Advertising, insurance and legal battles

Brenntag, Munich Re, Patrizia, LISI, Ströer, Knaus Tabbert, SAF-Holland, Swiss Life, Infineon Technologies, Bayer, Jungheinrich, FACC

At Lux Opes, we break down the latest company news into quick takes that get straight to the point - what happened, why it matters, and what to watch next.

We publish 2-4 times per week, depending on the news flow.

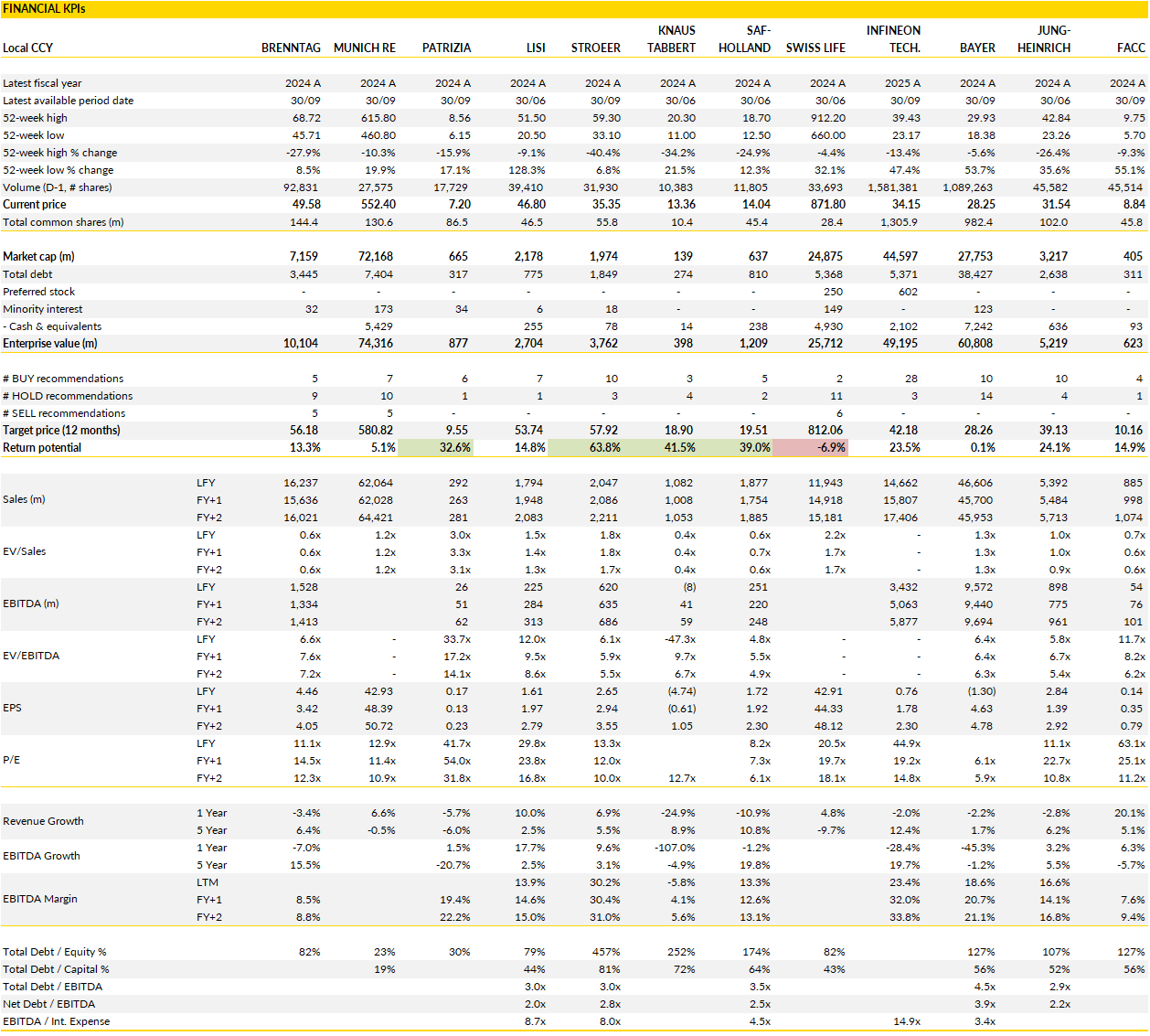

Financial KPIs

Brenntag (BNR Germany): cost discipline steadies the ship as strategic reset begins

A familiar mix of soft top-line trends offset by execution on costs over at Brenntag, a pattern that’s becoming the hallmark of this cycle.

