; submarines were the clear star performer, surface vessels showed stable margins despite lower volume, and Atlas Elektronik held up despite cost pressures in its naval weapons work. TKMS is proving it can execute profitably in a complex business that has historically been prone to volatility.

Yet the new guidance poured a little cold water on that narrative. Management expects revenue to be roughly flat next year and EBIT to land between €100–150 million, a midpoint that sits below market expectations and signals another “transition year.” That cautious tone reflects both operational realities and project timing: the ramp-up of the Wismar facility continues to weigh on near-term earnings, while the next wave of major orders still needs to move from contract signing into production. The company’s capex of around €200 million remains focused on modernizing shipyards and scaling capacity, an essential investment but one that temporarily constrains margins.

On the brighter side, management confirmed a 30–50% dividend payout policy, marking a step toward normalizing shareholder returns, an important signal for a business that is maturing beyond its restructuring phase.

In many ways TKMS sits at an intersection, of promise and patience. Demand for naval systems and undersea platforms is expanding across Europe and Asia, and TKMS holds one of the strongest technological positions in the segment. The €18 billion backlog shows its strategic relevance, yet the pace of margin recovery remains gradual and visibility into new order conversion still uneven.

With the stock already pricing in a premium multiple to peers, investors may need to see firmer evidence of growth re-acceleration before re-rating the shares much further.

Wolters Kluwer (WKL Netherlands): AI as an accelerator, not a disruptor

Wolters Kluwer used its latest AI teach-in to remind investors that the company is not playing catch-up with artificial intelligence, it’s been living with it for years.

The event showcased how AI has already been embedded across products like UpToDate Expert AI in healthcare and CCH Axcess Expert AI in tax and accounting, both examples of where automation has become augmentation. In healthcare, UpToDate remains a trusted decision-support tool (roughly a tenth of group revenue) and early uptake of its new AI-enhanced version has been rapid: 80 enterprises have already signed up, including nearly a third of the top 100 customers.

More strikingly, over a third of all existing users have upgraded to the higher-priced Pro+ tier, where pricing carries a roughly 20% premium but is seen as justified by clear productivity and accuracy gains. For Wolters Kluwer, this kind of pricing power, supported by retention rates around 95%, is a powerful statement about the stickiness and perceived indispensability of its products.

What stood out in the presentations was the message that Wolters Kluwer’s moat is widening, not narrowing. Management was explicit that free, GenAI-driven challengers face structural barriers in trying to replicate what the company has built. Eighty percent of Wolters Kluwer’s revenue comes from enterprise contracts where data governance, compliance, and reliability matter far more than the “free” tag.

Its moat is less about technology and more about the integration of proprietary datasets, domain-specific algorithms, and long-standing relationships within highly regulated end markets. In that context, AI becomes a feature of the workflow, not a substitute for it. Investors worrying about disruption may underestimate how much these businesses benefit from conservatism: hospitals, law firms, and audit practices are not eager to experiment with unproven AI when errors can cost lives, licenses, or lawsuits.

The broader takeaway is that Wolters Kluwer is using AI to deepen its value proposition rather than dilute it. The company has invested more than €650 million into product development around AI, but the returns are showing up in higher pricing, improved productivity for clients, and a defensible premium brand. It’s a rare combination of technology leverage and customer lock-in, underpinned by recurring subscription revenue and disciplined execution.

As the narrative around AI swings between hype and disruption, Wolters Kluwer sits comfortably, monetising the technology through tangible client outcomes rather than marketing slogans.

L’Oréal (OR France): polishing the U.S. story, but valuation still a touch rich

L’Oréal’s latest Capital Markets Day in the U.S. was a confident showcase of scale, structure, and brand depth in its most important growth market, but it didn’t really change the broader narrative.

The group reiterated its view that the global beauty market should expand around 4% in Q4, with North America remaining the key swing factor for 2026. In the U.S., management pointed to clear signs of renewed momentum: make-up is rebounding, haircare is premiumising, and perfume demand remains strong, particularly among male consumers. L’Oréal’s U.S. business, now about 27% of total sales, has returned to steady mid-single-digit growth and continues to outperform a $79 billion market where its share is roughly double that of its nearest competitor. That dominance extends across all categories (luxury, professional, consumer, and dermatological) underpinned by a broad, multi-channel presence that spans prestige retailers to Walmart and TikTok.

The story the company wanted to tell was one of endurance. U.S. management emphasised that the group’s diversified model, 37 brands across every segment and price point, is ideally suited to a market that is both fragmented and increasingly digital. E-commerce now represents about a third of U.S. beauty sales, and L’Oréal’s pivot from laggard to leader has been striking: online now accounts for a quarter of its U.S. revenue, up from just 5% in 2015. That digital catch-up, combined with a disciplined product innovation engine, explains why L’Oréal continues to post growth rates above the market, even as category expansion slows.

The CMD also featured a strategic reminder that the group still has tools for optionality, notably the increased stake in Galderma, which hints at ambitions beyond traditional beauty and deeper into skin health.

Still, despite the upbeat tone and operational excellence, the debate around the stock hasn’t changed much. L’Oréal trades at a premium multiple that already bakes in flawless execution, while organic growth near 5% and a 4% market backdrop leave little room for upside surprise.

The question investors keep circling is whether the company plans to remain the steady compounder of old, or evolve into a more aggressive consolidator of beauty’s “new frontiers.” For now, management seems content to let consistency do the talking, and that’s rarely a bad strategy.

Swiss Re (SREN Switzerland): conservatism returns as growth takes a back seat

Swiss Re’s 2026 outlook landed softer than investors had hoped, with guidance signaling a more cautious stance amid a gradually softening reinsurance cycle.