Operating EBITA came in at €243 million, a touch above market expectations, helped by rigorous expense control and a less severe downturn in the Essentials business than feared. Underlying gross profit slipped modestly by 3% year-on-year as global trade frictions and a sluggish industrial environment continued to weigh on pricing and demand, particularly in the Americas.

Within the portfolio, the contrast between divisions was stark: Specialties suffered a 14% year-on-year contraction in earnings amid fierce competition and destocking in life sciences and materials, while Essentials managed to limit its decline to 8% as management’s efficiency drive kept margins intact. The company shaved €30 million off its cost base compared with last year, a meaningful offset in a flat macro landscape where volume recovery still feels distant.

The guidance update was cautious. Management now expects full-year operating EBITA towards the low end of its €950–1,050 million range, implying a softer fourth quarter and sharper seasonal slowdown than usual. This reflects the continued pricing pressure across industrial chemicals and the absence of any cyclical uplift in customer demand.

Rather than reacting to the downturn, Brenntag is sizing its business to emerge leaner and more focused when the market turns. The emphasis on operational efficiency, shared infrastructure, and cross-divisional synergies highlights that management sees more value in integration than separation, a significant pivot from earlier discussions about potentially splitting the group. That decision alone provides a measure of strategic clarity for investors who had been waiting for direction since the leadership transition.

The new CEO’s plan to launch a full strategic review aimed at simplifying structures and improving the cost base will take time (results are not expected before the second half of 2026) but it underscores a clear intent to future-proof the company. In the meantime, Brenntag’s defensive qualities remain evident: strong cash generation, an underleveraged balance sheet, and the ability to flex costs faster than revenue declines.

The short-term outlook still hinges on macro stabilization, but the medium-term opportunity lies in building a more agile operating model in a fragmented, margin-sensitive industry.

Munich Re (MUV2 Germany): strong profits but growth momentum softens

Munich Re’s third-quarter numbers reaffirmed its position as the industry’s benchmark for underwriting discipline, even as volume growth faltered across key segments.

The group delivered a robust technical result of €2.8 billion, comfortably above expectations, and net profit of nearly €2.0 billion, aided by low catastrophe losses, higher investment income, and a one-off boost at ERGO. The headline strength shows Munich Re’s ability to convert stable underwriting margins into consistent earnings, helped by the tailwind of below-average major claims. With €5.2 billion in profit already accumulated in the first nine months, the company is well on track to achieve its full-year goal of around €6 billion. Still, management signaled that some of the Q3 outperformance could be recycled into additional reserve strengthening in Q4, a rather conservative move that fits the reinsurer’s cautious character and prepares the ground for a potentially more volatile 2026 claims environment.

The detailed breakdown shows solid technical execution offset by softer revenue dynamics. In property and casualty reinsurance, Munich Re’s combined ratio improved dramatically to 62.7% from 70.2%, reflecting an unusually benign claims quarter, while the normalized figure of 78.7% sits right in line with full-year guidance. Yet, volumes in this segment declined by more than 6% year-on-year, highlighting the group’s commitment to pricing discipline and its willingness to walk away from marginal business amid softening market conditions and foreign exchange headwinds. Global Specialty Insurance also delivered strong profitability with an 82.8% combined ratio, though growth here too lagged historical norms. Meanwhile, in life and health reinsurance, the group absorbed €158 million in adverse biometric experience, mainly in select international markets, but maintained a healthy 7% annualized expansion of its contractual service margin, confirming the resilience of its long-term profit engine.

ERGO, Munich Re’s primary insurance arm, continued to offer steady support with roughly €300 million in net profit, bolstered by a one-time gain from its stake in NEXT Insurance. Underlying margins remained healthy, though growth in German P/C lines was muted as management stayed selective in underwriting.

Overall, the Q3 print shows a company in enviable financial shape, with a Solvency II ratio of 293% and a clear capacity to maintain its shareholder returns despite macro uncertainty.

Still, the upcoming Investor Day in December will be pivotal: investors will be looking for clarity on how Munich Re plans to sustain growth as the reinsurance cycle softens and pricing momentum cools. For now, the group’s capital strength and disciplined underwriting offer comfort, but the next leg of the story depends on reigniting growth without compromising the conservative balance that defines the Munich Re model.

Patrizia (PAT Germany): cautious optimism as real assets thaw

Patrizia’s third quarter might mark a subtle but meaningful shift for a company that has spent two years navigating one of the toughest real estate investment environments in Europe.

The company surprised the market by releasing results a day early, showing an EBITDA rebound to €15.5 million versus a loss a year ago, comfortably above expectations. Management responded by nudging full-year guidance higher to a range of €50–65 million, citing ongoing cost control and better-than-expected co-investment results.

That cautious upgrade signals growing confidence that the firm’s self-help efforts, trimming overhead, stabilizing recurring fee income, and refocusing capital deployment, are beginning to stick. Total service fee income rose 3% year-on-year, modest but positive, and assets under management inched up to €55 billion, reflecting the early stages of investor re-engagement.

What’s becoming clearer is that the firm is positioning itself to capture a cyclical recovery rather than betting on its timing. Management noted that institutional clients are returning to the buy side, with transactions up 41% year-on-year to €1.8 billion as investors tentatively re-enter global real estate and infrastructure. The pickup is uneven (infrastructure inflows earlier in the year have now given way to international real estate deals) but it suggests sentiment is finally stabilizing after years of valuation resets. Still, transaction and performance fees remain subdued, and the firm’s recurring management income continues to do the heavy lifting. In the short term, this steady fee base, now covering operating costs more reliably, gives Patrizia breathing room to wait out a still-fragile recovery in deal flow.

The company’s balance sheet remains solid, its cost base leaner, and its investment platform ready for a thawing market, but the pace of improvement in fees tied to performance and asset turnover will depend heavily on where property valuations and rates settle in 2026.

The stock prices in little expectation of a near-term surge ioo, reflecting both sector fatigue and lingering caution toward real asset managers. Yet if capital gradually rotates back into real estate and Patrizia sustains its improved operating efficiency, this could mark the foundation of a quieter, steadier phase of recovery.

LISI (FII France): aerospace momentum powers a new cycle of operating leverage

LISI is entering one of its most visible, volume-driven growth phases in years, led by the sustained ramp-up of commercial aircraft production.

The aerospace division, long the backbone of the group, is benefiting from robust backlogs at both Airbus and Boeing, whose narrowbody output targets give LISI multi-year revenue visibility. After compounding roughly 20% annual growth since the industry’s post-pandemic restart, management expects double-digit expansion to persist, underpinned by strong order coverage and an improving product mix.

The fasteners business, where LISI holds critical supplier positions, is scaling productivity through its Watch Out automation initiative, aiming for fully robotic 24/7 manufacturing lines that expand capacity without adding labor intensity. Margins are already reflecting that operating leverage (H1 underlying profitability hit 12.4%, up from 8% a year ago) and further improvements should follow as volumes climb and the mix tilts toward high-value platforms such as the A350.

The structural tailwinds go beyond civil aviation. Defence and military programs now account for roughly a tenth of group sales and should continue to grow as European rearmament cycles take hold. LISI’s exposure to high-specification components positions it well to capture that demand, while upcoming contract renewals (Airbus this year and Boeing in 2026) provide opportunities to lock in favorable long-term pricing. Importantly, the aerospace rebound is translating not only into higher throughput but also into cash-rich incremental margins as the company keeps capital intensity low through process digitization.

This combination of visibility, pricing stability, and efficiency gains gives LISI one of the cleanest earnings trajectories among European industrial midcaps exposed to the supply-chain recovery theme.

Meanwhile, the automotive division is quietly rebuilding resilience after years of cyclical swings. Organic growth of nearly 4% in the third quarter in the first half underscores how the segment’s mix shift (toward EV and hybrid programs and a larger weighting to Tier-1 suppliers) is dampening volatility and improving profitability. Geographic diversification and restructuring, including the sale of lower-margin assets and the recent acquisition of Polysemble Hungary, are reinforcing that trend. The Hungarian business, a supplier of plastic assembly components to German OEMs and emerging EV players like BYD, broadens LISI’s reach into next-generation platforms.

Taken together, these steps create a more balanced portfolio, with aerospace providing high-margin growth and automotive ensuring steady base volumes. As automation gains spread and both end markets normalize, LISI is shaping up as a rare industrial with genuine earnings visibility.