Management now expects net profit of around $4.5 billion next year, up only marginally from 2025 and roughly 6% below consensus. The combined ratio targets remain disciplined at under 85% for P&C and below 91% for Corporate Solutions, but the real message lies elsewhere: Swiss Re appears to be prioritising balance sheet resilience over earnings growth. The decision to restart share buybacks at just $500 million, half of what the market had anticipated, reinforces that prudence. This suggests the group is keeping dry powder for potential M&A or opportunistic reinsurance capacity expansions, rather than stretching capital returns.

Behind the cautious tone is a shift back toward cycle management. Swiss Re is clearly choosing to bolster reserves and maintain flexibility in a market that has started to ease after two years of pricing strength. That trade-off, between near-term profitability and long-term balance sheet robustness, may frustrate investors looking for acceleration, but it fits the company’s historical playbook.

Meanwhile, the Life & Health review is nearing completion, with a few underperforming blocks in Australia, Israel, and South Korea being curtailed or placed in run-off. These adjustments will carry a modest near-term hit to profits but should clear the decks heading into 2026. Management’s cost-cutting programme, targeting $300 million in savings through 2027, remains on track, and the integration of AI into underwriting and back-office functions is starting to deliver tangible productivity benefits.

In essence, Swiss Re is using its current position of strength to double down on stability. The company’s cautious capital management, high-quality underwriting, and ongoing efficiency efforts are all sound, but they leave little in the way of immediate catalysts.

With excess capital now being managed more structurally and profit growth likely to remain modest, the investment case hinges on the next hardening phase of the reinsurance cycle.

Derichebourg (DBG France): steady hands through the metal market malaise

Derichebourg closed its fiscal year with results that outperformed expectations despite an unhelpful macro backdrop.

Revenue slipped 7.5% to just over €3.3 billion, reflecting weaker scrap and non-ferrous metal prices, but cost discipline and operational execution kept EBITDA almost flat year-on-year at €319 million, comfortably above guidance.

The numbers mask a tale of two halves: a solid first six months supported by relatively resilient industrial activity, followed by a steeper slowdown in the second half as steelmaking demand softened and energy costs weighed on production in Europe. Management also benefited from a stronger contribution from its stake in Elior, which boosted net income more than 60% year-on-year. It was a year that showed how a cyclical business can still defend profitability when discipline trumps growth.

The tone for 2026 is pragmatic. Management sees the worst of the price and volume contraction as behind them but is not ready to declare a rebound. Volumes in both scrap and non-ferrous metal recycling appear to have bottomed, though visibility remains low and pricing power is still thin. The European market is entering a transition period: energy costs are easing, Chinese exports are being tempered by higher import tariffs and quota restrictions starting mid-2026, and the new carbon border adjustment mechanism (CBAM) should gradually support local recyclers by penalising more carbon-intensive imports.

For now, these tailwinds will take time to filter through, so Derichebourg’s near-term guidance for flat revenues and only a marginal improvement in EBITDA looks deliberately cautious.

In the bigger picture, Derichebourg remains a play on cyclical normalisation. Its balance sheet is sound, and management’s cost focus continues to anchor margins, but visibility across its end markets (steel, automotive, and construction) is still patchy.

The valuation is modest compared to history, yet without a clear volume recovery or price upturn, that alone isn’t enough to re-rate the stock. For now, the company feels like it’s in holding mode: waiting for the metal cycle to turn while keeping operations lean and capital discipline intact.

Rio Tinto (RIO UK): sharpening the portfolio while riding the metals cycle

Rio Tinto’s latest Capital Markets Day had a clear message: less clutter, more efficiency. Management laid out a plan to trim $5–10 billion of non-core assets and cut unit costs by around 4% by 2030, signaling a renewed focus on discipline after a few years of heavy capital spending and operational noise.

The divestment list reads like a tidy-up of the empire: titanium dioxide, borates, and selected infrastructure assets are under review, while the group is taking a harder look at underperformers such as the Canadian iron ore venture IOC and parts of its aluminum footprint in Australasia. The intent is unmistakable: streamline the asset base, reallocate capital toward higher-margin, lower-emission metals, and stay predictable on shareholder returns. That last point matters; Rio knows investors prefer steady dividends and buybacks over big-ticket M&A, and the CMD made clear that management is listening.

Production guidance for 2026 was a bit softer than hoped, but hardly alarming. Lower copper grades at Escondida and technical hiccups at Kennecott will temporarily weigh on output, while aluminum volumes will hold steady despite the ramp-up of the AP60 smelter in Canada. Yet 2025 has already come in stronger than forecast, and Rio isn’t alone in facing these constraints, the whole industry is contending with ageing assets and tighter safety rules.

The bigger takeaway is that Rio’s medium-term growth pipeline still stacks up well. The ramp-up of Oyu Tolgoi in Mongolia, the long-awaited start of Simandou in Guinea, and new lithium developments give the company a portfolio that feels both forward-looking and well balanced between growth and cash generation.

The overall tone of the CMD was pragmatic and confident. Rio Tinto is not promising flashy growth, but a cleaner, more focused, and cost-competitive portfolio that can compound value through the metals cycle.

The group’s valuation remains undemanding relative to history and peers, and its exposure to copper, iron ore, aluminum, and lithium puts it squarely in the slipstream of the energy transition. If the mining sector is entering a phase where capital discipline once again trumps expansion, Rio looks among the best positioned to deliver.

If you appreciate this post, feel free to share and subscribe below!