Ströer (SAX Germany): advertising headwinds linger, but digital tailwinds build

Ströer’s third-quarter numbers reflected the same theme that has defined 2025 for European media names: the cyclical weakness in ad spending continues to bite, but the group’s mix shift toward higher-margin digital assets remains quietly supportive beneath the surface.

EBITDA came in just below market expectations at €147 million, held back by a softer German advertising environment and cautious corporate spending decisions. The out-of-home (OOH) division, which still anchors the business, was essentially flat year-on-year, a disappointment given an easier base effect and small M&A contributions, while digital screens (DOOH) posted a marginal 0.6% drop as advertisers temporarily pulled back on campaigns. The digital and dialog segment fell 3%, driven mainly by weakness in third-party ad sales, even as proprietary platforms such as T-Online outperformed, underscoring the benefit of controlling premium inventory. Working capital swings weighed on free cash flow, but management expects this to normalise in Q4, keeping year-end cash generation roughly in line with last year.

Despite the near-term softness, there are signs that the cycle may be bottoming out. Ströer guided to “low to mid-single digit” growth in OOH for Q4, with digital formats set to outperform classic placements as utilisation rates improve. That commentary aligns with anecdotal evidence of advertisers returning cautiously to the market, particularly in travel, retail, and telecom. On the digital side, Statista continues to recalibrate its business model (shifting from individual subscriptions to larger enterprise solutions) while e-commerce brands such as Asam are enjoying the seasonal lift heading into year-end.

The acquisition of Amevida, meanwhile, looks more like a preparatory step for an eventual asset sale than a long-term expansion, reflecting management’s focus on simplifying the group’s structure. While the balance sheet has seen temporary leverage upticks, operational visibility into 2026 appears to be improving as customers signal increased marketing budgets and greater appetite for cross-channel campaigns.

The strategic message seems clear: Ströer is positioning for a recovery year in 2026. With OOH still depressed and digital revenues under cyclical pressure, the group’s ability to sustain profitability through cost control and selective investment remains key. Over the medium term, the company’s strong footprint in urban infrastructure and its growing digital portfolio give it a unique platform to benefit once ad demand rebounds.

The much-speculated portfolio reshuffle, including potential disposals of non-core units, may take longer than expected, but it remains central to unlocking value. For now, Ströer remains a patient restructuring and cash-flow story rather than a momentum trade, with investors watching closely for the first real signs of a rebound in Germany’s ad spending cycle.

Knaus Tabbert (KTA Germany): supply snags stall progress as leverage stays high

Knaus Tabbert’s recent results show (again) how fragile the European leisure vehicle recovery remains when production logistics falter.

The company reported revenue of €190 million, broadly in line with market expectations but down year-on-year, as supply interruptions once again disrupted manufacturing schedules. EBITDA slipped into negative territory for the quarter, and year-to-date profitability fell by more than half to a margin of just 2.6%.

A recurring pattern: the company’s ambitious ramp-up is being constrained not by demand, which remains steady following healthy trade fair activity, but by an unstable supply chain and a competitive distribution environment. Dealer inventories and delayed chassis deliveries have created a stop-and-go rhythm in production that erodes operating leverage. Free cash flow also weakened as working capital absorbed the strain, pushing net debt up to nearly €290 million by September, a level that continues to weigh on flexibility.

The latest downward revision to full-year EBITDA guidance reflects that same operational reality. Management now expects margins between 3.2% and 4.2%, down from the initial 5–5.5%, as distributors negotiate discounts and delay deliveries into the 2026 season to clear existing stock.

Some suppliers, meanwhile, are adjusting capacity more cautiously, compounding short-term bottlenecks and forcing Knaus Tabbert to revise its own production phasing. Although management insists its €1 billion revenue target for 2025 remains intact, the implied growth required in the final quarter looks steep given the disruptions to output. The company has been able to lean on existing inventory to fill near-term gaps, but that does little to offset the margin pressure from underutilized production lines and pricing tension at retail.

In a cyclical sector where operational efficiency determines resilience, the combination of volatile supply conditions and elevated leverage leaves Knaus Tabbert in a delicate position. While medium-term fundamentals for outdoor leisure vehicles remain solid, supported by structural demand in Europe and a gradual normalization of distribution, the near-term outlook is dominated by execution risks.

Management’s focus now shifts to stabilizing its supplier base, improving cash conversion, and preserving liquidity as debt ratios hover above comfortable thresholds. The company’s ability to smooth production flow into 2026 will determine whether it can translate steady demand into sustainable margins.

For now, the story remains one of potential restrained by operational friction, a reminder that even in recovery, this business depends as much on supply chains as on wanderlust.

SAF-Holland (SFQ Germany): buyback move marks a quiet vote of confidence

SAF-Holland’s decision to launch a €40 million share buyback program is a signal from management that the recent selloff has gone too far and that the balance sheet can easily support a return of capital, in our view.

Coming only days after a profit warning that rattled investors, the move reframes the narrative around the group’s medium-term prospects. With no debt maturities before 2027 and a solid liquidity cushion, SAF-Holland is effectively using this buyback to communicate two things: first, that operational momentum remains intact despite softer near-term end markets; and second, that it views its own shares as materially undervalued. The program, representing roughly 6% of the company’s market cap, will run through the end of 2026 and has been structured under an existing AGM authorization, reinforcing the idea that management is not improvising under pressure but following a deliberate playbook.

The timing of this announcement is notable. After trimming guidance earlier in the month, SAF-Holland’s stock had fallen sharply, reflecting concerns about the trajectory of orders in Europe and normalization in the trailer and truck supply chain. But the company’s underlying cash generation has stayed healthy, and its diversification into suspension and axle systems across multiple geographies offers a degree of earnings resilience.

Management’s willingness to allocate liquidity to shareholder returns, rather than hoarding cash in anticipation of further weakness, suggests confidence that the business can absorb cyclical softness while continuing to deleverage organically. This stands in contrast to many industrial peers that remain in capital preservation mode. It also fits with the group’s broader shift toward a more balanced capital structure, where recurring cash flow funds both investment and buybacks without compromising strategic flexibility.

For investors, the message is straightforward: management sees value where the market does not. While the near-term environment remains mixed, with slower OEM production and lingering cost inflation, SAF-Holland’s fundamentals, particularly its positioning in high-spec trailer and truck components, remain sound.

The company is emerging from a period of heavy integration work with its systems business and now appears ready to focus again on efficiency, cash generation, and disciplined growth. The buyback, modest in size but rich in symbolism, should act as a stabilizing factor for sentiment ahead of the upcoming Q3 results.

Swiss Life (SLHN Switzerland): solid footing but little excitement as growth normalizes

The recent update was a model of Swiss restraint: steady, predictable, and largely uneventful (read, boring).

Premiums rose 2% year-on-year to CHF 16.3 billion, fee income reached CHF 1.9 billion, and both landed almost exactly in line with consensus. The incremental growth across local markets reflects a business running smoothly, though without much visible acceleration. The fee-based segments, particularly third-party asset management (TPAM), remain central to the company’s strategy of shifting away from balance sheet-heavy insurance earnings. Here, growth of 4% was respectable but short of the market’s hopes, and new net money inflows came in below expectations, softening the tone of what was otherwise a solid set of figures. The Solvency Test ratio, at 205%, remains well above target but slightly below consensus forecasts, another reminder that upside catalysts are scarce for now.

Swiss Life’s TPAM franchise, which has become its key engine for fee expansion, is under mild scrutiny as fee margins appear to be trending down, a reflection of mix effects and competition, especially in low-margin index strategies. This is where sentiment could turn more cautious if asset growth continues without corresponding profitability improvement. On the insurance side, the business remains admirably disciplined, supported by conservative underwriting and strong capital generation, but the organic growth profile is modest. The capital-light transformation is well underway, yet the transition phase inevitably brings a softer revenue trajectory before higher-return products and advisory income take over.

Under its “Swiss Life 2027” strategic plan, the company is aiming for a 17–19% ROE and a growing share of profits from its fee-based units, i.c. ambitions that still look credible, if unspectacular. The group’s operational stability, dividend reliability, and ample solvency headroom make it a safe haven within the European financials landscape, but that very safety limits short-term re-rating potential.

The near-term debate will likely revolve around whether TPAM can deliver consistent, profitable inflows in a slower market and whether management can sustain double-digit ROEs as rates plateau. For now, the Swiss Life case remains the same; a disciplined, capital-rich compounder whose main appeal lies in predictability.

Infineon Technologies (IFX Germany): cautious 2026 tone, but AI power ambitions lift the story

The recent results in short: short-term caution vs long-term conviction.

The company’s fourth-quarter results were solid on the top line, with revenue of €3.94 billion coming in marginally ahead of market expectations, supported by broad-based growth across segments and a resilient gross margin of 40.7%. Yet profitability lagged, with an 18.2% segment margin falling slightly short of consensus. Management’s tone on near-term demand was reserved, pointing to a soft start to fiscal 2026 and ongoing macro uncertainty in automotive and industrial end-markets. For the upcoming quarter, revenue guidance of around €3.6 billion and a margin in the mid- to high-teens underline that visibility remains patchy as customers continue to work through elevated inventories.

The bigger narrative, however, lies in Infineon’s strategic pivot toward AI-driven power management, which is beginning to reshape the investment case.

The company sharply upgraded its revenue expectations for power components in AI datacenters to €1.5 billion, up from €1 billion previously, as hyperscalers rush to deploy energy-efficient solutions to support next-generation compute workloads. This business sits within the Power & Sensor Systems division, which is expected to outgrow the rest of the group and provide a cushion against slower growth in automotive, where normalization after a multi-year boom is weighing on order volumes. Management’s guidance for ‘moderate revenue growth’ in 2026 may sound underwhelming against a high bar set by peers, but it reflects a cautious stance amid volatile currency moves and a soft industrial recovery rather than structural weakness.

Infineon is quietly positioning itself at the intersection of two long-duration secular trends: electrification and AI infrastructure. While short-term sentiment may soften after the muted guidance, the long-term opportunity remains intact, and arguably strengthened, by the company’s exposure to high-performance power semiconductors that enable data centers to scale efficiently. Capex discipline and healthy free cash flow guidance further reinforce balance sheet resilience, giving Infineon room to invest in capacity without overextending.

In a sector dominated by AI exuberance, the group’s conservatism on near-term growth might look dull, but its emerging relevance to AI’s power backbone suggests a more durable story than the market currently prices in.

Bayer (BAYN Germany): operational lift from Crop Science, but litigation still overshadows the story

Bayer’s latest quarter was another prove of contrasts: solid operational delivery on one hand, and lingering legal overhang on the other.

The group reported adjusted EBITDA 15% above market expectations, driven primarily by a strong rebound in Crop Science and a lower-than-usual loss in the Reconciliation line. Crop Science stood out with a sharp margin recovery as efficiency programs and lower input costs offset modestly weaker sales. This division, long the problem child of the portfolio, finally contributed positively as restructuring gains start to filter through. In contrast, Pharma and Consumer Health performed broadly in line with expectations, with the former still wrestling with the Xarelto patent decline and the latter benefiting from tight cost control. The company reiterated its full-year outlook, but the market’s focus is less on operational guidance and more on the continuing drag from litigation.

The core issue remains the ongoing glyphosate lawsuits in the United States, an expensive and reputation-heavy burden that continues to shape investor sentiment. Bayer added another layer of provisions this quarter, expanding its forecast for special items to as much as €4 billion for the year. CEO Bill Anderson remains publicly confident that the company can ‘contain’ the litigation risk by the end of 2026, citing new settlements and progress in the appeals pipeline.

Yet, the timing and ultimate cost remain uncertain, and this lack of visibility still clouds what could otherwise be a compelling turnaround narrative. Structurally, the group has improved its operational footing: cost discipline is showing up in better margins across divisions, and cash flow generation has stabilized. Still, each positive step on fundamentals is being offset by renewed caution on legal provisions.

Strategically, Bayer is inching toward a more streamlined model, with a stronger balance between its three major divisions. Crop Science is benefiting from productivity programs and a stabilizing pricing environment, Pharma continues to diversify its pipeline with newer products like Nubeqa and Kerendia, and Consumer Health’s efficiency push is holding margins steady.

But until litigation uncertainty subsides, any re-rating will likely remain capped. The group’s improved profitability and confirmed guidance send the right operational signals, yet investors are likely to remain focused on the balance sheet implications of legal risk rather than the business momentum underneath. For now, Bayer looks sturdier operationally, but it’s still a story waiting for legal clarity before the market truly rewards it.

Jungheinrich (JUN3 Germany): solid orders and cash flow mask a muddled earnings picture

Jungheinrich’s latest quarter was a mix of reassuring operational momentum and accounting noise that makes profitability harder to read than usual. Orders held up well, rising about 5% above consensus, while group sales of €1.35 billion came in ahead of expectations thanks largely to strength in Financial Services. The company’s intralogistics business also showed resilience, supported by ongoing replacement demand and early benefits from automation and digitalisation solutions.

However, reported EBIT swung to a loss, distorted by heavy one-offs tied to the exit from Russia and restructuring charges under the cost efficiency program. Stripping out those items, the underlying operating margin would have landed somewhere around 7%, modestly below last year’s level but still consistent with a steady, if unspectacular, performance in a tough industrial backdrop. Free cash flow was notably better than feared, hitting €94 million for the quarter, a sign that working capital discipline remains a bright spot even as earnings volatility clouds the short-term narrative.

The company’s full-year outlook was left unchanged, reflecting management’s cautious stance after two earlier forecast revisions this year. Sales and order intake are still seen in the €5.3–5.9 billion range, and EBIT between €160 million and €230 million, a wide band that reflects the uncertainty surrounding the pace of recovery in European intralogistics demand.

The pending sale of its Russian operations remains an overhang, and management also flagged the possibility of further restructuring-related costs into 2026. Meanwhile, the new joint venture with China’s EP Equipment (under the Anton brand) is just getting started, and investors are keen to see whether it can expand Jungheinrich’s reach into more cost-competitive electric and warehouse equipment segments. For now, Financial Services, the quiet outperformer of the group, continues to add stability to cash generation, even as the industrial side remains cyclical and margin-sensitive.

Strategically, Jungheinrich is positioning itself at an interesting inflection point. The core materials handling market is stabilising but remains below peak post-pandemic activity, while automation, robotics, and fleet digitalisation are opening higher-margin adjacencies. The company’s brand strength, engineering heritage, and disciplined capital structure provide a strong foundation, yet near-term earnings are likely to remain choppy as one-offs, divestments, and restructuring blur visibility.

In essence, Jungheinrich’s story at this stage is of operational resilience within a muted cycle: good orders, solid cash flow, but limited catalysts until the margin trajectory becomes clearer and the Russian exit finally moves off the balance sheet.

FACC (FACC Austria): softer quarter, stronger finish as margins take flight again

FACC’s latest set of results came in weaker than expected on the surface, but management’s confident upgrade to full-year margin guidance suggests a powerful rebound in the final stretch of the year.

Sales rose just 4% year-on-year to €213 million, well below estimates, as order phasing and softer activity in aerostructures weighed on topline momentum. Profitability also dipped sequentially, with EBIT at €3.1 million and a margin of 1.5%, down sharply from the unusually strong second quarter that had benefited from a one-off compensation gain in cabin interiors. Beneath the quarterly noise, though, the mix of businesses remains telling: engines and nacelles delivered robust profitability with double-digit margins, helped by steady A350 and B787 output and contributions from the advanced air mobility business. Meanwhile, aerostructures and cabin interiors reflected the usual volatility tied to program timing and seasonality, with the latter seeing margins swing negative in a quieter summer quarter.

The surprise came from management’s decision to lift its full-year EBIT margin target to 4–5%, up from the prior goal of a modest improvement over last year’s 3.2%. That implies a much stronger Q4, with earnings momentum set to accelerate as development revenues in aerostructures catch up and higher-margin programmes ramp. FACC kept its sales target of roughly €1 billion intact, pointing to a healthy year-on-year increase despite temporary delivery shifts by OEMs. Working capital expanded modestly, driven by timing in payables, while operating cash flow remained subdued and net debt ticked up to €255 million.

None of these movements appear alarming, especially in a capital-intensive phase marked by growth in newer programs. What matters more is the guidance upgrade, which points to confidence in pricing, productivity, and cost pass-through heading into year-end.

Strategically, FACC’s trajectory continues to track the broader aerospace cycle, a steady climb powered by commercial production ramp-ups and a growing foothold in emerging mobility technologies. The company remains a critical supplier to both Airbus and Boeing, and the gradual shift toward lightweight composite structures positions it well for the next generation of aircraft platforms.

The near-term margin dip is more a function of timing than deterioration, and the raised guidance signals that the operational groundwork laid over the past two years is beginning to pay off. With the industry’s recovery broadening beyond single-aisle aircraft and FACC’s cost base becoming leaner, the group seems set for a strong close to the year, even if investors may prefer to see evidence of consistent margin delivery before fully rewarding the stock.

If you appreciate this post, feel free to share and subscribe below!